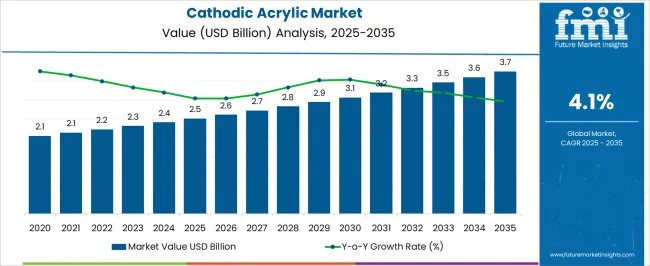

The Cathodic Acrylic Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Initial growth was fueled by regulatory push for eco-friendly coatings and pilot implementations across industrial segments. This period focused on product validation, awareness-building, and establishing supply chains, setting the stage for broader adoption.

From 2025 to 2030, the market enters a rapid expansion phase, climbing from USD 2.5 billion to USD 3.2 billion, driven by scaling production and wider commercial acceptance. By 2030–2035, growth moderates to consolidation, with the market reaching USD 3.7 billion. Leading players consolidate market share, while technological maturity and standardized applications stabilize demand. The industry shifts toward efficiency and long-term partnerships, solidifying Cathodic Acrylic as a mainstream solution in protective coatings, with a focus on sustained performance and regulatory compliance.

| Metric | Value |

|---|---|

| Cathodic Acrylic Market Estimated Value in (2025 E) | USD 2.5 billion |

| Cathodic Acrylic Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The cathodic acrylic market is experiencing consistent growth, supported by advancements in coating technologies and rising adoption in applications demanding high-performance protection. Waterborne formulations are gaining preference due to stricter environmental regulations on volatile organic compound emissions and the shift toward sustainable coating solutions. The market’s growth trajectory is being shaped by ongoing innovations in resin chemistry, enabling improved adhesion, chemical resistance, and weatherability.

Automotive manufacturers and industrial sectors are increasingly deploying cathodic acrylic coatings to enhance product longevity, reduce maintenance costs, and meet stringent global quality standards. Expanding industrial infrastructure, especially in emerging economies, is creating opportunities for market expansion, while established players continue to invest in research and process optimization.

Furthermore, the integration of cathodic acrylic coatings with advanced curing technologies is enabling faster production cycles without compromising performance With sustainability mandates intensifying and the need for durable surface protection growing, the market is poised for continued expansion across multiple end-use sectors.

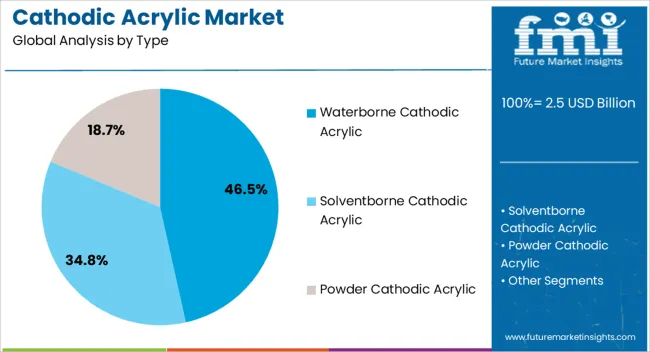

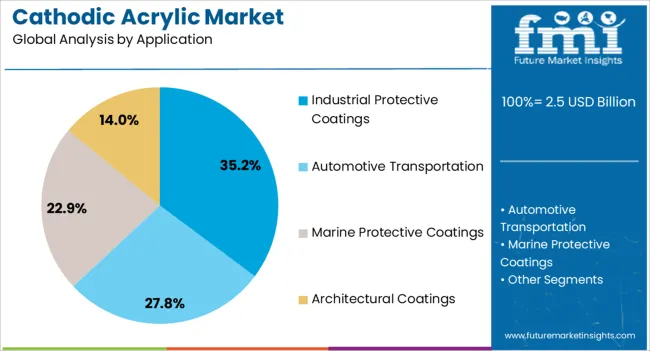

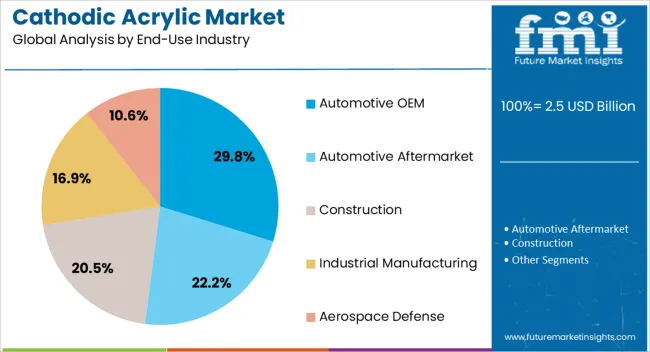

The cathodic acrylic market is segmented by type, application, end-use industry, technology, and geographic regions. By type, cathodic acrylic market is divided into Waterborne Cathodic Acrylic, Solventborne Cathodic Acrylic, and Powder Cathodic Acrylic. In terms of application, cathodic acrylic market is classified into Industrial Protective Coatings, Automotive Transportation, Marine Protective Coatings, and Architectural Coatings. Based on end-use industry, cathodic acrylic market is segmented into Automotive OEM, Automotive Aftermarket, Construction, Industrial Manufacturing, and Aerospace Defense. By technology, cathodic acrylic market is segmented into Emulsion Polymerization, Solution Polymerization, and Suspension Polymerization. Regionally, the cathodic acrylic industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The waterborne cathodic acrylic segment is projected to hold 46.5% of the total revenue share in the cathodic acrylic market in 2025, positioning it as the leading type. Its dominance is being driven by increasing adoption in industries aiming to meet stringent environmental regulations and reduce VOC emissions. Waterborne formulations provide excellent corrosion protection and surface coverage, making them suitable for high-demand applications.

Enhanced resin technologies have improved drying times, durability, and adhesion properties, further strengthening their competitive edge. The ability to apply these coatings in varied environmental conditions, coupled with easier cleanup and safer handling, has expanded their acceptance in automotive and industrial settings.

Market adoption is also being supported by advancements in water-dispersible resin systems, which offer superior gloss retention and chemical resistance With sustainability targets becoming a critical factor in procurement decisions, waterborne cathodic acrylic coatings are expected to maintain their leadership in the coming years.

The industrial protective coatings segment is estimated to account for 35.2% of the cathodic acrylic market revenue in 2025, making it the leading application category. Growth in this segment is being influenced by rising investments in infrastructure, energy, and heavy manufacturing sectors, where long-lasting surface protection is essential. Cathodic acrylic coatings are being deployed to shield metal structures, machinery, and equipment from corrosion, abrasion, and harsh weather conditions.

The capability of these coatings to provide a durable, aesthetically consistent finish has enhanced their adoption in both new construction and maintenance projects. Technological advancements have led to better film formation, improved impact resistance, and compatibility with diverse substrates, ensuring prolonged asset life.

The push for lower lifecycle costs and compliance with environmental standards is further propelling demand With industries prioritizing reliability and reduced downtime, cathodic acrylic-based protective coatings are set to retain a strong market position.

The automotive OEM segment is expected to represent 29.8% of the cathodic acrylic market revenue in 2025, emerging as the dominant end-use industry. The segment’s leadership is being reinforced by the automotive sector’s focus on high-performance coatings that enhance vehicle durability and visual appeal.

Cathodic acrylic coatings offer superior corrosion resistance, color retention, and surface finish quality, aligning with manufacturers’ stringent quality requirements. The adoption of these coatings in automotive production lines has been facilitated by their compatibility with automated application systems and efficient curing processes, enabling higher throughput without compromising finish standards.

Increasing consumer demand for long-lasting exterior finishes, combined with automakers’ commitments to sustainability, has encouraged the use of waterborne and low-emission cathodic acrylic formulations As electric vehicle production expands and global automotive output rebounds, the demand for advanced coating technologies such as cathodic acrylic is expected to remain robust.

The cathodic acrylic coatings market is expanding due to increasing demand for corrosion-resistant protective coatings in automotive, industrial, and marine applications. These coatings provide superior adhesion, chemical resistance, and long-term durability through electrodeposition processes. Rising automotive production, infrastructure development, and industrial machinery manufacturing drive adoption. Technological innovations in low-VOC formulations, enhanced film performance, and electrocoat bath efficiency are enabling growth. Asia-Pacific leads in production and consumption, while Europe and North America focus on high-performance, environmentally compliant formulations.

The automotive sector is the largest end-user of cathodic acrylic coatings due to stringent anti-corrosion and durability requirements. Cathodic electrodeposition coatings (E-coats) are widely used for car bodies, chassis, and structural components, providing uniform coverage and long-lasting protection. The rise of electric vehicles, lightweight metal substrates, and multi-material construction increases demand for high-performance coatings compatible with diverse substrates. Manufacturers investing in advanced formulations with improved throwpower, bath stability, and low VOC emissions gain a competitive edge. Until alternative protective technologies are scaled economically, the automotive industry will remain the primary growth driver.

Innovations in electrocoat bath chemistry, such as improved resin systems, pigment dispersion, and cathodic polymerization techniques, enhance coating efficiency, corrosion resistance, and film uniformity. Automation, real-time bath monitoring, and temperature control optimize deposition rates and reduce defects. Low-VOC and waterborne formulations meet environmental standards without sacrificing performance. Companies focusing on process optimization, energy efficiency, and customizable formulations for different substrates can differentiate themselves. Until next-generation coatings with higher deposition rates and lower environmental impact are commercialized widely, technological innovation in electrocoating remains a critical market driver.

Environmental regulations on volatile organic compounds (VOCs), hazardous air pollutants, and waterborne emissions influence cathodic acrylic formulations. Companies must develop waterborne, low-VOC coatings to comply with EPA, REACH, and other regional standards. Sustainable coatings reduce waste and environmental footprint, appealing to eco-conscious automotive and industrial clients. Investment in green chemistry, recycling of bath materials, and safe disposal processes is increasing. Until universally sustainable cathodic acrylic solutions are cost-competitive, regulatory compliance will remain a significant factor affecting production, adoption, and market expansion.

Beyond automotive, cathodic acrylic coatings are increasingly adopted in industrial machinery, construction equipment, and marine vessels due to their corrosion resistance, chemical stability, and adhesion on metal substrates. Marine and offshore applications benefit from long-term protection against saltwater, humidity, and chemical exposure. Growth is further supported by infrastructure development in Asia-Pacific and maintenance-driven coating replacement cycles globally. Manufacturers providing tailored solutions for harsh environments, including multi-layer systems and specialty primers, can capture niche markets. Until alternative coating systems achieve equivalent durability and efficiency, cathodic acrylic coatings will remain the preferred solution in industrial and marine applications.

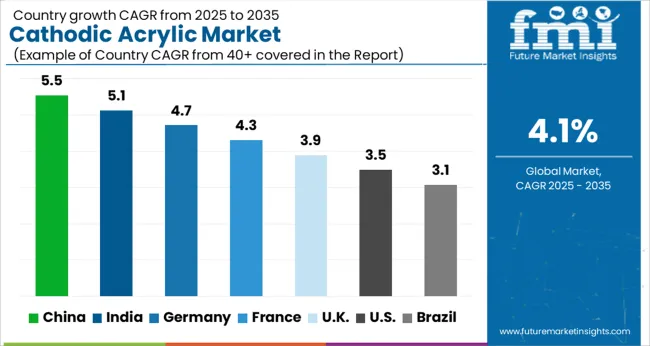

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

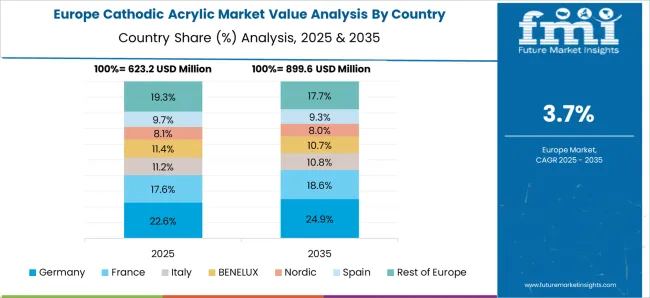

The global Cathodic Acrylic Market is projected to grow at a CAGR of 4.1% through 2035, supported by increasing demand across coatings, automotive, and industrial applications. Among BRICS nations, China has been recorded with 5.5% growth, driven by large-scale production and deployment in automotive and industrial coatings, while India has been observed at 5.1%, supported by rising utilization in protective and decorative applications. In the OECD region, Germany has been measured at 4.7%, where production and adoption for industrial, automotive, and specialty coatings have been steadily maintained. The United Kingdom has been noted at 3.9%, reflecting consistent use in automotive and industrial applications, while the USA has been recorded at 3.5%, with production and utilization across coatings and protective finishes being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The cathodic acrylic market in China is growing at a CAGR of 5.5%, driven by rising demand in automotive coatings, industrial protection, and construction applications. The expanding automotive and infrastructure sectors are major contributors, as cathodic acrylic coatings provide excellent corrosion resistance, durability, and adhesion on metal substrates. Increasing industrialization and rapid urban development support consistent demand for protective coatings in machinery, pipelines, and structural steel. Technological innovations, such as waterborne and eco-friendly formulations, are being adopted to comply with environmental regulations and reduce VOC emissions. China’s strong manufacturing base and investments in coating technology R&D enhance the production efficiency and quality of cathodic acrylic products. The growing focus on high-performance coatings in automotive manufacturing, metal fabrication, and industrial machinery continues to fuel the market. Increasing exports of coated products also contribute to stable market growth in China.

The cathodic acrylic market in India is expanding at a CAGR of 5.1%, supported by growth in automotive, industrial machinery, and construction sectors. Rising infrastructure development and industrial projects increase the demand for protective coatings that provide corrosion resistance and long-term durability. The automotive industry is a significant end-user, applying cathodic acrylic coatings to metal parts to enhance product longevity. Waterborne and low-VOC formulations are gaining adoption to meet environmental standards and sustainability goals. Increasing industrial safety awareness and regulations also drive demand for high-performance protective coatings. The market is further supported by technological advancements in coating application methods, such as electrophoretic deposition, which improve efficiency and product performance. As India continues to expand its manufacturing and infrastructure base, the cathodic acrylic market is expected to maintain steady growth across multiple industries.

The cathodic acrylic market in Germany is projected to grow at a CAGR of 4.7%, driven by high demand from automotive, industrial, and infrastructure applications. Germany’s stringent quality standards and environmental regulations encourage the adoption of low-VOC, waterborne cathodic acrylic coatings. The automotive sector is a key contributor, requiring durable corrosion-resistant coatings for metal components. Industrial applications, such as machinery, pipelines, and metal fabrication, further support market growth. Technological innovations, including advanced electrophoretic deposition and optimized coating formulations, enhance efficiency, reduce waste, and ensure consistent quality. Export-oriented manufacturing and the presence of established coating manufacturers strengthen the market’s resilience. German industries emphasize eco-friendly and high-performance coating solutions, which align with global sustainability trends. Ongoing investments in R&D and process automation continue to improve the competitiveness of cathodic acrylic products in Germany.

The cathodic acrylic market in the United Kingdom is expanding at a CAGR of 3.9%, supported by demand in automotive, construction, and industrial sectors. Protective coatings are increasingly applied to metal surfaces for corrosion resistance and longevity, particularly in infrastructure and manufacturing industries. Waterborne cathodic acrylic formulations are gaining popularity due to environmental regulations and sustainability initiatives. The automotive sector remains a significant contributor, applying these coatings to vehicle parts for durability. Industrial applications, such as machinery, pipelines, and metal frameworks, are adopting high-performance coatings to meet quality and safety standards. Ongoing technological improvements, such as optimized coating processes and improved formulation efficiency, enhance productivity and product performance. The UK market is also influenced by import and export dynamics, with manufacturers balancing local demand and global competitiveness. Overall, steady industrial growth and regulatory compliance support moderate expansion of the cathodic acrylic market.

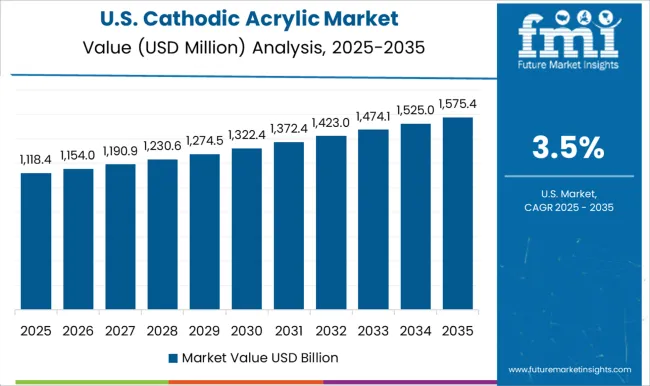

The cathodic acrylic market in the United States is growing at a CAGR of 3.5%, fueled by automotive, industrial, and infrastructure applications. High-performance coatings are increasingly required for corrosion protection and durability in metal components used in machinery, vehicles, and construction. Waterborne and eco-friendly cathodic acrylic coatings are gaining adoption due to stringent environmental regulations and sustainability goals. The automotive industry is a leading end-user, leveraging these coatings for metal parts and chassis components. Industrial applications, including pipelines, machinery, and structural steel, support consistent market demand. Technological innovations, such as enhanced electrophoretic deposition processes and improved coating formulations, ensure efficiency, product quality, and environmental compliance. Rising awareness of industrial safety standards and government initiatives further accelerate adoption. The USAmarket benefits from advanced R&D, manufacturing expertise, and innovation in coating technologies, driving steady growth for cathodic acrylic products.

The cathodic acrylic market is a critical segment of protective coatings, widely used in automotive, industrial, and marine applications due to its excellent corrosion resistance, durability, and adhesion properties. Cathodic acrylic coatings provide enhanced protection against rust and environmental degradation, making them a preferred choice for metal substrates exposed to harsh conditions.

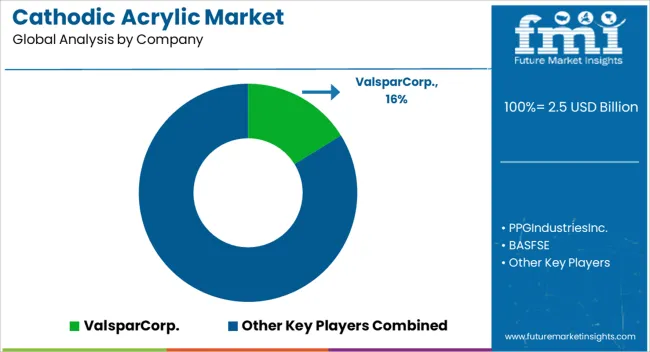

Among the top suppliers, Valspar Corp. is a recognized leader, offering innovative cathodic acrylic coatings for automotive and industrial sectors. PPG Industries Inc. provides a broad portfolio of high-performance coatings, combining corrosion resistance with aesthetic appeal. BASF SE leverages its chemical expertise to deliver advanced acrylic solutions for diverse industrial applications.

KCC Corporation and Axalta Coating Systems are key players, focusing on high-quality automotive and industrial coatings that meet stringent regulatory and performance standards. Hawking Electrotechnology Ltd. and Koch Membrane Systems Inc. contribute specialized solutions for niche applications in protective and industrial coatings. Metokote Corporation Inc. and Luvata OY provide tailored cathodic acrylic formulations for metal finishing and surface protection. Meanwhile, Nippon Paint Holdings Co. strengthens its global presence with durable coatings that cater to automotive, marine, and infrastructure projects.

The market is expected to grow steadily, driven by increasing demand for corrosion-resistant coatings across automotive, construction, and heavy industries. Rising environmental regulations and a focus on sustainable coatings are encouraging innovation, making cathodic acrylic a vital component in next-generation protective coatings. Manufacturers are continuously developing advanced formulations to enhance performance, reduce environmental impact, and meet evolving customer requirements worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Waterborne Cathodic Acrylic, Solventborne Cathodic Acrylic, and Powder Cathodic Acrylic |

| Application | Industrial Protective Coatings, Automotive Transportation, Marine Protective Coatings, and Architectural Coatings |

| End-Use Industry | Automotive OEM, Automotive Aftermarket, Construction, Industrial Manufacturing, and Aerospace Defense |

| Technology | Emulsion Polymerization, Solution Polymerization, and Suspension Polymerization |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Valspar Corp., PPG Industries Inc., BASF SE, KCC Corporation, Axalta Coating Systems, Hawking Electrotechnology Ltd., Koch Membrane Systems Inc., MetoKote Corporation Inc., Luvata OY, Nippon Paint Holdings Co.. |

| Additional Attributes | Dollar sales vary by product type, including cathodic acrylic primers, coatings, and paints; by application, such as automotive OEM, automotive refinish, industrial machinery, and metal infrastructure; by end-use industry, spanning automotive, construction, and industrial equipment; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising automotive production, demand for corrosion-resistant coatings, and adoption of eco-friendly, waterborne solutions. |

The global cathodic acrylic market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the cathodic acrylic market is projected to reach USD 3.7 billion by 2035.

The cathodic acrylic market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in cathodic acrylic market are waterborne cathodic acrylic, solventborne cathodic acrylic and powder cathodic acrylic.

In terms of application, industrial protective coatings segment to command 35.2% share in the cathodic acrylic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Industry Analysis in Japan Size, Growth, and Forecast (2025 to 2035)

Cathodic Protection Industry Analysis in South Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Cathodic Protection Market Share

Western Europe Cathodic Protection Market Trend Analysis Based on Solution, Type, Application, and Countries 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Polymer Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Resin Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Paper Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Pad Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

Acrylic Teeth Market Trends and Assessment for 2025 to 2035

Acrylic Styrene Acrylonitrile (ASA) Resin Market- Growth & Demand 2025 to 2035

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Analyzing Acrylic Boxes Market Share & Industry Leaders

Acrylic Acid Market Growth - Trends & Forecast 2024 to 2034

Acrylic Airless Bottle Market Trends - Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA