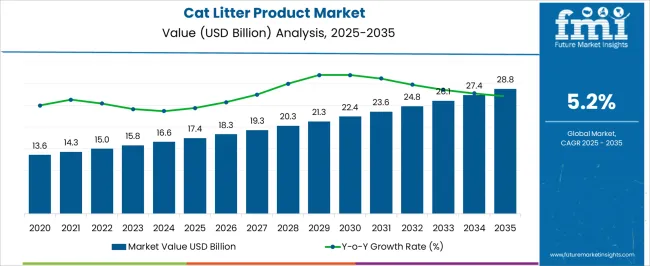

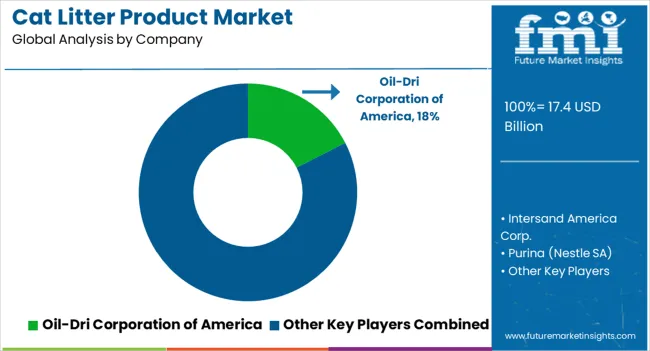

The cat litter product market is projected to grow from USD 17.4 billion in 2025 to USD 28.8 billion by 2035, at a CAGR of 5.2%. Clumping will dominate with a 63.4% market share, while clay will lead the material type segment with a 54.6% share. The global cat litter product industry will undergo significant modification over the next ten years. Analysts forecast a 5.2% CAGR between 2025 and 2035, higher than the stable but modest 5.00% rate predicted for 2020 through 2025.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 17.4 billion |

| Industry Value (2035F) | USD 28.8 billion |

| CAGR (2025 to 2035) | 5.2% |

The market for cat litter is a booming, quickly changing sector that meets the demands of our cherished feline companions. The need for practical, odor-controlling, and environmentally friendly cat litter choices has increased along with pet ownership.

Innovative items, including silica gel crystals, clumping clay, natural plant-based substitutes, and smart litter systems, are being introduced by manufacturers. Cat parents desire a litter that provides convenience, ease of cleanup, and extended freshness beyond usefulness.

The adoption of cat litter has spread widely among cat owners, especially those with many cats. However, the product's high price and some pet owners' reluctance to spend a lot of money on expensive items for their animals might serve as a market restriction. Additionally, this causes a situation where the market is unable to launch high-end items, which hinders market growth.

The growing cost of raw materials used to produce cat litter products is expected to hamper the market growth. Regular non-clumping litter can be made to control the raw material cost for the production of cat litter products, which is the cheapest material per pound for filling up litter boxes. Additional crucial aspects that are anticipated to impede the market's growth include growing worries about the environment and pet health.

For instance, the carbon footprint of silica, which is utilized in kitty litter products, is rather significant. It damages the climate as well. Switching to environmentally friendly kitty litter will have a significant effect on reducing carbon emissions.

| Top Product | Clumping Cat Litter |

|---|---|

| Market share | 72.50% |

| Top Sales Channel | Online Retailers |

|---|---|

| Market share | 22.20% |

| Country | United States |

|---|---|

| CAGR (2025 to 2035) | 5.3% |

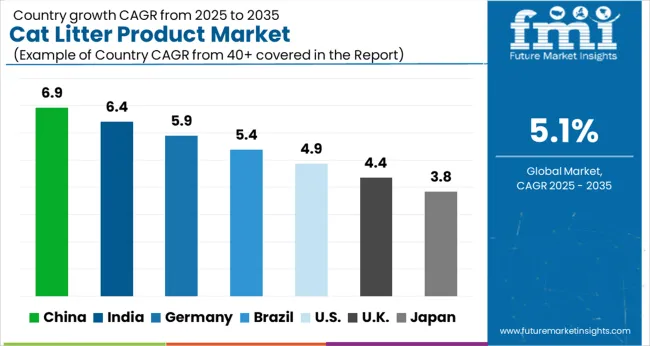

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 5.6% |

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 5.7% |

| Country | Australia |

|---|---|

| CAGR (2025 to 2035) | 5.9% |

| Country | Germany |

|---|---|

| CAGR (2025 to 2035) | 5.5% |

In the global cat litter product market, market players are still pursuing attracting more consumers to their brands and expanding their reach worldwide. Brands in cat care products are adopting a range of strategies to maintain their market positions and further develop their business. These strategies include mergers and acquisitions, forging partnerships and alliances, launching new products, expanding their international presence, and exploring other avenues. Pet product manufacturers can remain ahead of their competition and successfully satisfy the desires of consumers in various locations by employing multiple techniques.

Recent Developments in the Cat Litter Product Market

The global cat litter product market is estimated to be valued at USD 17.4 billion in 2025.

The market size for the cat litter product market is projected to reach USD 28.8 billion by 2035.

The cat litter product market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in cat litter product market are clumping and non-clumping.

In terms of material type, clay segment to command 54.6% share in the cat litter product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Cat Litter Products Market

Cat Litter Market Analysis - Size, Share, and Forecast 2025 to 2035

Cat Litter Boxes Market Analysis by Product Type, Material, End-User, Distribution Channel and Region, Forecast through 2035

Competitive Breakdown of Cat Litter Providers

Smart Cat Litter Box Market Insights – Growth & Forecast 2024-2034

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Bentonite Cat Litter Market Analysis by Type, Composition, Distribution Channel and Region Through 2025 to 2035

Lubricating Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA & Canada Cat Litter Market Growth, Demand, and Forecast 2025 to 2035

USA & Canada Cat Litter Box Market Trend, Growth and Forecast 2025 to 2035

Automatic Self-cleaning Cat Litter Box Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catalog Management System Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Acrylic Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA