The foot suction valve market is experiencing notable expansion due to the growing demand for reliable fluid control systems across industrial, agricultural, and municipal water management applications. Market growth is being supported by modernization of pumping infrastructure, rising investments in irrigation systems, and the need for improved efficiency in fluid handling operations. Manufacturers are focusing on enhancing product durability, corrosion resistance, and flow optimization to meet diverse operational requirements.

The current scenario is marked by increased adoption in both large-scale and small-scale pumping systems, supported by steady infrastructure development in emerging economies. The future outlook remains positive as advancements in material science, valve automation, and precision engineering continue to drive performance improvements.

Growth rationale is underpinned by expanding replacement demand, technological integration for efficiency monitoring, and growing emphasis on sustainability in fluid control components These factors collectively position the market for consistent value generation and long-term adoption across multiple end-use sectors.

| Metric | Value |

|---|---|

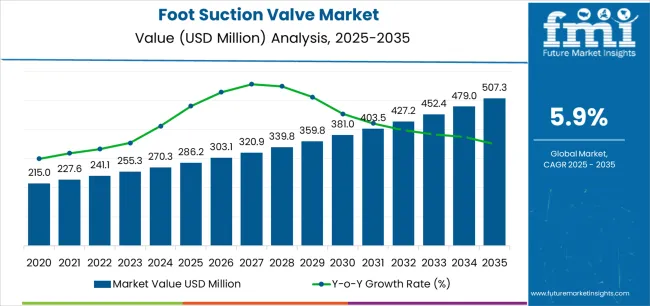

| Foot Suction Valve Market Estimated Value in (2025 E) | USD 286.2 million |

| Foot Suction Valve Market Forecast Value in (2035 F) | USD 507.3 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

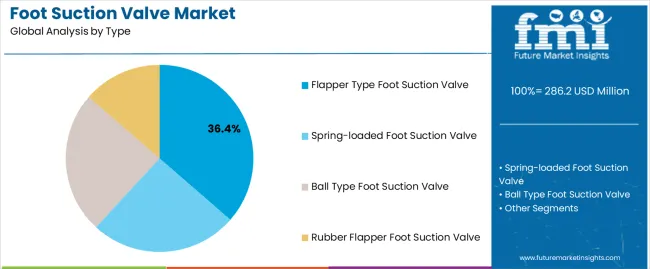

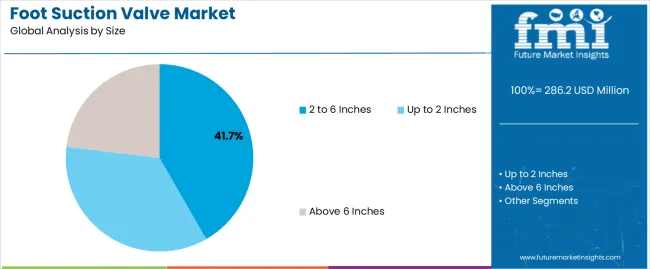

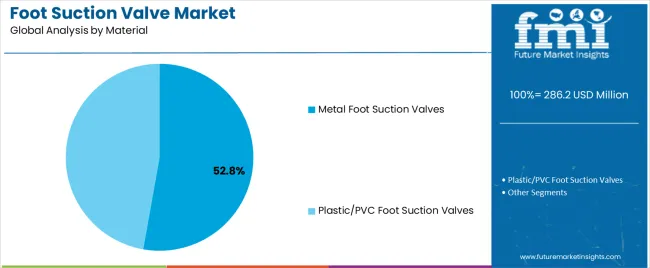

The market is segmented by Type, Size, Material, and End-use and region. By Type, the market is divided into Flapper Type Foot Suction Valve, Spring-loaded Foot Suction Valve, Ball Type Foot Suction Valve, and Rubber Flapper Foot Suction Valve. In terms of Size, the market is classified into 2 to 6 Inches, Up to 2 Inches, and Above 6 Inches. Based on Material, the market is segmented into Metal Foot Suction Valves and Plastic/PVC Foot Suction Valves. By End-use, the market is divided into Water & Wastewater Treatment, Oil & Gas, Energy & Power, Pharmaceuticals, Food & Beverages, Chemicals, Building & Construction, Paper & Pulp, Metals & Mining, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flapper type foot suction valve segment, accounting for 36.40% of the type category, has been leading the market due to its simple design, ease of maintenance, and effective performance in preventing backflow. Its operational reliability under varying pressure conditions has strengthened its use in agricultural and industrial pumping systems.

The segment benefits from lower installation costs, compatibility with multiple pump configurations, and minimal operational downtime. Continuous improvements in valve seating materials and design precision have enhanced sealing performance, contributing to higher efficiency and reduced leakage.

The segment’s consistent demand from irrigation and water distribution projects is expected to sustain its share over the coming years Increasing adoption in developing regions, driven by infrastructure upgrades and government-backed irrigation schemes, is also expected to reinforce its dominant position in the global market.

The 2 to 6 inches size category, holding 41.70% of the size segment, has remained the preferred choice for a wide range of medium-capacity pumping systems. Its versatility in handling moderate flow rates and adaptability to multiple applications have supported its steady market leadership.

This segment’s dominance is driven by strong usage across municipal water systems, agricultural irrigation networks, and construction dewatering setups. The size range offers an optimal balance between flow efficiency and installation flexibility, making it suitable for both stationary and mobile pumping systems.

Advancements in casting precision and surface finishing have improved durability and resistance to particulate abrasion Market expansion is being reinforced by increasing demand from small and medium-scale industries that prioritize cost-effective and efficient flow control systems, ensuring continued adoption of this valve size range.

The metal foot suction valves segment, representing 52.80% of the material category, has emerged as the leading material type due to its superior strength, resistance to pressure variations, and long operational lifespan. Its ability to withstand harsh operating environments and abrasive fluids has made it the preferred choice across industrial and municipal applications.

The segment’s growth is further supported by advancements in alloy compositions and protective coatings, which enhance corrosion resistance and reduce maintenance frequency. Consistent demand from sectors such as oil and gas, mining, and heavy-duty water treatment facilities continues to strengthen its market share.

The increasing emphasis on durable and high-performance materials in pump systems has positioned metal valves as a reliable and cost-efficient solution Continued innovation in fabrication processes and the integration of performance testing protocols are expected to sustain the segment’s leadership in the global foot suction valve market.

Foot Suction Valve Market to Expand Over 1.8x through 2035

The foot suction valve market is predicted to expand over 1.8x through 2035, accompanied by a 1.1% increase in the expected CAGR compared to the historical one. This is due to growing demand for foot suction valves in several industries, such as oil & gas, water & wastewater treatment, energy & power, pharmaceuticals, food & beverages, and chemicals. By 2035, the total market revenue is set to reach USD 491.8 million.

North America to Lead the Foot Suction Valve Market

North America is expected to dominate the foot suction valve market during the forecast period. It is set to hold around 29.1% of the global market share in 2035. This is attributed to the following factors:

The foot suction valve market grew at a CAGR of 5.1% between 2020 and 2025. The market reached a valuation of USD 286.2 million in 2025.

| Historical CAGR (2020 to 2025) | 5.1% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.2% |

The foot suction valve market witnessed steady growth between 2020 and 2025. This was due to economic growth in emerging markets, which LED to expansion of textile and food industries.

Over the forecast period, the foot suction valve market is poised to exhibit healthy growth, totaling a valuation of USD 507.3 million by 2035.

Increasing Demand in Oil and Gas Industry

Foot suction valves play a vital role in controlling the flow of oil & gas, ensuring the efficiency and reliability of several processes in the industry. Foot suction valves are ideal for oil & gas industries due to their robust construction and corrosive resistance, making them suitable for extreme conditions.

Advances in valve technology with improved control capability and automation align with the initiatives that move toward efficiency and safety. Due to its efficient role in oil & gas industries, foot suction valve demand is expected to remain high.

Rising Demand in the Healthcare Sector

Foot suction valves are important in medical suction devices, ensuring efficient and clean suction in healthcare settings. As global demand for medical equipment rises, foot suction valves are expected to gain traction in surgery, diagnosis, and patient care. These are projected to meet strict medical standards. As healthcare continues to evolve and modernize, foot suction valves are set to see continuous improvements to meet the evolving needs of the healthcare industry.

Environmental Sustainability and Regulatory Compliance

Rising focus on environmental sustainability and regulatory compliance drives the expansion of the foot suction valve market. With the global shift toward environmentally friendly practices, manufacturers are developing foot suction valves that meet strict environmental standards.

Regulatory frameworks promoting product safety, hygiene, and environmental sustainability push innovations in foot suction valve technology, requiring manufacturers to develop customized and effective solutions. As environmental concerns intensify and governments introduce stringent regulations globally, the foot suction valve market is poised to expand.

Cost Constraints and Affordability

Costs associated with the manufacturing of foot suction valve pipelines, particularly those incorporating advanced materials and technology to meet industry standards, are set to restrict widespread adoption.

Maintenance Challenges

Complex maintenance requirements and potential downtime pose challenges for the foot suction valve market, especially in industries such as healthcare and sustainable manufacturing.

The table below shows the estimated growth rates of several countries through 2035. India, China, and Hungary are set to record high CAGRs of 5.6%, 4.1%, and 3.2% respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

| China | 4.1% |

| Hungary | 3.2% |

| Poland | 2.3% |

| Chile | 1.9% |

The United States foot suction valve industry is poised to exhibit a significant CAGR during the assessment period. Key factors supporting market growth are:

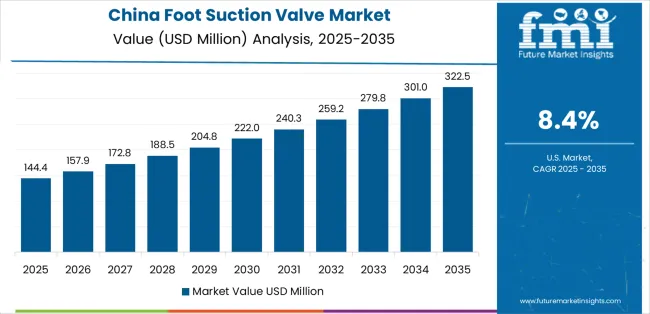

Foot suction valve demand in China is anticipated to rise at a steady CAGR of 4.1% during the forecast period. This is attributable to a combination of factors, including:

Demand for foot suction valves is increasing in India, with a projected CAGR of 5.6% through 2035. Emerging patterns in the market are as follows:

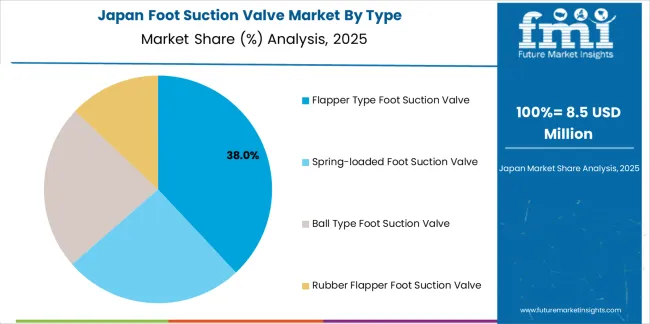

Japan's foot suction valve market is expected to reach a significant valuation by 2035. Top factors supporting the market expansion in the country include:

The foot suction valve market is projected to increase in Poland at a CAGR of 2.3% through 2035. Leading factors driving market growth are as follows:

The section below shows the oil and gas segment dominating based on end-use. It is forecast to thrive at 5.6% CAGR between 2025 and 2035.

Based on type, the ball type foot suction valve segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 5.9% during the forecast period.

| Top Segment (End-use) | Oil & Gas |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.6% |

| Top Segment (Type) | Ball Type Foot Suction Valve |

|---|---|

| Projected CAGR (2025 to 2035) | 5.9% |

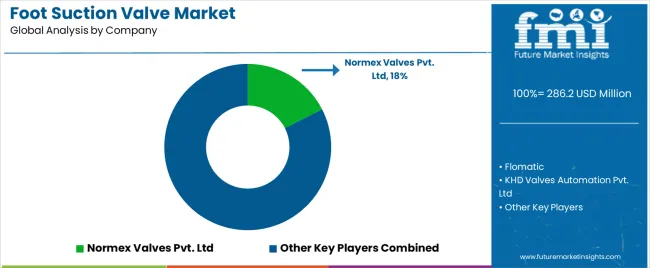

The foot suction valve market is consolidated, with leading players accounting for around 31% share. Normex Valves Pvt Ltd, Flomatic, KHD Valves Automation Pvt Ltd, Aquazen Polytech Pvt Ltd, FLUIDYNE INSTRUMENTS PVT. LTD, Tesco Steel & Engineering, and Darvin Polymers are the leading manufacturers and suppliers in the foot suction valve market listed in the report.

Key foot suction valve manufacturers invest in continuous research to produce new products and increase their capacity to meet end-user demand. Leading companies are also inclined toward adopting strategies to strengthen their footprint, including acquisitions, partnerships, mergers, and facility expansions.

Recent Developments

The global foot suction valve market is estimated to be valued at USD 286.2 million in 2025.

The market size for the foot suction valve market is projected to reach USD 507.3 million by 2035.

The foot suction valve market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in foot suction valve market are flapper type foot suction valve, spring-loaded foot suction valve, ball type foot suction valve and rubber flapper foot suction valve.

In terms of size, 2 to 6 inches segment to command 41.7% share in the foot suction valve market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Footprint Detection Light Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Foot Patches Market Size and Share Forecast Outlook 2025 to 2035

Foot and Mouth Disease Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Footwear Adhesives Market

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Hand, Foot and Mouth Disease Treatment Market

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Carbon Footprint Management Market

Women’s Footwear Market Size, Growth, and Forecast for 2025 to 2035

Medical Footwear Market Size and Share Forecast Outlook 2025 to 2035

Athletic Footwear Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA