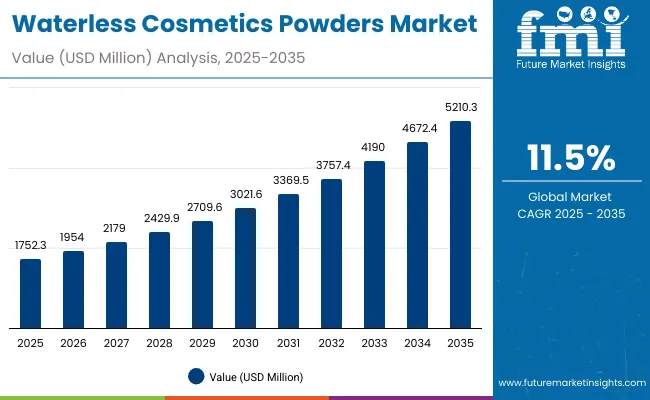

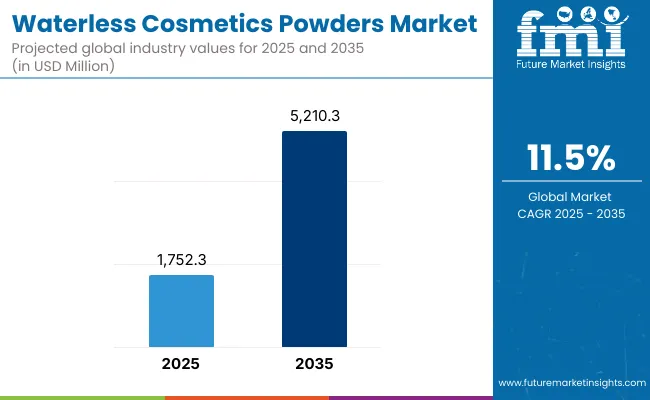

The Waterless Cosmetics Powders Market is anticipated to reach a valuation of USD 1,752.3 million in 2025 and is projected to touch USD 5,210.3 million by 2035. This expansion reflects an absolute gain of USD 3,458 million, marking an increase of nearly 197% over the decade. The growth trajectory corresponds to a robust CAGR of 11.5%, indicating that the market is poised to more than double its size within the forecast horizon.

Waterless Cosmetics Powders Market Key Takeaways

| Metric | Value |

|---|---|

| Waterless Cosmetics Powders Market Estimated Value in (2025E) | USD 1,752.3 million |

| Waterless Cosmetics Powders Market Forecast Value in (2035F) | USD 5,210.3 million |

| Forecast CAGR (2025 to 2035) | 11.5% |

In the first half of the forecast period, between 2025 and 2030, the market value is expected to climb from USD 1,752.3 million to USD 3,021.6 million, adding nearly USD 1,269.3 million. This phase represents about 36.7% of the total decade growth, supported by early adoption of waterless innovations in cleansing powders and shampoo powders.

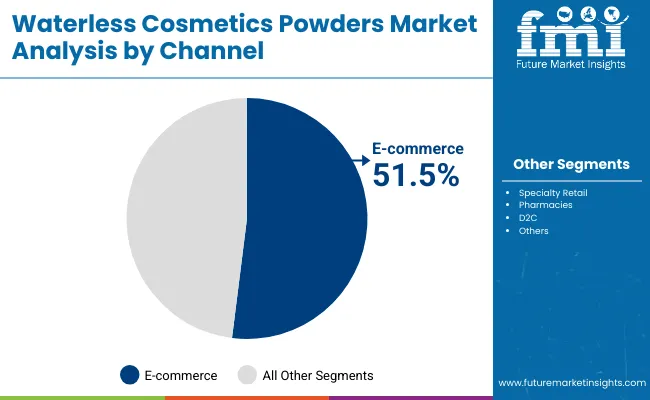

The rapid shift toward sustainable formats and strong penetration of e-commerce platforms is expected to accelerate visibility and consumer acceptance. E-commerce is likely to dominate with more than 51% market share by 2025, highlighting the digital-first evolution of this category.

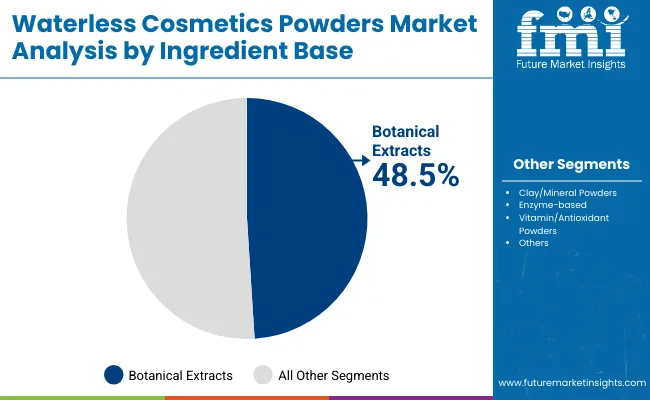

From 2030 to 2035, growth is forecasted to accelerate further as the market expands from USD 3,021.6 million to USD 5,210.3 million, adding approximately USD 2,188.7 million, equal to 63.3% of the overall decade gain. This surge will be reinforced by advanced formulations featuring botanical extracts and multifunctional properties, supported by strong consumer demand for clean-label solutions. Botanical extracts are projected to command nearly 48.5% share in 2025, while premium functional positioning is set to push brightening and hydration formats into mainstream adoption.

From 2020 to 2024, the Waterless Cosmetics Powders Market steadily advanced as early adoption was concentrated in niche beauty and sustainable skincare categories. By 2025, mainstream entry by global majors positioned the market for scale, with e-commerce ecosystems leading adoption.

Looking ahead, revenue composition is expected to shift further toward multifunctional innovations, clean-label formulations, and service-driven brand engagement. Competitive advantage will increasingly be defined by sustainability credentials, ingredient transparency, and digital-first distribution strategies rather than scale alone.

Growth in the Waterless Cosmetics Powders Market is being driven by rising consumer awareness of sustainability and the need to reduce water consumption in beauty routines. Strong preference for eco-friendly formulations has been encouraged by increasing concerns over environmental conservation and resource scarcity.

The appeal of concentrated, lightweight, and travel-friendly products has been reinforced by urban lifestyles and frequent mobility, creating stronger adoption across demographics. Demand is further being stimulated by e-commerce platforms that enable seamless access and education about innovative formats. Ingredient innovation, particularly in botanical extracts and vitamin-enriched powders, has enhanced consumer trust while addressing functional skincare needs such as cleansing, brightening, and hydration.

The market is also being accelerated by premiumization trends, with consumers seeking multifunctional, high-performance solutions that align with clean-label standards. Continuous investment by leading global brands and startups is expected to amplify product visibility, while technological advances in formulation science will further expand product applications.

The Waterless Cosmetics Powders Market has been segmented across multiple dimensions to capture evolving consumer demand and product innovation. Segmentation by channel highlights the distribution dynamics, where e-commerce and offline formats collectively shape accessibility. Ingredient base segmentation reflects consumer preferences for natural botanical extracts versus advanced formulations offering functional benefits.

Functional segmentation further emphasizes the growing role of cleansing powders alongside multifunctional products designed for hydration, brightening, and exfoliation. These categories provide a comprehensive view of how demand is being directed by sustainability, convenience, and efficacy. Each segment is expected to exhibit distinct growth patterns, with digital platforms, ingredient innovation, and multifunctional performance emerging as critical drivers of market expansion during the forecast horizon.

| Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 51.5% |

| Others | 48.5% |

E-commerce is projected to capture 51.5% share ,This dominance is expected to be reinforced by rising consumer preference for digital platforms that provide convenience, product variety, and access to innovative brands. Direct-to-consumer models are anticipated to thrive, offering tailored experiences and transparent product positioning.

Although offline formats will maintain a presence through specialty retail and pharmacies, their share is forecasted to remain secondary to e-commerce. Strong digital penetration, social commerce, and influencer-led marketing are expected to accelerate online adoption, ensuring e-commerce retains its leadership role throughout the forecast horizon.

| Segment | Market Value Share, 2025 |

|---|---|

| Botanical extracts | 48.5% |

| Others | 51.5% |

The ingredient base segment in 2025 is expected to be led by others with 51.5% share. This near-equal distribution reflects growing consumer demand for both natural and advanced formulations. Botanical extracts are projected to resonate strongly with clean-label preferences, attracting consumers seeking safety and familiarity.

At the same time, advanced ingredients, including enzyme-based and antioxidant-rich powders, are forecasted to capture functional demand for visible skincare benefits. The balance of consumer interest highlights a dual growth trajectory: trust in botanicals alongside innovation in performance-driven ingredients. This equilibrium is expected to expand further as scientific validation of formulations strengthens brand credibility.

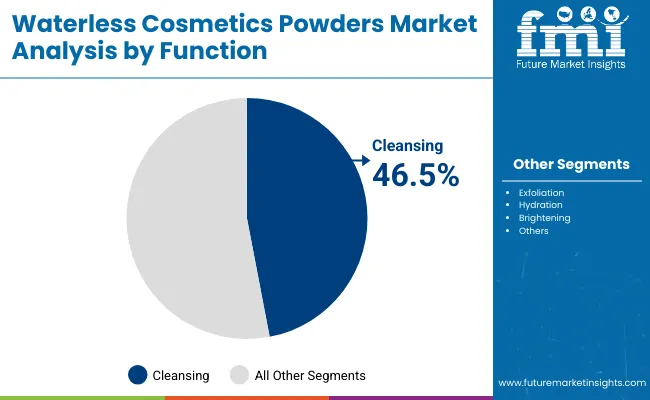

| Segment | Market Value Share, 2025 |

|---|---|

| Cleansing | 46.5% |

| Others | 53.5% |

In 2025, the function segment will be led by cleansing powders contributing 46.5% This leadership by multifunctional formats is expected to be fueled by increasing consumer demand for hydration, brightening, and exfoliation solutions bundled into single products. Cleansing powders, while retaining strong adoption, are anticipated to serve as the foundational category for market entry.

Growth in the “others” category reflects shifting preferences among younger, time-conscious consumers who favor multifunctional, premium-positioned offerings. This trend is projected to be reinforced by continuous product launches and innovations that blur boundaries between skincare and cosmetics, ensuring multifunctional powders remain the fastest-expanding functional category over the coming decade.

The Waterless Cosmetics Powders Market is being shaped by advanced formulation science, shifting consumer awareness, and evolving retail ecosystems, even as challenges persist in scaling innovation and balancing sustainability with performance in highly competitive global beauty landscapes.

Innovation in Multifunctional Formulations

Market expansion is being enabled by a growing emphasis on multifunctional powders that merge skincare and cosmetic benefits. Instead of single-purpose cleansing or hydration formats, advanced powders are being engineered to deliver combined exfoliating, brightening, and moisturizing results. This multifunctionality is expected to appeal to time-conscious urban consumers while reducing product clutter and aligning with minimalist lifestyle trends.

Global beauty leaders are anticipated to invest heavily in R&D pipelines to validate efficacy and differentiate offerings. The long-term growth potential of this driver lies in how multifunctional innovations increase repeat purchase rates and open premium price tiers, ensuring that the waterless powders category evolves from niche adoption into mainstream consumption across key international markets.

Integration of Waterless Beauty in Sustainability Narratives

A critical trend is the embedding of waterless powders within broader sustainability narratives adopted by beauty companies. Unlike early positioning as novelty formats, powders are now being positioned as integral to corporate ESG commitments, particularly in reducing water usage and plastic packaging. Transparent communication of lifecycle benefits is expected to shape consumer trust and brand loyalty.

Strategic partnerships with ingredient suppliers and packaging innovators are anticipated to reinforce this trend, making waterless cosmetics a proof point of authentic sustainability. This integration is likely to redefine marketing frameworks, transforming powders into symbolic products that signal a brand’s environmental responsibility. By aligning innovation with measurable ecological outcomes, this trend is projected to reshape competitive advantage in the decade ahead.

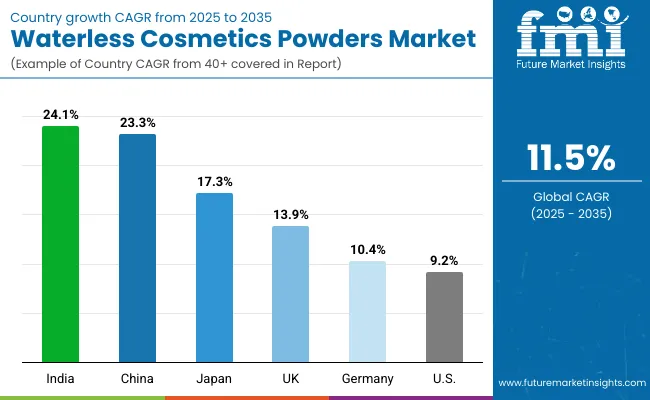

| Country | CAGR |

|---|---|

| China | 23.3% |

| USA | 9.2% |

| India | 24.1% |

| UK | 13.9% |

| Germany | 10.4% |

| Japan | 17.3% |

The global Waterless Cosmetics Powders Market is forecasted to display significant country-level variations in growth momentum, shaped by demographic shifts, digital retail penetration, and evolving consumer awareness of sustainable beauty. Asia-Pacific is projected to remain the fastest-expanding region, anchored by India at 24.1% CAGR and China at 23.3% CAGR. Growth in these markets is expected to be supported by younger populations, rising disposable incomes, and aggressive digital-first adoption, making them hubs of innovation and scale.

Japan, with an estimated 17.3% CAGR, is anticipated to gain traction from a combination of high per-capita spending on beauty and strong demand for multifunctional, premium-positioned powders. In Europe, the UK and Germany are projected to expand at 13.9% and 10.4% CAGR respectively, driven by stringent sustainability expectations and strong retail integration. Both countries are likely to act as trendsetters for clean-label formulations and eco-packaging.

The USA, with a comparatively moderate 9.2% CAGR, is forecasted to exhibit steady adoption, reinforced by premium consumer segments and increasing acceptance of minimalist, waterless routines. While growth rates differ, all key markets are expected to be unified by consumer education, digital ecosystems, and brand innovation, ensuring long-term global expansion of waterless powders.

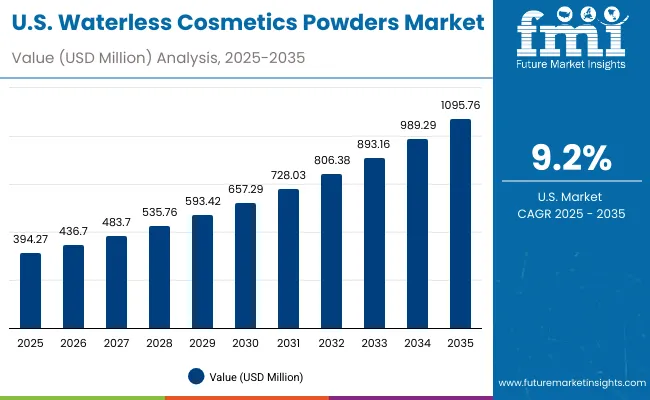

| Year | USA Waterless Cosmetics Powders Market (USD Million) |

|---|---|

| 2025 | 394.27 |

| 2026 | 436.70 |

| 2027 | 483.70 |

| 2028 | 535.76 |

| 2029 | 593.42 |

| 2030 | 657.29 |

| 2031 | 728.03 |

| 2032 | 806.38 |

| 2033 | 893.16 |

| 2034 | 989.29 |

| 2035 | 1,095.76 |

The USA Waterless Cosmetics Powders Market is projected to grow at a CAGR of 9.2% during 2025 to 2035, supported by steady adoption of sustainable beauty formats and increasing integration of digital-first retail ecosystems. Market performance is expected to be guided by consumer awareness of clean-label solutions and the premiumization of multifunctional powders.

From 2025 to 2030, adoption is anticipated to expand gradually as niche innovators and premium brands strengthen consumer education and visibility. This phase will set the foundation for growth by positioning waterless powders as eco-conscious, performance-driven solutions. From 2030 to 2035, growth is forecasted to accelerate, driven by stronger product penetration across mainstream channels, multifunctional innovations, and endorsement by dermatology-focused brands. The role of e-commerce and direct-to-consumer strategies will remain central in shaping the sales outlook.

The UK Waterless Cosmetics Powders Market is projected to grow at a CAGR of 13.9% during 2025 to 2035, supported by strong clean-label demand and regulatory emphasis on sustainability. Growth is expected to be shaped by consumer preference for eco-conscious formulations and premium-positioned multifunctional products.

Between 2025 and 2030, adoption is anticipated to accelerate through specialty retail and e-commerce platforms, particularly as brands highlight water conservation benefits and plastic-free packaging. The latter half of the decade is expected to record faster momentum as mainstream brands expand affordable offerings, creating wider consumer access. Functional powders that deliver brightening and hydration benefits are forecasted to capture urban consumer interest.

The India Waterless Cosmetics Powders Market is projected to expand at the fastest CAGR of 24.1% during 2025 to 2035, driven by younger demographics, rising disposable incomes, and rapid digital penetration. Market performance is expected to be shaped by affordable innovation and aspirational consumption.

From 2025 to 2030, growth is anticipated to be led by early adoption in metro cities, where digital-first brands will focus on clean-label education. The second half of the decade is forecasted to expand into tier-2 and tier-3 cities as affordability and awareness increase, strengthening mass-market penetration. Multifunctional powders offering cleansing and brightening benefits are expected to become popular in diverse consumer segments.

The China Waterless Cosmetics Powders Market is projected to grow at a CAGR of 23.3% during 2025 to 2035, reinforced by strong e-commerce ecosystems and rapid consumer adoption of sustainable beauty innovations. Growth is expected to be shaped by both premium and mass-market dynamics.

Between 2025 and 2030, urban consumers are anticipated to drive demand for multifunctional powders aligned with clean-label preferences. The second half of the forecast is projected to record accelerated growth as domestic brands expand into rural areas through social commerce and livestreaming platforms. The integration of traditional botanical extracts with advanced formulations is expected to strengthen consumer trust and drive market competitiveness.

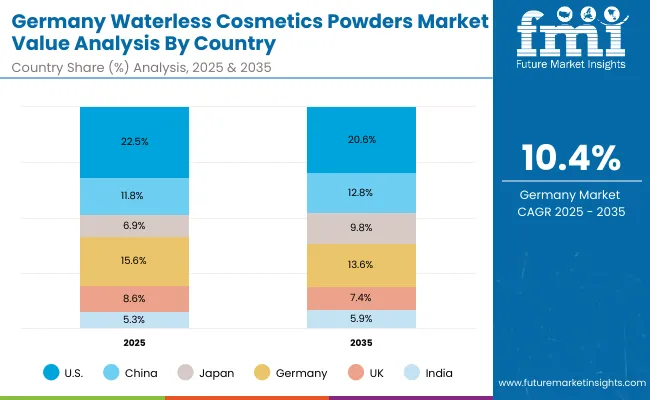

| Country | 2025 |

|---|---|

| USA | 22.5% |

| China | 11.8% |

| Japan | 6.9% |

| Germany | 15.6% |

| UK | 8.6% |

| India | 5.3% |

| Country | 2035 |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 9.8% |

| Germany | 13.6% |

| UK | 7.4% |

| India | 5.9% |

The Germany Waterless Cosmetics Powders Market is projected to grow at a CAGR of 10.4% during 2025 to 2035, supported by strong sustainability awareness and regulatory frameworks. Market adoption is expected to be guided by consumer trust in certified, clean-label beauty products.

From 2025 to 2030, market momentum is anticipated to be moderate, reinforced by premium positioning and pharmacy-led adoption. In the second half of the decade, broader acceptance is forecasted through e-commerce platforms and increased investment by multinational brands. Innovation in multifunctional and dermatology-backed powders is expected to appeal strongly to German consumers who prioritize safety, transparency, and eco-consciousness.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Cleansing | 49.10% |

| Others | 50.90% |

The Waterless Cosmetics Powders Market in Japan is projected at USD 120.9 million in 2025. Functional segmentation highlights a near balance, with cleansing contributing 49.1% while multifunctional formats under “others” command 50.9%, indicating a slight preference for versatile beauty routines. This marginal lead reflects the rising Japanese consumer inclination toward hybrid formats that deliver hydration, brightening, and exfoliation in one product, aligning with time-conscious lifestyles.

Cleansing powders are expected to remain highly relevant due to deep-rooted skincare traditions emphasizing purity and minimalism. However, multifunctional innovations are projected to accelerate growth as urban consumers increasingly prioritize convenience and premium positioning. Japanese brands are also expected to leverage botanicals fused with advanced formulations, strengthening consumer trust. As multifunctional adoption expands, this balance is forecasted to tilt further, positioning Japan as a premium-driven market where product innovation and tradition converge.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Cleansing | 48.00% |

| Others | 52.00% |

The Waterless Cosmetics Powders Market in South Korea is projected at USD 87.6 million in 2025. Functional segmentation shows a slight dominance of “others” at 52%, reflecting demand for multifunctional solutions that align with the country’s globally recognized K-beauty innovation ecosystem. Cleansing powders are forecasted to retain strong adoption, supported by cultural emphasis on skincare purity and layering routines.

Growth is expected to be accelerated by the export-driven influence of K-beauty trends, where powders are positioned as eco-friendly, travel-ready, and technologically advanced. E-commerce and cross-border online retail are anticipated to play a central role in extending reach to international consumers. Continuous innovation in multifunctional brightening and hydrating formats is projected to reinforce South Korea’s position as a global trendsetter in waterless beauty solutions.

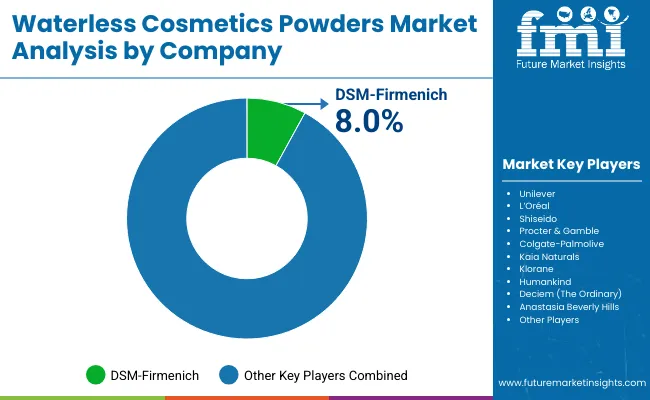

| Company | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.0% |

| Others | 92.0% |

The Waterless Cosmetics Powders Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists shaping its competitive outlook. Global players such as Unilever, L’Oréal, Procter & Gamble, Shiseido, and Colgate-Palmolive are expected to dominate through scale, distribution strength, and continuous investment in R&D pipelines. These companies are anticipated to leverage their broad brand portfolios to position waterless powders as premium sustainable alternatives, aligning with consumer awareness of clean-label beauty.

Mid-sized innovators, including Deciem (The Ordinary), By Humankind, Kaia Naturals, and Klorane, are projected to play a key role by offering differentiated, eco-conscious solutions tailored to niche audiences. Their agility in product innovation and digital-first strategies is likely to resonate strongly with millennial and Gen Z consumers, strengthening their market relevance.

Specialist brands such as Anastasia Beverly Hills are anticipated to focus on targeted segments like luxury beauty, where powder-based innovations will support portfolio diversification. Competitive differentiation is forecasted to shift toward multifunctional performance, eco-friendly packaging, and omnichannel integration, with e-commerce becoming the dominant sales platform.

According to 2025 estimates, DSM-Firmenich holds an 8% global value share, while the remaining 92% is fragmented among beauty majors and emerging players. DSM-Firmenich is expected to have maintained a similar share in 2024, consolidating its position as the leading ingredient supplier for this market.

Key Developments in Waterless Cosmetics Powders Market

| Item | Value |

|---|---|

| Market Size 2025 | USD 1,752.3 million |

| Market Size 2035 | USD 5,210.3 million |

| Absolute Growth 2025 to 2035 | USD 3,458.0 million |

| CAGR 2025 to 2035 | 11.5% |

| Leading Channel (2025) | E-commerce 51.5% (USD 902.0 million); Others 48.5% (USD 849.60 million) |

| Ingredient Base Split (2025) | Others 51.5% (USD 902.70 million); Botanical extracts 48.5% (USD 848.5 million) |

| Functional Split (2025) | Others 53.5% (USD 938.10 million); Cleansing 46.5% (USD 813.1 million) |

| USA Market (2025 → 2035) | USD 394.27 million → USD 1,095.76 million |

| High-Growth Countries (CAGR 2025 to 2035) | India 24.1%; China 23.3%; Japan 17.3%; UK 13.9%; Germany 10.4%; USA 9.2% |

| Packaging Types Considered | Sachets, Sticks, Refillable jars, Capsules |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever; L’Oréal; Shiseido; Procter & Gamble; Colgate-Palmolive; Kaia Naturals; Klorane; By Humankind; Deciem (The Ordinary); Anastasia Beverly Hills; DSM-Firmenich (ingredients) |

| Additional Attributes | Sustainability and water-saving positioning; e-commerce leadership; multifunctional powder innovation (brightening/hydration/exfoliation); clean-label and botanical claims; refillable/low-plastic packaging; premiumization; country-specific CAGRs; 2025 segment shares for channel, ingredient base, and function included above. |

The global Waterless Cosmetics Powders Market is estimated to be valued at USD 1,752.3 million in 2025, supported by strong demand for sustainable, travel-friendly, and multifunctional beauty formats.

The market size for the Waterless Cosmetics Powders Market is projected to reach USD 5,210.3 million by 2035, indicating a strong long-term expansion trajectory.

The Waterless Cosmetics Powders Market is expected to grow at a CAGR of 11.5% between 2025 and 2035, more than doubling its overall size.

The key product types in the Waterless Cosmetics Powders Market include cleansing powders, shampoo powders, powdered masks, and powder-to-cream moisturizers.

In terms of distribution, the e-commerce channel is projected to command a 51.5% share of the Waterless Cosmetics Powders Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Market Analysis - Growth & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Vegan Cosmetics Market Analysis - Trends, Growth & Forecast 2025 to 2035

Tinted Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Colour Cosmetics Market Insights – Growth & Forecast 2024-2034

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Natural Cosmetics Market - Size, Share, and Forecast 2025-2035

UK Nutricosmetics Market Growth – Demand, Trends & Forecast 2025-2035

Organic Cosmetics Market Insights – Growth & Forecast 2024-2034

GCC Nutricosmetics Market Outlook - Size, Growth & Trends 2025-2035

USA Nutricosmetics Market Trends – Size, Share & Growth 2025-2035

Anti-acne Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Male Color Cosmetics Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA