The Surgical Drapes Market is projected to expand at a remarkable pace during the forecast period of 2025 to 2035 owing to an increase in surgical procedures, growing awareness regarding infection control, and strict hospital regulations regarding hygiene and safety.

Surgical drapes protect the devices used during the operations from contaminants while also safeguarding the patients from post-operative infections and other complications. The increasing use of disposable, antimicrobial, and fluid-repellent drapes due to (HAI) preventions and technological advancements in fabric materials is fuelling its growth.

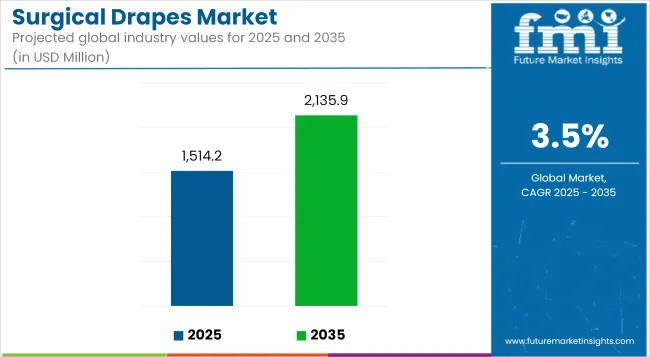

The market is expected to be worth USD 1,514.2 Million in 2025 and will register a CAGR of 3.5% over the forecast period to reach USD 2,135.9 Million in 2035. Additionally, the market growth is also driven by the rise of ambulatory surgical centres (ASCs), change in patients preference for use of single-use surgical drapes, and advancements in antimicrobial coating, which are contributing to the market expansion.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1,514.2 Million |

| Market Value (2035F) | USD 2,135.9 Million |

| CAGR (2025 to 2035) | 3.5% |

The region dominates the surgical drapes market due to the growing volume of surgeries, stringent hospital infection control regulations, and the establishment of healthcare infrastructure.

North America is the second most lucrative market after Europe and will continue to dominate the market with leading market players such as leading medical device manufacturers based in the USA and Canada along with growing hospital budgets for urological infection prevention. Throwaway & disposable drapes are seen as less cross contaminating, with adoption in the region increasing.

Europe also accounts for a sizable market share, supported by rigorous EU regulations regarding sterilization and infection control. Biodegradable and antimicrobial drapes are leading the way by Germany, the UK, and France Aging populations and greater spending on health care are only increasing demand for surgery. Moreover, sustainability campaigns are encouraging the manufacturers to produce eco-friendly surgical drapes with the minimum environmental effect.

Asia-Pacific is expected to register the highest CAGR, owing to the improving healthcare infrastructure, growing medical tourism and increasing investments by governments for infection prevention and control. Among them, China, Japan & India are going to dominate the market with rising surgical procedures and growing consciousness regarding hospital-acquired infections (HAIs).

The rise of a low-cost, high-quality disposable drape is picking up pace in developing parts of the world, backed by the public health agenda to enhance the hygienic conditions in hospitals.

Challenges

High Costs of Advanced Surgical Drapes

The high cost of antimicrobial and fluid-resistant surgical drapes is a major factor limiting their adoption, especially in developing regions with a low budget. Hospitals and clinics sometimes prefer to use reusable drapes to save money even though the risk of infection spread is greater by doing so. Besides, they also have to spend heavily on sterilizing and disposing surgical waste.

Opportunities

Increasing Demand for Eco-Friendly and Antimicrobial Drapes

Some bioplastic categories show promise in these areas, including biodegradability, composability, and antimicrobial properties, so some opportunities for these types of surgical drapes are emerging, the report said.

Manufacturers that invest in these innovative new materials, from plant-based fibres to nanotechnology-infused coatings, will find themselves able to compete on cost while maintaining quality. Moreover, increasing awareness of infection control practices in developing countries opens up opportunities for companies to introduce low-cost, high-performance disposable drapes in these regions.

The growth of surgical drapes market from 2020 to 2024 is primarily attributed to increase in surgical procedures, rising focus on preventing infections, and the growth of ambulatory surgical centres. Introduction Healthcare facilities have focused on using fluid-resistant, antimicrobial-coated drapes to reduce surgical site infections (SSIs) risk. Other products included sterile, pre-assembled surgical draping systems that reduce setup time and improve OR efficiency.

But issues such as the environmental impact of disposable drapes, changing raw material prices, and supply chain bottlenecks provided headwinds. In spite of this, manufacturers reacted by creating draping that can be biodegradable or recyclable to pursue sustainability aims.

The surgical drapes market is set to witness significant transformation between 2025 and 2035, driven by innovations in smart textiles, sustainable materials, and AI-driven sterilization tracking.

To up the infection prevention game even further, manufacturers will incorporate antimicrobial Nano coatings and moisture-wicking technology into drapes. The Innovative Intelligence of Surgical Drapes. The next generation of smart surgical drapes will be equipped with sensors that monitor the absorption of fluids in real-time and alert the surgical team to contamination as it occurs.

Another key trend will be sustainability, with hospitals continuing to choose biodegradable, reusable, and recyclable drapes to combat medical waste. Customization of surgical procedures will demand the surgical drapes kit based on the type of procedure and the preference of the surgical team.

Self-adhering and non-slip drapes can also be made using sweet breathable and impervious materials, both of which need a requirement whilst enhancing patient comfort and surgical precision. The use of AI-assisted inventory management will also allow for even better utilization of the drape by minimizing waste and increasing cost efficiency.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Infection Control Innovations | Disposable, fluid-resistant drapes to minimize SSIs. |

| Material Advancements | Antimicrobial-coated and pre-sterilized surgical drapes. |

| Customization & Efficiency | Standardized surgical draping systems for general use. |

| Smart & Digital Integration | Basic sterilization indicators on drapes. |

| Sustainability Focus | Concerns over medical waste from disposable drapes. |

| Market Growth Drivers | Increased surgical procedures and infection control regulations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Infection Control Innovations | Smart drapes with real-time contamination alerts and moisture-wicking technology. |

| Material Advancements | Biodegradable, reusable, and recyclable drapes for sustainable healthcare. |

| Customization & Efficiency | Custom-designed draping kits tailored to specific procedures. |

| Smart & Digital Integration | Sensor-equipped drapes with contamination tracking and AI-driven inventory management. |

| Sustainability Focus | Shift toward eco-friendly, reusable, and compostable surgical drapes. |

| Market Growth Drivers | Growth driven by sustainability initiatives, smart textiles, and cost-efficient inventory systems. |

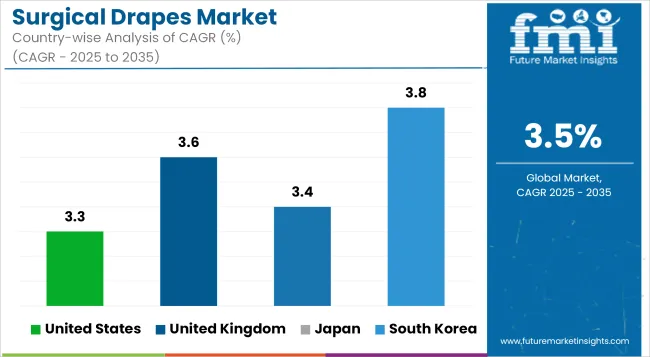

In the United States, the surgical drapes market is analysed with several key factors including an inert and healthy surgical environment which assists in its growth, especially as the number of surgical procedures continues to rise within the healthcare community, coupled with an increase in hospital admissions, which increases the risk of hospital-acquired infections or HAIs, fuelling the need for proper infection control.

Technological advances in antimicrobial and disposable drapes are offering benefits for the market, as such drapes are more frequently preferred than reusable drapes due to their superior hygiene and convenience. Moreover, the increasing demand for customized surgical drapes based on specific procedures will continue to boost market growth. The continued evolution of minimally invasive surgeries and robotic-assisted procedures has also added to the demand of specialized draping solutions in operating rooms.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

The United Kingdom surgical drapes market is being driven by the increasing emphasis on infection prevention, stricter regulations, and improvements in health care infrastructure. The ever-increasing number of surgical procedures performed within a hospital setting and in freestanding outpatient surgical centres is creating demand for premium disposable drapes that provide maximum barrier protection.

Furthermore, the increasing usage of sustainable and biodegradable materials for draping, supporting the well-being of the planet, are also shaping purchasing patterns in the market. The trend toward higher resource efficiency and economies of scale, as health care facilities are becoming increasingly modernized, will fuel the expansion of the market toward single-use, cost-effective devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.6% |

The European Union surgical drapes market is under moderate growth due to increasing surgical volumes, improvements in healthcare settings and strict regulation of infection control. Advanced surgical draping solutions other than just fluid-repellent and antimicrobial-coated drapes segment are primarily adopted in Europe for countries i.e. Germany, France, and Italy.

Chronic diseases that need surgical interventions and advanced performance disposable medical supplies are at their zenith as the key growth drivers. Moreover, driving the adoption of eco-friendly production methods and recyclables in surgical drapes production is becoming a trend across the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan's surgical drapes market is steadily expanding, driven by the aging population in the country and increasing number of surgical procedures done in hospitals and specialty clinics. Need for advanced draping solutions is proliferating due to the changing landscape of healthcare safety protocols and developments in medical textile technology.

High-performance multi-layered surgical drapes are held by Japanese manufacturers, which provide weather protection and serve as a strong barrier against fluid penetration and microbial pollution. Furthermore, the demand for lightweight, breathable materials that help the surgeon and increase patient safety is driving trends in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The market for surgical drapes is expected to grow rapidly due to the increased number of hospitals in South Korea, advancements in the medical field, increased healthcare expenditure among the population, growing facilities for surgical procedures, etc. Growing consumption of disposable surgical drapes, which addresses infection control concerns and aids in regulatory compliance, is a key factor expected to bolster market progress.

Moreover, local manufacturers are attempting to produce drapes that are both inexpensive and high-quality to target local and international markets. Advances in operating rooms and increased penetration of robotic-assisted surgeries are creating a further avenue for growth of high-tech draping solutions in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

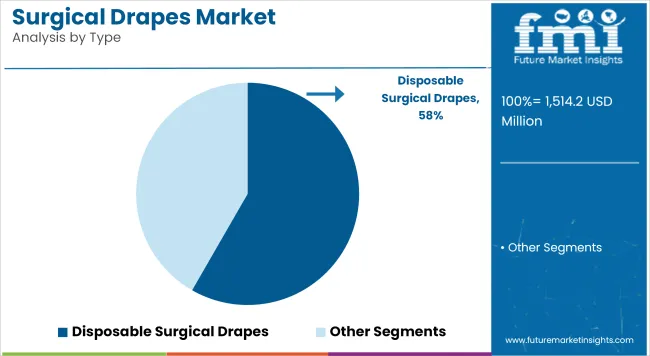

| By Type | Market Share (2025) |

|---|---|

| Disposable Surgical Drapes | 58.3% |

Disposable surgical drapes are a dominant market segment as infection control, patient safety, and convenience become major priorities for healthcare facilities. Ideal for use during surgical procedures, they are highly effective as a sterile barrier against bacteria, blood, and other bodily fluids. Disposable drapes are widely used in hospitals and ambulatory surgical centres to maintain an optimal level of sanitation and reduce hospital-acquired infections (HAIs).

To enhance patient and surgical staff protection and comfort manufacturers are producing new performance disposable drapes utilizing fluid-repellent, antimicrobial and breathable materials. These drapes are constructed of nonwoven fabrics such as polypropylene and polyethylene that allow for a lightweight design combined with increased absorbency. Disposable Gowns (as with all disposables) are pre-sterilized, which means they do not have to be laundered and reprocessed multiple times, maximizing both cost and time efficiency.

The growing volume of surgeries globally in accordance with strict infection control measures is further increasing the demand for disposable surgical drapes. The trend also exacerbated growth of disposable drapes due to increased volume of outpatient surgeries and minimally invasive procedures since they offer an expedient, hygienic and reliable solution for operating rooms.

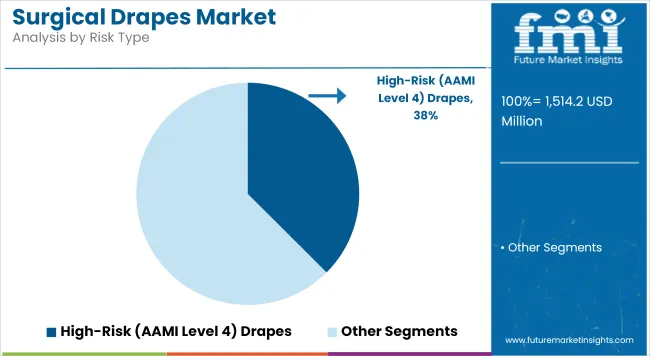

| By Risk Type | Market Share (2025) |

|---|---|

| High-Risk (AAMI Level 4) Drapes | 37.5% |

High-risk (AAMI Level 4) surgical drapes hold a substantial market share owing to their excellent barrier characteristics which are required for high-complexity and high-exposure procedures. The drapes are intended for surgeries with heavy fluid exposure, such as cardiovascular, orthopedic, and transplant surgeries, where maintaining sterility is critical to the prevention of post-operative infections.

AAMI Level 4 drapes are tested to resist fluid penetration, bacterial strike-through, and microbial contamination. The multi-layered reinforced fabrics used in their production are usually combined with laminated or absorbent backing materials to improve fluid management. Surgeons and other health workers like them for their high tensile strength, durability, and waterproofness, providing maximum protection in lengthy procedures.

The growing prevalence of chronic diseases has resulted in increased instances of surgical procedures owing to which the adoption of AAMI Level 4 drapes has been increasing. Hospitals and surgical centres focus on these drapes to adhere to strict regulatory requirements and enhance patient outcomes.

In addition, improvements in material technology, such as the incorporation of breathable but waterproof membranes, have improved not only patient comfort but also surgical precision, thus strengthen the demand for high-risk surgical drapes (surgical drapes with a higher chance of major bloodstream infections) in the global market.

The growth of the Surgical Drapes Market is driven by the increasing demand for infection control, the rising number of surgical procedures, and advancements in technology. Market leaders are responding by manufacturing high-barrier, fluid-repellent, and antimicrobial drapes that comply with the strict regulatory guidelines. The same push for sustainability feeds innovations in biodegradable and reusable surgical drapes.

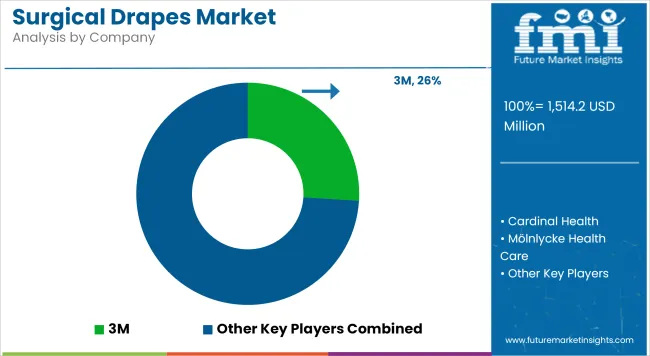

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M | 20-24% |

| Cardinal Health | 18-22% |

| Mölnlycke Health Care | 15-19% |

| Steris | 10-14% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M | In 2024, introduced antimicrobial surgical drapes with enhanced fluid resistance. |

| Cardinal Health | In 2025, expanded its surgical drape portfolio with eco-friendly disposable options. |

| Mölnlycke Health Care | In 2024, launched hybrid reusable surgical drapes for cost-effective infection control. |

| Steris | In 2025, developed single-use high-barrier drapes for complex surgical procedures. |

Key Company Insights

3M (20-24%)

3M leads the market with innovative antimicrobial and high-barrier drapes that offer superior infection prevention. The company invests heavily in research and development, integrating advanced polymer coatings into its product lines.

Cardinal Health (18-22%)

Cardinal Health strengthens its market position by expanding its range of surgical drapes with biodegradable and sustainable materials, addressing environmental concerns in healthcare.

Mölnlycke Health Care (15-19%)

Mölnlycke Health Care focuses on premium-quality surgical drapes, offering both disposable and reusable options that enhance surgical efficiency while reducing waste.

Steris (10-14%)

Steris gains market traction with its specialized single-use drapes designed for highly invasive and high-risk procedures, ensuring maximum patient protection.

Other Key Players (30-40% Combined)

Several companies contribute to the market with innovative product developments and regional expansions:

The overall market size for the Surgical Drapes Market was USD 1,514.2 Million in 2025.

The Surgical Drapes Market is expected to reach USD 2,135.9 Million in 2035.

The demand is driven by rising surgical procedures globally, increasing awareness of infection control measures, stringent hospital regulations on sterilization, growing demand for disposable surgical drapes, and advancements in antimicrobial and fluid-resistant drape materials.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The disposable surgical drapes segment is expected to command a significant share over the assessment period.

Table 1: Global Value (US$ Million), By Type, 2018 to 2022

Table 2: Global Value (US$ Million), By Type, 2023 to 2033

Table 3: Global Value (US$ Million), By End-Use, 2018 to 2022

Table 4: Global Value (US$ Million), By End-Use, 2023 to 2033

Table 5: Global Value (US$ Million), By Risk Type, 2018 to 2022

Table 6: Global Value (US$ Million), By Risk Type, 2023 to 2033

Table 7: Global, By Region, 2018 to 2022

Table 8: Global, By Region, 2023 to 2033

Table 9: North America Value (US$ Million), By Type, 2018 to 2022

Table 10: North America Value (US$ Million), By Type, 2023 to 2033

Table 11: North America Value (US$ Million), By End-Use, 2018 to 2022

Table 12: North America Value (US$ Million), By End-Use, 2023 to 2033

Table 13: North America Value (US$ Million), By Risk Type, 2018 to 2022

Table 14: North America Value (US$ Million), By Risk Type, 2023 to 2033

Table 15: North America, By Country, 2018 to 2022

Table 16: North America, By Country, 2023 to 2033

Table 17: Latin America Value (US$ Million), By Type, 2018 to 2022

Table 18: Latin America Value (US$ Million), By Type, 2023 to 2033

Table 19: Latin America Value (US$ Million), By End-Use, 2018 to 2022

Table 20: Latin America Value (US$ Million), By End-Use, 2023 to 2033

Table 21: Latin America Value (US$ Million), By Risk Type, 2018 to 2022

Table 22: Latin America Value (US$ Million), By Risk Type, 2023 to 2033

Table 23: Latin America, By Country, 2018 to 2022

Table 24: Latin America, By Country, 2023 to 2033

Table 25: Europe Value (US$ Million), By Type, 2018 to 2022

Table 26: Europe Value (US$ Million), By Type, 2023 to 2033

Table 27: Europe Value (US$ Million), By End-Use, 2018 to 2022

Table 28: Europe Value (US$ Million), By End-Use, 2023 to 2033

Table 29: Europe Value (US$ Million), By Risk Type, 2018 to 2022

Table 30: Europe Value (US$ Million), By Risk Type, 2023 to 2033

Table 31: Europe, By Country, 2018 to 2022

Table 32: Europe, By Country, 2023 to 2033

Table 33: Asia Pacific Value (US$ Million), By Type, 2018 to 2022

Table 34: Asia Pacific Value (US$ Million), By Type, 2023 to 2033

Table 35: Asia Pacific Value (US$ Million), By End-Use, 2018 to 2022

Table 36: Asia Pacific Value (US$ Million), By End-Use, 2023 to 2033

Table 37: Asia Pacific Value (US$ Million), By Risk Type, 2018 to 2022

Table 38: Asia Pacific Value (US$ Million), By Risk Type, 2023 to 2033

Table 39: Asia Pacific, By Country, 2018 to 2022

Table 40: Asia Pacific, By Country, 2023 to 2033

Table 41: MEA Value (US$ Million), By Type, 2018 to 2022

Table 42: MEA Value (US$ Million), By Type, 2023 to 2033

Table 43: MEA Value (US$ Million), By End-Use, 2018 to 2022

Table 44: MEA Value (US$ Million), By End-Use, 2023 to 2033

Table 45: MEA Value (US$ Million), By Risk Type, 2018 to 2022

Table 46: MEA Value (US$ Million), By Risk Type, 2023 to 2033

Table 47: MEA, By Country, 2018 to 2022

Table 48: MEA, By Country, 2023 to 2033

Table 49: Global Incremental $ Opportunity, By Type, 2018 to 2022

Table 50: Global Incremental $ Opportunity, By End-Use, 2023 to 2033

Table 51: Global Incremental $ Opportunity, By Risk Type, 2018 to 2022

Table 52: Global Incremental $ Opportunity, By Region, 2023 to 2033

Table 53: North America Incremental $ Opportunity, By Type, 2018 to 2022

Table 54: North America Incremental $ Opportunity, By End-Use, 2023 to 2033

Table 55: North America Incremental $ Opportunity, By Risk Type, 2018 to 2022

Table 56: North America Incremental $ Opportunity, By Country, 2023 to 2033

Table 57: Latin America Incremental $ Opportunity, By Type, 2018 to 2022

Table 58: Latin America Incremental $ Opportunity, By End-Use, 2023 to 2033

Table 59: Latin America Incremental $ Opportunity, By Risk Type, 2018 to 2022

Table 60: Latin America Incremental $ Opportunity, By Country, 2023 to 2033

Table 61: Europe Incremental $ Opportunity, By Type, 2018 to 2022

Table 62: Europe Incremental $ Opportunity, By End-Use, 2023 to 2033

Table 63: Europe Incremental $ Opportunity, By Risk Type, 2018 to 2022

Table 64: Europe Incremental $ Opportunity, By Country, 2023 - 2033 Table

Table 65: Asia Pacific Incremental $ Opportunity, By Type, 2018 to 2022

Table 66: Asia Pacific Incremental $ Opportunity, By End-Use, 2023 to 2033

Table 67: Asia Pacific Incremental $ Opportunity, By Risk Type, 2018 to 2022

Table 68: Asia Pacific Incremental $ Opportunity, By Country, 2023 to 2033

Table 69: MEA Incremental $ Opportunity, By Type, 2018 to 2022

Table 70: MEA Incremental $ Opportunity, By End-Use, 2023 to 2033

Table 71: MEA Incremental $ Opportunity, By Risk Type, 2018 to 2022

Table 72: MEA Incremental $ Opportunity, By Country, 2023 - 2033

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2018-2033

Figure 2: Global Market Absolute $ Historical Gain (2018 to 2022) and Opportunity (2023 to 2033), US$ Million Figure

Figure 3: Global Market Share, By Type, 2023 & 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Type – 2023 to 2033

Figure 6: Global Market Share, By End-Use, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 8: Global Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 9: Global Market Share, By Risk Type, 2023 & 2033

Figure 10: Global Market Y-o-Y Growth Projections, By Risk Type – 2023 to 2033

Figure 11: Global Market Attractiveness Index, By Risk Type – 2023 to 2033

Figure 12: Global Market Share, By Region, 2023 & 2033

Figure 13: Global Market Y-o-Y Growth Projections, By Region – 2023 to 2033

Figure 14: Global Market Attractiveness Index, By Region – 2023 to 2033

Figure 15: North America Market Value (US$ Million) and Year-on-Year Growth, 2018-2033

Figure 16: North America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 17: North America Market Share, By Type, 2023 & 2033

Figure 18: North America Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 19: North America Market Attractiveness Index, By Type – 2023 to 2033

Figure 20: North America Market Share, By End-Use, 2023 & 2033

Figure 21: North America Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 22: North America Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 23: North America Market Share, By Risk Type, 2023 & 2033

Figure 24: North America Market Y-o-Y Growth Projections, By Risk Type – 2023 to 2033 Figure

Figure 25: North America Market Attractiveness Index, By Risk Type – 2023 to 2033

Figure 26: North America Market Share, By Country, 2023 & 2033

Figure 27: North America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 28: North America Market Attractiveness Index, By Country – 2023 to 2033

Figure 29: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2018-2033

Figure 30: Latin America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 31: Latin America Market Share, By Type, 2023 & 2033

Figure 32: Latin America Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 33: Latin America Market Attractiveness Index, By Type – 2023 to 2033

Figure 34: Latin America Market Share, By End-Use, 2023 & 2033

Figure 35: Latin America Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 36: Latin America Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 37: Latin America Market Share, By Risk Type, 2023 & 2033

Figure 38: Latin America Market Y-o-Y Growth Projections, By Risk Type – 2023 to 2033

Figure 39: Latin America Market Attractiveness Index, By Risk Type – 2023 to 2033

Figure 40: Latin America Market Share, By Country, 2023 & 2033

Figure 41: Latin America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 42: Latin America Market Attractiveness Index, By Country – 2023 to 2033

Figure 43: Europe Market Value (US$ Million) and Year-on-Year Growth, 2018-2033

Figure 44: Europe Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 45: Europe Market Share, By Type, 2023 & 2033

Figure 46: Europe Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 47: Europe Market Attractiveness Index, By Type – 2023 to 2033

Figure 48: Europe Market Share, By End-Use, 2023 & 2033

Figure 49: Europe Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 50: Europe Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 51: Europe Market Share, By Risk Type, 2023 & 2033

Figure 52: Europe Market Y-o-Y Growth Projections, By Risk Type – 2023 to 2033

Figure 53: Europe Market Attractiveness Index, By Risk Type – 2023 to 2033

Figure 54: Europe Market Share, By Country, 2023 & 2033

Figure 55: Europe Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 56: Europe Market Attractiveness Index, By Country – 2023 to 2033

Figure 57: MEA Market Value (US$ Million) and Year-on-Year Growth, 2018-2033

Figure 58: MEA Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 59: MEA Market Share, By Type, 2023 & 2033

Figure 60: MEA Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 61: MEA Market Attractiveness Index, By Type – 2023 to 2033

Figure 62: MEA Market Share, By End-Use, 2023 & 2033

Figure 63: MEA Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 64: MEA Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 65: MEA Market Share, By Risk Type, 2023 & 2033

Figure 66: MEA Market Y-o-Y Growth Projections, By Risk Type – 2023 to 2033

Figure 67: MEA Market Attractiveness Index, By Risk Type – 2023 to 2033

Figure 68: MEA Market Share, By Country, 2023 & 2033

Figure 69: MEA Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 70: MEA Market Attractiveness Index, By Country – 2023 to 2033

Figure 71: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2018-2033

Figure 72: Asia Pacific Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 73: Asia Pacific Market Share, By Type, 2023 & 2033

Figure 74: Asia Pacific Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness Index, By Type – 2023 to 2033

Figure 76: Asia Pacific Market Share, By End-Use, 2023 & 2033

Figure 77: Asia Pacific Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 78: Asia Pacific Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 79: Asia Pacific Market Share, By Risk Type, 2023 & 2033

Figure 80: Asia Pacific Market Y-o-Y Growth Projections, By Risk Type – 2023 to 2033

Figure 81: Asia Pacific Market Attractiveness Index, By Risk Type – 2023 to 2033

Figure 82: Asia Pacific Market Share, By Country, 2023 & 2033

Figure 83: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 84: Asia Pacific Market Attractiveness Index, By Country – 2023 to 2033

Figure 85: US Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 86: US Market Share, By Type, 2022 Figure 87: US Market Share, By End-Use, 2022

Figure 87: US Market Share, By Risk Type, 2022

Figure 88: Canada Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 89: Canada Market Share, By Type, 2022

Figure 90: Canada Market Share, By End-Use, 2022

Figure 91: Canada Market Share, By Risk Type, 2022

Figure 92: Brazil Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 93: Brazil Market Share, By Type, 2022

Figure 94: Brazil Market Share, By End-Use, 2022

Figure 95: Brazil Market Share, By Risk Type, 2022

Figure 96: Mexico Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 97: Mexico Market Share, By Type, 2022

Figure 98: Mexico Market Share, By End-Use, 2022

Figure 99: Mexico Market Share, By Risk Type, 2022

Figure 100: Germany Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 101: Germany Market Share, By Type, 2022

Figure 102: Germany Market Share, By End-Use, 2022

Figure 103: Germany Market Share, By Risk Type, 2022

Figure 104: United Kingdom Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 105: United Kingdom Market Share, By Type, 2022

Figure 106: United Kingdom Market Share, By End-Use, 2022

Figure 107: United Kingdom Market Share, By Risk Type, 2022

Figure 108: France Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 109: France Market Share, By Type, 2022

Figure 110: France Market Share, By End-Use, 2022

Figure 111: France Market Share, By Risk Type, 2022

Figure 112: Italy Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 113: Italy Market Share, By Type, 2022

Figure 114: Italy Market Share, By End-Use, 2022

Figure 115: Italy Market Share, By Risk Type, 2022

Figure 116: BENELUX Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 117: BENELUX Market Share, By Type, 2022

Figure 118: BENELUX Market Share, By End-Use, 2022

Figure 119: BENELUX Market Share, By Risk Type, 2022

Figure 120: Nordic Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 121: Nordic Countries Market Share, By Type, 2022

Figure 12: Nordic Countries Market Share, By End-Use, 2022

Figure 123: Nordic Countries Market Share, By Risk Type, 2022

Figure 124: China Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 125: China Market Share, By Type, 2022

Figure 126: China Market Share, By End-Use, 2022

Figure 127: China Market Share, By Risk Type, 2022

Figure 128: Japan Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 129: Japan Market Share, By Type, 2022

Figure 130: Japan Market Share, By End-Use, 2022

Figure 131: Japan Market Share, By Risk Type, 2022

Figure 133: South Korea Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 133: South Korea Market Share, By Type, 2022

Figure 134: South Korea Market Share, By End-Use, 2022

Figure 135: South Korea Market Share, By Risk Type, 2022

Figure 136: GCC Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 137: GCC Countries Market Share, By Type, 2022

Figure 138: GCC Countries Market Share, By End-Use, 2022

Figure 139: GCC Countries Market Share, By Risk Type, 2022

Figure 140: South Africa Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 141: South Africa Market Share, By Type, 2022

Figure 142: South Africa Market Share, By End-Use, 2022

Figure 143: South Africa Market Share, By Risk Type, 2022

Figure 144: Turkey Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 145: Turkey Market Share, By Type, 2022

Figure 146: Turkey Market Share, By End-Use, 2022

Figure 147: Turkey Market Share, By Risk Type, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA