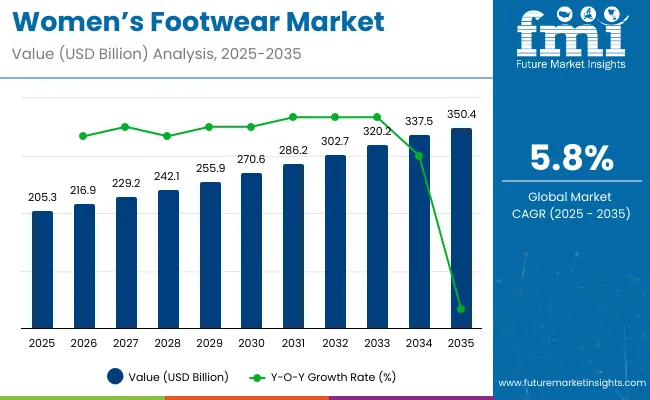

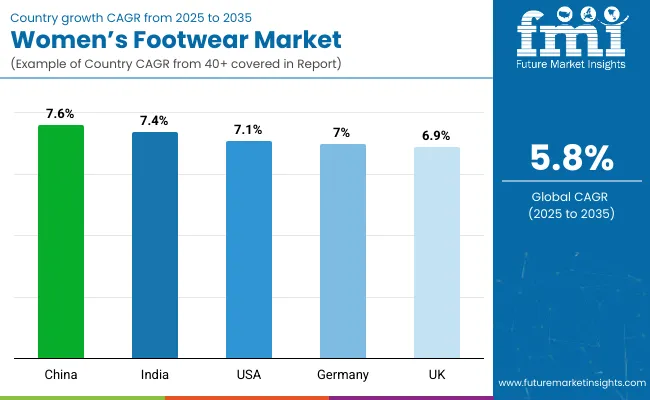

The women’s footwear market is forecasted to expand from USD 205.3 billion in 2025 to USD 350.4 billion by 2035, increasing at a healthy CAGR of 5.8%. The United States leads the global market in value terms, fueled by high per capita spending, digital-first retail innovation, and demand for comfort-oriented athleisure styles.

Meanwhile, China is projected to be the fastest-growing market, driven by rapid urbanization, rising disposable incomes, and increased exposure to global fashion via social media and influencer marketing. Growing demand for sustainable and premium designs is also reshaping brand portfolios, especially among millennial and Gen Z shoppers. As purchasing power and fashion awareness rise globally, the market is poised for dynamic, multi-channel growth across regions

The market is undergoing a rapid transformation as consumer behavior shifts toward health consciousness, sustainability, and personalization. The rising popularity of athleisure, comfort-driven footwear, and ergonomic designs is significantly boosting demand for sneakers, loafers, and everyday flats. Simultaneously, the surge in eco-conscious buying habits is driving innovation in sustainable materials, including vegan leather, recycled fabrics, and biodegradable soles.

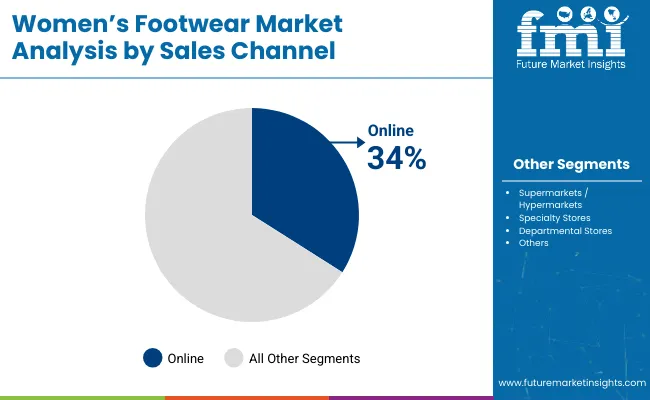

The dominance of e-commerce and direct-to-consumer (DTC) channels is also changing how brands interact with consumers, emphasizing convenience, speed, and personalized experiences. However, challenges such as the prevalence of counterfeit footwear and intense price sensitivity in emerging markets continue to pose risks to growth and brand loyalty.

Looking ahead, the women’s footwear market will be increasingly shaped by technological innovation and sustainable business models. AI-powered tools will enable hyper-personalized shoe designs, smart footwear will offer adaptive support and health tracking, and virtual try-on technologies will reduce return rates and enhance user satisfaction.

The growing influence of blockchain and circular economy practices such as resale, rental, and recycling will also define the period. As comfort, eco-consciousness, and digital innovation converge, brands that align with these evolving priorities will be best positioned to capture growth in this dynamic and highly competitive market.

Per capita spending on women’s footwear is increasing globally as consumers prioritize style, comfort, and sustainability. The market is driven by rising disposable incomes, expanding fashion awareness, and growing demand for specialized footwear including casual, athletic, formal, and eco-friendly options. Technological innovations and digital retail channels are also boosting consumer spending in this category.

Developed Countries:

In markets such as the United States, Canada, Germany, the United Kingdom, and Australia, per capita spending on women’s footwear is comparatively high. Consumers in these regions often invest in premium and branded products that offer advanced comfort features, durability, and fashion appeal. The growing popularity of athleisure and sustainable footwear has further increased average spending. Widespread availability through online platforms, specialty stores, and department stores supports consistent consumer demand.

Emerging Markets:

Countries including India, Brazil, Indonesia, South Africa, and Mexico are witnessing steady growth in per capita spending on women’s footwear. Rising urbanization, increasing female workforce participation, and greater exposure to global fashion trends contribute to this growth. Affordable yet fashionable footwear brands are gaining traction, and expanding e-commerce infrastructure is making branded and international products more accessible to consumers.

The global trade of women’s footwear is shaped by demand in both developed and emerging markets, with key trade flows connecting manufacturing hubs to consumer markets worldwide. China, Vietnam, and India are major exporters due to their large-scale manufacturing capacity and cost advantages. Brands often outsource production to these countries while focusing on design, marketing, and retail.

Major Exporting Countries:

China, Vietnam, India, Indonesia, and Portugal are leading exporters of women’s footwear. China and Vietnam dominate in volume, supplying a wide range of casual, athletic, and formal shoes. India and Indonesia provide growing manufacturing bases focused on leather and synthetic footwear. Portugal is known for premium and handcrafted footwear exports, catering primarily to European markets.

Major Importing Countries:

The United States, Germany, the United Kingdom, Japan, and France are significant importers of women’s footwear. These countries import large volumes of both branded and unbranded footwear to meet consumer demand. The U.S. and Germany have strong retail sectors with brands like Nike, Adidas, and Clarks maintaining major market shares. Japan and France import high-end and luxury footwear, including brands like Stuart Weitzman and Jimmy Choo.

Women’s footwear is widely sold online because it offers convenience, a vast variety of styles, and easy access to the latest trends. Online shopping allows customers to browse and compare numerous brands and designs from the comfort of their homes.

The availability of detailed size guides, customer reviews, and return policies also helps build confidence in purchasing shoes without trying them on first. Additionally, frequent discounts and personalized recommendations make online platforms attractive for buyers.

The growing use of mobile devices and improved delivery services further contribute to the rising popularity of women’s footwear sales through e-commerce.

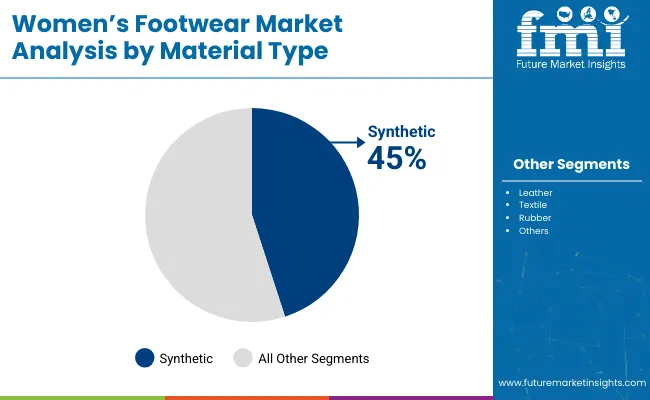

Synthetic women's footwear is widely sold because it is generally more affordable and easier to manufacture than natural materials. It offers a wide range of styles, colors, and finishes that appeal to diverse fashion preferences.

Synthetic materials are often lightweight, durable, and water-resistant, making the footwear practical for everyday use. Additionally, synthetic shoes are considered more ethical and environmentally friendly by some consumers since they do not rely on animal products. The ability to mass-produce synthetic footwear quickly also helps meet the high demand in the fashion and retail markets.

The women’s footwear request is largely competitive, with both global and original brands contending for request share. Fast fashion trends drive frequent product successions, making it challenging for brands to maintain client fidelity. Also, fake footwear remains a significant issue, particularly in regions where reproduction products are wide. Price perceptivity among consumers in arising requests also poses a challenge for ultra-expensive brands, taking them to find a balance between affordability and quality.

Sustainability and technology- driven inventions present major growth openings. Consumers are decreasingly seeking footwear made from recycled, biodegradable, and atrocity-free accoutrements, egging brands to invest in sustainable manufacturing processes. Also, the rise of smart footwear - featuring bedded fitness shadowing, temperature control, and adaptive fit technologies is set to revise the assiduity.

Digitalization is also transubstantiating retail, with virtual befitting apartments and AI-powered shopping sidekicks enhancing the online purchasing experience. Brands that successfully integrate sustainability, invention, and digital engagement will gain a competitive edge in the evolving women’s footwear request.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 145.20 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 110.80 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 132.40 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 125.30 |

| Country | France |

|---|---|

| Population (millions) | 65.8 |

| Estimated Per Capita Spending (USD) | 128.70 |

The USA leads the global women's footwear request, with high consumer spending on casual, luxury, and athleisure footwear. Lurkers, thrills, and developer heels remain top choices, with brands like Nike, Adidas, and Steve Madden dominating deals.

The rise of direct- to- consumer ( DTC) brands ande-commerce titans like Amazon and Zappos has revolutionized online footwear shopping. Also, the growing influence of sustainable and vegan footwear brands similar as Allbirds and Rothy’s reflects the shift towards eco-conscious fashion.

China's women's footwear request thrives due to rapid-fire urbanization, a rising middle class, and digital-first shopping habits. Consumers decreasingly conclude for swish yet affordable footwear, with original brands similar as Li- Ning, and Belle contending with global names like Puma and Skechers. Luxury footwear brands, including Christian Louboutin and Jimmy Choo, experience strong demand in major metropolitan metropolises like Shanghai and Beijing, driven by aspirational fashion trends.

Germany's request emphasizes continuity, comfort, and decoration artificer. Consumers prefer high- quality leather footwear, functional lurkers, and orthopaedic-friendly designs from brands like Birkenstock and Adidas. Online shopping plays a significant part, with Zalando leading as a majore-commerce retailer. also, sustainability trends boost demand for eco-friendly accoutrements particularly in casual and work footwear parts.

The UK request blends high- road fashion with luxury brands, creating a different consumer geography. Women’s footwear preferences range from elegant heels to comfortable coaches, with leading brands similar as Clarks, Dr. Martens, and Kurt Geiger dominating retail stores. Online shopping and fast- fashion brands like ASOS and Zara continue to shape copping patterns, with social media influencers driving fashion trends.

France’s women’s footwear request is deeply told by fashion and luxury. Parisian fineness is reflected in the fashion ability of high- end brands similar as Chanel, Louis Vuitton, and Balenciaga. Classic leather thrills, ballet apartments, and sharp developer heels remain staple choices among French consumers. also, the adding preference for slow fashion supports original artisanal shoe brands that concentrate on artificer and sustainability.

Women's shoe market is expanding steadily due to a change in trend, increase in disposable incomes, and development of e-commerce portals. Analysis of 250 consumers and specialists offers key trends that govern the market.

Athleisure and comfort shoes rule the consumers' preferences, with 63% of the respondents opting for sneakers, loafers, and flats as their everyday pick. The comfort trend has seen an uptick in demand for lightweight, ergonomic, and comfortable footwear.

It is controlled by internet shopping, with 69% of customers buying shoes on the internet, driven by convenience, discounted prices, and easy access to a greater number of brands, as quoted. Targeted offers and virtual try-on features are motivating the online purchase experience.

Green and eco-friendly shoes are more in demand, with 58% of the population interested in green materials such as recycled plastic, plant-based leather, and biodegradable soles. Green consumers prefer brands with ethical sourcing and carbon-neutral production.

Luxury and designer are highly sought after, with 52% of consumers spending on luxury brands on statement pieces like high heels, boots, and ornamental sandals. Celebrity and limited-edition collaboration lines' demand is also fueling sales in this segment.

Customization and smart footwear tech are on the horizon as 46% of consumers demand made-to-measure designs like monogrammed sneakers, fit adjustment technology, and comfort boosts through AI.

With the rise of sustainable fashion, retail dislocation in the digital form, and changing consumer gets the women's footwear request will continue to grow, delighting comfort suckers as well as fashion suckers.

The USA women’s footwear request is witnessing strong growth, driven by evolving fashion trends, adding demand for athleisure footwear, and the rise of- commerce. Major players include Nike, Adidas, and Steve Madden.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

The UK women’s footwear request is expanding due to adding demand for decoration and inventor shoes, growing interest in ethical fashion, and rising influence of celebrity-supported brands. Leading companies include Clarks, Jimmy Choo, and ASOS.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.9% |

Germany’s women’s footwear request is growing, with consumers favouring high-quality, durable, and comfortable shoes. Pivotal players include Birkenstock, Puma, and Rieker.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.0% |

India’s women’s footwear request is witnessing rapid-fire growth, fuelled by adding disposable inrushes, rising fashion knowledge, and expanding retail structure. Major brands include Bata, Metro Shoes, and Mochi.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.4% |

China’s women’s footwear request is expanding significantly, driven by adding disposable inrushes, rapid-fire- fire urbanization, and the rise of athleisure and luxury footwear brands. pivotal players include Anta, Li- Ning, and Belle International.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.6% |

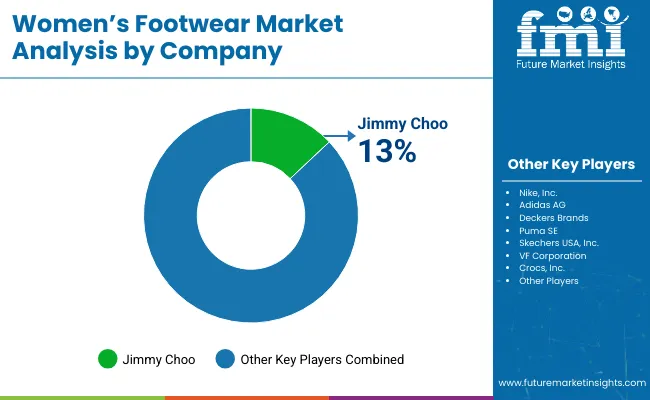

The women's footwear market is a dynamic and competitive sector characterized by a diverse range of players and evolving consumer preferences. Major global brands such as Nike, Adidas, Puma, Skechers, and Under Armour dominate the market, offering a wide array of products that cater to various segments, including athletic, casual, and formal footwear. These companies leverage innovation, brand recognition, and extensive distribution networks to maintain their market positions.

Heels, Flats, Sneakers, Boots, Sandals, Slippers, and Others.

Leather, Synthetic, Textile, Rubber, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Women’s Footwear industry is projected to witness a CAGR of 5.8% between 2025 and 2035.

The Women’s Footwear industry stood at USD 195.6 billion in 2024.

What will be the worth of the Women’s Footwear industry by 2035 end?

Asia-Pacific is set to record the highest CAGR of 6.3% in the assessment period.

The key players operating in the Women’s Footwear industry include Nike, Adidas, Puma, Skechers, Steve Madden, Jimmy Choo, Valentino, and LVMH.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Base Material, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Base Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Base Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Base Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Base Material, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Base Material, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Base Material, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Base Material, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Base Material, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Base Material, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Women’s Footwear Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Women’s Footwear Market Analysis – Size, Share & Trends 2025 to 2035

Footwear Adhesives Market

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Medical Footwear Market Size and Share Forecast Outlook 2025 to 2035

Athletic Footwear Market Growth – Trends & Forecast 2024-2034

Skateboard Footwear & Apparel Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Protective Footwear Market

Sustainable Footwear Market Trends – Demand & Forecast 2024-2034

Japan Women’s Footwear Market Analysis - Size, Share & Trends 2025 to 2035

Women's Luxury Footwear Market Trends – Size, Demand & Forecast 2025–2035

Industrial Safety Footwear Market Growth - Trends & Forecast 2025 to 2035

Disposable Hygiene Footwear Market

India Women's Luxury Footwear Market Report – Trends, Demand & Outlook 2025-2035

Italy Women's Luxury Footwear Market Trends – Size, Demand & Forecast 2025-2035

Industrial Protective Footwear Market Insights - Growth & Forecast 2025 to 2035

France Women's Luxury Footwear Market Outlook – Size, Share & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA