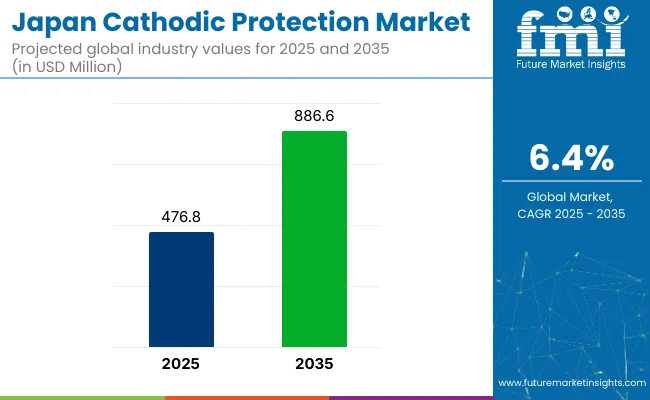

The Cathodic Protection Industry Analysis in Japan is valued at USD 476.8 million in 2025 and is slated to reach USD 886.6 million by 2035, at a CAGR of 6.4%. Its demand is driven by the need for corrosion prevention across ageing infrastructure, oil & gas pipelines, marine structures, and public utility assets.

| Metric | Value |

|---|---|

| Industry Size (2025) | USD 476.8 Million |

| Industry Value (2035) | USD 886.6 Million |

| CAGR (2025 to 2035) | 6.4% |

Growth is being supported as companies invest in galvanic and impressed current systems to enhance asset longevity, safety compliance, and operational efficiency.

The market holds an estimated 100% share of the domestic cathodic protection industry, reflecting its dominant role in this segment. Within the corrosion protection market, it commands approximately 5-10%, showcasing its importance in safeguarding infrastructure.

It contributes around 2-4% to the broader industrial coatings market and nearly 1-2% to the oil and gas sector, which utilizes cathodic protection extensively. In the larger context of the global industrial equipment market, its share remains minimal, below 0.05%, due to its specialized and niche application.

Government regulations impacting the market focus on infrastructure safety, corrosion prevention, and environmental protection. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) enforces guidelines for corrosion control in public infrastructure, while the Japan Industrial Standards (JIS) provide technical requirements for cathodic protection systems.

Additionally, the Environmental Protection Agency (EPA) mandates corrosion prevention measures to safeguard against environmental damage caused by deteriorating structures. These regulations drive the adoption of advanced cathodic protection technologies, ensuring compliance and extending the lifespan of critical infrastructure, such as pipelines and offshore platforms.

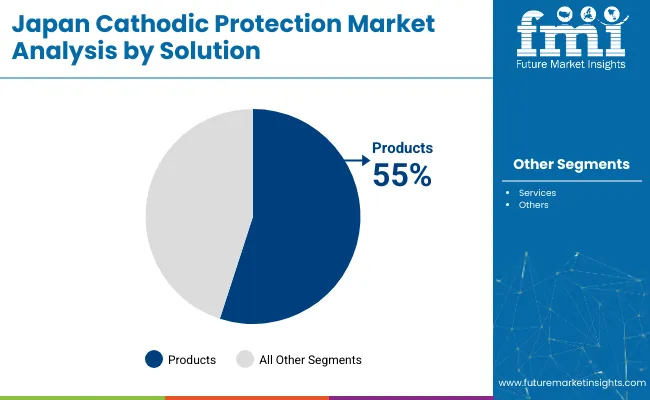

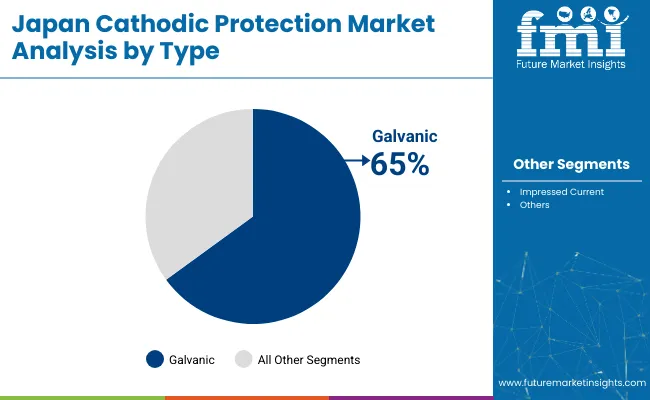

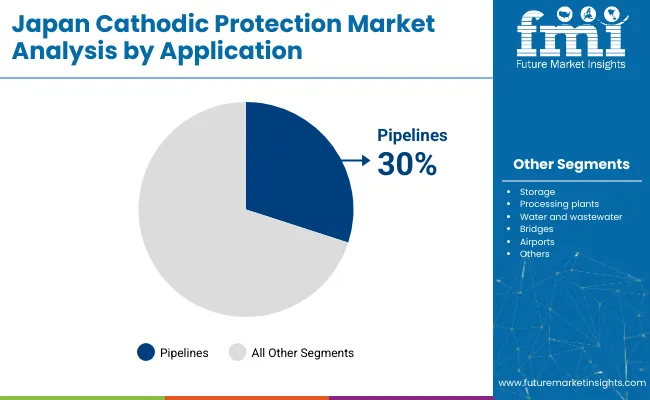

Products will lead the solution segment with a 55% share, while galvanic systems will dominate the type segment with 65% share in 2025. Kanto will emerge as the fastest-growing region at 7.4% CAGR. Pipelines are projected to lead applications with a 30% share. Services will hold the remaining 45% in solutions.

The market is segmented into solution, type, application, and region. By solution, the market is divided into products (anodes, power supplies, junction boxes, test stations, remote monitors, coating, and instrumentation) and services (inspection, design & construction, and maintenance). Based on type, the market is bifurcatedinto galvanic (sacrificial anodes) and impressed current.

In terms of application, the market is segmented into pipelines, storage facilities, processing plants, water & wastewater, transportation, bridges, airports, fuelling systems, metros, buildings, and others. Regionally, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and Rest of Japan.

Products are projected to lead the solution segment, accounting for 55% of the Japan market share by 2025. The segment includes anodes, coatings, power supplies, and instrumentation essential for marine structures, pipelines, and bridges to prevent corrosion effectively.

Galvanic is expected to lead the type segment, securing 65% of the market share in 2025. Galvanic (sacrificial anode) systems are preferred for their low maintenance and cost-effectiveness, especially in small-scale installations.

Pipelines are anticipated to lead the application segment with 30% market share due to the extensive oil, gas, and water pipeline networks requiring robust corrosion protection. Cathodic protection systems have been integral for maintaining pipeline integrity and preventing leaks or structural failures.

The Japan cathodic protection market has been experiencing steady growth, driven by increasing demand for corrosion prevention in ageing infrastructure, pipelines, marine structures, and public utilities.

Recent Trends in the Japan Cathodic Protection Market

Challenges in the Japan Cathodic Protection Market

Kanto leads with the highest CAGR of 7.4%, driven by dense urban infrastructure and marine industry demand. Kinki follows with 6.9% CAGR, supported by Osaka’s ports and Kobe’s shipbuilding sector. Chubu records a 6.8% CAGR, driven by automotive and coastal industries. Kyushu & Okinawa show a 6.6% CAGR, with strong demand from offshore energy and LNG sectors.

Tohoku has the lowest CAGR of 6%, influenced by reconstruction-focused investments and limited industrial development. Overall, Kanto remains the growth leader, while Tohoku lags due to budget constraints and slower high-tech adoption.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Kanto remains the largest regional market for cathodic protection, projected to grow at a CAGR of 7.4% from 2025 to 2035. Dense urban infrastructure, heavy industries, and strict regulations drive demand for corrosion prevention systems to protect subways, tunnels, bridges, and coastal facilities, ensuring asset safety and operational longevity.

The sales of cathodic protection in Chubuareforecast to grow at a CAGR of 6.8% during 2025 to 2035. Its strong automotive, heavy machinery, and coastal industries require effective corrosion protection for pipelines, manufacturing plants, LNG terminals, and marine facilities to maintain operational efficiency, compliance, and long-term durability of critical infrastructure assets.

The Kinki cathodic protection market is projected to grow at a CAGR of 6.9% between 2025 and 2035. Osaka’s industrial complexes and Kobe’s shipbuilding industry drive demand for impressed current and hybrid cathodic protection systems to support structural integrity, environmental compliance, and operational sustainability in port, logistics, and maritime sectors.

The Kyushu & Okinawa cathodic protection revenueis expected to grow at a CAGR of 6.6% from 2025 to 2035. Strong demand comes from marine, offshore energy, LNG, and shipbuilding sectors, where corrosion protection ensures safe operations, sustainability, and asset longevity in coastal and offshore industrial infrastructure projects.

The Tohokucathodic protection revenueis forecast to grow at a CAGR of 6% from 2025 to 2035. Reconstruction initiatives after past natural disasters have increased investments in corrosion-resistant pipelines, bridges, and rail infrastructure to improve asset resilience, public safety, and operational sustainability across critical industries in the region.

The market is moderately consolidated, with domestic leaders and global players shaping competitive dynamics through technological innovation, regulatory compliance expertise, and integrated service offerings. Companies focus on durable anode solutions, advanced impressed current systems, and smart monitoring technologies to meet infrastructure safety standards and long-term operational efficiency goals.

Tier-one firms, such as Nippon Steel Engineering, Mitsubishi Materials, Sumitomo Metal Mining, and Dai Nippon Toryo (DNT), have been investing in hybrid anode systems, energy-efficient impressed current units, and AI-integrated monitoring solutions. These companies prioritize innovations that ensure durability, cost efficiency, and regulatory compliance for industrial, marine, and public infrastructure applications.

Other key players, including Tokyo Gas Engineering Solutions, Japan Corrosion Engineering, and Toyo Denka, continue to strengthen their market presence through region-specific engineering capabilities, tailored maintenance contracts, and technology licensing agreements with global firms. Their strategies emphasize service integration and technical support to expand client portfolios in Japan's corrosion protection sector.

Recent Japan Cathodic Protection Industry News

In December 2024, Sumitomo Metal Mining and its subsidiary Hyuga Smelting Co., Ltd. unveiled their intent to establish a new production unit as Hyuga Smelting to produce nickel matte.

In March 2024, Aegion Corporation (now known as Azuria Water Solutions) completed the acquisition of Toncco, Inc., integrating Toncco into its Insituform coating services.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 476.8 million |

| Projected Market Size (2035) | USD 886.6 million |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million /Volume in units |

| By Solution | Products (Anodes, Power Supplies, Junction Boxes, Test Stations, Remote Monitors, Coating, Instrumentation), Services (Inspection, Design & Construction, Maintenance) |

| By Type | Galvanic (Sacrificial Anodes) and Impressed Current |

| By Application | Pipelines, Storage Facilities, Processing Plants, Water & Wastewater, Transportation , Bridges, Airports, Fuelling Systems, Metros, Buildings, Others |

| Regions Covered | Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, Rest of Japan |

| Key Players | The Nippon Corrosion Engineering Co., Ltd, Nakabohtec Corrosion Protecting Co, Aegion Corporation, BAC Corrosion Control Ltd, CMP Europe, Farwest Corrosion Control Company, Imenco AS, James Fisher, and MATCOR, Inc. |

| Additional Attributes | Dollar sales by equipment type, share by power, regional demand growth, policy influence, automation trends, competitive benchmarking |

Products and services

galvanic and impressed current

pipelines, storage, processing plants, water and wastewater, bridges, airports, fuelling systems, metros, buildings and others

Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku and Rest of Japan

The market is expected to reach USD 886.6 million by 2035.

The market is projected to expand at a CAGR of 6.4% during this period.

The products segment is expected to lead with over 55% market share in 2025.

The galvanic type segment is expected to hold approximately 65% of the market share in 2025.

Kanto is anticipated to be the fastest-growing region with a CAGR of 7.4% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cathodic Acrylic Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Cathodic Protection Market Share

Cathodic Protection Industry Analysis in South Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe Cathodic Protection Market Trend Analysis Based on Solution, Type, Application, and Countries 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Head Protection Equipment Market Growth – Trends & Forecast 2024-2034

Data Protection as a Service (DPaaS) Market

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA