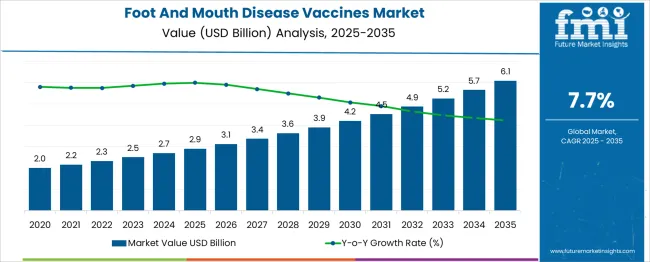

The foot and mouth disease vaccines market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period. The market creates an absolute dollar opportunity of USD 3.2 billion at a healthy CAGR of 7.7%. During the first five-year phase (2025–2030), the market is projected to grow from USD 2.9 billion to USD 4.2 billion, adding USD 1.3 billion, which accounts for 40.6% of the total incremental growth. This initial phase is driven by strong livestock health initiatives, mandatory vaccination programs, and rising concerns over disease outbreaks impacting meat and dairy supply chains globally.

The second phase (2030–2035) contributes USD 1.9 billion, or 59.4% of incremental growth, signaling faster adoption of advanced vaccine formulations and improved distribution in emerging markets. Annual increments during the first phase average USD 0.26 billion per year, with gains accelerating post-2030 due to government-backed disease eradication campaigns and private sector investments in biosecurity solutions. Manufacturers emphasizing thermostable vaccine formulations, cost-efficient bulk production, and enhanced cold-chain logistics will capture maximum value in this USD 3.2 billion opportunity, particularly across Asia-Pacific, Latin America, and Africa, where disease prevalence remains high and livestock farming expansion drives vaccination demand.

| Metric | Value |

|---|---|

| Foot And Mouth Disease Vaccines Market Estimated Value in (2025 E) | USD 2.9 billion |

| Foot And Mouth Disease Vaccines Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The foot and mouth disease (FMD) vaccines market holds a notable share within several veterinary and livestock health-related sectors. In the veterinary vaccines market, its share is approximately 8–10%, as this category includes vaccines for poultry, companion animals, and other livestock diseases. Within the broader animal health market, FMD vaccines account for around 3–4%, since pharmaceuticals, diagnostics, and feed additives dominate overall revenues. In the livestock disease prevention and control market, its share is significant at nearly 15–18%, given the economic impact of FMD outbreaks on cattle, pigs, and sheep.

For the veterinary biologicals market, the share stands at about 12–14%, as FMD vaccines represent a critical segment alongside other viral and bacterial immunizations. In the agricultural and livestock healthcare solutions market, it contributes around 5–6%, as this sector includes a wide range of health and productivity-enhancing products. Growth in this market is driven by government vaccination programs, rising livestock population, and stringent regulations to control disease outbreaks that threaten trade and food security. Technological advancements such as improved oil-adjuvant formulations, thermostable vaccines, and research into recombinant and marker vaccines are boosting adoption. With the global focus on reducing livestock losses and ensuring meat and dairy supply chain resilience, the FMD vaccine market is expected to maintain steady growth across these parent markets.

The foot and mouth disease (FMD) vaccines market is experiencing sustained expansion due to increasing outbreaks of viral infections affecting cloven-hoofed animals and the rising need to safeguard livestock health. The prevalence of highly contagious FMD strains has compelled governments and livestock-dependent economies to intensify vaccination programs, thereby driving demand. The market outlook is being shaped by growing emphasis on livestock productivity, trade compliance, and food security.

Enhanced disease surveillance systems, improved vaccine production capabilities, and broader immunization campaigns are supporting future market opportunities. In developing regions, the introduction of subsidized vaccination schemes and stronger veterinary infrastructure is contributing to market penetration.

Additionally, rising awareness among farmers and livestock owners about disease prevention and economic losses associated with FMD is fostering higher vaccination uptake. Strategic collaborations between animal health organizations and regional governments are further reinforcing the vaccination ecosystem, ensuring that preventive healthcare measures remain a central focus across the livestock sector.

The foot and mouth disease vaccines market is segmented by vaccine type, animal type, distribution channel, and geographic regions. The foot and mouth disease vaccine market is divided by vaccine type into Conventional vaccines and Emergency vaccines. The foot and mouth disease vaccines market is classified by animal type into Cattle, Sheep & Goat, Pig, and Other animals. The distribution channel of the foot and mouth disease vaccines market is segmented into Veterinary hospitals & clinics, Government institutions, Retail pharmacies, and Online pharmacies. Regionally, the foot and mouth disease vaccines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

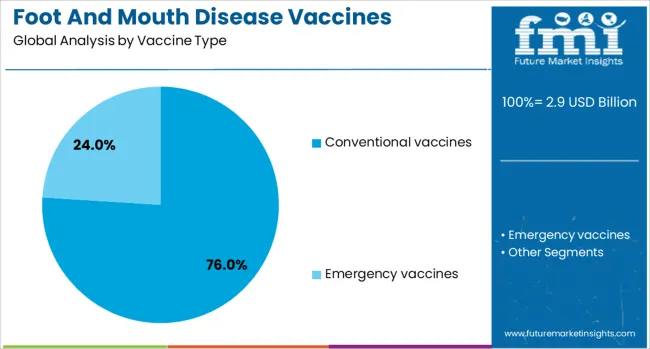

The conventional vaccines segment is projected to hold 76% of the Foot and Mouth Disease Vaccines market revenue share in 2025, positioning it as the dominant vaccine type. This leadership has been driven by the long-standing reliability, proven efficacy, and cost-effectiveness of conventional vaccines in managing large-scale immunization efforts. These vaccines have been widely adopted in mass vaccination programs due to their ability to offer broad-spectrum protection against multiple FMD virus serotypes.

As regulatory agencies and global veterinary organizations endorse these vaccines for routine use, they continue to serve as the standard in national control plans. Moreover, conventional vaccines benefit from established manufacturing processes and storage protocols, making them readily deployable across diverse geographies.

Their adaptability to existing distribution channels and compatibility with cold chain systems ensure uninterrupted supply and consistent immunization coverage. The strong market hold of conventional vaccines is further reinforced by their regulatory acceptance and widespread field performance, securing their leadership in the global FMD vaccination strategy.

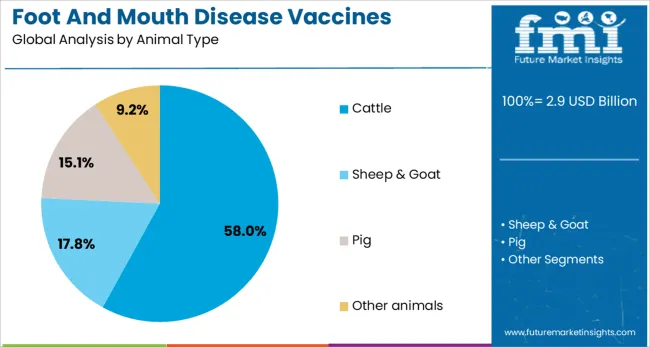

The cattle segment is expected to account for 58% of the Foot and Mouth Disease Vaccines market revenue share in 2025, reflecting its prominence as the leading animal type. The increased susceptibility of cattle to FMD and the substantial economic impact associated with disease outbreaks in bovine populations have made vaccination an indispensable strategy. In regions with high-density cattle farming, mass immunization campaigns have been implemented as a preventive measure to avoid trade restrictions and production losses.

The segment's growth has also been supported by targeted government policies and veterinary health initiatives focused on protecting dairy and beef industries. Strong emphasis on disease containment, coupled with the role of cattle in regional food security and agricultural income, has accelerated vaccine adoption.

Furthermore, public-private partnerships promoting awareness and accessibility of cattle vaccines have contributed to improved immunization rates. These factors have collectively sustained the dominance of cattle in the FMD vaccines market and are expected to uphold its leadership in the coming years.

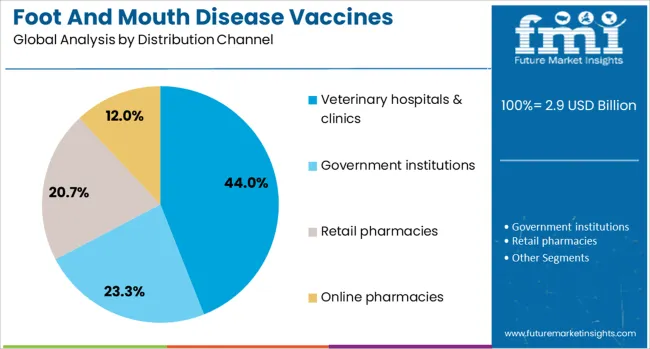

The veterinary hospitals and clinics segment is anticipated to hold 44% of the foot and mouth disease vaccines market revenue share in 2025, making it the leading distribution channel. This segment's growth has been influenced by the trust placed in veterinary professionals for accurate diagnosis, timely vaccination, and ongoing herd health management. Livestock owners have increasingly relied on veterinary establishments to ensure proper vaccine administration and follow-up care.

Veterinary clinics provide a centralized platform for education, disease reporting, and post-vaccination monitoring, which enhances the effectiveness of immunization campaigns. Governments and animal health organizations often coordinate vaccination programs through veterinary facilities, ensuring consistent outreach and compliance.

The segment's dominance is also attributed to the infrastructure and technical capabilities of these institutions to handle large-scale vaccination drives, particularly in organized farming setups. As awareness around livestock disease management continues to grow, veterinary hospitals and clinics are expected to remain integral to vaccine distribution and livestock welfare programs.

The foot and mouth disease vaccine market is expanding due to rising outbreaks among livestock, particularly in developing regions with high cattle and pig populations. Growth is supported by government-led vaccination campaigns and growing trade controls in 2024 and 2025. Opportunities are evident in thermostable vaccine formats, DIVA-compatible vaccines, and multivalent formulations. Trends include the adoption of recombinant vaccines and simplified delivery systems for remote areas. Major restraints include cold chain logistics challenges, short shelf life, and high production costs, limiting access in underserved regions. Overall, consistent expansion is expected amid evolving disease control priorities.

Major growth is being driven by frequent foot and mouth disease outbreaks in cattle, sheep, goats, and pigs. In 2024 and 2025, epidemic events across South America, Asia, and Africa prompted large-scale immunization drives. Governments intensified vaccination schedules and established regional antigen banks to support rapid response. The resulting procurement demand has been particularly strong in Asia‑Pacific and the Middle East, where livestock trade is vital. These responses emphasise the critical nature of disease prevention in maintaining herd health and supply chain stability.

Significant opportunities are being identified in advanced vaccine types offering broader strain coverage and ease of deployment. In 2025, interest increased in thermostable formulations that reduce reliance on cold-storage infrastructure. Simultaneously, DIVA‑type vaccines (enabling disease differentiation) gained attention for surveillance-linked vaccination campaigns. The development of multivalent vaccines effective against multiple FMD virus serotypes also presented potential to streamline immunization programs. These innovations suggest that manufacturers focused on next‑generation biologics are positioned to capture larger shares within evolving veterinary healthcare strategies.

Emerging trends include the shift toward recombinant vaccine platforms and simplified administration routes. In 2024, recombinant FMD vaccines were introduced that offered improved safety, quicker production timelines, and better immunogenicity. Subcutaneous and intramuscular formats remained dominant, but needle-free or oral delivery systems gained traction in pilot programs for remote livestock areas. The emphasis on ease of use and reduced animal stress reflected a move toward farmer‑friendly formulations. These patterns demonstrate an industry move toward efficient, scalable vaccination methods.

Key restraints include logistical challenges related to temperature-sensitive vaccines and cost constraints. In 2024 and 2025, distribution of traditional FMD vaccines was hindered by the need for refrigerated transport, especially in rural African and South American regions. The short shelf life of conventional inactivated vaccines increased wastage and operational load. Manufacturing costs for multivalent and recombinant products also remained elevated, limiting adoption among smaller farming communities and undermining mass immunization efforts in resource-constrained settings.

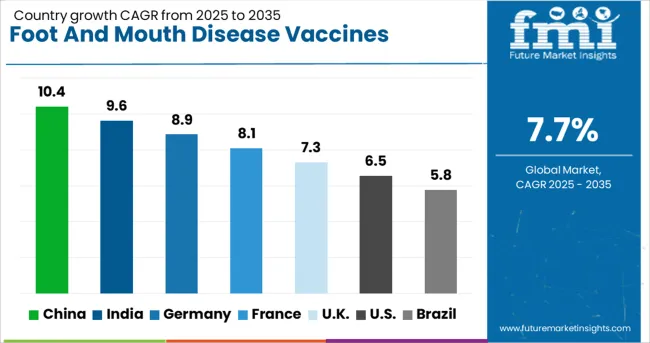

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

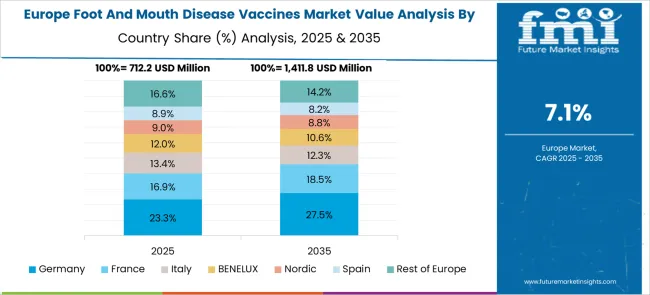

The global foot and mouth disease vaccines market is projected to grow at 7.7% CAGR between 2025 and 2035. China leads with 10.4% CAGR, supported by large-scale livestock production and aggressive government immunization programs. India follows at 9.6%, driven by national disease control initiatives and increasing demand for dairy and meat products. France records 8.1% CAGR, with growth tied to EU biosecurity standards and livestock welfare regulations. The UK posts 7.3%, while the United States grows at 6.5%, reflecting steady adoption in preventive health programs for cattle, swine, and other susceptible species. Asia-Pacific dominates market growth due to the scale of animal farming and export-driven strategies, while Western markets emphasize advanced vaccine technologies, including recombinant and marker vaccines.

China is projected to grow at 10.4% CAGR, driven by the country’s dominant livestock industry and strict disease eradication measures. Large-scale cattle and swine farms adopt FMD vaccines extensively to prevent economic losses associated with outbreaks. Government-backed immunization programs and subsidies ensure high coverage across rural and peri-urban regions. Domestic vaccine producers leverage advanced antigen purification technologies for improved efficacy, while international firms collaborate on recombinant vaccine development for differentiated strains. Expansion of cold-chain infrastructure ensures timely vaccine distribution to remote areas.

The market in India is expected to grow at 9.6% CAGR, supported by the National Animal Disease Control Programme (NADCP) targeting full eradication of FMD. Subsidized vaccination schemes for cattle and buffalo under government programs ensure consistent demand. Rising dairy consumption and export opportunities necessitate disease-free certification, boosting compliance among farmers. Manufacturers emphasize cost-effective vaccines with multi-strain coverage to cater to diverse epidemiological conditions. The emergence of private veterinary service providers offering vaccination and health monitoring creates new channels for distribution and service-based revenue models.

France records 8.1% CAGR, supported by strong regulatory frameworks ensuring biosecurity in livestock operations. EU health directives mandate regular vaccination in high-risk zones, sustaining demand in cattle, sheep, and swine farming segments. Veterinary authorities emphasize traceability and compliance with advanced monitoring systems for vaccination programs. Research institutions collaborate with pharmaceutical companies to develop recombinant and marker vaccines enabling differentiation between infected and vaccinated animals (DIVA), critical for disease control and trade facilitation.

The United Kingdom is expected to grow at 7.3% CAGR, with vaccination programs aligned with national contingency plans for animal disease outbreaks. Commercial livestock operators and government agencies prioritize preventive vaccination to avoid economic disruptions from potential FMD resurgence. Advanced vaccine formulations featuring oil adjuvants and thermostable properties gain prominence for long-lasting immunity. Integration of digital animal health monitoring systems enhances traceability and compliance for large herds. Premium vaccine adoption grows in high-value livestock sectors such as dairy and pedigree cattle farming.

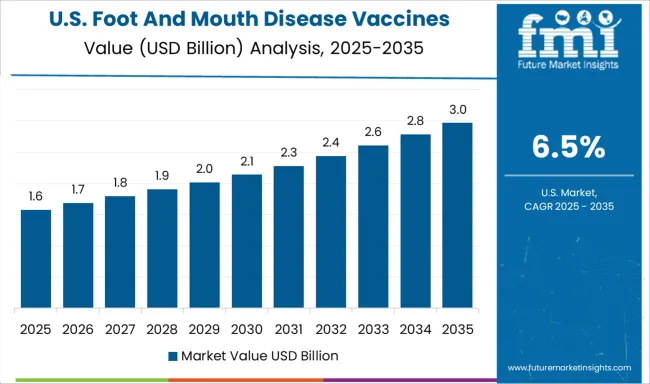

The United States market is forecasted to grow at 6.5% CAGR, reflecting steady demand for preventive measures across cattle, swine, and sheep populations. Federal agencies, in collaboration with veterinary associations, enforce biosecurity protocols in commercial farming clusters. Strategic stockpiling of vaccines for emergency outbreak control creates recurring demand for bulk procurement. Technological advancements in antigen production, combined with marker vaccines, enhance precision in disease management and facilitate trade certification. Regional disparities in vaccination adoption are addressed through government-subsidized programs in high-risk zones.

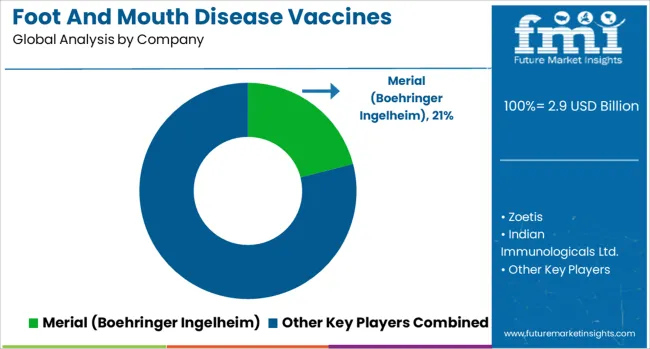

The foot and mouth disease (FMD) vaccines market is moderately consolidated, with Merial (Boehringer Ingelheim) recognized as a leading player due to its advanced vaccine formulations, global distribution capabilities, and strong presence in livestock health management. The company focuses on high-efficacy vaccines designed to prevent outbreaks in cattle, swine, and other cloven-hoofed animals, supporting animal health and economic stability in agriculture. Key players include Zoetis, Indian Immunologicals Ltd., MSD Animal Health, and Brilliant Bio Pharma. These companies develop and supply inactivated and oil-adjuvanted vaccines tailored to regional FMD strains, ensuring broad-spectrum protection for livestock.

Their offerings prioritize rapid immunity development, stability under varied storage conditions, and compliance with international veterinary standards. Market growth is driven by the rising incidence of FMD in endemic regions, increasing government initiatives for livestock disease control, and expanding demand for meat and dairy products necessitating preventive healthcare. Leading manufacturers are investing in regional manufacturing facilities, strain-specific vaccine research, and combination vaccines to enhance disease control efficiency. Emerging trends include the development of thermostable vaccines for easier distribution, adoption of recombinant technologies for improved immunity, and partnerships with veterinary organizations to implement large-scale vaccination programs. Asia-Pacific dominates the market due to high livestock populations and frequent outbreaks, while Africa and Latin America represent growing opportunities with intensified disease eradication programs.

In June 2025, Canada announced the creation of a national Foot-and-Mouth Disease vaccine bank to strengthen livestock protection. This initiative ensures rapid vaccine availability during outbreaks, reinforcing emergency preparedness and safeguarding the country’s agricultural sector against potential biosecurity threats and economic disruptions from FMD incidents.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Vaccine Type | Conventional vaccines and Emergency vaccines |

| Animal Type | Cattle, Sheep & Goat, Pig, and Other animals |

| Distribution Channel | Veterinary hospitals & clinics, Government institutions, Retail pharmacies, and Online pharmacies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Merial (Boehringer Ingelheim), Zoetis, Indian Immunologicals Ltd., MSD Animal Health, and Brilliant Bio Pharma |

| Additional Attributes | Dollar sales by vaccine type (inactivated/conventional ~56% share) and administration route (intramuscular ~76%, subcutaneous fastest at ~7.9% CAGR). Asia-Pacific leads (~50%), North America (~39%) and MEA grow fastest. Buyers prefer multiserotype, DIVA-compliant, thermostable vaccines with government-backed procurement. Innovations include nanoparticle adjuvants, lyophilized formats, and automated cold-chain distribution systems. |

The global foot and mouth disease vaccines market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the foot and mouth disease vaccines market is projected to reach USD 6.1 billion by 2035.

The foot and mouth disease vaccines market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in foot and mouth disease vaccines market are conventional vaccines, _aluminium hydroxide & saponin-based vaccines, _oil-based vaccines and emergency vaccines.

In terms of animal type, cattle segment to command 58.0% share in the foot and mouth disease vaccines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hand, Foot and Mouth Disease Treatment Market

Foot Door Opener Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Valve Market Forecast and Outlook 2025 to 2035

Footprint Detection Light Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Foot Patches Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Mouth Freshener Market Size, Growth, and Forecast for 2025 to 2035

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Footwear Adhesives Market

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA