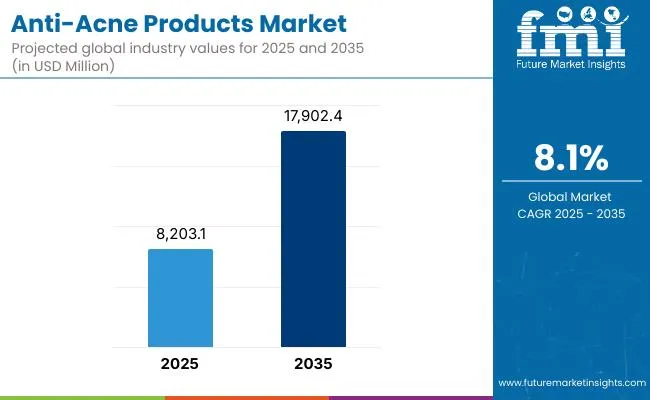

The global Anti-Acne Products Market is expected to record a valuation of USD 8,203.1 million in 2025 and USD 17,902.4 million in 2035, with an increase of USD 9,699.3 million, which equals a growth of more than 118% over the decade. The overall expansion represents a CAGR of 8.1% and demonstrates more than a 2X increase in market size.

Global Anti-Acne Products Market Key Takeaways

| Metric | Value |

|---|---|

| Global Anti-Acne Products Market Estimated Value in (2025E) | USD 8,203.1 million |

| Global Anti-Acne Products Market Forecast Value in (2035F) | USD 17,902.4 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 8,203.1 million to USD 12,118.4 million, adding USD 3,915.3 million, which accounts for around 40% of the total decade growth. This phase records steady adoption in the U.S. and Europe, where consumer awareness of dermatologist-tested and over-the-counter (OTC) formulations is strong.

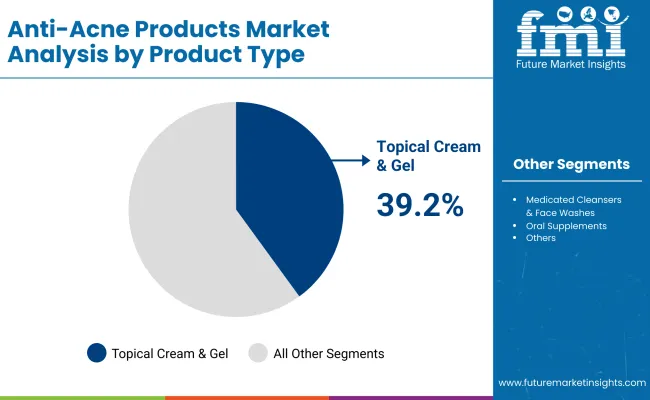

Topical creams & gels dominate this period as they cater to over 39% of market demand, particularly among teenagers and young adults who require accessible, pharmacy-grade solutions. The U.S. alone adds more than USD 689 million during this five-year period, driven by strong pharmacy and e-commerce sales.

The second half from 2030 to 2035 contributes USD 5,784.0 million, equal to nearly 60% of total growth, as the market jumps from USD 12,118.4 million to USD 17,902.4 million. This acceleration is powered by widespread adoption of advanced actives like retinoids and niacinamide, alongside botanical formulations such as tea tree oil that appeal to the clean-label consumer base.

China and India drive much of this growth, with CAGRs of 14.6% and 16.4% respectively, reflecting rising disposable incomes, growing beauty consciousness, and higher dermatology clinic penetration. By the end of the decade, East Asia and South Asia collectively outpace North America in absolute incremental growth. E-commerce-led platforms and subscription-based OTC oral supplements increase recurring revenue, lifting digital channel contribution well beyond traditional pharmacies.

From 2020 to 2024, the global Anti-Acne Products Market grew from less than USD 7,000 million to over USD 8,000 million, driven by topical and cleanser-based adoption. During this period, the competitive landscape was dominated by pharmacy-oriented global brands controlling nearly 70% of revenue, with leaders such as Neutrogena, La Roche-Posay, and CeraVe focusing on clinically validated formulations for teens and adults.

Competitive differentiation relied on active ingredient choice (salicylic acid, benzoyl peroxide, and retinoids), dermatologist endorsements, and safety claims such as fragrance-free and sensitive-skin safe. Oral supplements and patches had limited traction, contributing less than 15% of the total market value.

Demand for anti-acne products expands to USD 8,203.1 million in 2025, and the revenue mix shifts as digital-first and clean-label players grow to over 25% share. Traditional global leaders face rising competition from niche entrants offering personalized formulations, vegan claims, and AI-driven skincare routines. Major multinational brands are pivoting to hybrid models, integrating subscription-based direct-to-consumer sales, influencer-led engagement, and dermatologist-linked e-commerce strategies to retain relevance.

Emerging entrants in China and India specializing in niacinamide- and botanical-driven formulations are gaining share. The competitive advantage is moving away from mass OTC products alone to ecosystem strength, omnichannel scalability, and recurring consumer engagement.

Advances in dermatology science and ingredient innovation have improved efficacy and tolerability, allowing for more efficient acne management across diverse skin types. Topical creams & gels have gained popularity due to their suitability for first-line treatment and convenience for teens and young adults.

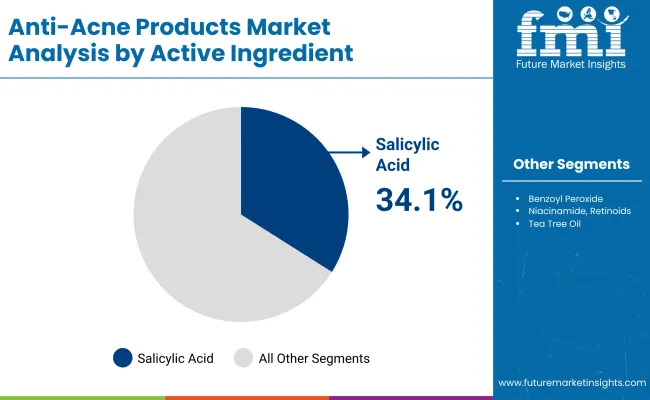

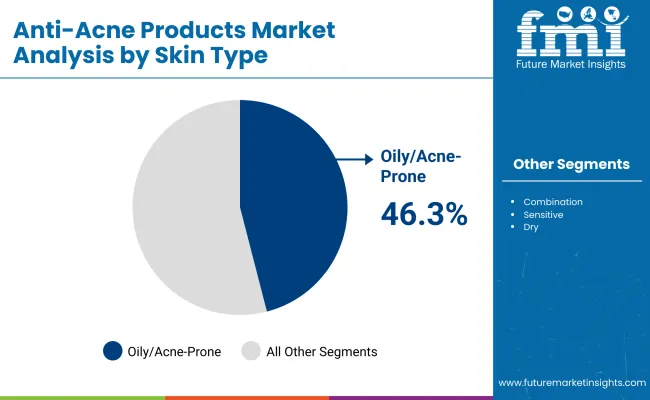

The rise of salicylic acid and benzoyl peroxide combinations has contributed to faster relief, while niacinamide and retinoids have enabled long-term acne and scar control. Oily and acne-prone skin categories are driving adoption, commanding nearly half the global market, while the sensitive skin category is seeing higher growth as consumers demand dermatologist-tested and fragrance-free formulations.

Expansion of e-commerce and digital dermatology consultations has fueled market growth. Innovations in spot treatments and patches, combined with oral supplements positioned for hormonal and adult acne, are expected to open new application areas.

Segment growth is expected to be led by topical formulations, oily-skin-oriented products, and active ingredients such as salicylic acid due to their clinical effectiveness and global consumer familiarity. Asia-Pacific will continue to outpace other regions with double-digit CAGRs, driven by demand from China, India, and Japan.

The market is segmented by product type, active ingredient, skin type, channel, end user, and geography. Product types include topical creams & gels, medicated cleansers & face washes, spot treatments & patches, and oral supplements, highlighting the breadth of OTC adoption. Active ingredient segmentation covers salicylic acid, benzoyl peroxide, niacinamide, retinoids, and tea tree oil to cater to varying levels of severity and consumer preference.

Based on skin type, the segmentation includes oily/acne-prone, combination, sensitive, and dry, reflecting dermatology-driven targeting. Channels span pharmacies & drugstores, e-commerce, dermatology clinics, and mass retail/supermarkets, ensuring both clinical and consumer accessibility.

End users include teens, adults, men, and women, indicating demographic-specific buying trends. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Product Type | Value Share % 2025 |

|---|---|

| Topical creams & gels | 39.2% |

| Others | 60.8% |

The topical creams & gels segment is projected to contribute 39.2% of the global Anti-Acne Products Market revenue in 2025, maintaining its lead as the dominant product category. This growth is driven by continued consumer reliance on over-the-counter topical solutions as the first line of treatment for acne across both teenage and adult populations. Formulations enriched with actives such as benzoyl peroxide, salicylic acid, and niacinamide have been widely adopted due to their proven efficacy and dermatologist endorsements.

The segment’s growth is also supported by the innovation of lightweight gel-based formulations and non-comedogenic creams that improve consumer compliance and broaden accessibility across oily, combination, and sensitive skin types. As clean-label trends rise, creams & gels featuring botanical blends and fragrance-free claims are gaining traction. The topical category is expected to retain its position as the backbone of the anti-acne market, with consistent demand across pharmacies, dermatology clinics, and online platforms.

| Active Ingredient | Value Share % 2025 |

|---|---|

| Salicylic acid | 34.1% |

| Others | 65.9% |

The salicylic acid segment is forecasted to hold 34.1% of the global Anti-Acne Products Market share in 2025, led by its extensive application in exfoliation, pore cleansing, and acne lesion reduction. Salicylic acid remains a dermatologist-preferred ingredient and is especially favored in topical gels, face washes, and spot treatments due to its keratolytic properties. Its ability to penetrate deeply into pores and regulate sebum makes it indispensable for oily and acne-prone skin types.

This segment benefits from salicylic acid’s established consumer trust and strong presence across both mass-market and premium product lines. The introduction of encapsulated and slow-release formulations has enhanced tolerability, reducing irritation risks and broadening adoption among sensitive-skin consumers. With consistent clinical validation and versatility across multiple product types, salicylic acid is expected to remain the cornerstone active in the anti-acne products category.

| Skin Type | Value Share % 2025 |

|---|---|

| Oily/acne-prone | 46.3% |

| Others | 53.7% |

The oily/acne-prone skin segment is projected to account for 46.3% of the global Anti-Acne Products Market revenue in 2025, establishing it as the leading skin type category. The dominance of this segment is driven by the high global prevalence of oily and acne-prone conditions, particularly among teenagers and young adults. Consumers with oily skin seek products designed to reduce sebum, unclog pores, and prevent breakouts, fueling demand across cleansers, gels, and leave-on treatments.

The segment’s growth is further supported by the expansion of oil-control formulations that combine salicylic acid, niacinamide, and tea tree oil for multi-functional benefits. E-commerce platforms have amplified accessibility, enabling targeted product recommendations for oily skin regimes. With continued awareness of preventative skincare and the role of acne in overall skin health, oily/acne-prone products are expected to maintain their dominant market position.

Rising Dermatology-Backed OTC Adoption in Developed Markets

One of the strongest growth drivers for the global Anti-Acne Products Market is the rising consumer trust in dermatologist-recommended OTC products, especially in North America and Europe. Brands like CeraVe, La Roche-Posay, and Differin are backed by clinical evidence and dermatology endorsements, which help bridge the gap between prescription-only treatments and consumer-available solutions.

The USA market demonstrates this shift clearly, where FDA-approved adapalene gels transitioned from prescription to OTC, immediately boosting consumer accessibility. This trend is expanding as dermatology clinics and online telehealth platforms increasingly recommend OTC topical creams, gels, and cleansers, giving consumers professional-grade assurance at affordable price points. The driver is particularly powerful in mature markets where health literacy and product transparency are high, supporting consistent long-term adoption.

Explosive Growth in Asia-Pacific Due to Beauty-Conscious Youth Demographics

Asia-Pacific, particularly China, India, and Japan, is driving incremental market expansion due to its vast youth population with rising disposable incomes and growing concern over skin health. India’s CAGR of 16.4% (2025-2035) and China’s 14.6% highlight the rapid uptake of anti-acne solutions, supported by beauty influencers, social media-driven awareness, and e-commerce penetration.

Unlike Western markets, where adult acne is a significant driver, the Asia-Pacific surge is youth-dominated, with teenagers and young adults seeking quick solutions such as spot patches, medicated cleansers, and affordable topical gels. Additionally, localized formulations with herbal actives like tea tree oil resonate strongly with cultural preferences. This regional driver ensures that Asia-Pacific outpaces global averages, contributing more than 35% of new revenue between 2025 and 2035.

Growing Consumer Sensitivity and Product-Related Side Effects

A key restraint is the rising concern around irritation, dryness, and long-term side effects caused by common acne actives such as benzoyl peroxide and retinoids. Consumers with sensitive skin often experience redness, flaking, or post-inflammatory hyperpigmentation, discouraging continued use. This has led to negative reviews on digital platforms, reducing brand loyalty and raising product skepticism.

In Western Europe, for instance, nearly 22% of surveyed consumers reported discontinuing anti-acne formulations due to intolerance. As sensitive-skin claims and dermatologist-tested assurances grow in demand, traditional benzoyl peroxide-heavy formulations face scrutiny. Brands unable to adapt formulations for tolerability risk losing consumer trust, limiting category growth in mature, discerning markets.

Regulatory and Compliance Challenges Across Geographies

The fragmented regulatory frameworks across geographies act as another major restraint. While the USA FDA enforces stringent OTC monograph requirements for acne drugs, Europe often regulates them under cosmetic directives, and Asia-Pacific countries like China have additional import and safety testing requirements.

This lack of harmonization increases costs for multinational players and slows down product launches across borders. For instance, retinoid-based products face stricter approval timelines in Europe compared to the USA, delaying expansion strategies. Compliance with claims like “dermatologist-tested,” “clean-label,” and “vegan-certified” also varies widely, forcing companies to adapt product messaging per market, which raises costs and creates inconsistencies.

Shift Toward Multi-Functional and Preventive Anti-Acne Solutions

A major trend shaping the market is the consumer preference for multi-functional formulations that not only treat active acne but also prevent recurrence and address secondary concerns like acne scars, pigmentation, and hydration. For example, niacinamide has risen sharply in prominence due to its dual role in sebum regulation and barrier repair, while retinoids are used for both acne management and anti-aging.

This shift is visible in product innovations where a single cream may combine salicylic acid for exfoliation, niacinamide for calming, and hyaluronic acid for hydration. Preventive solutions targeting early signs of acne in teenagers and hormonal acne in adults are driving this multi-functional positioning, aligning with consumer demand for comprehensive skincare rather than one-dimensional treatments.

Digital-First Consumer Engagement and E-Commerce Acceleration

The global Anti-Acne Products Market is witnessing rapid digital transformation, with e-commerce platforms and teledermatology services reshaping distribution and engagement. Influencer-driven marketing on TikTok, Instagram, and YouTube has made niche brands like The Ordinary and Paula’s Choice household names, particularly among Gen Z. Subscription-based e-commerce models offering acne kits with cleansers, gels, and supplements are driving recurring revenue streams.

In China, platforms like Tmall and Douyin account for over 60% of skincare sales in certain categories, with acne products among the top searches. This trend is expanding globally, making digital-first engagement a critical growth engine, as consumers increasingly trust peer reviews, dermatologist influencers, and online-exclusive formulations over traditional retail recommendations.

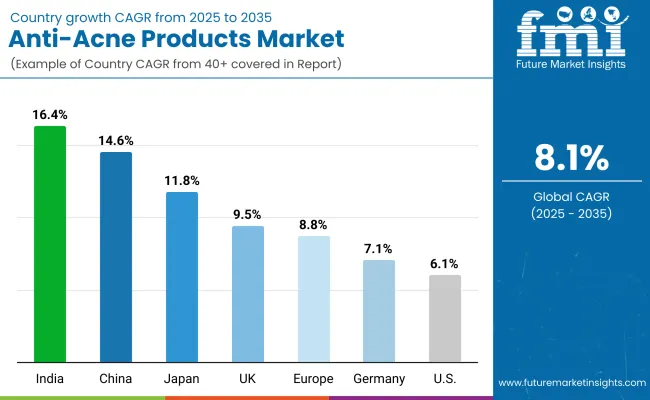

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.6% |

| USA | 6.1% |

| India | 16.4% |

| UK | 9.5% |

| Germany | 7.1% |

| Japan | 11.8% |

| Europe | 8.8% |

The global Anti-Acne Products Market shows distinct growth patterns across key geographies, with emerging economies in Asia-Pacific outpacing mature Western markets. India leads with an estimated CAGR of 16.4% from 2025 to 2035, reflecting rapid urbanization, a large youth demographic, and increasing disposable income.

Awareness campaigns driven by dermatologists, influencers, and expanding e-commerce penetration have further accelerated adoption in urban and semi-urban areas. China follows with a 14.6% CAGR, driven by a digitally savvy consumer base that actively engages with skincare products through platforms like Tmall and Douyin.

Clean-label and herbal-based anti-acne formulations resonate strongly in this market, where younger consumers are highly experimental and responsive to influencer-led recommendations. Japan, with a 11.8% CAGR, also represents a key growth hub, propelled by its beauty-conscious population and high trust in clinical-grade products that combine acne care with anti-aging benefits.

In contrast, growth in developed Western markets is comparatively moderate but stable, anchored by established OTC adoption and high consumer trust in dermatologist-backed brands. The USA is projected to expand at a 6.1% CAGR, supported by strong pharmacy and e-commerce channels, though rising competition from generic OTCs may cap acceleration.

The U.K. at 9.5% and Germany at 7.1% reflect the steady expansion of premium dermocosmetics, with European consumers increasingly drawn to sensitive-skin-safe and fragrance-free solutions. Broader Europe is expected to post an 8.8% CAGR, highlighting a balanced growth trajectory supported by both clinical dermatology and digital-first skincare adoption. Collectively, these trends underscore a two-speed market: rapid expansion in Asia-Pacific markets driven by youth demographics and digital adoption, and steady, premium-led growth in North America and Europe.

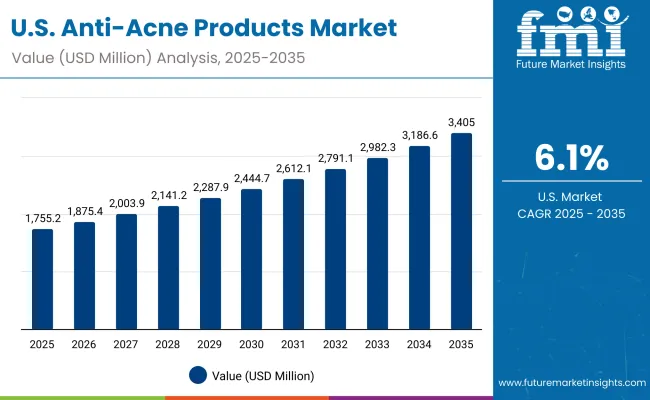

| Year | USA Anti-Acne Products Market (USD Million) |

|---|---|

| 2025 | 1755.24 |

| 2026 | 1875.49 |

| 2027 | 2003.98 |

| 2028 | 2141.27 |

| 2029 | 2287.96 |

| 2030 | 2444.71 |

| 2031 | 2612.19 |

| 2032 | 2791.15 |

| 2033 | 2982.37 |

| 2034 | 3186.69 |

| 2035 | 3405.00 |

The Anti-Acne Products Market in the United States is projected to grow at a CAGR of 6.1%, led by steady demand across pharmacies, drugstores, and rapidly expanding e-commerce channels. Topical creams & gels account for more than one-third of sales, underpinned by dermatologist endorsements and OTC approvals such as adapalene gel.

The rise of teledermatology and digital pharmacy platforms is boosting accessibility and driving repeat purchases, particularly among young adults seeking affordable OTC options. The market is also benefiting from growing awareness of adult acne, with women in their 20s and 30s showing rising adoption of niacinamide- and retinoid-based products.

The Anti-Acne Products Market in the United Kingdom is expected to grow at a CAGR of 9.5%, supported by strong adoption of dermocosmetic products and premium pharmacy-led sales. Brands such as La Roche-Posay and CeraVe have solidified their market presence through NHS dermatologist endorsements and pharmacy distribution partnerships.

Increasing demand for fragrance-free and sensitive-skin-safe claims has pushed formulators to innovate with niacinamide and salicylic acid blends. In addition, younger consumers in the U.K. are turning to e-commerce platforms for subscription-based spot treatments and acne patches.

India is witnessing rapid growth in the Anti-Acne Products Market, which is forecast to expand at a CAGR of 16.4% through 2035, the highest globally. Demand is rising sharply in tier-2 and tier-3 cities due to affordable OTC launches and awareness campaigns led by dermatologists and influencers.

Domestic companies are strengthening their portfolios with herbal and botanical blends such as neem and tea tree oil, which resonate strongly with local consumer preferences. The integration of acne products into mass retail chains, coupled with strong uptake on e-commerce platforms like Nykaa and Flipkart, is accelerating penetration.

The Anti-Acne Products Market in China is expected to grow at a CAGR of 14.6%, one of the fastest among major economies. Rising disposable incomes, a beauty-conscious youth demographic, and heavy reliance on e-commerce platforms like Tmall and Douyin are propelling growth.

Local brands are competitively priced, offering niacinamide- and salicylic acid-based formulations that appeal to Gen Z consumers. At the same time, dermocosmetic imports from Japan and Korea are popular among urban consumers seeking higher-end solutions. Social media influencers and key opinion leaders (KOLs) continue to play a critical role in driving awareness and trust.

| Country | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.4% |

| India | 4.5% |

| Europe | 20.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.0% |

| China | 11.8% |

| Japan | 7.7% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

| Europe | 18.4% |

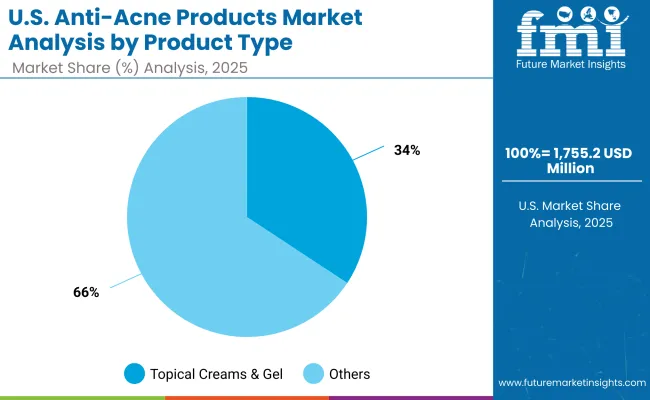

| USA By Product Type | Value Share % 2025 |

|---|---|

| Topical creams & gels | 34.3% |

| Others | 65.7% |

The Anti-Acne Products Market in the United States is valued at USD 1,755.24 million in 2025 and is projected to expand steadily at a CAGR of 6.1% through 2035. Topical creams & gels dominate the market with a 34.3% share, reflecting their strong role as the first line of treatment for teenagers and adults.

This dominance is fueled by FDA-approved OTC products such as adapalene gel, which has transitioned from prescription-only to mass adoption. The USA market also reflects a maturing pattern where OTC and dermocosmetic products coexist, supported by growing demand for multi-functional formulations that address acne, scars, and pigmentation simultaneously.

E-commerce channels and teledermatology platforms are shaping consumer access, while pharmacies and drugstores remain critical for over-the-counter purchases. The adult acne segment, especially among women in their 20s and 30s, is growing faster than the teen category, driven by hormonal changes and lifestyle stressors. As brands integrate niacinamide, retinoids, and benzoyl peroxide into innovative formulations, the USA market demonstrates strong potential for hybrid OTC-digital care ecosystems.

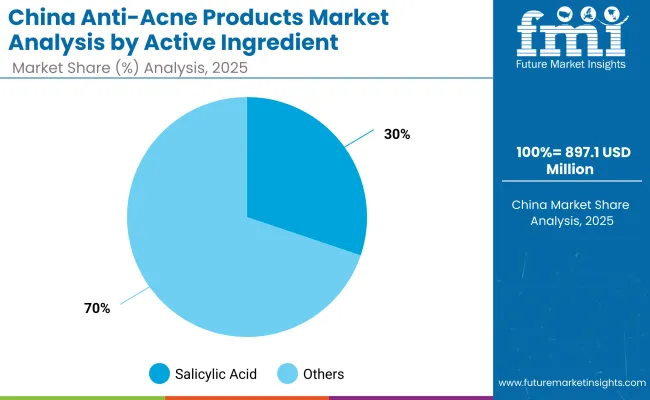

| China By Source | Value Share % 2025 |

|---|---|

| Salicylic acid | 30.2% |

| Others | 69.8% |

The Anti-Acne Products Market in China is valued at nearly USD 897.12 million in 2025, with salicylic acid-based products contributing 30.2% of revenue. The Chinese market is forecasted to grow at a CAGR of 14.6%, among the highest globally, driven by rising disposable income, rapid e-commerce penetration, and beauty-conscious Gen Z and millennial consumers. Salicylic acid continues to dominate as a trusted exfoliating and pore-clearing ingredient, but niacinamide and tea tree oil-based formulations are seeing rapid growth due to demand for gentler, clean-label alternatives.

China’s digital-first beauty ecosystem is a defining factor, with platforms such as Tmall and Douyin capturing the majority of sales. Local players are disrupting the market with affordable yet effective products, while international dermocosmetic brands from Korea, Japan, and Europe target the premium segment. Influencer and KOL (Key Opinion Leader) engagement plays a crucial role in brand awareness, while social commerce accelerates adoption in tier-2 and tier-3 cities.

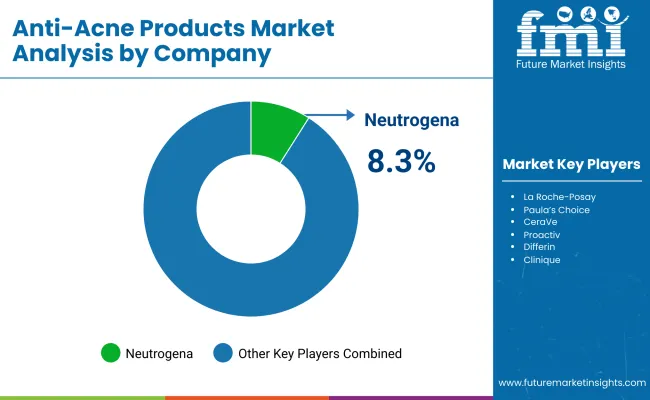

| Company | Global Value Share 2025 |

|---|---|

| Neutrogena | 8.3% |

| Others | 91.7% |

The global Anti-Acne Products Market is moderately consolidated, with a few multinational leaders dominating while mid-sized and niche players capture growth in specialized categories. Neutrogena leads with an 8.3% share in 2025, supported by its broad OTC portfolio distributed across pharmacies, supermarkets, and e-commerce platforms worldwide.

Other global leaders, including La Roche-Posay, CeraVe, and Paula’s Choice, focus on dermatologist-tested formulations, sensitive-skin claims, and clean-label positioning that resonate strongly in North America and Europe. Their strategies emphasize clinical validation, broad retail availability, and omni-channel marketing. Mid-sized brands such as The Ordinary, Murad, and Proactiv cater to niche segments like minimal-ingredient formulations, premium subscription kits, and targeted adult acne solutions.

They differentiate through influencer engagement, digital-first campaigns, and recurring D2C models. Mass-market players like Clean & Clear and Differin remain popular in the teen segment, leveraging affordability and strong retail footprints. Clinique positions itself as a premium dermocosmetic option, appealing to consumers seeking hybrid anti-acne and skincare benefits.

Competitive differentiation is shifting away from single-ingredient hero products toward ecosystem-driven solutions that combine multi-functional actives, subscription models, teledermatology integration, and consumer trust built on safety claims. With rising demand from Asia-Pacific, companies are increasingly localizing portfolios with herbal actives and region-specific claims to capture the high-growth youth segment.

Key Developments in Global Anti-Acne Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Topical creams & gels, Medicated cleansers & face washes, Spot treatments & patches, Oral supplements (OTC) |

| Active Ingredient | Salicylic acid, Benzoyl peroxide, Niacinamide , Retinoids , Tea tree oil |

| Skin Type | Oily/acne-prone, Combination, Sensitive, Dry |

| Channel | Pharmacies & drugstores, E-commerce, Dermatology clinics, Mass retail/supermarkets |

| End User | Teens, Adults, Men, Women |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neutrogena, La Roche- Posay , Paula’s Choice, CeraVe , Proactiv , Murad, The Ordinary, Clean & Clear, Differin , Clinique |

| Additional Attributes | Dollar sales by product type, active ingredient, skin type, and channel; adoption trends in OTC and dermocosmetics ; rising demand for e-commerce, subscription kits, and acne patches; sector-specific growth among teens and adult acne segments; ingredient-level revenue segmentation; integration of AI/ teledermatology with skincare; regional trends influenced by digital-first consumer adoption; and innovations in salicylic acid delivery, niacinamide -based formulations, and botanical actives. |

The Global Anti-Acne Products Market is estimated to be valued at USD 8,203.1 million in 2025.

The market size for the Global Anti-Acne Products Market is projected to reach USD 17,902.4 million by 2035.

The Global Anti-Acne Products Market is expected to grow at a CAGR of 8.1% between 2025 and 2035.

The key product types in the Global Anti-Acne Products Market are topical creams & gels, medicated cleansers & face washes, spot treatments & patches, and oral supplements (OTC).

In terms of skin type, the oily/acne-prone segment is projected to command 46.3% share in the Global Anti-Acne Products Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Corn Co-Products Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA