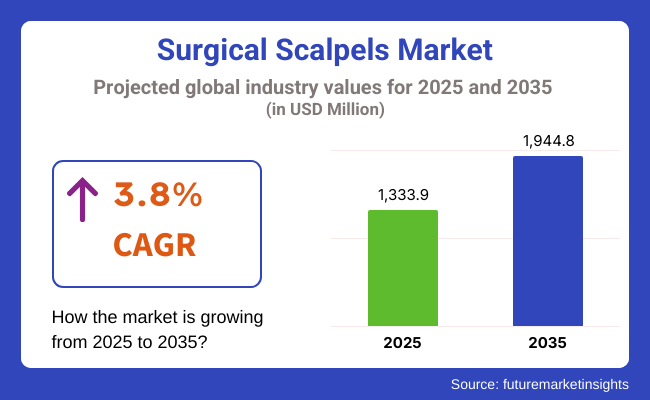

The global Surgical Scalpels Market is projected to be valued at USD 1,333.9 million in 2025, reaching USD 1,944.8 million by 2035, with a compound annual growth rate (CAGR) of 3.8% during the forecast period. Market growth has been supported by rising surgical procedure volumes, driven by chronic disease prevalence and expanding aging populations.

Rising demand for minimally invasive surgery (MIS) and enhanced procedural precision has further increased scalpel usage. Additionally, infection control mandates and single-use device preferences have amplified demand for disposable scalpels. Manufacturers’ investments in ergonomic handle design, advanced blade materials, and safety-engineered instruments have reinforced clinical adoption.

Moreover, outpatient surgical facilities and ambulatory centers have increased scalpel demand due to streamlined workflows and heightened emphasis on sterile, on-demand instruments. As health systems globally prioritize patient safety and operational efficiency, continued growth is anticipated, particularly in reusable versus disposable shifts and spec.ialty blade innovations.

Key manufacturers in the surgical scalpel market include Hill‑Rom (BD), Swann‑Morton, KAI Group, Feather, B. Braun, Olympus, and Medtronic. These leaders are driving growth through product innovation, regulatory compliance, and strategic partnerships in infection prevention.

In 2024, announced the receipt of 510(k) clearance from the FDA for the next generation The Shaw Scalpel System. "The FDA clearance for the next generation of Shaw Scalpel System is the culmination of in-depth user feedback and extensive efforts from every team member, This milestone not only validates the safety and effectiveness of our technology but also highlights our commitment to provide healthcare professionals with state-of-the-art tools to enhance patient outcomes." Stated by Ben Burnham, VP of Sales and Marketing, C2Dx. Moreover, market growth continues to be driven by rising outpatient procedures, infection control regulations, and hospital safety mandates propelling demand for sterile, convenient, and compliant scalpel products.

North America retains its leadership in the surgical scalpel market, reflecting its advanced surgical infrastructure, high volume of MIS procedures, and stringent infection control regulations. Disposable scalpel usage has been driven by mandates for single-use devices in hospitals and ASCs. Demand is being supported by the expansion of outpatient and ambulatory surgery centers, where disposables are preferred for procedural efficiency.

Europe’s surgical scalpel market is expanding due to enhanced regulatory focus on needlestick injury prevention and the shift to single-use devices. Additionally, procurement standards now emphasize eco-friendly disposable instruments and biodegradable packaging.

The region’s advanced surgical training programs have also accelerated the adoption of blade-plus-handle kits that integrate ergonomic design and safety features. Manufacturers are collaborating with hospital groups to pilot smart blister-pack systems that record usage for inventory control, optimizing supply management in EU health systems

The global surgical scalpels market's compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.8%, followed by a slightly lower growth rate of 4.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 4.8% (2024 to 2034) |

| H2 | 4.3% (2024 to 2034) |

| H1 | 3.8% (2025 to 2035) |

| H2 | 3.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.8% in the first half and remain relatively moderate at 3.4% in the second half. In the first half (H1) the industry witnessed a decrease of 90 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

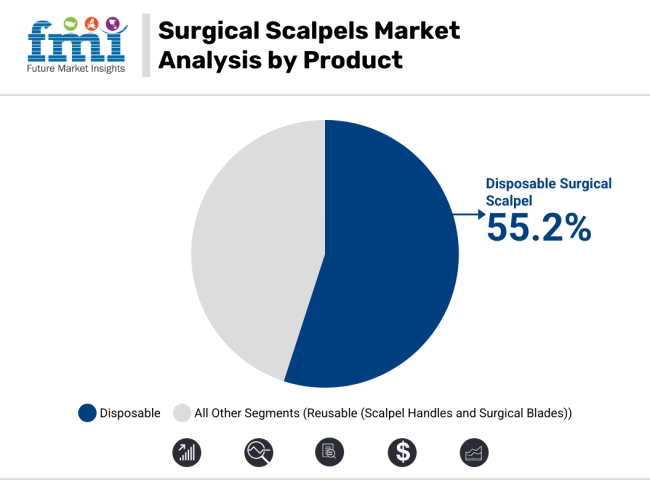

In 2025, the disposable surgical scalpel segment has been observed to dominate the market, accounting for 55.2% of total revenue. This leadership position has been attributed to heightened infection control regulations, particularly in hospital and outpatient settings, where sterility and cross-contamination prevention are prioritized.

Disposable scalpels have been increasingly adopted due to their cost-effectiveness, ease of use, and elimination of the need for reprocessing, which reduces operational burden on sterilization units. Additionally, compliance with OSHA sharps safety protocols has been reinforced by the widespread integration of safety-engineered blades in disposable models.

Growing demand for ambulatory surgeries and the expansion of minimally invasive procedures have further supported this segment’s growth, as disposable variants enable rapid instrument turnover. Moreover, manufacturers’ innovations-such as ergonomic handle designs and blunted-tip safety mechanisms-have contributed to clinician preference and procedural efficiency. As procedural volumes rise globally, the convenience and safety profile of disposable scalpels is expected to sustain segmental leadership.

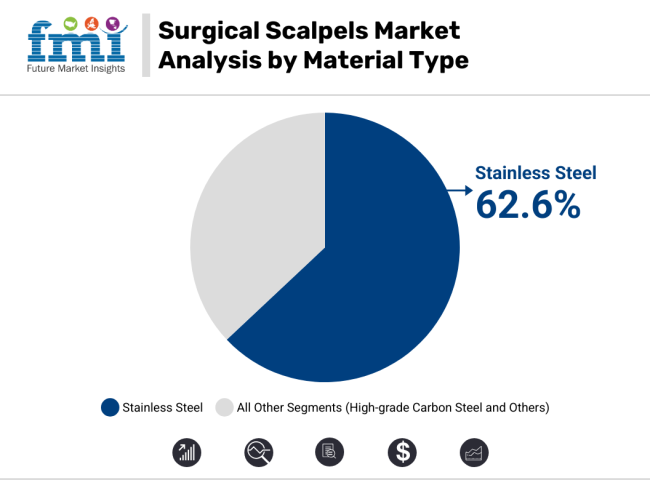

The stainless steel segment has emerged as the leading material type in the surgical scalpels market, securing a 62.6% revenue share in 2025. This dominance has been driven by stainless steel’s unmatched balance of durability, corrosion resistance, and precision-cutting performance. Superior edge retention and reduced risk of microscopic blade deformation under pressure have positioned stainless steel blades as the preferred choice for both routine and complex surgeries.

Furthermore, the material’s compatibility with both reusable and disposable formats has reinforced its widespread adoption across various clinical settings. Regulatory bodies and hospital procurement agencies have continued to prioritize stainless steel due to its proven biocompatibility and historical safety profile.

Additionally, advances in steel forging and automated grinding technologies have enabled manufacturers to consistently deliver ultra-sharp edges with minimal variance. With increasing demand for reliable, high-precision surgical instruments, stainless steel remains the gold standard, ensuring performance continuity across surgical disciplines and contributing significantly to overall market growth.

Increasing Number of Surgical Procedures and Driving the Market Growth

The rise in the number of surgeries worldwide has greatly driven the demand for the market of surgical scalpels. Disease that requires surgical interventions has increases recently. In addition to this, increased cases of traumas in people such as road accidents, among other injuries has further driven the demand for precise surgical tools like scalpels.

Surgical scalpels are crucially needed instruments in diverse surgeries from minor to the major such as, cardiovascular, orthopedic, neurosurgeries and any other complex form of surgeries in hospitals and ambulatory settings across the world. As the global burden of chronic diseases continues to grow, healthcare providers are performing more surgeries to manage and treat these conditions, thereby increasing the consumption of surgical scalpels.

For instance, bypass grafting and valve repair require scalpels to be ultra-sharp and precise to ensure minimal damage to the tissues after these cardiovascular surgeries. In trauma surgeries, rough and versatile scalpels may be required to handle various injuries, which need proper treatment.

Advancements in surgical techniques- the highest growth rate is registered by robotic-assisted and minimally invasive surgeries-expanding the scope of surgeries performed-continues to drive requirements for specialty and high-quality scalpels, driven by the global healthcare shift toward meeting the growing surgical demands of an aging and chronically ill population.

Growing Preference for Disposable Scalpels for Infection Control is Driving the Industry Growth

The rising concern toward infection control within the healthcare service sector is contributing highly to demand for disposable surgical scalpels. Healthcare-associated infections are still very common, primarily in surgical practice, and to minimize the transfer of infection through cross-contamination, hospitals and clinics are also opting for a single-use medical instrument. Since a disposable scalpels is an instrument that used once and gets discarded, so it provides a proper method for avoiding cross-infection among patients.

Besides infection prevention, disposable scalpels also help prevent the time- and cost-inefficiency of sterilizing. Most modern healthcare facilities rely on single-use instruments such as disposable scalpels to increase effectiveness and patient care.

For instance, in high-turnover surgical centers or in cases of emergency procedures, the speed factor becomes important; as such, these facilities prefer disposable scalpels for their convenience and less likelihood of contamination. Additionally, as hospitals and surgical facilities increasingly increase efforts to meet strict infection control standards, the demand for disposable scalpels will increase even further.

The movement towards the usage of disposable products is both boosting patient safety and driving market growth, mainly in outpatient departments and in geographies with strong hygiene regulations.

Increased Adoption of Custom-Designed Scalpels for Specialized Surgeries Creates Further Growth Opportunity in the Market

Different types of surgeries, neurosurgery and plastic surgery being examples, need special instruments unique to the surgical needs of every procedure. Fine procedures demands certain scalpels having specific features; for example, a smaller or more precise blade, specialized tip, or even an ergonomic grip for the precision of the incision and for the surgeon not to damage the patient more than required

For instance, for neurosurgical procedures, extremely fine, ultra-sharp blades are needed for scalpel use as the delicate edges of surrounding tissue in the brain cannot be afforded to be scarred. Likewise, plastic surgeons may use well-designed, very comfortable scalpels to enable minute incisions, thus causing the slightest scarring; customization makes these manufacturers address niche-specific needs by coming up with tools that make better surgical outcomes and give surgeons greater satisfaction.

However, this trend towards the use of specialized surgical tools can act as an opportunity for scalpel manufacturers to specialize themselves with specialized solutions tailored to meet the growing demands for precision and performance. For instance, with the increasing need for specialized surgeries over time, such as minimally invasive procedures, a demand for scalpels will exist that is customized to the specific needs of various surgical specialties.

Competition from Alternative Surgical Tools May Restrict Market Growth

Alternative surgical instruments compete as one of the key restrains of the surgical scalpels market. Advanced technology in surgery results in more preference to laser scalpels, electrosurgical equipment, and ultrasonic scalpels. These alternative scalpels ensure a higher precision of surgery along with less bloodshed and a speedy recovery, thus making these preferred in specific oncology, microsurgery, and neurosurgery applications where precision is a primary requirement.

For example, laser scalpels can evaporate tissue with very minor thermal damage and, therefore, find very good application in such high-precision surgeries as the removal of tumors. Electrosurgical devices are useful for cutting tissue and coagulating blood vessels simultaneously by using high-frequency electrical currents.

They also minimize blood loss during surgery, thus holding applications in all surgical specialties. Ultrasonic scalpels cut with minimal heat generation and tissue damage using high-frequency sound waves.

As these technologies continue to evolve, they will offer a strong competition to traditional scalpels, especially in the specialized surgical fields. The use of these high-performance advanced tools may restrict the market share for traditional surgical scalpels as health care providers continue to embrace the use of efficient, high-performance equipment in their procedures.

The global surgical scalpels market recorded a CAGR of 3.1% during the historical period between 2020 and 2024. The growth of surgical scalpels market was positive as it reached a value of USD 1,290.8 million in 2024 from USD 1,142.0 million in 2020.

Historically, surgeries were conducted using simple tools like knives and scalpels made from crude materials such as stone, bronze, or early forms of steel. These instruments were usually imprecise, thus increasing the risks of infection, longer recovery periods, and higher trauma to patients. With time, surgical techniques improved with more refined instruments and sterilization methods, which significantly improved patient outcomes.

Surgical scalpels designed for precision and durability are manufactured from stainless steel or high-grade carbon steel, with sharp fine blades that offer precise incision without tissue damage. Advances in ergonomic material coatings and disposables have greatly enhanced safety, sterility, and comfort of modern surgical scalpels, rendering them a much better tool compared to historical practices.

Cosmetic and aesthetic surgeries have greatly contributed to the penetration of precision surgical scalpels. As more people embrace facial rejuvenation, nasal rhinoplasty, or body contouring through surgery to look better, the high-quality instrument that offers fine and precise incisions has also increased.

Such procedures require scalpels with ultra-sharp blades and ergonomic designs that help avoid tissue damage and reduce scarring and promote cosmetic results. Surgeons performing sensitive procedures require instrumentation that offers exquisite control and accuracy to produce naturally beautiful results.

The increasing acceptance of non-invasive or minimally invasive cosmetic treatments also fuels this demand, as this often requires the utilization of specialty scalpels. Therefore, the surge in demand for cosmetic surgery holds great growth prospects for manufacturers who can offer excellent quality, high-precision surgical scalpels.

Tier 1 companies are the industry leaders with 38.8% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Integra Life Sciences, Koninklijke Philips N.V, Medtronic Plc. And B. Braun Melsungen AG.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 31.7% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Visiopharm, Indica Labs Inc, Swann-Morton Limited and Hill-Rom.

Compared to Tiers 1 and 2, Tier 3 companies offer surgical scalpels, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as VOGT Medical, Hu-Friedy Mfg. Co. and Others and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for surgical scalpels in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

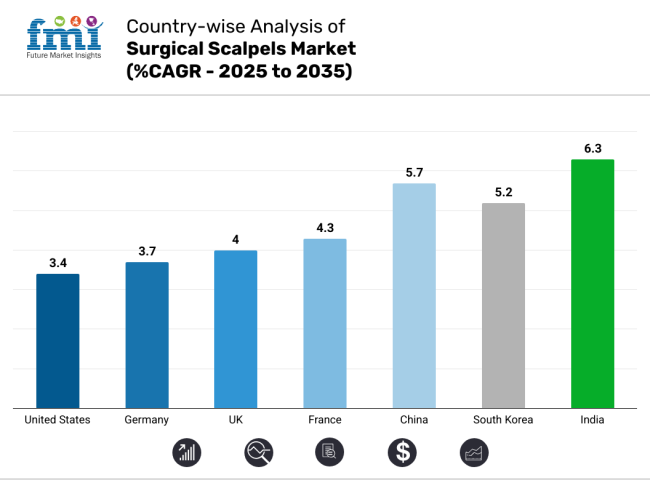

It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 84.7%. By 2035, China is expected to experience a CAGR of 5.7% in the Asia-Pacific region.

Germany’s surgical scalpels market is poised to exhibit a CAGR of 3.7% between 2025 and 2035. The Germany holds highest market share in European market.

The growth of outpatient surgeries in Germany is driving demand for disposable surgical scalpels very strongly. The cost efficiency of ASCs, reduced patient recovery time, and rapid turnaround in procedures have contributed to their increasing popularity.

Centers focus on sterility at high levels and aim to minimize operating costs. For these settings, disposable scalpels are the perfect fit since they are used once and do not require sterilization. They offer convenience, reduce the risk of infection, and streamline the surgical process.

The advanced healthcare infrastructure of Germany, coupled with an aging population and an increasing number of minor surgeries, has further fueled outpatient procedures. Healthcare providers focus on patient throughput while following strict hygiene standards, pointing to disposable scalpel use as the optimal choice. This trend is expected to continue as ASCs in Germany expand. The outlook for manufacturers of disposable surgical instruments is astronomical.

United States is anticipated to show a CAGR of 3.4% between 2025 and 2035.

The rising cases of chronic diseases as well as elevated trauma cases raise the United States demand for surgical scalpels significantly. The population is aging and the incidence of diseases like heart disease, diabetes, and cancers has increased and led to surgeries to try and manage those chronic conditions.

As hospitals continue to become more advanced places where surgeries get more complex with each passing year, the call for good and accurate surgical knives, like scalpels, will always be there as these are usually used to achieve the precision for incisions to be made across various operations.

Adding up to the rise in surgical volumes, and innovative surgical techniques-such as that of minimally invasive procedures-enhance the imperative for safe sharp scalpels during surgery for optimizing patient outcomes, which will in turn fuel a trend and aid in the progression of the growth of the market for surgical scalpels in the USA.

China is anticipated to show a CAGR of 5.7% between 2025 and 2035.

The current advance in MIS has propelled the demand significantly in China for specialized surgical scalpels. With the development in medical technology and modernization of healthcare systems, there is a preference for MIS due to its benefits-they actually leave the smallest incisions, it tends to have a faster recovery time, and there's less risk of complications. These procedures are especially utilized in orthopedics, urology, and gynecology, in which very precise and specific scalpels are needed for delicate incisions.

Increased expenditure on health, and other moves by the government to develop improved health care systems also add impetus to applying the MIS technology. The specialists that carry out this procedure do depend on precision scalpels possessing extremely fine but very sharp cutting blades that create minor damage, improving the prospect for patients receiving aesthetic surgeries.

Additionally, as the demand for aesthetic surgeries rises in China, precision scalpels are essential for minimally invasive cosmetic procedures. This combination of technological advances, healthcare infrastructure development, and the demand from patients to have quicker recovery times is going to drive the market for specialized surgical scalpels in China.

Key market players in the surgical scalpel industry are adopting various growth strategies to expand their market presence. These include product innovation, focusing on the development of precision scalpels with advanced features such as ergonomic handles and specialized coatings.

Geographic expansion is another strategy, with companies entering emerging markets like Asia Pacific and Latin America to capitalize on rising healthcare demand. Strategic partnerships and collaborations with healthcare institutions, hospitals, and surgical centers help increase distribution and adoption. Additionally, players are investing in sustainability initiatives, developing eco-friendly, and biodegradable scalpel options to meet environmental and regulatory demands.

Recent Industry Developments in Surgical Scalpels Market:

In terms of product, the industry is divided into disposable surgical scalpel and reusable surgical scalpel (scalpel handles and surgical blades)

In terms of material type, the industry is segregated into stainless steel, high-grade carbon steel and others

In terms of end user, the industry is divided into hospitals, clinics, ambulatory surgical centers, nursing centers, and reference laboratories.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global surgical scalpels industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global surgical scalpels market stood at USD 1,290.8 million in 2024.

The global surgical scalpels industry is anticipated to reach USD 1,944.8 million by 2035 end.

China is expected to show a CAGR of 5.7% in the assessment period.

The key players operating in the global surgical scalpels industry Integra Life Sciences, Koninklijke Philips N.V, Medtronic, B. Braun Melsungen AG, Visiopharm, Indica Labs, Inc, Swann-Morton Limited, Hill-Rom, VOGT Medical, Hu-Friedy Mfg. Co. and Others

Table 01: Global Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 03: Global Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 04: Global Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 05: Global Market Value (US$ million) Analysis and Forecast 2012 to 2032, by Region

Table 06: North America Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 07: North America Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product by Segment 2

Table 08: North America Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 09: North America Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 10: North America Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 11: Latin America Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 12: Latin America Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 14: Latin America Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 15: Latin America Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 16: Europe Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 17: Europe Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 18: Europe Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 19: Europe Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 20: Europe Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 21: South Asia Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 22: South Asia Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 24: South Asia Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 25: South Asia Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 26: East Asia Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 27: East Asia Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 29: East Asia Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 30: East Asia Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 31: Oceania Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 32: Oceania Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 34: Oceania Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 35: Oceania Market Value (US$ million) Analysis and Forecast 2012 to 2032, By End User

Table 36: MEA Market Value (US$ million) Analysis 2012-2021 and Forecast 2022 to 2032, by Country

Table 37: MEA Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Product

Table 38: MEA Market Volume (Units) Analysis and Forecast 2012 to 2032, By Product

Table 39: MEA Market Value (US$ million) Analysis and Forecast 2012 to 2032, By Material Type

Table 40: MEA Market Value (US$ million) Analysis and Forecast 2012 to 2032, by segment

Figure 01: Global Market Volume (Units), 2012 to 2021

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2022 to 2032

Figure 03: Global Market , Pricing Analysis per unit (US$), in 2022

Figure 04: Global Market , Pricing Forecast per unit (US$), in 2032

Figure 05: Global Market Value (US$ million) Analysis, 2012 to 2021

Figure 06: Global Market Forecast & Y-o-Y Growth, 2022 to 2032

Figure 07: Global Market Absolute $ Opportunity (US$ million) Analysis, 2021 to 2032

Figure 08: Global Market Value Share (%) Analysis 2022 and 2032, By Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, By Product

Figure 10: Global Market Attractiveness Analysis 2022 to 2032, By Product

Figure 11: Global Market Value Share (%) Analysis 2022 and 2032, By Material Type

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, By Material Type

Figure 13: Global Market Attractiveness Analysis 2022 to 2032, By Material Type

Figure 14: Global Market Value Share (%) Analysis 2022 and 2032, By End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, By End User

Figure 16: Global Market Attractiveness Analysis 2022 to 2032, By End User

Figure 17: Global Market Value Share (%) Analysis 2022 and 2032, by Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2021 to 2032, by Region

Figure 19: Global Market Attractiveness Analysis 2022 to 2032, by Region

Figure 20: North America Market Value (US$ million) Analysis, 2012 to 2021

Figure 21: North America Market Value (US$ million) Forecast, 2022 to 2032

Figure 22: North America Market Value Share, By Product (2022 E)

Figure 23: North America Market Value Share, By Material Type (2022 E)

Figure 24: North America Market Value Share, By End User (2022 E)

Figure 25: North America Market Value Share, by Country (2022 E)

Figure 26: North America Market Attractiveness Analysis By Product, 2022 to 2032

Figure 27: North America Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 28: North America Market Attractiveness Analysis By End User, 2022 to 2032

Figure 29: North America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 30: U.S. Market Value Proportion Analysis, 2021

Figure 31: Global Vs. U.S. Growth Comparison, 2022 to 2032

Figure 32: U.S. Market Share Analysis (%) By Product, 2022 to 2032

Figure 33: U.S. Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 34: U.S. Market Share Analysis (%) By End User, 2022 to 2032

Figure 35: Canada Market Value Proportion Analysis, 2021

Figure 36: Global Vs. Canada. Growth Comparison, 2022 to 2032

Figure 37: Canada Market Share Analysis (%) By Product, 2022 to 2032

Figure 38: Canada Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 39: Canada Market Share Analysis (%) By End User, 2022 to 2032

Figure 40: Latin America Market Value (US$ million) Analysis, 2012 to 2021

Figure 41: Latin America Market Value (US$ million) Forecast, 2022 to 2032

Figure 42: Latin America Market Value Share, By Product (2022 E)

Figure 43: Latin America Market Value Share, By Material Type (2022 E)

Figure 44: Latin America Market Value Share, By End User (2022 E)

Figure 45: Latin America Market Value Share, by Country (2022 E)

Figure 46: Latin America Market Attractiveness Analysis By Product, 2022 to 2032

Figure 47: Latin America Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 48: Latin America Market Attractiveness Analysis By End User, 2022 to 2032

Figure 49: Latin America Market Attractiveness Analysis by Country, 2022 to 2032

Figure 50: Mexico Market Value Proportion Analysis, 2021

Figure 51: Global Vs Mexico Growth Comparison, 2022 to 2032

Figure 52: Mexico Market Share Analysis (%) By Product, 2022 to 2032

Figure 53: Mexico Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 54: Mexico Market Share Analysis (%) By End User, 2022 to 2032

Figure 55: Brazil Market Value Proportion Analysis, 2021

Figure 56: Global Vs. Brazil. Growth Comparison, 2022 to 2032

Figure 57: Brazil Market Share Analysis (%) By Product, 2022 to 2032

Figure 58: Brazil Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 59: Brazil Market Share Analysis (%) By End User, 2022 to 2032

Figure 60: Argentina Market Value Proportion Analysis, 2021

Figure 61: Global Vs Argentina Growth Comparison, 2022 to 2032

Figure 62: Argentina Market Share Analysis (%) By Product, 2022 to 2032

Figure 63: Argentina Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 64: Argentina Market Share Analysis (%) By End User, 2022 to 2032

Figure 65: Europe Market Value (US$ million) Analysis, 2012 to 2021

Figure 66: Europe Market Value (US$ million) Forecast, 2022 to 2032

Figure 67: Europe Market Value Share, By Product (2022 E)

Figure 68: Europe Market Value Share, By Material Type (2022 E)

Figure 69: Europe Market Value Share, By End User (2022 E)

Figure 70: Europe Market Value Share, by Country (2022 E)

Figure 71: Europe Market Attractiveness Analysis By Product, 2022 to 2032

Figure 72: Europe Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 73: Europe Market Attractiveness Analysis By End User, 2022 to 2032

Figure 74: Europe Market Attractiveness Analysis by Country, 2022 to 2032

Figure 75: UK Market Value Proportion Analysis, 2021

Figure 76: Global Vs. UK Growth Comparison, 2022 to 2032

Figure 77: UK Market Share Analysis (%) By Product, 2022 to 2032

Figure 78: UK Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 79: UK Market Share Analysis (%) By End User, 2022 to 2032

Figure 80: Germany Market Value Proportion Analysis, 2021

Figure 81: Global Vs. Germany Growth Comparison, 2022 to 2032

Figure 82: Germany Market Share Analysis (%) By Product, 2022 to 2032

Figure 83: Germany Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 84: Germany Market Share Analysis (%) By End User, 2022 to 2032

Figure 85: Italy Market Value Proportion Analysis, 2021

Figure 86: Global Vs. Italy Growth Comparison, 2022 to 2032

Figure 87: Italy Market Share Analysis (%) By Product, 2022 to 2032

Figure 88: Italy Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 89: Italy Market Share Analysis (%) By End User, 2022 to 2032

Figure 90: France Market Value Proportion Analysis, 2021

Figure 91: Global Vs France Growth Comparison, 2022 to 2032

Figure 92: France Market Share Analysis (%) By Product, 2022 to 2032

Figure 93: France Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 94: France Market Share Analysis (%) By End User, 2022 to 2032

Figure 95: Spain Market Value Proportion Analysis, 2021

Figure 96: Global Vs Spain Growth Comparison, 2022 to 2032

Figure 97: Spain Market Share Analysis (%) By Product, 2022 to 2032

Figure 98: Spain Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 99: Spain Market Share Analysis (%) By End User, 2022 to 2032

Figure 100: Russia Market Value Proportion Analysis, 2021

Figure 101: Global Vs Russia Growth Comparison, 2022 to 2032

Figure 102: Russia Market Share Analysis (%) By Product, 2022 to 2032

Figure 103: Russia Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 104: Russia Market Share Analysis (%) By End User, 2022 to 2032

Figure 105: BENELUX Market Value Proportion Analysis, 2021

Figure 106: Global Vs BENELUX Growth Comparison, 2022 to 2032

Figure 107: BENELUX Market Share Analysis (%) By Product, 2022 to 2032

Figure 108: BENELUX Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 109: BENELUX Market Share Analysis (%) By End User, 2022 to 2032

Figure 110: East Asia Market Value (US$ million) Analysis, 2012 to 2021

Figure 111: East Asia Market Value (US$ million) Forecast, 2022 to 2032

Figure 112: East Asia Market Value Share, By Product (2022 E)

Figure 113: East Asia Market Value Share, By Material Type (2022 E)

Figure 114: East Asia Market Value Share, By End User (2022 E)

Figure 115: East Asia Market Value Share, by Country (2022 E)

Figure 116: East Asia Market Attractiveness Analysis By Product, 2022 to 2032

Figure 117: East Asia Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 118: East Asia Market Attractiveness Analysis By End User, 2022 to 2032

Figure 119: East Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 120: China Market Value Proportion Analysis, 2021

Figure 121: Global Vs. China Growth Comparison, 2022 to 2032

Figure 122: China Market Share Analysis (%) By Product, 2022 to 2032

Figure 123: China Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 124: China Market Share Analysis (%) By End User, 2022 to 2032

Figure 125: Japan Market Value Proportion Analysis, 2021

Figure 126: Global Vs. Japan Growth Comparison, 2022 to 2032

Figure 127: Japan Market Share Analysis (%) By Product, 2022 to 2032

Figure 128: Japan Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 129: Japan Market Share Analysis (%) By End User, 2022 to 2032

Figure 130: South Korea Market Value Proportion Analysis, 2021

Figure 131: Global Vs South Korea Growth Comparison, 2022 to 2032

Figure 132: South Korea Market Share Analysis (%) By Product, 2022 to 2032

Figure 133: South Korea Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 134: South Korea Market Share Analysis (%) By End User, 2022 to 2032

Figure 135: South Asia Market Value (US$ million) Analysis, 2012 to 2021

Figure 136: South Asia Market Value (US$ million) Forecast, 2022 to 2032

Figure 137: South Asia Market Value Share, By Product (2022 E)

Figure 138: South Asia Market Value Share, By Material Type (2022 E)

Figure 139: South Asia Market Value Share, By End User (2022 E)

Figure 140: South Asia Market Value Share, by Country (2022 E)

Figure 141: South Asia Market Attractiveness Analysis By Product, 2022 to 2032

Figure 142: South Asia Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 143: South Asia Market Attractiveness Analysis By End User, 2022 to 2032

Figure 144: South Asia Market Attractiveness Analysis by Country, 2022 to 2032

Figure 145: India Market Value Proportion Analysis, 2021

Figure 146: Global Vs. India Growth Comparison, 2022 to 2032

Figure 147: India Market Share Analysis (%) By Product, 2022 to 2032

Figure 148: India Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 149: India Market Share Analysis (%) By End User, 2022 to 2032

Figure 150: Indonesia Market Value Proportion Analysis, 2021

Figure 151: Global Vs. Indonesia Growth Comparison, 2022 to 2032

Figure 152: Indonesia Market Share Analysis (%) By Product, 2022 to 2032

Figure 153: Indonesia Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 154: Indonesia Market Share Analysis (%) By End User, 2022 to 2032

Figure 155: Malaysia Market Value Proportion Analysis, 2021

Figure 156: Global Vs. Malaysia Growth Comparison, 2022 to 2032

Figure 157: Malaysia Market Share Analysis (%) By Product, 2022 to 2032

Figure 158: Malaysia Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 159: Malaysia Market Share Analysis (%) By End User, 2022 to 2032

Figure 160: Thailand Market Value Proportion Analysis, 2021

Figure 161: Global Vs. Thailand Growth Comparison, 2022 to 2032

Figure 162: Thailand Market Share Analysis (%) By Product, 2022 to 2032

Figure 163: Thailand Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 164: Thailand Market Share Analysis (%) By End User, 2022 to 2032

Figure 165: Oceania Market Value (US$ million) Analysis, 2012 to 2021

Figure 166: Oceania Market Value (US$ million) Forecast, 2022 to 2032

Figure 167: Oceania Market Value Share, By Product (2022 E)

Figure 168: Oceania Market Value Share, By Material Type (2022 E)

Figure 169: Oceania Market Value Share, By End User (2022 E)

Figure 170: Oceania Market Value Share, by Country (2022 E)

Figure 171: Oceania Market Attractiveness Analysis By Product, 2022 to 2032

Figure 172: Oceania Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 173: Oceania Market Attractiveness Analysis By End User, 2022 to 2032

Figure 174: Oceania Market Attractiveness Analysis by Country, 2022 to 2032

Figure 175: Australia Market Value Proportion Analysis, 2021

Figure 176: Global Vs. Australia Growth Comparison, 2022 to 2032

Figure 177: Australia Market Share Analysis (%) By Product, 2022 to 2032

Figure 178: Australia Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 179: Australia Market Share Analysis (%) By End User, 2022 to 2032

Figure 180: New Zealand Market Value Proportion Analysis, 2021

Figure 181: Global Vs New Zealand Growth Comparison, 2022 to 2032

Figure 182: New Zealand Market Share Analysis (%) By Product, 2022 to 2032

Figure 183: New Zealand Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 184: New Zealand Market Share Analysis (%) By End User, 2022 to 2032

Figure 185: Middle East & Africa Market Value (US$ million) Analysis, 2012 to 2021

Figure 186: Middle East & Africa Market Value (US$ million) Forecast, 2022 to 2032

Figure 187: Middle East & Africa Market Value Share, By Product (2022 E)

Figure 188: Middle East & Africa Market Value Share, By Material Type (2022 E)

Figure 189: Middle East & Africa Market Value Share, By End User (2022 E)

Figure 190: Middle East & Africa Market Value Share, by Country (2022 E)

Figure 191: Middle East & Africa Market Attractiveness Analysis By Product, 2022 to 2032

Figure 192: Middle East & Africa Market Attractiveness Analysis By Material Type, 2022 to 2032

Figure 193: Middle East & Africa Market Attractiveness Analysis By End User, 2022 to 2032

Figure 194: Middle East & Africa Market Attractiveness Analysis by Country, 2022 to 2032

Figure 195: GCC Countries Market Value Proportion Analysis, 2021

Figure 196: Global Vs GCC Countries Growth Comparison, 2022 to 2032

Figure 197: GCC Countries Market Share Analysis (%) By Product, 2022 to 2032

Figure 198: GCC Countries Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 199: GCC Countries Market Share Analysis (%) By End User, 2022 to 2032

Figure 200: Turkey Market Value Proportion Analysis, 2021

Figure 201: Global Vs. Turkey Growth Comparison, 2022 to 2032

Figure 202: Turkey Market Share Analysis (%) By Product, 2022 to 2032

Figure 203: Turkey Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 204: Turkey Market Share Analysis (%) By End User, 2022 to 2032

Figure 205: South Africa Market Value Proportion Analysis, 2021

Figure 206: Global Vs. South Africa Growth Comparison, 2022 to 2032

Figure 207: South Africa Market Share Analysis (%) By Product, 2022 to 2032

Figure 208: South Africa Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 209: South Africa Market Share Analysis (%) By End User, 2022 to 2032

Figure 210: North Africa Market Value Proportion Analysis, 2021

Figure 211: Global Vs North Africa Growth Comparison, 2022 to 2032

Figure 212: North Africa Market Share Analysis (%) By Product, 2022 to 2032

Figure 213: North Africa Market Share Analysis (%) By Material Type, 2022 to 2032

Figure 214: North Africa Market Share Analysis (%) By End User, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA