The Tennis Shoes Market is expected to reach a significant growth point in between the years 2025 to 2035 due to the increasing participation in tennis & racquet sports (such as badminton and squash), rising demand for performance-oriented footwear, and the increasing influence of athleisure trends.

Consumers are gravitating to comfort, durability and technology-led revolutions, and the result is lightweight, breathable and high-traction tennis shoes. Moreover, rising endorsement by celebrities and sponsorship deals along with the global tournaments in tennis is influencing the market growth as brands are getting more inclined towards investing in sustainable and high-performance materials.

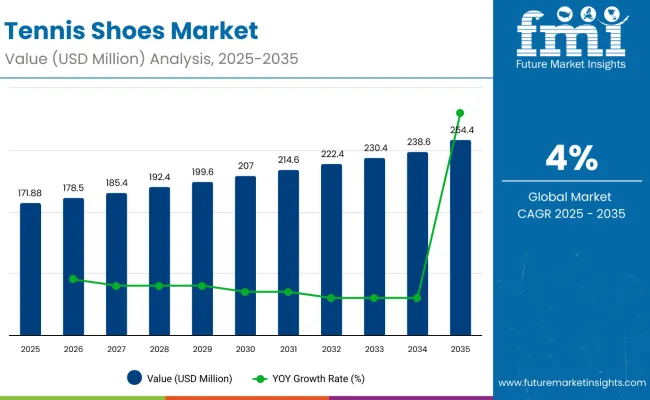

By 2035, the market will account for USD 254.4 Million, growing from USD 171.88 Million in 2025 at a CAGR of 4.0% during 2025 to 2035. Over the last few years there have been advances in smart footwear tech, customisation options and sustainable production methods that shape the industry. Moreover, growing inclination towards court-specific tennis shoes for clay, grass, and hard surfaces are propelling the product diversification and consumer demand.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 171.88 Million |

| Market Value (2035F) | USD 254.4 Million |

| CAGR (2025 to 2035) | 4.0% |

Per capita spending on tennis shoes continues to rise as consumers prioritize both athletic performance and everyday comfort. Tennis shoes have evolved from sport-specific gear into essential items in casual fashion and fitness lifestyles. Leading global brands and local manufacturers are influencing purchasing behavior across diverse income groups and regions.

Developed Countries:

In countries such as the United States, Canada, Germany, and Japan, consumers spend more on tennis shoes due to higher purchasing power and strong brand loyalty. Popular brands include Nike, Adidas, New Balance, Asics, and Puma, with premium offerings frequently purchased for sports, fitness, and casual wear. The athleisure trend has also contributed to higher spending, as consumers often buy multiple pairs for different occasions, including running, walking, and everyday fashion.

Emerging Markets:

In markets such as India, Brazil, Indonesia, and South Africa, spending on tennis shoes is increasing as fitness awareness and urbanization grow. Consumers are showing greater interest in brands like Reebok, Fila, Skechers, and local players such as Campus, Sparx, and Olympikus. While affordability remains a key factor, international brands are expanding their presence through online retail and localized marketing to tap into growing demand.

The global trade of tennis shoes is driven by strong demand for sportswear, rising fitness trends, and the popularity of athleisure fashion. Countries with established manufacturing hubs export large volumes of athletic footwear, while consumer-driven markets import a wide range of branded and non-branded tennis shoes. Trade flows are also influenced by shifts in production bases, free trade agreements, and e-commerce expansion.

Major Exporting Countries:

Leading exporters include China, Vietnam, Indonesia, and India. China remains a dominant player due to its large-scale manufacturing capacity and supply chain infrastructure. Vietnam and Indonesia have become key production hubs for global brands such as Nike, Adidas, and Puma, offering competitive labor costs and efficient logistics. India is growing as an exporter of affordable tennis shoes, supported by a strong domestic manufacturing base and expanding OEM partnerships.

Major Importing Countries:

Top importers include the United States, Germany, United Kingdom, Japan, and France.

These countries have high consumer demand for premium, performance, and lifestyle-oriented tennis shoes. The United States is the largest importer, sourcing shoes from Asia to meet demand across various price segments. European nations import both mid-range and high-end tennis shoes for retail and online sales, with a focus on brand diversity, comfort, and sustainability features.

North America continues to be a leading market, alongside a growing trend in tennis participation, professional tournaments and fitness culture in the USA and Canada. Top brands like Nike, Adidas and New Balance are introducing tech-focused tennis shoes that offer cushioning, stability and energy-return capabilities. Sales are also buoyed by the popularity of celebrity-sponsored shoe lines and limited-edition drops.

In Europe, this makes consumers' purchase behaviour more conditioned by the world of renowned tennis tournaments like Wimbledon, Roland Garros, ATP tours. The desire for eco-friendly and recycled-material tennis shoes is on the rise, and brands are working on innovations for sustainable footwear.

The growth of the Asia-Pacific region, dominated by China, Japan, Australia, and India, is accelerating as increasing discretionary income and more people playing tennis drive demand. This region being the fastest-growing emerging sports market and the increasing impact of international players and sports academies and government initiatives to promote tennis are broadening the consumer base. In China and Japan, for example, technologies dedicated to smart and AI-integrated footwear are on the rise, fuelling market progress.

High Competition and Pricing Pressure

The tennis shoes market is fiercely competitive, with leading brands battling for market share through innovation, sponsorships, and aggressive marketing. Consumers, especially in emerging markets, are price-sensitive, a concern for premium footwear brands. In order to remain competitive, companies are prioritizing brand positioning through a focus on direct-to-consumer (DTC) models, digital customization, and leveraging influencer marketing.

Rise of Sustainable and Smart Tennis Shoes

As demand for eco-friendly footwear continues to rise, the plant-based, biodegradable and recycled-material shaken up tennis shoes make for a profitable opportunity for brands keen to invest. And innovations in smart shoe technology through motion tracking, impact absorption and AI-driven performance analytics are also becoming popular among amateur and professional players. We will see companies utilizing 3D printing, carbon-fibre materials and responsive cushioning tech create more differentiation in the upcoming market.

The market increased consistently between 2020 and 2024, driven by the growing sports participation, augmented fitness awareness, and technological development of footwear. Tennis grew in popularity among all age groups, fuelled by high-profile tournaments, soaring interest among young players, and endorsements from celebrities.

The emphasis of Research and Development in the brands like Nike, Adidas, Asics and New Balance was on lightweight materials, better cushioning and durability to make the footwear more performance-driven, focusing not just on the needs of professionals but amateurs too. Tennis shoes have turned into showcases of 3D-printing technology and energy-return midsoles and hybrids that are said to be specific to one type of court surface.

The emergence of personalized tennis shoes Brands started to release tailored fit shoes, scanning feet with AI technology, and developing specialized fit footwear for optimal performance on the court. Sustainability was another buzzword, with brands trying to make the biggest dent in their environmental footprint by introducing eco-conscious materials (including its recycled polyester uppers and bio-based soles).

However, supply chain disruptions, rising and falling prices of raw materials, and counterfeit products were holding manufacturers back. Brands were able to strengthen their positions in the marketplace through direct-to-consumer (DTC) sales channels, growth in online retail and limited-edition collaborations.

2025 to 2035 in Tennis Shoes Market will see technologically advanced innovative products, sustainability replacing all other approaches and Artificial intelligence embodied performance improvements. The future products of the industry will shift towards smart tennis shoes embedded with sensors, pressure-mapping technology, and AI-powered motion analysis. Such innovations will assist players in perfecting techniques, minimizing injury likelihood, and customizing training regimes.

Sustainability will be a key component, with brands looking at biodegradable midsoles, plant-based fabrics and carbon-neutral manufacturing processes. Closed Loop Recycling Company With a New in-your-Shoe Systems, you will find that you reuse & draw away your footwear waste out. With the advent of 3D-printed tennis-shoes, the next big revolution in customization is round the corner different players means differently designed shoes based on foot-arch, foot pressure points and even types of courts. These on-demand shoes will be manufactured locally, minimizing production waste as well as shipping-related carbon emissions.

Court-adaptive tennis shoes with self-adjusting grip technology will also become available, allowing players to go effortlessly from clay to grass to hard courts. Ground-breaking shock-absorption materials, energy-return foams, and AI-assistance with ergonomic designs will make long periods of wear comfortable and durable.

Distribution will be led by e-commerce platforms, and as always, the online shopping experience will be enhanced by virtual try-on technologies, AR shopping, and AI-based size recommendations. Consumer engagement will be driven by DTC sales, blockchain-based authenticity verification and NFT-linked limited-edition footwear.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Technological Advancements | 3D-printing, energy-return soles, lightweight materials. |

| Customization & Fit | AI-based foot scanning for better fit. |

| Sustainability Initiatives | Recycled materials and eco-friendly production. |

| Retail & Distribution | DTC sales and online retail growth. |

| Player Performance Optimization | Ergonomic design, improved cushioning. |

| Court Adaptability | Shoes designed for specific surfaces (clay, grass, hard). |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Technological Advancements | AI-driven smart tennis shoes, self-adjusting grip, motion tracking. |

| Customization & Fit | On-demand 3D-printed shoes tailored to foot structure. |

| Sustainability Initiatives | Biodegradable soles, closed-loop recycling, and carbon-neutral production. |

| Retail & Distribution | NFT-linked exclusive releases, blockchain authenticity tracking. |

| Player Performance Optimization | AI-powered injury prevention, movement tracking, and energy optimization. |

| Court Adaptability | Self-adjusting grip technology for all-court adaptability. |

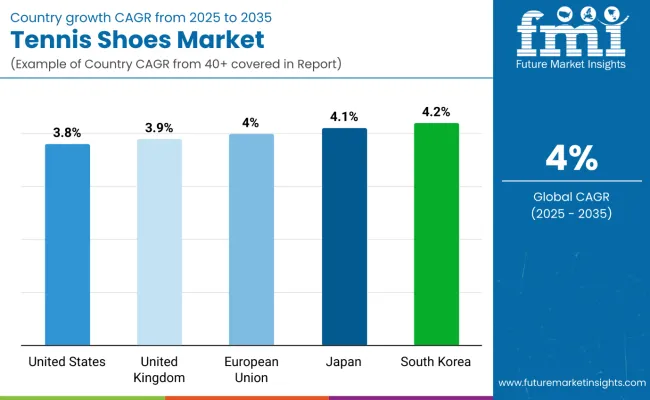

The United States Tennis Shoes Market is holding up due to rise in tennis and other racket sports participation. The burgeoning trend of professional tournaments and the endorsement by rop athletes are driving consumer interests in high-performance tennis shoes. Wicked shoe tech (lighter materials and improved grip) are also drawing both the pros and average. Increased adoption of athleisure and incorporation of sportswear into daily fashion are also playing a role in the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

Trends of racket sports, particularly with the younger generation's affinity for the sport, is driving the growth of North America's Tennis Shoes Market. Grassroots programs and tennis clubs are blossoming, leading people to invest in proper footwear. Consumer tastes are also evolving with the emergence of eco-friendlier, sustainable shoe designs. The increasing demand for premium sports footwear has led prominent brands to take measures to strengthen their digital presence by developing online retail channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

Increasing government initiatives to promote sports participation and fitness have been one of the factors augmenting the growth of the Tennis Shoes Market in the European Union. Across countries like Germany, France and Spain, the demand for such performance-enhancing footwear is booming, especially ones with advanced shock absorption and breathable materials. Sustainability is still a big focus as many manufacturers implement recycled and biodegradable materials. Moreover, the rising popularity of innovative product designs catering to various types of courts is fueling the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.0% |

Japan's Tennis Shoes Market is growing steadily owing to the country's tennis sport culture which has been ingrained in the roots over a long period of time and growing participation in competitive and recreational tennis. Various electronic shoes consisting of sensors, which track playing performance, are becoming popular among players for performance analytics. Furthermore, the demand for lightweight and durable stylish tennis shoes is on the rise especially among the younger consumers. Oil field and exploration companies have expanded this segment as well as e-commerce platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

International tennis tournaments and global athletes are also contributing to the growing popularity of tennis shoes in South Korea, leading to a growing demand for these shoes. Although market sales are also benefiting from the trend of mixing tennis footwear with lifestyle fashion, especially urban consumers. These additions encourage a higher uptake of the game in general because of the number of sports facilities and tennis clubs available. To follow the changing preferences of South Korean people, brands have been advancing new composite designs that mix high-performance characteristics with eco-friendly design.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

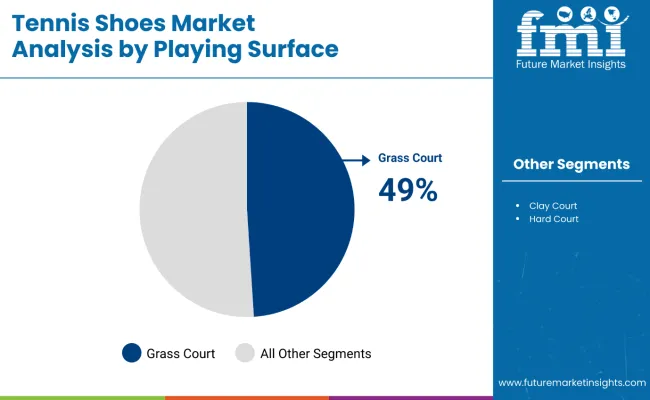

Tennis shoes are widely purchased for grass courts due to their specialized design that enhances performance and safety on this unique playing surface. Grass courts are naturally slick and can cause players to slip, so tennis shoes made for grass typically feature a nubbed or dimpled outsole that provides better grip without damaging the turf.

These shoes also offer stability and support tailored to the fast-paced, low-bounce nature of grass court play, making them a preferred choice for players seeking both comfort and control.

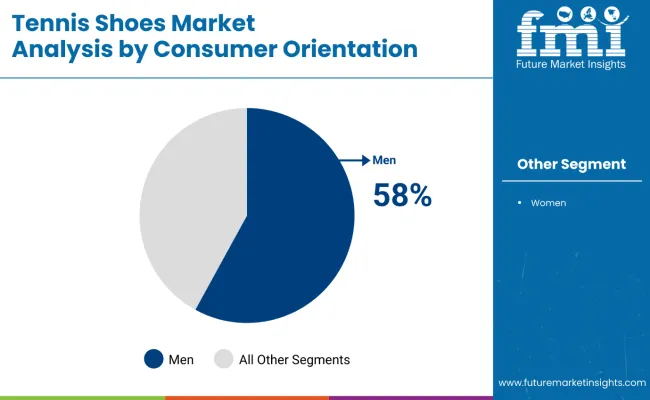

Men are often the major target audience for tennis shoes because they generally make up a large portion of the active tennis-playing population and tend to spend more on sports footwear.

Additionally, men’s tennis shoes are designed to accommodate broader foot sizes and specific performance needs, making them a popular choice. Marketing efforts also focus heavily on male athletes and sports enthusiasts, as men are more likely to engage in competitive and recreational tennis, driving demand in this segment.

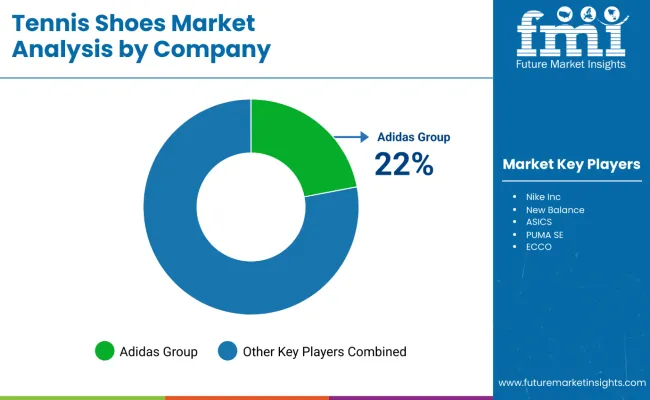

Tennis Shoes Market Companies develop high-performance footwear in terms of advanced cushioning, durability, and lightweight materials propelling the Tennis Shoes Market segment. The growth in the market is attributed to the increasing demand for athletic and lifestyle footwear, and the rising participation in tennis and racket sports. Innovation, sustainability, and endorsements are thus mechanisms for companies to understand which organizations are strengthening or weakening their competitive advantage.

| Company Name | Estimated Market Share (%) |

|---|---|

| Adidas Group | 22-26% |

| Nike Inc. | 20-25% |

| New Balance | 12-16% |

| ASICS | 10-14% |

| PUMA SE | 8-12% |

| Under Armour, Inc. | 5-9% |

| Li Ning Company Ltd. | 4-8% |

| ECCO | 3-7% |

| China Dongxiang (Group) Co., Ltd. | 3-6% |

| 361 Degrees International Limited | 2-5% |

| Company Name | Key Offerings/Activities |

|---|---|

| Adidas Group | Develops Boost and Lightstrike cushioning technology for speed and comfort in tennis footwear. |

| Nike Inc. | Innovates with Zoom Air and React Foam technologies, enhancing court performance and agility. |

| New Balance | Expands its Tennis FuelCell and Fresh Foam series, focusing on stability and energy return. |

| ASICS | Leverages Gel Cushioning System to offer shock absorption and durability for professional players. |

| PUMA SE | Focuses on hybrid cushioning and lightweight mesh uppers, improving breathability and grip. |

| Under Armour, Inc. | Develops UA HOVR and Flow cushioning for support and responsiveness on hard courts. |

| Li Ning Company Ltd. | Enhances regional presence in Asia by offering cost-effective, high-quality tennis shoes. |

| ECCO | Specializes in premium leather tennis shoes with Fluidform Direct Comfort Technology. |

| China Dongxiang (Group) Co., Ltd. | Strengthens market presence by partnering with tennis academies and athletes in China. |

| 361 Degrees International Limited | Focuses on affordable yet high-performing tennis footwear for emerging markets. |

Adidas Group (22-26%)

Adidas leads the market with its Barricade and Ubersonic series, integrating Lightstrike cushioning and Adiwear outsole technologyfor superior grip and comfort.

Nike Inc. (20-25%)

Nike dominates the market with itsAir Zoom Vapor and Air Zoom Cageseries, offeringlightweight responsiveness and durability for professional athletes.

New Balance (12-16%)

New Balance strengthens its position by offering Fresh Foam and FuelCell-powered tennis shoes, improving comfort and stability for both professional and amateur players.

ASICS (10-14%)

ASICS prioritizes foot support and impact absorption, incorporating FlyteFoam and Gel Cushioning technologies in its Court FF and Solution Speed series.

PUMA SE (8-12%)

PUMA expands its tennis footwear line with a focus on style, comfort, and energy-efficient designs for both performance and casual wear.

Other Market Players (Combined 20-30%)

The overall market size for the Tennis Shoes Market was USD 171.88 Million in 2025.

The Tennis Shoes Market is expected to reach USD 254.4 Million in 2035.

The demand is driven by increasing participation in tennis and other racket sports, rising consumer preference for high-performance footwear, growing influence of athlete endorsements, and advancements in shoe technology for improved comfort and durability.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The men's segment is expected to command a significant share over the assessment period.

Table 1: Global Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 2: Global Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 3: Global Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 4: Global Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 5: Global Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 6: Global Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 7: Global Value Value (US$ Million) Forecast, By Sales Channel, 2017 to 2032

Table 8: Global Value Volume (Million Units) Forecast, By Sales Channel, 2017 to 2032

Table 9: North America Value Value (US$ Million) Forecast, By Country, 2017 to 2032

Table 10: North America Value Volume (Million Units) Forecast, By Country, 2017 to 2032

Table 11: North America Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 12: North America Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 13: North America Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 14: North America Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 15: North America Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 16: North America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 17: North America Value Value (US$ Million) Forecast, By Sales Channel, 2017 to 2032

Table 18: North America Volume (Million Units) Forecast, By Sales Channel, 2017 to 2032

Table 19: Latin America Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 20: Latin America Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 21: Latin America Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 22: Latin America Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 23: Latin America Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 24: Latin America Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 25: Latin America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 26: Europe Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 27: Europe Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 28: Europe Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 29: Europe Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 30: Europe Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 31: Europe America Value Value (US$ Million) Forecast, By Consumer Orientation, 2017 to 2032

Table 32: Europe America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 33: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 34: East Asia Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 35: East Asia Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 36: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 37: East Asia Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 38: East Asia Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 39: East Asia Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 40: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 41: East Asia Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 42: East Asia Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 43: East Asia Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 44: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 45: East Asia Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 46: East Asia Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 47: East Asia Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 48: East Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 49: South Asia Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 50: South Asia Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 51: South Asia Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 52: South Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 53: South Asia Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 54: South Asia Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 55: South Asia America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 56: South Asia Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 57: South Asia Value Volume (Million Units) Forecast, By Country, 2017 to 2032

Table 58: Oceania Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 59: Oceania Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 60: Oceania Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 61: Oceania Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 62: Oceania Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 63: Oceania Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 64: Oceania America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 65: Oceania Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 66: Oceania Value Value (US$ Million) Forecast, By Application, 2017 to 2032

Table 67: Oceania Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 68: MEA Value Volume (Million Units) Forecast, By Country, 2017 to 2032

Table 69: MEA Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 70: MEA Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 71: MEA Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 72: MEA Value Volume (Million Units) Forecast, By Application, 2017 to 2032

Table 73: MEA Value Value (US$ Million) Forecast, By Playing Surface, 2017 to 2032

Table 74: MEA Value Volume (Million Units) Forecast, By Playing Surface, 2017 to 2032

Table 75: MEA Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 76: MEA America Value Volume (Million Units) Forecast, By Consumer Orientation, 2017 to 2032

Figure 01: Global Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 02: Global Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 03: Global Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 04: Global Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 05: Global Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 06: Global Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 07: Global Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 09: Global Market Attractiveness by Playing Surface, 2022 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 13: Global Market Attractiveness by Application, 2022 to 2033

Figure 14: Global Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 17: Global Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 19: Global Market Attractiveness by Region, 2022 to 2033

Figure 20: North America Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 21: North America Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 22: North America Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 23: North America Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 24: North America Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 26: North America Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 28: North America Market Attractiveness by Playing Surface, 2022 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 30: North America Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 31: North America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 32: North America Market Attractiveness by Application, 2022 to 2033

Figure 33: North America Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 34: North America Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 35: North America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 36: North America Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 37: North America Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 38: North America Market Attractiveness by Region, 2022 to 2033

Figure 39: Latin America Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 40: Latin America Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 41: Latin America Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 42: Latin America Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 43: Latin America Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 46: Latin America Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 47: Latin America Market Attractiveness by Playing Surface, 2022 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 51: Latin America Market Attractiveness by Application, 2022 to 2033

Figure 52: Latin America Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 53: Latin America Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 54: Latin America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 55: Latin America Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 57: Latin America Market Attractiveness by Region, 2022 to 2033

Figure 58: Europe Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 59: Europe Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 60: Europe Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 61: Europe Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 62: Europe Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 63: Europe Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 64: Europe Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 66: Europe Market Attractiveness by Playing Surface, 2022 to 2033

Figure 67: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 68: Europe Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 70: Europe Market Attractiveness by Application, 2022 to 2033

Figure 71: Europe Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 72: Europe Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 74: Europe Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 75: Europe Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 76: Europe Market Attractiveness by Region, 2022 to 2033

Figure 77: East Asia Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 78: East Asia Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 79: East Asia Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 80: East Asia Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 81: East Asia Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 83: East Asia Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 85: East Asia Market Attractiveness by Playing Surface, 2022 to 2033

Figure 86: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 87: East Asia Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 88: East Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2022 to 2033

Figure 90: East Asia Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 91: East Asia Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 92: East Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 93: East Asia Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 94: East Asia Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 95: East Asia Market Attractiveness by Region, 2022 to 2033

Figure 96: South Asia Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 97: South Asia Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 98: South Asia Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 99: South Asia Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 100: South Asia Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 101: South Asia Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 102: South Asia Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 103: South Asia Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 104: South Asia Market Attractiveness by Playing Surface, 2022 to 2033

Figure 105: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 106: South Asia Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 107: South Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 108: South Asia Market Attractiveness by Application, 2022 to 2033

Figure 109: South Asia Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 110: South Asia Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 112: South Asia Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 113: South Asia Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 114: South Asia Market Attractiveness by Region, 2022 to 2033

Figure 115: Oceania Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 116: Oceania Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 117: Oceania Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 118: Oceania Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 119: Oceania Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 121: Oceania Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 122: Oceania Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 123: Oceania Market Attractiveness by Playing Surface, 2022 to 2033

Figure 124: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 125: Oceania Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 126: Oceania Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 127: Oceania Market Attractiveness by Application, 2022 to 2033

Figure 128: Oceania Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 129: Oceania Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 131: Oceania Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 132: Oceania Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 133: Oceania Market Attractiveness by Region, 2022 to 2033

Figure 134: MEA Market Value (US$ Million) and Volume (Units) Analysis, 2017 to 2033

Figure 135: MEA Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 136: MEA Market Value (US$ Million) and Volume (Units), 2017 to 2033

Figure 137: MEA Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 138: MEA Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 139: MEA Market Value (US$ Million) Analysis by Playing Surface, 2017 to 2033

Figure 140: MEA Market Volume (Units) Analysis by Playing Surface, 2017 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections, By Playing Surface, 2022 to 2033

Figure 142: MEA Market Attractiveness by Playing Surface, 2022 to 2033

Figure 143: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 144: MEA Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 145: MEA Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2033

Figure 146: MEA Market Attractiveness by Application, 2022 to 2033

Figure 147: MEA Market Value (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 148: MEA Market Volume (Units) Analysis by Consumer Orientation, 2017 to 2033

Figure 149: MEA Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2033

Figure 150: MEA Market Attractiveness by Consumer Orientation, 2022 to 2033

Figure 151: MEA Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2033

Figure 152: MEA Market Attractiveness by Region, 2022 to 2033

Figure 153: MEA Market Attractiveness By Consumer Orientation, 2022 to 2032

Figure 154: MEA Market Value (US$ Million) Analysis By Application, 2017 to 2032

Figure 155: MEA Market Volume (Million Units) Analysis By Application, 2017 to 2032

Figure 156: MEA Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 157: MEA Market Attractiveness By Application, 2022 to 2032

Figure 158: MEA Market Value (US$ Million) Analysis By Sales Channel, 2017 to 2032

Figure 159: MEA Market Volume (Million Units) Analysis By Sales Channel, 2017 to 2032

Figure 160: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 161: MEA Market Attractiveness By Sales Channel, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Water Shoes Market Trends – Demand & Forecast 2025 to 2035

Japan Tennis Equipment Market Analysis - Size, Share, and Forecast 2025 to 2035

Korea Tennis Equipment Market Analysis - Size, Share, and Forecast 2025 to 2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Trail Shoes Market

Casual Shoes Market Size and Share Forecast Outlook 2025 to 2035

Custom Shoes Market Report – Growth & Industry Trends 2024-2034

Skating Shoes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Running Shoes Market Growth - Trends & Demand Forecast 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Light Up Shoes Market Analysis – Growth & Forecast 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA