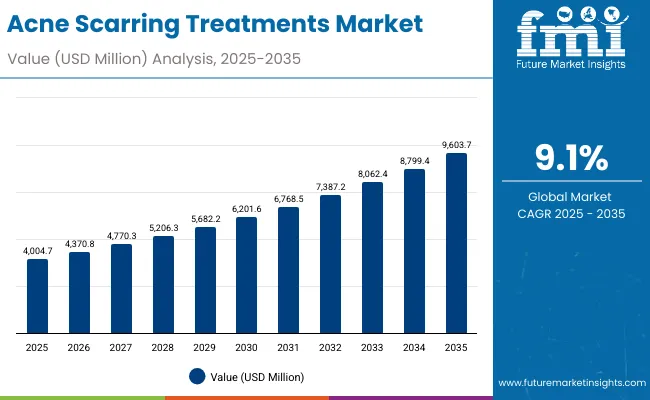

The Acne Scarring Treatments Market is expected to record a valuation of USD 4,004.7 million in 2025 and USD 9,603.7 million in 2035, with an increase of USD 5,599 million, which equals a growth of over 193% across the decade. The overall expansion represents a strong CAGR of 9.1% and a more than 2X increase in market size.

Quick Stats for Acne Scarring Treatments Market

Acne Scarring Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Acne Scarring Treatments Market Estimated Value in (2025E) | USD 4,004.7 million |

| Acne Scarring Treatments Market Forecast Value in (2035F) | USD 9,603.7 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 4,004.7 million to USD 6,201.6 million, adding USD 2,196.9 million, which accounts for nearly 39% of the total decade growth. This phase records steady adoption in over-the-counter skincare formulations, pharmacy-based offerings, and clinical dermatologist recommendations, driven by consumer awareness of scar visibility and skin health. PIH and atrophic scars dominate demand, while topical resurfacing solutions such as AHA/BHA/PHA systems and retinoids hold significant preference.

The second half from 2030 to 2035 contributes USD 3,402.1 million, equal to 61% of total growth, as the market jumps from USD 6,201.6 million to USD 9,603.7 million. This acceleration is powered by widespread adoption of combination therapies, expansion of silicone polymer-based scar systems, and the growing influence of e-commerce platforms that drive consumer reach in emerging markets like China and India. Professional adjunct care and dermatologist-tested formulations capture broader trust, while premium claims such as "clinically proven" and "sensitive-skin safe" drive higher willingness to pay.

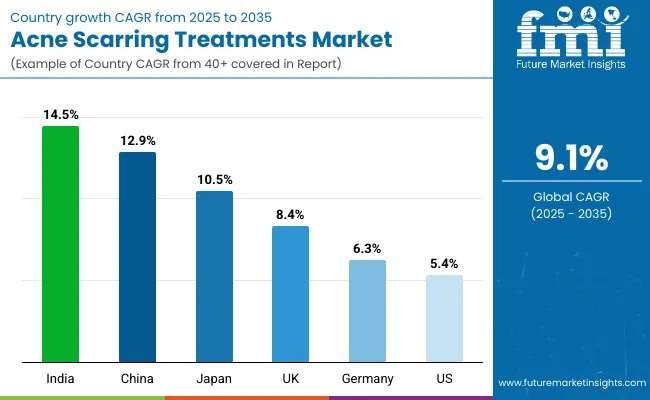

From 2020 to 2024, the Acne Scarring Treatments Market expanded steadily, building a strong base through pharmacy-led skincare sales and clinical dermatology procedures. By 2025, the USA accounted for USD 996.3 million, reflecting its leadership in scar care but with a slower CAGR of 5.4% compared to Asia-Pacific. China and India are forecast to outpace global averages, with CAGR of 12.9% and 14.5% respectively, driven by a younger demographic, rising disposable incomes, and increased skincare penetration. Competitive advantage during this phase was anchored in evidence-based formulations, particularly from legacy brands such as Mederma and Stratpharma, supported by dermatologist endorsements and strong pharmacy distribution networks.

Demand for acne scarring treatments is expected to accelerate to USD 9,603.7 million by 2035, with revenue contributions shifting heavily toward Asia-Pacific. While North America maintains leadership in value, Asia emerges as the fastest-growing hub due to digital retail expansion and high clinical acceptance. Leading global players are diversifying portfolios with hybrid solutions combining active resurfacing (AHA/BHA/PHA, retinoids, vitamin C) with silicone-based polymers to deliver multi-layered scar reduction. E-commerce-first brands like The Ordinary and Paula’s Choice are intensifying competition against traditional clinical brands. The shift toward ecosystem-driven skincare, digital dermatologist platforms, and claim-backed safety ("fragrance-free," "sensitive-skin safe") is redefining competitive positioning and consumer trust globally.

Advances in active ingredient formulations such as retinoids, AHA/BHA/PHA blends, and silicone polymers have improved treatment outcomes, allowing consumers to address scars more effectively at home and in clinics. PIH remains the most common scar type, particularly in younger populations, and its prominence has created strong demand for dark-spot correctors and resurfacing products. The rise of dermatology-driven skincare and growing awareness of scar treatment protocols are fueling sustained adoption across both clinical and retail channels.

Expansion of professional adjunct care such as post-laser or microneedling treatments has further accelerated consumer engagement. Digital-native beauty brands are leveraging clinical claims and dermatologist testing to build trust, particularly among millennial and Gen Z consumers who are highly responsive to social media influence. Segment growth is expected to be led by topical resurfacing treatments, serum-based delivery formats, and pharmacy/e-commerce channels due to their accessibility and strong clinical validation.

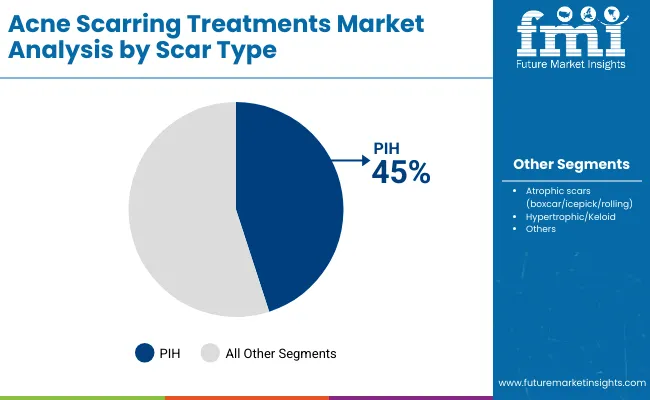

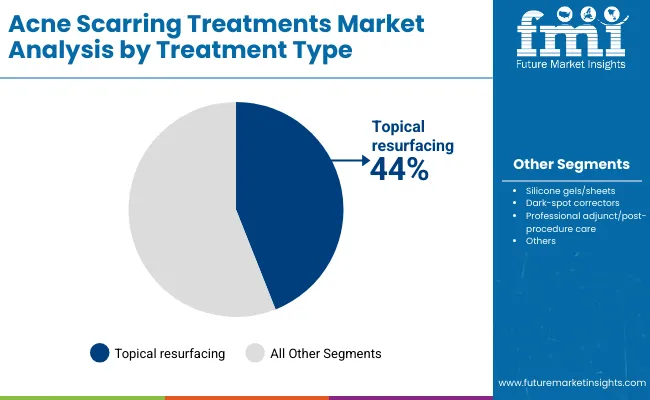

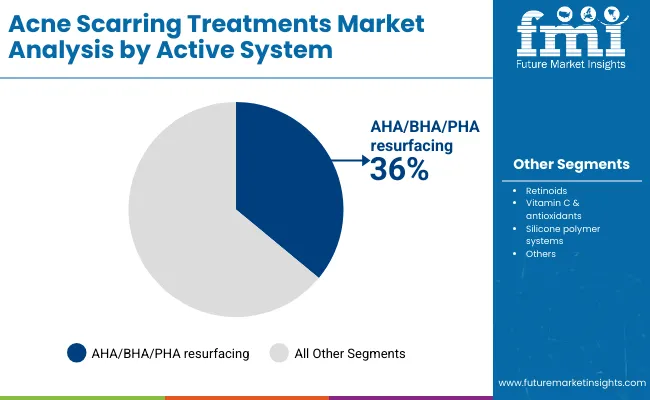

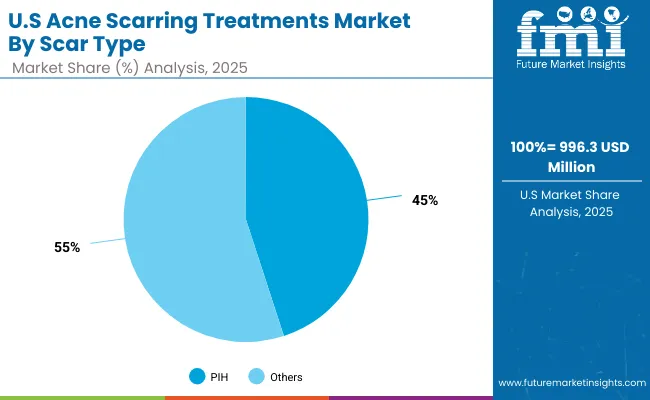

The market is segmented by scar type, treatment type, active system, form, distribution channel, claims, and geography. By scar type, PIH leads with 45% in 2025, supported by high prevalence across all regions, while atrophic and hypertrophic scars continue to grow with dermatology-focused solutions. By treatment type, topical resurfacing dominates with 44%, reflecting strong adoption of retinoids and acids for resurfacing. Active systems are led by AHA/BHA/PHA at 36%, while vitamin C and silicone systems gain steady momentum.

Serums and gels are the preferred delivery forms due to ease of use, with silicone sheets holding niche but growing relevance. Channels are dominated by pharmacies and e-commerce, supported by clinical credibility and global reach. Key claims such as "clinically proven," "fragrance-free," and "sensitive-skin safe" strongly influence consumer purchasing decisions. Geographically, North America leads in value, but Asia-Pacific, particularly China and India, record the fastest CAGR growth, reshaping the competitive landscape by 2035.

| Scar Type | Value Share% 2025 |

|---|---|

| PIH | 45% |

| Others | 55.0% |

The PIH segment is projected to contribute 45% of the Acne Scarring Treatments Market revenue in 2025, maintaining its position as the leading scar type category. This dominance is largely attributed to the high prevalence of PIH in younger populations and individuals with higher melanin content, where discoloration and uneven pigmentation are the most visible outcomes of acne. The segment’s strength also comes from consumer demand for dark-spot correctors, resurfacing treatments, and vitamin C-based solutions that directly address pigmentation.

Growing awareness of PIH-specific treatments through dermatology clinics, combined with e-commerce promotion of clinically proven products, is sustaining its growth. Moreover, the rise of multifunctional skincare that targets both acne and pigmentation has further fueled adoption. With innovation focusing on safe yet potent active ingredients, PIH treatments are expected to remain the backbone of global acne scar care solutions.

| Treatment Type | Value Share% 2025 |

|---|---|

| Topical resurfacing | 44% |

| Others | 56.0% |

The topical resurfacing segment is forecasted to hold 44% of the market share in 2025, led by its role as the most widely used and accessible treatment category. Consumers prefer resurfacing solutions such as exfoliating acids and retinoids for their clinically proven ability to promote cell turnover, reduce pigmentation, and smooth atrophic scars. Their broad use across both at-home skincare routines and clinical post-procedure regimens reinforces their widespread adoption.

Ease of formulation into serums, gels, and creams makes topical resurfacing versatile, while the affordability factor has helped it penetrate both premium and mass skincare categories. The segment’s growth is further boosted by dermatologist endorsements and strong consumer education around acids and retinoids. As awareness deepens globally, topical resurfacing will continue to dominate the acne scar treatment space with expanding relevance in both retail and clinical care.

| Active System | Value Share% 2025 |

|---|---|

| AHA/BHA/PHA resurfacing | 36% |

| Others | 64.0% |

The AHA/BHA/PHA resurfacing segment is projected to account for 36% of the Acne Scarring Treatments Market revenue in 2025, establishing it as the leading active system. These chemical exfoliants are valued for their ability to remove dead skin cells, improve skin texture, and reduce post-acne hyperpigmentation, making them highly effective in addressing PIH and shallow atrophic scars.

This category benefits from being both consumer-friendly and dermatologist-approved, with wide formulation flexibility in serums, peels, and professional-grade treatments. Innovations in gentler PHAs and buffered AHAs are expanding accessibility to sensitive-skin users, reducing irritation risks while maintaining efficacy. Given their proven balance of safety, affordability, and effectiveness, resurfacing acids are expected to maintain their role as the foundation of active scar care systems, outpacing other categories in terms of consumer preference and global adoption.

Rising Prevalence of PIH and Atrophic Scars in High-Growth Demographics

The increasing prevalence of post-inflammatory hyperpigmentation (PIH) and atrophic scars among younger populations, especially in Asia-Pacific, is a major growth driver. Countries such as India (14.5% CAGR) and China (12.9% CAGR) are recording rapid urbanization and lifestyle shifts that correlate with higher acne incidence rates. These demographics show heightened sensitivity to visible scarring, fueling demand for topical resurfacing solutions like AHA/BHA/PHA acids and retinoids. The link between self-confidence, social media influence, and clear skin standards has amplified adoption rates. As a result, brands are tailoring products for pigmentation-prone skin tones, strengthening PIH-targeted treatment dominance.

Expansion of E-Commerce and Dermatology-Backed Digital Retail

E-commerce has emerged as a transformative driver, particularly for acne scarring solutions that benefit from clinically proven claims and strong consumer reviews. In markets such as the USA, China, and India, platforms like Amazon, Tmall, and specialized beauty retailers have expanded product accessibility beyond urban clinics and pharmacies. Digital dermatologist platforms are further fueling adoption by recommending customized regimens that blend resurfacing actives and silicone-based systems. This democratization of scar care has enabled smaller players like The Ordinary and Paula’s Choice to compete directly with established brands, boosting global sales volumes.

Irritation and Compliance Issues with Potent Active Systems

While AHA/BHA/PHA acids and retinoids are the most effective treatment actives, they pose a challenge due to irritation, dryness, and prolonged adjustment periods, particularly among sensitive-skin users. Compliance remains a key restraint, as inconsistent usage reduces efficacy, leading to consumer dissatisfaction. Brands addressing scars often face negative reviews from first-time users who expect rapid results. Although innovations in PHAs and encapsulated retinoids are mitigating sensitivity issues, concerns around skin tolerance still slow down mass adoption, especially in emerging markets with less dermatological guidance.

Fragmented Market and Low Clinical Penetration Outside Tier-1 Cities

Despite robust growth, the market remains highly fragmented with over 90% share distributed among smaller brands and local players. In emerging economies, clinical penetration is still limited to Tier-1 and Tier-2 cities, restricting consumer access to advanced scar care products. This uneven distribution is compounded by counterfeit skincare flooding e-commerce channels, undermining consumer trust. As a result, adoption lags in rural and semi-urban populations despite high acne incidence, slowing the pace of market expansion in fast-growth regions.

Hybrid Scar Care Regimens Combining Actives with Silicone Systems

A clear trend is the convergence of resurfacing actives (AHA/BHA, retinoids, vitamin C) with silicone-based polymers into hybrid regimens. Consumers are increasingly layering products for example, pairing exfoliating serums with silicone gels or sheets to maximize results across both pigmentation and raised scar types. Brands are responding with bundled product lines or dual-function formulations, blurring the lines between medical-grade and cosmetic scar treatments. This hybridization reflects consumer preference for holistic solutions that address multiple scar profiles simultaneously, strengthening ecosystem-driven brand loyalty.

Rising Influence of Dermatologist-Tested and Sensitive-Skin Safe Claims

With scar care being a highly personal and long-term commitment, claims around "dermatologist-tested," "fragrance-free," and "sensitive-skin safe" have emerged as decisive purchase drivers. Consumers wary of irritation from acids and retinoids actively seek dermatologist-endorsed formulations, boosting trust and premiumization. Brands like La Roche-Posay and SkinCeuticals are leveraging clinical trials and strong physician networks to differentiate in this crowded space. Over the forecast period, dermatologist-backed claims are expected to transition from being a premium feature to a mainstream consumer expectation, shaping product development pipelines.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.9% |

| USA | 5.4% |

| India | 14.5% |

| UK | 8.4% |

| Germany | 6.3% |

| Japan | 10.5% |

The decade ahead highlights a clear geographic divergence in growth rates across leading economies. India (14.5% CAGR) and China (12.9% CAGR) are set to be the strongest growth engines, supported by their large youth populations, rising disposable incomes, and higher acne incidence among urban consumers. Increasing digital penetration, social media-driven beauty standards, and growing access to dermatology clinics are also accelerating demand for PIH- and atrophic scar-focused solutions.

Japan (10.5% CAGR) follows as another high-growth market, where a deep-rooted skincare culture, emphasis on innovation, and adoption of multi-step regimens are fueling demand for resurfacing actives and premium scar treatment solutions. These Asian markets are increasingly becoming focal points for global players, who are expanding e-commerce channels and dermatologist-backed offerings to capture rising consumer willingness to invest in long-term scar care.

In contrast, growth in developed Western economies is more modest, reflecting market maturity and slower incremental demand. The USA (5.4% CAGR), despite holding one of the largest market bases in 2025 at USD 996.3 million, is projected to grow at a slower pace, as penetration is already high, and consumer adoption stabilizes around premium clinically proven brands. Similarly, Germany (6.3% CAGR) and the UK (8.4% CAGR) represent steady yet slower growth rates, reflecting established pharmacy and dermatology networks with limited untapped demand.

These markets will continue to drive value through innovation and premium claims such as "sensitive-skin safe" and "dermatologist-tested," but volume growth will remain restrained compared to Asia. Overall, the global landscape is shifting, with Asia-Pacific emerging as the primary growth corridor for acne scarring treatments by 2035.

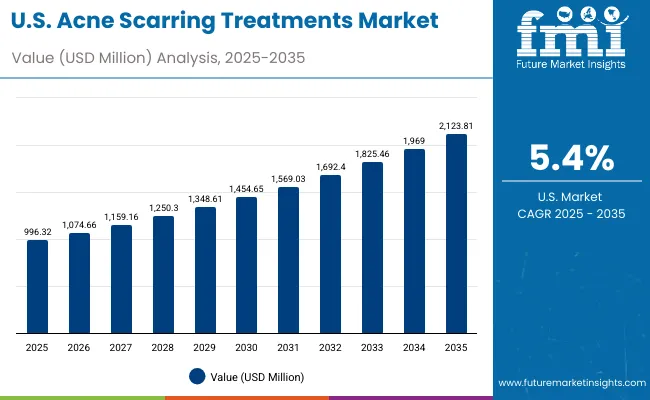

| Year | USA Acne Scarring Treatments Market (USD Million) |

|---|---|

| 2025 | 996.32 |

| 2026 | 1074.66 |

| 2027 | 1159.16 |

| 2028 | 1250.30 |

| 2029 | 1348.61 |

| 2030 | 1454.65 |

| 2031 | 1569.03 |

| 2032 | 1692.40 |

| 2033 | 1825.46 |

| 2034 | 1969.00 |

| 2035 | 2123.81 |

The Acne Scarring Treatments Market in the United States is projected to grow at a CAGR of 5.4%, reflecting steady yet moderate expansion. Growth is led by strong adoption of topical resurfacing products, especially retinoids and AHA/BHA-based serums available through both dermatology clinics and pharmacies. PIH remains the largest scar type category, supported by the popularity of dark-spot correctors and vitamin C formulations. Digital retail platforms, combined with dermatologist-tested claims, are influencing consumer trust and repeat purchase behavior. The USA market is also seeing increased clinical integration, with dermatologists recommending adjunct post-procedure care products to enhance results from microneedling and laser treatments.

The Acne Scarring Treatments Market in the United Kingdom is expected to grow at a CAGR of 8.4%, driven by rising consumer preference for clinically proven, fragrance-free scar solutions. The UK market is characterized by strong demand for premium dermocosmetic brands such as La Roche-Posay and SkinCeuticals, often recommended by dermatologists for sensitive skin. PIH and atrophic scars remain the main treatment focus, with topical resurfacing products and silicone gels recording steady growth. Cultural emphasis on dermatology consultation and the expansion of pharmacy chains like Boots and Superdrug are supporting access and sales.

India is witnessing rapid growth in the Acne Scarring Treatments Market, forecast to expand at a CAGR of 14.5% through 2035, the highest globally. Demand is driven by a large young population with high acne incidence, combined with rising social media influence and beauty awareness. Tier-2 and Tier-3 cities are emerging hotspots, as affordable resurfacing serums and gels penetrate beyond metro regions through e-commerce channels. PIH treatments dominate, given the prevalence of pigmentation concerns in darker skin tones, while adjunct care and silicone systems are gradually entering premium urban segments. Educational campaigns by dermatologists and influencers are further expanding awareness.

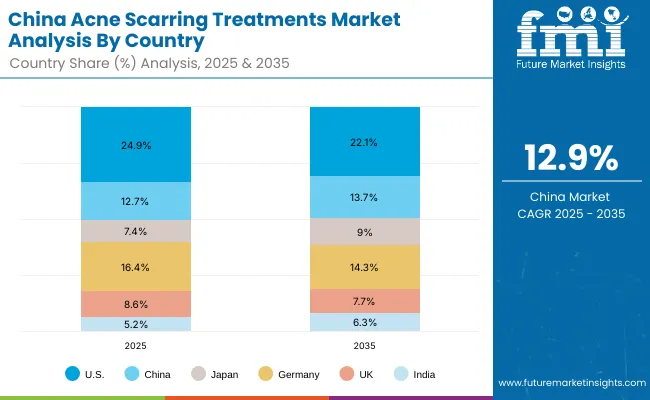

| Countries | 2025 Share (%) |

|---|---|

| USA | 24.9% |

| China | 12.7% |

| Japan | 7.4% |

| Germany | 16.4% |

| UK | 8.6% |

| India | 5.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 9.0% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.3% |

The Acne Scarring Treatments Market in China is expected to grow at a CAGR of 12.9%, supported by strong demand for both clinical and retail scar care solutions. Rapid urbanization, growing disposable incomes, and beauty-conscious youth are driving adoption of topical resurfacing and dark-spot correctors. Clinics are increasingly integrating adjunct care post-laser and microneedling procedures, boosting premium product adoption. Local beauty-tech firms and e-commerce giants like Tmall and JD.com are fueling mass accessibility, while affordable silicone gels and serums are penetrating both metro and smaller cities. China is also becoming a hub for innovation, with domestic brands competing against global leaders on both price and clinical claims.

| USA By Scar Type | Value Share% 2025 |

|---|---|

| PIH | 45% |

| Others | 55.0% |

The Acne Scarring Treatments Market in the USA is projected at USD 996.3 million in 2025, growing at a CAGR of 5.4%. PIH accounts for 45% of market value, reflecting strong demand for dark-spot correctors, vitamin C serums, and acid-based resurfacing products. This dominance reflects the growing preference for pigmentation-focused solutions, supported by dermatologist-endorsed brands and wide retail availability. Atrophic scars are treated with retinoids and silicone gels, which also enjoy significant uptake.

The market is shaped by consumer reliance on dermatologist recommendations and the availability of clinically tested products in pharmacies and drugstores. Digital skincare platforms and subscription-based regimens are enhancing accessibility, especially among younger demographics. With high brand trust, the USA continues to lead in premium scar care, though volume growth remains moderate compared to Asia-Pacific.

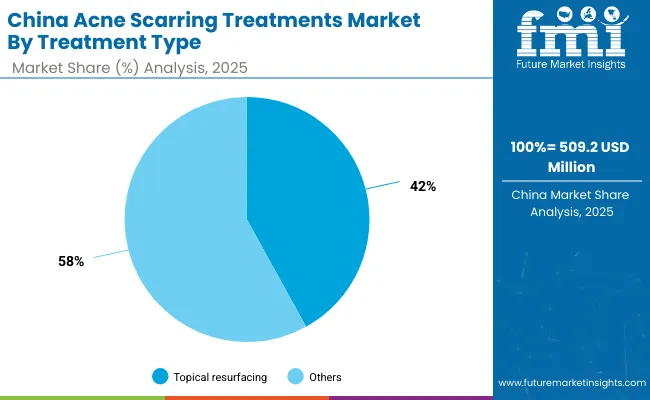

| China By Treatment Type | Value Share% 2025 |

|---|---|

| Topical resurfacing | 42% |

| Others | 58.0% |

The Acne Scarring Treatments Market in China is valued at USD 509.2 million in 2025, expanding rapidly with a CAGR of 12.9%, one of the highest globally. Topical resurfacing leads with 42% share, underscoring the popularity of exfoliating acids, retinoid formulations, and vitamin C-based solutions widely marketed through e-commerce platforms such as Tmall and JD.com. Strong adoption of dermatologist-tested and sensitive-skin safe claims is reshaping consumer choices, particularly among urban millennials and Gen Z.

Growth is further fueled by rising demand for adjunct care post-laser and microneedling procedures in dermatology clinics, creating opportunities for hybrid regimens combining acids with silicone systems. Local beauty-tech firms are competing with global leaders by offering affordable, clinically validated formulations, thereby boosting access across both metro and Tier-2/3 cities. China is emerging as a pivotal growth hub for acne scarring treatments due to its scale, innovation, and consumer readiness to invest in evidence-backed skincare.

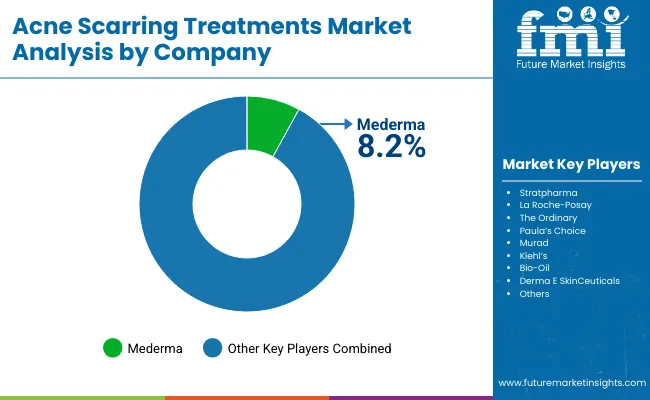

The Acne Scarring Treatments Market is highly fragmented, with a wide mix of clinical-grade leaders, dermocosmetic specialists, and mass-market skincare players. Mederma leads with an 8.2% share in 2025, leveraging its established reputation in scar care and wide distribution across both pharmacies and e-commerce channels. Other global brands such as La Roche-Posay, SkinCeuticals, and Stratpharma dominate premium segments with dermatologist-tested and sensitive-skin safe formulations, while mass-oriented brands like The Ordinary, Paula’s Choice, and Bio-Oil appeal to younger and price-sensitive consumers through direct-to-consumer channels.

Mid-sized brands such as Derma E and Murad are capturing niche markets by offering hybrid solutions combining natural actives with clinically proven claims, while regional firms in Asia are entering aggressively with affordable silicone gels and vitamin C-based formulations. The competitive edge is shifting from product-only differentiation to ecosystem strategies, where companies emphasize dermatologist endorsements, influencer-led campaigns, bundled regimens, and claims of long-term clinical efficacy. With consumer trust hinging on transparency, safety, and proven results, the market is evolving toward multi-brand competition where both heritage scar-care specialists and agile digital-first brands hold growth opportunities.

Key Developments in Acne Scarring Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Scar Type | Post-inflammatory hyperpigmentation (PIH), Atrophic scars (boxcar/icepick/rolling), Hypertrophic/Keloid |

| Treatment Type | Topical resurfacing (AHA/BHA/PHA, retinoids), Silicone gels/sheets, Dark-spot correctors, Professional adjunct/post-procedure care |

| Active System | AHA/BHA/PHA resurfacing, Retinoids, Vitamin C & antioxidants, Silicone polymer systems |

| Form | Serums, Gels, Creams, Silicone sheets |

| Distribution Channel | E-commerce, Pharmacies/Drugstores, Dermatology Clinics, Specialty Beauty Retail |

| Claim | Clinically proven, Fragrance-free, Sensitive-skin safe, Dermatologist-tested |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mederma, Stratpharma, La Roche-Posay, The Ordinary, Paula’s Choice, Murad, Kiehl’s, Bio-Oil, Derma E, SkinCeuticals |

| Additional Attributes | Dollar sales by scar type, treatment type, and distribution channel; adoption trends of e-commerce and clinical skincare; rising demand for PIH and topical resurfacing products; sector-specific growth in dermatology clinics, pharmacies, and online platforms; revenue segmentation by active systems (retinoids, acids, antioxidants, silicones); increasing preference for dermatologist-tested and sensitive-skin safe claims; regional shifts led by Asia-Pacific’s double-digit CAGR; innovations in delivery forms such as serums and silicone polymer systems. |

The Acne Scarring Treatments Market is estimated to be valued at USD 4,004.7 million in 2025.

The market size for the Acne Scarring Treatments Market is projected to reach USD 9,603.7 million by 2035.

The Acne Scarring Treatments Market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in the Acne Scarring Treatments Market include serums, gels, creams, and silicone sheets.

In terms of scar type, post-inflammatory hyperpigmentation (PIH) is projected to command 45% share in the Acne Scarring Treatments Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-acne Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

Hormonal Acne Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Moderate-to-Severe Acne Treatment Market Trends and Forecast 2025 to 2035

The Dyslexia Treatments Market Is Segmented by Drug Type and Distribution Channel from 2025 to 2035

Dark Circle Treatments Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Zygomycosis Treatments Market

Ingrown Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Conditioning Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Sol-Gel Based Skin Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA