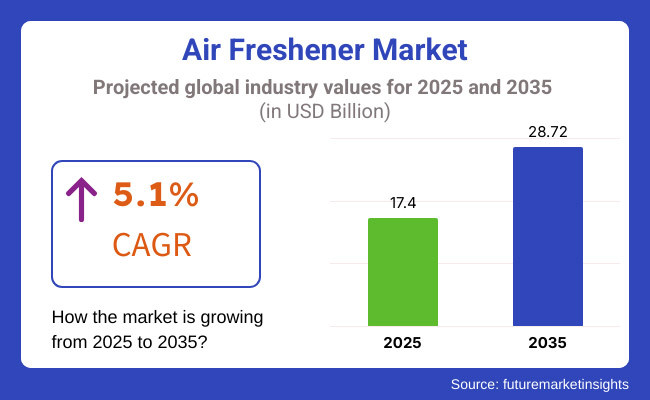

The air freshener market is estimated to grow from USD 17.4 billion in 2025 to USD 28.72 billion in 2035, with a 5.1% CAGR throughout the forecast period. The global industry is anticipated to undergo massive expansion throughout the period from 2025 to 2035 because of the increase in the consumer demand for high-quality indoor air, green solutions, and the innovative air care technology.

The most important factor of growth is urbanization, which is the foremost reason for the increased product demand in the residential, commercial, and automotive sectors. The move of customers toward ingredients that are totally natural, organic, and good for health got more and more consumers aligned to sustainability goals.

In addition, the emergence of high-tech fresheners that have AI-controlled scent diffusion and the ability to be programmed appeal to tech-savvy users who are looking for individualized fragrance. Moreover, North America is anticipated to take the lead in the demand for advanced fresheners, while Europe will be focused on sustainability and organic formulations. Meanwhile, the Asia Pacific region will be the most attractive location for the fast-increasing urbanization and rising household incomes.

These dynamisms will be the primary contributors to the stable growth that will continue in the air freshener industry through 2035. Nevertheless, the industry is under increasing pressure to make environmental, and health concerns their priority. The issues of emissions or pollution from volatile organic compounds (VOCs), synthetic fragrances, and aerosol-based are coming into greater focus.

Consumers are now more aware of indoor air pollution, so they are pursuing safer, chemical-free alternatives to these products, which leads to a shift toward organic, essential oil-based, and eco-friendly fresheners. Therefore, brands need to not only use plant-based materials but also develop products that are low emissions and meet the safety guidelines imposed worldwide.

Sprays are widely used due to their instant and effective odor elimination. Unlike other forms of fresheners, sprays provide immediate freshness with just a simple press, making them ideal for quick fixes in homes, offices, and public spaces. Their ability to neutralize unwanted smells, such as cooking odors, pet scents, and bathroom odors, makes them a popular choice for maintaining a pleasant environment.

The residential segment is poised to obtain the largest share in 2025 due to increasing consumers awareness of indoor air quality and preference to enhance home ambience. This growth is driven by an increasing awareness of odor elimination, the stress-relief benefits of fragrances, and the popularity of premium home fragrance products. Sprays, plug-in diffusers and scented candles remain the most popular, with floral, citrus and lavender scents dominating consumer preferences.

Online stores are highly favored to buy fresheners because of their convenience and ease of accessibility. Customers have access to an extensive range of brands, fragrances, and types from home without having to go to traditional stores. It is particularly advantageous for busy shoppers who desire to have a stress-free shopping experience. Furthermore, there are detailed descriptions of the product, reviews by customers, and ratings from websites, which enable buyers to make informed decisions using actual user feedback.

Flower scents are commonly used for fresheners due to their naturally calming and refreshing attractiveness. Floral fragrances, including lavender, rose, jasmine, and lily, are most famous for bringing a sense of calmness and pleasantness. These scents remind people of cleanliness, relaxation, and coziness, thus making them suitable for homes, offices, and personal areas. Most individuals equate floral scents with nature and freshness, which makes them more attractive for indoor use.

From 2020 to 2024, the industry witnessed a gradual growth due to rising urbanization, growing disposable incomes, and customer demand for clean indoor spaces. Natural and environmentally friendly fresheners experienced high demand as the consciousness of artificial chemicals and allergens in conventional products rose.

There were new developments in gel-based, aerosol-free, and essential oil-based fresheners, keeping pace with sustainable trends. Smart fresheners with IoT also picked up, enabling fragrance strength and scheduling control through mobile applications. Yet, regulatory constraints on volatile organic compounds (VOCs) and volatile raw material prices impacted market growth.

Between 2025 and 2035, the landscape will transition to AI-driven and automated fragrance diffusion systems, which provide customized scent experiences. Bio-based and probiotic fresheners will increase in popularity as people seek health-friendly and biodegradable options. Nanotechnology developments will also introduce longer-lasting odor-neutralizing products. Smart homes and internet-enabled devices will further propel development, combining fresheners with air quality monitoring systems for increased convenience for the users.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Firms launched natural and essential oil-based fresheners, lowering dependence on artificial fragrances. Aromatherapy-inspired fragrances became popular for stress reduction and wellness purposes. | Fragrance customization using AI enables customers to personalize scents according to their mood and surroundings. Bioengineered fragrances from plant sources go mainstream. |

| Brands adopted eco-friendly packaging, reducing single-use plastics. Refillable and biodegradable packaging became common. Aerosol-free diffusers gained traction. | Fully compostable and reusable packaging becomes standard. Smart dispensers optimize scent diffusion while minimizing waste. Carbon-negative manufacturing processes emerge. |

| Smart fresheners with IoT-enabled scent control and programmable settings were introduced. Voice assistant compatibility (Alexa, Google Home) was a selling feature. | Artificial intelligence-enabled fresheners learn about room usage and air quality, adjusting scent levels. Scent-based wellness monitoring is integrated with health-tracking devices. |

| Home and vehicle freshener demand skyrocketed, particularly in urban areas. E-commerce and subscription-based refills gained popularity. | The landscape expands into wellness and workspaces, with customizable air scent solutions for offices and public spaces. AI-driven recommendations boost online and direct-to-consumer sales. |

| Stricter regulations on VOC emissions and synthetic chemicals influenced product reformulation. Greater ingredient transparency in sourcing became differentiating. | Zero-VOC and fully biodegradable ingredients are encouraged by regulatory agencies. Brands combine compliance tracking with air quality monitoring using real-time measures. |

| Seasonal scent lines and mood-based fresheners became available from companies. Intensity settings were provided to consumers by mobile apps. | Custom scent profiles fully integrated by users support fragrance mixing and blending. AI-based personalized suggestions of scents are provided with subscription models. |

| Brands used lifestyle influencers and wellness activists to natural fresheners. TikTok and Instagram Reels fueled product discovery. | Virtual influencers and AR-enabled scent previews boost online shopping. Metaverse-based scent experiences offer immersive brand engagement. |

| Consumers prioritized non-toxic, pet-friendly, and hypoallergenic fresheners. Demand for multifunctional fresheners with odor-neutralizing properties increased. | Demand for wellness-oriented fresheners rises, integrating aromatherapy benefits. Consumers embrace smart, self-regulating air freshening systems. |

The air fresheners market is not without its risks, which could have multifactorial consequences for profitability and brand image. With dominant giants and a slew of local brands, the players are engaged in cut-throat competition within a hyper-saturated industry leading to high price sensitivity and margin erosion.

Consumers can easily pivot to low-cost alternatives, forcing companies to overspend on marketing and innovation in order to stand out. Especially in emerging markets, counterfeit and poor-quality goods further undermine the global brands and introduce safety risks. In addition, the rising health and environmental issues related to chemicals, VOCs, and unsustainable ingredients have ramped up pressure from consumers and regulators.

Economic volatility further complicates demand, with discretionary spending on unnecessary purchases such as air fresheners likely declining during downturns. Last but not least, the heterogeneity of global regulatory requirements makes it necessary for a company to repeatedly adjust its formulations and compliance, elevating operational costs across the board, and the potential for penalties incurred by deviating from compliance. These challenges need proactive measures to retain market share, as well as consumer trust.

Premium Segment and Value-based Pricing

Not every freshener is a budget buy - there is a premium sub-market, frequently dedicated to natural or designer perfumes. Products such as premium scented candles, essential-oil-based diffusers or luxury-car fresheners (Diptyque, Jo Malone and Bath & Body Works wallflowers) follow a version of value-based pricing. They highlight better scent quality, stylish packaging and brand cachet to charge much more than the mass-market fresheners. A luxury home diffuser, for instance, is around USD 60; a Glade plug-in starter is under USD 5.

These high prices are bolstered by catering to wealthy, niche consumers who regard fragrance as part of a lifestyle or home décor. Though a smaller segment, this has higher margins and expanded with trends in home ambiance and self-care. In a lacklustre economy, boutique lines are launching with better options at higher prices -Febreze has previous limited-edition scents, and Air Wick's got the “Essential Mist” diffuser at a higher price point.

Mainstream companies are struggling more than ever to break away with established businesses. The challenge is convincing consumers that the premium is worthwhile, especially when cheaper options are everywhere. But a certain sector of shoppers will indeed cough up more for natural ingredients and fancy scents, including 74% of consumers who said they’d pay a premium for eco-friendly packaging or natural content in our survey.

North America will continue to dominate the market, fueled by rising consumer awareness of indoor air quality and a preference for premium products. Consumers in the region are looking for health-conscious and high-tech air freshening solutions, leading to the increasing adoption of smart fresheners with customizable scent options and natural essential oils. Companies are expected to introduce innovative formulations free from harmful chemicals, catering to growing concerns over allergens and respiratory sensitivities.

The demand for eco-friendly and sustainable fresheners will rise as regulatory bodies tighten environmental standards. This will encourage brands to adopt biodegradable formulations and recyclable packaging, ensuring minimal environmental impact. Additionally, direct-to-consumer (DTC) sales models, influencer marketing, and subscription-based freshener services will gain traction, increasing brand accessibility across the USA and Canada. Retail partnerships with major supermarkets, e-commerce platforms, and home care brands will further enhance regional penetration.

Sustainability will be the driving force in the Europe, as consumers increasingly seek organic, plant-based, and ethically sourced fragrance solutions. The demand for minimalistic and functional home care products will shape purchasing behaviors, influencing manufacturers to create low-waste, refillable fresheners and zero-VOC (volatile organic compound) sprays.

Regulatory pressures will push companies to develop clean-label and non-toxic fresheners that comply with stringent safety standards. Transparency in ingredient sourcing and carbon footprint reduction initiatives will play a critical role in influencing consumer trust.

Asia Pacific will witness the fastest growth in the market, driven by increasing disposable income, rapid urbanization, and evolving consumer preferences. Countries such as China, India, and Japan will see a surge in demand for high-quality yet affordable air freshening solutions, particularly in urban households and commercial spaces. The growing middle-class population will contribute to a greater emphasis on home fragrance and air quality improvement.

Localized scent preferences will play a major role in product innovation, encouraging brands to tailor fragrances based on cultural preferences and regional trends. Additionally, e-commerce and digital retail expansion will accelerate penetration, with brands leveraging influencer collaborations and lifestyle bloggers to engage younger consumers.

Per Capita Spending on Air Fresheners - Top Countries

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| USA | 5.6 |

| China | 3.8 |

| Japan | 4.9 |

| Germany | 5.4 |

| UK | 5.2 |

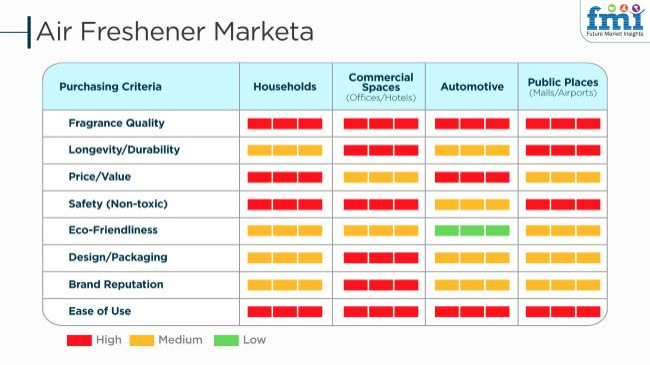

Demand is growing rapidly, driven by rising urbanization, increasing consumer preference for ambient home environments, and growing demand for natural and long-lasting fragrances. A survey of 250 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East highlights key factors influencing purchasing behavior.

65% of respondents prioritize long-lasting and natural fragrances, with 60% in the USA and UK preferring essential oil-based and non-toxic fresheners. 50% of consumers in Southeast Asia and China seek affordable and multi-functional fresheners, such as odor-neutralizing sprays. 45% of respondents in Korea and Japan favor aesthetic and minimalist designs, reflecting home décor trends.

Pricing sensitivity varies, with 55% of USA and UK respondents willing to pay USD 15+ for premium fresheners, while only 30% in Southeast Asia and China opt for high-end options. 40% of respondents across markets expect fresheners to be priced competitively, aligning with everyday household expenses.

E-commerce is a key driver of sales, with 50% of USA and 55% of Chinese consumers purchasing fresheners online via Amazon, Tmall, and Shopee. 45% of consumers in Korea and Japan still prefer physical retail stores, valuing in-store testing. 35% of respondents across ASEAN markets trust social media influencers and online reviews when selecting fresheners.

Sustainability is gaining traction, with 50% of respondents in the UK and EU preferring eco-friendly, refillable, and biodegradable options. 40% of consumers in Southeast Asia and China show interest in locally manufactured fresheners, supporting affordability and regional fragrance preferences. 45% of respondents in ANZ and the Middle East prioritize non-aerosol and hypoallergenic formulations, reflecting health-conscious trends.

Premium fresheners (USD 15+) have strong demand in the USA, UK, and EU, while affordable and multi-functional options dominate in Southeast Asia, China, and the Middle East. E-commerce continues to shape trends, making digital marketing and online distribution crucial. Local brands have an opportunity in price-sensitive markets, while global brands must emphasize natural ingredients, long-lasting effectiveness, and eco-conscious solutions to stay competitive. The industry is evolving rapidly, with opportunities for brands to focus on fragrance innovation, sustainability, and digital engagement

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.8% |

| Germany | 5.2% |

| India | 3.2% |

| China | 3.4% |

The market is growing steadily with growing consumer demand for home and auto fragrances, natural ingredients, and odor-concealing technology. Consumers are moving toward environmentally friendly and longer-lasting fresheners, and mass merchants such as Walmart, Target, and Amazon carry an enormous variety of products. FMI is of the opinion that the USA air freshener market is slated to observe 5.4% CAGR during the study period.

The USA market, valued at USD 1.93 billion, benefits from high consumer preference for home ambiance, fragrance innovation, and premium air care products. Growing demand for eco-friendly, long-lasting fresheners and smart air purifiers is driving sales. Retail and e-commerce channels play a crucial role in product accessibility.

Growth Factors in the USA

| Key Factors | Details |

|---|---|

| Increased Demand for Natural and Eco-Friendly Fragrances | Toxic-free plant-based fresheners are the customer favorite. |

| Innovations in Smart and Automated Dispensers | Highly automated fresheners are becoming fashionable. |

| Segmentation of Offline and Online Channels | Online platforms facilitate increased product coverage. |

The UK industry is experiencing high demand due to rising urbanization, focus on in-home climate, and growing demand for eco-friendly products. Tesco, Sainsbury's, and other major supermarket retailers, along with online retailers like Amazon UK, dominate the distribution channels. FMI is of the opinion that the UK industry is set to expand at 4.8% CAGR during the study period.

The UK’s USD 382.48 million air freshener market is shaped by trends in home ambiance, scented candles, and plug-in fresheners. Consumers prefer luxury scents and wellness-driven air care solutions. Retail chains, online shopping, and premium brand offerings contribute to expansion, with sustainability and cruelty-free options gaining traction.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Growing Consumer Awareness about Indoor Air Quality | Greater concern about elimination of allergens and contaminants. |

| Trend towards Sustainable and Recyclable Packaging | Environmental consumers spur product innovations. |

| Car Freshener Segment Growth | Vehicle fragrances remain very popular. |

Germany's market is expanding with increased demand for fragrance-free and dermatologically tested fresheners. German consumers tend to use chemical-free and hypoallergenic products. Chains such as Amazon Germany, Rossmann, and DM are the largest distribution channels. FMI is of the opinion that the German market is slated to capture 5.2% CAGR during the study period.

Germany’s USD 470.96 million industry benefits from sustainability-focused consumers seeking natural and biodegradable fresheners. Eco-conscious sprays, essential oil diffusers, and smart air purification systems are gaining popularity. Increasing health awareness and demand for allergen-free fresheners have pushed brands toward organic and plant-based formulations.

Japan’s USD 690 million air freshener market thrives on minimalist, high-tech, and natural fragrance preferences. Japanese consumers prefer subtle, low-chemical fresheners for both homes and vehicles. The demand for compact, rechargeable, and sensor-based fresheners is rising, while premium brands dominate with innovative product formulations.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Prefer Hypoallergenic and Fragrance-Free Products | Increased demand for skin-sensitive products. |

| Smart Home Fragrance Device Innovation | Automated and Bluetooth-based fresheners are sought after. |

| Retail and E-commerce Growth | Mainline retailers drive product availability. |

Demand is rising in India at a fast rate due to increasing disposable incomes, increasing awareness regarding home hygiene, and urbanization. Amazon India, and Flipkart and Big Bazaar, hypermarket chains, lead expansion. This, along with the surging working class population has bolstered the disposable income in the country. FMI is of the opinion that the India is set to witness 3.2% CAGR during the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Growth in disposable income | Growing expenditure on car and home fragrances. |

| Growing demand for natural and herbal fresheners | Ayurvedic- and essential oil-based fresheners’ trend. |

| Growth in the e-commerce market | Convenience of access through online platforms to multiple brands. |

Demand in China is growing due to rising demand for home environment products with quality and greater numbers of urban middle-class consumers. China's domestic e-commerce giants, Tmall and JD.com, dominate product distribution. FMI is of the opinion that the Chinese market is set to witness 3.4% CAGR during the forecast period.

China’s USD 7.96 billion industry is fueled by rapid urbanization, rising disposable incomes, and an increasing focus on indoor air quality. Consumers favor automatic fresheners, essential oil diffusers, and smart fragrance solutions. The expansion of online retail and homecare trends is accelerating market growth, with global and domestic brands competing.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Fast-rising urbanization and middle-Class Expenditure | Higher demand for indoor air freshening products. |

| Increasing intelligent and automatic fresheners | Sophisticated fragrance diffusers are trendy. |

| Government control of chemical-based fresheners | Transition towards green alternatives. |

The global air freshener market is characterized by the presence of several key players employing diverse growth strategies to maintain and enhance their positions. Procter & Gamble, for instance, has expanded its product line under the Febreze brand, introducing innovative products like the Febreze Airia, an intelligent fragrance dispenser utilizing patented SmartJet technology for consistent scent distribution.

Similarly, S.C. Johnson & Son, through its Glade brand, has launched new fragrances such as Coastal Sunshine Citrus, designed with smart light technology and long-lasting freshener oils, catering to evolving consumer preferences.

Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Procter & Gamble co. | 15-20% |

| Reckitt Benckiser Group plc | 12-16% |

| S. C. Johnson & Son, inc. | 10-14% |

| Henkel AG & Co. Kgaa | 8-12% |

| Church & dwight co., inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Procter & Gamble Co. | Offers a wide range of fresheners under the 'Febreze' brand, utilizing advanced odor elimination technology. Focuses on sustainability with recyclable packaging and natural ingredient formulations. |

| Reckitt Benckiser Group plc | Markets fresheners through the 'Air Wick' brand, emphasizing natural scents and essential oils. Invests in product innovation, including automated and smart air freshening solutions. |

| S. C. Johnson & Son, Inc. | Provides diverse air care products under the 'Glade' brand, including sprays, candles, and plug-ins. Prioritizes consumer preferences with seasonal and limited-edition fragrances. |

| Henkel AG & Co. KGaA | Offers fresheners under the 'Bref' and 'Pril' brands, focusing on long-lasting freshness and innovative delivery systems. Expands market presence through strategic acquisitions and partnerships. |

| Church & Dwight Co., Inc. | Markets fresheners under the 'Arm & Hammer' brand, leveraging the deodorizing power of baking soda. Emphasizes value-for-money products targeting budget-conscious consumers. |

Key Company Insights

Procter and Gamble Co. (15-20%)

Procter and Gamble defines the air fresheners market with its 'Febreze' brand, famous for removing odors, and with a range of scents available at customer preference. The commitment of the company to research and development is evident with the new product launches like fabric refreshers and car vent clips. Sustainability offers recyclable materials and eco-inspired formulations.

Reckitt Benckiser Group plc (12-16%)

With 'Air Wick', Reckitt focuses on presenting the aromas of nature indoors. Products like diffusers filled with essential oils and automated spray systems are available. Earlier this year, it expanded its botanically sourced fragrance and made them available through a range of retail channels.

S. C. Johnson & Son, Inc. (10-14%)

S. C. Johnson's 'Glade' brand gives consumers the full range of air care products according to all taste preferences. This company does real innovation with things like motion-activated sprays and scented oil plugins. Their marketing techniques involve working alongside artists and designers to produce limited edition collections.

Henkel AG & Co. KGaA (8-12%)

Henkel provides hygiene and long-lasting fresh air fresheners. The company launched innovative formats, including gel activators, and continuous-action devices, to quickly expand its product line. Strategic acquisitions strengthen Henkel's market share and broaden its geographical breadth.

Church & Dwight Co., Inc. (6-10%)

This effort uses its relationship between the 'Arm & Hammer' brand and baking soda to focus sales toward selling effective air fresheners for odor elimination. They manufacture many products from room sprays and car air fresheners with a focus on being cost-efficient and effective as well. These distribution efforts in the mass-market retail channel have supported the growth of market share.

Other Key Players (30-40% Combined)

There are also several emerging and niche companies stretching the growth of the market. Some of these companies have carved a niche for themselves with unique selling propositions like organic, artisanal scents, and customizable offerings.

By product type, the market is segmented into spray/aerosols, electric air fresheners, gels, candles, and others.

The application segmentation includes residential, commercial, cars, and others.

Based on sales channel, this market is segmented into hypermarkets/supermarkets, independent stores, specialty stores, departmental stores, online retailers, and other sales channels.

In terms of fragrance type, the market is divided into flowers, fruits, wood chips, and others.

Geographically, the market is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is set to be worth USD 17.4 billion in 2025.

The industry is anticipated to reach USD 28.72 billion by 2035 end.

The USA, set to grow at 5.4% CAGR during the study period, is set to witness fastest growth.

Sprays are widely used.

The key players include Procter & Gamble, SC Johnson, Reckitt Benckiser, Henkel, Church & Dwight, California Scents, ST Corporation, Scott’s Liquid Gold, Inc., Amway, Kobayashi, Liby, Houdy, Farcent, Jiali, Ludao, and Mengjiaolan.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Diffuser Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Diffuser Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Specialty Product, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Specialty Product, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Specialty Product, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Specialty Product, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Specialty Product, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Specialty Product, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Specialty Product, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Specialty Product, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Specialty Product, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Diffuser Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Specialty Product, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Diffuser Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Diffuser Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Diffuser Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Diffuser Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Specialty Product, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Specialty Product, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Specialty Product, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Specialty Product, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Diffuser Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Specialty Product, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Car Air Freshener Market Size and Share Forecast Outlook 2025 to 2035

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Electric Air Freshener Market Analysis - Trends, Growth & Forecast 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA