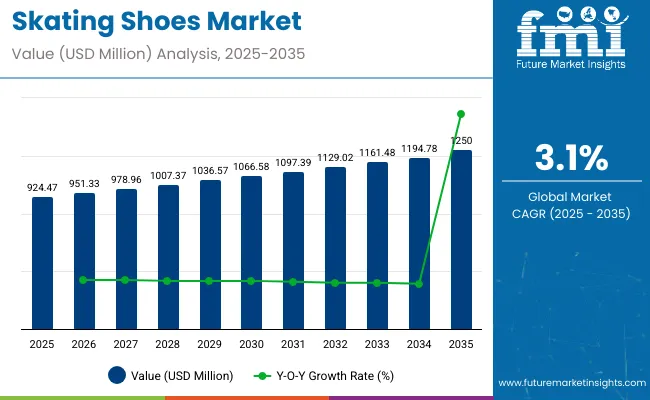

The global skating shoes market is projected to grow steadily over the next decade, driven by rising interest in skating as a recreational and professional sport. In 2025, the market is valued at USD 924.47 million, and it is forecast to reach USD 1.25 billion by 2035, expanding at a CAGR of 3.1% from 2025 to 2035.

Key growth drivers include increasing sports participation among youth, lifestyle shifts favoring fitness and outdoor activities, and significant traction from the street culture and Olympic recognition of skateboarding. In urban and semi-urban settings, community skate parks, school-level competitions, and sports funding by governments have fueled a strong foundation for the market.

In 2024, major brands like Nike, Vans, and Adidas introduced specialized skateboarding shoes designed for both professionals and beginners. These shoes incorporated innovations such as breathable materials, shock-absorbing soles, and sustainable components. For instance, Nike's "Day One" skate shoe was crafted to provide children with a stable and supportive experience, utilizing mesh materials for enhanced ventilation and comfort. To enhance brand stickiness, leading manufacturers are now leveraging limited-edition drops and NFT-linked shoe designs to attract Gen Z skaters and collectors.

In emerging economies, rising disposable incomes and global access to youth media are boosting aspirational buying behavior. The availability of unisex and customizable skate shoes is further expanding consumer reach, particularly among women and non-binary users. The market is also witnessing the rise of 3D-printed soles and modular grip technologies, enabling performance personalization. This convergence of technology, design, and street identity is expected to reinforce demand across both performance and lifestyle categories through 2035.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 924.47 million |

| Industry Value (2035F) | USD 1.25 billion |

| CAGR (2025 to 2035) | 3.1% |

Per capita spending on skating shoes varies widely across regions due to differences in sports culture, income levels, and availability of specialized footwear. Skating shoes are popular among youth and sports enthusiasts for activities such as roller skating, inline skating, and skateboarding. The demand is influenced by lifestyle trends, growing interest in recreational sports, and urban infrastructure supporting skating activities.

Skating has evolved into a globally recognized recreational and competitive activity, though its popularity varies significantly by region. While North America and parts of Europe boast mature skating cultures, other regions like Asia-Pacific and Latin America are witnessing rapid growth fueled by youth interest and social influence.

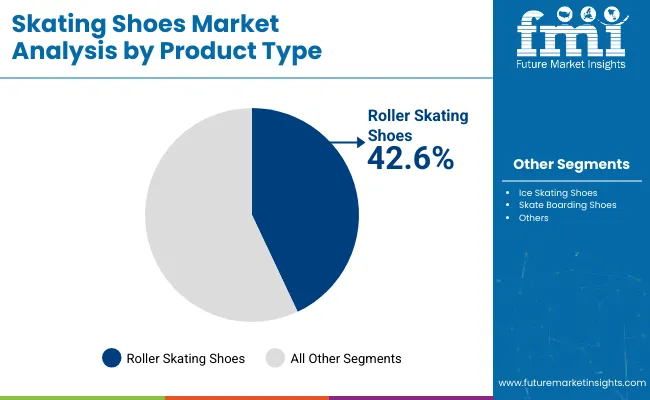

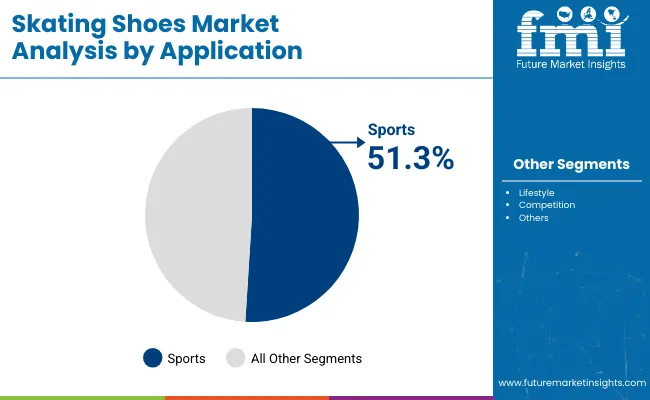

Roller skating shoes dominate product demand due to their popularity in recreational and urban environments. The sports segment is growing rapidly, fueled by professional competitions and rising youth participation. Both segments are supported by influencer culture, custom product innovation, and rising engagement with skating as a fashion-forward fitness activity among Gen Z and Millennials.

Roller skating shoes dominate the market with 42.6% share due to their wide appeal among both recreational and fitness users. These shoes are commonly used in indoor skating rinks, parks, and community centers. The simplicity and stability of four-wheeled roller skates attract beginners and casual skaters. For example, in the United States, school physical education programs often include roller skating activities.

Ice skating shoes follow, especially popular in colder regions such as Canada and Northern Europe, where winter sports are part of the culture. They are used in figure skating and ice hockey, making them essential in professional training academies. Skateboarding shoes hold a steady share, preferred by youth engaged in street sports. These shoes are designed for grip and ankle support. For instance, in Brazil and Japan, skateboarding has surged in popularity after Olympic inclusion.

The others category includes inline skates and hybrid models used for specialized activities such as roller derby and slalom skating. The diversity in skating disciplines is expected to drive product innovation and market penetration.

Sports applications account for the largest share at 51.3%, as skating is widely recognized for its health and fitness benefits. Roller skating and ice skating are included in school curriculums and local athletic programs. Competitive sports like ice hockey and figure skating also require high-performance gear.

For example, in Germany, government support for winter sports promotes year-round demand for quality skating shoes. Lifestyle use is growing steadily. Skating has become a part of urban recreation and fashion expression. Cities like Paris and Seoul have introduced skating lanes and parks, making skating a popular weekend activity.

Competition use is smaller but essential. Professional events, including World Skating Championships and Olympic qualifiers, generate demand for premium performance shoes. In countries like South Korea and Russia, competition-grade shoes are customized for speed, flexibility, and durability.

Global trends in wellness and alternative fitness continue to expand the consumer base. Lifestyle and competition categories are expected to grow faster as more youth take up skating for leisure and sports. This opens up new marketing avenues for brands focusing on both performance and style.

Skating shoe demand is expanding as consumers pursue affordable, flexible fitness routines. E-commerce is amplifying access to high-quality products across regions. However, premium product costs and brand saturation challenge market entry and profit margins. The need for sustainable designs, quick trend adaptation, and athlete-focused marketing is reshaping competitive strategies across all market tiers.

Skating has emerged as a low-cost, cardiovascular fitness activity suitable for a broad age range. Its physical benefits-such as improved balance, strength, and aerobic endurance-align with the global trend toward active lifestyles. Cities across the United States, Europe, and Asia-Pacific are witnessing higher footfall in public skating areas, facilitated by community parks and skating lanes.

In response, brands are producing cross-trainers that blur the lines between casual and fitness footwear. These hybrid shoes often include enhanced sole shock absorption and ventilated toe caps for sustained use. The fitness appeal, when combined with fun and sociability, makes skating an accessible fitness solution, especially for Gen Z.

Advanced skating shoes equipped with premium soles, ankle stabilizers, and cushioning technologies often carry retail prices exceeding USD 100, creating affordability issues in countries like India, Brazil, and Indonesia. While elite athletes and affluent consumers can afford these, mass-market penetration remains restricted.

Domestic manufacturers in cost-sensitive regions struggle to offer similar functionality without inflating production costs. Consequently, high-quality performance skating shoes remain a luxury segment. Market penetration will depend heavily on economies of scale, outsourcing, or simplified product designs that maintain durability without premium pricing.

eCommerce is acting as a great equalizer in the global skating shoes market. Customers in smaller towns and emerging economies now access top-tier products without relying on brick-and-mortar sports stores. Personalized shopping experiences, social proof through reviews, and influencer-led campaigns have all contributed to increased conversion rates.

Brands are shifting toward direct-to-consumer (DTC) strategies to capture more margin and control customer engagement. Smaller brands such as Cariuma and Woodland have built strong identities via online-only models, avoiding traditional retail overheads. As digital platforms continue to expand, geographic reach and product availability are expected to grow in tandem.

With skating shoes straddling both sport and fashion, product life cycles are getting shorter. Consumer allegiance is often influenced more by influencer campaigns or seasonal trends than technical specifications. This fluidity increases R&D and marketing expenditure, particularly for Tier 1 brands trying to maintain relevance.

Fast-fashion players and knock-offs add pressure on pricing, further complicating profitability. Companies must now manage quick product rollouts, trend forecasting, and limited editions-all while ensuring inventory control and brand value. Strategic alliances with athletes, creators, and sustainability campaigns are key to managing this volatility.

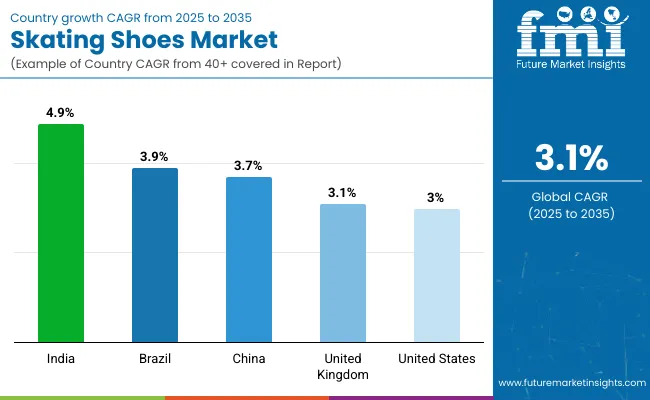

The skating shoes market study identifies top trends across 30+ countries. Skating footwear brands operating in top-performing nations can leverage key strategies based on material innovation, regional sports popularity, youth adoption, and climate conditions influencing outdoor activity trends. India emerges as the fastest-growing skating shoes market, followed by China. The chart below highlights the growth prospects of the leading five skating shoe markets during the forecast period.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3% |

| United Kingdom | 3.1% |

| China | 3.7% |

| India | 4.9% |

| Brazil | 3.9% |

The United States skating shoes market is set to expand at a CAGR of 3% between 2025 and 2035. Growth stems from a mature sporting culture, strong retail distribution, and broad participation across figure skating, roller sports, and inline skating. National skating associations, recreational rinks, and school-level programs ensure continuous youth involvement. Brands like Riedell, Jackson Ultima, and Rollerblade lead in material innovation, offering enhanced ankle support, cushioned linings, and eco-conscious production. Skating is popular among both performance-focused users and lifestyle skaters.

High internet penetration supports online retail and customizable product trends. Recreational and professional skaters alike seek durable, technologically advanced footwear. Continued investment in product R&D, including lightweight composites and impact-resistant wheels, meets these evolving demands. Skating shoes in the US benefit from cross-category usage, including fitness routines and recreational sports. With its established market base and consistent urban-suburban demand, the United States retains its status as the largest market by share in the global skating footwear segment.

The United Kingdom skating shoes market is projected to grow at a CAGR of 3.1%, supported by the popularity of lifestyle sports and growing interest in outdoor wellness trends. Urban centers like London, Bristol, and Manchester feature public skating-friendly spaces, enabling growth in roller skating and inline skating. A younger demographic drawn to retro styles and sustainability drives adoption. Brands such as Rio Roller, Power slide, and SFR offer collections aligned with fashion-forward and sustainable practices.

The popularity of indoor rinks, roller discos, and community fitness programs strengthens year-round demand. Government-led sports initiatives encourage youth participation, while private sports clubs and after-school programs increase accessibility. Skating is also emerging as a form of urban mobility and group fitness.

Consumers prioritize products that blend comfort, durability, and custom aesthetics. Distribution via e-commerce and specialty stores expands market penetration. Local innovation in design and ergonomics, along with rising demand for clean-label performance gear, ensures that the UK market remains agile. The sector’s alignment with recreational fitness and conscious consumerism ensures continued momentum through 2035.

The China skating shoes market is forecast to grow at a CAGR of 3.7% from 2025 to 2035, driven by rapid urbanization, increased youth sports engagement, and state support post-Winter Olympics. Skating is rising as a favored activity in cities such as Shanghai, Beijing, and Chengdu, where public infrastructure supports recreational and competitive skating. Government programs promoting sports diversification and fitness culture among youth elevate demand.

Local manufacturers like Xiamen Good Roller and Decathlon China offer cost-effective, high-performance products, while global brands expand through platforms like JD.com and Tmall. Consumer preferences favor shoes with breathable fabrics, reinforced support systems, and smart tracking features. Indoor skating arenas and school partnerships introduce skating to younger age groups. Integration of smart technology and wearable safety gear into skating shoes enhances user experience.

China's dominance in production scale and its expanding middle-class market make it a prime growth zone. Policies promoting physical education, combined with fitness trends in metropolitan zones, ensure China’s continued ascent as a critical market for global skating footwear manufacturers.

The skating shoes market is set to achieve the highest growth rate globally at a CAGR of 4.9% between 2025 and 2035. Growth is propelled by expanding youth engagement, improving urban infrastructure, and growing emphasis on fitness in education. Cities like Delhi, Mumbai, and Bangalore see increasing popularity in inline, roller, and speed skating. The introduction of skating academies, integration of skating in school curriculums, and local competitions contribute to early adoption. Domestic brands such as Nivia, Cosco, and Vector X produce affordable, durable footwear catering to Indian terrain.

Skating is being positioned as both a sporting discipline and fitness lifestyle activity. International brands are expanding through online platforms and sports retailers, targeting aspirational middle-income families. Key product trends include ventilated padding, shock-absorbing soles, and vibrant aesthetic designs. Skating shoes are also featured in fitness-based campaigns led by schools and youth organizations. India’s digital retail expansion, government promotion of physical activity, and the appeal of skating as a low-cost fitness sport consolidate its status as the top growth market in the forecast period.

The Brazil skating shoes market is projected to expand at a CAGR of 3.9% from 2025 to 2035. Brazil’s year-round warm climate, active urban youth culture, and growing street sports movement support this momentum. Cities like São Paulo, Brasília, and Rio de Janeiro offer extensive public skating zones and beachfront promenades ideal for recreational skating. Social media platforms drive skating’s popularity as a cultural and athletic trend, with influencers and events spotlighting inline and roller skating.

Local manufacturers and distributors focus on affordable pricing, making skating accessible across income segments. International brands gain visibility through e-commerce and sports chains. Government-backed recreational programs and NGO efforts expand community engagement. Consumers favor vibrant designs, comfortable fit, and terrain-resilient wheels. Skating’s rise as a family-friendly and youth-driven sport ensures sustained interest.

Skating shoes are increasingly sold via bundled sports kits and seasonal promotions, especially in fitness and back-to-school campaigns. Brazil’s unique combination of outdoor lifestyle, urban sports culture, and youthful demographics positions it as a vital player in the future of global skating footwear consumption.

The skating shoes market comprises dominant global brands such as Nike, Adidas, Vans, PUMA, Under Armour, ASICS, New Balance, Reebok, Converse, and luxury label Louis Vuitton alongside niche innovators like CARIUMA, Woodland, Etnies, DC Shoes, Lakai, Rollerblade, Roces, K2 Sports, Powerslide, Riedell, and Sure‑Grip. Leading firms leverage strong branding, athlete sponsorships, urban culture influences, and innovative materials to capture market share.

Emerging brands focus on sustainability, personalization, regional appeal, or performance engineering. Strategic initiatives include tech‑infused sizing tools, eco‑friendly materials, influencer partnerships, community engagement, and direct online retail to enhance visibility and loyalty.

The skating shoes industry features a competitive landscape composed of Tier 1 multinationals, Tier 2 performance brands, and Tier 3 value or niche players. Tier 1 companies like Nike Inc., Adidas Group, Vans, and PUMA SE dominate through global retail networks, elite sponsorships, and continual R&D investment.

Tier 2 companies such as ASICS, New Balance, and Under Armour focus on specialized performance and sport-specific innovations. Tier 3 brands like CARIUMA and Woodland are focused on sustainability, affordability, or local appeal. Barriers to entry include branding costs, material sourcing, and marketing agility.

While consolidation is limited, partnerships are common-such as athlete collaborations or material licensing deals. Suppliers who align with youth trends, eco-consciousness, and digital-first strategies are poised for growth in the coming decade.

In 2025, CARIUMA launched “NAIOCA Pro,” a sustainable skate shoe made from sugarcane EVA and recycled canvas. In 2024, Vans deployed AI-based sizing and customization tools for mobile users. In 2023, Nike CEO John Donahoe stated, “The intersection of sport, culture, and sustainability is where our next decade of product innovation lies,” reflecting a strategic shift toward tech and eco-led design.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 924.47 million |

| Projected Market Size (2035) | USD 1.25 billion |

| CAGR (2025 to 2035) | 3.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million /billion for value and million units for volume |

| Product Types Analyzed | Roller Skating Shoes, Ice Skating Shoes, Skate Boarding Shoes, Others |

| Applications Covered | Sports, Lifestyle, Competition |

| Closure Types Covered | Laces, Velcro, Straps, Zippers |

| Consumer Orientation Covered | Men, Women |

| Sales Channels Covered | Multi-brand Stores, Independent Small Stores, Online Retailers, Other Sales Channel |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, China, India, Brazil |

| Key Players Influencing Market | Nike Inc., Adidas Group, Vans, PUMA SE, Under Armour, Inc., Louis Vuitton, ASICS, New Balance, Woodland, CARIUMA |

| Additional Attributes | Dollar sales by segment, Olympic skateboarding impact, e-commerce penetration, youth fitness trends, price competitiveness, and regional distributor strategies |

By product type, the industry is segmented into roller skating shoes, ice skating shoes, skate boarding shoes, and others.

By application, the industry is segmented into sports, lifestyle, and competition.

By closure type, the industry is segmented into laces, velcro, straps, and zippers.

By consumer orientation, the industry is segmented into men and women.

By sales channel, the industry is segmented into multi-brand stores, independent small stores, online retailers, and other sales channel.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The industry is slated to reach USD 924.47 million in 2025.

The industry is predicted to reach a size of USD 1.25 billion by 2035.

Key companies include Nike Inc., Adidas Group, PUMA SE, Under Armour, Inc., and Vans.

Roller skating shoes are expected to lead due to versatility and recreational appeal.

Brands like CARIUMA are integrating eco-friendly materials and ethical production practices.

Table 1: Global Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 2: Global Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 3: Global Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 4: Global Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 5: Global Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 6: Global Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 7: Global Value Value (US$ Million) Forecast, By Closure Type, 2017 to 2032

Table 8: Global Value Volume (Million Units) Forecast, By Closure Type, 2017 to 2032

Table 9: Global Value Value (US$ Million) Forecast, By Sales Channel, 2017 to 2032

Table 10: Global Value Volume (Million Units) Forecast, By Sales Channel, 2017 to 2032

Table 11: North America Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 12: North America Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 13: North America Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 14: North America Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 15: North America Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 16: North America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 17: North America Value Value (US$ Million) Forecast, By Closure Type, 2017 to 2032

Table 18: North America Volume (Million Units) Forecast, By Closure Type, 2017 to 2032

Table 19: Latin America Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 20: Latin America Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 21: Latin America Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 22: Latin America Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 23: Latin America Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 24: Latin America Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 25: Latin America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 26: Europe Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 27: Europe Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 28: Europe Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 29: Europe Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 30: Europe Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 31: Europe America Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 32: Europe America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 33: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 34: East Asia Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 35: East Asia Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 36: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 37: East Asia Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 38: East Asia Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 39: East Asia Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 40: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 41: East Asia Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 42: East Asia Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 43: East Asia Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 44: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 45: East Asia Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 46: East Asia Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 47: East Asia Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 48: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 49: South Asia Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 50: South Asia Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 51: South Asia Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 52: South Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 53: South Asia Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 54: South Asia Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 55: South Asia America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 56: South Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 57: South Asia Value Volume (Million Units) Forecast, By Country, 2017 to 2032

Table 58: Oceania Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 59: Oceania Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 60: Oceania Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 61: Oceania Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 62: Oceania Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 63: Oceania Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 64: Oceania America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 65: Oceania Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 66: Oceania Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 67: Oceania Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 68: MEA Value Volume (Million Units) Forecast, By Country, 2017 to 2032

Table 69: MEA Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 70: MEA Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 71: MEA Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 72: MEA Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 73: MEA Value Value (US$ Million) Forecast, By Product Type, 2017 to 2032

Table 74: MEA Value Volume (Million Units) Forecast, By Product Type, 2017 to 2032

Table 75: MEA Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 76: MEA America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 77: Oceania Market Value (US$ Million) Forecast, By End-User, 2017 to 2032

Table 78: Oceania Market Volume (Million Units) Forecast, By End-User, 2017 to 2032

Table 79: Oceania Market Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 80: Oceania Market Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 81: Oceania Market Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 82: Oceania Market Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 83: Oceania Market Value (US$ Million) Forecast, By Sales Channel, 2017 to 2032

Table 84: Oceania Market Volume (Million Units) Forecast, By Sales Channel, 2017 to 2032

Table 85: MEA Market Value (US$ Million) Forecast, By Country, 2017 to 2032

Table 86: MEA Market Volume (Million Units) Forecast, By Country, 2017 to 2032

Table 87: MEA Market Value (US$ Million) Forecast, By Product Product Type, 2017 to 2032

Table 88: MEA Market Volume (Million Units) Forecast, By Product Product Type, 2017 to 2032

Table 89: MEA Market Value (US$ Million) Forecast, By End-User, 2017 to 2032

Table 90: MEA Market Volume (Million Units) Forecast, By End-User, 2017 to 2032

Table 91: MEA Market Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 92: MEA Market Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 93: MEA Market Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 94: MEA Market Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 95: MEA Market Value (US$ Million) Forecast, By Sales Channel, 2017 to 2032

Table 96: MEA Market Volume (Million Units) Forecast, By Sales Channel, 2017 to 2032

Figure 01: Global Market Value (US$ Million) and Volume (Million Units) Analysis, 2017 to 2021

Figure 02: Global Market Value (US$ Million) and Volume (Million Units) Forecast, 2022 to 2032

Figure 03: Global Market Value (US$ Million) Analysis, 2017 to 2021

Figure 04: Global Market Value (US$ Million) Forecast, 2022 to 2032

Figure 05: Global Market Absolute $ Opportunity Value (US$ Million), 2022 to 2032

Figure 06: Global Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 07: Global Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 09: Global Market Attractiveness By Product Type, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 11: Global Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 13: Global Market Attractiveness By Application, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis By Closure Type, 2017 to 2032

Figure 15: Global Market Volume (Million Units) Analysis By Closure Type, 2017 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Closure Type, 2022 to 2032

Figure 17: Global Market Attractiveness By Closure Type, 2022 to 2032

Figure 18: Global Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 19: Global Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 21: Global Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 23: Global Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 24: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 25: Global Market Attractiveness By Sales Channel, 2022 to 2032

Figure 26: Global Market Value (US$ Million) Analysis By Region, 2017 to 2032

Figure 27: Global Market Volume (Million Units) Analysis By Region, 2017 to 2032

Figure 28: Global Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2032

Figure 29: Global Market Attractiveness By Region, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 31: North America Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 33: North America Market Attractiveness By Country, 2022 to 2032

Figure 34: North America Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 35: North America Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 37: North America Market Attractiveness By Product Type, 2022 to 2032

Figure 38: North America Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 39: North America Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 41: North America Market Attractiveness By Application, 2022 to 2032

Figure 42: North America Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 43: North America Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 45: North America Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 46: North America Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 47: North America Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 48: North America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 49: North America Market Attractiveness By Application, 2022 to 2032

Figure 50: North America Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 51: North America Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 52: North America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 53: North America Market Attractiveness By Sales Channel, 2022 to 2032

Figure 54: Latin America Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 55: Latin America Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 57: Latin America Market Attractiveness By Country, 2022 to 2032

Figure 58: Latin America Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 59: Latin America Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 61: Latin America Market Attractiveness By Product Type, 2022 to 2032

Figure 62: Latin America Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 63: Latin America Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 65: Latin America Market Attractiveness By Application, 2022 to 2032

Figure 66: Latin America Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 67: Latin America Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 69: Latin America Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 71: Latin America Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 72: Latin America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 73: Latin America Market Attractiveness By Application, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 75: Latin America Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 76: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 77: Latin America Market Attractiveness By Sales Channel, 2022 to 2032

Figure 78: Europe Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 79: Europe Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 81: Europe Market Attractiveness By Country, 2022 to 2032

Figure 82: Europe Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 83: Europe Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 85: Europe Market Attractiveness By Product Type, 2022 to 2032

Figure 86: Europe Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 87: Europe Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 89: Europe Market Attractiveness By Application, 2022 to 2032

Figure 90: Europe Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 91: Europe Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 93: Europe Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 94: Europe Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 95: Europe Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 96: Europe Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 97: Europe Market Attractiveness By Application, 2022 to 2032

Figure 98: Europe Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 99: Europe Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 100: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 101: Europe Market Attractiveness By Sales Channel, 2022 to 2032

Figure 102: East Asia Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 103: East Asia Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 105: East Asia Market Attractiveness By Country, 2022 to 2032

Figure 106: East Asia Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 107: East Asia Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 108: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 109: East Asia Market Attractiveness By Product Type, 2022 to 2032

Figure 110: East Asia Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 111: East Asia Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 112: East Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 113: East Asia Market Attractiveness By Application, 2022 to 2032

Figure 114: East Asia Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 115: East Asia Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 117: East Asia Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 118: East Asia Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 119: East Asia Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 120: East Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 121: East Asia Market Attractiveness By Application, 2022 to 2032

Figure 122: East Asia Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 123: East Asia Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 124: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 125: East Asia Market Attractiveness By Sales Channel, 2022 to 2032

Figure 126: South Asia Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 127: South Asia Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 128: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 129: South Asia Market Attractiveness By Country, 2022 to 2032

Figure 130: South Asia Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 131: South Asia Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 132: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 133: South Asia Market Attractiveness By Product Type, 2022 to 2032

Figure 134: South Asia Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 135: South Asia Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 136: South Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 137: South Asia Market Attractiveness By Application, 2022 to 2032

Figure 138: South Asia Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 139: South Asia Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 140: South Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 141: South Asia Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 142: South Asia Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 143: South Asia Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 144: South Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 145: South Asia Market Attractiveness By Application, 2022 to 2032

Figure 146: South Asia Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 147: South Asia Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 148: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 149: South Asia Market Attractiveness By Sales Channel, 2022 to 2032

Figure 150: Oceania Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 151: Oceania Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 152: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 153: Oceania Market Attractiveness By Country, 2022 to 2032

Figure 154: Oceania Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 155: Oceania Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 156: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 157: Oceania Market Attractiveness By Product Type, 2022 to 2032

Figure 158: Oceania Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 159: Oceania Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 160: Oceania Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 161: Oceania Market Attractiveness By Application, 2022 to 2032

Figure 162: Oceania Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 163: Oceania Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 164: Oceania Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 165: Oceania Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 166: Oceania Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 167: Oceania Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 168: Oceania Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 169: Oceania Market Attractiveness By Application, 2022 to 2032

Figure 170: Oceania Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 171: Oceania Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 172: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 173: Oceania Market Attractiveness By Sales Channel, 2022 to 2032

Figure 174: MEA Market Value (US$ Million) Analysis By Country, 2017 to 2032

Figure 175: MEA Market Volume (Million Units) Analysis By Country, 2017 to 2032

Figure 176: MEA Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 177: MEA Market Attractiveness By Country, 2022 to 2032

Figure 178: MEA Market Value (US$ Million) Analysis By Product Type, 2017 to 2032

Figure 179: MEA Market Volume (Million Units) Analysis By Product Type, 2017 to 2032

Figure 180: MEA Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 181: MEA Market Attractiveness By Product Type, 2022 to 2032

Figure 182: MEA Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 183: MEA Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 184: MEA Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 185: MEA Market Attractiveness By Application, 2022 to 2032

Figure 186: MEA Market Value (US$ Million) Analysis By Consumer Orientation, 2017 to 2032

Figure 187: MEA Market Volume (Million Units) Analysis By Consumer Orientation, 2017 to 2032

Figure 188: MEA Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 189: MEA Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 190: MEA Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 191: MEA Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 192: MEA Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 193: MEA Market Attractiveness By Application, 2022 to 2032

Figure 194: MEA Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 195: MEA Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 196: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 197: MEA Market Attractiveness By Sales Channel, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Water Shoes Market Trends – Demand & Forecast 2025 to 2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Trail Shoes Market

Tennis Shoes Market Insights - Demand & Growth 2025 to 2035

Casual Shoes Market Size and Share Forecast Outlook 2025 to 2035

Custom Shoes Market Report – Growth & Industry Trends 2024-2034

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Running Shoes Market Growth - Trends & Demand Forecast 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Light Up Shoes Market Analysis – Growth & Forecast 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Volleyball Shoes Market Analysis - Growth & Forecast 2025 to 2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Gypsy Jazz Shoes Market Insights - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA