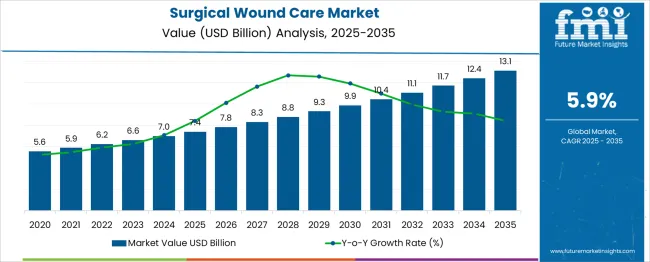

The Surgical Wound Care Market is estimated to be valued at USD 7.4 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. During the initial phase from 2020 to 2025, the market value increases from USD 5.6 billion to USD 7.4 billion. This growth is driven by rising surgical procedures worldwide, growing prevalence of chronic wounds, and increasing awareness of advanced wound care products and technologies. The adoption of innovative wound dressings, negative pressure wound therapy, and bioengineered skin substitutes contributes to enhanced healing outcomes, thereby boosting market demand.

The rising geriatric population and increasing incidence of diabetes and obesity also escalate the need for effective wound management solutions. Between 2026 and 2030, the market is expected to advance from USD 7.8 billion to USD 10.4 billion, fueled by technological advancements, improved healthcare infrastructure, and expanded product portfolios. Growing emphasis on outpatient care and home healthcare settings drives the uptake of user-friendly wound care products and telemedicine-enabled wound management solutions. From 2031 to 2035, the market accelerates from USD 11.1 billion to USD 13.1 billion, supported by ongoing research, increased healthcare spending, and rising demand in emerging economies. Overall, the Surgical Wound Care Market is positioned for robust and sustained growth through 2035, driven by innovation, demographic trends, and evolving clinical practices focused on improving patient outcomes and reducing healthcare costs.

| Metric | Value |

|---|---|

| Surgical Wound Care Market Estimated Value in (2025 E) | USD 7.4 billion |

| Surgical Wound Care Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The surgical wound care market is witnessing significant expansion driven by the increasing volume of surgeries, growing emphasis on infection prevention, and advancements in wound closure technologies. Rising geriatric populations, higher prevalence of chronic illnesses, and improved healthcare infrastructure have resulted in increased surgical procedures globally.

This has amplified demand for advanced wound closure and care products that accelerate healing while reducing the risk of surgical site infections. Regulatory support for improved patient safety standards, coupled with reimbursement frameworks favoring modern surgical dressings and devices, is accelerating product adoption.

Technological innovations such as antimicrobial sutures, bioactive dressings, and absorbable staplers are helping to standardize outcomes, enhance surgical precision, and reduce hospital stay durations.

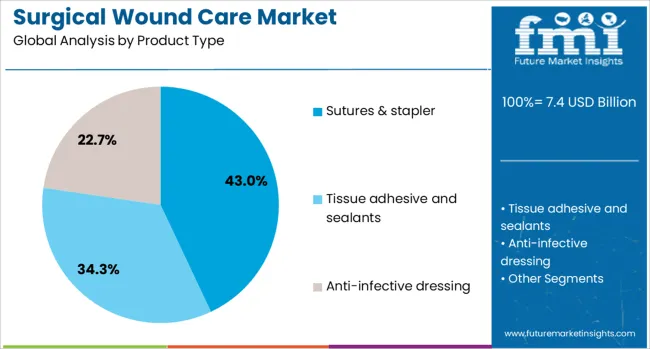

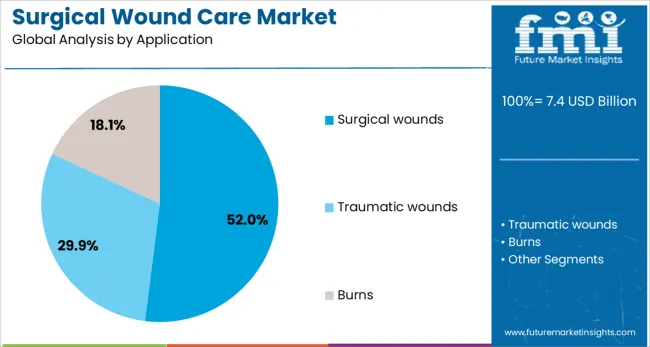

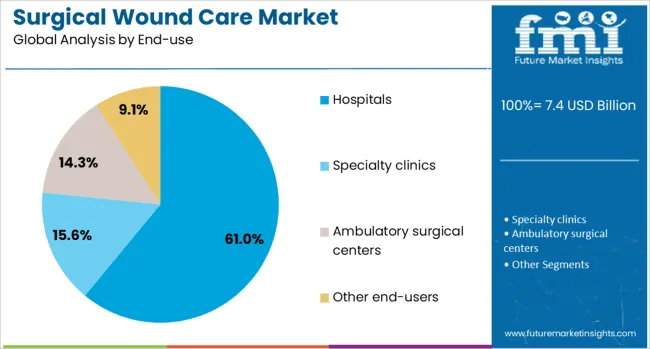

The surgical wound care market is segmented by product type, application, end-use, and geographic regions. The surgical wound care market is divided into Sutures & staplers, Tissue adhesives and sealants, and Anti-infective dressings. In terms of application, the surgical wound care market is classified into Surgical wounds, Traumatic wounds, and Burns. The end-use of the surgical wound care market is segmented into Hospitals, Specialty clinics, Ambulatory surgical centers, and other end-users. Regionally, the surgical wound care industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sutures and staplers are projected to dominate the product type segment with a 43.00% market share in 2025. Their widespread usage across surgical specialties, proven effectiveness in tissue approximation, and compatibility with minimally invasive techniques are key contributors to this leadership.

Increasing development of absorbable variants and smart sutures with drug delivery or healing-monitoring capabilities is further reinforcing their clinical value.

The rapid procedural efficiency and reduced post-operative complications associated with these closure devices make them essential tools in both routine and complex surgeries.

Surgical wounds are expected to account for 52.00% of the total market share by 2025, making them the dominant application area within surgical wound care. This is due to the global rise in elective and emergency surgical procedures, spanning orthopedics, cardiovascular, and general surgery domains.

The need for precision closure, risk mitigation against infections, and long-term aesthetic and functional recovery is driving demand for specialized wound care interventions in surgical settings.

As surgical volumes continue to rise across both developed and emerging markets, this segment is poised for sustained leadership.

Hospitals are anticipated to lead the end-use category with a commanding 61.00% share in 2025. This dominance stems from the central role hospitals play in major surgical care, post-operative monitoring, and infection control.

The availability of skilled personnel, high surgical throughput, and institutional preference for standardized, FDA-approved wound closure systems support greater procurement in hospital settings.

In addition, the presence of dedicated surgical units and advanced sterilization infrastructure further reinforces hospitals’ market position.

The surgical wound care market is driven by increasing surgical procedures, infection-control strategies, adoption in outpatient care, and growing use of regenerative solutions. These factors collectively reinforce its essential role in modern healthcare.

The growing number of surgical procedures worldwide is a major driver for the surgical wound care market. Rising prevalence of chronic conditions like diabetes and cardiovascular disorders has significantly increased the frequency of surgical interventions. Lifestyle-related health issues contribute to higher demand for operative treatments, boosting the need for effective post-surgical wound care solutions. Hospitals and ambulatory centers are adopting advanced dressings and closure systems to minimize complications and promote faster recovery. Manufacturers are introducing tailored wound care solutions to cater to complex surgical requirements. This upward trend in surgical volumes directly correlates with market growth, making surgical wound management an indispensable part of healthcare delivery.

Preventing surgical site infections remains a priority for healthcare providers, influencing strong adoption of antimicrobial wound care products. Advanced dressings with infection-control properties are increasingly being used to reduce the risk of hospital-acquired infections, which can lead to prolonged hospital stays and additional treatment costs. The integration of silver-based and iodine-infused dressings is gaining popularity due to their proven effectiveness against bacterial growth. Regulatory bodies emphasize strict compliance with infection prevention protocols, creating opportunities for manufacturers offering clinically tested solutions. These developments reinforce the role of infection-control strategies as a key growth factor in the surgical wound care market globally.

The growing trend toward outpatient surgeries has transformed demand patterns for surgical wound care products. Ambulatory surgical centers require easy-to-use and cost-effective wound management solutions that ensure faster recovery and reduce the risk of complications after discharge. Patients prefer minimally invasive procedures, leading to shorter hospital stays and a greater need for advanced dressings that provide long-lasting protection. Manufacturers are responding by designing compact, high-performance wound care systems suited for homecare environments. This shift reflects a broader preference for decentralized healthcare models, where convenience and patient comfort significantly influence product selection in the surgical wound care sector.

Bioactive wound care products are gaining attention for their ability to promote faster tissue regeneration and improve post-operative healing outcomes. Solutions incorporating growth factors, collagen, and hydrocolloid formulations are being introduced to address complex surgical wounds, especially in patients with delayed healing conditions. Healthcare providers are increasingly prioritizing such advanced products to minimize recovery time and reduce the risk of post-surgical complications. The adoption of bioactive technologies is particularly strong in specialized surgical areas like orthopedics and cardiovascular procedures, where enhanced healing efficiency is critical. This trend positions regenerative wound care as a promising area of growth within the broader surgical wound care market.

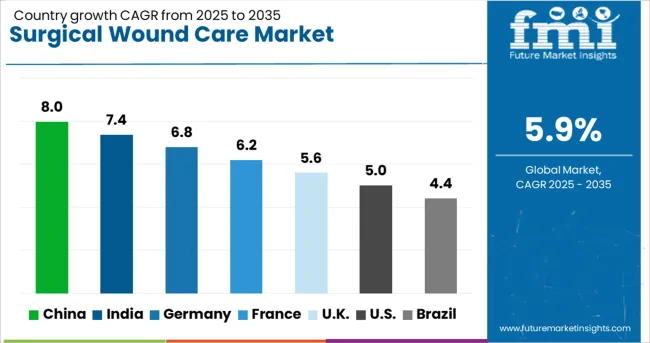

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

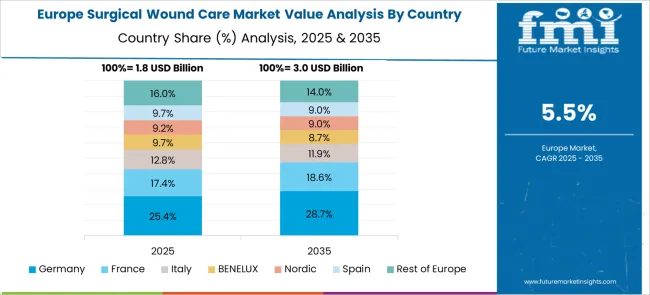

The surgical wound care market is expected to grow globally at a CAGR of 5.9% from 2025 to 2035, supported by an increase in surgical procedures, advancements in wound healing technologies, and a rising focus on infection prevention. China leads with a CAGR of 8.0%, driven by growing healthcare investments, large-scale hospital infrastructure development, and government-backed initiatives improving surgical care standards. India follows at 7.4%, supported by an expanding population base requiring elective and emergency surgeries, combined with increased affordability of advanced wound care solutions. France posts a CAGR of 6.2%, benefitting from rising surgical volumes, strong reimbursement policies, and early adoption of negative pressure wound therapy. The United Kingdom grows at 5.6%, reflecting demand for post-operative homecare solutions and growing use of advanced dressings in ambulatory centers. The United States posts 5.0%, influenced by a mature market environment, demand for outpatient surgical care, and adoption of bioactive and antimicrobial wound care technologies. The analysis spans more than 40 countries globally, with these five markets serving as benchmarks for evaluating technological trends, regulatory frameworks, and opportunities for strategic investments in surgical wound management solutions.

China posted a CAGR of about 6.9% during 2020–2024, which climbed to 8.0% for 2025–2035, supported by rising surgical volumes and increased adoption of advanced wound healing solutions. The early phase growth was driven by infrastructure improvements in Tier-1 hospitals and gradual penetration of antimicrobial dressings. Moving into the next decade, expansion of public healthcare programs, government incentives for infection prevention, and growing demand for bioactive dressings are accelerating adoption. The rise in complex surgeries such as cardiovascular and orthopedic procedures has also fueled demand for advanced wound management systems. Domestic and international manufacturers continue to scale production capacity to meet rising demand in both hospital and homecare settings.

India recorded a CAGR of nearly 6.2% between 2020–2024, which advanced to 7.4% during 2025–2035, driven by rapid expansion in healthcare access and higher surgical procedure volumes. The earlier growth period was shaped by increased adoption of basic dressings in urban hospitals and rising public awareness of infection control. During the next decade, government-driven insurance programs, combined with a shift toward minimally invasive surgeries, stimulated demand for advanced surgical wound care products. The integration of antimicrobial technologies and bioactive materials in post-operative dressings has significantly improved healing outcomes, enhancing market penetration in both public and private healthcare sectors.

France saw a CAGR of about 5.5% in 2020–2024, which strengthened to 6.2% for 2025–2035, driven by stringent infection prevention norms and early adoption of advanced wound care technologies. In the earlier phase, demand was dominated by traditional dressings, with gradual uptake of antimicrobial products across major hospitals. By the next decade, investments in healthcare digitization, along with government reimbursement policies for advanced wound therapy, have accelerated adoption. Negative pressure wound therapy and hydrocolloid dressings are gaining strong momentum in surgical settings, ensuring faster healing and reduced hospital stays. This transition reflects France’s commitment to adopting innovative clinical protocols in post-operative care.

The United Kingdom recorded a CAGR of 4.8% during 2020–2024, which rose to 5.6% in 2025–2035, reflecting steady market progress influenced by patient-centric care models and cost-effective outpatient solutions. Early growth was driven by conventional wound care products, with limited uptake of advanced dressings due to budget constraints in NHS facilities. In the forecast period, initiatives promoting infection control, along with wider adoption of bioactive and antimicrobial technologies, strengthened demand. Increasing emphasis on home-based recovery and advanced wound care kits tailored for ambulatory settings is shaping the next phase of market expansion.

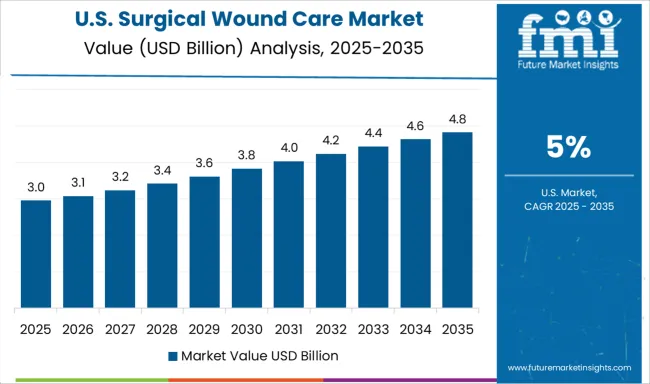

The United States experienced a CAGR of approximately 4.3% during 2020–2024, which improved to 5.0% during 2025–2035, driven by rising outpatient surgeries and integration of advanced wound care systems. Initial growth relied on steady hospital demand for traditional surgical dressings, supported by incremental adoption of antimicrobial technologies. The coming decade brings greater emphasis on negative pressure wound therapy and bioactive solutions, addressing complex wounds and reducing hospital readmissions. Favorable reimbursement frameworks and increasing partnerships between healthcare providers and suppliers are accelerating market penetration, while smart wound monitoring devices are emerging as a differentiator for premium healthcare facilities.

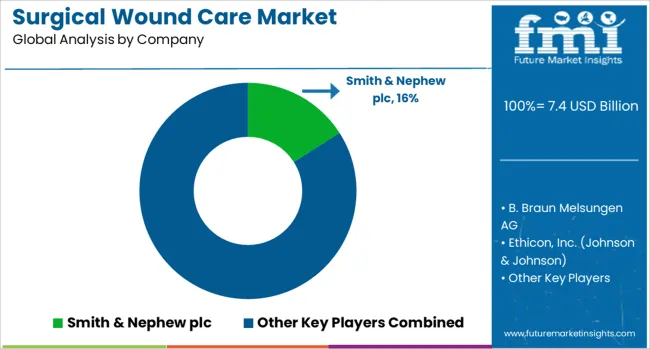

The surgical wound care market is highly competitive, shaped by global leaders such as Smith & Nephew plc, B. Braun Melsungen AG, Ethicon, Inc. (Johnson & Johnson), Medtronic plc, Mölnlycke Health Care AB, Baxter International Inc., 3M Company, ConvaTec Group plc, URGO Medical, Coloplast A/S, Derma Sciences Inc. (Integra LifeSciences Holdings Corporation), Medline Industries, LP, and Advancis Medical. These players compete through innovation in advanced dressings, negative pressure wound therapy (NPWT) systems, and bioactive materials to accelerate healing and minimize infection risks. Smith & Nephew maintains leadership in NPWT and advanced surgical dressings, supported by investments in digital wound monitoring platforms. B. Braun Melsungen AG leverages its strong hospital networks to distribute comprehensive wound care solutions across Europe and emerging markets. Ethicon (Johnson & Johnson) focuses on surgical closure systems combined with infection prevention technologies, enhancing surgical outcomes.

Medtronic emphasizes integrated wound closure and hemostasis solutions, particularly for high-risk surgical cases. Mölnlycke Health Care is a key player in foam dressings and antimicrobial technology for surgical site infection control, while 3M Company capitalizes on its robust adhesive technology portfolio for surgical dressings and drapes. ConvaTec, Coloplast, and URGO Medical have strengthened their positions in advanced wound care through bioactive dressings and moisture-balancing technologies. Baxter International is expanding through hospital partnerships, offering comprehensive wound management kits. Competitive strategies include acquisitions, digital platform integration for wound monitoring, and geographic expansion into Asia-Pacific and Latin America. Future success will depend on cost optimization, regulatory compliance, and alignment with clinical protocols for faster recovery, positioning these players as crucial contributors to the evolution of surgical wound care globally.

In January 2025, Smith & Nephew plc launched ALLEVYN LIFE Sacrum Foam Dressing and LEAF Patient Monitoring System, both received ‘favorable’ ECRI Evidence Bar™ ratings for pressure injury prevention.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.4 Billion |

| Product Type | Sutures & stapler, Tissue adhesive and sealants, and Anti-infective dressing |

| Application | Surgical wounds, Traumatic wounds, and Burns |

| End-use | Hospitals, Specialty clinics, Ambulatory surgical centers, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smith & Nephew plc, B. Braun Melsungen AG, Ethicon, Inc. (Johnson & Johnson), Medtronic plc, Mölnlycke Health Care AB, Baxter International Inc., 3M Company, ConvaTec Group plc, URGO Medical, Coloplast A/S, Derma Sciences Inc. (Integra LifeScience Holdings Corporation), Medline Industries, LP, and Advancis Medical |

| Additional Attributes | Dollar sales, share by product type and region, competitive positioning, pricing benchmarks, hospital vs ambulatory demand, regulatory frameworks, procurement trends, and forecasted growth for advanced and traditional surgical wound care solutions. |

The global surgical wound care market is estimated to be valued at USD 7.4 billion in 2025.

The market size for the surgical wound care market is projected to reach USD 13.1 billion by 2035.

The surgical wound care market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in surgical wound care market are sutures & stapler, tissue adhesive and sealants and anti-infective dressing.

In terms of application, surgical wounds segment to command 52.0% share in the surgical wound care market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA