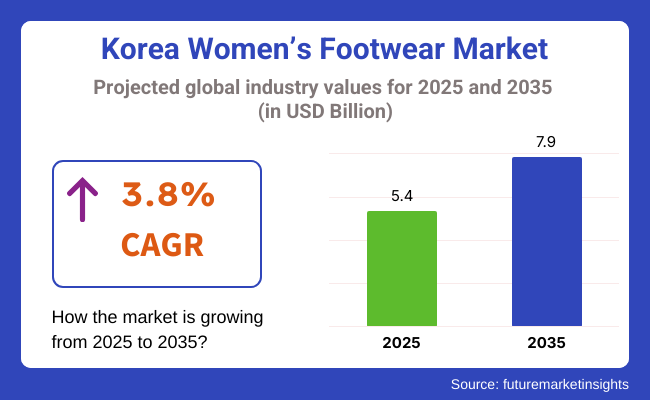

The Korea women’s footwear market is poised to register a valuation of USD 5.4 billion in 2025. The industry is slated to grow at 3.8% CAGR from 2025 to 2035, witnessing USD 7.9 billion by 2035. The expansion of the Korean market is fueled by a combination of economic, cultural, and lifestyle changes that influence consumer behavior in dynamic ways.

Increasing women's expenditure power, particularly in urban regions, is one of the key drivers. As more Korean women enter the workforce and advance in their careers, they are not only looking for fashionable footwear for the workplace but are also willing to spend money on quality and variety for both work and play.

Fashion and self-expression also come into play. South Korea is a world fashion trendsetter, with its entertainment and K-beauty sectors dictating fashion trends throughout Asia and the world. Women's shoes, from sleek, bare-bones sneakers to statement-making high heels and fashion collaborations, have become an outward expression of personal identity.

Younger consumers, including Gen Z and Millennials, are also driving demand through social media marketing and affection for style-forward but comfortable designs. This has resulted in quick product rotation and increased brand experimentation.Furthermore, the growth of e-commerce has substantially increased accessibility and visibility for local as well as international footwear brands.

Digital platforms provide easy access to consumers in order to explore niche brands or limited drops irrespective of geography. On the other hand, increased demand for wellness and outdoor sports has driven demand for performance and athleisure footwear, thereby further increasing the size of the industry

The Korean women's footwear market is influenced by varied trends brought about by changes in lifestyles, fashion, and changing consumer interests. Demand for casual, day-to-day use is fuelled by a mix of style, comfort, and versatility, where sneakers, slip-ons, and sleek loafers are on top.

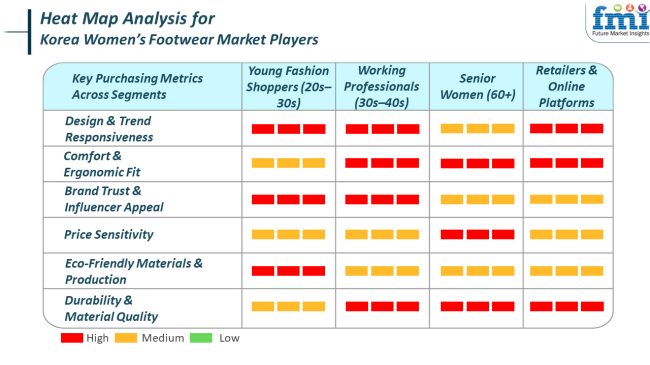

Athleisure driven by young shoppers and social media trends has mainstreamed sporty-chic looks for everyday lifestyles. For work and business wear, women aim for a fusion of sophistication and convenience-dressing in fine flats, block heel, and comfort materials ideal for long periods without compromising appearance. Comfort, credibility of brand, durability, and visual adjustability are important purchase factors for these segments.

The sports and outdoor wear footwear segment is booming due to a health-oriented increasing population with surging participation in walking, hiking, and physical exercises. Here, consumers value technical attributes such as grip, breathability, and cushioning, in addition to sustainability and design.

On the other hand, the high-end and occasion footwear category caters to fashion-conscious consumers who value uniqueness, designer brands, and memorable designs for special occasions. While comfort is secondary, the popularity of high-end comfort hybrids is picking up steam.

Throughout all categories, Korean women are making decisions that respond to their lifestyle, values, and social identity-combining practicality with fashion-forward mentality in an increasingly digital and brand-conscious shopping climate.

Between 2020 and 2024, the Korea women's footwear market experienced significant change, influenced by the COVID-19 pandemic, digitalization, and shifting consumer values. The initial part of the era witnessed an acute shift towards comfort-oriented footwear, as work-from-home and lifestyle lockdowns diminished the demand for formal and occasion-based footwear.

These were replaced by informal sneakers, slide sandals, and wellness-driven designs. E-commerce quickly became the leading channel, with digital-first brands and online-only releases garnering consumer interest. Sustainability was also a strong theme-enabling both global and local brands to test out vegan materials, recyclable packaging, and transparent supply chains.

By 2024, the industry bounced back to normalcy, owing to hybrid work lifestyles, demand for fashion, and increasing interest in adaptable yet expressive footwear choices.

Ahead from 2025 to 2035, the business will grow gradually, driven by long-term demographic, technological, and consumer awareness changes. Personalization and technological integration will be the key factors driven by AI-aided fitting technology and 3D-printed personalized insoles.

Sustainability will progress from fad to norm expectation, as brands embrace circular design paradigms, local material sourcing, and zero-waste manufacturing techniques. In addition, South Korea's cultural expansion in the form of K-fashion and entertainment will increasingly globalize local brands, creating opportunities for cross-border expansion.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 (Projected) |

|---|---|

| Post-COVID, there was a massive change in consumer behavior because the pandemic compelled people to work from home, signif icantly lowering the demand for footwear. Comfort was the driving factor in shopping, and customers went for sneakers, slides, flats, and comfortable shoes. | The industry will witness a growing demand for shoes that measure up on both comfort and looks in the next decade, as hybrid working environments and a fit life become permanent features. |

| Since 2020, e-commerce has rapidly established itself as the leading sales platform, with accelerated online buying during the pandemic lock-downs. Footwear brands took advantage of the increased focus on digital platforms by introducing virtual try-ons and leveraging social media and influencer marketing to further expand their markets. | Between 2025 and 2035, the footwear sector will persist in its digitization but further concentrate on mixing physical and virtual retail environments. Brands will spend money on omnichannel approaches where the in-store and online customer experience is harmoniously integrated. |

| More consumers started to prioritize ecologically friendly and ethically sourced products, particularly as issues surrounding climate change and the effects of fast fashion on the environment escalated. | Footwear brands will use circular economy models, with designs for reuse and recycling, minimizing waste across the product life cycle. |

| As individuals spent more time at home and concentrated on health and fitness during the pandemic, demand for functional footwear-especially in categories like athleisure and outdoor activity-exploded. | From 2025 and beyond, fashion and function will be further indistinguishable from each other, with technology becoming a core element of footwear. Footwear will not only be comfortable and fashionable but also implanted with intelligent features like health monitoring (e.g., step tracking, posture tracking) and performance-enhancing technologies. |

The Korean women's footwear industry is exposed to various risks that would affect growth and stability in the short and long term. Economic recessions present one of the biggest risks since spending by consumers on discretionary products such as fashion and footwear goes down during times of economic downturn. If a global recession or inflation hits South Korea, consumers will scale back on discretionary spending, which means less demand for luxury brands or more expensive footwear.

This is especially relevant since many consumers in South Korea are increasingly price-conscious and could opt for lower-priced, mass-market footwear instead of high-end options. Additionally, changes in economic policy or trade law may disturb the supply of important materials, particularly if the industry is based on imports or international supply chains, introducing further uncertainty.

Another major risk is supply chain disruptions. The COVID-19 pandemic exposed weaknesses in global supply chains, and though the industry has started to recover, the footwear industry remains vulnerable to possible delays, price fluctuations, and supply shortages-especially for such inputs as leather, synthetic materials, and rubber.

The use of foreign manufacturing, particularly in countries with unstable economies or geopolitical tensions, would only complicate sourcing further and result in price increases or product shortages.

Casual shoes are widely sold in Korea owing to a mixture of functionality, fashion, and the country's hectic lifestyle. There is a powerful urban culture in Korea, with a large population residing in bustling cities such as Seoul, where walking and commuting are necessary parts of life.

Casual shoes, including sneakers, slip-ons, and flats, provide comfort and convenience, which is perfect for women who require shoes that can withstand hours of walking or standing. Such practicality is the reason why casual shoes are a wardrobe staple.

In addition, casual shoes have become an integral part of South Korean fashion. South Korea is famous for its fashion-forward culture, where style and comfort are usually blended together. Women's casual shoes are made available in many shades, colors, patterns, and designs that can make them functional as well as fashionable.

In Korea, 3rd party online sales is the dominant sales channel for women's shoes, and there are good reasons why. The nation has an extremely advanced digital infrastructure, and online purchasing is well ingrained in the everyday lives of Koreans. The ease of shopping at home, combined with rapid delivery systems, has driven the internet platform as a preferred destination for most consumers.

Online stores such as Coupang, Gmarket, and 11st, and foreign websites such as Amazon, are commonly utilized in buying shoes. These websites have a variety of brands, types, and prices, which can be appealing for customers seeking assortment and convenience.

Special discounts, promotions, and exclusive offers are frequently available on online sale platforms, further encouraging consumers to buy from the comfort of home instead of going to physical stores. The convenience of side-by-side price comparisons and reviews from fellow consumers is another feature that improves the attractiveness of online shopping for shoes.

The women's footwear industry in Korea is intensely competitive with both international footwear majors and domestic players raising their stakes. The competition is driven by the escalating desire for fashion, comfort, and high-performance footwear. Brands are emphasizing innovation, design, and addressing the changing demands of Korean consumers who need both form and function from their footwear.

The competition in the industry has been intense from both the premium and economical segments, where success depends on brand recognition, innovative designs, and the capacity to be able to meet the varied tastes of Korean consumers.

YUUL YIE has established a niche in the Korean industry with its high-end, fashion-oriented designs. The brand is recognized for its upscale yet contemporary style, and it is favored by fashion-forward women seeking elegant footwear. Its concentration on craftsmanship and distinctive designs has enabled it to gain a loyal base in Korea's high-end footwear industry.

SOVO is yet another domestic brand that has picked up a lot of momentum in Korea. With its fashionable and wearable shoes, SOVO appeals to a younger generation that is concerned with both style and comfort. The brand has managed to balance trendy aspects with wearable designs, which has made it a hit among women who seek stylish and wearable shoes.

VANILLASHU provides fashionable and budget-friendly options, making it popular with the price-sensitive group of the Korean industry. The brand aims to sell fashionable but affordable shoes, attractive to women who look for stylish footwear without paying a premium. VANILLASHU's broad appeal lies in its capacity to deliver high-fashion aesthetics at an economical price.

PINK ELEPHANT is another brand concentrated on providing a broad variety of women's shoes in Korea. The brand is famous for offering various styles to fulfill casual as well as formal purposes. With its creative, playful designs and reasonable price tag, PINK ELEPHANT has been successful in attracting younger shoppers in South Korea.

Nike Inc., Adidas AG, and Puma SE have a strong hold in the Korean industry in the activewear and sports footwear category. These multinational players are extremely popular as they have strong brand names worldwide and increasing athleisure and sporty footwear popularity in Korean fashion.

Their wide ranges of products, innovative product offerings, and endorsements with celebrities and influencers establish them as top contenders among consumers seeking performance and style. Nike, specifically, has a strong presence in the Korean industry, emphasizing both athletic performance and streetwear fashionability.

SKECHERS is another major name in the Korean industry, which provides stylish yet comfortable shoes to a broad-based demographic. As a brand associated with cushioning in its shoes and sensible design, SKECHERS has established a formidable presence in casual and comfort shoes. Its focus on offering premium-quality footwear within affordable prices has earned it huge popularity among several Korean consumers.

Under Armour Inc. has increased its industry share in Korea through its emphasis on performance footwear. The brand's concentration on cutting-edge technology and high-performance footwear for sportsmen has struck a chord with Korea's active and health-conscious populace. Under Armour's effective branding and innovation focus have helped it become more prominent in the industry.

Wolverine World Wide has covered the Korean industry through its extensive portfolio of footwear brands, such as Merrell and Hush Puppies. Both these brands are highly rated for their long-lasting, comfortable, and fashionable designs. The capability of Wolverine World Wide to offer different types of footwear for different occasions has enabled it to gain a solid presence in the Korean industry, targeting customers who value durability and comfort.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| YUUL YIE | 7-10% |

| SOVO | 5-7% |

| VANILLASHU | 4-6% |

| PINK ELEPHANT | 3-5% |

| Nike Inc. | 15-18% |

| Adidas AG | 12-15% |

| Puma SE | 8-10% |

| SKECHERS | 10-12% |

| Under Armour Inc. | 6-8% |

| Wolverine World Wide | 5-7% |

| Other Key Players | 10-12% |

Nike Inc. holds the top industry position in Korea with a share of 15-18% due to strong brand recall, collaborations with homegrown influencers, and a range of high-performing and lifestyle shoes. Adidas AG is placed second with 12-15% industry share, riding on the popularity wave of athleisure and streetwear sport-fashion in Korea. Puma SE also holds a strong share of 8-10%, mostly because of its active lifestyle shoes that appeal to athletic as well as fashion buyers.

SKECHERS is well-established with a 10-12% industry share, with a balance of comfort and fashion that appeals to Korea's varied demographics. Under Armour Inc., with a 6-8% share, targets performance-oriented footwear that appeals to the sporty and health-conscious segment. Wolverine World Wide enjoys a 5-7% industry share, supported by its rugged and comfortable brands such as Merrell and Hush Puppies, which target the more functional segments of the industry.

On the local brand front, YUUL YIE has grown to be a luxury footwear brand with a 7-10% industry share, whereas SOVO and VANILLASHU find favour among mid-range consumers, holding 5-7% and 4-6% industry share, respectively. PINK ELEPHANT, which concentrates on more fun and fashionable designs, controls a 3-5% industry share.

With respect to product type, the industry is divided into casual shoes, boots, heels & pumps, sandals, flip flops & slippers, sports shoes, and safety shoes.

In terms of material, the industry is classified into rubber, leather, plastic, velvet, textiles, and others.

By sales channel, the industry is divided into hypermarkets/supermarkets, specialty stores, multi-brand stores, direct sales, 3rd party online stores, and others.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 5.4 billion in 2025.

The industry is projected to witness USD 7.9 billion by 2035.

The industry is slated to grow at 3.8% CAGR during the study period.

Casual shoes are widely sold.

Leading companies include YUUL YIE, SOVO, VANILLASHU, PINK ELEPHANT, Nike Inc., Adidas AG, Puma SE, SKECHERS, Under Armour Inc., and Wolverine World Wide.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Pairs) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 15: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: North Jeolla Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 17: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 18: North Jeolla Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 21: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: South Jeolla Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 23: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 24: South Jeolla Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 25: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: South Jeolla Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 27: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Jeju Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 29: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 30: Jeju Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 31: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 32: Jeju Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 33: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 35: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Material, 2019 to 2034

Table 37: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 38: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Pairs) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 26: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 27: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 28: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 29: South Gyeongsang Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 30: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 43: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 44: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 45: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 46: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 47: North Jeolla Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 48: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 49: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 50: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 51: North Jeolla Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 52: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 53: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 54: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 61: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 63: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 64: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 65: South Jeolla Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 66: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 67: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 68: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 69: South Jeolla Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 70: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 71: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 72: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 73: South Jeolla Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 74: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 75: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 76: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 77: South Jeolla Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 78: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: Jeju Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 81: Jeju Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 82: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 83: Jeju Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 84: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 85: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 86: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 87: Jeju Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 88: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 89: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 90: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 91: Jeju Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 92: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 93: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 94: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 95: Jeju Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 96: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 97: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 98: Rest of Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 99: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 100: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 102: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 105: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Material, 2019 to 2034

Figure 106: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 107: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 108: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 109: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 110: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 111: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 112: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 113: Rest of Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 114: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA