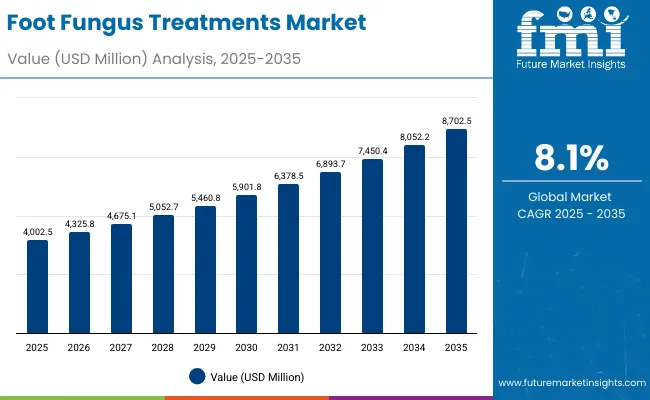

The Foot Fungus Treatments Market is expected to record a valuation of USD 4,002.5 million in 2025 and USD 8,702.5 million in 2035, with an increase of USD 4,700.0 million, which equals a growth of 117% over the decade. The overall expansion represents a CAGR of 8.1% and more than a 2X increase in market size.

Foot Fungus Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Foot Fungus Treatments Market Estimated Value in (2025E) | USD 4,002.5 million |

| Foot Fungus Treatments Market Forecast Value in (2035F) | USD 8,702.5 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 4,002.5 million to USD 5,901.8 million, adding USD 1,899.3 million, which accounts for 40% of the total decade growth. This phase records steady adoption in pharmacy-based treatments, over-the-counter creams, and preventive sprays, driven by higher awareness of fungal infections. Topical antifungal creams dominate this period as they cater to more than half of patients requiring immediate relief and convenient applications.

The second half from 2030 to 2035 contributes USD 2,800.7 million, equal to 60% of total growth, as the market jumps from USD 5,901.8 million to USD 8,702.5 million. This acceleration is powered by rising diabetic populations, increasing adoption of online pharmacy purchases, and wider availability of natural extract-based remedies. Oral antifungals and combined therapies gain ground, while e-commerce and mass retail channels capture a larger share above 50% by the end of the decade. Natural formulations with tea tree oil, oregano, and other extracts add further traction, expanding consumer base and driving diversification of the market revenue mix.

From 2020 to 2024, the Foot Fungus Treatments Market grew from below USD 3,500 million to nearly USD 4,000 million, driven by demand for topical creams and powders. During this period, the competitive landscape was dominated by well-known OTC treatment brands controlling the majority of revenue, with leaders such as Lamisil and Lotrimin focusing on accessible pharmacy-based antifungal therapies. Competitive differentiation relied on speed of action, safety profile, and consumer trust, while sprays, powders, and soaks gained traction in niche applications. Natural extract-based treatments had limited share, contributing less than 10% of the total market value.

Demand for antifungal solutions will expand to USD 4,002.5 million in 2025, and the revenue mix will shift as oral antifungals and natural-based remedies grow to above 20% share. Traditional cream leaders face rising competition from botanical formulations and e-commerce-first brands offering plant-based therapies and subscription-driven digital pharmacy services. Major pharmaceutical players are pivoting to hybrid models, integrating fast-acting topicals with oral regimens to retain relevance. Emerging entrants specializing in natural formulations, diabetic-focused therapies, and dermatology-specific solutions are gaining share. The competitive advantage is moving away from topical cream availability alone to ecosystem strength, consumer trust, diversified product portfolio, and innovative treatment delivery.

Increasing prevalence of fungal infections such as athlete’s foot, toenail fungus, and diabetic-related foot conditions has heightened demand for accessible treatments. Topical antifungal creams have gained popularity due to their affordability, ease of use, and effectiveness for surface-level infections. Oral antifungals are increasingly adopted for stubborn or recurring cases, supported by greater physician awareness. Preventive products such as sprays and powders have gained traction with athletes and working professionals, who seek to limit infection risk through daily use.

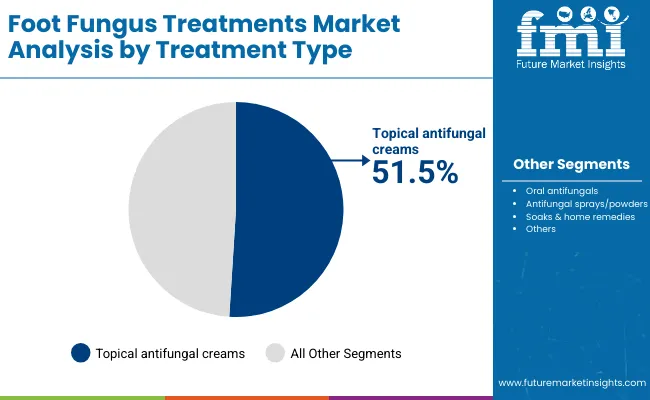

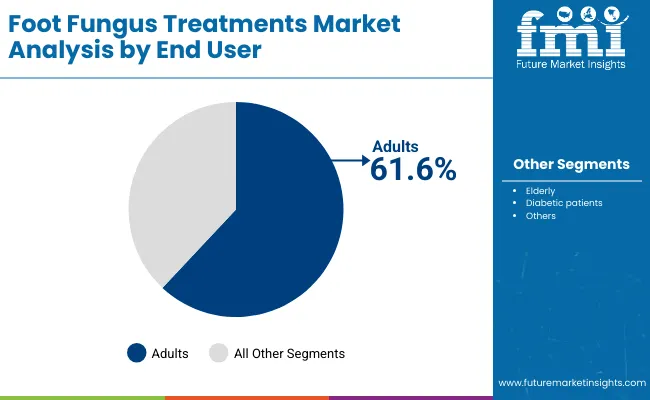

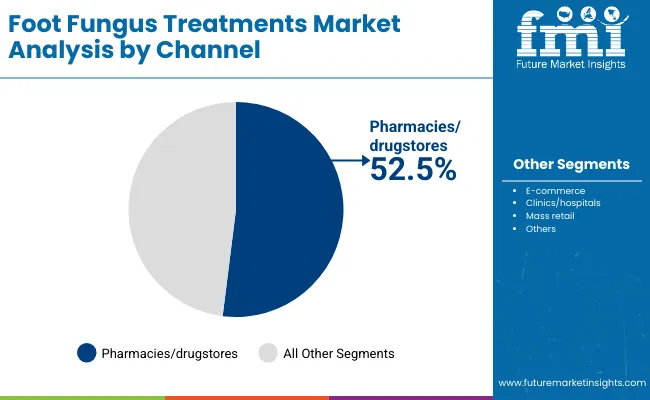

Advances in treatment formulations, such as combination therapies that pair antifungal agents with soothing ingredients, have improved compliance and outcomes. Natural extract-based remedies with tea tree and oregano oils are expanding as consumers seek alternative, plant-based solutions with minimal side effects. Distribution expansion via pharmacies, hospitals, e-commerce platforms, and mass retail ensures global reach. Rising elderly and diabetic populations create a large and recurring consumer base, while growing awareness campaigns by healthcare providers encourage early detection and treatment. Segment growth is expected to be led by topical antifungal creams, adult end users, and pharmacy/drugstore channels, while e-commerce emerges as a fast-growing distribution route.

The market is segmented by treatment type, active ingredient, application area, channel, and end user. Treatment types include topical antifungal creams, oral antifungals, antifungal sprays/powders, and soaks & home remedies. Active ingredients cover clotrimazole, terbinafine, miconazole, tolnaftate, and natural extracts such as tea tree and oregano. Applications span athlete’s foot, toenail fungus, foot skin fungus, and general prophylaxis. Channels include pharmacies/drugstores, e-commerce, clinics/hospitals, and mass retail. End users include adults, elderly, and diabetic patients. Regionally, the market scope includes North America, Europe, Asia-Pacific, and other key growth regions such as Latin America and the Middle East.

| Treatment Type | Value Share% 2025 |

|---|---|

| Topical antifungal creams | 51.5% |

| Others | 48.5% |

The topical antifungal creams segment is projected to contribute 51.5% of the Foot Fungus Treatments Market revenue in 2025, maintaining its lead as the dominant treatment type. This dominance is driven by the widespread use of creams as first-line therapies, their affordability, and their proven efficacy in treating common fungal conditions such as athlete’s foot and mild toenail infections. Consumers continue to prefer topical formulations for their convenience and immediate relief, making them a go-to solution for over-the-counter treatment.

The segment’s growth is also supported by innovation in combination formulations that add soothing or moisturizing benefits alongside antifungal action. Expansion of pharmacy distribution networks and e-commerce platforms has further boosted availability of creams globally. Topical antifungal creams are expected to remain the backbone of treatment approaches throughout the forecast period.

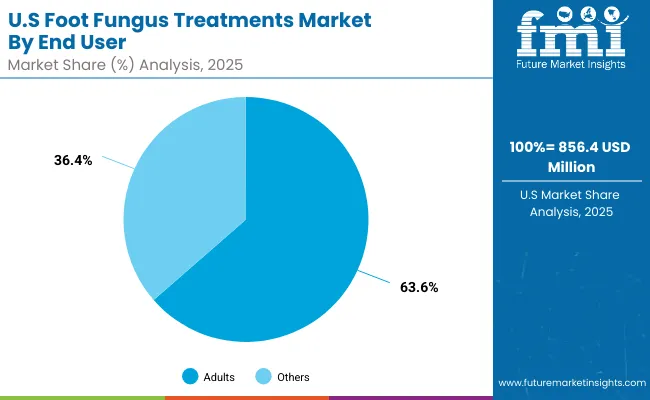

| End User | Value Share% 2025 |

|---|---|

| Adults | 61.6% |

| Others | 38.4% |

The adult segment is forecasted to hold 61.6% of the market share in 2025, led by higher prevalence of fungal infections such as athlete’s foot and toenail fungus in working-age populations. Adults are more likely to be exposed to fungal risk factors, including prolonged shoe use, gym activities, and sports participation. Their awareness and purchasing power also reinforce demand for preventive and therapeutic solutions.

This segment benefits from the wide availability of topical and oral antifungals, both prescription-based and OTC, that cater specifically to adult consumers. Increasing engagement in self-care practices and preference for quick-relief products further strengthen the adult segment’s dominance.

As awareness campaigns and preventive healthcare practices continue to expand, adults are expected to remain the largest and most consistent consumer group within the global market.

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 52.5% |

| Others | 47.5% |

Pharmacies/drugstores are projected to account for 52.5% of the Foot Fungus Treatments Market revenue in 2025, reflecting their critical role as the most trusted and accessible distribution channel. Pharmacies provide professional guidance, a wide assortment of brands, and immediate availability, all of which drive consumer reliance on this channel for antifungal treatments.

The segment’s strength is reinforced by the continued dominance of OTC medications, most of which are purchased through pharmacy outlets. Retail pharmacy chains and independent drugstores alike cater to both urban and semi-urban populations, ensuring broad access.

With the rise of healthcare-focused retail models and integrated consultation services, pharmacies/drugstores are expected to remain the leading distribution channel globally despite rising e-commerce penetration.

Rising prevalence of fungal infections in diabetic and elderly populations

One of the strongest drivers of the Foot Fungus Treatments Market is the increasing incidence of fungal infections among diabetic and elderly patients. Diabetes compromises immune responses and creates higher susceptibility to chronic fungal conditions such as onychomycosis, while elderly populations experience reduced skin elasticity and slower healing, making them prone to persistent infections. This demographic expansion is not only increasing demand for continuous treatment but also fostering the need for more specialized antifungal solutions, including stronger oral formulations and preventive sprays tailored for long-term care. As these populations grow globally, particularly in Asia-Pacific and Europe, they will provide a stable and recurring demand base that anchors market growth.

Expanding retail and digital distribution channels

Accessibility is another critical growth driver, with pharmacies, drugstores, and increasingly e-commerce platforms acting as the primary gateways for foot fungus treatments. Pharmacies remain dominant due to trust and professional consultation, but the rapid expansion of digital platforms is transforming access, especially in China, India, and the USA Online channels provide discreet purchasing options, subscription models, and wider product variety, which strongly appeal to younger adults and urban consumers. The dual strength of physical and digital channels ensures both mass reach and convenience, accelerating adoption across geographies and demographic groups.

Risk of recurrence and treatment non-compliance

A significant challenge in this market is the high recurrence rate of fungal infections coupled with patient non-compliance. Many consumers discontinue treatment prematurely once symptoms subside, leading to incomplete eradication of fungi and subsequent relapse. This not only diminishes the effectiveness of topical and oral antifungals but also undermines consumer trust in available solutions. Chronic recurrence often requires prolonged or combined therapies, which can discourage patients due to costs and regimen complexity, restraining overall market growth.

Regulatory hurdles and side-effect concerns in oral antifungals

While oral antifungals represent a growing treatment category, their expansion is restricted by strict regulatory oversight and safety concerns. Products like terbinafine and itraconazole require prescription and carry risks of liver toxicity and drug interactions. These safety considerations limit their use, especially among elderly and diabetic patients who form a large consumer base. Such restrictions slow down the uptake of systemic treatments and push consumers toward topicals and home remedies, thereby capping potential market value growth in this category.

Shift toward natural and plant-based antifungal remedies

A notable trend reshaping the Foot Fungus Treatments Market is the rising demand for natural extract-based products. Ingredients such as tea tree oil, oregano oil, and other botanical formulations are gaining traction as consumers seek alternatives perceived as safer and with fewer side effects. This trend is particularly strong in markets like the USA, UK, and Japan, where clean-label and wellness-driven purchasing behaviors are prominent. Companies are responding by developing hybrid formulations that combine proven antifungal agents with natural soothing ingredients, expanding both consumer trust and product appeal.

Increasing integration of preventive products into daily routines

Another emerging trend is the rising adoption of antifungal sprays, powders, and prophylactic treatments as part of everyday hygiene practices. Athletes, fitness enthusiasts, and professionals with long hours in footwear are turning to preventive measures to avoid infections, particularly athlete’s foot. This trend shifts the market from being treatment-centric to prevention-focused, increasing overall product penetration. Preventive categories also benefit from repeat usage and higher purchase frequency, making them an attractive growth engine for manufacturers looking to stabilize revenue streams.

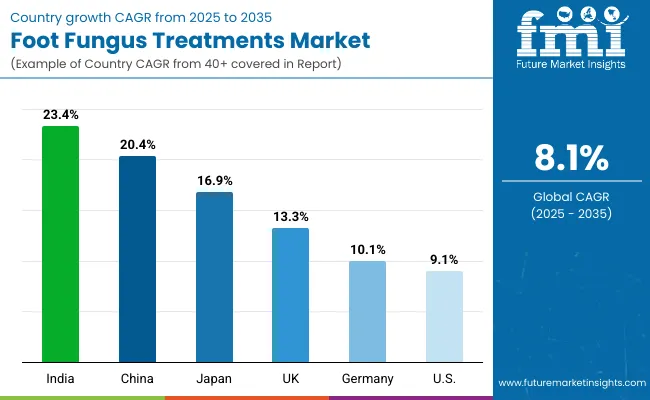

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.4% |

| USA | 9.1% |

| India | 23.4% |

| UK | 13.3% |

| Germany | 10.1% |

| Japan | 16.9% |

China and India stand out as the fastest-growing markets for foot fungus treatments, with projected CAGRs of 20.4% and 23.4% respectively between 2025 and 2035. Both countries are experiencing a surge in urbanization, lifestyle changes, and rising incidence of fungal infections due to humid climates and expanding diabetic populations. In India, awareness campaigns and the rapid expansion of e-commerce platforms are making treatments more accessible even in tier-2 and tier-3 cities, while China benefits from the increasing dominance of retail pharmacies and aggressive distribution by global brands. Both markets also show a strong shift toward natural and preventive formulations, aligning with consumer demand for safe, plant-based products. This growth trajectory positions Asia-Pacific as the primary engine of future expansion in the global market.

Meanwhile, developed regions like the USA, UK, Germany, and Japan exhibit steady but relatively moderate growth. The USA market, with a CAGR of 9.1%, remains large due to high consumer awareness, wide product availability, and established OTC treatment culture, though growth is capped by maturity and high penetration levels. Japan, with a robust 16.9% CAGR, is benefiting from rising elderly populations and growing preference for premium, clinically tested formulations.

Germany and the UK, growing at 10.1% and 13.3% respectively, are supported by strong healthcare infrastructure and a rising focus on preventive hygiene, though stricter regulations on oral antifungals keep expansion moderate. Collectively, these countries provide a balanced mix of stability and innovation-driven growth for the Foot Fungus Treatments Market.

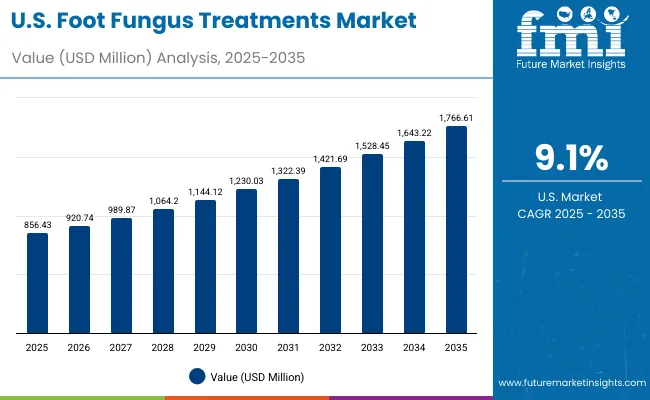

| Year | USA Foot Fungus Treatments Market (USD Million) |

|---|---|

| 2025 | 856.43 |

| 2026 | 920.74 |

| 2027 | 989.87 |

| 2028 | 1,064.20 |

| 2029 | 1,144.12 |

| 2030 | 1,230.03 |

| 2031 | 1,322.39 |

| 2032 | 1,421.69 |

| 2033 | 1,528.45 |

| 2034 | 1,643.22 |

| 2035 | 1,766.61 |

The Foot Fungus Treatments Market in the United States is projected to grow at a CAGR of 9.1%, driven by rising awareness of fungal infections and strong penetration of over-the-counter antifungal creams. Adults form the largest consumer group, accounting for 63.6% of the USA market in 2025. Growth is supported by a highly developed retail pharmacy network, consistent physician engagement, and strong brand recognition among leading products such as Lamisil and Lotrimin. Preventive treatments such as antifungal sprays and powders are gaining momentum, particularly among athletes and gym-goers. Digital pharmacies are gradually expanding reach, though brick-and-mortar pharmacies continue to dominate sales.

The Foot Fungus Treatments Market in the United Kingdom is expected to grow at a CAGR of 13.3%, supported by increasing demand for topical creams and preventive sprays. Strong public healthcare systems and awareness campaigns have heightened detection of fungal infections, particularly athlete’s foot and toenail fungus. Retail pharmacy chains play a central role in distribution, with e-commerce platforms adding momentum through discreet purchasing options. Rising participation in sports and fitness is expanding the consumer base for prophylactic antifungal products, while premium formulations are being introduced to cater to higher-income groups.

India is witnessing rapid growth in the Foot Fungus Treatments Market, which is forecast to expand at a CAGR of 23.4% through 2035, the fastest among major economies. Rising prevalence of diabetes and humid climatic conditions are significantly increasing susceptibility to foot fungal infections. Urbanization, along with improved access to pharmacies and digital platforms, has accelerated treatment adoption even in tier-2 and tier-3 cities. The affordability of topical antifungal creams and powders supports mass usage, while awareness campaigns by healthcare providers are encouraging earlier diagnosis and treatment. Natural and herbal formulations are also gaining traction in line with India’s strong tradition of plant-based remedies.

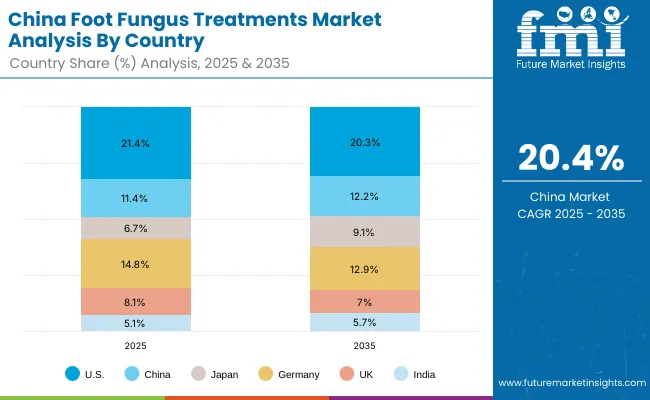

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 11.4% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 8.1% |

| India | 5.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.3% |

| China | 12.2% |

| Japan | 9.1% |

| Germany | 12.9% |

| UK | 7.0% |

| India | 5.7% |

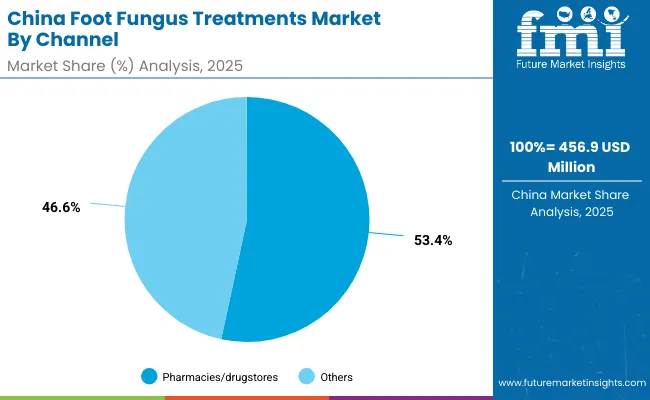

The Foot Fungus Treatments Market in China is expected to grow at a CAGR of 20.4%, making it one of the fastest-growing regional markets. Pharmacies/drugstores dominate distribution with 53.4% share in 2025, reflecting strong consumer trust in physical outlets. Rapid expansion of urban retail chains and aggressive product placement by international and domestic brands are driving penetration. E-commerce is further boosting access, particularly among younger consumers who prefer discreet and convenient purchasing. Rising income levels, greater focus on preventive care, and growing elderly populations are amplifying demand. Affordable creams and sprays are widespread, while premium herbal-based antifungals are steadily gaining share.

| USA by End User | Value Share% 2025 |

|---|---|

| Adults | 63.6% |

| Others | 36.4% |

The Foot Fungus Treatments Market in the USA is valued at USD 856.4 million in 2025, with adults leading at 63.6%, equal to USD 544.8 million, followed by other groups at 36.4%. Adult dominance is strongly linked to higher exposure to fungal infections through sports, gym use, and prolonged shoe wear in professional environments. Early detection rates and consumer awareness campaigns further strengthen adoption among this group, while pharmacies provide easy access to a broad range of over-the-counter creams, sprays, and powders.

This advantage positions adults as the most stable and recurring consumer base, ensuring long-term growth through preventive and treatment-oriented demand. Elderly and diabetic patients form the remainder, representing a valuable secondary opportunity due to their higher risk of chronic fungal infections requiring longer treatment cycles. Digital pharmacy expansion and premium product introductions are expected to further enhance adoption.

| China by Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 53.4% |

| Others | 46.6% |

The Foot Fungus Treatments Market in China is valued at USD 456.9 million in 2025, with pharmacies/drugstores leading at 53.4%, equal to USD 244.1 million, followed by other channels at 46.6%. The dominance of pharmacy sales reflects consumer trust in professional consultation and product authenticity, particularly as counterfeit medicines remain a challenge in online markets. Rapid expansion of urban retail chains and aggressive product placement by domestic and international brands reinforce this leadership.

This advantage positions pharmacies as the backbone of China’s treatment landscape, supported by e-commerce platforms gaining traction among younger consumers for discreet purchases. Preventive sprays and herbal-based remedies are also expanding, reflecting China’s cultural alignment with natural healthcare solutions. With growing diabetic and elderly populations, the channel is expected to sustain its strength while e-commerce becomes a critical secondary growth driver.

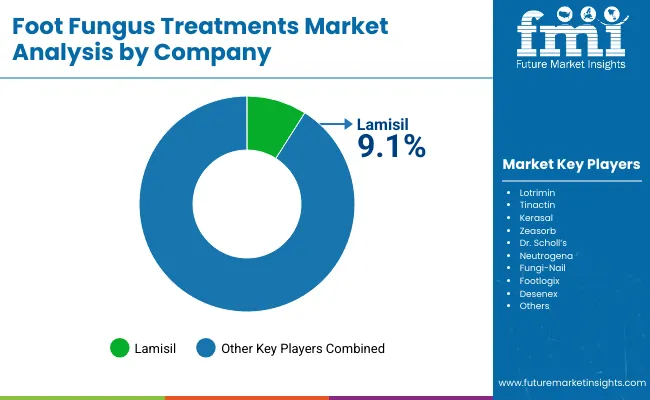

The Foot Fungus Treatments Market is moderately fragmented, with a mix of established multinational brands and niche-focused specialists competing across topical, oral, and preventive categories. Lamisil holds the leading global share at 9.1% in 2025, supported by strong brand recognition, diverse formulations, and widespread retail penetration. Its dominance reflects the continued preference for clinically proven solutions, particularly in developed markets such as the USA and Europe.

Other major players such as Lotrimin, Tinactin, Kerasal, Zeasorb, Dr. Scholl’s, Neutrogena, Fungi-Nail, Footlogix, and Desenex collectively shape competitive dynamics. These brands differentiate through innovation in topical delivery, expansion into preventive sprays and powders, and the introduction of natural extract-based products to address evolving consumer preferences. Smaller regional players also contribute by offering herbal formulations tailored to local demand, especially in Asia.

Competitive differentiation is shifting from pure topical dominance toward diversified portfolios that integrate natural ingredients, preventive solutions, and digital distribution models. E-commerce penetration and growing consumer demand for safe, long-term therapies are expected to accelerate competition, rewarding brands that can balance efficacy, affordability, and innovation.

Key Developments in Foot Fungus Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Treatment Type | Topical antifungal creams, Oral antifungals, Antifungal sprays/powders, Soaks & home remedies |

| Active Ingredient | Clotrimazole, Terbinafine, Miconazole, Tolnaftate, Natural extracts (tea tree, oregano) |

| Application Area | Athlete’s foot, Toenail fungus, Foot skin fungus, General prophylaxis |

| Channel | Pharmacies/drugstores, E-commerce, Clinics/hospitals, Mass retail |

| End User | Adults, Elderly, Diabetic patients |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lamisil, Lotrimin, Tinactin, Kerasal, Zeasorb, Dr. Scholl’s, Neutrogena, Fungi-Nail, Footlogix, Desenex |

| Additional Attributes | Dollar sales by treatment type and channel, adoption trends in preventive antifungal sprays and powders, rising demand among diabetic and elderly populations, sector-specific growth in pharmacies and e-commerce, consumer shift toward natural extract-based remedies, regional trends influenced by hygiene awareness campaigns, and innovations in combination topical formulations and oral therapies. |

The Foot Fungus Treatments Market is estimated to be valued at USD 4,002.5 million in 2025.

The market size for the Foot Fungus Treatments Market is projected to reach USD 8,702.5 million by 2035.

The Foot Fungus Treatments Market is expected to grow at a CAGR of 8.1% between 2025 and 2035.

The key treatment types in the Foot Fungus Treatments Market are topical antifungal creams, oral antifungals, antifungal sprays/powders, and soaks & home remedies.

In terms of treatment type, topical antifungal creams are projected to command 51.5% share in 2025, representing USD 2,060.6 million.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foot Door Opener Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Valve Market Forecast and Outlook 2025 to 2035

Footprint Detection Light Market Size and Share Forecast Outlook 2025 to 2035

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Foot Patches Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Foot and Mouth Disease Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Footwear Adhesives Market

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Hand, Foot and Mouth Disease Treatment Market

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Carbon Footprint Management Market

Women’s Footwear Market Size, Growth, and Forecast for 2025 to 2035

Medical Footwear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA