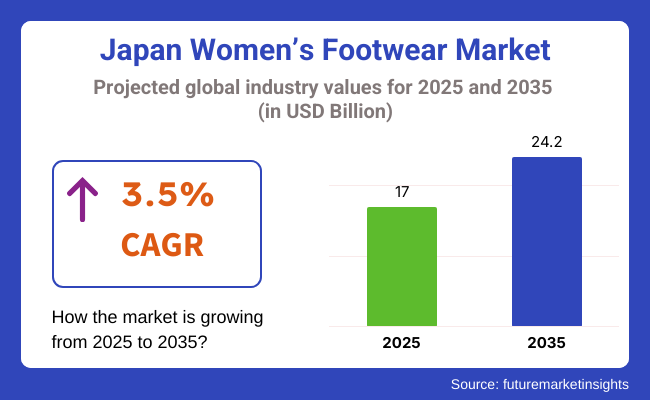

The Japan women’s footwear market is poised to register a valuation of USD 17 billion in 2025. The industry is slated to grow at 3.5% CAGR from 2025 to 2035, witnessing USD 24.2 billion by 2035. The market is witnessing high growth because of a number of major factors that are in sync with the changing tastes, technological innovations, and cultural transformations in the nation.

As Japan's aging population keeps on increasing, the need for supportive and ergonomic shoes has increased, fueling the growth of the market. Companies are meeting this need by incorporating cushioning technologies and creating shoes that balance both style and comfort, appealing to a wider group of consumers.

In addition, fashion and trends in Japan have a significant impact on the women's footwear market. The Japanese consumer is characterized by their strong desire for the latest fashion trends and willingness to spend on high-quality, fashionable products. Consequently, local and foreign footwear brands are continually developing products that meet the distinct tastes of Japanese women.

Furthermore, Japan's increasing interest in sustainable and eco-friendly products has fueled the demand for environmentally friendly footwear. Brands which employ recycled materials, eco-friendly production processes, and minimize carbon footprints are gaining immense popularity, connecting with the environment-conscious consumer base.

The growth of e-commerce and internet-based shopping platforms in Japan has generated new channels for women's shoe sales, easing the way for consumers to discover and buy a vast range of products.

The ease of doing business on the Internet, coupled with new-age marketing techniques and influencer culture, has enabled women to keep themselves updated about the latest trends in footwear and place orders at their convenience. The phenomenon, coupled with the rising disposable income of numerous Japanese women, further spurs the growth of the market.

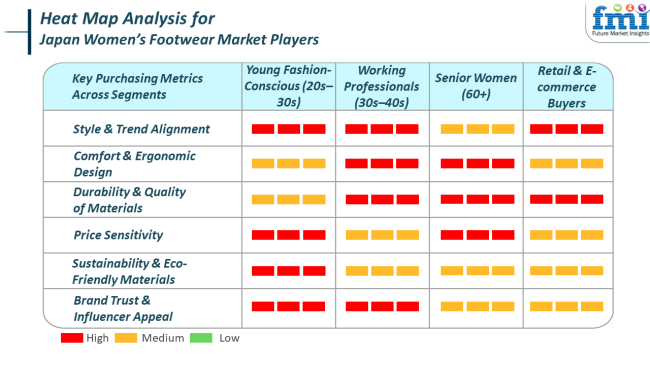

The Japanese women's footwear industry is marked by varied trends across different end-use segments, as a result of changing consumer preferences, lifestyles, and cultural influences. Casual and daily footwear is the market leader, with Japanese women giving high importance to comfort, versatility, and style.

Demand for sneakers, slip-ons, and flats remains on the rise, as consumers look for shoes that couple comfort with style to suit their busy, on-the-go lifestyle. In the formal shoe category, there is a move towards comfort without sacrificing professionalism, in the form of cushioned loafers and low heels, because of increased working hours and ergonomic designs being favored.

The sport shoe category also experiences growth due to the growing health and fitness culture, with women spending money on performance shoes for sports and gym usage. Moreover, sports shoes are increasingly being used as regular wear, demarcating the distinction between athletic and casual shoes. As far as purchase criteria go, comfort, durability, and adaptability are the most important factors in the casual shoe category, with people seeking shoes that do not fade as quickly.

In formal shoes, professional look and comfort are the primary concerns, with ergonomic benefits such as arch support and cushioning being of growing concern. The sport footwear category is very concerned about performance attributes such as shock absorption and traction, with brand image and technology being significant factors in purchase decisions.

Between 2020 and 2024, Japan's women's footwear industry changed dramatically in terms of response to changing consumer desires, innovations and technological leaps, and responses to global forces including the COVID-19 pandemic. The pandemic responded to increased demands for relaxed and home footwear due to increased remote working and desires for casual and multichromatic versatile shoes.

Brands followed this trend by providing slip-ons, slippers, and athleisure-type shoes that fit the increased demand for comfort without sacrificing style. There was also a greater emphasis on sustainability, with environmentally conscious consumers forcing brands to be environmentally friendly. This involved the utilization of recycled materials, minimized waste in manufacturing processes, and clear supply chains.

During the forecast period, between 2025 and 2035, a number of trends are likely to influence the women's footwear market in Japan. First, there will be further increased demand for eco-friendly and sustainable products, as more brands shift towards adopting circular economy systems and strive to lower their carbon footprint.

Consumers will tend to give greater priority to products reflecting their ethical considerations as concern over climate change and environmental issues becomes higher. The use of technology in footwear is another critical trend, with wearable technology and smart shoes providing health tracking, personalized comfort settings, and performance improvement.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The pandemic led to more demand for relaxed, home-casual wear shoes, such as slippers and sneakers, with work-from-home gaining prominence. | Increasing need for totally sustainable products, where circular economy approaches become the norm, including sneakers that use recycled or biodegradable materials. |

| An increase in customer demand for sustainable and responsibly made footwear, prompting brands to use sustainable processes and materials. | The addition of intelligent shoes and wearable technology, including health monitoring and customized comfort levels, led by innovation in shoe design and customer demand for it. |

| The fast pace of digital shopping channels because of social distancing, pushing leading brands to enhance their online presence and offer seamless online experiences. | Growing demand for ergonomically designed and supportive footwear for an aging population, with further designs based on comfort, foot health, and accessibility without compromising style. |

| Growing need for comfortable, casual, and slip-on shoes that harmonize style and comfort for everyday wear, catering to lifestyle transformations triggered by the pandemic. | Functionality-driven shoes that smoothly merge casual, formal, and athletic wear to accommodate the need for multi-purpose and convenient footwear, suitable for women with varying lifestyles. |

The Japan women's footwear market, although ready to grow, has several risks that might affect its trend over the next few years. The most critical risk is the economic downturn or volatility, which might curtail consumer spending. Japan's elderly population and slow economic growth could make people become more careful with their spending habits, especially on discretionary categories like fashion and footwear.

Economic recessions, changing disposable incomes, and possible disturbances in the global supply chain may greatly influence demand, particularly for high-end or luxury footwear. Furthermore, due to Japan's heavy dependence on imports of materials, any change in global trade policies or tariffs might drive up costs for footwear brands, which might be transferred to customers.

Shifting consumer trends is another important risk. Whereas comfort and sustainability have been the driving forces behind recent fashion trends, these tastes might shift, particularly as younger generations, who tend to influence fashion trends, might have different styles or technologies as priorities in footwear.

For example, unforeseen changes in fashion trends might see a drop in demand for particular types of footwear, such as the casual or athleisure shoes that have become increasingly popular. Moreover, if companies do not remain in line with technological progress or the growing popularity of environmentally friendly products, they will find it difficult to remain competitive.

In Japan, casual shoes is the best-selling category of women's shoes, fueled by the nation's urban lifestyle that values comfort and convenience. Casual shoes like slip-ons, sneakers, and flats are popular due to their feasibility, especially in densely populated cities like Osaka and Tokyo, where women spend most of their time in constant motion.

These shoes are commonly selected for their convenience in effortlessly changing from work to social occasions, and thus are a staple for daily wear. The Japanese market has also witnessed an increasing popularity of athleisure trends, as comfort-led trends have been increasingly integrated into fashion, especially after the COVID-19 pandemic when home-based living triggered the demand for comfortable footwear.

Boots are also favored in Japan, especially in the colder season. Ankle and knee-high boots are widely used, particularly during winter, as they are warm, comfortable, and look fashionable. The flexibility of boots, which can be worn for casual as well as semi-formal purposes, has helped them gain popularity.

Japanese women prefer boots that are both fashionable and functional, like waterproof or insulated ones, to suit the changing seasons. Boots are usually worn with skirts, dresses, or jeans, so they are a very versatile option for different styles.

In Japan, leather is the most common material for women's shoes, especially in business, formal, and high-end casual categories. Leather is prized for its long-lasting nature, breathability, and capacity to mold itself into the shape of the wearer's foot over a period of time, providing a fitted feel that is very comfortable.

It is also culturally attractive in Japan, where longevity and craftsmanship are greatly valued. Leather footwear is particularly well-suited for office attire, where professionalism and elegance are of primary concern. Furthermore, the visual attractiveness of leather-its smooth finish, natural texture, and classic character-resonates with Japanese fashion aesthetics that prefer understated, sophisticated looks.

Rubber is also a widely utilized material, particularly for casual footwear, sportswear, and seasonal accessories such as rain boots. Japan's rainy season creates the perfect condition for rubber to be used as an ideal material for the everyday shoe that requires water-proofing, strength, and slip-resistance.

Rubber soles have also become popular in sneakers and walking shoes due to its ease of movement and traction, which is prevalent in a culture where walking and public transport rule commuting. Its practicality and affordability also make rubber a central ingredient in mass-market footwear.

Domestic market players like HOSHINO and Kawano Co. Ltd. are well-entrenched in Japanese retail culture, offering delicately designed leather footwear and seasonal lines that find appeal among mature and fashion-aware consumers.

On the other hand, ASICS Corporation, a domestically grown global player, is taking advantage of its strong R&D capabilities and cultural understanding to supply ergonomically designed footwear, especially in the sports and casual categories, which are in high demand among health-aware Japanese women.

With global fashion and fitness trends playing an ever greater role in shaping Japanese purchasing patterns, global giants like Nike Inc., Adidas AG, and Puma SE are quickly increasing their presence. These brands specialize in athleisure and performance-inspired designs, integrating cutting-edge cushioning, eco-friendly materials, and minimalist styling.

Their appeal is not only in terms of functionality but also in terms of branding and lifestyle marketing, which appeals to Japan's fashion-conscious urban consumers. SKECHERS and Crocs Inc. are riding the increasing trend towards comfort footwear-particularly slip-ons, platform sandals, and walking shoes that are casual-in presenting affordable and practical designs for daily wear.

Under Armour Inc. and Wolverine World Wide Inc. are finding a niche by launching performance-oriented and utility footwear, which targets niche groups like gym enthusiasts, active commuters, and professionals who need durable but fashionable footwear.

Industry Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ASICS Corporation | 14-16% |

| Nike Inc. | 12-14% |

| Adidas AG | 10-12% |

| Kawano Co. Ltd. | 9-11% |

| Puma SE | 8-10% |

| SKECHERS | 7-9% |

| Crocs Inc. | 6-8% |

| HOSHINO | 4-6% |

| Under Armour Inc. | 3-5% |

| Wolverine World Wide Inc. | 2-4% |

| Others (local boutiques, online labels) | 10-12% |

ASICS Corporation is the leader in Japan's women's footwear market with a projected 14-16% market share, owing to its extensive knowledge of local tastes and excellent reputation for quality sportswear. It is the leader in the performance footwear category with ergonomically shaped sneakers that focus on comfort, posture alignment, and casual athletic wear.

Nike Inc. and Adidas AG trail closely behind, with strong brand equity and diversified product portfolios that resonate with Japan's fashion-conscious and health-aware consumers. Both companies emphasize innovation in cushioning, breathability, and using environmentally friendly materials, which resonate with growing demand for eco-friendly and multi-purpose footwear.

Kawano Co. Ltd. and HOSHINO are traditional Japanese corporations famous for high-quality leather footwear and dedication to craftsmanship. They supply consumers that are looking for quality and class for formal as well as semi-formal functions and have a faithful customer base with local retail partnerships and seasonally released collections.

Puma SE, SKECHERS, and Crocs Inc. hold prominent mid-range market positions with comfort-focused and fashion-related offerings like platform sneakers, walk shoes, and cushioning sandals. Their success stems from affordability, aggressive design, and utility, primarily among young women and recreational consumers.

Under Armour Inc. and Wolverine World Wide Inc. target the active and utility categories, providing performance-enhanced shoes that are rugged. Although they have smaller market shares, they cater to an expanding niche of consumers who want gym-ready and weather-resistant footwear.

In terms of product type, the industry is classified into casual shoes, boots, heels & pumps, sandals, flip flops& slippers, sports shoes, and safety shoes.

Based on material, the market is divided into rubber, leather, plastic, velvet, textiles, and others.

By sales channel, the industry is divided into hypermarkets/supermarkets, specialty stores, multi-brand stores, direct sales, 3rd party online sales, and others.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 17 billion in 2025.

The industry is projected to witness USD 24.2 billion by 2035.

The industry is projected to witness 3.5% CAGR during the study period.

Casual shoes are widely sold.

Leading companies include Kawano Co. Ltd., HOSHINO, Nike Inc., Adidas AG, Puma SE, SKECHERS, Under Armour Inc., Wolverine World Wide Inc., Crocs Inc., and ASICS Corporation.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Pairs) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 9: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: Kanto Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: Kanto Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 14: Kanto Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 15: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Chubu Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 17: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 18: Chubu Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: Chubu Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 21: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Kinki Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 23: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 24: Kinki Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 25: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: Kinki Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 27: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Kyushu & Okinawa Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 29: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 30: Kyushu & Okinawa Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 31: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 32: Kyushu & Okinawa Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 33: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Tohoku Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 35: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Tohoku Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 37: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 38: Tohoku Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 39: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 41: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 42: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Pairs) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: Kanto Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 26: Kanto Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 27: Kanto Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 28: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 29: Kanto Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 30: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 31: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 33: Kanto Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 34: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 35: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 36: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 37: Kanto Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 38: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 39: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 40: Kanto Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 41: Kanto Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 42: Kanto Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 43: Chubu Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 44: Chubu Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 45: Chubu Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 46: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 47: Chubu Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 48: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 49: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 50: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 51: Chubu Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 52: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 53: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 54: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 55: Chubu Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 56: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 57: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 58: Chubu Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 59: Chubu Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 60: Chubu Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 61: Kinki Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: Kinki Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 63: Kinki Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 64: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 65: Kinki Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 66: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 67: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 68: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 69: Kinki Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 70: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 71: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 72: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 73: Kinki Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 74: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 75: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 76: Kinki Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 77: Kinki Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 78: Kinki Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 81: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 82: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 83: Kyushu & Okinawa Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 84: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 85: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 86: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 87: Kyushu & Okinawa Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 88: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 89: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 90: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 91: Kyushu & Okinawa Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 92: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 93: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 94: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 95: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 96: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 97: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 98: Tohoku Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 99: Tohoku Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 100: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Tohoku Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 102: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 105: Tohoku Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 106: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 107: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 108: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 109: Tohoku Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 110: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 111: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 112: Tohoku Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 113: Tohoku Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 114: Tohoku Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 116: Rest of Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 117: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 118: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 119: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 120: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 121: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 122: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 123: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 124: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 125: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 126: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 127: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 132: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA