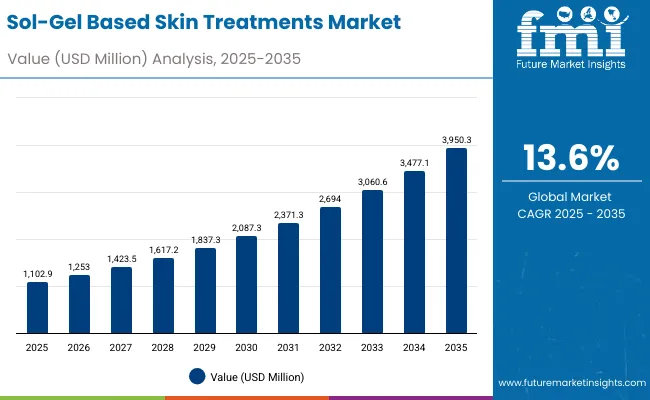

The global Sol-Gel Based Skin Treatments Market is expected to record a valuation of USD 1,102.9 million in 2025 and USD 3,950.3 million in 2035, with an increase of USD 2,847.4 million, which equals a growth of more than 258% over the decade. The overall expansion represents a CAGR of 13.6% and a more than 3X increase in market size.

Global Sol-Gel Based Skin Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Global Sol-Gel Based Skin Treatments Market Estimated Value in (2025E) | USD 1,102.9 million |

| Global Sol-Gel Based Skin Treatments Market Forecast Value in (2035F) | USD 3,950.3 million |

| Forecast CAGR (2025 to 2035) | 13.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,102.9 million to USD 2,087.3 million, adding USD 984.4 million, which accounts for 34.5% of the total decade growth. This phase records steady adoption in clinical-grade formulations, encapsulated vitamins, and dermatologist-tested hydration systems, driven by rising demand for scientifically backed skin treatments. Serums dominate this period as they cater to nearly 48.8% of applications, offering targeted delivery of sol-gel encapsulated actives like vitamin C and peptides.

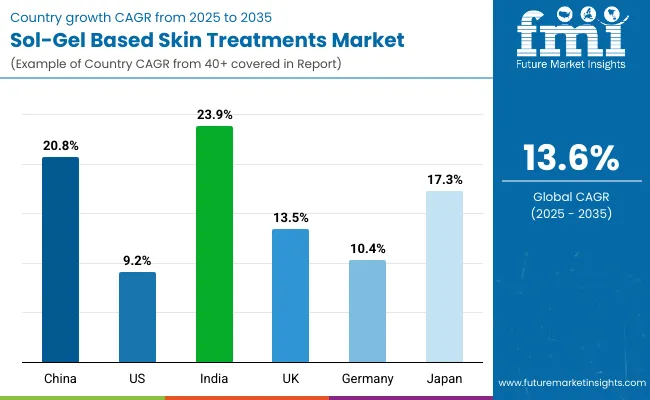

The second half from 2030 to 2035 contributes USD 1,863.0 million, equal to 65.5% of total growth, as the market jumps from USD 2,087.3 million to USD 3,950.3 million. This acceleration is powered by widespread deployment of premium e-commerce platforms, adoption of clean-label sol-gel sunscreens, and integration of peptides and minerals in clinical-grade dermatology clinic offerings. Asian countries including China (20.8% CAGR) and India (23.9% CAGR) push expansion as consumers in these regions shift from conventional topicals to advanced nanostructured sol-gel formulations. Digital retailing strategies further expand access, making e-commerce a strong growth channel by the end of the decade.

From 2020 to 2024, the global Sol-Gel Based Skin Treatments Market grew steadily from a niche science-driven category to an emerging dermatology-aligned solution segment, fueled by hardware-like precision in sol-gel encapsulation and clinical claims. During this period, the competitive landscape was dominated by chemical majors such as BASF, Evonik, and Croda, which together accounted for a significant share of innovation pipelines, focusing on sol-gel matrices for encapsulation and UV-filtering gels. Competitive differentiation relied on sustained release, skin penetration efficiency, and multi-active delivery systems. Service-oriented models, such as dermatology clinic treatments, were still under 10% of value share, while pharmacies and premium retail slowly began adopting sol-gel infused products.

Demand for sol-gel based skin treatments will expand to USD 1,102.9 million in 2025, and the revenue mix will shift as clinical-grade and dermatologist-tested claims rise above 55% share by 2035. Traditional chemical leaders face competition from biotech-driven entrants integrating plant extract sol-gels, vegan claims, and clean-label positioning. Major established players are pivoting to hybrid models, merging chemical expertise with biotech formulations and skin microbiome research. Emerging companies focusing on UV-protective gels, hydration systems, and eco-conscious vegan sol-gel actives are capturing market attention. The competitive advantage is moving away from basic formulation supply towards ecosystem strength, integration with clinical dermatology, and consumer trust in premium beauty retail.

Advances in sol-gel encapsulation science have improved stability, skin penetration, and release control, allowing for more efficient delivery of vitamins, peptides, and plant extracts. Clinical-grade products are gaining popularity due to their suitability for long-lasting, dermatologist-tested results. The rise of sol-gel based UV-filtering gels and hydration systems has contributed to enhanced consumer trust in performance-oriented treatments. Industries such as dermatology, cosmeceuticals, and premium skincare are driving demand for solutions that can integrate seamlessly into professional and consumer workflows.

Expansion of dermatology clinic procedures and premium e-commerce distribution has fueled market growth. Innovations in sol-gel structured serums, patches, and sunscreens are expected to open new application areas. Segment growth is expected to be led by clinical-grade claims, encapsulation and sustained release functions, and serum-based products due to their precision, adaptability, and higher consumer acceptance in anti-aging and skin protection regimes.

The market is segmented by function, active type, product type, channel, and claim. Functions include encapsulation & sustained release, barrier formation, UV-filtering gels, and hydration systems, highlighting the core science behind consumer adoption. Active type classification covers vitamins (C, E, retinoids), peptides, minerals & oxides, and plant extracts, which represent the biologically active portfolio driving differentiation. Based on product type, segmentation includes creams/lotions, serums, patches/masks, and sunscreens to cater to diverse consumer needs.

By channel, categories include dermatology clinics, e-commerce, premium beauty retail, and pharmacies, showcasing the hybrid professional-consumer pathway. Claims include clinical-grade, dermatologist-tested, vegan, and clean-label, aligning with shifting consumer expectations. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with leading countries being the USA, China, India, Japan, UK, and Germany.

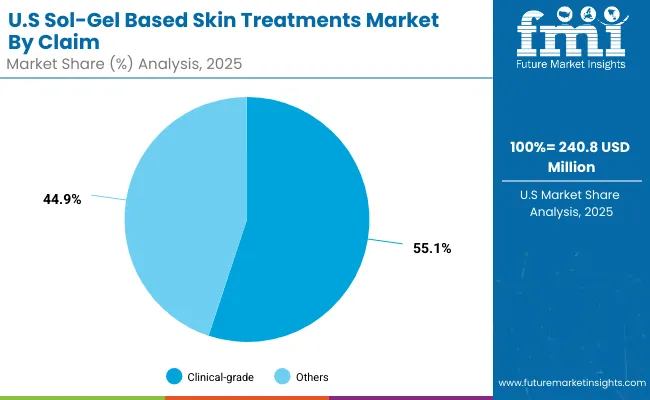

| Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 53.3% |

| Others | 46.7% |

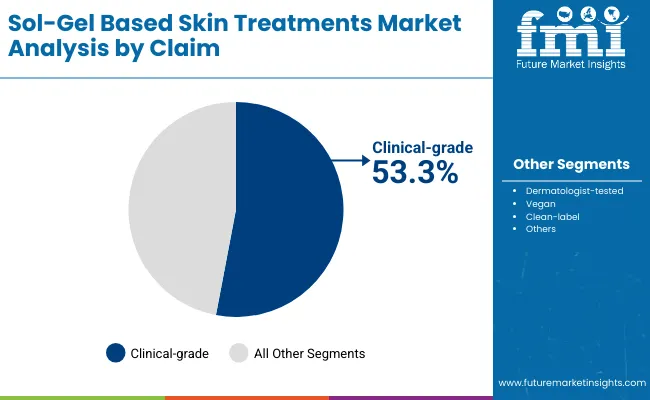

The clinical-grade segment is projected to contribute 53.3% of global Sol-Gel Based Skin Treatments Market revenue in 2025, maintaining its lead as the dominant claim category. This is driven by consumer demand for dermatologist-backed efficacy, regulatory trust, and the expansion of professional dermatology clinics prescribing sol-gel based therapies. Growth is supported by rising consumer inclination toward skin safety, high-potency results, and premium product positioning. By 2035, clinical-grade claims are expected to remain dominant due to their alignment with cosmeceutical credibility and medical skincare adoption.

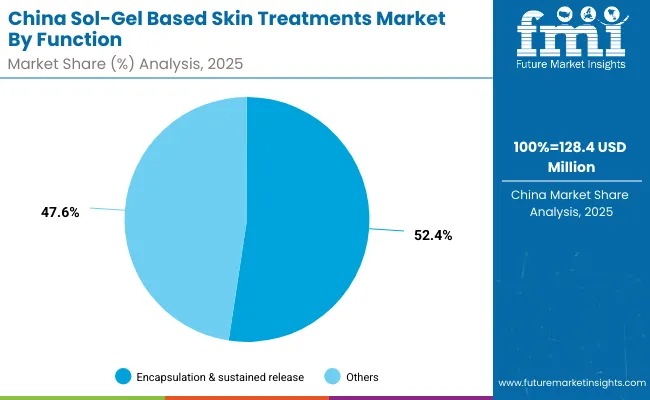

| Function | Value Share% 2025 |

|---|---|

| Encapsulation & sustained release | 55.1% |

| Others | 48.5% |

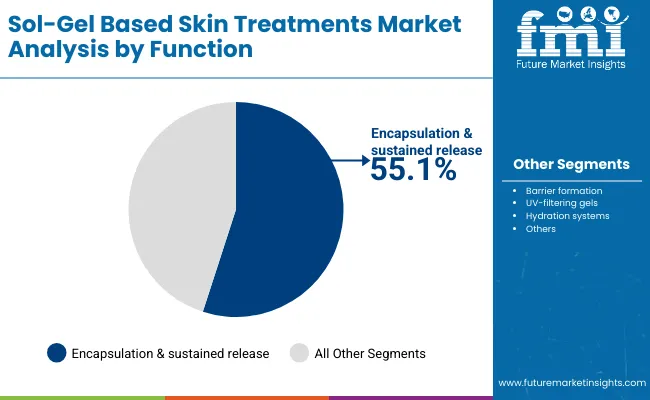

The encapsulation and sustained release function is forecasted to hold 55.1% of market share in 2025, led by its role in protecting sensitive actives like vitamin C and peptides from degradation and ensuring prolonged release on the skin surface. These systems enhance treatment efficacy and reduce irritation risks, making them highly sought after in premium formulations. As sol-gel research advances, encapsulation is expected to dominate not just serums and creams but also patches, masks, and sunscreens, extending consumer trust across categories.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 48.8% |

| Others | 51.2% |

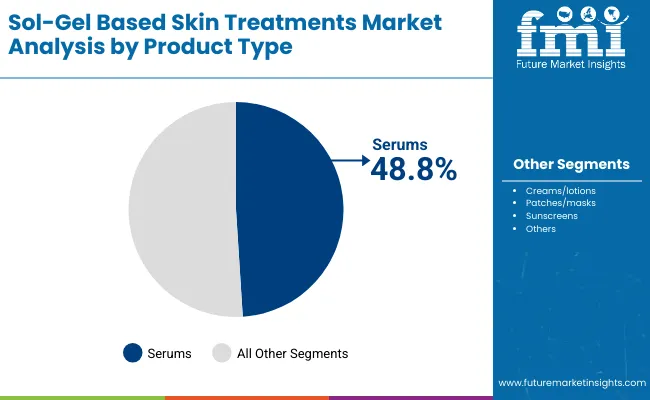

The serum segment is projected to account for 48.8% of global Sol-Gel Based Skin Treatments Market revenue in 2025, establishing itself as the leading product type. Serums are preferred for their lightweight textures, concentrated actives, and faster absorption, making them ideal for anti-aging, hydration, and brightening treatments. Sol-gel delivery enhances stability and potency of vitamins, peptides, and minerals within serum formulations. With consumers demanding visible and measurable results, serums are expected to retain their leadership in the product type category through 2035.

Clinical-Grade Validation Driving Dermatology Integration

One of the strongest drivers of the global Sol-Gel Based Skin Treatments Market is the increasing adoption of clinical-grade validation and dermatologist endorsement. In your data, clinical-grade already represents 53.3% of market value in 2025 (USD 588.9 Mn). Unlike traditional cosmetics that rely on consumer perception, sol-gel formulations are being integrated into dermatology clinics where scientific evidence, sustained-release encapsulation, and high stability of actives such as vitamin C and retinoids are critical. This driver is particularly strong in the USA and Germany, where regulatory oversight and consumer preference for dermatologist-tested products are higher. Clinical validation not only drives trust and premium pricing but also positions sol-gel products as a bridge between cosmetics and medical skincare (cosmeceuticals), expanding market penetration into prescription-based treatments and professional channels.

Encapsulation & Sustained Release Enabling Next-Generation Product Innovation

The second major driver is the technological capability of sol-gel matrices to encapsulate unstable actives and release them gradually, which directly explains why this function holds 51.5% share in 2025 (USD 566.7 Mn). Ingredients such as vitamin C, peptides, and retinoids traditionally degrade quickly in topical formulations. With sol-gel, these actives retain potency for longer and are released in a controlled manner, reducing side effects like irritation while enhancing therapeutic outcomes. This has enabled innovation in serums, patches, and sunscreens, which are top growth categories. In Asia-Pacific, particularly China and Japan, this driver is even more pronounced because consumers seek multi-functional products that deliver efficacy without compromising skin sensitivity. Controlled release also allows brands to justify premium price points, enhancing profitability across both retail and clinical channels.

High Cost of Manufacturing and Scale-Up Barriers

Despite strong demand, sol-gel processing remains expensive and technically complex compared to conventional emulsion-based skincare. The need for specialized equipment, high-purity precursors, and stringent stability testing increases costs, making products significantly pricier than mass-market alternatives. This cost factor restricts penetration into pharmacies and mass beauty retail channels, where consumers are highly price-sensitive. While premium retail and e-commerce channels absorb the higher costs, scalability remains a challenge in emerging markets such as India where demand is high but willingness to pay for premium-priced treatments is limited. The cost barrier slows down mass adoption and restricts sol-gel products to higher-income consumer groups and clinical applications.

Regulatory Ambiguity in Functional Claims

Another restraint is the unclear regulatory classification of sol-gel formulations across different markets. In the USA, products marketed as “clinical-grade” often face scrutiny from the FDA if positioned too close to therapeutic claims, while in Europe, sol-gel sunscreens and UV-filtering gels face rigorous safety and labeling requirements under the EU Cosmetics Regulation. This creates compliance costs and delays in product launches, particularly for smaller companies. Furthermore, claims such as “sustained release” or “encapsulation technology” are not standardized for cosmetic regulations, leaving brands vulnerable to legal challenges or consumer skepticism if efficacy data is not transparent. This restraint may slow adoption in regions with strict oversight such as the USA and Germany, even as Asia-Pacific moves ahead with faster commercialization.

Rise of Vegan and Clean-Label Sol-Gel Skincare

While clinical-grade dominates the market today, there is a growing consumer shift toward vegan and clean-label formulations, particularly in e-commerce and premium retail channels. Vegan claims align with sustainability and ethical sourcing, while clean-label aligns with consumer demand for transparency in ingredient lists. Brands are increasingly experimenting with plant extract sol-gels and mineral oxides that not only meet ethical standards but also leverage sol-gel encapsulation to enhance performance. In markets like the UK and Japan, vegan sol-gel sunscreens and serums are gaining early traction as a differentiation strategy. This trend is expected to grow strongly by 2030, offering mid-tier players a route to compete against giants like BASF and Evonik by targeting eco-conscious and younger demographics.

E-Commerce as the Fastest-Growing Distribution Channel

Although dermatology clinics remain the trust anchor for clinical-grade sol-gel treatments, e-commerce is emerging as the fastest-growing channel, especially in Asia-Pacific and North America. Platforms like Tmall, Sephora online, and direct-to-consumer websites are increasingly offering serums, patches, and sunscreens with sol-gel technology, supported by AI-based skin analysis tools and subscription models. This trend is fueled by the ability of e-commerce to educate consumers about complex technologies like encapsulation and controlled release through digital content and influencer marketing. For China, which is already posting a 20.8% CAGR, this channel is a catalyst for mass adoption, while in the USA, premium e-commerce is helping push dermatologist-tested sol-gel serums to wider audiences. By 2035, e-commerce could rival clinics in revenue share, particularly for vegan and clean-label sol-gel lines.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.8% |

| USA | 9.2% |

| India | 23.9% |

| UK | 13.5% |

| Germany | 10.4% |

| Japan | 17.3% |

Between 2025 and 2035, the global Sol-Gel Based Skin Treatments Market will see emerging Asian markets leading growth trajectories. India stands out with the highest CAGR of 23.9%, supported by rapid urbanization, a young consumer base, and increasing awareness of premium skincare. The shift from conventional herbal formulations to advanced sol-gel encapsulated actives like vitamin C and peptides is fueling premium adoption. China, with a 20.8% CAGR, is leveraging its strong e-commerce dominance and high consumer acceptance of technologically advanced beauty products. Domestic players are partnering with global chemical majors to deliver localized sol-gel serums, sunscreens, and hydration systems tailored for sensitive skin concerns such as pollution-related damage. Japan also records a robust 17.3% CAGR, driven by its tradition of high-tech skincare innovation, where consumers prefer products with proven clinical backing and long-term efficacy. Together, these Asian markets will account for the fastest acceleration of global value, making the region the epicenter of sol-gel skincare innovation by 2035.

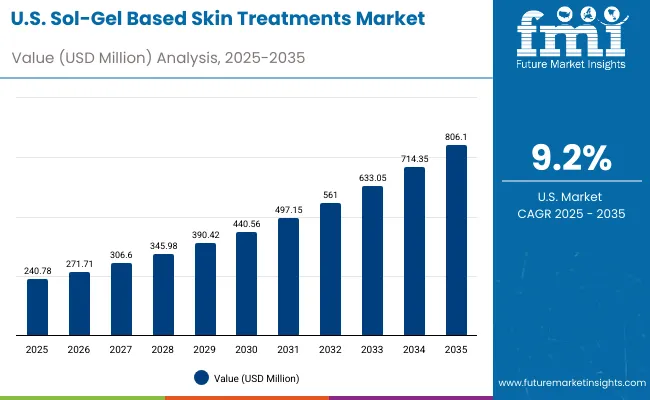

In contrast, mature Western markets grow at a more measured pace. The USA will post a 9.2% CAGR, reflecting steady expansion through clinical-grade sol-gel treatments offered in dermatology clinics and premium beauty retail. While the market value is large, growth is tempered by regulatory scrutiny and a slower shift toward mass consumer adoption. The UK, with 13.5% CAGR, benefits from rising consumer preference for vegan and clean-label sol-gel products, aligning with broader sustainability-driven purchasing behavior. Germany, at 10.4% CAGR, is anchored by its strong pharmacy channel and strict regulatory environment, ensuring that only clinically validated formulations achieve traction. Western Europe is therefore expected to remain a stable but slower-growth market, compared to Asia’s rapid expansion, with innovation focused more on compliance, clinical credibility, and premium positioning.

| Year | USA Sol-Gel Based Skin Treatments Market (USD Million) |

|---|---|

| 2025 | 240.78 |

| 2026 | 271.71 |

| 2027 | 306.60 |

| 2028 | 345.98 |

| 2029 | 390.42 |

| 2030 | 440.56 |

| 2031 | 497.15 |

| 2032 | 561.00 |

| 2033 | 633.05 |

| 2034 | 714.35 |

| 2035 | 806.10 |

The global Sol-Gel Based Skin Treatments Market in the United States is projected to grow at a CAGR of 9.2%, led by strong adoption of clinical-grade and dermatologist-tested formulations. Clinical validation has been the anchor of growth, with clinical-grade claims already accounting for 55.1% share in 2025 (USD 132.8 Mn). Dermatology clinics are driving early adoption of sol-gel encapsulated serums and sunscreens for anti-aging, acne management, and photoprotection. The USA consumer base values clinical efficacy and transparency, pushing companies to invest in peer-reviewed studies and FDA-compliant claims. Pharmacies and premium beauty retailers are expanding shelf space for sol-gel hydration systems and patches that demonstrate measurable results.

The global Sol-Gel Based Skin Treatments Market in the United Kingdom is expected to grow at a CAGR of 13.5%, supported by increasing consumer preference for vegan and clean-label formulations. The UK is a hub for sustainability-conscious consumers, where plant extract sol-gel serums and mineral oxide sunscreens are gaining traction. Premium retail and e-commerce platforms such as Selfridges and Lookfantastic have accelerated product visibility, while dermatologists are increasingly recommending sol-gel hydration systems for sensitive skin types. Local demand is also being influenced by strong regulation of ingredient transparency and cruelty-free claims, reinforcing growth in vegan-certified sol-gel solutions.

India is witnessing the fastest expansion globally, with the Sol-Gel Based Skin Treatments Market forecast to grow at a CAGR of 23.9% through 2035. Rising middle-class incomes, beauty-conscious youth demographics, and growing urbanization are accelerating demand for advanced formulations. Indian consumers are moving from traditional ayurvedic products to premium sol-gel based serums and patches due to their visible performance in brightening, hydration, and sun protection. Cost-effective launches are penetrating tier-2 and tier-3 cities, where e-commerce platforms are key distribution enablers. Additionally, dermatology clinics in metros are increasingly adopting clinical-grade sol-gel treatments for pigmentation and acne therapy, supported by a surge in cosmetic dermatology demand.

The global Sol-Gel Based Skin Treatments Market in China is projected to expand at a CAGR of 20.8%, the highest among leading economies after India. Growth is powered by e-commerce leadership, smart retail ecosystems, and rising adoption of high-tech beauty solutions. Encapsulation and sustained release functions already account for 52.4% share in 2025 (USD 67.4 Mn), showing that Chinese consumers value advanced delivery technologies that prolong the efficacy of vitamins and peptides. Domestic brands are competing with global majors by offering affordable sol-gel serums and sunscreens, while premium consumers gravitate toward dermatologist-tested solutions with international credibility. The rise of digital-native beauty brands on platforms like Tmall and Douyin is accelerating mass awareness of sol-gel formulations, making China a high-volume growth driver.

| USA by Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 55.1% |

| Others | 44.9% |

The global Sol-Gel Based Skin Treatments Market in the United States is valued at USD 240.8 million in 2025, growing at a CAGR of 9.2%. Clinical-grade formulations hold a clear lead with 55.1% market share (USD 132.8 Mn), supported by strong demand for dermatologist-tested serums, sunscreens, and hydration systems. This dominance reflects the USA consumer emphasis on efficacy and safety, where dermatologist recommendations and FDA-compliant claims strongly influence purchasing decisions. Pharmacies and dermatology clinics are the main distribution pillars, while premium beauty retailers and e-commerce channels provide expansion into lifestyle-driven skincare adoption.

The USA market outlook is shaped by rising integration of sol-gel encapsulated vitamins, peptides, and oxides into professional treatments. These are increasingly used for anti-aging, acne, and pigmentation management, demonstrating measurable clinical outcomes. Furthermore, dermatologist-tested vegan and clean-label sol-gel serums are gaining traction among younger demographics seeking a balance of science and sustainability. By 2035, the USA is expected to remain a high-value but steady-growth market, dominated by clinical validation and strict regulatory compliance.

| China by Function | Value Share% 2025 |

|---|---|

| Encapsulation & sustained release | 52.4% |

| Others | 47.6% |

The global Sol-Gel Based Skin Treatments Market in China is valued at USD 128.4 million in 2025, with encapsulation and sustained release leading at 52.4% (USD 67.4 Mn). China is projected to grow at a CAGR of 20.8%, one of the fastest globally. The dominance of encapsulation is directly tied to consumer expectations for potent yet gentle skincare, where stability of vitamins and peptides under high pollution and UV exposure conditions is a priority. Chinese consumers, especially in Tier-1 cities, are highly receptive to advanced delivery systems and clinical-science claims, accelerating adoption of sol-gel serums and sunscreens.

The market opportunity is further expanded by e-commerce ecosystems such as Tmall, JD.com, and Douyin, where sol-gel infused products are marketed with strong scientific storytelling and influencer advocacy. Local brands are competing with global majors by introducing cost-effective sol-gel sunscreens and hydration masks, while premium imports attract affluent consumers demanding dermatologist-tested or clean-label claims. By 2035, China is set to outpace Western markets in growth share, becoming one of the core global hubs for sol-gel skincare innovation.

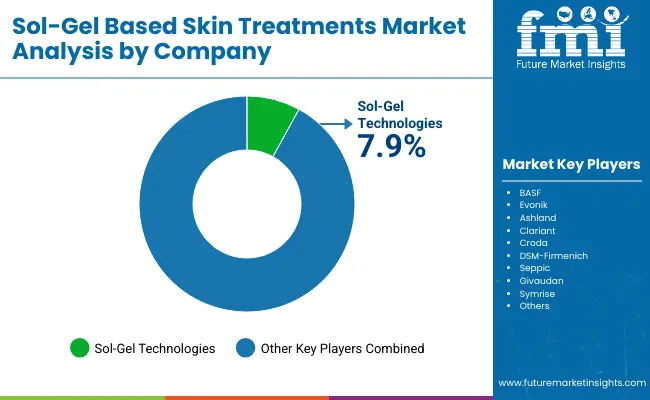

| Company | Global Value Share 2025 |

|---|---|

| Sol-Gel Technologies | 7.9% |

| Others | 92.1% |

The global Sol-Gel Based Skin Treatments Market is moderately fragmented, with chemical majors, biotech innovators, and niche cosmeceutical specialists competing across claims, functions, and product categories. Sol-Gel Technologies holds a visible lead with 7.9% global share in 2025, leveraging proprietary expertise in encapsulation and sustained release systems for clinical dermatology. Their pipeline includes advanced serums and sunscreen prototypes that are gaining traction in both the USA and European markets.

Global chemical leaders such as BASF, Evonik, Croda, Ashland, DSM-Firmenich, and Clariant drive scale through raw material expertise, focusing on sol-gel precursors and active delivery platforms. These players are actively positioning themselves as backbone suppliers for global premium skincare brands, integrating sol-gel science into broader cosmeceutical formulations. Mid-sized innovators like Seppic, Givaudan, and Symrise emphasize plant extract sol-gel systems and vegan/clean-label formulations, targeting e-commerce-driven beauty brands in Asia-Pacific.

Competitive differentiation is increasingly shifting away from chemical supply alone to integrated ecosystems, combining sol-gel encapsulation with clinical validation, consumer-friendly claims (dermatologist-tested, vegan, clean-label), and multichannel distribution strategies. Partnerships between dermatology clinics and premium retailers are creating exclusive sol-gel product lines, while biotech entrants are carving space by combining sol-gel technology with microbiome research and AI-driven personalized skincare.

Key Developments in Global Sol-Gel Based Skin Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,102.9 Million |

| Function | Encapsulation & sustained release, Barrier formation, UV-filtering gels, Hydration systems |

| Active Type | Vitamins (C, E, retinoids), Peptides, Minerals & oxides, Plant extracts |

| Product Type | Creams/lotions, Serums, Patches/masks, Sunscreens |

| Channel | Dermatology clinics, E-commerce, Premium beauty retail, Pharmacies |

| Claim | Clinical-grade, Dermatologist-tested, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Evonik, Ashland, Clariant, Croda, Sol-Gel Technologies, DSM- Firmenich, Seppic, Givaudan, Symrise |

| Additional Attributes | Dollar sales by claim, function, and product type; rising adoption in dermatology clinics and premium retail; e-commerce penetration driving vegan and clean-label launches; encapsulation innovation in vitamins and peptides; regional differences in clinical-grade adoption; growing demand for sol-gel sunscreens in high-UV markets; active R&D in encapsulation stability; sustained release systems as innovation pipelines; mergers and partnerships between chemical majors and skincare brands. |

The global Sol-Gel Based Skin Treatments Market is estimated to be valued at USD 1,102.9 million in 2025.

The market size for the global Sol-Gel Based Skin Treatments Market is projected to reach USD 3,950.3 million by 2035.

The global Sol-Gel Based Skin Treatments Market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in the global Sol-Gel Based Skin Treatments Market are creams/lotions, serums, patches/masks, and sunscreens.

In terms of claim, the clinical-grade segment commands 53.3% share of the global Sol-Gel Based Skin Treatments Market in 2025, equivalent to USD 588.9 million.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

AI-based Clinical Trials Solution Provider Market Trends – Growth & Forecast 2024-2034

Biobased Transformer Oil Market

CO2-based Polycarbonate Polyol Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Sky Based Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA