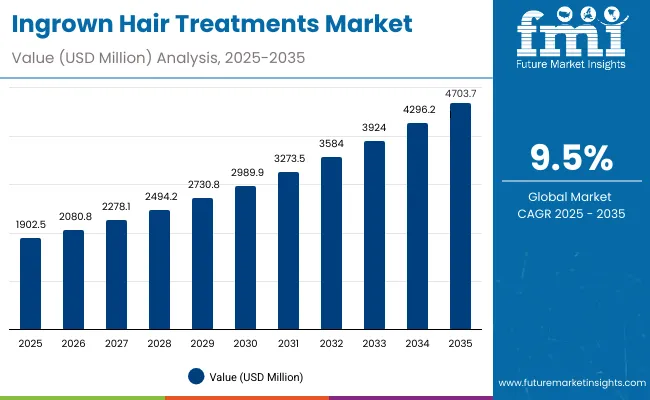

The Ingrown Hair Treatments Market is expected to record a valuation of USD 1,902.5 million in 2025 and USD 4,703.7 million in 2035, with an increase of USD 2,803.2 million, which equals a growth of nearly 147% over the decade. The overall expansion represents a CAGR of 9.5% and a more than 2X increase in market size.

Ingrown Hair Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Ingrown Hair Treatments Market Estimated Value in (2025E) | USD 1,902.5 million |

| Ingrown Hair Treatments Market Forecast Value in (2035F) | USD 4,703.7 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

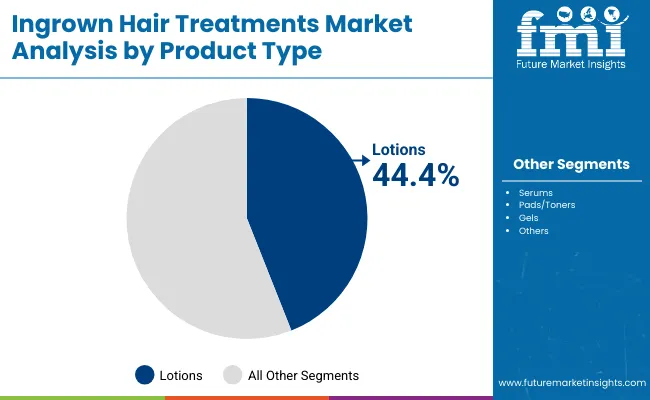

During the first five-year period from 2025 to 2030, the market increases from USD 1,902.5 million to USD 2,989.9 million, adding USD 1,089.4 million, which accounts for 39% of the total decade growth. This phase records steady adoption in dermatologist-tested formulas, salon-focused soothing and post-hair removal repair solutions, and rising consumer awareness of prevention-based routines. Lotions dominate this period as they cater to over 44% of consumer applications, reflecting strong consumer preference for lightweight, daily-use formats.

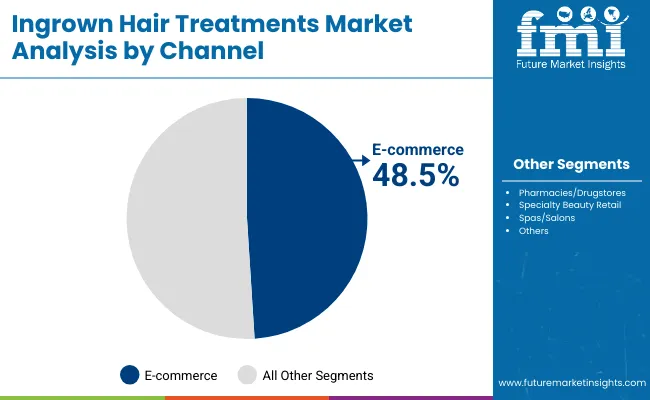

The second half from 2030 to 2035 contributes USD 1,713.8 million, equal to 61% of total growth, as the market jumps from USD 2,989.9 million to USD 4,703.7 million. This acceleration is powered by widespread deployment of AI-driven recommendation engines on e-commerce platforms, premiumization of serums and gels targeting redness and irritation, and a sharp increase in vegan and clean-label claims. E-commerce and specialty retail together capture a larger share above 55% by the end of the decade. Claim-led differentiation, particularly dermatologist-tested and clean-label positioning, adds recurring revenue opportunities, pushing premium brand penetration further.

From 2020 to 2024, the Ingrown Hair Treatments Market expanded steadily from salon-led adoption of soothing and anti-redness products to wider consumer use of dermatologist-tested prevention solutions. During this period, the competitive landscape was dominated by niche skincare specialists controlling significant revenue, with leaders such as Tend Skin and PFB Vanish focusing on precision-based exfoliating and repairing formulas. Competitive differentiation relied on active ingredients like salicylic acid and glycolic acid, known for exfoliation and resurfacing, while tea tree oil and aloe vera were bundled for soothing properties. Service-based salon models had moderate traction, contributing to consumer awareness but accounting for less than 15% of the total market value.

Demand for ingrown hair treatments is forecast to expand to USD 1,902.5 million in 2025, and the revenue mix will shift as e-commerce and specialty retail grow to over 50% share. Traditional leaders face rising competition from digital-first players offering vegan-certified products, clean-label serums, and subscription-based post-hair removal kits. Major personal care vendors are pivoting to hybrid models, integrating dermatologist endorsements and AI-driven consumer personalization to retain relevance. Emerging entrants specializing in natural actives, AR-driven virtual skincare diagnostics, and gender-inclusive marketing are gaining share. The competitive advantage is moving away from generic lotion formats alone to ecosystem strength, claims-driven trust, and channel integration.

Advances in active ingredient formulations have improved efficacy in reducing irritation, redness, and ingrown recurrence, allowing for more effective post-hair removal routines across diverse consumer groups. Lotions and serums have gained popularity due to their suitability for everyday prevention, with dermatologist-tested claims significantly influencing trust-driven purchases. The rise of salicylic acid and glycolic acid-based exfoliation technology has contributed to enhanced skin resurfacing and improved consumer outcomes. Industries such as beauty retail, salon services, and e-commerce-driven direct-to-consumer brands are driving adoption of solutions that integrate seamlessly into grooming and skincare regimens.

Expansion of clean-label, vegan, and fragrance-free claims has fueled market growth. Innovations in convenient formats such as pads/toners and portable gels are expected to open new application areas. Segment growth is expected to be led by lotions in product type, e-commerce in channel categories, and dermatologist-tested claims in positioning, due to their widespread consumer acceptance and adaptability across geographies.

The market is segmented by function, active ingredient, product type, channel, claim, and region. Functions include ingrown prevention, exfoliation & resurfacing, soothing & anti-redness, and post-hair removal repair, highlighting the diverse needs across consumer routines. Active ingredients cover salicylic acid, glycolic acid, tea tree oil, aloe vera, and lactic acid to address both exfoliation and soothing applications. By product type, categories encompass lotions, serums, pads/toners, and gels, representing traditional and evolving skincare solutions.

By channel, segmentation includes e-commerce, pharmacies/drugstores, specialty beauty retail, and spas/salons, capturing both digital and physical consumer touchpoints. By claim, classifications feature fragrance-free, dermatologist-tested, clean-label, and vegan, reflecting rising consumer demand for safer, natural, and inclusive options. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Product Type | Value Share% 2025 |

|---|---|

| Lotions | 44.4% |

| Others | 55.6% |

The lotions segment is projected to contribute 44.4% of the Ingrown Hair Treatments Market revenue in 2025, maintaining its lead as the dominant product type category. This strong position comes from the daily usability, familiarity, and affordability of lotions, which makes them a consumer’s first choice in addressing ingrown hair concerns. Lotions also offer multifunctionality by providing hydration, exfoliation, and soothing in a single format, appealing to both men and women across different age groups.

The segment’s growth is also supported by the wide availability of lotions in both mass retail and premium skincare portfolios. Their adaptability allows brands to incorporate active ingredients such as salicylic acid, glycolic acid, aloe vera, and tea tree oil, making them effective in prevention, exfoliation, and soothing applications. As clean-label and dermatologist-tested claims gain momentum, lotions are being reformulated with gentler bases and natural actives, further broadening their consumer acceptance. With their balance of price, effectiveness, and accessibility, lotions are expected to retain their position as the backbone of product offerings in the ingrown hair treatments market.

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 48.5% |

| Others | 51.5% |

The e-commerce segment is forecasted to hold 48.5% of the market share in 2025, establishing itself as the largest sales channel for ingrown hair treatment products. This dominance is led by the rapid shift in consumer purchasing behavior towards online platforms, fueled by convenience, variety, and the ability to access dermatologist-approved brands globally. Direct-to-consumer models have made specialized products such as serums, gels, and post-hair removal repair kits widely available to consumers across regions, significantly expanding market reach.

E-commerce platforms also provide enhanced engagement through product tutorials, influencer reviews, and subscription-based delivery models, which are increasingly popular among younger demographics. The segment’s growth is further bolstered by digital marketing campaigns targeting niche consumer groups such as men’s grooming, clean-label skincare, and salon professionals. With the rise of AI-driven personalization and virtual skin consultations, e-commerce platforms are not only facilitating product sales but also shaping consumer preferences. As online penetration continues to grow globally, e-commerce is expected to remain the most influential sales channel in the ingrown hair treatments market.

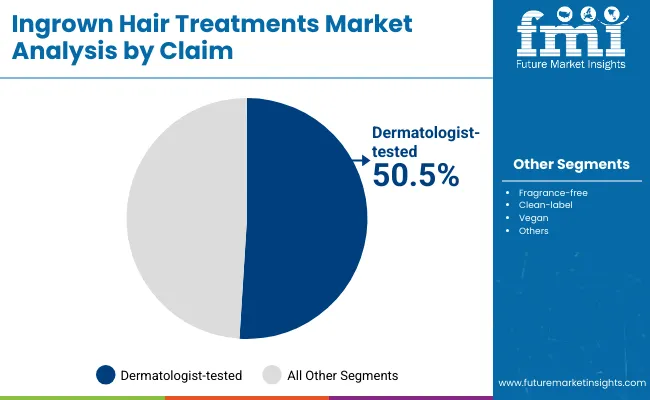

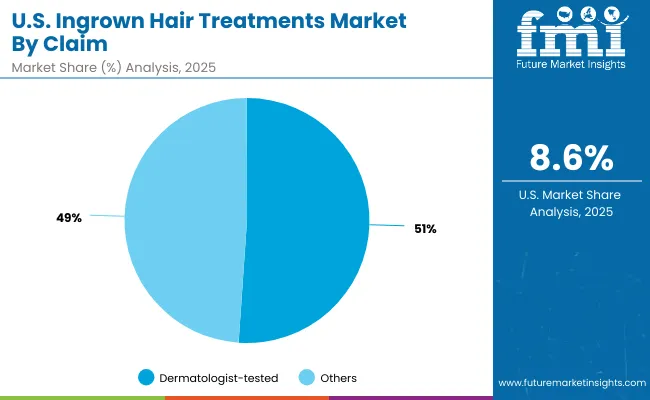

| Claim | Value Share% 2025 |

|---|---|

| Dermatologist-tested | 50.5% |

| Others | 49.5% |

The dermatologist-tested claim segment is projected to account for 50.5% of the Ingrown Hair Treatments Market revenue in 2025, making it the most influential positioning attribute. Consumers increasingly view dermatologist validation as a guarantee of safety, efficacy, and credibility, particularly for sensitive skin conditions such as redness, irritation, and post-hair removal repair. The growing demand for clinically backed skincare has enabled dermatologist-tested products to secure leadership across both premium and mass-market portfolios.

This segment’s strength is also tied to the expanding consumer base for preventive grooming solutions, where trust and effectiveness are paramount. Major brands are leveraging dermatologist endorsements and clinical trial results in marketing campaigns to enhance product credibility and drive adoption. Furthermore, dermatologist-tested products often align with other rising claims such as fragrance-free, vegan, and clean-label, giving them multi-claim appeal. Given the rising demand for science-driven and clinically validated solutions, the dermatologist-tested segment is expected to maintain its leadership, shaping consumer confidence and premiumization trends in the Ingrown Hair Treatments Market.

Rising Male Grooming and Beard-Care Related Demand

A major growth driver comes from the rising demand among male consumers who face frequent ingrown hair issues due to daily shaving, beard trimming, and body grooming. With the expansion of men’s grooming routines globally, ingrown hair treatments are moving beyond niche skincare and entering mainstream men’s personal care aisles. Brands like Jack Black and Gillette are increasingly promoting soothing and repair-focused solutions that specifically target razor bumps and beard-related ingrown hairs. This male-centric demand adds a strong new consumer base to the market, which historically leaned toward female grooming needs. The crossover into beard-care and men’s grooming kits has widened distribution through barbershops, men’s e-commerce portals, and specialty grooming stores.

Integration of Multi-Claim and Multi-Functional Formulations

Another driver is the increasing consumer preference for multifunctional skincare products that address multiple concerns in one solution. Ingrown hair treatments are now being developed with added claims such as soothing, anti-redness, exfoliation, and hydration. Products with salicylic acid or glycolic acid not only prevent ingrown hairs but also provide resurfacing and acne control benefits, making them appealing to younger consumers with broader skincare concerns. Dermatologist-tested and vegan-certified serums and gels that combine exfoliation with soothing aloe vera or tea tree oil are gaining rapid adoption. This multifunctionality encourages higher consumer spend and repeat purchase rates, particularly through e-commerce channels where comparative claim-marketing is highly effective.

Sensitivity Concerns with Acid-Based Formulations

While exfoliating acids like salicylic and glycolic are proven actives in ingrown prevention, their use often raises concerns among consumers with sensitive skin. Overuse or incorrect application of these ingredients can lead to redness, stinging, and peeling, particularly in regions with high humidity or among first-time users. Negative reviews or consumer experiences shared online can quickly impact brand trust, especially in markets like the USA where dermatologist validation strongly influences purchasing. This restraint forces brands to reformulate products with buffered acids, lower concentrations, or paired soothing agents, which can increase production costs and slow down rapid scaling.

Limited Penetration Beyond Urban and Premium Retail Clusters

Another restraint is the market’s concentration in urban centers and premium retail environments. Ingrown hair treatments remain underpenetrated in mass-market and pharmacy-led distribution in many developing economies, limiting their exposure to wider populations. While awareness is growing in countries like India and China, adoption is still heavily skewed toward affluent consumers and urban millennials. This concentration limits market growth potential in suburban and rural areas where basic hair removal is common but specialized post-care treatments are not yet seen as essential. Without stronger pharmacy or mid-tier retail presence, the market risks being confined to premium segments and losing out on volume-driven growth.

Dermatologist-Tested and Clinical Validation Becoming a Marketing Standard

One of the strongest trends in the Ingrown Hair Treatments Market is the rise of dermatologist-tested claims, which already hold 50.5% share in 2025. Consumers are increasingly equating clinical validation with safety and reliability, particularly in categories addressing irritation, bumps, and post-hair removal redness. Brands are highlighting dermatological studies, clinical trials, and doctor endorsements in their advertising to differentiate themselves in crowded digital marketplaces. This trend is especially pronounced in the USA and Europe, where consumer trust in professional-backed skincare is driving premiumization, repeat purchases, and willingness to pay higher prices for certified products.

E-Commerce Subscription Models and Direct-to-Consumer Expansion

Another key trend is the rapid rise of subscription-based e-commerce models in the ingrown hair treatments market. Direct-to-consumer brands like Fur and niche online retailers are offering replenishment-based subscriptions for serums, pads, and lotions, ensuring continuous usage and boosting lifetime customer value. This model works particularly well in grooming routines, where ingrown prevention is a recurring need. Subscription services also allow brands to personalize offers, upsell new formulations, and build strong digital communities around clean-label and vegan claims. By 2030-2035, e-commerce is expected to capture more than half of all global sales, driven by these recurring subscription models and influencer-led awareness campaigns.

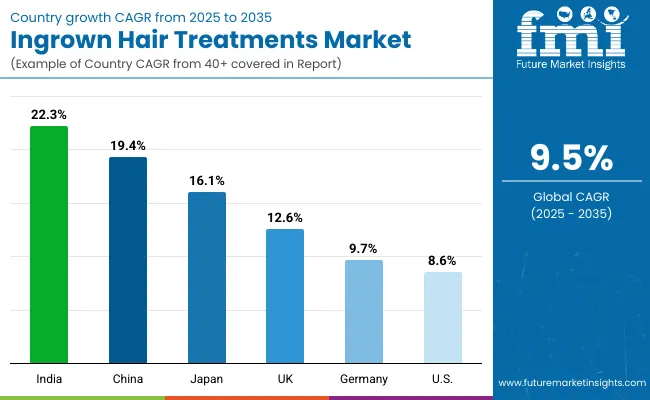

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.4% |

| USA | 8.6% |

| India | 22.3% |

| UK | 12.6% |

| Germany | 9.7% |

| Japan | 16.1% |

The Ingrown Hair Treatments Market is witnessing highly uneven growth across countries, with emerging economies showing far stronger momentum than mature markets. India (22.3% CAGR) and China (19.4% CAGR) are expected to be the fastest-growing regions, supported by rising disposable incomes, urban lifestyle shifts, and increasing adoption of modern hair removal practices such as waxing, laser, and shaving products. Greater consumer awareness around skincare, combined with the strong penetration of e-commerce platforms, is enabling wider access to dermatologist-tested and clean-label ingrown hair solutions.

Japan, with a 16.1% CAGR, is also experiencing rapid growth, fueled by a culture of high skincare investment and the popularity of multifunctional serums and gels that combine soothing, brightening, and exfoliating benefits. These Asian markets are not only driving overall market expansion but also shaping innovation trends, particularly in vegan formulations and multifunctional actives.

By contrast, mature Western markets such as the USA (8.6% CAGR), Germany (9.7% CAGR), and the UK (12.6% CAGR) are projected to grow at steadier but slower rates. In these regions, the market is already relatively developed, with dermatologist-tested lotions and serums forming the backbone of demand. Growth is primarily being driven by claim-led differentiation (fragrance-free, vegan, dermatologist-tested) and premiumization, rather than new consumer adoption.

However, the USA retains a strong revenue base, supported by male grooming trends and subscription-based e-commerce models. The UK is benefiting from a younger consumer base adopting vegan and clean-label products, while Germany continues to favor clinically validated solutions distributed through pharmacies and drugstores. Together, these countries highlight a dual-speed market where Asia is propelling growth through new adoption, while North America and Europe rely more on innovation, clinical trust, and premium positioning.

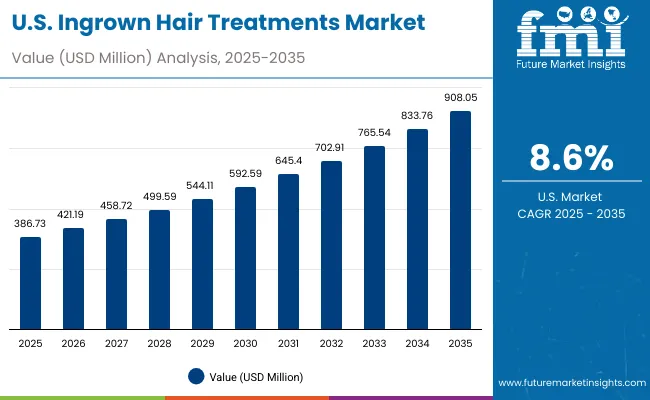

| Year | USA Ingrown Hair Treatments Market (USD Million) |

|---|---|

| 2025 | 386.73 |

| 2026 | 421.19 |

| 2027 | 458.72 |

| 2028 | 499.59 |

| 2029 | 544.11 |

| 2030 | 592.59 |

| 2031 | 645.40 |

| 2032 | 702.91 |

| 2033 | 765.54 |

| 2034 | 833.76 |

| 2035 | 908.05 |

The ingrown hair treatments market in the United States is projected to grow at a CAGR of 8.6%, supported by high grooming frequency, rising male grooming adoption, and strong consumer trust in dermatologist-tested products. Preventive and soothing formulas dominate, with lotions and serums leading sales. E-commerce continues to expand as the preferred channel, while pharmacies maintain importance for clinical positioning. Subscription-based models and bundled beard-care kits are boosting repeat sales, while dermatologist endorsements strengthen premiumization.

The ingrown hair treatments market in the United Kingdom is expected to grow at a CAGR of 12.6%, driven by younger demographics adopting vegan, clean-label, and dermatologist-approved solutions. Specialty beauty retail and spas play a strong role in educating consumers, while online platforms boost awareness through influencer-driven campaigns. The market also benefits from the rise of gender-neutral skincare and grooming products, encouraging broader adoption across segments.

India is witnessing rapid growth in the ingrown hair treatments market, with a forecast CAGR of 22.3% through 2035, the highest globally. This momentum is driven by rising disposable incomes, growing exposure to salon and waxing services, and increasing awareness of post-hair removal care among urban and tier-2 consumers. E-commerce platforms are expanding penetration, making serums, gels, and dermatologist-tested solutions widely accessible beyond metros. The combination of affordability, digital promotions, and premium brand entry is creating a strong long-term growth pathway.

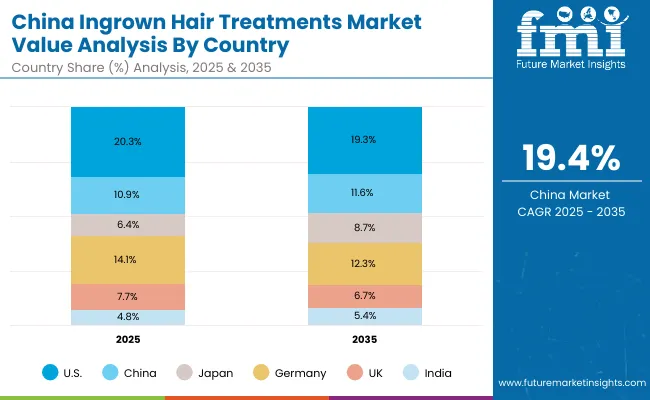

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.3% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.3% |

| China | 11.6% |

| Japan | 8.7% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

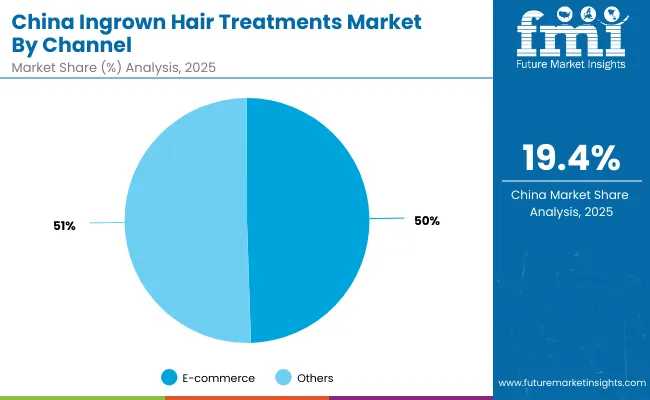

The ingrown hair treatments market in China is expected to grow at a CAGR of 19.4%, one of the fastest among global economies. Growth is led by the expansion of e-commerce channels, with 49.5% of sales in 2025 coming from online platforms. Digital campaigns, influencer marketing, and rising men’s grooming adoption are shaping the market. Domestic brands offering clean-label, herbal, and multifunctional serums are expanding quickly, competing with international entrants. Younger consumers increasingly seek dermatologist-tested and vegan-certified products, making China a critical growth engine for global players.

| USA by Claim | Value Share% 2025 |

|---|---|

| Dermatologist-tested | 51.1% |

| Others | 48.9% |

The ingrown hair treatments market in the United States is projected at USD 386.7 million in 2025. Dermatologist-tested products contribute 51.1%, while other claims such as vegan, fragrance-free, and clean-label hold 48.9%, showing a clear consumer tilt toward medically validated and science-backed solutions. This claim dominance reflects the rising trust consumers place in dermatologist endorsements, particularly in products targeting irritation, razor bumps, and post-hair removal redness. Unlike generic soothing lotions, dermatologist-tested serums and gels offer stronger purchase motivation in the USA where clinical evidence and product efficacy messaging resonate heavily.

Growing adoption of subscription-based e-commerce bundles for men’s grooming kits is also fueling this shift, as male consumers increasingly look for clinically validated solutions to address shaving-related ingrown hairs. Additionally, USA pharmacies and drugstores actively recommend dermatologist-tested brands, reinforcing their position as safe and effective. As competition intensifies, brands are amplifying product differentiation by combining dermatologist-tested positioning with vegan or fragrance-free attributes, creating hybrid claims that resonate across multiple demographics.

| China by Channel | Value Share% 2025 |

|---|---|

| E-commerce | 49.5% |

| Others | 50.5% |

The ingrown hair treatments market in China is valued at USD 206.3 million in 2025, with e-commerce leading at 49.5%, followed closely by offline channels at 50.5%. The dominance of e-commerce is a direct outcome of China’s digital-first consumer culture, where beauty and personal care sales are increasingly driven by social commerce, influencer marketing, and livestream selling. Younger consumers in China rely heavily on platforms like Tmall, JD.com, and Douyin for purchasing dermatologist-tested, clean-label, and soothing-focused ingrown hair treatments.

This advantage positions e-commerce as the most influential growth lever, with direct-to-consumer brands using aggressive digital campaigns and subscription services to gain loyalty. Offline channels such as salons and specialty beauty retail still play a key role, particularly for premium-priced serums and gels, but their influence is being overtaken by digital distribution. The speed of product discovery, trial through samples, and targeted digital campaigns have made online platforms indispensable for foreign and domestic brands alike.

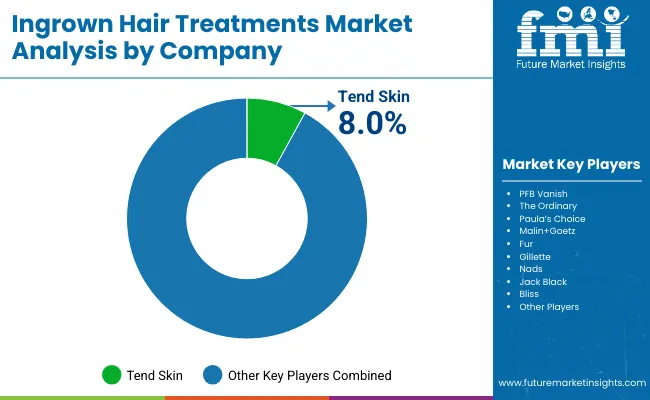

The Ingrown Hair Treatments Market is moderately fragmented, with specialist brands, premium skincare companies, and mass grooming leaders competing across different product formats and claims. Specialist brands such as Tend Skin and PFB Vanish hold strong recognition in the niche segment, with Tend Skin accounting for 8% of global share in 2025 through its established reputation for razor bump and ingrown hair solutions. Their positioning focuses on efficacy-led formulations and loyal repeat customers.

Premium skincare players including The Ordinary, Paula’s Choice, Malin+Goetz, and Bliss are leveraging active ingredient expertise (salicylic acid, glycolic acid, lactic acid) and dermatologist-tested claims to expand into preventive and soothing formulas. These companies emphasize clean-label, vegan-friendly positioning, and e-commerce-focused strategies that resonate strongly with millennials and Gen Z.

Mass-market grooming leaders like Gillette and Nads integrate ingrown hair treatments into broader shaving and hair removal ecosystems, creating bundled offerings for both men and women. Meanwhile, challenger brands like Fur are driving disruption through clean, gender-neutral marketing and subscription-based digital sales models.

Competitive differentiation is shifting away from product function alone toward claim credibility, channel dominance, and digital ecosystem strength. Success increasingly depends on combining dermatologist endorsements with digital-first consumer engagement, enabling brands to scale in both mature and high-growth Asian markets.

Key Developments in Ingrown Hair Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Component | Lotions, Serums, Pads/Toners, and Gels |

| Range | Ingrown prevention, Exfoliation & resurfacing, Soothing & anti-redness, and Post-hair removal repair |

| Technology | Salicylic acid, Glycolic acid, Tea tree oil, Aloe vera, and Lactic acid |

| Type | Fragrance-free, Dermatologist-tested, Clean-label, and Vegan |

| End-use Industry | E-commerce, Pharmacies/Drugstores, Specialty beauty retail, and Spas/Salons |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tend Skin, PFB Vanish, The Ordinary, Paula’s Choice, Malin+Goetz, Fur, Gillette, Nads, Jack Black, Bliss |

| Additional Attributes | Dollar sales by product type and channel, claim-based adoption trends (dermatologist-tested, vegan, clean-label), rising demand for post-hair removal repair and prevention formulas, segment-specific growth in e-commerce and pharmacy distribution, clean-label and vegan-driven premiumization, regional trends shaped by salon penetration and digital-first beauty adoption, and innovations in multifunctional formulations combining exfoliation and soothing properties. |

The Ingrown Hair Treatments Market is estimated to be valued at USD 1,902.5 million in 2025.

The market size for the Ingrown Hair Treatments Market is projected to reach USD 4,703.7 million by 2035.

The Ingrown Hair Treatments Market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in the Ingrown Hair Treatments Market are Lotions, Serums, Pads/Toners, and Gels.

In terms of channel, the E-commerce segment is projected to command 48.5% share in the Ingrown Hair Treatments Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA