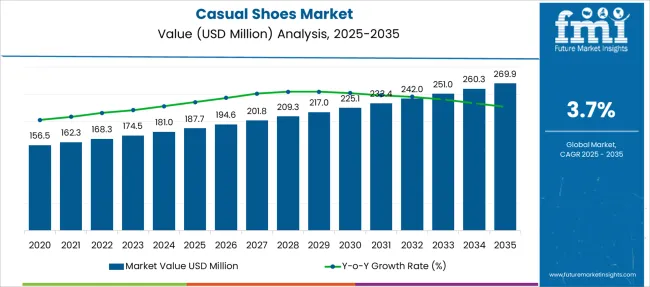

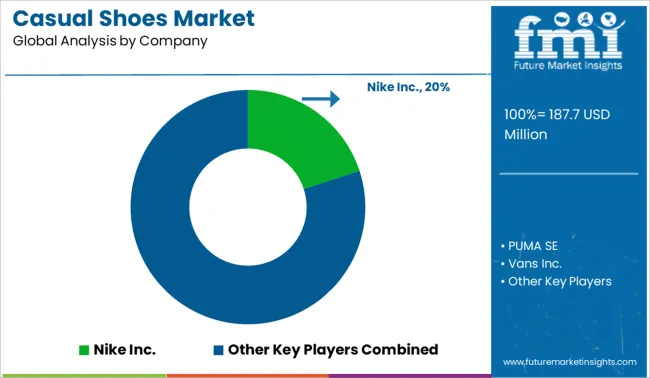

The Casual Shoes Market is estimated to be valued at USD 187.7 million in 2025 and is projected to reach USD 269.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Casual Shoes Market Estimated Value in (2025 E) | USD 187.7 million |

| Casual Shoes Market Forecast Value in (2035 F) | USD 269.9 million |

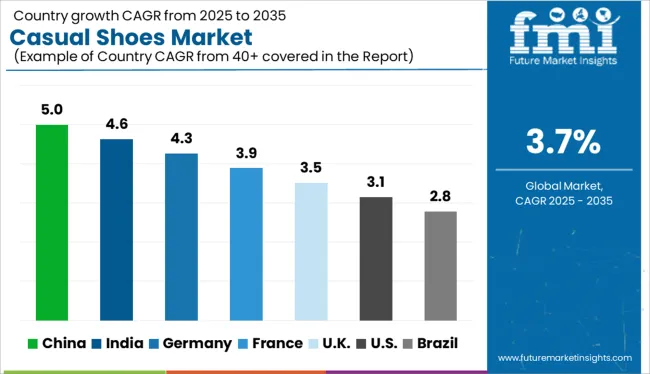

| Forecast CAGR (2025 to 2035) | 3.7% |

The casual shoes market is experiencing consistent growth, supported by the rising influence of lifestyle fashion, urbanization, and changing consumer behavior globally. Demand has been steadily increasing due to a greater emphasis on comfort, style versatility, and everyday utility among working professionals and younger demographics. Industry developments indicate that brands are investing in sustainable materials, customization options, and direct-to-consumer retail strategies to cater to evolving preferences.

Social media trends and influencer marketing have also contributed to consumer awareness and purchase behavior, particularly in emerging markets. Future growth is expected to be shaped by innovation in lightweight materials, foot health-conscious designs, and the expansion of omnichannel retail platforms.

Manufacturers are further aligning their offerings with lifestyle-centric consumption patterns, driving repeat purchases and higher brand loyalty As companies continue to focus on style-function fusion and environmentally responsible production, the casual shoes market is set to expand its global footprint across all age groups and income segments.

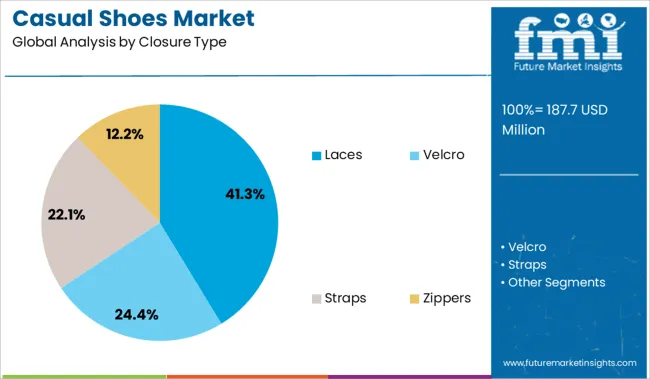

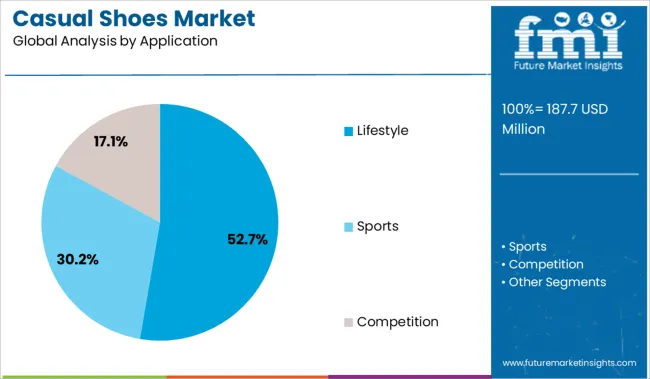

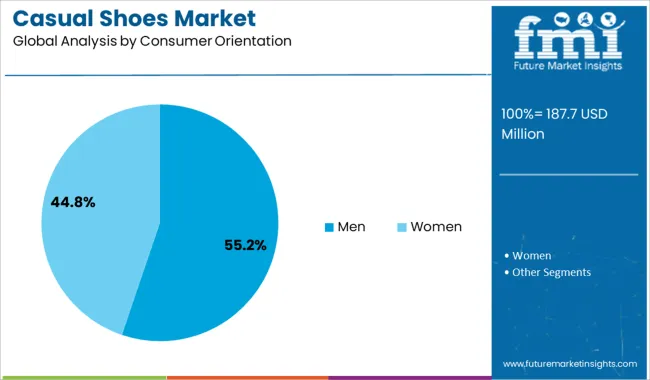

The market is segmented by Closure Type, Application, Consumer Orientation, and Sales Channel and region. By Closure Type, the market is divided into Laces, Velcro, Straps, and Zippers. In terms of Application, the market is classified into Lifestyle, Sports, and Competition. Based on Consumer Orientation, the market is segmented into Men and Women. By Sales Channel, the market is divided into Online Retailers, Multi-brand Stores, Independent Small Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The laces segment is projected to account for 41.3% of the casual shoes market revenue share in 2025, positioning it as the leading closure type. Its dominance has been driven by its ability to offer adjustable fit, enhanced support, and aesthetic appeal across a wide range of shoe designs. Brands have emphasized lace-up designs in both traditional and modern collections to cater to comfort, customizability, and trend relevance.

Industry sources indicate that lace closures are preferred for their adaptability across gender, age, and activity categories. Their use in both casual and semi-formal styles has expanded their appeal, especially among consumers seeking both fashion and function.

Manufacturing flexibility and cost efficiency have further contributed to the mass-market availability of lace-up shoes As demand for versatile footwear rises, the lace closure design continues to meet expectations for fit precision and visual appeal, securing its dominant position in the closure type segment.

The lifestyle application segment is anticipated to lead the market with a 52.7% revenue share in 2025. This segment’s growth has been supported by the increasing popularity of casual wear in daily routines, workplace settings, and social environments. A shift in consumer mindset toward fashion-forward yet comfort-focused footwear has been widely observed, particularly in urban areas.

Brands have responded by expanding their lifestyle shoe portfolios with diverse materials, color options, and ergonomic designs that cater to personal expression and everyday usability. Product launches and marketing campaigns have further emphasized style relevance, influencing purchasing behavior among young adults and working professionals.

The integration of lifestyle footwear into broader fashion collections has reinforced its visibility in both online and offline channels As consumers prioritize both form and function in their daily wardrobe, lifestyle shoes continue to hold a dominant share, driven by consistent demand across regions and age groups.

The men segment is expected to contribute 55.2% of the casual shoes market revenue share in 2025, maintaining its position as the largest consumer orientation category. This growth is being supported by increased purchasing power, brand consciousness, and a growing acceptance of fashion as a lifestyle identity among male consumers. The availability of casual shoes in multiple silhouettes, including sneakers, loafers, and derby styles, has encouraged men to expand their footwear collection beyond formal wear.

Market trends show that men are increasingly engaging with digital and retail fashion platforms, driving interest in new product drops, collaborations, and limited-edition releases. Brands have also focused on inclusive sizing, comfort-first technologies, and minimalist aesthetics to appeal to the male demographic.

The rise in remote and hybrid work culture has further blurred the line between casual and professional attire, reinforcing the need for versatile footwear These evolving preferences and increased market participation have led to the segment’s continued dominance in 2025.

Casual shoes are less formal than other styles of shoes. They may be built of less costly materials and have a simpler style. Casual shoes are frequently worn for activities such as strolling, running, and participating in sports. They can also be worn to more formal occasions when a less formal appearance is desired. They are frequently worn with jeans or other casual attire. Casual shoes are available in a range of styles, such as sneakers, loafers, and slip-on.

Casual shoes have the advantage of providing excellent foot support, and ladies can wear them while jogging or participating in other high-impact activities. Another benefit of casual shoes is their versatility. They may be used for walking exercise as well as on casual days at work.

Most casual shoes cover the majority of the foot providing extra safety and support. They are composed of a permeable material known as mesh. This substance absorbs moisture from the feet, preventing them from stinking and developing fungal infections.

Increasing per capita income is fuelling the casual shoes industry. People may now purchase exquisite and expensive brands of casual shoes due to increased income and financial independence. This element is generating a profitable market for casual shoes. Rapid urbanization and improving economic conditions in emerging nations, notably in Africa, Asia, and the Middle East, are paving the way for the global casual shoes market to thrive.

The introduction of fresh designs, ideas, and concepts into the casual shoes market is also propelling its global expansion. Another element influencing the casual shoe industry is the growing popularity of eco-friendly footwear. Sneakers are an excellent example of eco-friendly casual wear, and vegan versions are available on request. However, several factors are impeding the growth of the global casual shoes market.

The profitability in the casual shoes market is decreasing owing to higher manufacturing costs, and this aspect is the most significant impediment to the expansion of the global casual shoes market. Another factor limiting market expansion is fierce rivalry among footwear producers. While the presence of counterfeit brands endangers the reputation of key manufacturers and hampers the market.

Additionally, casual shoes are worn in informal settings and cannot be worn with professional or traditional clothes, creating a barrier. Other styles of footwear, such as formal, traditional, and sandals, are also popular with customers. Furthermore, fashion trends change often, all of which are expected to stymie the expansion of the global casual shoes market.

Carlos Santana Relaunches His Fashion Footwear Line

Carlos is a women's fashion footwear company founded by the Rock and Roll Hall of Fame inductee Carlos Santana, will be relaunched next month in collaboration with original brand stewards Gary Rich and Rick Gelber. They have launched the Jubilation LLC partnership, which will administer the brand. Santana's namesake shoe label began in 2001, under license with St. Louis-based footwear manufacturer Brown Shoe Co. (now Caleres). The collection quickly became a smash hit, selling in department shops and big retail chains across the USA and beyond. However, it was closed in 2020 after a nearly two-decade run after Caleres made various adjustments to its brand portfolio.

Regional companies are collaborating with international players to enhance their reach

Biion makes EVA shoes that are lightweight, comfy, and multifunctional. The shoes are ventilated with little BioVents and feature anti-microbial characteristics, making them suitable for professionals who must be on their feet for lengthy periods of time. Their HEXTRA-GRIP traction outsoles are exceptionally low-profile, providing the greatest connection to the ground with the perfect balance.

Metro Brands Limited (MBL), one of India's top footwear retailer specialists, has formed a strategic alliance with the Canadian footwear firm Biion to introduce their varied range to the nation. The collection of premium footwear mixes technology and function to create stylish shoes for the demand of high performance from the population's lifestyle.

Metro Brands will especially showcase Biion footwear through their shops of Mochi and Metro which utilize top strategies to attract customers, as well as the online shopping site that caters to this highly narrow consumer base, as part of this launch.

Made-in-China brands are gaining popularity in China

Regardless of how long Adidas and Nike have been around, their reign in Chinese shoe culture may be going to an end. The market capitalization of the top players shows how swiftly the Made in China brand has developed.

Furthermore, challenges with the shoe industry's supply chain caused by the epidemic and Chinese regulations are disrupting the long-established global balance. Without a doubt, China's development policies are accelerating. It's almost unbelievable to imagine that over 50 years have gone between Adidas and Nike, and the two Chinese competitors Li-Ning and Anta.

Lace-up shoes are mainly preferred by consumers

The most common form of footwear is lace-up shoes. They are held together by the lace that is threaded through lugs or eyelets, as the name indicates. Because of the fundamental method of tying, this sort of shoe is favored by the majority of buyers. People like to wear their laces in various patterns through eyelets. As a result, lace-up shoes are the most popular among consumers.

Men tend to opt for casual shoes for daily use

The market was headed by the man casual shoe application category, which accounted for more than half of the entire share. Male adults have a larger demand than female adults due to their higher engagement rate in sports and physical activities. Furthermore, males are more likely to participate in outdoor activities such as hiking, bicycling, camping, and so on, which contributes to the demand for comfortable shoes with adequate support and grip.

Consumers favor online stores the most.

E-commerce platforms have risen in popularity in recent years, allowing buyers to choose from a wide range of shoes for casual use based on their preferences and desires. Customers choose their shoes based on the activities they want to participate in. Furthermore, sneaker lovers are very interested in owning the most trending and latest pair of sneakers, which are initially made available through online shops by the manufacturers on their official websites.

To attract more clients, top companies in the casual shoes market are focusing on and implementing unique techniques. While regional enterprises collaborate with important actors to meet the needs of customers.

For Instance:

The Nike Sportswear team unveiled one of their newest women's options, the Dunk Low Disrupt, to the globe. This newest version, a modernized spin on one of the Swoosh's legendary basketball-turned-lifestyle styles, definitely retains enough heritage-inspired DNA to recognize its muse.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & Middle East and Africa(MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, South Africa, Northern Africa GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand. |

| Key Segments Covered | Closure Type, Application, Consumer Orientation, Sales Channel, and Region. |

| Key Companies Profiled | Adidas Group; Nike Inc.; New Balance; ASICS; PUMA SE; Under Armour, Inc.; Li Ning Company Ltd.; ECCO; China Dongxiang (Group) Co., Ltd.; 361 Degrees International Limited.; Vans; Converse |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global casual shoes market is estimated to be valued at USD 187.7 million in 2025.

The market size for the casual shoes market is projected to reach USD 269.9 million by 2035.

The casual shoes market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in casual shoes market are laces, velcro, straps and zippers.

In terms of application, lifestyle segment to command 52.7% share in the casual shoes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Casual AI Market Insights – Growth & Forecast 2024-2034

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Water Shoes Market Trends – Demand & Forecast 2025 to 2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Trail Shoes Market

Tennis Shoes Market Insights - Demand & Growth 2025 to 2035

Custom Shoes Market Report – Growth & Industry Trends 2024-2034

Skating Shoes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Running Shoes Market Growth - Trends & Demand Forecast 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Light Up Shoes Market Analysis – Growth & Forecast 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Volleyball Shoes Market Analysis - Growth & Forecast 2025 to 2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA