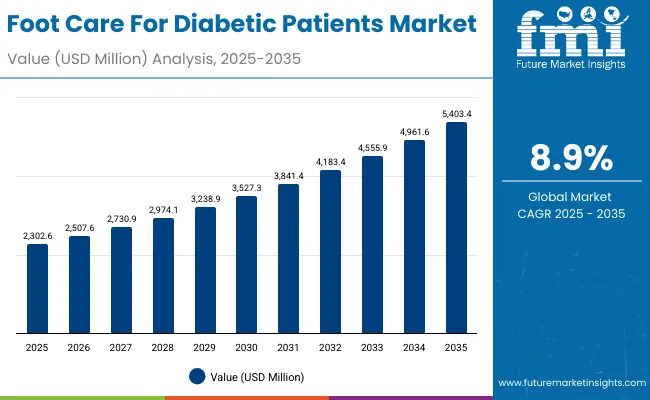

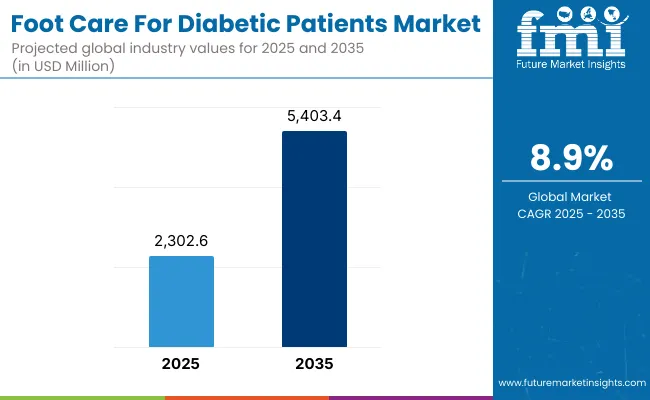

A valuation of USD 2,302.6 Million is projected for the Foot Care for Diabetic Patients Market in 2025, which is forecasted to advance steadily and reach USD 5,403.4 Million by 2035. This rise represents a net addition of over USD 3,100 Million during the assessment period, translating into a compound annual growth rate (CAGR) of 8.9%. The long-term outlook indicates that market value will more than double by the end of the decade as prevention-driven care gains wider adoption and structured management protocols are mainstreamed.

Foot Care For Diabetic Patients Market Key Takeaways

| Metric | Value |

|---|---|

| Foot Care For Diabetic Patients Market Estimated Value in (2025E) | USD 2,302.6 Million |

| Foot Care For Diabetic Patients Market Forecast Value in (2035F) | USD 5,403.4 Million |

| Forecast CAGR (2025 to 2035) | 8.90% |

Between 2025 and 2030, the market is set to increase from USD 2,302.6 Million to USD 3,527.3 Million, contributing nearly USD 1,225 Million in incremental revenue, which accounts for close to 40% of the total decade expansion.

This early phase will be characterized by stronger penetration of medical-grade solutions, increased adoption of fragrance-free and hypoallergenic claims, and the solidification of pharmacies as the dominant channel with 47% share. The emphasis on barrier restoration and infection prevention in diabetic patients is expected to drive significant uptake in moisturizing and repair-focused offerings, which already hold a 44% share in 2025.

In the second half, from 2030 to 2035, the market is forecasted to expand from USD 3,527.3 Million to USD 5,403.4 Million, contributing nearly USD 1,876 Million, equivalent to 60% of overall growth. This acceleration will be supported by faster adoption in Asia, particularly China and India, where CAGRs of 20.2% and 23.2% respectively are projected.

The competitive outlook suggests that fragmentation will persist, but brands backed by dermatologist and diabetologist recommendations will consolidate trust and capture higher repeat purchase rates, ensuring a robust trajectory through 2035.

From 2020 to 2024, the market advanced steadily as diabetic foot care shifted toward proactive management and improved retail penetration. By 2025, global value is estimated at USD 2,302.6 Million, setting the stage for a decade of robust expansion. A forecasted CAGR of 8.9% is expected to drive the market to USD 5,403.4 Million by 2035, more than doubling its size.

During the early period, leadership will be maintained by moisturizing & repair products, which command 44% share in 2025, owing to their central role in barrier restoration and fissure prevention. Pharmacies and drugstores are expected to remain the anchor distribution channel with 47% share, leveraging their accessibility and professional credibility.

Growth momentum is projected to accelerate in Asia, led by China and India, where double-digit CAGRs of 20.2% and 23.2% respectively are forecasted. This expansion is anticipated to reshape global market distribution, reducing the relative dominance of the USA while increasing Asia’s contribution.

The competitive landscape is expected to remain fragmented, with the leading player accounting for only 8.1% share in 2025. Brands backed by dermatologist and diabetologist endorsements are projected to gain preference, while evidence-based formulations and digital adherence models will serve as future differentiators.

The growth of the Foot Care for Diabetic Patients Market is being driven by rising diabetes prevalence worldwide, which has heightened awareness of complications such as neuropathy and ulceration. Preventive care has been prioritized by healthcare systems, and patients are being encouraged to adopt continuous regimens rather than episodic treatment. Demand has been boosted by pharmacist-led education, physician referrals, and increased accessibility of medical-grade moisturizers, antifungal creams, and specialized footwear.

Technological advances in product formulations, including hypoallergenic and fragrance-free solutions, have been widely adopted, ensuring better adherence among sensitive skin groups. Expansion of e-commerce channels has enabled broader reach, while pharmacies and clinics have reinforced trust through personalized guidance.

Emerging economies such as China and India have been recording double-digit CAGRs, supported by policy initiatives and awareness campaigns. As a result, the market is expected to maintain strong momentum, with clinical efficacy, dermatologist recommendations, and patient-friendly packaging anticipated to remain central growth drivers.

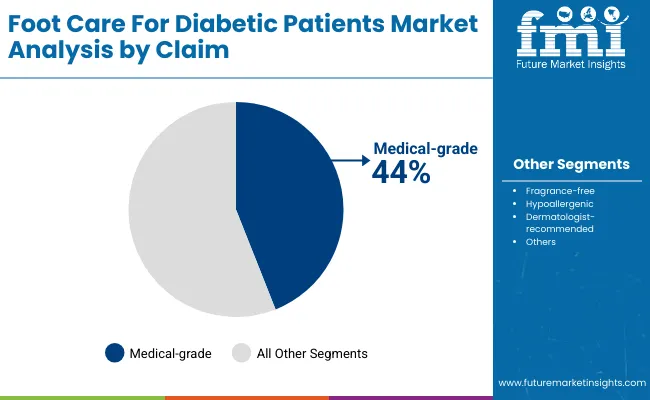

The Foot Care for Diabetic Patients Market has been segmented on the basis of claim, function, and product type, with each category reflecting unique demand drivers and growth pathways. Medical-grade claims are anticipated to strengthen credibility and reinforce physician-driven recommendations.

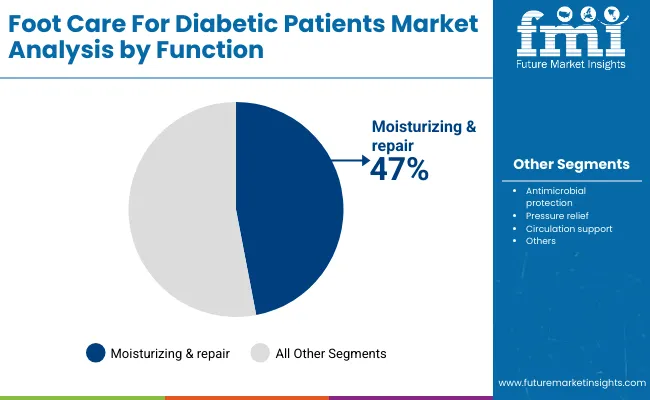

By function, moisturizing & repair is projected to remain central as prevention-led therapies gain prominence. In product type, moisturizing creams & lotions are expected to dominate owing to daily usability and broad accessibility. Each segment is forecasted to contribute significantly to overall growth, supported by clinical validation, expanding pharmacy networks, and increasing awareness of preventive diabetic care.

| Claim | Market Value Share, 2025 |

|---|---|

| Medical-grade | 44% |

| Others | 56.0% |

The claim segment is expected to be led by medical-grade products with 44% share in 2025 (USD 588.9 Million), while others account for 56% share (USD 1,289.46 Million). Demand for medical-grade formulations is being reinforced by clinical validation and stronger physician recommendations. Patients with higher awareness of diabetic foot complications are projected to adopt dermatologist-endorsed products more actively.

Broader claims including hypoallergenic and fragrance-free benefits within the “others” category are anticipated to maintain volume-driven growth. Over the decade, medical-grade positioning is expected to gain momentum, supported by transparent efficacy data and rising healthcare professional advocacy

| Function | Market Value Share, 2025 |

|---|---|

| Moisturizing & repair | 47% |

| Others | 53.0% |

The function segment is projected to be dominated by moisturizing & repair with 47% share in 2025 (USD 566.7 Million), while others contribute 53% share (USD 1,220.38 Million). Moisturizing & repair remains central as prevention of dryness, fissures, and ulcers is prioritized in diabetic care. Clinical focus on skin barrier restoration is expected to expand adherence, particularly through pharmacy-led interventions.

The “others” segment continues to play a strong role, covering antimicrobial, pressure relief, and circulation support functions. Over the outlook period, innovation in multi-functional therapies is anticipated to reinforce moisturizing & repair as the backbone of diabetic foot care solutions.

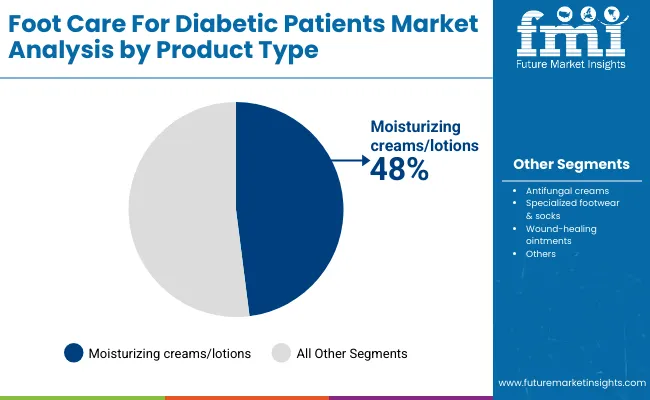

| Product Type | Market Value Share, 2025 |

|---|---|

| Moisturizing creams/lotions | 48% |

| Others | 52.0% |

The product type segment is expected to be driven by moisturizing creams & lotions with 48% share in 2025 (USD 533.3 Million), compared to others at 52% share (USD 1,197.35 Million). Creams and lotions dominate due to their affordability, daily usability, and wider availability across pharmacies and retail. Preventive care programs have strengthened demand for these products as part of routine diabetic management.

The “others” category, including antifungal creams, wound-healing ointments, and footwear, contributes a larger overall share but is more diversified in use cases. The evolution of multi-purpose creams with antimicrobial and restorative properties is expected to enhance the leadership of moisturizing creams & lotions through 2035.

Growing diabetic prevalence and clinical awareness are reshaping demand for preventive care solutions in the Foot Care for Diabetic Patients Market. While affordability challenges persist, advances in evidence-backed formulations and expanding pharmacy-based education programs are expected to accelerate structured adoption worldwide.

Integration of Preventive Care into Clinical Protocols

Growth is being reinforced by the integration of diabetic foot care into standardized clinical pathways. Hospitals and primary-care settings are embedding moisturizing, antimicrobial, and wound-prevention products within discharge kits and chronic care regimens.

This institutional embedding ensures consistent patient exposure to advanced care formats, leading to higher adherence and stronger long-term outcomes. Expansion of value-based healthcare frameworks is further incentivizing providers to incorporate preventive solutions that minimize costly ulcer-related complications. As a result, product positioning is expected to shift from discretionary to essential, creating a stable demand base across both developed and emerging healthcare systems.

Affordability Gaps in Low-Resource Settings

Market expansion is likely to be constrained by affordability challenges in low-resource economies. While awareness campaigns are increasing, the high relative cost of medical-grade formulations and specialized footwear is limiting penetration among lower-income diabetic populations. Out-of-pocket healthcare expenditure is particularly burdensome in emerging regions, where reimbursement frameworks are underdeveloped. Without affordable alternatives or subsidized distribution, preventive regimens may remain underutilized, sustaining reliance on late-stage interventions.

This affordability gap risks reinforcing disparities in patient outcomes and is anticipated to create uneven market growth patterns. Policy-driven support and tiered product strategies will be required to mitigate these structural limitations.

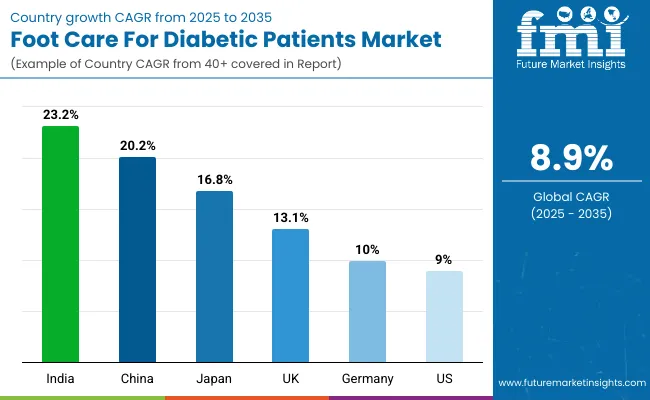

| Country | CAGR |

|---|---|

| China | 20.2% |

| USA | 9.0% |

| India | 23.2% |

| UK | 13.1% |

| Germany | 10.0% |

| Japan | 16.8% |

The global Foot Care for Diabetic Patients Market is projected to grow at varying speeds across major countries, reflecting differences in healthcare infrastructure, diabetic population size, and preventive care adoption. Asia is expected to lead expansion, anchored by India at a CAGR of 23.2% and China at 20.2%.

In India, the sharp rise is anticipated to be supported by broad-based awareness campaigns, strengthened pharmacy penetration, and government-backed health initiatives targeting diabetes management. China’s trajectory is expected to benefit from large urban diabetic populations, rising healthcare expenditure, and accelerating adoption of e-commerce channels that improve accessibility of advanced care products.

Japan, with a CAGR of 16.8%, is positioned to record robust gains driven by aging demographics and growing prioritization of ulcer-prevention regimens. The UK (13.1% CAGR) and Germany (10.0% CAGR) are expected to reinforce Europe’s role, where strict quality standards and physician-guided recommendations are sustaining steady adoption. Broader Europe is projected to grow at 8.7%, reflecting maturity and stable penetration rates.

The USA is forecasted to expand at a moderate CAGR of 9.0%, as a relatively saturated market shifts toward innovation-led differentiation through clinical evidence, dermatologist endorsements, and digital adherence platforms. This diverse global landscape highlights preventive care integration as the common anchor for growth through 2035.

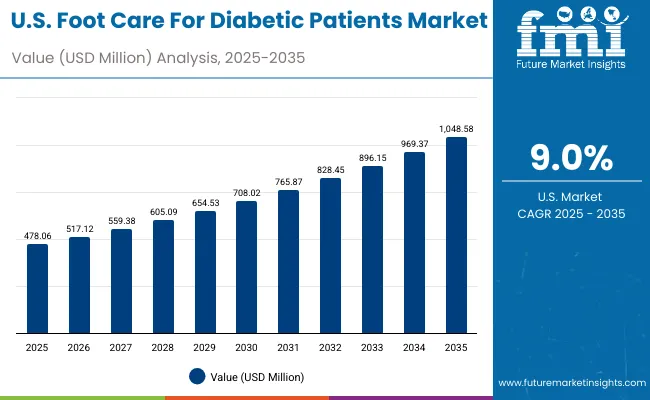

| Year | USA Foot Care For Diabetic Patients Market (USD Million) |

|---|---|

| 2025 | 478.06 |

| 2026 | 517.12 |

| 2027 | 559.38 |

| 2028 | 605.09 |

| 2029 | 654.53 |

| 2030 | 708.02 |

| 2031 | 765.87 |

| 2032 | 828.45 |

| 2033 | 896.15 |

| 2034 | 969.37 |

| 2035 | 1,048.58 |

The Foot Care for Diabetic Patients Market in the United States is projected to grow at a CAGR of 9.0%, expanding from USD 478.06 Million in 2025 to USD 1,048.58 Million by 2035, reflecting consistent year-on-year growth supported by structured diabetic care practices. A steady rise in sales values across the decade highlights the integration of preventive foot care into mainstream healthcare protocols. From USD 478.06 Million in 2025, the market is projected to advance to USD 517.12 Million in 2026, USD 559.38 Million in 2027, and USD 605.09 Million in 2028, crossing USD 654.53 Million by 2029 and USD 708.02 Million by 2030. The upward trajectory is further reinforced, with projections of USD 765.87 Million in 2031, USD 828.45 Million in 2032, USD 896.15 Million in 2033, USD 969.37 Million in 2034, and reaching USD 1,048.58 Million in 2035.

Growth is being influenced by rising awareness of diabetic complications, stronger physician referrals, and expanded pharmacy-based distribution. Medical-grade products and fragrance-free claims are anticipated to dominate USA adoption patterns, while e-commerce is expected to complement offline channels by offering convenient access to recurring care products. Evidence-backed formulations and dermatologist endorsements are projected to strengthen consumer trust, sustaining the market’s robust trajectory through 2035.

The Foot Care for Diabetic Patients Market in the United Kingdom is projected to expand at a CAGR of 13.1% from 2025 to 2035, reflecting accelerated adoption of preventive care measures. Stronger diabetic screening programs, rising prescription integration, and improved pharmacy counseling are expected to sustain this momentum.

Market expansion is projected to be supported by high physician engagement and the widespread availability of dermatology-backed products across both retail and clinical settings. A consistent focus on compliance-driven preventive healthcare in the UK is expected to enhance adoption, positioning the market on a steady upward trajectory through 2035.

The Foot Care for Diabetic Patients Market in India is projected to record the fastest CAGR of 23.2% during 2025-2035, reflecting rapid expansion of diabetic populations, increased awareness, and improved healthcare outreach. Rural and semi-urban areas are expected to emerge as high-growth pockets, supported by affordable product launches and government-led diabetic care programs.

Expanding distribution through pharmacies and the rise of e-commerce platforms are forecasted to enhance accessibility for patients across income groups. Growth is also anticipated to be reinforced by locally adapted, cost-effective medical-grade solutions that align with affordability constraints, creating a strong momentum through 2035.

Sales Outlook for Foot Care For Diabetic Patients in China

The Foot Care for Diabetic Patients Market in China is expected to grow at a CAGR of 20.2% through 2035, supported by urbanization, rising healthcare expenditure, and an increasing diabetic base. Preventive diabetic care is being integrated into hospital discharge kits and outpatient follow-ups, reinforcing adoption at clinical touchpoints.

Expanding e-commerce penetration is projected to accelerate access to fragrance-free and medical-grade formulations in Tier 1 and Tier 2 cities. Product adoption is anticipated to be strengthened by consumer trust in dermatologist-endorsed labels and hospital-recommended brands, ensuring strong momentum for both premium and affordable offerings across China.

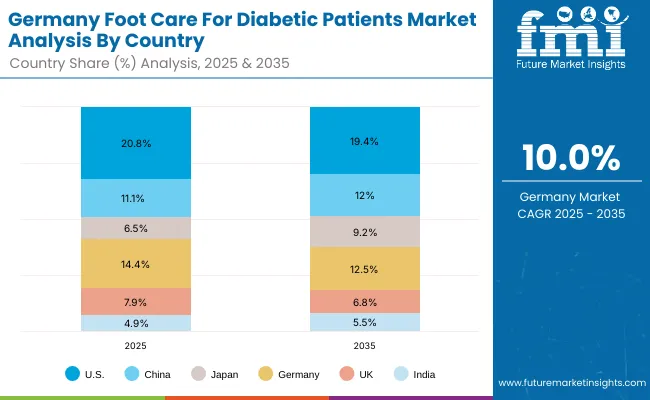

| Country | 2025 |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.9% |

| Country | 2035 |

|---|---|

| USA | 19.4% |

| China | 12.0% |

| Japan | 9.2% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

The Foot Care for Diabetic Patients Market in Germany is projected to expand at a CAGR of 10.0% from 2025 to 2035, supported by strict quality standards and well-established diabetic care protocols. Preventive care is being prioritized across clinics, pharmacies, and hospitals, where product adoption is reinforced by physician recommendations.

Growing demand for hypoallergenic and fragrance-free formulations is expected to align with patient preferences in dermatology-driven markets. Accessibility through established pharmacy networks and the increasing presence of specialized diabetic care centers are projected to sustain long-term growth. By 2035, Germany is anticipated to remain a key European hub for structured diabetic care adoption.

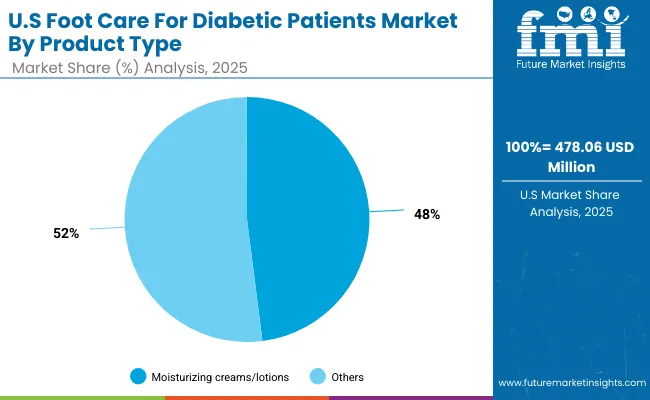

| USA by product type | Market Value Share, 2025 |

|---|---|

| Moisturizing creams/lotions | 48% |

| Others | 52.0% |

The Foot Care for Diabetic Patients Market in the United States is projected at USD 478.06 million in 2025. Moisturizing creams and lotions contribute 48% (USD 229.5 million), while others account for 52% (USD 248.59 million), indicating a balanced but slightly diversified product mix.

The strong share of creams and lotions reflects their role as first-line defense in maintaining hydration, preventing fissures, and reducing ulcer risks among diabetic patients. The dominance of the “others” segment highlights the growing contribution of antifungal creams, wound-healing ointments, and specialized products addressing infection prevention and circulation support.

The market outlook is expected to be shaped by preventive care adoption, clinical endorsements, and patient awareness campaigns, which emphasize the importance of routine use. Accessibility through pharmacies ensures consistent engagement, while e-commerce channels are anticipated to expand reach and convenience. Over the decade, innovation in multifunctional creams with antimicrobial and restorative properties is expected to reinforce the leadership of moisturizing lotions while also boosting growth across diversified offerings.

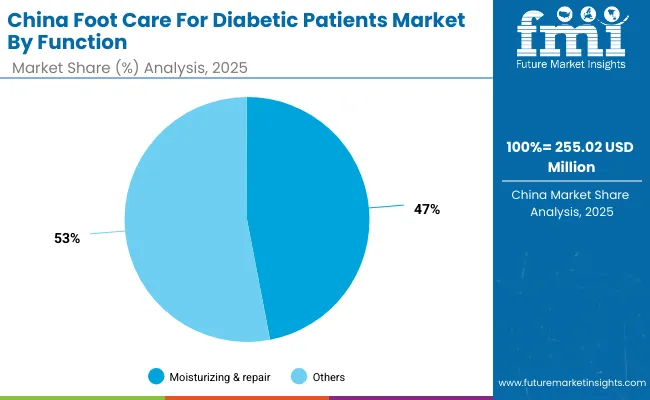

| China by Function | Market Value Share, 2025 |

|---|---|

| Moisturizing & repair | 47% |

| Others | 53.0% |

The Foot Care for Diabetic Patients Market in China is projected at USD 255.02 million in 2025. Moisturizing & repair contributes 47% (USD 119.9 million), while others account for 53% (USD 135.16 million), underscoring a diversified functional demand base. The significance of moisturizing & repair stems from its critical role in restoring skin barrier function and preventing fissures, which are increasingly prioritized in urban diabetic care programs. This segment is expected to gain further traction as hospitals and clinics integrate hydration-focused regimens into structured diabetic care.

The “others” segment leads slightly, reflecting rising adoption of antimicrobial solutions, pressure relief aids, and circulation-supportive products. This strength highlights the growing attention on infection control and comprehensive prevention strategies across China’s diabetic population. Accessibility is being reinforced through both pharmacy networks and fast-growing e-commerce channels, which are expanding reach into Tier 2 and Tier 3 cities.

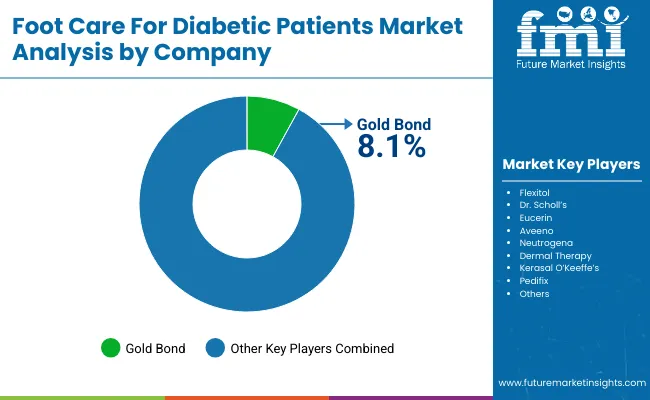

| Company | Global Value Share 2025 |

|---|---|

| Gold Bond | 8.1% |

| Others | 91.9% |

The Foot Care for Diabetic Patients Market is highly fragmented, with a mix of global consumer healthcare leaders, mid-sized dermatology-focused brands, and specialized diabetic-care providers competing for market presence. Global leaders such as Gold Bond are projected to hold a global value share of 8.1% in 2025, making it the largest identifiable brand in this segment. Its dominance is being reinforced by a strong portfolio of diabetic-focused creams, reputation for dermatologist-tested formulations, and wide distribution through both retail and pharmacy channels.

Mid-sized players, including Flexitol, Dr. Scholl’s, Eucerin, and Aveeno, are actively addressing diabetic skin needs with portfolios covering moisturizing, antifungal, and barrier-repair products. These companies are expanding adoption through targeted awareness campaigns and pharmacist-led promotions, positioning their offerings as preventive essentials for everyday diabetic care.

Specialized providers such as Dermal Therapy, O’Keeffe’s, and Pedifix are contributing to competitive diversity by focusing on cost-effective and patient-friendly solutions. Their strength lies in tailoring products for niche demands such as severe dry skin, cracked heels, and wound-prevention regimens, often with strong physician referral support.

Competitive differentiation is expected to shift from traditional product claims toward integrated care approaches, including medical-grade positioning, clinical validation, and digital adherence tools. Fragmentation is likely to persist, but trust signals through healthcare endorsements and proven clinical outcomes are projected to define future market leadership.

Key Developments in Foot Care For Diabetic Patients Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,302.6 Million (2025E) - USD 5,403.4 Million (2035F) |

| Product Type | Moisturizing creams/lotions, Antifungal creams, Specialized footwear & socks, Wound-healing ointments |

| Function | Moisturizing & repair, Antimicrobial protection, Pressure relief, Circulation support |

| Claim | Medical-grade, Fragrance-free, Hypoallergenic, Dermatologist-recommended |

| Distribution Channel | Pharmacies/drugstores, Hospitals & clinics, E-commerce, Mass retail |

| End-use Focus | Diabetic patients (neuropathy prevention, ulcer prevention, wound healing, infection management) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gold Bond, Flexitol, Dr. Scholl’s, Eucerin, Aveeno, Neutrogena, Dermal Therapy, Kerasal, O’Keeffe’s, Pedifix |

| Additional Attributes | Dollar sales by product type, function, and claim; adoption trends in pharmacies and e-commerce; rising demand for medical-grade and fragrance-free formulations; sector-specific growth in preventive diabetic care; physician and pharmacist-led recommendations; regional differences in healthcare reimbursement and affordability; innovations in multifunctional creams and barrier-repair formulations. |

The global Foot Care for Diabetic Patients Market is estimated to be valued at USD 2,302.6 million in 2025.

The market size for the Foot Care for Diabetic Patients Market is projected to reach USD 5,403.4 million by 2035.

The Foot Care for Diabetic Patients Market is expected to grow at a CAGR of 8.9% between 2025 and 2035.

The key product types in the Foot Care for Diabetic Patients Market are moisturizing creams/lotions, antifungal creams, specialized footwear & socks, and wound-healing ointments.

In terms of function, moisturizing & repair is projected to command 47% share in the Foot Care for Diabetic Patients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foot Door Opener Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Valve Market Forecast and Outlook 2025 to 2035

Footprint Detection Light Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Foot Patches Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Foot and Mouth Disease Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Footwear Adhesives Market

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Hand, Foot and Mouth Disease Treatment Market

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Carbon Footprint Management Market

Women’s Footwear Market Size, Growth, and Forecast for 2025 to 2035

Medical Footwear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA