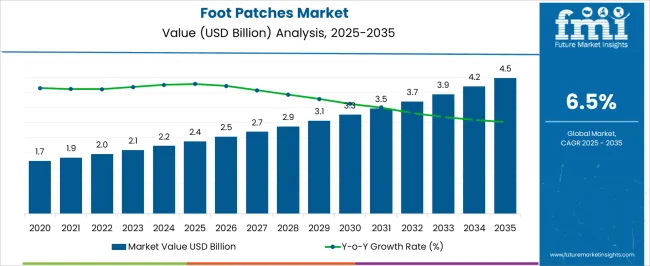

The foot patches market is anticipated to be USD 2.4 billion in 2025 and is projected to reach USD 4.5 billion by 2035, progressing at a CAGR of 6.5%. The long-term value accumulation curve of this segment reflects a steady but compounding growth pattern, underpinned by rising consumer interest in wellness products, detoxification routines, and alternative health practices.

Between 2025 and 2029, the curve displays gradual momentum as awareness campaigns, online retail channels, and lifestyle influencers continue to introduce foot patches to wider audiences, lifting the market from USD 2.4 billion to about USD 2.9 billion. Midway through the cycle, from 2030 to 2032, stronger adoption occurs as regional wellness programs and premium formulations with herbal and mineral ingredients gain consumer trust, accelerating demand across both developed and emerging economies.

By the final stretch between 2033 and 2035, the curve rises more sharply, adding over USD 1 billion in value within three years, demonstrating that consumer reliance shifts from occasional use to regular incorporation in wellness routines. This accumulation pathway highlights how foot patches are evolving from niche products into mainstream wellness staples, with growth being reinforced by e-commerce penetration, personalization trends, and cross-border marketing initiatives that transform localized products into global wellness solutions.

| Metric | Value |

|---|---|

| Foot Patches Market Estimated Value in (2025 E) | USD 2.4 billion |

| Foot Patches Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The foot patches market is shaped by several interconnected parent categories that define its demand structure and future growth outlook. The wellness and detoxification products sector holds the largest share at nearly 38%, as consumers increasingly associate foot patches with body cleansing routines and alternative health remedies. The personal care and beauty segment contributes around 27%, with products marketed for relaxation, skin rejuvenation, and stress relief, often tied to spa-inspired treatments.

The herbal and natural remedies market accounts for close to 15%, driven by formulations using plant-based ingredients such as ginger, bamboo vinegar, and lavender that appeal to health-conscious buyers. The over-the-counter healthcare category provides about 12%, as foot patches are purchased alongside sleep aids, pain relief solutions, and lifestyle wellness products in pharmacies and retail stores.

The remaining 8% comes from niche sectors such as fitness recovery and senior care, where patches are positioned for circulation support and relief from fatigue. This layered share distribution shows that the foot patches market is not a standalone category but one deeply connected to wellness, personal care, and healthcare ecosystems. Companies that emphasize herbal formulations, affordability, and e-commerce distribution are likely to consolidate share within these parent markets.

The foot patches market is experiencing notable growth driven by increasing consumer preference for natural wellness products and holistic health solutions. Rising awareness about alternative therapies and self-care routines is shaping the current market scenario, with herbal-based products gaining widespread acceptance.

The future outlook remains optimistic as consumers seek non-invasive and cost-effective methods to improve health and well-being. Expanding distribution through eCommerce channels and growing interest in detoxification and pain relief therapies further propel market growth.

Additionally, the appeal of herbal foot patches is enhanced by their perceived safety and natural ingredients, aligning with broader trends favoring organic and plant-based products. As lifestyle-related health issues continue to rise globally, demand for foot patches is expected to increase across diverse demographic segments, providing ample growth opportunities for manufacturers.

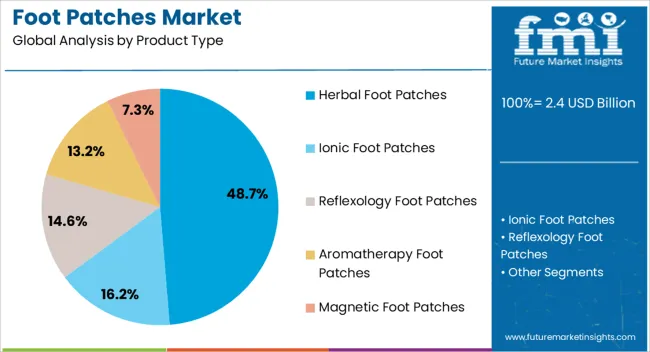

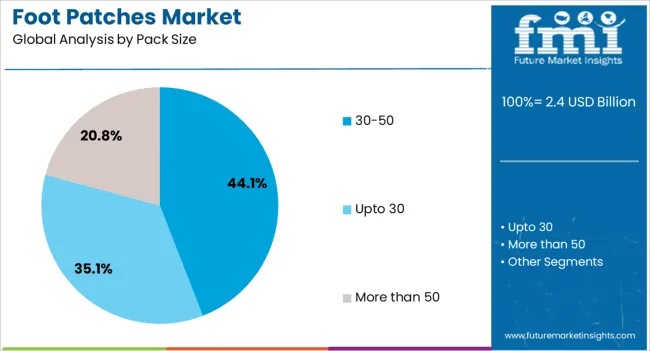

The foot patches market is segmented by product type, pack size, price range, application, end-use, distribution channel, and geographic regions. By product type, foot patches market is divided into Herbal Foot Patches, Ionic Foot Patches, Reflexology Foot Patches, Aromatherapy Foot Patches, and Magnetic Foot Patches. In terms of pack size, foot patches market is classified into 30-50, Upto 30, and More than 50.

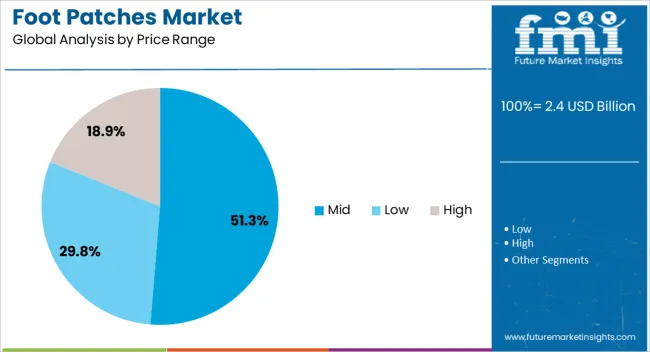

Based on price range, foot patches market is segmented into Mid, Low, and High. By application, foot patches market is segmented into Detox, Pain relief, Hydrating, and Others. By end-use, foot patches market is segmented into Individual and Commercial. By distribution channel, foot patches market is segmented into Online and Offline. Regionally, the foot patches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Herbal foot patches are estimated to hold 48.7% of the Foot Patches market revenue share in 2025, representing the leading product type. This dominance can be attributed to the strong consumer inclination towards natural and plant-based health remedies.

Herbal patches are perceived as safer and more effective for detoxification and pain relief, which drives consumer preference. The rising adoption is also supported by growing awareness of traditional medicine practices that emphasize herbal formulations.

The flexibility in combining multiple herbal extracts tailored to specific health needs enhances product appeal. Furthermore, the trend of integrating wellness products into daily routines has reinforced demand for herbal foot patches, positioning this segment for sustained growth.

The pack size segment of 30-50 units is projected to account for 44.1% of the market revenue in 2025, making it the most favored packaging option. This preference is largely due to the balance it offers between cost-effectiveness and convenience for consumers.

Packs within this range are typically seen as providing sufficient supply for sustained treatment periods without overwhelming storage needs. Retailers benefit from this pack size as it aligns well with consumer purchasing behavior and promotes repeat sales.

The availability of moderately sized packs also supports trial adoption among new users who seek to evaluate product efficacy before committing to larger volumes. The 30-50 pack size segment maintains a significant market share driven by its practical appeal.

The mid-price range segment holds approximately 51.3% of the Foot Patches market revenue share in 2025, emerging as the leading price category. This pricing tier is favored as it offers an optimal balance between product quality and affordability, attracting a broad spectrum of consumers.

Mid-priced foot patches are accessible to both value-conscious buyers and those seeking premium benefits without high costs. The competitive pricing in this segment supports wider distribution across various retail channels, including pharmacies, wellness stores, and online platforms.

Additionally, manufacturers often position mid-range products with enhanced herbal formulations and packaging to appeal to discerning consumers, reinforcing this segment’s market leadership. The strong demand for reasonably priced yet effective wellness products ensures continued growth in this category.

The foot patches market is supported by wellness trends, herbal-based formulations, digital distribution, and competitive product innovation. Brands combining affordability with authenticity and accessibility are positioned to capture long-term growth.

The foot patches market has gained momentum as wellness routines become part of daily lifestyles across different demographics. Consumers are increasingly drawn to detoxification products that promise improved circulation, relaxation, and energy restoration. Foot patches are marketed as natural and easy-to-use solutions that align with holistic health practices. Growth is further supported by rising adoption in spa treatments and home wellness kits, where patches are bundled with aromatherapy and herbal remedies. Social media campaigns and endorsements from wellness influencers have amplified awareness, pushing foot patches from niche alternatives into mainstream health products. This segment benefits from being simple, accessible, and increasingly accepted as part of preventive care routines.

E-commerce has reshaped the accessibility of foot patches, making them available across borders and to wider demographics. Online platforms such as Amazon, Alibaba, and dedicated wellness stores have become central to product visibility. Bundled offers, subscriptions, and influencer-driven promotions are further increasing penetration in both developed and emerging markets. The ability to showcase detailed product benefits, customer reviews, and demonstration videos has enhanced consumer trust and improved conversion rates. Traditional retail continues to play a role, but digital distribution dominates growth. Companies that leverage omnichannel strategies and strong digital marketing will gain a lasting edge in this highly competitive space.

Competition in the foot patches market is driven by branding, ingredient innovation, and affordability. Established companies differentiate by offering premium variants with advanced herbal mixes, while emerging players compete on price and accessibility. Packaging innovations, such as multi-day detox kits and themed blends for relaxation or energy, are attracting diverse consumer groups. Strong aftersales service, reliable quality assurance, and regulatory compliance have also become competitive levers. Regional players in Asia often focus on traditional herbal bases, while Western brands highlight wellness lifestyle positioning. Companies that combine authenticity in ingredients with effective marketing and fair pricing will secure stronger brand loyalty and larger consumer bases.

The use of herbal and plant-based formulations has been a major driver of the foot patches market. Ingredients such as bamboo vinegar, ginger, tourmaline, and lavender appeal to consumers seeking natural health remedies without chemical additives. This focus on traditional remedies has created strong demand in both Asian markets, where herbal medicine has deep roots, and Western markets, where natural wellness products are gaining popularity. Manufacturers are differentiating through unique blends and highlighting detoxifying, calming, or energizing properties on packaging. The natural positioning of foot patches strengthens their credibility and broadens appeal across consumers who prioritize safe and holistic health solutions.

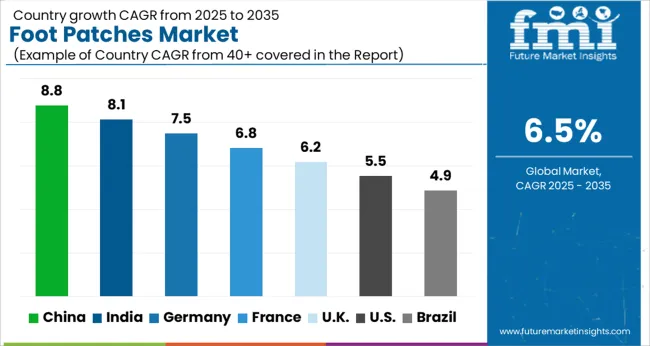

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

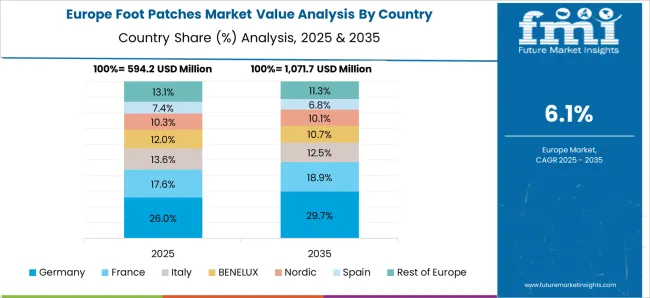

The global foot patches market is projected to grow at a CAGR of 6.5% between 2025 and 2035. China leads with an 8.8% CAGR, supported by strong consumer interest in herbal wellness remedies, large-scale e-commerce penetration, and domestic manufacturing scale. India follows at 8.1%, fueled by rising disposable incomes, popularity of natural healthcare, and broader retail expansion into tier-2 and tier-3 cities. Germany, at 7.5%, benefits from strong demand for herbal formulations, wellness-focused consumer behavior, and regulatory-driven product positioning. France posts 6.8%, supported by the country’s emphasis on lifestyle wellness, spa-inspired personal care, and premium product offerings. The UK, growing at 6.2%, shows steady adoption driven by e-commerce channels, influencer marketing, and demand for detoxification products. The USA, at 5.5%, reflects moderate growth shaped by its mature wellness industry, demand for alternative therapies, and consumer inclination toward preventive healthcare routines. Asia continues to dominate with scale and adoption speed, while Europe emphasizes quality standards and consumer wellness trends, and North America sustains demand through lifestyle-driven personal care adoption. The analysis spans 40+ countries, with the leading markets shown below.

The foot patches market in China is projected to grow at a CAGR of 8.8% from 2025 to 2035, supported by strong interest in herbal wellness and fast digital commerce adoption. Demand is being pushed by consumers who prefer simple, at-home routines for relaxation, circulation support, and overnight detox practices. Pharmacies and online marketplaces are stocking wide assortments, while private labels compete with premium imports using traditional ingredients such as bamboo vinegar, ginger, and lavender. Spa chains and beauty clinics are bundling patches with massages and aromatherapy, creating repeat purchases. Clear labeling, safety assurances, and influencer education are shaping brand preferences. China will remain the volume anchor as domestic manufacturing scale, social commerce, and regional distribution continue to expand reach across city tiers.

The foot patches market in India is expected to expand at a CAGR of 8.1% between 2025 and 2035, supported by growing interest in natural wellness and rising household spending on personal care. Ayurveda-inspired ingredients and simple usage are resonating with first-time buyers, while pharmacies and beauty retail chains introduce trial packs to stimulate adoption. E-commerce and quick-commerce platforms are pushing discovery in tier two and tier three cities, where affordable multi-pack offerings encourage repeat use. Partnerships with wellness influencers and yoga communities have improved credibility. Clear claims and compliance with local labeling norms are being prioritized by leading brands. India will deliver sustained upside as affordability, regional language marketing, and omnichannel availability strengthen penetration beyond metropolitan centers.

The foot patches market in France is projected to advance at a CAGR of 6.8% from 2025 to 2035, driven by wellness-led lifestyles and premium beauty retail formats. Consumers favor products with clear ingredient provenance, dermatological testing, and calm-sleep propositions. Pharmacies and parapharmacies remain influential, while specialty beauty chains curate higher-end assortments featuring herbal and mineral blends. Tourism and spa culture contribute to seasonal lifts, and subscription models in online channels are encouraging continuity of use. Packaging that communicates recyclable materials and allergen cautions is being preferred by informed buyers. France will remain a quality-conscious market where brand trust, sensory experience, and pharmacist recommendation determine share gains.

The foot patches market in the UK is anticipated to grow at a CAGR of 6.2% from 2025 to 2035, supported by e-commerce convenience, influencer education, and interest in simple night-time routines. Retailers promote mix-and-match wellness baskets that include patches, bath soaks, and sleep aids, which raises basket value. Consumers are responsive to transparent claims and third-party testing, pushing brands to publish safety data and ingredient explanations. Multipacks and travel formats are gaining traction among frequent users. Retail media networks and targeted promotions are improving conversion across grocery and pharmacy chains. Steady gains are expected as affordability and credible storytelling remain at the center of consumer decisions.

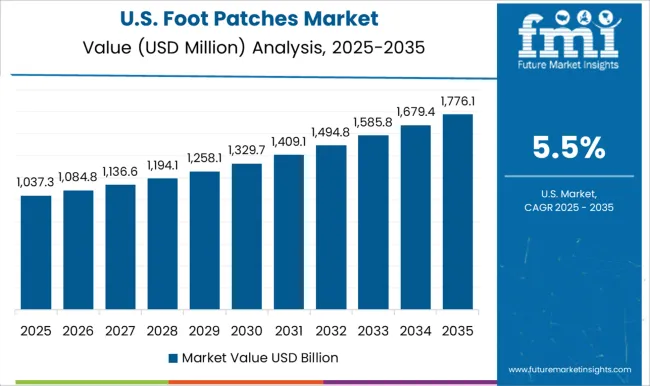

The foot patches market in the USA is forecast to grow at a CAGR of 5.5% through 2035, shaped by a mature wellness ecosystem and discerning consumers who seek verifiable benefits. Sales are concentrated in online marketplaces, specialty beauty stores, and mass retailers that favor brands with clear certifications and safe ingredient lists. Positioning around relaxation, odor control, and next-day freshness is gaining traction. Influencer reviews and before-after testimonials are important, yet compliance statements and dermatology guidance remain decisive for repeat purchase. Cross-selling with sleep masks and magnesium balms has improved attachment rates. The USA will reward brands that combine credible science, pleasant sensory cues, and fair value.

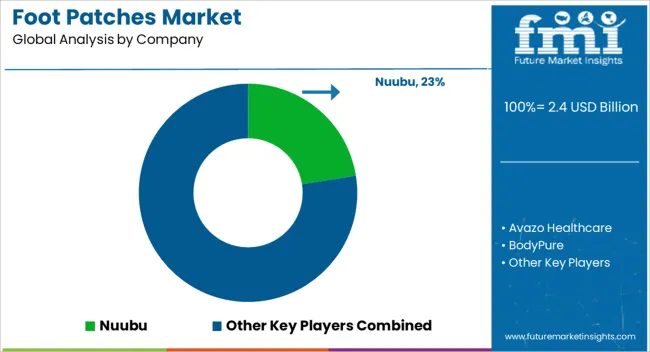

Competition in the foot patches market is influenced by product differentiation, consumer trust, distribution channels, and herbal formulation credibility. Nuubu has achieved global recognition, largely due to its detoxification claims and extensive online retail visibility, positioning itself as a premium wellness brand. Avazo Healthcare and BodyPure focus on clinical credibility and wellness-centric branding, targeting health-aware consumers seeking natural alternatives for detoxification and stress relief. Detox Foot Pads and Doctor Organic have emphasized herbal purity, organic certifications, and the use of traditional Asian botanicals, which resonate with health-conscious consumers valuing authenticity and plant-based remedies. Foot Cure and Global Healing are pursuing niche strategies by merging aromatherapy with detoxification benefits, creating functional blends that expand consumer interest beyond simple detox claims. Groots and Herb-Science are leveraging e-commerce platforms to gain traction, focusing on affordability, subscription models, and social media-driven marketing to maintain recurring sales.

Kiyome Kinoki retains legacy status as one of the earliest adopters in the category, maintaining brand recognition across international markets. Medi-7 and Patch-It prioritize consumer comfort through advanced adhesive technologies and packaging differentiation, catering to multi-age demographics seeking convenience and usability. SMYLLS and Takara adopt aggressive value-based pricing to appeal to middle-income groups, particularly in Asian and European regions. Verseo strengthens its competitive position by cross-selling foot patches as part of its broader personal wellness and lifestyle product line, expanding consumer loyalty through portfolio integration. Competition will intensify as companies innovate with cleaner formulations, eco-friendly packaging, and deeper partnerships with wellness retailers and pharmacies. Future growth will rely on clinical validation, transparent ingredient sourcing, influencer-backed campaigns, and pricing discipline, while brands that successfully blend credibility with convenience will secure larger market share and stronger customer loyalty.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Product Type | Herbal Foot Patches, Ionic Foot Patches, Reflexology Foot Patches, Aromatherapy Foot Patches, and Magnetic Foot Patches |

| Pack Size | 30-50, Upto 30, and More than 50 |

| Price Range | Mid, Low, and High |

| Application | Detox, Pain relief, Hydrating, and Others |

| End-use | Individual and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nuubu, Avazo Healthcare, BodyPure, Detox Foot Pads, Doctor Organic, Foot Cure, Global Healing, Groots, Herb-Science, Kiyome Kinoki, Medi-7, Patch-It, SMYLLS, Takara, and Verseo |

| Additional Attributes | Dollar sales, share, consumer adoption trends, regional demand hotspots, pricing strategies, regulatory compliance, ingredient preferences, distribution channels, competitor moves, and growth opportunities across wellness and detox product lines. |

The global foot patches market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the foot patches market is projected to reach USD 4.5 billion by 2035.

The foot patches market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in foot patches market are herbal foot patches, ionic foot patches, reflexology foot patches, aromatherapy foot patches and magnetic foot patches.

In terms of pack size, 30-50 segment to command 44.1% share in the foot patches market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foot Suction Valve Market Forecast and Outlook 2025 to 2035

Footprint Detection Light Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Foot and Mouth Disease Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Footwear Adhesives Market

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Hand, Foot and Mouth Disease Treatment Market

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Carbon Footprint Management Market

Women’s Footwear Market Size, Growth, and Forecast for 2025 to 2035

Medical Footwear Market Size and Share Forecast Outlook 2025 to 2035

Athletic Footwear Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA