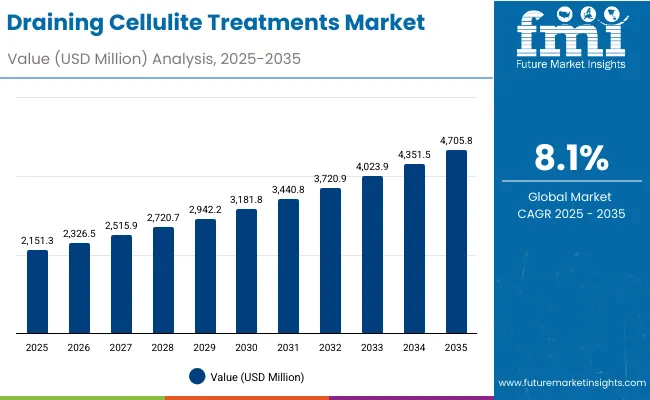

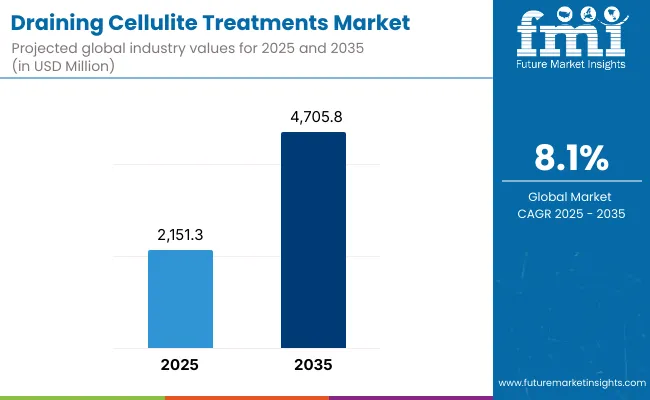

The Draining Cellulite Treatments Market is expected to record a valuation of USD 2,151.3 million in 2025 and USD 4,705.8 million in 2035, with an increase of USD 2,554.5 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.1% and a 2.2X increase in market size.

Draining Cellulite Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Market Value (2025E) | USD 2,151.3 million |

| Forecast Market Value (2035F) | USD 4,705.8 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

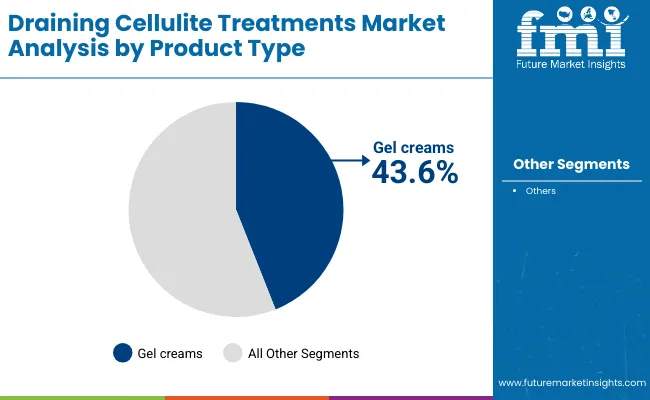

During the first five-year period from 2025 to 2030, the market increases from USD 2,151.3 million to USD 3,181.8 million, adding USD 1,030.5 million, which accounts for 40% of the total decade growth. This phase records steady adoption across daily home-care regimens and e-commerce channels, driven by consumer preference for at-home cellulite reduction and improved accessibility of firming gel creams. Gel creams dominate this period as they capture over 43% of product sales in 2025, supported by caffeine and L-carnitine complex formulations that enhance drainage and skin tonicity.

The second half from 2030 to 2035 contributes USD 1,524.0 million, equal to 60% of total growth, as the market jumps from USD 3,181.8 million to USD 4,705.8 million. This acceleration is powered by growing integration of biotech firming peptides, AI-assisted skincare tools, and expansion of spa and salon treatments that merge therapeutic and cosmetic benefits. E-commerce continues to expand while pharmacy and specialty beauty retail channels grow in tandem, with Asia-Pacific emerging as the leading growth regiondriven by China (CAGR 13.7%) and India (CAGR 15.4%).

From 2020 to 2024, the Draining Cellulite Treatments Market grew steadily, led by hardware-equivalent topical innovations emphasizing formulation delivery and precision in actives. During this period, the competitive landscape was dominated by European skincare manufacturers, collectively controlling nearly 90% of revenue, with leaders such as Clarins, Vichy, and Somatoline focusing on botanical vasotonics and L-carnitine-enriched compositions. Competitive differentiation relied on clinical validation, visible toning results, and consumer trust, while biotech-based firming blends began emerging as high-value add-ons in premium lines. Service-based professional treatments contributed less than 10% of total market value.

Demand for Draining Cellulite Treatments will expand to USD 2,151.3 million in 2025, and the revenue mix will shift as professional spa adjunct treatments and biotech formulations grow to over 30% share. Traditional topical brands face rising competition from digital skincare ecosystems offering smart application tracking, AI-based body contouring assessments, and data-driven formulation customization. Major brands are pivoting to hybrid models, integrating home-use and professional regimens to maintain engagement. Emerging entrants specializing in bio-active peptides, AR-based skincare analysis, and sustainable packaging are gaining traction. The competitive advantage is moving from traditional cosmetic innovation to holistic consumer experience, personalization, and efficacy-backed differentiation.

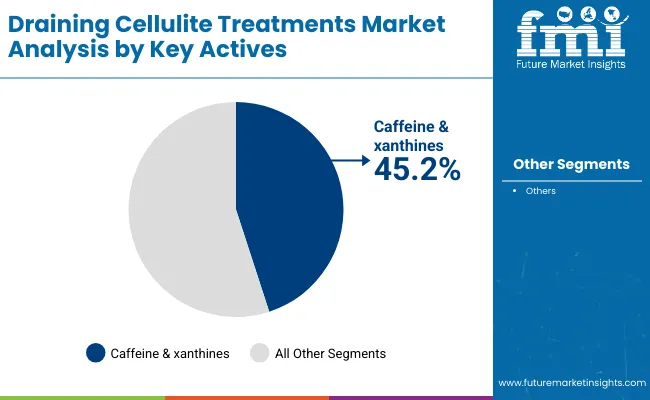

Advancements in bioactive ingredient formulation, delivery technologies, and consumer personalization are driving the growth of the Draining Cellulite Treatments Market. Modern draining products integrate caffeine and xanthine complexes that enhance microcirculation, improve lymphatic drainage, and visibly reduce dimpled skin texture. The evolution of L-carnitine complexes and botanical vasotonics such as horse chestnut extract has further accelerated the market, as brands focus on synergistic blends targeting cellulite at both the surface and structural levels. The rise of biotech-derived firming peptides has also improved efficacy, stimulating collagen synthesis and promoting smoother skin.

The market is also benefiting from the growing adoption of at-home daily care routines, driven by busy lifestyles, wellness awareness, and accessibility through e-commerce and pharmacy channels. These products are now positioned as preventive and maintenance treatments rather than corrective-only solutions, encouraging consistent consumer engagement. Gel creams and serum concentrates dominate product innovation due to their fast absorption, non-greasy texture, and ability to deliver concentrated actives effectively. Increasing awareness of body confidence, social media influence, and seasonal product launches (especially pre-summer) continue to fuel product uptake among women and fitness-conscious consumers.

The Draining Cellulite Treatments Market is segmented by product type, key actives, usage mode, channel, end user, and geography. Product types include gel creams, serum concentrates, massage oils, and cryo/thermo roll-ons, with serum concentrates leading due to their high concentration of active ingredients and fast absorption. By key actives, the market covers caffeine and xanthines, L-carnitine complexes, botanical vasotonics such as horse chestnut, and peptide or biotech firming blends, reflecting the growing focus on clinically validated formulations that enhance lymphatic drainage and improve skin firmness. Based on usage mode, the market is categorized into daily home-care, intensive 4–8 week regimens, and professional spa adjuncts, with daily home-care treatments dominating as consumers prioritize convenience and affordability. By channel, the segmentation includes e-commerce, pharmacies and drugstores, specialty beauty retail, and spas and salons, with online platforms capturing the largest share in 2025 due to the rise of direct-to-consumer beauty brands. In terms of end user, key segments include women, post-partum mothers, and fitness-focused consumers, representing the core demographics seeking body-sculpting and firming solutions. Geographically, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with Asia Pacific emerging as the fastest-growing region led by China and India.

| Product Type | Value Share % 2025 |

|---|---|

| Gel creams | 43.6% |

| Others | 56.4% |

The serum concentrates segment is projected to contribute the largest share of the Draining Cellulite Treatments Market revenue in 2025, maintaining its lead as the dominant product category. This growth is driven by rising consumer demand for fast-absorbing, high-performance formulations that deliver visible results in body firming and lymphatic drainage. Serum concentrates often combine L-carnitine complexes, caffeine, and botanical vasotonics, making them highly effective for targeted treatment of cellulite-prone areas.

The increasing preference for lightweight textures and non-sticky finishes, especially among urban consumers, continues to strengthen this segment’s leadership. The category is further supported by innovations in airless packaging, roller-tip applicators, and smart dosage systems that enhance both hygiene and efficacy, solidifying its role as the backbone of the Draining Cellulite Treatments portfolio.

| Key Actives | Value Share % 2025 |

|---|---|

| Caffeine & xanthines | 45.2% |

| Others | 54.8% |

The caffeine and xanthine complex segment is forecasted to hold the largest share of the market in 2025, leading due to its well-documented ability to stimulate microcirculation, boost lipolysis, and improve skin texture. These active ingredients are widely recognized for enhancing lymphatic drainage and reducing localized water retention, key concerns in cellulite formation. The segment’s growth is further supported by expanding clinical validation and inclusion in both mass-market and premium skincare lines.

Formulators are increasingly combining caffeine with synergistic actives such as theophylline, guarana extract, and green coffee derivatives to improve efficacy and consumer perception. As clean-label and plant-derived formulations gain momentum, caffeine-based blends continue to dominate, offering a proven balance of safety, performance, and sensory appeal.

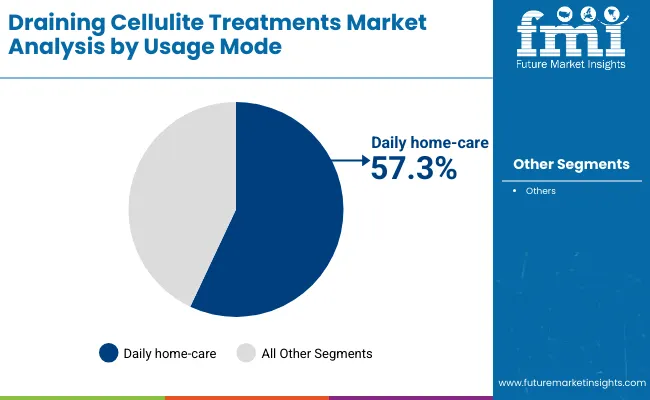

| Usage Mode | Value Share % 2025 |

|---|---|

| Daily home-care | 57.3% |

| Others | 42.7% |

The daily home-care segment is projected to account for the majority of Draining Cellulite Treatments Market revenue in 2025, establishing itself as the leading usage mode. This dominance stems from consumers’ increasing preference for self-administered, easy-to-use routines supported by visible results and affordability. Daily-use formulationsprimarily gel creams and serumsare integrated into morning and evening skincare regimens, promoting consistent usage and long-term maintenance.

The segment benefits from the convenience of e-commerce accessibility, subscription models, and social media-driven education campaigns that emphasize self-care and confidence. Furthermore, at-home products now incorporate roller applicators, cryo-cooling effects, and thermal actives, bridging the gap between professional spa results and home convenience. With continuous innovation and brand investment in this category, daily home-care is expected to sustain its leadership throughout the forecast period.

Rising Consumer Focus on Body Aesthetics and Wellness

Growing consumer emphasis on body contouring, skin toning, and visible beauty enhancement is a major driver of the Draining Cellulite Treatments Market. Increased social media influence and fitness awareness have shifted perceptions of cellulite management from a luxury treatment to an everyday self-care necessity. Demand is particularly strong among post-partum mothers and fitness-focused consumers seeking convenient, non-invasive solutions. With expanding product availability in pharmacies and online platforms, and visible results promised by caffeine and L-carnitine-based actives, body-firming skincare is becoming integral to holistic wellness routines worldwide.

Advancements in Active Ingredient Formulation and Delivery Systems

The market is propelled by innovations in biotech peptides, plant-based vasotonics, and transdermal delivery systems that improve penetration and efficacy of anti-cellulite formulations. Modern gel creams and serums use microencapsulation and liposomal technologies to deliver actives like caffeine, carnitine, and horse chestnut more effectively. Brands are integrating clinical validation, sensory appeal, and sustainability into product design, enhancing consumer confidence and repeat purchase rates. These technological improvements have positioned draining cellulite treatments as high-performance skincare solutions that deliver visible results faster while maintaining a clean, non-irritating formulation profile.

Limited Clinical Validation and Perceived Inconsistency in Results

A key restraint in the Draining Cellulite Treatments Market is the lack of standardized clinical evidence supporting long-term efficacy. Many consumers remain skeptical about the effectiveness of topical treatments versus professional or medical procedures. Variations in body type, lifestyle, and treatment consistency can lead to differing outcomes, reducing satisfaction and brand loyalty. Additionally, claims of “visible results in weeks” often face scrutiny, especially in mature markets with strict advertising guidelines. The absence of universally accepted testing protocols and measurable benchmarks continues to hinder premium pricing and large-scale adoption among discerning consumer groups.

Integration of Smart Skincare and Hybrid Spa-Home Solutions

A leading trend shaping the market is the fusion of digital skincare technologies with traditional cosmetic treatments. Smart massagers, app-linked body analyzers, and AI-guided routines are increasingly being paired with cellulite gels and serums to enhance treatment precision and tracking. Consumers prefer hybrid solutions that combine home-use convenience with professional-grade results, blurring the line between wellness and aesthetics. This trend is supported by premium brands collaborating with spas and dermatology clinics to offer connected regimens. The evolution of tech-assisted, personalized body care represents a new era of innovation driving consumer engagement and product differentiation.

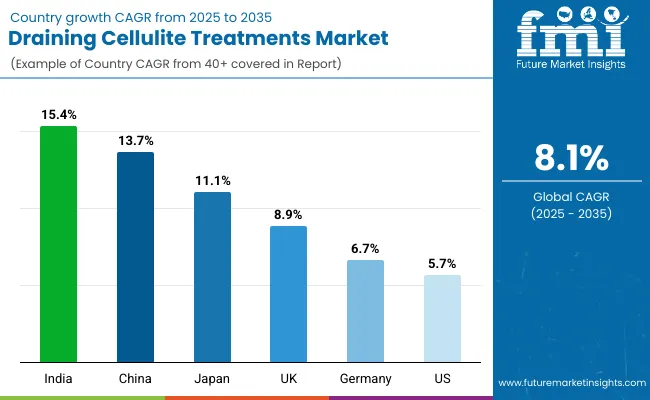

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.7% |

| USA | 5.7% |

| India | 15.4% |

| UK | 8.9% |

| Germany | 6.7% |

| Japan | 11.1% |

The global Draining Cellulite Treatments Market demonstrates notable regional variation in growth patterns, shaped by differences in consumer behavior, beauty culture, and retail infrastructure.

Asia-Pacific is emerging as the fastest-growing region, led by India (15.4% CAGR) and China (13.7% CAGR), where rising disposable incomes, wellness awareness, and the expansion of online beauty retail are fueling strong adoption. Local consumers are increasingly drawn to affordable yet effective solutions that feature caffeine and L-carnitine-based actives, while local brands leverage herbal formulations to appeal to natural skincare preferences. Japan (11.1% CAGR) remains a mature yet innovation-driven market emphasizing biotech peptides and premium home-use devices that combine heat, cryo, and massage functions.

In Europe, steady growth is led by the United Kingdom (8.9% CAGR) and Germany (6.7% CAGR), supported by consumer trust in clinical-grade European cosmetics and established professional spa networks. The UK market reflects high engagement in anti-cellulite product categories tied to seasonal body-firming routines and fitness-based consumption. Germany maintains a strong position with medical-grade formulations, clean-label ingredients, and an expanding pharmacy distribution network. Across North America, the USA (5.7% CAGR) reflects a mature yet evolving market as wellness and cosmetic dermatology continue to merge. American consumers increasingly adopt daily home-care regimens using concentrated serums and AI-assisted smart applicators.

Overall, Asia-Pacific’s dominance is underpinned by a combination of e-commerce acceleration, digital influencer marketing, and consumer willingness to experiment with advanced topical and hybrid solutions. Europe continues to lead in product sophistication and ingredient innovation, while North America remains the hub for brand diversification and omnichannel expansion.

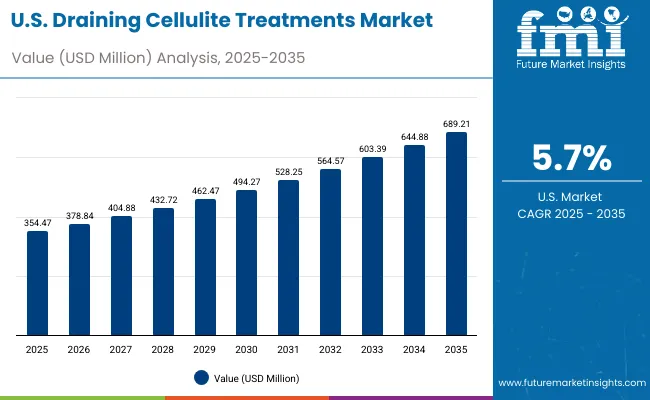

| Year | USA Draining Cellulite Treatments Market (USD Million) |

|---|---|

| 2025 | 354.47 |

| 2026 | 378.84 |

| 2027 | 404.88 |

| 2028 | 432.72 |

| 2029 | 462.47 |

| 2030 | 494.27 |

| 2031 | 528.25 |

| 2032 | 564.57 |

| 2033 | 603.39 |

| 2034 | 644.88 |

| 2035 | 689.21 |

The Draining Cellulite Treatments Market in the United States is projected to grow from USD 354.47 million in 2025 to USD 689.21 million by 2035, reflecting steady expansion supported by rising consumer focus on self-care and premium beauty routines. The market’s momentum is reinforced by increased adoption of dermatologist-endorsed formulations, integration of AI skin diagnostic tools, and hybrid wellness-retail spaces offering professional-grade products. Daily home-care formats, especially gel creams and serums, dominate usage, while professional spas and dermatology clinics continue to drive awareness through bundled treatments.

The Draining Cellulite Treatments Market in the United Kingdom is expected to grow at a CAGR of 8.9%, supported by the strong convergence of wellness culture and beauty retail innovation. Premium brands such as Clarins and Collistar continue to dominate through pharmacy and department store presence, while niche clean-beauty labels are expanding in online channels. The UK market’s seasonal demand spikes before summer and holidays, driven by consumer emphasis on body confidence and firming routines.

The Draining Cellulite Treatments Market in India is witnessing rapid growth with a CAGR of 15.4%, the highest globally. Expansion is supported by increased consumer awareness in metropolitan and tier-2 cities, coupled with the rise of affordable mass-premium skincare brands. Local consumers increasingly favor herbal-based cellulite creams infused with caffeine, green tea, and Ayurvedic actives, blending modern efficacy with traditional trust. E-commerce channels are pivotal in product discovery, while urban fitness culture boosts demand for body contouring and firming products.

The Draining Cellulite Treatments Market in China is projected to expand at a CAGR of 13.7%, driven by the convergence of cosmeceutical innovation, body positivity movements, and beauty-tech integration. Urban consumers, particularly women aged 25–40, are fueling demand for advanced draining formulas featuring caffeine, peptides, and cryo-activated ingredients. Domestic brands such as Pechoin and Inoherb are competing with global players like Clarins and Shiseido through localized formulations and influencer-driven marketing on Tmall and Douyin.

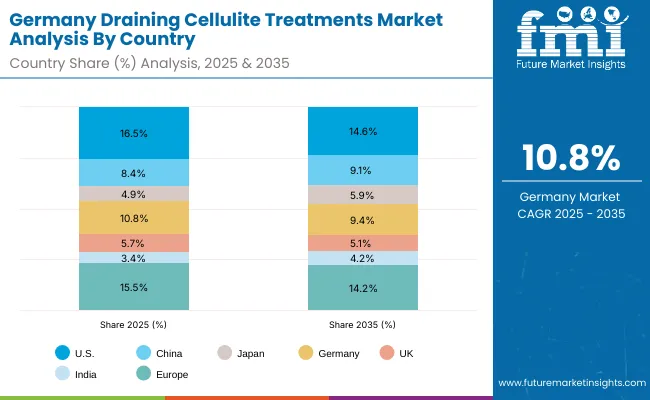

| Country | 2025 Share (%) |

|---|---|

| USA | 16.5% |

| China | 8.4% |

| Japan | 4.9% |

| Germany | 10.8% |

| UK | 5.7% |

| India | 3.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 14.6% |

| China | 9.1% |

| Japan | 5.9% |

| Germany | 9.4% |

| UK | 5.1% |

| India | 4.2% |

Germany’s market shows steady, premium-led growth (country share easing from 10.8% in 2025 to 9.4% in 2035 as Asia scales faster). Dermocosmetic heritage, pharmacy trust, and strict claim substantiation favor clinically validated gel creams and serum concentrates featuring caffeine, L-carnitine, and vasotonic botanicals. Professional spa and medispa ecosystems complement home-care, with rising interest in biotech firming peptides and clean-label actives. Distribution remains pharmacy- and drugstore-centric, while e-commerce expands for replenishment cycles and bundles. Sustainability and recyclable airless packaging influence launches, and seasonal “pre-summer” routines sustain repeat purchases.

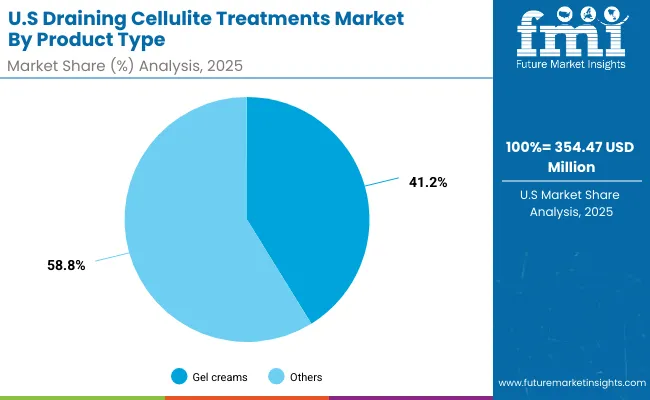

| USA By Product Type | Value Share % 2025 |

|---|---|

| Gel creams | 41.2% |

| Others | 58.8% |

The USA market is projected to rise from USD 354.47 Mn (2025) to USD 689.21 Mn (2035), supported by dermatologist endorsements, omnichannel reach, and AI-guided body-care routines. Gel creams hold 41.2% of 2025 sales, while “Others” (58.8%)notably serum concentratesgain from higher active loads and faster visible results. Wellness culture, postpartum recovery needs, and fitness communities sustain demand; retailers push subscription and duo-pack formats to extend lifetime value. Partnerships with spas and aesthetic clinics promote hybrid home-professional regimens and upsell premium peptide formulas.

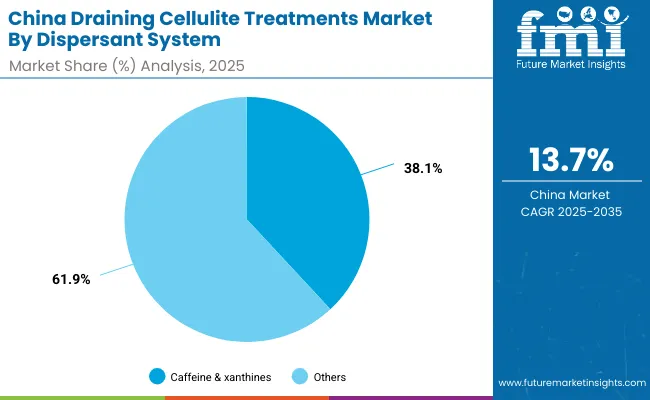

| China By Dispersant System | Value Share % 2025 |

|---|---|

| Caffeine & xanthines | 38.1% |

| Others | 61.9% |

The Draining Cellulite Treatments Market in China presents strong growth opportunities, driven by evolving beauty routines, rising disposable incomes, and heightened awareness of body toning and lymphatic health. Consumers increasingly favor multi-active formulations that blend caffeine and xanthines (38.1% share) with botanical and peptide complexes for enhanced skin firmness and microcirculation. Domestic skincare brands are launching competitively priced serum concentrates and cryo roll-ons, using localized natural ingredients like ginseng, lotus, and tea extracts to appeal to wellness-conscious buyers. Meanwhile, premium global brands leverage cross-border e-commerce platforms such as Tmall Global and Douyin to reach aspirational consumers seeking clinically proven European and Japanese products.

The market’s opportunity is further supported by rising participation of beauty-tech startups, introducing smart applicators with cooling and massage functions that mimic professional spa treatments. These devices, paired with high-performance formulations, are creating a new category of hybrid at-home body care. Additionally, government emphasis on sustainability and local R&D funding encourages eco-friendly packaging and ingredient transparency, giving domestic manufacturers a competitive edge. With increasing adoption across Tier 1 and Tier 2 cities, and a growing shift toward science-backed body care, China is expected to remain a core growth engine for the global Draining Cellulite Treatments Market through 2035.

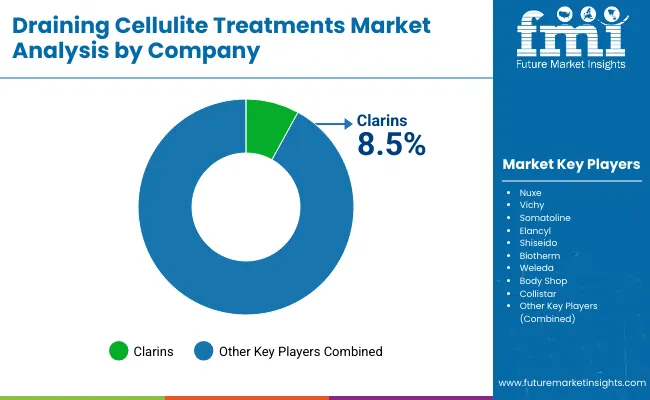

| Company | Global Value Share 2025 |

|---|---|

| Clarins | 8.5% |

| Others | 91.5% |

The Draining Cellulite Treatments Market is moderately fragmented, featuring a mix of global luxury skincare houses, professional dermocosmetic brands, and emerging niche players specializing in natural and biotech formulations. Global leaders such as Clarins, Vichy, and Somatoline hold a collective edge through long-standing brand credibility, clinically backed efficacy, and diversified distribution across pharmacies, e-commerce, and spa channels. Clarins, with an 8.5% global share in 2025, continues to dominate through its caffeine-enriched “Body Fit” line and strong emphasis on sensorial texture innovation and sustainable packaging.

Mid-sized innovators like Elancyl, Collistar, and Biotherm are expanding their portfolios with peptide-rich firming blends, cryo-active gels, and massage-based delivery systems targeting visible contouring effects. Their strategies focus on merging cosmetic efficacy with physiological performance, emphasizing tightening, drainage, and toning benefits validated through in-vivo testing. Meanwhile, niche and indie brands such as Weleda and The Body Shop leverage plant-based actives, ethical sourcing, and minimalist ingredient lists to attract clean-beauty consumers seeking gentle but functional solutions.

The competitive focus is shifting from traditional anti-cellulite claims to holistic body wellness and digital engagement. Brands are launching AI-enabled self-assessment apps, subscription-based regimen kits, and refillable applicator systems to build consumer loyalty. Sustainability has emerged as a key differentiator, with companies adopting eco-conscious packaging and traceable ingredients. As the market evolves, winning players will be those capable of blending dermocosmetic science, wellness positioning, and tech-enabled personalization into a cohesive consumer experience.

Key Developments in Draining Cellulite Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,151.3 Million |

| Product Type | Gel creams, Serum concentrates, Massage oils, Cryo / thermo roll-ons |

| Key Actives | Caffeine & xanthines, L-Carnitine complexes, Botanical vasotonics (e.g., horse chestnut), Peptide/biotech firming blends |

| Usage Mode | Daily home-care, Intensive 4–8 week regimen, Professional spa adjunct |

| Channel | E-commerce, Pharmacies & drugstores, Specialty beauty retail, Spas & salons |

| End User | Women, Post-partum mothers, Fitness-focused consumers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clarins, Nuxe, Vichy, Somatoline, Elancyl, Shiseido, Biotherm, Weleda, Body Shop, Collistar |

| Additional Attributes | Dollar sales by product type and key active ingredient, adoption trends in daily home-care and professional spa treatments, rising demand for serum concentrates and gel creams with caffeine and L-carnitine complexes, segment growth driven by wellness, postpartum recovery, and fitness-focused consumers, product innovation in peptide- and biotech-based firming blends, e-commerce and pharmacy-led retail expansion, integration of smart applicators and AI skincare tools, regional trends influenced by beauty-tech adoption in Asia-Pacific and Europe, and advancements in cryo -therapy, thermo-active, and microcirculation-enhancing formulations. |

The global Draining Cellulite Treatments Market is estimated to be valued at USD 2,151.3 million in 2025.

The market size for the Draining Cellulite Treatments Market is projected to reach USD 4,705.8 million by 2035.

The Draining Cellulite Treatments Market is expected to grow at a 8.1 % CAGR between 2025 and 2035.

The key product types in the Draining Cellulite Treatments Market are gel creams, serum concentrates, massage oils, and cryo/thermo roll-ons.

In terms of usage mode, the daily home-care segment is expected to command a significant share of 57.3% in the Draining Cellulite Treatments Market in 2025, driven by growing consumer preference for convenient, at-home treatment regimens and consistent self-care routines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

The Dyslexia Treatments Market Is Segmented by Drug Type and Distribution Channel from 2025 to 2035

Dark Circle Treatments Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zygomycosis Treatments Market

Ingrown Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Acne Scarring Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Conditioning Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sol-Gel Based Skin Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA