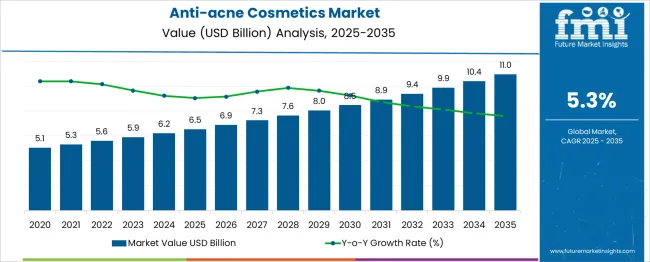

The Anti-acne Cosmetics Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. From 2025 to 2030, the market is expected to increase from USD 6.5 billion to USD 8.5 billion, indicating a strong upward trajectory. Year-on-year analysis shows consistent progress, reaching USD 6.9 billion in 2026 and USD 7.3 billion in 2027, supported by heightened consumer focus on skin clarity and product innovation featuring clinically tested ingredients.

Expanding e-commerce platforms and influencer-driven marketing strategies are anticipated to strengthen demand across diverse demographics. By 2028, the market is projected to reach USD 7.6 billion, advancing to USD 8.0 billion in 2029 and USD 8.5 billion by 2030. Increasing product launches incorporating botanicals, salicylic acid formulations, and non-comedogenic properties are expected to drive adoption, particularly among urban consumers seeking multifunctional solutions.

Competitive strategies will revolve around personalization, subscription models, and AI-driven skincare analysis. These developments position anti-acne cosmetics as a dynamic segment within the broader beauty and personal care industry, offering a compelling growth opportunity for brands leveraging science-backed claims and digital engagement to capture consumer trust and loyalty.

| Metric | Value |

|---|---|

| Anti-acne Cosmetics Market Estimated Value in (2025 E) | USD 6.5 billion |

| Anti-acne Cosmetics Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The anti-acne cosmetics market forms a specialized yet significant segment within the global beauty and skincare domain. In the skincare products market, it accounts for approximately 7–9%, as acne-focused solutions complement broader categories like moisturizers and anti-aging products. Within the cosmetics and personal care market, its share is around 3–4%, reflecting its niche role compared to color cosmetics and general grooming products.

The dermatology and medicinal skincare market sees a higher share of 10–12%, as anti-acne formulations overlap with therapeutic and prescription-strength offerings. In the beauty and wellness products market, its contribution remains modest at 2–3%, since this category also includes hair care and body care products. For the over-the-counter (OTC) skincare treatments market, the share stands at 12–14%, driven by strong consumer demand for self-managed acne care without prescription dependency.

The market is expanding as consumers seek effective solutions combining cosmetic appeal with clinical benefits, including non-comedogenic formulations and natural extracts. Increasing awareness of skincare routines, lifestyle-induced acne prevalence, and influencer-driven trends amplify demand globally. Brands are innovating with multifunctional products integrating hydration, tone correction, and oil control, which positions anti-acne cosmetics as an essential subcategory shaping the convergence of beauty and dermatological care across multiple parent markets.

The anti-acne cosmetics market is witnessing sustained growth as increasing consumer focus on skincare, rising prevalence of acne across age groups, and greater awareness of non-prescription solutions converge to drive demand. Manufacturers are responding by introducing formulations with active ingredients that offer both therapeutic and cosmetic benefits, aligning with evolving consumer expectations for multifunctional products.

The growing influence of social media and beauty influencers is enhancing awareness and encouraging trial of premium and targeted solutions. Regulatory emphasis on safe formulations and clean labeling practices is fostering innovation and consumer trust.

Opportunities are expected to arise from the development of personalized products, the integration of natural and bioactive ingredients, and expansion into emerging markets where skincare routines are evolving rapidly. Enhanced product efficacy, premium positioning, and direct-to-consumer strategies are paving the way for long-term market expansion and deeper penetration among diverse consumer segments.

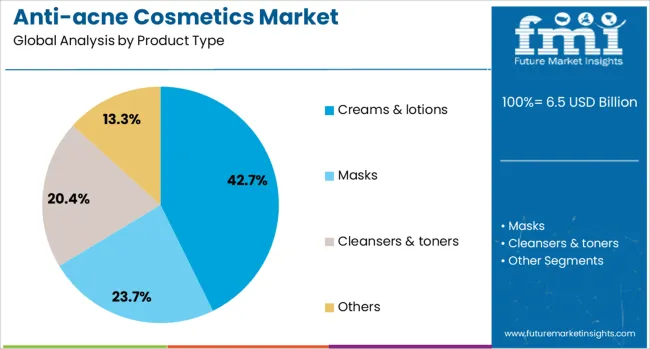

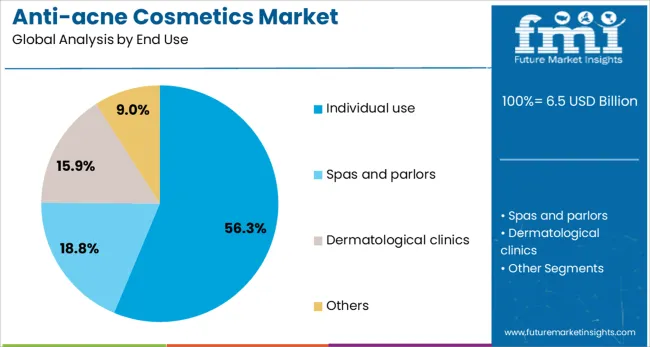

The anti-acne cosmetics market is segmented by product type, end use, price range, distribution channel, and geographic regions. The anti-acne cosmetics market is divided by product type into creams and lotions, Masks, cleansers and toners, and Others. The end use of the anti-acne cosmetics market is classified into Individual use, Spas and parlors, Dermatological clinics, and Others.

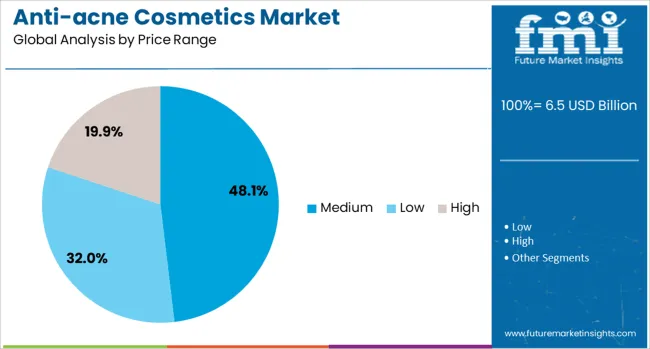

Based on the price range, the anti-acne cosmetics market is segmented into Medium, Low, and High. The distribution channel of the anti-acne cosmetics market is segmented into Offline and Online. Regionally, the anti-acne cosmetics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, creams and lotions are expected to account for 42.7% of the total market revenue in 2025, making them the leading product category. This dominance has been driven by consumer preference for easy-to-apply and fast-absorbing formulations that seamlessly fit into daily skincare routines.

The versatility of creams and lotions in delivering active ingredients with soothing and hydrating properties has positioned them as the preferred choice among users seeking both treatment and cosmetic enhancement. Advances in formulation technologies have improved texture, efficacy, and skin compatibility, which has further supported adoption in both mild and moderate acne conditions.

Their ability to address diverse skin concerns while offering an affordable and widely available solution has reinforced their leadership in the market, particularly as consumers prioritize convenience, efficacy, and aesthetic appeal in anti-acne regimens.

Segmented by end use, individual use is projected to capture 56.3% of the market revenue in 2025, solidifying its position as the dominant segment. This leadership has been underpinned by growing consumer confidence in managing acne independently through over-the-counter solutions rather than clinical interventions.

Increasing awareness of skincare through digital platforms and easy access to information have empowered consumers to self-diagnose and select appropriate products. The appeal of privacy, affordability, and immediate availability has driven preference for individual use products, while improvements in product efficacy have reduced reliance on professional treatments.

This segment’s prominence has also been reinforced by lifestyle trends favoring personalized and routine-based skincare approaches, which have been widely adopted among younger demographics seeking proactive control over their skin health.

When segmented by price range, medium priced products are forecast to hold 48.1% of the market revenue in 2025, establishing themselves as the leading price category. This position has been supported by the balance these products strike between affordability and perceived quality, which resonates strongly with a broad consumer base.

Medium priced products have benefited from offering credible efficacy through recognizable active ingredients while maintaining accessibility to both mass and aspirational buyers. The segment has also been strengthened by retailers and brands positioning these products as reliable, value-driven solutions with premium cues such as improved packaging and clean ingredient claims.

Their ability to cater to a wide audience without alienating cost-sensitive or quality-conscious consumers has enabled sustained growth, firmly anchoring medium priced products at the center of market demand.

The anti-acne cosmetics market is advancing as skincare brands respond to rising consumer demand for targeted blemish treatment and preventative formulations. In 2024, product lines featuring salicylic acid and encapsulated microbead delivery systems gained traction among young consumer segments.

By 2025, probiotic-enriched and barrier-restoring formulations became mainstream as brands aimed to minimize irritation while maintaining efficacy. Players providing clinically backed, microbiome-friendly cosmetics with substantiated ingredient profiles and clear usage guidelines are positioned to dominate this clinical skincare category.

Breakthroughs in acne-targeted actives have significantly influenced cosmetic formulation trends. In 2024, manufacturers advanced the use of encapsulated acids and slow-release benzoyl peroxide delivery to reduce surface irritation while improving absorption.

By 2025, microbial balance–focused ingredients such as probiotic prebiotics and anti-inflammatory botanicals were included to restore skin barriers while treating blemishes. This shift suggests that effectiveness combined with gentleness, is informing product development decisions. Suppliers offering validated ingredient systems with controlled delivery mechanisms and tolerance clinical data are increasingly preferred in both premium and over-the-counter ranges.

Emerging focus on microbiome-centric skincare has created opportunities for differentiated anti-acne solutions. In 2024, formulations featuring prebiotic-laden cleansers and moisturizers were trialed to support beneficial bacteria while minimizing acne triggers. By 2025, brands expanded such offerings into full regimen kits, integrating probiotic balms and barrier-repair serums.

These innovations underscore that acne care can evolve from spot treatment into holistic skin ecosystem support. Suppliers that combine targeted antimicrobial actives with microbiome-supportive ingredients, validated via skin microbiota studies, are positioned to capture growth in mindful skincare portfolios.

In 2024 and 2025, it was observed that elevated pricing for advanced anti‑acne formulations limited widespread use across price‑sensitive segments. Creams, serums, and specialized spot treatments containing premium actives were presented at higher cost brackets. As a consequence, lower-income consumers and value-oriented buyers preferred generic or store-brand offerings.

Pricing elasticity constraints were reported especially in emerging markets where budget alternatives remained prevalent. This pricing barrier was noted to suppress adoption velocity for innovative anti‑acne cosmetics in mid‑tier retail channels, thereby restricting category expansion beyond affluent demographics.

An observable shift in 2024 and 2025 was noted toward multiple active combinations designed to treat acne and support skin repair afterward. Products incorporating tranexamic acid alongside niacinamide, azelaic acid, or vitamin C were formulated to reduce pigmentation resulting from blemishes.

Dermatologist‑recommended multifunctional serums and night creams targeted not only lesion clearance but also post‑inflammatory recovery. This approach was accepted favourably by consumers seeking both corrective and restorative benefits in one regimen, suggesting one clear opportunity for brands to differentiate through dual‑action formulations.

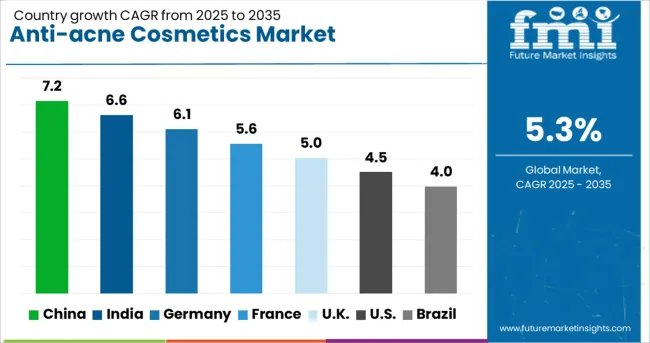

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global anti-acne cosmetics market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads with 7.2%, followed by India at 6.6% and Germany at 6.1%. France records 5.6%, while the United Kingdom posts 5.0%. Growth is driven by rising skincare awareness, demand for clean-label formulations, and adoption of premium anti-acne ranges targeting young consumers. China and India dominate due to urban lifestyle changes and rapid growth in e-commerce channels. Germany focuses on dermatology-based formulations, while France and the UK emphasize luxury skincare brands with clinically backed solutions for sensitive skin.

China is forecast to grow at 7.2%, supported by a surge in demand for K-beauty-inspired products and advanced formulations. Natural, herbal-based anti-acne solutions dominate premium skincare categories. Manufacturers integrate AI-powered skin analysis tools for product personalization. Social commerce and influencer-driven marketing significantly boost consumer engagement and brand visibility.

India is expected to grow at 6.6%, driven by increasing skincare awareness among millennials and Gen Z consumers. Affordable anti-acne creams and gels dominate mass-market demand. Manufacturers focus on sulfate- and paraben-free formulations aligned with clean-label trends. Rapid growth of D2C beauty brands leveraging digital platforms strengthens overall product penetration.

Germany is projected to grow at 6.1%, supported by demand for dermatologist-recommended and clinically tested formulations. Non-comedogenic products dominate adoption in pharmacy retail chains. Manufacturers prioritize vegan and cruelty-free certifications to meet consumer expectations. Integration of active ingredients like salicylic acid and niacinamide in multifunctional skincare lines enhances appeal.

France is forecast to grow at 5.6%, driven by luxury skincare innovation and strong demand for high-end dermocosmetic brands. Oil-free, lightweight formulations dominate adoption among sensitive skin consumers. Companies focus on integrating anti-inflammatory botanicals for added therapeutic value. Premium beauty retailers and e-commerce platforms support wider product availability.

The UK is projected to grow at 5.0%, driven by increasing demand for hybrid beauty products with acne-control benefits. Gel-based formulations dominate products targeting younger demographics. Manufacturers develop multifunctional skincare integrating anti-acne and brightening properties. Growth in subscription-based beauty boxes accelerates the penetration of niche anti-acne brands.

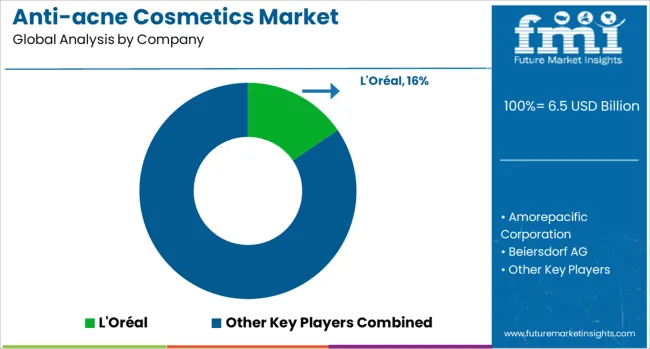

The anti-acne cosmetics market is moderately consolidated, with L'Oréal recognized as a leading player through its broad skincare portfolio, strong global presence, and continued innovation in dermatologically tested formulations. The company’s offerings cater to multiple consumer segments with targeted solutions under brands like La Roche-Posay and Vichy.

Key players include Amorepacific Corporation, Beiersdorf AG, Blackbird Skincare, Cetaphil, Honasa Consumer Ltd., Johnson & Johnson, Kao Corporation, Mario Badescu Skin Care, Natura &Co, Shiseido Company, Limited, Sunday Riley, The Estée Lauder Companies Inc., Unilever, and Waldencast plc. These companies provide cleansers, serums, spot treatments, and masks formulated with active ingredients such as salicylic acid, benzoyl peroxide, and botanical extracts aimed at reducing acne and improving skin health.

Market growth is being driven by rising consumer awareness of skincare, expanding e-commerce channels, and increased demand for premium, multifunctional products. Companies are focusing on innovations like non-comedogenic, dermatologist-approved, and cruelty-free formulations to cater to evolving consumer preferences.

The trend toward personalization and the integration of AI-driven skin diagnostics is shaping product development strategies. Additionally, growth in emerging markets and the popularity of natural and clean-label solutions present opportunities for both established brands and niche entrants to strengthen their market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Product Type | Creams & lotions, Masks, Cleansers & toners, and Others |

| End Use | Individual use, Spas and parlors, Dermatological clinics, and Others |

| Price Range | Medium, Low, and High |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L'Oréal, Amorepacific Corporation, Beiersdorf AG, Blackbird Skincare, Cetaphil, Honasa Consumer Ltd., Johnson & Johnson, Kao Corporation, Mario Badescu Skin Care, Natura &Co, Shiseido Company, Limited, Sunday Riley, The Estée Lauder Companies Inc., Unilever, and Waldencast plc |

| Additional Attributes | Dollar sales by product type (cleansers, creams & lotions, masks, spot treatments), regional demand trends, competitive landscape, consumer preferences for clean-label and non-comedogenic ingredients, integration with digital dermatology platforms, innovations in microbiome-friendly and ingredient-targeted formulations. |

The global anti-acne cosmetics market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the anti-acne cosmetics market is projected to reach USD 11.0 billion by 2035.

The anti-acne cosmetics market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in anti-acne cosmetics market are creams & lotions, masks, cleansers & toners and others.

In terms of end use, individual use segment to command 56.3% share in the anti-acne cosmetics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Vegan Cosmetics Market Analysis - Trends, Growth & Forecast 2025 to 2035

Colour Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Tinted Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Natural Cosmetics Market - Size, Share, and Forecast 2025-2035

UK Nutricosmetics Market Growth – Demand, Trends & Forecast 2025-2035

USA Nutricosmetics Market Trends – Size, Share & Growth 2025-2035

GCC Nutricosmetics Market Outlook - Size, Growth & Trends 2025-2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Market Analysis - Growth & Forecast 2025 to 2035

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Male Color Cosmetics Market - Trends, Growth & Forecast 2025 to 2035

Japan Nutricosmetics Market Report – Trends, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA