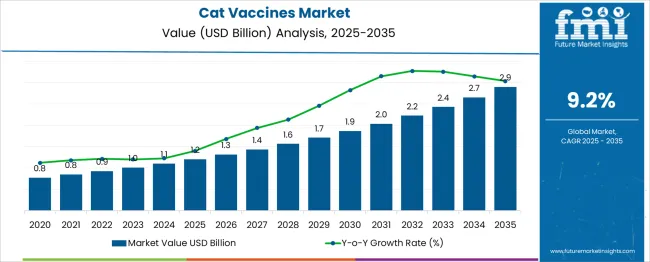

The Cat Vaccines Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. The cat vaccines market is projected to show a growth multiplier of 2.42x over the forecast period. Supported by a strong CAGR of 9.2%, this expansion is driven by the rising pet population, increasing awareness of feline health, and advancements in combination and core vaccines.

During the first five-year phase (2025–2030), the market is expected to reach USD 1.9 billion, adding USD 0.7 billion, which accounts for 41.2% of total incremental growth, with a 5-year multiplier of 1.58x, as routine immunization programs expand globally. The second half (2030–2035) contributes USD 1.0 billion, representing 58.8% of incremental growth, signaling continued momentum driven by innovations in intranasal and recombinant vaccine technologies and the growing popularity of preventive veterinary care. Annual increments rise from USD 0.1 billion in the early years to USD 0.3 billion toward 2035, highlighting acceleration in advanced markets and emerging economies alike. Manufacturers focusing on extended-duration vaccines, cold-chain optimization, and digital veterinary platforms will be well-positioned to capture significant value in this USD 1.7 billion opportunity, particularly as companion animal healthcare expenditure continues to rise globally.

| Metric | Value |

|---|---|

| Cat Vaccines Market Estimated Value in (2025 E) | USD 1.2 billion |

| Cat Vaccines Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The cat vaccines market holds a defined share within key veterinary and pet care sectors. In the Veterinary Vaccines Market, it accounts for about 10%, as vaccines for cattle, poultry, and dogs dominate overall demand. Within the Companion Animal Health Market, its share is approximately 8%, given the inclusion of dogs, horses, and other pets in this broader category. For the Animal Health Market, cat vaccines contribute around 3%, since livestock health products form a major portion of revenue. In the Preventive Veterinary Medicine Market, its share is close to 7%, as vaccines remain a core preventive measure alongside deworming and diagnostics. Within the Pet Care Market, it represents about 2%, considering the dominance of nutrition, grooming, and accessories. Growth is driven by increasing awareness of feline health, higher rates of pet adoption, and strict vaccination protocols against diseases such as rabies, feline leukemia virus (FeLV), and panleukopenia.

Advances in combination vaccines, intranasal formulations, and long-acting immunization solutions are further supporting uptake. The rising popularity of pet insurance and expanding veterinary care infrastructure also contribute to increased accessibility. These factors position cat vaccines as an essential preventive healthcare component, ensuring long-term disease control and improved quality of life for domestic cats globally.

The cat vaccines market is witnessing steady advancement, driven by heightened awareness of feline disease prevention, increasing pet ownership, and regulatory emphasis on veterinary immunization standards. Veterinary service providers are reporting improved vaccine coverage in both urban and rural settings, supported by government-led animal welfare programs and the rising disposable income of pet parents.

Growing recognition of zoonotic risks and cross-species disease transmission has also bolstered demand for routine feline immunization. Technological advancements in adjuvants and formulation stability have enabled longer shelf life and better efficacy.

Furthermore, the proliferation of pet healthcare startups and veterinary chains has streamlined access to vaccinations, especially in emerging markets. The market outlook remains favorable with a push toward preventive veterinary medicine and standardized immunization schedules across companion animal care.

The cat vaccines market is segmented by vaccine type, disease type, route of administration, component, duration of immunity, and geographic regions. The cat vaccines market is divided by vaccine type into Inactivated, Modified/attenuated live, and Other vaccine types. In terms of disease type, the cat vaccine market is classified into Feline respiratory diseases, Feline leukemia, Feline panleukopenia (feline distemper), Feline rabies, and Other disease types. Based on the route of administration, the cat vaccines market is segmented into Injectables and Intranasal. The cat vaccines market is segmented into the Combined vaccine and the Mono vaccine. Based on the duration of immunity, the cat vaccines market is segmented into 3 years, 1 year, and Other durations of immunity. Regionally, the cat vaccines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

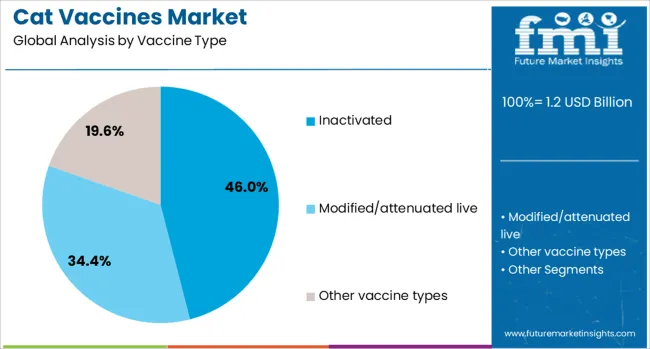

Inactivated vaccines are expected to lead the market with a 46.0% share in 2025. This segment's dominance has been supported by the stable antigen structure and low risk of reversion associated with inactivated formulations.

Veterinarians favor these vaccines for their safety profile, especially in immunocompromised or older cats. Improvements in production technologies and quality control have enhanced immunogenicity, increasing trust among healthcare providers.

Regulatory approvals for broad-spectrum inactivated feline vaccines have further expanded their use in clinics and veterinary hospitals. The availability of multivalent inactivated vaccines has also optimized dosing schedules, making them a cost-effective and convenient choice.

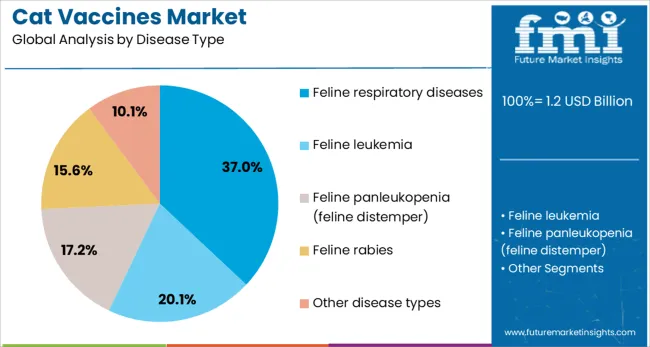

Vaccines targeting feline respiratory diseases are projected to account for 37.0% of market revenue in 2025, making this the dominant disease type. The high incidence of upper respiratory infections, particularly in shelter and multi-cat environments, has driven vaccine adoption.

These conditions often caused by feline herpesvirus and calicivirus are highly contagious, making immunization critical for disease control. Increased diagnostic rates and awareness among pet owners have reinforced the demand for preventive vaccines.

Veterinary guidelines continue to prioritize respiratory disease vaccines as core, ensuring their widespread use across geographies. As respiratory health gains prominence in feline wellness programs, this segment is set to maintain its leadership.

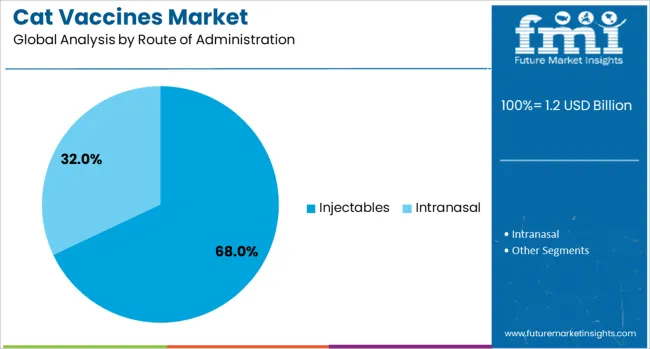

Injectables are forecast to capture 68.0% of the market in 2025, leading among administration routes. Their sustained dominance is attributed to high bioavailability, proven delivery efficiency, and broader coverage across different vaccine types.

Injectable vaccines have remained the standard in clinical veterinary practices due to ease of administration and clear immunization tracking. Advances in syringe design and pain-minimizing technologies have improved compliance and pet comfort.

Injectable formats also benefit from better cold chain integrity and regulatory predictability. As clinics continue to standardize vaccine administration protocols, injectable delivery will remain the preferred method for feline immunization.

Growth during 2024 and 2025 was supported by the higher incidence of viral infections such as feline herpesvirus and calicivirus, driving demand for core and non-core vaccines. Opportunities lie in combination vaccines and specialized immunization programs tailored for companion animals. Key trends include intranasal vaccine delivery and recombinant formulations improving safety and effectiveness. However, high product pricing, limited access in rural areas, and supply chain issues remain significant barriers affecting consistent market penetration.

The major growth driver is the rising pet population and need for disease prevention in feline care. In 2024 and 2025, increased adoption of cats in North America and Europe boosted vaccine demand, particularly for rabies and feline leukemia. Outbreaks of respiratory infections in multi-cat households further encouraged regular immunization schedules recommended by veterinarians. Companion animal clinics expanded vaccine availability through bundled wellness packages to ensure compliance. These developments confirm that preventive healthcare measures and stronger pet-human bonds will continue to drive vaccine adoption across global markets.

Significant opportunities exist in the development of multi-disease vaccines and formulations adapted to regional risks. In 2025, demand for combination vaccines addressing feline distemper, herpesvirus, and calicivirus rose among veterinary clinics aiming to simplify dosing and improve compliance. Regional manufacturers introduced rabies and tick-borne disease vaccines tailored to local regulatory guidelines. Premium growth prospects emerged in developing markets, where organized pet care channels are expanding rapidly. These factors suggest that suppliers focusing on diversified portfolios and geographic customization will secure a competitive advantage in a dynamic vaccine landscape.

Emerging trends include the adoption of recombinant vaccine technology and alternative administration methods to improve safety and convenience. In 2024, intranasal vaccines gained attention as a stress-free option for feline patients, reducing injection-related complications. Recombinant formulations targeting specific viral strains improved efficacy while lowering the risk of adverse reactions. Digital health platforms also supported vaccination reminders for pet owners, enhancing compliance rates. These patterns indicate a decisive shift toward user-friendly solutions and scientifically advanced products, reinforcing the importance of innovation and adaptability in the evolving pet care sector.

Market restraints are influenced by elevated vaccine costs, limited distribution channels in rural regions, and regulatory complexities. In 2024 and 2025, price sensitivity in emerging markets reduced uptake, as premium vaccines often remained accessible only through specialized clinics. Disruptions in veterinary supply chains during adverse economic conditions further restricted timely availability. Additionally, varying approval timelines for new formulations delayed market entry in several countries. These challenges emphasize the need for cost-effective solutions, improved veterinary infrastructure, and streamlined regulatory frameworks to ensure widespread access and adoption of feline vaccines globally.

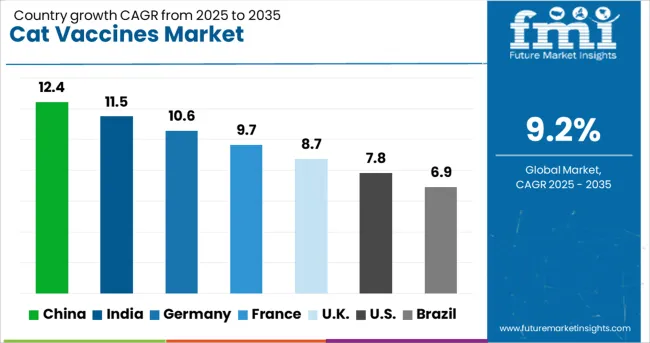

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The global cat vaccines market is projected to grow at 9.2% CAGR between 2025 and 2035. China leads at 12.4% CAGR, driven by rising pet ownership and government focus on zoonotic disease prevention. India follows at 11.5%, supported by increasing awareness of feline health and urban pet care services. France records 9.7% CAGR, emphasizing regulatory compliance and premium preventive care solutions. The United Kingdom grows at 8.7%, while the United States posts 7.8%, reflecting steady growth in mature markets focusing on advanced immunization programs and combination vaccines. Asia-Pacific leads demand due to rapid urbanization and expanding veterinary infrastructure, while Europe and North America prioritize innovation and premium product offerings. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cat vaccines market in China is forecasted to grow at 12.4% CAGR, supported by rapid growth in the companion animal segment and government initiatives to curb zoonotic diseases. Increasing adoption of cats in urban households drives demand for core and non-core vaccines, including rabies, calicivirus, and feline leukemia. Global players expand partnerships with local distributors to improve cold-chain supply for high-quality vaccines. Rising disposable income among pet owners boosts uptake of premium multivalent vaccines that offer broad-spectrum protection.

The cat vaccines market in India is projected to grow at 11.5% CAGR, driven by growing awareness of feline health and expansion of organized veterinary care. Demand for rabies and feline panleukopenia vaccines rises significantly due to increased emphasis on disease control. Veterinary clinics in urban and semi-urban areas adopt advanced cold storage facilities to maintain vaccine efficacy. E-commerce platforms and tele-veterinary services improve accessibility, making routine vaccination more convenient for pet owners. Manufacturers focus on cost-effective formulations to cater to the price-sensitive market.

The cat vaccines market in France is expected to grow at 9.7% CAGR, supported by strong regulatory frameworks and rising adoption of indoor cats. Premium vaccine formulations offering combined protection against multiple viral and bacterial infections see high demand. Veterinary clinics integrate digital health records and reminder systems to improve compliance with booster schedules. Manufacturers invest in research for intranasal and needle-free vaccine delivery technologies to enhance safety and convenience. Growth in pet insurance coverage further supports higher vaccination rates.

The cat vaccines market in the United Kingdom is forecasted to grow at 8.7% CAGR, driven by strong emphasis on preventive veterinary care and growth in companion animal ownership. Demand for vaccines against feline calicivirus, herpesvirus, and rabies rises in both household pets and shelter cats. Pet wellness programs offered by clinics include annual vaccination plans, improving affordability and compliance. Manufacturers develop thermostable vaccine formulations to minimize cold-chain dependency. Advanced antibody titer tests gain traction for personalized vaccination protocols.

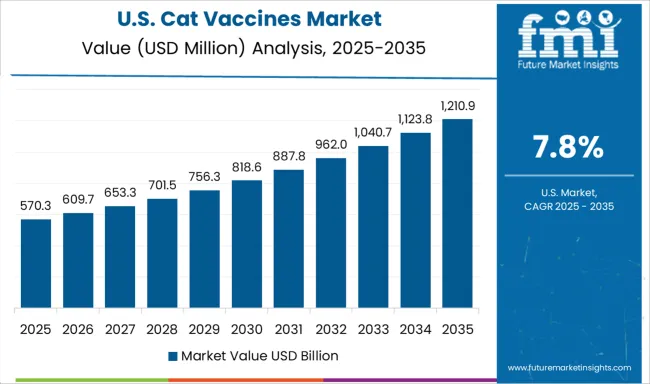

The cat vaccines market in the United States is projected to grow at 7.8% CAGR, reflecting steady demand in a mature veterinary care system. Increasing pet insurance penetration and rising preference for preventive care strengthen vaccine adoption. Manufacturers focus on next-generation vaccines featuring recombinant technology for enhanced immunity and fewer side effects. Growth in feline adoption through animal shelters drives demand for mass immunization programs. Emerging trends include combination vaccines and extended-duration formulations to reduce clinic visits.

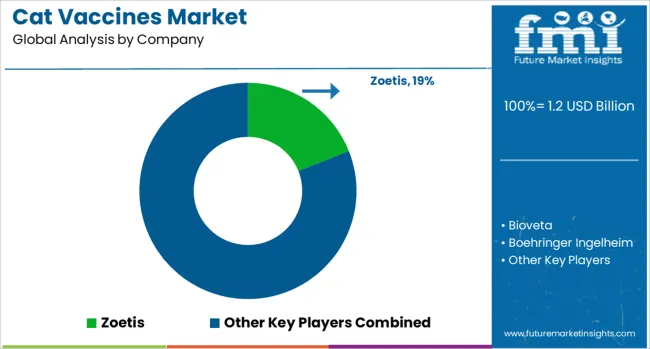

The cat vaccines market is dominated by Zoetis, which secures its leadership through a broad portfolio of vaccines addressing core feline diseases such as rabies, feline leukemia, and respiratory infections. Zoetis strengthens its dominant position with advanced R&D, global distribution channels, and strong partnerships with veterinary clinics to ensure effective disease prevention programs. Key players such as Boehringer Ingelheim, Elanco, Merck, and Virbac hold significant shares by offering multi-component vaccines designed for comprehensive feline immunization. These companies focus on high efficacy, safety, and ease of administration while complying with stringent regulatory standards across diverse geographies.

Emerging players including Bioveta, Durvet, Indian Immunologicals, INTAS Animal Health, and Spectra are expanding their market footprint by introducing cost-effective and region-specific vaccines. Their strategies include developing freeze-dried formulations for better shelf stability and targeting preventive care for stray and shelter populations. Market growth is driven by increasing pet adoption, rising awareness of feline health, and regulatory emphasis on vaccination compliance to prevent zoonotic diseases. Continuous innovation in recombinant vaccine technologies and combination formulations is expected to influence competitive dynamics, providing both established and emerging players with opportunities to strengthen their presence in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Vaccine Type | Inactivated, Modified/attenuated live, and Other vaccine types |

| Disease Type | Feline respiratory diseases, Feline leukemia, Feline panleukopenia (feline distemper), Feline rabies, and Other disease types |

| Route of Administration | Injectables and Intranasal |

| Component | Combined vaccine and Mono vaccine |

| Duration of Immunity | 3 years, 1 year, and Other durations of immunity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis, Bioveta, Boehringer Ingelheim, Durvet, Elanco, Indian Immunologicals, INTAS Animal Health, Merck, Spectra, and Virbac |

| Additional Attributes | Dollar sales by vaccine type (live-attenuated, recombinant, toxoid) and distribution channel (clinics, retail, online), segmented by indication (core vs non-core). North America leads, Asia-Pacific grows fastest. Buyers prioritize broad-spectrum efficacy and compliance. Innovations include mucosal/vector platforms, thermostable doses, and AI-driven disease surveillance enhancing vaccination strategies and insurance-linked preventive care uptake. |

The global cat vaccines market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the cat vaccines market is projected to reach USD 2.9 billion by 2035.

The cat vaccines market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in cat vaccines market are inactivated, modified/attenuated live and other vaccine types.

In terms of disease type, feline respiratory diseases segment to command 37.0% share in the cat vaccines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Cat Litter Product Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catalog Management System Market Size and Share Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Acrylic Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Catering Management Market Size and Share Forecast Outlook 2025 to 2035

Catecholamines Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cat Food Toppers Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Industry Analysis in Japan Size, Growth, and Forecast (2025 to 2035)

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA