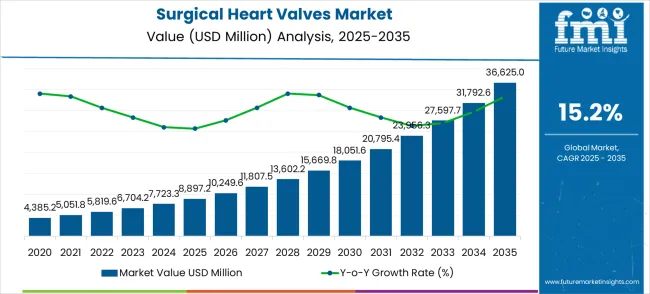

The surgical heart valves market is estimated at USD 8,897.2 million in 2025 and is forecasted to reach USD 36,625.0 million by 2035, demonstrating a robust CAGR of 15.2% over the forecast period. This substantial growth reflects increasing prevalence of cardiovascular diseases, rising geriatric population, and advancements in surgical procedures and valve technology. The market trajectory highlights consistent year-on-year growth, with the highest annual increments occurring in the mid-to-late period of the decade. The initial value, projected value, and CAGR underscore the high expansion potential of the surgical heart valve sector, positioning it as one of the fastest-growing segments within cardiovascular medical devices. The global surgical heart valves market is projected to grow from USD 8,897.2 million in 2025 to approximately USD 36,625.0 million by 2035, recording an absolute increase of USD 27,727.8 million over the forecast period.

This translates into a total growth of 311.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 15.2% between 2025 and 2035. The overall market size is expected to grow by nearly 4.12X during the same period, supported by increasing prevalence of cardiovascular diseases and growing adoption of minimally invasive transcatheter procedures across various cardiac intervention applications and aging population demographics.

Analyzing comparative performance across the forecast period, the market grows from USD 8,897.2 million in 2025 to USD 10,249.6 million in 2026, reflecting a 15.2% YoY increase. Growth accelerates in subsequent years, reaching USD 13,602.2 million in 2028–2029 and USD 18,051.6 million in 2030–2031. These years can be considered peak growth periods as annual increases are higher than the average YoY percentage change, indicating rapid adoption of advanced heart valve technologies and increasing procedural volumes globally.

Early years show steady but slightly lower increments, whereas mid-to-late years reflect the compounding effect of technological integration and market penetration. Between 2025 and 2030, the surgical heart valves market is projected to expand from USD 8,897.2 million to USD 18,051.6 million, resulting in a value increase of USD 9,154.4 million, which represents 33.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising aging populations across developed countries, increasing prevalence of aortic stenosis and mitral regurgitation, and growing adoption of transcatheter valve replacement procedures in high-risk patient populations. Cardiac centers are investing in advanced valve technologies to improve patient outcomes and expand treatment options for patients previously considered inoperable.

From 2030 to 2035, the market is forecast to grow from USD 18,051.6 million to USD 36,625.0 million, adding another USD 18,573.4 million, which constitutes 67.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of transcatheter procedures to lower-risk patient populations, the integration of artificial intelligence in valve sizing and positioning, and the development of next-generation valve designs with enhanced durability and hemodynamics. The growing focus on patient-specific treatment approaches and minimally invasive techniques will drive demand for innovative and precisely engineered surgical heart valve solutions across multiple cardiovascular specialties.

Between 2020 and 2025, the surgical heart valves market experienced robust expansion, driven by increasing cardiovascular disease prevalence globally and growing clinical evidence supporting transcatheter valve interventions. The market developed as cardiac surgeons and interventional cardiologists recognized the benefits of minimally invasive valve replacement procedures for reducing surgical risks and improving patient recovery outcomes. Clinical trials and regulatory approvals began influencing treatment protocols toward transcatheter valve technologies from established medical device manufacturers.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 8,897.2 million |

| Market Forecast Value (2035) | USD 36,625.0 million |

| Forecast CAGR (2025–2035) | 15.2% |

The market’s trough performance is observed in the initial year of 2025, where the base value sets the reference for subsequent expansion. While all years exhibit positive growth, the initial phase of adoption may be constrained by regulatory clearances and hospital procurement cycles. Later years from 2032 to 2035 show continued strong growth with values moving from USD 27,597.7 million to USD 36,625.0 million, indicating that the market sustains momentum even after mid-decade peaks. This reflects the cumulative effect of technological innovation, patient awareness, and expansion of cardiac surgical infrastructure in emerging and developed regions.

Comparative analysis across segments and geographies, where available, shows that mechanical and bioprosthetic valve segments often demonstrate varied growth patterns, with bioprosthetic valves typically witnessing faster adoption due to improved patient outcomes. Regional variations indicate that North America and Europe dominate early adoption, while Asia-Pacific exhibits accelerated growth in later years, contributing significantly to the total market size by 2035. The market demonstrates strong expansion with clear peak years in the mid-decade and sustained growth in later years, underlining its resilience and high investment potential.

Market expansion is being supported by the rapidly aging global population and the corresponding increase in age-related cardiovascular diseases requiring surgical intervention. Modern cardiac care requires advanced valve replacement technologies that provide superior clinical outcomes while minimizing procedural risks and recovery times. The excellent safety profiles and proven clinical efficacy of transcatheter heart valve procedures make them essential components in contemporary cardiovascular medicine where patient outcomes and quality of life improvement are paramount.

The growing emphasis focus on minimally invasive cardiac procedures and patient-centered care is driving demand for advanced valve technologies from certified manufacturers with proven track records of clinical safety and procedural success. Healthcare providers are increasingly investing in transcatheter valve systems that offer reduced procedural risks and improved patient experiences compared to traditional open-heart surgery approaches. Clinical evidence and regulatory guidelines are establishing treatment standards that favor minimally invasive valve replacement solutions with demonstrated long-term durability and hemodynamic performance.

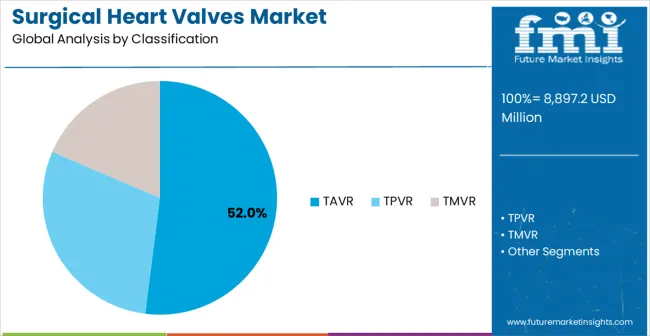

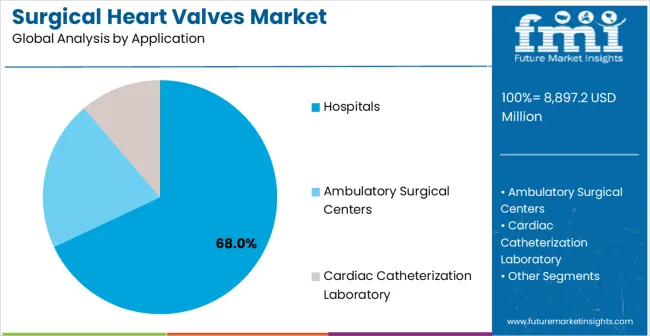

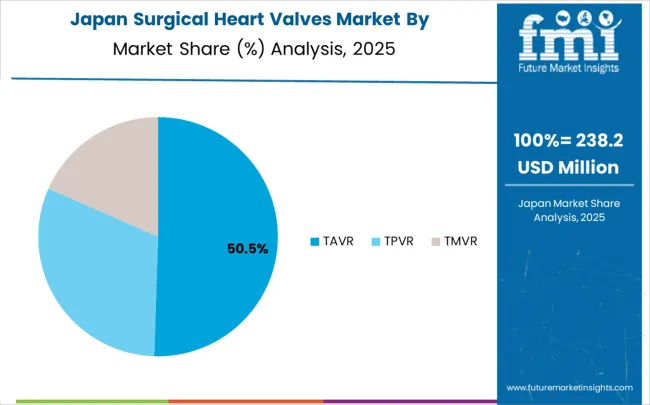

The market is segmented by procedure type, application, and region. By intervention approach, the market is divided into TAVR (Transcatheter Aortic Valve Replacement), TPVR (Transcatheter Pulmonary Valve Replacement), and TMVR (Transcatheter Mitral Valve Replacement). Based on application, the market is categorized into hospitals, ambulatory surgical centers, and cardiac catheterization laboratories. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

TAVR (Transcatheter Aortic Valve Replacement) procedures are projected to account for 52% of the surgical heart valves market in 2025. This leading share is supported by the well-established clinical evidence base for TAVR procedures and the large patient population with aortic stenosis requiring intervention. TAVR provides excellent clinical outcomes with reduced procedural risks compared to surgical aortic valve replacement, making it the preferred treatment approach for high-risk and intermediate-risk patients with severe aortic stenosis. The segment benefits from extensive clinical experience, proven long-term durability, and expanding indications that now include lower-risk patient populations.

Modern TAVR systems incorporate advanced valve designs, precise delivery mechanisms, and comprehensive imaging guidance that ensure optimal valve positioning and hemodynamic performance. These innovations have significantly improved procedural success rates and long-term clinical outcomes while reducing complications through minimally invasive access approaches and enhanced valve technologies. The cardiology and cardiac surgery communities particularly drive demand for TAVR solutions, as these procedures offer proven benefits for patients across multiple risk categories and age groups.

AdditionallyT, the aging population and increasing prevalence of degenerative aortic stenosis create sustained demand for TAVR procedures globally. The integration of advanced imaging technologies and artificial intelligence in valve sizing and positioning creates opportunities for further procedural optimization and outcome improvement, accelerating market adoption as cardiac centers seek the most effective treatment options for their patient populations.

Hospital applications are expected to represent 68% of surgical heart valves demand in 2025. This dominant share reflects the complex nature of cardiac valve procedures and the institutional infrastructure required for comprehensive cardiovascular care. Hospital environments provide the necessary resources for pre-procedural planning, advanced imaging capabilities, surgical backup, and post-procedural monitoring required for successful valve interventions. The segment benefits from established cardiovascular service lines, specialized cardiac teams, and the capability to manage complex patient cases and potential complications.

Hospital applications demand exceptional clinical support capabilities to ensure optimal patient outcomes across diverse valve pathologies and patient risk profiles. These applications require comprehensive cardiovascular programs with interventional cardiology, cardiac surgery, anesthesiology, and critical care capabilities working collaboratively to deliver optimal patient care. The growing emphasis focus on cardiovascular excellence and patient outcome optimization drives consistent demand for advanced valve technologies in hospital settings that can demonstrate superior clinical results. Major medical centers and cardiovascular hospitals contribute significantly to market growth as institutions invest in leading-edge valve technologies to maintain clinical leadership and attract referring physicians.

AdditionallyT, the trend toward hybrid cardiovascular programs and heart team approaches in hospital systems creates opportunities for comprehensive valve treatment programs that combine surgical and transcatheter expertise. The segment also benefits from increasing hospital system consolidation and the development of specialized cardiovascular centers of excellence focused on valve disease management.

The surgical heart valves market is advancing rapidly due to increasing cardiovascular disease prevalence and growing recognition of transcatheter valve intervention benefits in improving patient outcomes. However T, the market faces challenges including high device costs affecting healthcare budgets, reimbursement complexity across different healthcare systems, and the need for specialized training in transcatheter techniques. Clinical evidence development and physician education programs continue to influence adoption patterns and procedural volume growth.

The growing implementation of 3D imaging systems, advanced echocardiography, and AI-powered valve sizing algorithms is enabling precise procedural planning and optimal valve selection in transcatheter interventions. Advanced imaging technologies provide comprehensive anatomical assessment and procedural guidance while optimizing valve positioning and reducing procedural complications. These technologies are particularly important for complex anatomical cases and patients requiring precise valve sizing for optimal hemodynamic outcomes.

Modern valve manufacturers are incorporating advanced materials science, refined valve leaflet designs, and innovative delivery mechanisms that improve valve hemodynamics while reducing procedural complexity and paravalvular regurgitation. Integration of biocompatible materials and enhanced valve durability enables superior long-term performance and significant clinical advantages compared to earlier-generation valve technologies. Advanced manufacturing techniques and quality control systems also support development of patient-specific valve solutions for diverse anatomical variations and clinical requirements.

| Country | CAGR (2025–2035) |

|---|---|

| China | 20.5% |

| India | 19.0% |

| Germany | 17.5% |

| Brazil | 16.0% |

| United States | 14.4% |

| United Kingdom | 12.9% |

| Japan | 11.4% |

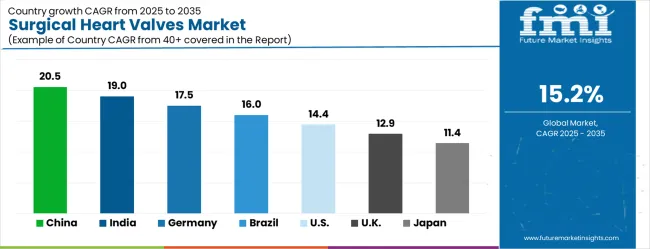

The global market is projected to grow at a CAGR of 15.2% between 2025 and 2035, driven by rising prevalence of cardiovascular diseases and increasing demand for advanced cardiac surgical procedures. China leads with 20.5% growth, supported by expanding healthcare infrastructure, rising surgical volumes, and adoption of innovative heart valve technologies. India follows at 19.0%, reflecting growing awareness of cardiovascular health, increasing hospital capacities, and advanced surgical adoption. Germany records 17.5%, driven by high standards in cardiac care and rapid integration of minimally invasive valve technologies. Brazil is projected at 16.0%, supported by improving healthcare access and rising cardiovascular procedure rates. The United States grows at 14.4% with steady demand for surgical valves and technological advancements, while the United Kingdom expands at 12.9% and Japan at 11.4%, reflecting gradual market growth and ongoing adoption of advanced cardiac interventions.

The surgical heart valves market is growing rapidly, with China leading at a 20.5% CAGR through 2035, driven by massive healthcare infrastructure development, increasing cardiovascular disease prevalence, and growing adoption of advanced cardiac interventions. India follows at 19.0%, supported by expanding healthcare access and rising awareness of transcatheter valve procedures in treating structural heart disease. Germany records strong growth at 17.5%, emphasizing clinical excellence, advanced cardiovascular care capabilities, and comprehensive healthcare coverage for cardiac interventions. Brazil grows steadily at 16.0%, integrating modern cardiac technologies into expanding healthcare systems and specialist cardiac centers. The United States shows strong growth at 14.4%, focusing on clinical innovation and expanding transcatheter procedure indications. The United Kingdom maintains robust expansion at 12.9%, supported by NHS cardiac services and clinical research programs. Japan demonstrates significant growth at 11.4%, emphasizing technological innovation and aging population cardiac care solutions.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is projected to grow at a CAGR of 20.5% from 2025 to 2035, emerging as one of the fastest-growing surgical heart valve markets globally. Rising prevalence of cardiovascular diseases, aging population, and increasing number of cardiac surgeries are driving demand for advanced surgical valve solutions. Hospitals and specialty cardiac centers are adopting both mechanical and bioprosthetic valves to enhance patient outcomes. Local manufacturers are investing in research and development to produce high-performance, durable valves while complying with stringent medical regulations. Collaborations with international valve manufacturers are facilitating technology transfer and improving access to premium surgical solutions. Expanding health insurance coverage and rising patient awareness of minimally invasive procedures are further supporting growth in both urban and semi-urban regions.

India is expected to grow at a CAGR of 19.0% from 2025 to 2035, fueled by increasing cardiovascular disease burden and expanding cardiac care infrastructure. Hospitals and specialty cardiac centers are adopting advanced mechanical and tissue valves for valve replacement surgeries. Government healthcare initiatives and rising health insurance penetration are improving accessibility for patients requiring surgical interventions. Domestic manufacturers are collaborating with international players to introduce innovative, cost-effective valve designs. Adoption is further enhanced by training programs for cardiologists and surgical teams, ensuring quality outcomes. Minimally invasive valve replacement procedures are becoming increasingly popular, especially in urban healthcare centers, boosting the market. Growth is supported by rising patient awareness, technological advancements, and expansion of private and public hospital networks across India.

Germany is estimated to grow at a CAGR of 17.5% from 2025 to 2035, driven by adoption of high-performance surgical heart valves and technological innovation in cardiac care. Hospitals are increasingly preferring tissue and mechanical valves with advanced durability and biocompatibility. German manufacturers are focusing on research for improved hemodynamic performance, anti-calcification coatings, and minimally invasive deployment systems. Regulatory standards for device safety and efficacy encourage the production of high-quality valves, supporting sustained growth. The country’s well-established cardiac surgery infrastructure and growing elderly population contribute to increased procedure volumes. Collaborations between research institutes and medical device companies are fostering product innovation, ensuring Germany remains a leading market for advanced heart valve solutions in Europe.

Brazil is projected to expand at a CAGR of 16.0% from 2025 to 2035, driven by rising cardiovascular disease incidence and increasing accessibility of cardiac surgical procedures. Adoption of both mechanical and tissue valves is growing in hospitals and specialty cardiac centers across urban and semi-urban regions. Local and international manufacturers are collaborating to provide cost-effective and durable valve solutions. Government initiatives to improve healthcare infrastructure and increase insurance coverage are supporting market growth. Minimally invasive and transcatheter procedures are increasingly implemented, reducing patient recovery time and boosting hospital adoption. Demand for valve replacement in high-risk patients, coupled with growing patient awareness, ensures steady growth across both public and private healthcare segments in Brazil.

The United States is expected to grow at a CAGR of 14.4% during 2025–2035, driven by advanced healthcare infrastructure and rising prevalence of valvular heart diseases. Hospitals and specialty cardiac centers are adopting mechanical, tissue, and transcatheter valves for both adult and pediatric populations. Domestic manufacturers focus on innovative materials, minimally invasive deployment systems, and anti-calcification technology. Rising patient awareness and health insurance coverage contribute to higher procedure volumes. Adoption of transcatheter aortic valve replacement (TAVR) and mitral valve procedures is increasing steadily, offering alternatives to conventional open-heart surgeries. The USA market benefits from early adoption of medical innovations, clinical trial participation, and strong research funding in cardiovascular care.

The United Kingdom is projected to grow at a CAGR of 12.9% from 2025 to 2035, led by increasing demand for mechanical and tissue heart valves in hospitals and cardiac specialty centers. Adoption is driven by rising awareness of valvular heart disease, government healthcare programs, and improved access to surgical procedures. Manufacturers focus on high-performance valves with durability and biocompatibility, while import of premium transcatheter valves complements domestic offerings. Minimally invasive valve replacement procedures are gaining traction, reducing hospital stays and recovery time. Collaborations between NHS hospitals and medical device companies support clinical trials and technology adoption, reinforcing market growth. The UK market is shaped by patient-centric care, hospital modernization, and procedural innovation.

Japan is expected to grow at a CAGR of 11.4% from 2025 to 2035, reflecting steady demand for mechanical, tissue, and transcatheter surgical heart valves. Hospitals and specialized cardiac centers are increasingly implementing minimally invasive procedures to improve patient outcomes. Domestic manufacturers focus on high-quality valve production and collaborate with international companies to ensure access to advanced valve technologies. Rising prevalence of valvular heart disease among the aging population supports consistent growth. Government healthcare programs and insurance coverage facilitate adoption, particularly in private and specialty hospitals. Patient awareness campaigns and training programs for surgical teams improve procedure efficiency and expand market acceptance. The market is characterized by technological adoption, regulatory compliance, and strong hospital infrastructure.

Revenue from surgical heart valves systems in China is projected to exhibit the highest growth rate with a CAGR of 20.5% through 2035, driven by rapid healthcare infrastructure development and massive expansion of cardiovascular care capabilities across major metropolitan and regional medical centers. The country's growing elderly population and increasing cardiovascular disease prevalence are creating significant demand for advanced heart valve technologies. Major cardiac centers are establishing comprehensive structural heart disease programs to support growing patient populations and meet international care standards.

Healthcare modernization programs are supporting widespread adoption of transcatheter valve technologies across cardiovascular centers, driving demand for proven valve systems with demonstrated clinical efficacy and safety profiles.

Aging population demographics and cardiovascular disease prevalence are creating substantial opportunities for advanced valve applications in healthcare settings requiring sophisticated cardiac intervention capabilities.

Revenue from surgical heart valves systems in India is expanding at a CAGR of 19.0%, supported by increasing healthcare accessibility across diverse populations and growing investments in advanced cardiac care infrastructure. The country's expanding healthcare system and rising awareness of structural heart disease treatment options are driving demand for transcatheter valve technologies capable of treating complex patient populations. Healthcare facilities are investing in proven valve systems to improve cardiac care capabilities and expand treatment options for previously underserved patient populations.

Healthcare access expansion and cardiac care development are creating opportunities for advanced valve applications across diverse healthcare settings requiring reliable treatment solutions and clinical outcomes.

Infrastructure development programs and specialty care expansion are driving investments in modern valve technologies for cardiovascular applications throughout major medical centers and regional cardiac programs.

Demand for surgical heart valves systems in Germany is projected to grow at a CAGR of 17.5%, supported by the country's emphasis on clinical excellence and comprehensive cardiovascular care delivery standards. German cardiac centers are implementing advanced valve technologies that meet stringent clinical requirements and evidence-based treatment protocols. The market is characterized by focus on clinical outcomes, patient safety, and compliance with rigorous healthcare quality standards.

Cardiovascular excellence investments are prioritizing advanced valve technologies that demonstrate superior clinical performance and evidence-based outcomes while meeting German healthcare quality and safety standards.

Clinical research programs and evidence-based medicine initiatives are driving adoption of proven valve systems that support optimal patient outcomes and cardiovascular care excellence.

Revenue from surgical heart valves systems in Brazil is growing at a CAGR of 16.0%, driven by expanding cardiac care infrastructure and increasing adoption of transcatheter valve technologies across public and private healthcare sectors. The country's developing cardiovascular care capabilities are investing in advanced valve solutions to improve patient access to modern cardiac interventions. Healthcare facilities are adopting proven valve technologies to support growing cardiac patient populations and evolving treatment standards.

Cardiac care infrastructure expansion and healthcare system development are facilitating adoption of advanced valve technologies capable of supporting improved cardiovascular outcomes in expanding healthcare environments.

Healthcare modernization initiatives and specialty care development are driving demand for reliable valve solutions that meet evolving clinical standards and patient care requirements.

Demand for surgical heart valves systems in the United States is expanding at a CAGR of 14.4%, driven by ongoing clinical innovation and comprehensive cardiovascular care programs across healthcare systems. Cardiac centers are investing in next-generation valve technologies that demonstrate superior clinical outcomes and expanded treatment indications. The market benefits from robust clinical research infrastructure and evidence-based adoption programs supporting advanced cardiovascular interventions.

Clinical innovation and cardiovascular excellence programs are driving adoption of advanced valve systems that demonstrate superior clinical benefits and evidence-based treatment advantages.

Healthcare quality initiatives and outcome-based care programs are supporting adoption of valve technologies that provide measurable improvements in patient outcomes and cardiovascular care delivery.

Demand for surgical heart valves systems in the United Kingdom is projected to grow at a CAGR of 12.9%, supported by comprehensive NHS cardiac services and national clinical research programs focused on cardiovascular innovation. Healthcare providers are implementing evidence-based valve technologies that provide consistent clinical outcomes and meet established treatment guidelines. The market is characterized by focus on clinical effectiveness, cost-effectiveness, and compliance with national healthcare standards.

NHS cardiac service initiatives and clinical excellence programs are supporting adoption of advanced valve systems that meet contemporary clinical standards and evidence-based treatment requirements.

Clinical research and healthcare innovation programs are creating demand for proven valve technologies that provide reliable clinical outcomes and healthcare system benefits.

Demand for surgical heart valves systems in Japan is expanding at a CAGR of 11.4%, driven by the country's emphasis on technological innovation and comprehensive cardiac care solutions for aging populations. Japanese manufacturers and healthcare providers are developing advanced valve technologies that address the specific needs of elderly patients and complex cardiac conditions. The market benefits from focus on innovation, precision engineering, and continuous improvement in cardiovascular care delivery.

Aging population care programs and technological innovation initiatives are driving development of advanced valve systems that address specific cardiovascular needs of elderly patients and complex disease management.

Medical device innovation and precision healthcare programs are supporting adoption of high-quality valve solutions that optimize clinical outcomes and cardiovascular care effectiveness.

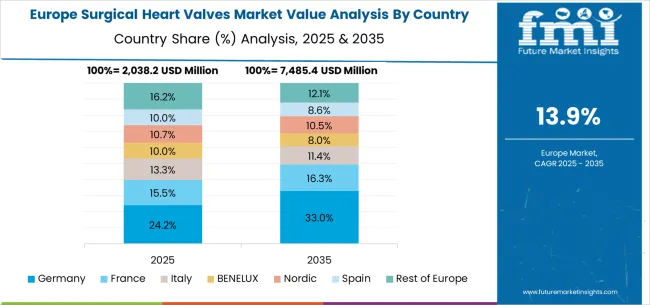

The surgical heart valves market in Europe is projected to grow from USD 2,399.5 million in 2025 to USD 9,873.8 million by 2035, registering a CAGR of 15.2% over the forecast period. Germany is expected to maintain its leadership with a 28.4% share in 2025, supported by its comprehensive cardiovascular healthcare system and advanced cardiac care infrastructure. The United Kingdom follows with 17.8% market share, driven by NHS cardiac services and clinical research programs. France holds 15.6% of the European market, benefiting from healthcare system modernization and cardiovascular care expansion. Italy and Spain collectively represent 23.2% of regional demand, with growing focus on transcatheter valve procedures and cardiac care development. The Rest of Europe region accounts for 15.0% of the market, supported by healthcare development in Eastern European countries and Nordic cardiovascular care systems.

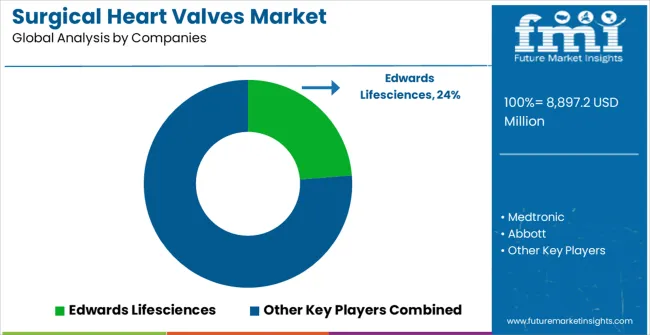

The market is highly competitive, driven by innovation, clinical reliability, and procedural efficiency. Edwards Lifesciences, Medtronic, and Abbott dominate with advanced transcatheter and mechanical valve technologies, focusing durability, biocompatibility, and minimally invasive delivery systems. Their competitive strength lies in extensive clinical data, global regulatory approvals, and comprehensive training programs for cardiologists and cardiac surgeons. Brochures highlight long-term hemodynamic performance, reduced complication rates, and compatibility with diverse patient anatomies, positioning these firms as leaders in both surgical and transcatheter valve replacement procedures.

Boston Scientific, Venus Medtech, and Meril Life Sciences compete by offering novel transcatheter heart valve systems with cost-effective solutions and tailored designs for emerging markets. Venus Medtech emphasizes innovation in self-expanding valves, while Meril Life Sciences focuses on accessibility and regional support, targeting hospitals seeking reliable yet affordable alternatives. Boston Scientific strengthens its position through integration with digital imaging and delivery systems, enhancing procedural precision and patient outcomes.

Braile Biomedica and other regional players differentiate through localized production, niche device designs, and flexible customer support. Product brochures emphasize valve durability, ease of implantation, and post-procedural safety. Competition is defined by clinical efficacy, procedural efficiency, and regulatory compliance. Companies invest in research, next-generation valve designs, and minimally invasive delivery technologies, while regional players leverage affordability and proximity to clients. Continuous innovation in material science, valve design, and implantation methods remains central to sustaining leadership in the market.The surgical heart valves market is defined by competition among established medical device manufacturers, specialized cardiac technology companies, and innovative cardiovascular solution providers. Companies are investing in advanced valve designs, clinical evidence development, physician training programs, and comprehensive patient support services to deliver safe, effective, and clinically superior valve solutions. Strategic partnerships, clinical research, and geographic expansion are central to strengthening product portfolios and market presence.

Edwards Lifesciences, operating globally, offers comprehensive transcatheter heart valve solutions with focus on clinical innovation, evidence generation, and physician education programs. Medtronic provides advanced structural heart technologies with emphasis on comprehensive valve portfolio and clinical support services. Abbott, multinational healthcare leader, delivers innovative cardiovascular solutions with focus on transcatheter valve advancement and patient outcomes. Boston Scientific offers specialized heart valve technologies with proven clinical performance and comprehensive training support.

Venus Medtech provides innovative transcatheter valve systems with emphasis on Asian market applications and clinical development. Meril Life Sciences delivers comprehensive cardiovascular technologies with focus on emerging market access and clinical evidence development. Braile Biomedica offers specialized heart valve solutions with regional expertise and clinical support capabilities.

The surgical heart valves market underpins cardiovascular care advancement, patient outcome optimization, minimally invasive treatment development, and healthcare quality improvement. With clinical evidence requirements, regulatory compliance mandates, and demand for improved patient outcomes, the sector must balance innovation leadership, clinical safety, and healthcare accessibility. Coordinated contributions from governments, healthcare systems, manufacturers, clinical organizations, and investors will accelerate the transition toward evidence-based, patient-centered, and clinically optimized heart valve technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 8,897.2 mMillion |

| Classification Type | TAVR, TPVR, TMVR |

| Application | Hospitals, Ambulatory Surgical Centers, Cardiac Catheterization Laboratory |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Edwards Lifesciences, Medtronic, Abbott, Boston Scientific, Venus Medtech, Meril Life Sciences, Braile Biomedica |

| Additional Attributes | Dollar sales by procedure type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device manufacturers and emerging cardiac technology companies, clinical preference analysis for different transcatheter valve approaches, integration with advanced imaging and procedural guidance technologies, innovations in valve design and delivery systems for enhanced clinical outcomes and procedural efficiency, and adoption of next-generation valve technologies with improved durability and hemodynamic performance for expanded patient populations and clinical indications. |

The global surgical heart valves market is estimated to be valued at USD 8,897.2 million in 2025.

The market size for the surgical heart valves market is projected to reach USD 36,625.0 million by 2035.

The surgical heart valves market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in surgical heart valves market are tavr, tpvr and tmvr.

In terms of application, hospitals segment to command 68.0% share in the surgical heart valves market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA