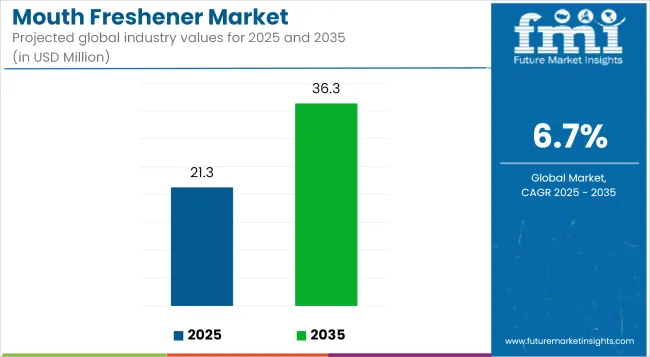

With increasing demand for on-the-go hygiene and rising consumption of confectionery-based refreshment products, the mouth freshener market is anticipated to rise from USD 21.25 billion in 2025 to USD 36.33 billion by 2035, advancing at a CAGR of 6.7%. This surge is shaped by evolving oral hygiene habits, particularly among younger urban populations, and a wider acceptance of breath-freshening products beyond traditional use cases.

A noticeable transformation has been underway in the category, driven by shifting consumer preferences from chewing gums to low-calorie, sugar-free mints, lozenges, and sprays. Increased demand for discreet, portable formats has been shaping product innovation, while natural ingredient inclusion such as herbal extracts, cardamom, and menthol is being prioritized for perceived safety and functionality.

However, market expansion is being restrained by regulatory scrutiny on synthetic flavors and sweeteners. A strong trend favoring organic and ayurvedic variants is creating new pathways for premium-positioned brands. Competitive activity has intensified as players broaden product lines to include functional attributes like antibacterial or probiotic properties and invest in localized flavors and formats catering to regional palates.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 21.25 Billion |

| Projected Global Industry Value (2035F) | USD 36.33 Billion |

| Value-based CAGR (2025 to 2035) | 6.7% |

Over the next decade, the market is expected to witness heightened penetration across middle-income demographics and emerging markets, fueled by improving awareness of oral hygiene and rising disposable incomes. By 2025, spray and strip formats will gain further traction for their perceived sophistication and convenience, especially among urban millennial consumers.

By 2035, demand will likely be concentrated in Asia Pacific and Middle East regions, supported by cultural consumption of breath fresheners and an expanding retail infrastructure. Functional breath-freshening products featuring health claims, such as immunity-boosting or digestive benefits, are projected to capture a growing share of innovation pipelines. Overall, premiumization, format innovation, and health-aligned repositioning are expected to define the future landscape of the global mouth freshener market.

Modern retail formats are projected to account for approximately 43.6% of global mouth freshener sales by 2025, with significant share gains anticipated from online platforms by 2035. This transition is being led by urban millennial consumers, whose preference for contactless shopping, fast delivery, and broader SKU access is reshaping distribution dynamics.

Traditional channels like small-format grocery and kiosks are declining in influence, particularly in North America and parts of Southeast Asia, where specialty chains and pharmacy outlets are leveraging impulse category expansion to reposition mouth fresheners as part of holistic wellness. For example, India-based DMart and BigBasket have steadily increased their private-label assortment of sugar-free and ayurvedic mints, with Amazon India also entering the segment with Ayurvedic brands such as Kapiva.

Regulatory frameworks such as the EU’s Novel Food Regulation (EU) 2015/2283 have also impacted the product entry of herbal and functional breath fresheners through online channels, mandating evidence-backed claims and ingredient traceability.

In markets like South Korea, convenience chains like GS25 have started bundling probiotic mints with beauty and self-care kits, reflecting convergence with the health segment. Going forward, format innovation must align with omnichannel merchandising to meet rising consumer expectations for portability, clean labeling, and multi-functionality.

Corporate wellness initiatives are forecast to drive over 9.3% of incremental growth in institutional demand for mouth fresheners between 2025 and 2030, particularly in Europe, Japan, and GCC economies. Post-pandemic emphasis on employee well-being, including hygiene kits and personal care products at the workplace, is expanding procurement of sugar-free mints, pocket sprays, and lozenges for office use.

According to a 2024 update from Japan’s Ministry of Health, Labour and Welfare (MHLW), workplace wellness programs now include provision for daily-use hygiene items, catalyzing higher adoption of on-desk fresheners. Similarly, Dubai-based conglomerates in the hospitality and BFSI sectors are partnering with regional suppliers like Al Harith and My Perfume Group to stock customized mint sachets and herbal strips in office lounges and meeting kits.

These programs are influencing bulk procurement behavior, especially for brands that comply with corporate sustainability goals such as recyclable packaging or herbal formulations free from artificial colors. Workplace-driven demand is also linked to cultural emphasis on oral freshness in public-facing roles across hospitality, aviation, and retail. As employers pivot toward improving experiential wellness, especially in hybrid or in-person models, brands aligning with ESG-compliant, professional-grade hygiene products will find deeper institutional penetration.

Awareness in Oral Hygiene is Driving the Market Growth

People are becoming more and more conscious of the importance of dental and oral hygiene. Furthermore, it is a significant issue that the major players also prioritize. As a result of the increased awareness the major players are moving forward with their marketing campaigns to highlight the effectiveness of their oral care products.

Tier 1 companies comprises industry leaders acquiring a 50% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

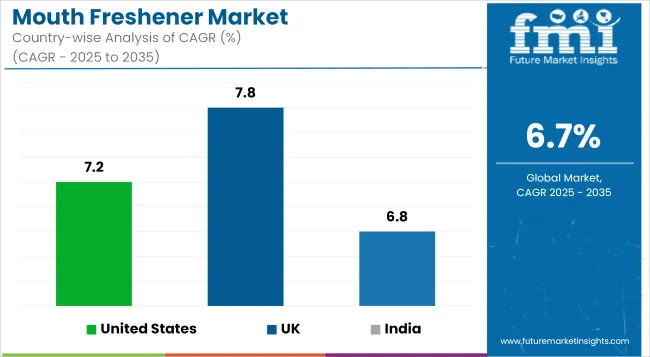

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and India come under the exhibit of high consumption, recording CAGRs of 7.2%, 7.8% and 6.8%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 7.2% |

| UK | 7.8% |

| India | 6.8% |

The USA Regionally the market is anticipated to expand at the fastest CAGR during the forecast period. More people are looking for easy ways to breathe fresh air due to growing awareness of oral hygiene which is influenced by dental care education and increased health consciousness. Additionally, a hectic lifestyle that includes eating out and snacking on the run makes quick and portable solutions necessary to preserve oral freshness.

Over the next few years the Indian market is expected to expand considerably. Market expansion is fueled by the increased emphasis on oral hygiene and fresh breath especially among the younger and working population. Convenient and portable hygiene products such as mouth fresheners that are easy to use on the go are becoming more and more popular as lifestyles get busier.

Furthermore, the growing impact of Western media and culture has made mouth fresheners a common part of everyday grooming practices.

It is anticipated that the UK market will expand significantly during the forecast period. Health organizations and the UK government have stressed the value of maintaining proper oral hygiene which includes routine dental examinations and appropriate dental care practices that include using mouth fresheners. The multicultural society of the UK has also brought about a number of culinary customs some of which include strong flavors that could make people worry about how fresh their breath is.

Mouth fresheners have a highly fragmented global market. About 10% to 15% of the mouth freshener market worldwide is made up of a few small manufacturers. The market for mouth fresheners is seeing a rise in small vendors as a result of the low manufacturing costs.

In order to remain competitive in the market startups in the mouth fresheners sector are making a substantial contribution to market expansion through a variety of strategies including expansion new marketing approaches investment in small businesses mergers and acquisitions and the introduction of new products.

By type, methods industry has been categorized into Mint Candies, Spray and Gum

By distribution channel channel industry has been categorized into Retail Stores and Online Stores

Industry analysis has been carried out in key countries of North America, Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 6.7% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 36.33 Billion.

Rise in oral hygiene is increasing demand for Mouth Freshener.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Mars, Incorporated, Kraft Foods Inc., Lotte and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Freshener Market Analysis by Product Type, Application Type, Sales Channel, Fragrance Type, and Region from 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Wide Mouth Jars Market Size and Share Forecast Outlook 2025 to 2035

Wide Mouth Bottles Market – Trends & Forecast 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Car Air Freshener Market Size and Share Forecast Outlook 2025 to 2035

Foot and Mouth Disease Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Container Mouth Inner Seal Market

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Electric Air Freshener Market Analysis - Trends, Growth & Forecast 2025 to 2035

Hand, Foot and Mouth Disease Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA