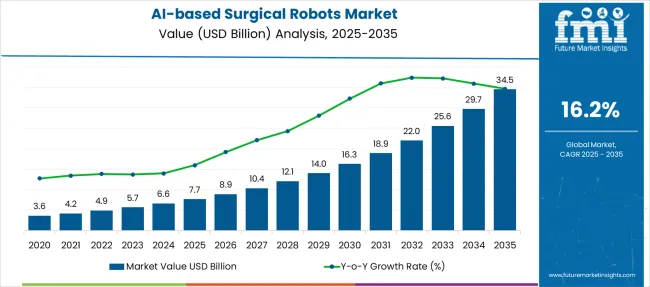

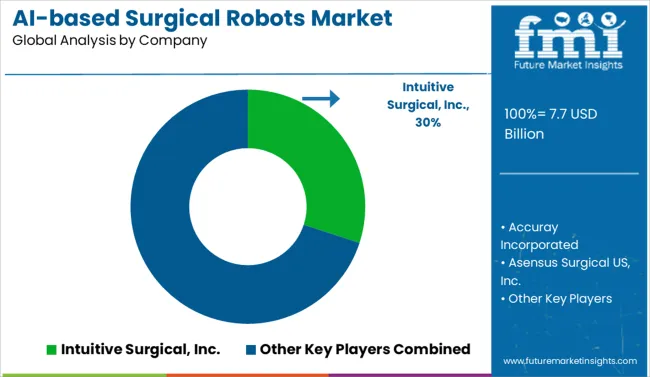

The AI-based Surgical Robots Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 34.5 billion by 2035, registering a compound annual growth rate (CAGR) of 16.2% over the forecast period.

| Metric | Value |

|---|---|

| AI-based Surgical Robots Market Estimated Value in (2025E) | USD 7.7 billion |

| AI-based Surgical Robots Market Forecast Value in (2035F) | USD 34.5 billion |

| Forecast CAGR (2025 to 2035) | 16.2% |

The AI-based surgical robots market is undergoing significant transformation as advancements in artificial intelligence, precision engineering, and clinical workflow integration reshape surgical practices. The adoption of these systems is being driven by the need for minimally invasive procedures, improved patient outcomes, and reduced operating times.

Hospitals and surgical centers are increasingly investing in AI-driven robotic platforms to enhance surgeon capabilities, lower complication rates, and optimize resource utilization. Future growth is expected to be supported by ongoing innovation in machine learning algorithms, haptic feedback technologies, and cloud-based data analytics that enhance system intelligence and usability.

Regulatory approvals for broader indications and rising acceptance among surgeons are paving the way for deeper market penetration and long-term scalability across diverse surgical disciplines.

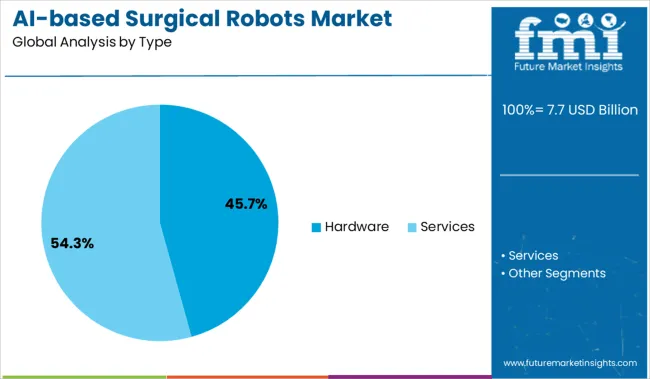

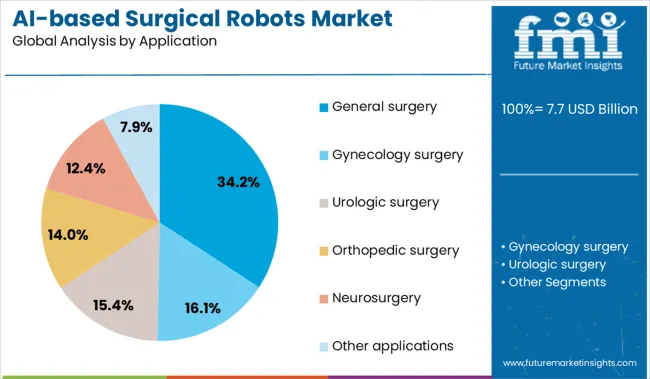

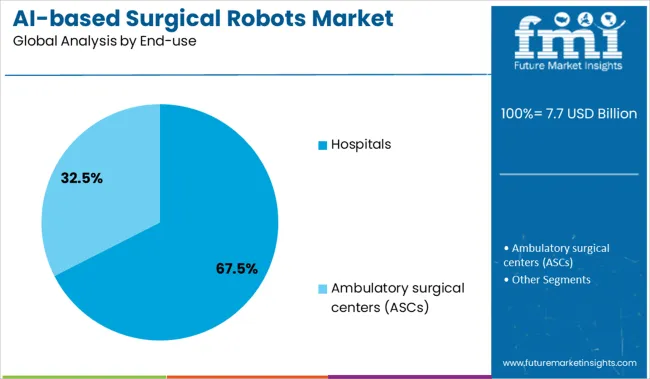

The AI-based surgical robots market is segmented by type, application, and end-use and geographic regions. By type of the AI-based surgical robots market is divided into Hardware and Services. In terms of application of the AI-based surgical robots market is classified into General surgery, Gynecology surgery, Urologic surgery, Orthopedic surgery, Neurosurgery, and Other applications. Based on end-use of the AI-based surgical robots market is segmented into Hospitals and Ambulatory surgical centers (ASCs). Regionally, the AI-based surgical robots industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, hardware is expected to account for 45.7% of the total market revenue in 2025, positioning it as the leading segment. This dominance is being attributed to the substantial investment required for high-precision robotic arms, control consoles, and visualization systems that form the core of AI-based surgical solutions.

The mechanical and electronic components are engineered for accuracy, stability, and sterility, which are critical in surgical environments. The durability and customization options of hardware have enabled healthcare providers to achieve better return on investment by extending system lifecycles and upgrading software without replacing the entire platform.

Continuous improvements in robotic architecture, material science, and sensor integration have reinforced hardware’s indispensable role in delivering reliable and reproducible surgical performance.

In terms of application, general surgery is projected to contribute 34.2% of the market revenue share in 2025, making it the largest application segment. This leadership is being driven by the widespread applicability of AI-enabled robotic systems in common procedures such as cholecystectomies, hernia repairs, and colorectal surgeries.

The ability of these systems to enhance precision, minimize tissue trauma, and reduce postoperative recovery times has encouraged their adoption in general surgery settings. AI algorithms are being leveraged to support intraoperative decision-making and adapt instrument trajectories in real time, increasing procedural safety and efficiency.

Hospitals are prioritizing general surgery for robotic integration due to the high procedural volumes and opportunity to improve throughput while maintaining clinical quality standards, further consolidating this segment’s position.

Segmented by end use, hospitals are expected to command 67.5% of the market revenue in 2025, retaining their status as the dominant end-user segment. This leadership is being underpinned by the concentration of surgical expertise, financial resources, and patient volumes within hospital settings, which enable effective deployment of advanced AI-based robotic platforms.

Hospitals have been actively investing in these systems to remain competitive, attract skilled surgeons, and meet rising patient expectations for cutting-edge care. Centralized procurement processes, availability of dedicated operating rooms, and trained support staff have facilitated seamless integration of robotic technology into hospital workflows.

Furthermore, the focus on enhancing operational efficiency and meeting accreditation standards has reinforced hospitals’ preference for adopting these systems at scale, ensuring sustained leadership of this segment in the foreseeable future.

AI powered surgical robot systems are advancing rapidly as hospitals prioritize precision driven robotic surgery and improved patient outcomes. Future opportunities exist in adaptive learning platforms, cross integration with imaging modalities, and expansion into general surgery and ambulatory care.

Hospitals worldwide are adopting AI guided surgical robots to perform complex procedures with greater accuracy and minimal invasiveness. These systems support precise instrument guidance, tremor filtration, and real time analytics to help surgeons navigate challenging anatomical structures and reduce errors. Clinical evidence demonstrates shorter recovery times and lower complication rates in procedures ranging from urology to thoracic surgery. Health institutes are increasingly investing in robot assisted surgeries to enhance surgical throughput and maintain competitive quality metrics. Enhanced post-surgical data capture builds predictive models for patient recovery and outcome optimization. These features, combined with training simulation integration, help hospitals build proficiency in robotic techniques and support faster expansion of robotic surgery programs.

Growth opportunities lie in AI driven adaptive learning platforms that refine robotic movements through machine learning from historical surgical data. Integration with imaging technologies such as intra operative MRI and augmented reality overlays enables dynamic targeting and surgical planning. As system intelligence evolves, entry into general surgery, ENT, orthopaedics, and outpatient procedures becomes viable. Subscription based service models that include software updates and analytics even for installed hardware enable flexible deployment. Partnerships between robotics providers and academic medical centers support clinical validation and early adopters. Development of compact surgical robots suitable for ambulatory care settings or procedure specific systems for eye surgery or pediatric applications opens new commercial pathways.

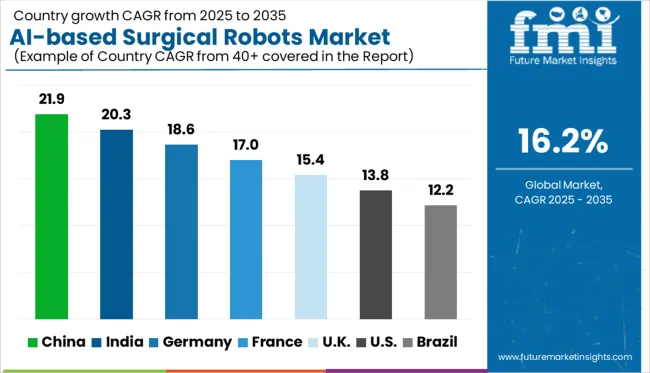

| Country | CAGR |

|---|---|

| China | 21.9% |

| India | 20.3% |

| Germany | 18.6% |

| France | 17.0% |

| UK | 15.4% |

| USA | 13.8% |

| Brazil | 12.2% |

The global AI-based surgical robots market is projected to expand at a CAGR of 16.2% from 2025 to 2035, driven by advances in precision robotics, real-time data processing, and AI-assisted clinical decision-making. Despite the strong global trajectory, growth rates vary significantly across regions. China, representing BRICS, leads the pack with a 6.3% CAGR, supported by strategic government investments, rising surgical volumes, and rapid AI integration in healthcare infrastructure. India follows at 5.9%, driven by increasing robotic surgery adoption in urban hospitals and med-tech innovation hubs. Germany, a core OECD member, maintains a 5.4% CAGR, focused on high-tech surgical systems and training frameworks. In contrast, the UK (4.5%) and the US (4.0%) show modest growth due to market maturity and regulatory pacing. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is expected to grow its AI-based surgical robot market at a CAGR of 6.3%, driven by massive digitization of healthcare systems. Unlike the slower-expanding USA market, China benefits from direct government subsidies, domestic manufacturing incentives, and high-volume procedural demand. National AI pilots are pushing boundaries in pre-surgical planning, image-guided navigation, and post-operative analytics. Hospital adoption extends beyond top-tier cities, with rural installations rising. While India is rapidly advancing, China maintains a technological edge with AI-native robotic systems.

India is charting a strong CAGR of 5.9%, placing it ahead of both Germany and the United Kingdom in market momentum. Unlike China, India’s growth is led by the private sector, with corporate hospital chains aggressively investing in robotic systems for high-margin specialties. Cost innovation is central, with startups engineering compact robots for Tier-2 city hospitals. However, challenges persist in AI localization and surgeon training. The Indian market shows divergence from the USA by skipping legacy surgical systems and directly embracing AI-enhanced robotics.

In Germany, AI-based surgical robot market is advancing at a CAGR of 5.4%, backed by a robust medtech ecosystem and demand for surgical precision in orthopedic and neurological fields. Growth, while solid, lags behind India and China due to slower integration of AI into clinical practice. German institutions prioritize proven, CE-certified systems and often require multiple clinical validation studies before adoption. Compared to the UK, Germany has deeper collaborations between hospitals and local robotics firms, allowing for iterative design based on direct surgical feedback.

The United Kingdom is projected to see a CAGR of 4.5%, reflecting budget constraints and procurement delays in the public health sector. Growth trails behind Germany, as the National Health Service requires longer validation timelines. However, the private sector and academic hospitals are exploring hybrid AI-assisted surgical modules. Unlike Germany, the UK emphasizes open-system compatibility, preferring modular solutions that integrate with existing OR infrastructure. Innovation is seen more in software overlays than full robotic platforms.

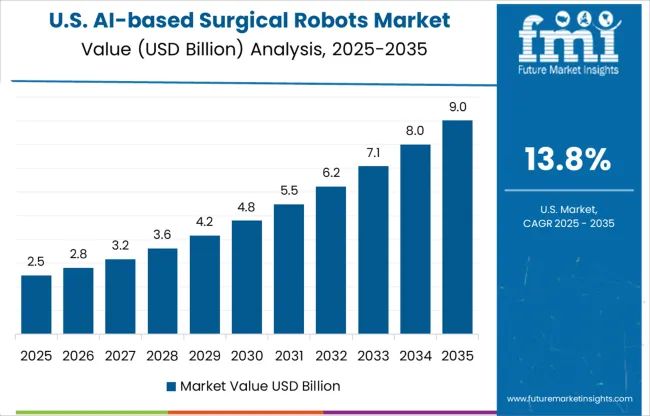

The United States market is set to expand at a CAGR of 4%, the slowest among the top five economies. This mature market is pivoting from hardware growth to software upgrades. Hospitals prefer extending the life of existing robotic systems through AI software layering, rather than purchasing new units. Unlike China, where government directives lead demand, the USA relies on ROI-driven procurement models. While leading in early innovation, saturation of systems like Da Vinci has limited incremental growth.

The AI-based surgical robots market is moderately consolidated, dominated by a few global players with proprietary robotic platforms and AI-integrated systems. Intuitive Surgical leads with its da Vinci Surgical System, supported by a strong global installed base and continuous software innovation. Medtronic follows closely, investing in AI-powered enhancements for its Hugo™ system. Johnson & Johnson (through Auris Health) and Stryker are also key players, advancing minimally invasive and orthopedic robotics, respectively. Zimmer Biomet and Siemens Healthineers are strengthening their portfolios via acquisitions and AI integration. Market competition revolves around precision, clinical outcomes, regulatory approvals, and AI-driven data analytics, driving ongoing innovation and partnerships.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Type | Hardware and Services |

| Application | General surgery, Gynecology surgery, Urologic surgery, Orthopedic surgery, Neurosurgery, and Other applications |

| End-use | Hospitals and Ambulatory surgical centers (ASCs) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Intuitive Surgical, Inc., Accuray Incorporated, Asensus Surgical US, Inc., CMR Surgical, Inc., Medtronic plc, meerecompany Inc., Moon Surgical, Smith and Nephew, Stryker Corporation, and Zimmer Biomet |

| Additional Attributes | Dollar sales by robot type, surgical specialty, and healthcare facility type; regional demand driven by aging populations, surgical precision needs, and hospital automation; innovation in real-time imaging, machine learning, and robotic-assisted decision-making; cost dynamics shaped by system integration, maintenance, and training; environmental impact of device lifecycle and disposables; and emerging use cases in microsurgery, tele-surgery, and outpatient robotic procedures. |

The global AI-based surgical robots market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the AI-based surgical robots market is projected to reach USD 34.5 billion by 2035.

The AI-based surgical robots market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in AI-based surgical robots market are hardware, _robotic systems, _instruments & accessories and services.

In terms of application, general surgery segment to command 34.2% share in the AI-based surgical robots market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA