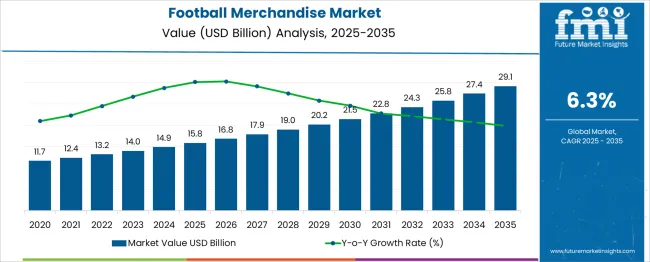

The Football Merchandise Market is estimated to be valued at USD 15.8 billion in 2025 and is projected to reach USD 29.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. The initial five-year period from 2020 to 2025 witnesses growth from USD 11.7 billion to USD 15.8 billion, driven by the rising global popularity of football and increasing fan engagement through merchandising. Official club merchandise, including jerseys, footwear, and collectibles, sees higher adoption, supported by digital marketing and e-commerce platforms that enhance accessibility.

Licensing agreements and collaborations with popular players and clubs further fuel demand. From 2026 to 2030, the market accelerates from USD 16.8 billion to USD 21.5 billion, fueled by expanded product portfolios and the introduction of innovative fan experiences such as augmented reality and personalized merchandise. Growing investments in international tournaments and rising football viewership globally also support this phase of growth. The latter half of the forecast period, spanning 2031 to 2035, sees the market rise from USD 22.8 billion to USD 29.1 billion, propelled by increasing commercialization of football, sponsorship deals, and expansion into emerging markets with expanding fan bases. The Football Merchandise Market is positioned for consistent and dynamic growth through 2035, supported by evolving fan culture, technological integration, and expanding global football ecosystems.

| Metric | Value |

|---|---|

| Football Merchandise Market Estimated Value in (2025 E) | USD 15.8 billion |

| Football Merchandise Market Forecast Value in (2035 F) | USD 29.1 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The football merchandise market occupies a prominent position within the global licensed sports merchandise industry, accounting for nearly 35–38% share, driven by its strong fan base and global popularity of football as a sport. Within the wider sports apparel and accessories segment, football merchandise contributes about 25–27%, supported by consistent demand for jerseys, footwear, and training gear associated with leading clubs and national teams. In the fan engagement and collectibles category, football holds approximately 40% share, fueled by the commercialization of leagues, rising e-commerce penetration, and the proliferation of official club stores. For the global licensed sports goods ecosystem, football-related products represent 30–32%, with increasing tie-ins between clubs and global fashion brands amplifying premium sales.

Growth is underpinned by expanding viewership of major tournaments like the FIFA World Cup, UEFA Champions League, and regional leagues, alongside endorsement deals with high-profile athletes influencing consumer preferences. Digital platforms and social media have further strengthened direct-to-fan sales, enabling real-time merchandise drops and personalized offerings. However, market expansion faces challenges from counterfeit goods and fluctuating discretionary spending. Despite these risks, future demand will be shaped by rising youth participation in football, integration of smart fabrics in apparel, and continued growth of women’s football leagues, ensuring football merchandise remains a cornerstone of the global sports merchandise economy.

The Football Merchandise market is experiencing sustained growth, driven by a rising global fan base, increased media coverage of leagues, and commercialization strategies adopted by football clubs. Growth in e-commerce channels has allowed merchandise to become more accessible, especially across emerging markets where digital penetration continues to expand. Consumer affinity toward club loyalty and identity has led to increased purchases of officially licensed products across all tiers of football enthusiasts.

Collaborations between clubs and fashion or sportswear brands have enhanced product variety and design appeal. As the popularity of international tournaments and domestic leagues grows, football merchandise is being positioned as a lifestyle category, attracting consumers beyond core sports fans.

Factors such as youth engagement, influencer marketing, and fan-based community events are reinforcing recurring demand. With clubs investing in global marketing and international expansion, the market is expected to maintain a steady upward trajectory through personalized offerings, seasonal launches, and direct-to-fan strategies..

The football merchandise market is segmented by product, category, price, end use, distribution channel, and geographic regions. The product of the football merchandise market is divided into Apparel, Footwear, Toys & Games, Accessories, Homeware, and Others (Souvenirs, Novelties, etc.). In terms of the category, the football merchandise market is classified into Club football and Country football. Based on the price, the football merchandise market is segmented into Medium, Low, and High. The end use of the football merchandise market is segmented into Adults and Kids. The distribution channel of the football merchandise market is segmented into Online and Offline. Regionally, the football merchandise industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

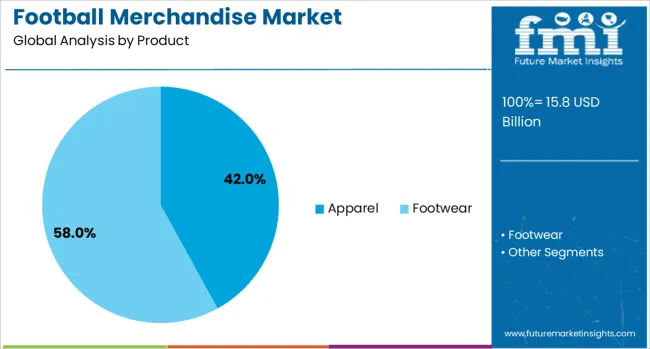

The apparel product segment is expected to capture 42% of the Football Merchandise market revenue share in 2025, positioning it as the leading product category. Growth in this segment has been influenced by fans' strong emotional connection with their teams, which is often expressed through branded clothing. Jerseys, training kits, jackets, and lifestyle apparel have witnessed consistent demand due to their dual function as fashion statements and symbols of loyalty.

Sales in this category have been strengthened by seasonal kit launches, player endorsements, and exclusive collections, which have generated high consumer interest. Additionally, the shift toward premium athletic wear and athleisure trends has enabled football apparel to appeal to broader lifestyle audiences.

Retailers and clubs have also implemented data-driven inventory strategies, ensuring timely replenishment and limited edition drops. The growing emphasis on sustainable materials and ethical production has added further appeal, making apparel not only a high-volume category but also a highly profitable one in the football merchandise landscape..

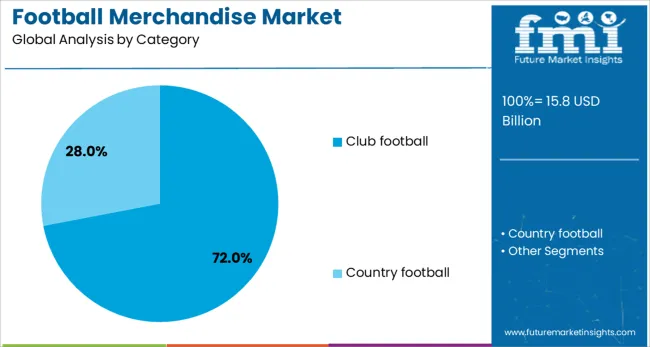

The club football category segment is projected to hold 72% of the Football Merchandise market revenue share in 2025, making it the dominant category within the market. The growth of this segment has been driven by the widespread popularity and global reach of professional football clubs. Fan loyalty is often most deeply associated with club identity, leading to high purchasing intent for branded gear, especially during league seasons, title runs, and player transfers.

Clubs have enhanced their merchandising operations through global partnerships, regional licensing deals, and immersive fan experiences, all of which have fueled product sales. Digital fan engagement strategies, including exclusive content and virtual experiences, have also converted online interactions into merchandise purchases.

Furthermore, iconic club branding and heritage collections have broadened appeal beyond local fan bases, allowing clubs to tap into international markets. This strong emotional affiliation with club brands continues to underpin the segment’s leadership in overall merchandise sales..

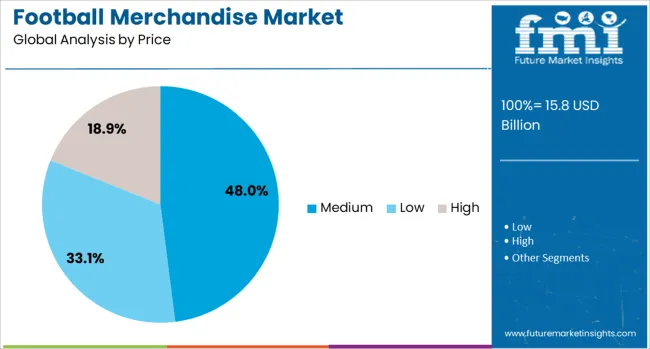

The medium price segment is anticipated to command 48% of the Football Merchandise market revenue share in 2025, positioning it as the preferred pricing tier. This segment’s growth has been supported by a balance between perceived value and affordability, making products accessible to a larger portion of the fan base. Consumers have demonstrated a willingness to invest in official merchandise that offers authentic branding and quality, while still being mindful of cost.

Brands and clubs have tailored their offerings to meet these expectations, with mid-range collections that preserve the club’s image and feature key player endorsements. The medium tier also supports strong sales volumes in both physical retail outlets and online platforms, ensuring consistent revenue generation.

Enhanced product packaging, flexible payment options, and seasonal discounts have further encouraged adoption of medium-priced items. This segment has also been instrumental in expanding the global footprint of football merchandise, particularly in price-sensitive yet brand-conscious emerging markets..

The football merchandise market thrives on global league popularity, digital retail adoption, and celebrity-driven demand. Strategic brand partnerships and tournament-based campaigns further drive growth across diverse fan segments.

The growth of the football merchandise market is strongly linked to the increasing popularity of major football leagues such as the English Premier League, La Liga, and UEFA Champions League. These leagues have expanded their international presence through global broadcasting rights and sponsorship deals, driving higher fan engagement across continents. The growing influence of social media platforms allows clubs to connect directly with fans, promoting official merchandise collections and exclusive drops. Licensed partnerships with apparel brands also play a crucial role in maintaining authenticity and quality. This trend has created steady demand for jerseys, accessories, and lifestyle products aligned with team branding.

Mega events such as the FIFA World Cup, Copa America, and continental championships significantly boost merchandise demand during tournament seasons. Limited-edition products tied to these events often experience rapid sell-outs, creating revenue spikes for both clubs and official suppliers. National team jerseys and commemorative collections remain highly sought after, particularly in emerging football markets across Asia, Africa, and Latin America. Retailers and e-commerce platforms capitalize on these periods with exclusive campaigns, often combining merchandise with digital fan engagement strategies. The emotional connection fans develop during such events directly influences their purchasing behavior, driving premium product sales.

The rapid growth of e-commerce platforms and official club websites has transformed the football merchandise industry by offering direct-to-fan access. Digital marketplaces allow clubs and brands to launch global campaigns without geographical limitations, enhancing availability of official merchandise. Personalized options such as customized jerseys with player names and numbers have become a major revenue stream. Social media-driven marketing and influencer collaborations further amplify visibility, encouraging impulse buying during key match events. This shift from traditional retail to digital-first strategies ensures that clubs maintain higher profit margins and build long-term relationships with their fan base worldwide.

High-profile footballers significantly impact merchandise sales through individual endorsements and club loyalty. Players such as Lionel Messi, Cristiano Ronaldo, and Kylian Mbappé act as global ambassadors for their respective teams, driving consumer affinity for official merchandise. Collaborations between football clubs and leading fashion brands have further elevated the premium appeal of merchandise collections, blending sport with lifestyle trends. Exclusive capsule collections and limited-edition releases create scarcity, boosting consumer interest and resale value. These partnerships not only generate substantial revenue but also reinforce brand positioning in both sports and fashion markets, securing a competitive edge for major clubs globally.

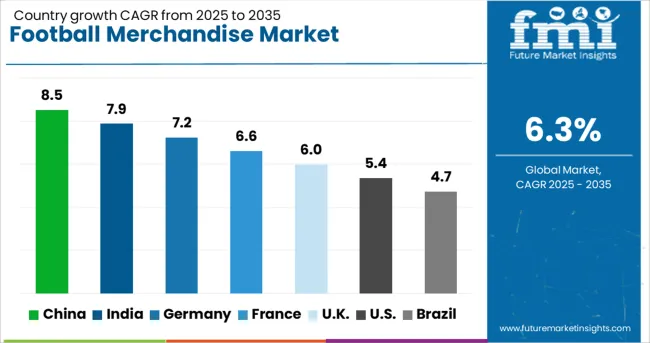

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

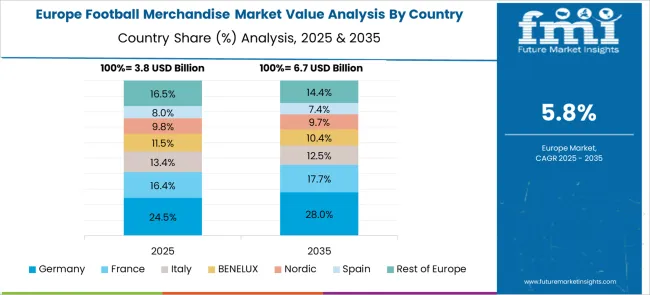

The football merchandise market is projected to grow globally at a CAGR of 6.3% between 2025 and 2035, driven by rising fan engagement, international league popularity, and the expansion of digital retail platforms. China leads with a CAGR of 8.5%, supported by growing football fandom, increasing investments in domestic leagues, and strong consumer spending on premium merchandise. India follows at 7.9%, fueled by the growing popularity of global tournaments, partnerships between European clubs and local brands, and rapid e-commerce penetration. Germany posts 7.2%, benefiting from its strong football culture, sustained Bundesliga viewership, and heightened demand for authentic club products. The United Kingdom grows at 6.0%, anchored by the English Premier League’s massive global influence and club-focused digital merchandising strategies, while the United States records 5.4%, supported by increasing soccer adoption, rising MLS prominence, and fan demand for international team jerseys. The analysis spans over 40 countries, with these six markets serving as key benchmarks for strategic merchandising, retail expansion, and long-term growth opportunities within the global football merchandise sector.

China is expected to post a CAGR of 8.5% during 2025–2035, an increase from nearly 7.4% recorded between 2020–2024. The surge is driven by the country’s growing football fandom, massive investments in grassroots football programs, and partnerships between top European clubs and Chinese brands. The earlier period saw steady demand primarily from international tournaments, while the upcoming decade will be fueled by increasing digital retail penetration and higher disposable incomes. The popularity of online fan engagement platforms and influencer marketing has accelerated official merchandise sales. Limited-edition releases and collaborations with global fashion brands have added further appeal among younger consumers.

India is projected to register a CAGR of 7.9% for 2025–2035, up from approximately 6.6% during 2020–2024, showing a strong acceleration. The earlier growth was driven by the popularity of international tournaments and gradual adoption of club-based merchandise. Post-2024, the Indian Super League’s rising influence, combined with strategic tie-ups between European football clubs and local brands, has amplified fan-driven sales. Affordable licensed merchandise and growing prominence of mobile commerce platforms are fueling market expansion. Increasing participation in fantasy football leagues and the surge in influencer-led campaigns are strengthening brand loyalty among Indian consumers.

Germany is forecasted to achieve a CAGR of 7.2% from 2025–2035, up from 6.1% in 2020–2024, indicating a healthy rise. Growth in the earlier period was mainly linked to Bundesliga popularity and club loyalty programs. The coming decade will see additional momentum from technology-driven fan engagement, online exclusive drops, and collaborations with premium lifestyle brands. Expansion of women’s football leagues and successful hosting of international events will further amplify merchandise demand. Customization options, including personalized jerseys and digital collectibles, are expected to strengthen consumer appeal.

The CAGR for the UK football merchandise market is anticipated to rise to 6.0% for 2025–2035, compared to nearly 5.1% during 2020–2024, marking an evident increase. Earlier growth was driven by core club followers and local retail networks. In the next decade, the popularity of the English Premier League globally, combined with integrated digital retail strategies, will push demand further. Limited-edition collaborations with luxury brands and increased e-commerce activity will be primary accelerators. Rising interest in women’s football and personalized merchandise options will also contribute significantly to revenue generation.

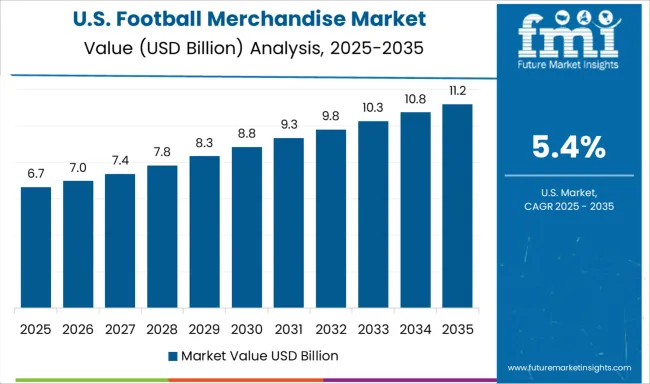

The USA market is estimated to post a CAGR of 5.4% during 2025–2035, compared to 4.3% during 2020–2024, reflecting steady progress in a developing football culture. The earlier period saw rising popularity of MLS and strong engagement during FIFA World Cup years. The future growth phase will be powered by a growing youth fan base, increased investments in domestic soccer infrastructure, and broader integration of official merchandise with lifestyle products. Global club collaborations with American retailers and digital-exclusive launches are strengthening market penetration across major states.

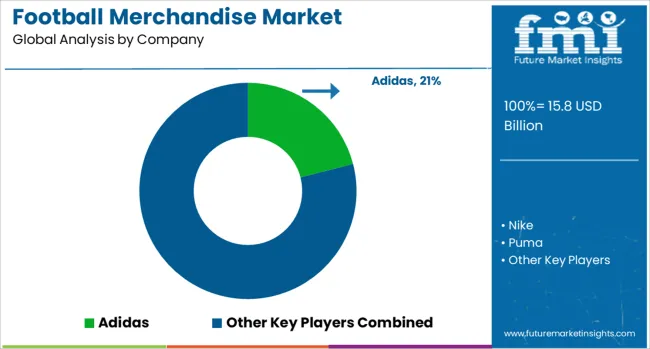

The football merchandise market demonstrates a highly competitive structure driven by global sportswear leaders, emerging digital platforms, and regional brands leveraging strong distribution channels. Adidas holds a leading position with its long-standing partnerships with iconic football clubs such as Real Madrid and Manchester United, along with key national teams. These collaborations enable Adidas to maintain dominance in jersey sales, training kits, and premium performance apparel. Nike competes aggressively through alliances with elite clubs like FC Barcelona and Paris Saint-Germain, complemented by endorsements from global football icons that influence consumer preferences worldwide. Its ability to merge athletic performance with lifestyle trends strengthens its brand presence in major markets. Puma continues to focus on market expansion through sponsorships of European and African football clubs while promoting lifestyle-oriented collections to attract younger demographics.

Fanatics, recognized as a digital-first powerhouse, dominates licensed sports merchandise with exclusive online partnerships and innovative offerings such as customizable jerseys and limited-edition fan gear. Under Armour, while smaller in scale, emphasizes high-performance gear and selective partnerships to carve out a unique niche in football apparel and accessories. The “Others” category, comprising regional and local brands, further intensifies competition by offering affordable alternatives tailored for emerging markets. Strategic priorities across the competitive landscape include enhancing e-commerce capabilities, launching exclusive collaborations, and integrating personalization options to increase consumer loyalty. With the convergence of digital retail strategies, influencer-driven marketing, and growing global fandom for football, these players are positioned to capture significant revenue opportunities in both established and developing markets.

n August 2024, Puma announced Q2 performance expectations and flagship product launches, including ULTRA and MB.04 models.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.8 Billion |

| Product | Apparel, Footwear, Toys & Games, Accessories, Homeware, and Others (Souvenirs, Novelties etc.) |

| Category | Club football and Country football |

| Price | Medium, Low, and High |

| End Use | Adults and Kids |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adidas, Nike, Puma, Fanatics, Under Armour, and Others |

The global football merchandise market is estimated to be valued at USD 15.8 billion in 2025.

The market size for the football merchandise market is projected to reach USD 29.1 billion by 2035.

The football merchandise market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in football merchandise market are apparel, _tops, _jerseys, _t-shirts, _jackets, _bottoms, _shorts, _track pants, _joggers, _others (scarves, baseball caps, beanies, socks, gloves), footwear, _sports shoes, _cleats, _others (flip-flops, snickers, etc.), toys & games, _board games, _video games, accessories, _bags, _snaps bags, _wristbands, _keychains, _others (badges, stickers), homeware, _bottles, _coasters, _mugs, _others (cushion, rugs, towels, etc.) and others (souvenirs, novelties etc.).

In terms of category, club football segment to command 72.0% share in the football merchandise market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Licensed Sports Merchandise Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Photo Printing and Merchandise Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Photo Printing and Merchandise Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Refrigerated Ice Cream Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Japan Photo Printing & Merchandise Market Analysis - Size, Share & Trends 2025 to 2035

Korea Photo Printing and Merchandise Market Analysis - Size, Share & Trends 2025 to 2035

Countertop Pizza Warmers & Merchandisers Market - Fresh & Ready Pizzas 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA