The world market for surgical clips is set to grow from USD 1,161.2 Million in 2025 to USD 23,349.4 Million by 2035. This means it will grow 35% each year. More hospitals and surgery places, new medical tools, and more money for health in both rich and poor countries will help this growth. Also, government efforts to improve healthcare systems and a higher need for low-cost, effective surgeries help the market grow.

The surgical clips market is set to grow a lot from 2025 to 2035. This is because more people are having surgeries. There are also new ways to do small cuts in the body and more people are using clips instead of stitches. Surgical clips are handy in many surgeries.

They are used in small cut surgery, open surgery, and with robots. Clips save time and help to avoid problems. The market will likely see more need for clips soon. This is due to more old people, more long-term diseases, and a shift to new surgeries that help patients better.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1,161.2 Million |

| Market Value (2035F) | USD 23,349.4 Million |

| CAGR (2025 to 2035) | 35% |

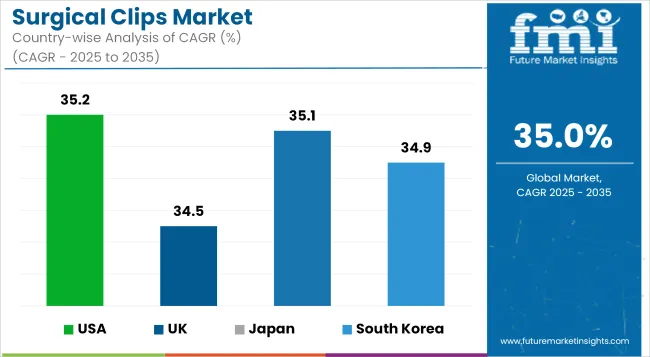

North America will lead the market for surgical clips. This is because it has good health systems, many surgeries, and large amounts spent on research. The USA has the biggest market due to many cases of serious diseases like heart issues and cancer, needing surgery. More people using robot-helped surgeries and better clip designs are big growth factors. Top medical device makers and good payment rules also help this market grow.

Europe has a big part in the surgical clips market. Germany, the UK, France, and Italy are key players. The region has good medical facilities, spends a lot on healthcare, and wants more small-scale operations. European healthcare aims to better patient results with new surgical methods, raising the use of surgical clips. Also, rules that help new medical devices and big companies in the area boost market growth.

Asia will see fast growth in the surgical clips market. Better healthcare, more medical travel, and more surgeries are driving this. China, India, Japan, and Korea are investing in healthcare. This leads to more hospitals and surgery centers. More old people and long-term diseases are raising market needs. Governments are pushing for better medical care too. Cheap production spots are bringing medical device makers to this area.

High Cost and Stringent Regulatory Requirements

High prices of advanced surgical clips and stringent regulatory requirements for the approval and distribution of medical devices are some of the primary obstacles hindering the market growth. Surgical clips used specifically during the performed robotic and laparoscopic procedures require optimal materials and precise manufacturing steps, which add to high-costs.

The stringent approval processes imposed by regulatory bodies, including but not limited to the USA FDA, European Medicines Agency (EMA), and other national regulatory agencies further delay new products from entering the market, thus affecting overall growth. In particular, smaller medical device companies have to deal with a lot of barriers when obtaining the certifications needed to produce their devices due to complex compliance requirements and the high cost of research and development.

Growth in Robotic-Assisted Surgeries and Biocompatible Materials

There is a significant opportunity for the surgical clips market with an increase in robotic-assisted surgeries and biocompatible materials. Enhanced precision, reduced surgical trauma and faster patient recovery times make robotic-assisted procedures an attractive option for patients and surgeons alike.

This trend has also driven the need for surgical clips compatible with robotic systems. Innovation in the market is likely to progress with the introduction of biodegradable and bioabsorbable surgical clips, eliminating the need for removal of clip post-surgery and improving patient convenience. The rise of these developments is expected to give manufacturers that focus on advanced surgical solutions a competitive advantage

The global surgical clips market is expected to grow steadily between 2025 to 2035. This will grow due to the increases in easy and small surgery methods, the amount of surgeries in the world, and safe-to-body products. Surgical clips are frequently used in medicine to control bleeding, close wounds, and approximate tissues. Clips like these are getting increasingly common because they speed up surgery, decrease complications after surgery, and lead to improved healing among patients.

More people have long-term illnesses that require surgery, such as heart disease, stomach problems and cancer. That means more people than ever need surgical clips. Moreover, the market is also expected to grow because old people need more surgeries.

New technology including absorbable clips, absorbable vs. non-absorbable clips, robot surgeries, and MRI-safe materials are accelerating the market growth. Increasing investment in hospital care, especially in developing regions, fuels the need for surgical clips in hospitals, surgery centers, and specific clinics.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA and EU medical device regulations for safety and efficacy. |

| Technological Advancements | Development of titanium and polymer-based surgical clips for enhanced durability. |

| Industry Applications | Primarily used in laparoscopic surgeries, cholecystectomy, and vascular surgeries. |

| Adoption of Smart Equipment | Limited integration with robotic-assisted surgery. |

| Sustainability & Cost Efficiency | Focus on cost-effective reusable clips for cost-conscious hospitals. |

| Data Analytics & Predictive Modeling | Basic clinical data collection for surgical clip performance. |

| Production & Supply Chain | Global supply chains disrupted due to pandemic-related shortages. |

| Market Growth Drivers | Rising number of minimally invasive procedures and growing geriatric population. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations focusing on biocompatibility, sterilization standards, and MRI-compatibility. |

| Technological Advancements | Expansion of bioabsorbable clips and smart surgical clips that integrate with robotic surgical systems. |

| Industry Applications | Broader adoption in robotic-assisted surgeries, neurological procedures, and oncological treatments. |

| Adoption of Smart Equipment | Increased usage of robotic-assisted and AI-guided surgical clipping systems. |

| Sustainability & Cost Efficiency | Growth of biodegradable clips that reduce environmental impact and risk of post-surgical complications. |

| Data Analytics & Predictive Modeling | Advanced predictive analytics for surgical outcomes and real-time monitoring of clip placement. |

| Production & Supply Chain | Strengthened regional manufacturing hubs and automated production to reduce supply chain disruptions. |

| Market Growth Drivers | Increased adoption of AI in surgery, advancements in patient-specific surgical clips, and expanding applications in robotic surgery. |

The USA has a strong surgical clips market. The need for less invasive and laparoscopic surgeries keeps growing. More people get heart and stomach issues. Robotic surgeries are getting better too. Surgical clips you see in these studies must pass FDA rules for safety.

Trends show people like biodegradable and clips that work with MRI. More money goes into new surgery ideas. Titanium and polymer clips are also more popular. Advanced clip tech is needed. This comes from more hospitals and more small surgery centers opening.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 35.2% |

The United Kingdom surgical clips market is driving due to rising incidence of chronic diseases and growing demand for surgical procedures are some of the factors that drive surgical clips market. Surgical clips and their regulation and safety are overseen by the Medicines and Healthcare Products Regulatory Agency (MHRA).

Increased demand for robotic-assisted laparoscopic surgeries, a shift toward biocompatible and corrosion-resistant materials, and growing adoption of customized clip applicators for augmented surgical precision comprise the market trends. Moreover, the growth of the surgical training and skills market is aiding the expansion of the equipment market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 34.5% |

Growing medical regulations in the EU and domestic surgical adoption rates drive the demand for Surgical Clips in the European Union (EU) are high due to the increasing need for short surgical procedures and technological advances in the surgical tool industry In order to comply strictly with safety and performance requirements, the European Medicines Agency (EMA) and Medical Device Regulation (MDR) has to be followed.

Germany, France, and Italy are key market players in Europe due to factors such as strong healthcare infrastructure, high adoption rates of advanced surgical techniques, and growing investments in research & development activities. The market is also gaining from the increasing use of biodegradable and absorbable surgical clips to decrease post-operative complications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 34.8% |

In Japan, The surgical clips market is currently evolving at a moderate pace due to a rapidly aging demographic, surging demand for less invasive procedures, and the deployment of high-tech & sophisticated surgical technologies. This agency is called the Pharmaceuticals and Medical Devices Agency (PMDA) and serves to ensure that surgical clips (among other medical devices) are safe and effective.

The major trends being witnessed in this domain include the increasing demand for laparoscopy and endoscopy surgeries, development of newer clip materials to improve biocompatibility and growing integration of robotics into medicine. Moreover, the increased emphasis of Japan on premium medical devices and patient safety is driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 35.1% |

The market for surgical clips in South Korea is growing fast. This is because of more money for healthcare, higher use of new surgery ways, and help from the government for new medical tools. The Korean Food and Drug Safety Ministry (MFDS) checks if surgical clips are safe and work well.

Trends in the market show more interest in robot-assisted surgeries, more need for MRI-safe and clips that break down in the body, and more use of clips made from polymers to lower surgery issues. Also, South Korea's booming medical tourism is boosting the need for precise surgical tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 34.9% |

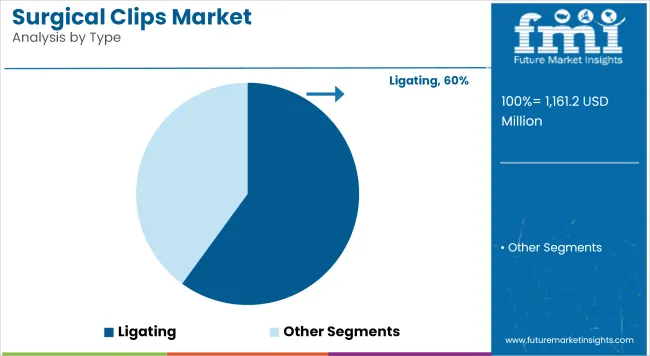

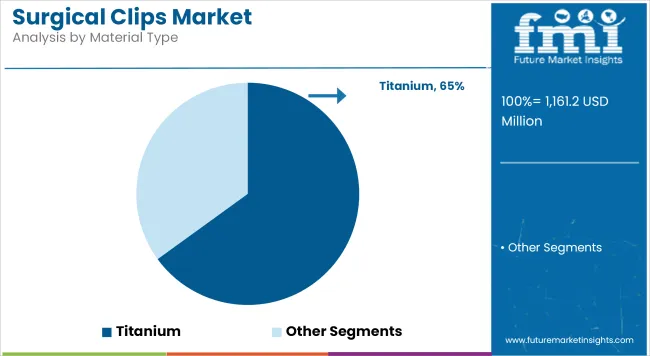

The market for surgical clips is growing because more people are having surgeries. Also, more doctors are using less invasive methods, and there are better materials now. Ligating clips are the most popular type. Titanium is the top material because it is strong, doesn't rust, and works well for many surgeries.

Market Share by Type (2025)

| Type | Market Share (2025) |

|---|---|

| Ligating | 60.0% |

Ligating clips dominate the market as they are essential in surgeries for closing vessels, stopping bleeding, and managing the tissues. These clips are employed in numerous kinds of surgery, including general surgical procedures, gynecological and urological surgery, in addition to laparoscopic surgeries. They serve as good alternatives to stitches.

Now more people are undergoing less invasive surgeries. Robotic and laparoscopic procedures are also increasing, so the demand for these clips is increasing. New designs, for example self-locking clips, absorbable clips and clips with improved coatings, make them perform better and minimize problems in the post-operative period.

Market Share by Material Type (2025)

| Material Type | Market Share (2025) |

|---|---|

| Titanium | 65.0% |

Titanium clips for surgery lead the market because they work well with the body. They don't react, are strong, and perfect for important tasks that need a strong and steady closure. These clips work well with MRI machines too, thus, doctors use them in brain and vessel surgeries.

More people now want light, sturdy, and precise clips, pushing the use of titanium clips. New improvements in surface layers, blending of materials, and custom 3D-printed clips are set to make surgeries better and safer for patients.

The need for improved ways to stop bleeding in surgeries is making the market for surgical clips grow. These clips help stop bleeding and close vessels in both open surgeries and smaller, less invasive ones. The increase in surgeries, new clip designs, and the favor for minimally invasive techniques are driving the market. Companies aim at making new products like clips that the body can absorb and those that work with surgical robots.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Teleflex Incorporated | 18-22% |

| B. Braun Melsungen AG | 14-18% |

| Medtronic | 12-16% |

| Johnson & Johnson (Ethicon) | 10-14% |

| Boston Scientific Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Teleflex Incorporated | In 2024, launched a cutting-edge polymer clip for straightforward surgery. |

| B. Braun Melsungen AG | In 2025, added safe surgical clips to its list for better patient care. |

| Medtronic | In 2024, brought out a robotic clip tool for exact vessel closing. |

| Johnson & Johnson (Ethicon) | In 2025, made clips that dissolve to help recovery and lower risks. |

| Boston Scientific Corporation | In 2024, introduced MRI-safe clips for brain and heart procedures. |

Key Company Insights

Teleflex Incorporated (18-22%)

A top maker of surgery clips, they focus on high-grade plastic and metal clips. Their clips are used for vein and stomach operations.

B. Braun Melsungen AG (14-18%)

Specializes in biocompatible and corrosion-resistant surgical clips, enhancing safety and long-term effectiveness.

Medtronic (12-16%)

Develops innovative robotic-assisted clip appliers, improving precision in minimally invasive surgeries.

Johnson & Johnson (Ethicon) (10-14%)

Pioneers absorbable surgical clips, reducing the need for post-surgical interventions and minimizing complications.

Boston Scientific Corporation (6-10%)

Focuses on specialized surgical clips for cardiovascular and neurological applications, ensuring compatibility with imaging technologies.

Other Key Players (30-40% Combined)

Many makers and sellers add to the market using new ideas in surgical clip design, better materials, and task-specific improvements. These firms are:

The overall market size for the surgical clips market was USD 1,161.2 Million in 2025.

The surgical clips market is expected to reach USD 23,349.4 Million in 2035.

Rising prevalence of chronic diseases requiring surgical interventions, increasing adoption of minimally invasive surgeries, technological advancements in surgical clip materials, and growing demand for effective hemostatic solutions will drive market growth.

The USA, Germany, China, Japan, and India are key contributors.

The titanium surgical clips segment is expected to lead due to its biocompatibility, non-corrosive properties, and widespread use in laparoscopic and open surgeries.

Table 1: Global Market Value (US$ Million),By Type, 2018 to 2022

Table 2: Global Market Value (US$ Million),By Type, 2023 to 2033

Table 3: Global Market Value (US$ Million), By Material Type, 2018 to 2022

Table 4: Global Market Value (US$ Million), By Material Type, 2023 to 2033

Table 5: Global Market Value (US$ Million), By Surgery Type, 2018 to 2022

Table 6: Global Market Value (US$ Million), By Surgery Type, 2023 to 2033

Table 7: Global Market Value (US$ Million), By End-User, 2018 to 2022

Table 8: Global Market Value (US$ Million), By End-User, 2023 to 2033

Table 9: Global Market, By Region, 2018 to 2022

Table 10: Global Market, By Region, 2023 to 2033

Table 11: North America Market Value (US$ Million),By Type, 2018 to 2022

Table 12: North America Market Value (US$ Million),By Type, 2023 to 2033

Table 13: North America Market Value (US$ Million), By Material Type, 2018 to 2022

Table 14: North America Market Value (US$ Million), By Material Type, 2023 to 2033

Table 15: North America Market Value (US$ Million), By Surgery Type, 2018 to 2022

Table 16: North America Market Value (US$ Million), By Surgery Type, 2023 to 2033

Table 17: North America Market Value (US$ Million), By End-User, 2018 to 2022

Table 18: North America Market Value (US$ Million), By End-User, 2023 to 2033

Table 19: North America Market, By Country, 2018 to 2022

Table 20: North America Market, By Country, 2023 to 2033

Table 21: Latin America Market Value (US$ Million),By Type, 2018 to 2022

Table 22: Latin America Market Value (US$ Million),By Type, 2023 to 2033

Table 23: Latin America Market Value (US$ Million), By Material Type, 2018 to 2022

Table 24: Latin America Market Value (US$ Million), By Material Type, 2023 to 2033

Table 25: Latin America Market Value (US$ Million), By Surgery Type, 2018 to 2022

Table 26: Latin America Market Value (US$ Million), By Surgery Type, 2023 to 2033

Table 27: Latin America Market Value (US$ Million), By End-User, 2018 to 2022

Table 28: Latin America Market Value (US$ Million), By End-User, 2023 to 2033

Table 29: Latin America Market, By Country, 2018 to 2022

Table 30: Latin America Market, By Country, 2023 to 2033

Table 31: Europe Market Value (US$ Million),By Type, 2018 to 2022

Table 32: Europe Market Value (US$ Million),By Type, 2023 to 2033

Table 33: Europe Market Value (US$ Million), By Material Type, 2018 to 2022

Table 34: Europe Market Value (US$ Million), By Material Type, 2023 to 2033

Table 35: Europe Market Value (US$ Million), By Surgery Type, 2018 to 2022

Table 36: Europe Market Value (US$ Million), By Surgery Type, 2023 to 2033

Table 37: Europe Market Value (US$ Million), By End-User, 2018 to 2022

Table 38: Europe Market Value (US$ Million), By End-User, 2023 to 2033

Table 39: Europe Market, By Country, 2018 to 2022

Table 40: Europe Market, By Country, 2023 to 2033

Table 41: Asia Pacific Market Value (US$ Million),By Type, 2018 to 2022

Table 42: Asia Pacific Market Value (US$ Million),By Type, 2023 to 2033

Table 43: Asia Pacific Market Value (US$ Million), By Material Type, 2018 to 2022

Table 44: Asia Pacific Market Value (US$ Million), By Material Type, 2023 to 2033

Table 45: Asia Pacific Market Value (US$ Million), By Surgery Type, 2018 to 2022

Table 46: Asia Pacific Market Value (US$ Million), By Surgery Type, 2023 to 2033

Table 47: Asia Pacific Market Value (US$ Million), By End-User, 2018 to 2022

Table 48: Asia Pacific Market Value (US$ Million), By End-User, 2023 to 2033

Table 49: Asia Pacific Market, By Country, 2018 to 2022

Table 50: Asia Pacific Market, By Country, 2023 to 2033

Table 51: MEA Market Value (US$ Million),By Type, 2018 to 2022

Table 52: MEA Market Value (US$ Million),By Type, 2023 to 2033

Table 53: MEA Market Value (US$ Million), By Material Type, 2018 to 2022

Table 54: MEA Market Value (US$ Million), By Material Type, 2023 to 2033

Table 55: MEA Market Value (US$ Million), By Surgery Type, 2018 to 2022

Table 56: MEA Market Value (US$ Million), By Surgery Type, 2023 to 2033

Table 57: MEA Market Value (US$ Million), By End-User, 2018 to 2022

Table 58: MEA Market Value (US$ Million), By End-User, 2023 to 2033

Table 59: MEA Market, By Country, 2018 to 2022

Table 60: MEA Market, By Country, 2023 to 2033

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 2: Global Market Absolute $ Historical Gain (2018 - 2022) and Opportunity (2023 to 2033), US$ Million Figure 3: Global Market Share, By Type, 2023 & 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Type – 2023 to 2033

Figure 6: Global Market Share, By Material Type, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth Projections, By Material Type – 2023 to 2033

Figure 8: Global Market Attractiveness Index, By Material Type – 2023 to 2033

Figure 9: Global Market Share, By End-User, 2023 & 2033

Figure 10: Global Market Y-o-Y Growth Projections, By End-User – 2023 to 2033

Figure 11: Global Market Attractiveness Index, By End-User – 2023 to 2033

Figure 12: Global Market Share, By Surgery Type, 2023 & 2033

Figure 13: Global Market Y-o-Y Growth Projections, By Surgery Type – 2023 to 2033

Figure 14: Global Market Attractiveness Index, By Surgery Type – 2023 to 2033

Figure 15: Global Market Share, By Region, 2023 & 2033

Figure 16: Global Market Y-o-Y Growth Projections, By Region – 2023 to 2033

Figure 17: Global Market Attractiveness Index, By Region – 2023 to 2033

Figure 18: North America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 19: North America Market Absolute $ Opportunity Historical (2018 - 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 20: North America Market Share, By Type, 2023 & 2033

Figure 21: North America Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 22: North America Market Attractiveness Index, By Type – 2023 to 2033

Figure 23: North America Market Share, By Material Type, 2023 & 2033

Figure 24: North America Market Y-o-Y Growth Projections, By Material Type – 2023 to 2033

Figure 25: North America Market Attractiveness Index, By Material Type – 2023 to 2033

Figure 26: North America Market Share, By End-User, 2023 & 2033

Figure 27: North America Market Y-o-Y Growth Projections, By End-User – 2023 to 2033

Figure 28: North America Market Attractiveness Index, By End-User – 2023 to 2033

Figure 29: North America Market Share, By Surgery Type, 2023 & 2033

Figure 30: North America Market Y-o-Y Growth Projections, By Surgery Type – 2023 to 2033

Figure 31: North America Market Attractiveness Index, By Surgery Type – 2023 to 2033

Figure 32: North America Market Share, By Country, 2023 & 2033

Figure 33: North America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 34: North America Market Attractiveness Index, By Country – 2023 to 2033

Figure 35: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 36: Latin America Market Absolute $ Opportunity Historical (2018 - 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 37: Latin America Market Share, By Type, 2023 & 2033

Figure 38: Latin America Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 39: Latin America Market Attractiveness Index, By Type – 2023 to 2033

Figure 40: Latin America Market Share, By Material Type, 2023 & 2033

Figure 41: Latin America Market Y-o-Y Growth Projections, By Material Type – 2023 to 2033

Figure 42: Latin America Market Attractiveness Index, By Material Type – 2023 to 2033

Figure 43: Latin America Market Share, By End-User, 2023 & 2033

Figure 44: Latin America Market Y-o-Y Growth Projections, By End-User – 2023 to 2033

Figure 45: Latin America Market Attractiveness Index, By End-User – 2023 to 2033

Figure 46: Latin America Market Share, By Surgery Type, 2023 & 2033

Figure 47: Latin America Market Y-o-Y Growth Projections, By Surgery Type – 2023 to 2033

Figure 48: Latin America Market Attractiveness Index, By Surgery Type – 2023 to 2033

Figure 49: Latin America Market Share, By Country, 2023 & 2033

Figure 50: Latin America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 51: Latin America Market Attractiveness Index, By Country – 2023 to 2033

Figure 52: Europe Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 53: Europe Market Absolute $ Opportunity Historical (2018 - 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 54: Europe Market Share, By Type, 2023 & 2033

Figure 55: Europe Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 56: Europe Market Attractiveness Index, By Type – 2023 to 2033

Figure 57: Europe Market Share, By Material Type, 2023 & 2033

Figure 58: Europe Market Y-o-Y Growth Projections, By Material Type – 2023 to 2033

Figure 59: Europe Market Attractiveness Index, By Material Type – 2023 to 2033

Figure 60: Europe Market Share, By End-User, 2023 & 2033

Figure 61: Europe Market Y-o-Y Growth Projections, By End-User – 2023 to 2033

Figure 62: Europe Market Attractiveness Index, By End-User – 2023 to 2033

Figure 63: Europe Market Share, By Surgery Type, 2023 & 2033

Figure 64: Europe Market Y-o-Y Growth Projections, By Surgery Type – 2023 to 2033

Figure 65: Europe Market Attractiveness Index, By Surgery Type – 2023 to 2033

Figure 66: Europe Market Share, By Country, 2023 & 2033

Figure 67: Europe Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 68: Europe Market Attractiveness Index, By Country – 2023 to 2033

Figure 69: MEA Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 70: MEA Market Absolute $ Opportunity Historical (2018 - 2022) and Forecast arket Attractiveness Index, By Type – 2023 to 2033

Figure 74: MEA Market Share, By Material Type, 2023 & 2033

Figure 75: MEA Market Y-o-Y Growth Projections, By Material Type – 2023 to 2033 FigurePeriod (2023 to 2033), US$ Million

Figure 71: MEA Market Share, By Type, 2023 & 2033

Figure 72: MEA Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 73: MEA M 76: MEA Market Attractiveness Index, By Material Type – 2023 to 2033

Figure 77: MEA Market Share, By End-User, 2023 & 2033

Figure 78: MEA Market Y-o-Y Growth Projections, By End-User – 2023 to 2033

Figure 79: MEA Market Attractiveness Index, By End-User – 2023 to 2033

Figure 80: MEA Market Share, By Surgery Type, 2023 & 2033

Figure 81: MEA Market Y-o-Y Growth Projections, By Surgery Type – 2023 to 2033

Figure 82: MEA Market Attractiveness Index, By Surgery Type – 2023 to 2033

Figure 83: MEA Market Share, By Country, 2023 & 2033

Figure 84: MEA Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 85: MEA Market Attractiveness Index, By Country – 2023 to 2033

Figure 86: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 87: Asia Pacific Market Absolute $ Opportunity Historical (2018 - 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 88: Asia Pacific Market Share, By Type, 2023 & 2033

Figure 89: Asia Pacific Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness Index, By Type – 2023 to 2033

Figure 91: Asia Pacific Market Share, By Material Type, 2023 & 2033

Figure 92: Asia Pacific Market Y-o-Y Growth Projections, By Material Type – 2023 to 2033

Figure 93: Asia Pacific Market Attractiveness Index, By Material Type – 2023 to 2033

Figure 94: Asia Pacific Market Share, By End-User, 2023 & 2033

Figure 95: Asia Pacific Market Y-o-Y Growth Projections, By End-User – 2023 to 2033

Figure 96: Asia Pacific Market Attractiveness Index, By End-User – 2023 to 2033

Figure 97: Asia Pacific Market Share, By Surgery Type, 2023 & 2033

Figure 98: Asia Pacific Market Y-o-Y Growth Projections, By Surgery Type – 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness Index, By Surgery Type – 2023 to 2033

Figure 100: Asia Pacific Market Share, By Country, 2023 & 2033

Figure 101: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 102: Asia Pacific Market Attractiveness Index, By Country – 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA