The head protection equipment market is gaining consistent traction, driven by increasing awareness of workplace safety and stringent regulatory mandates across high-risk industries. Industry announcements and government safety advisories have emphasized the critical role of headgear in preventing traumatic brain injuries and occupational fatalities.

Investments in industrial safety infrastructure, particularly in sectors such as construction, oil & gas, and manufacturing, have spurred the demand for certified protective gear. Technological advancements in material science have enabled the development of lightweight, impact-resistant headgear with integrated communication systems and enhanced comfort, encouraging long-term wear and compliance.

Moreover, employer-led safety programs and worker compensation policies have contributed to widespread product adoption. The market outlook remains optimistic, with emerging economies investing in large-scale infrastructure and industrial projects. The demand for protective headgear is expected to remain high, particularly in sectors with elevated exposure to falling objects, electrical hazards, and confined workspaces. Future growth will likely be driven by product innovations that integrate smart safety features and meet evolving international safety standards.

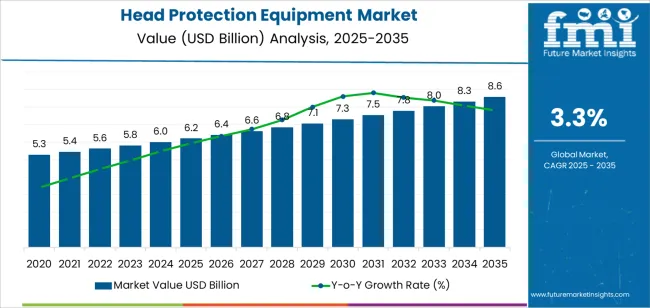

| Metric | Value |

|---|---|

| Head Protection Equipment Market Estimated Value in (2025 E) | USD 6.2 billion |

| Head Protection Equipment Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

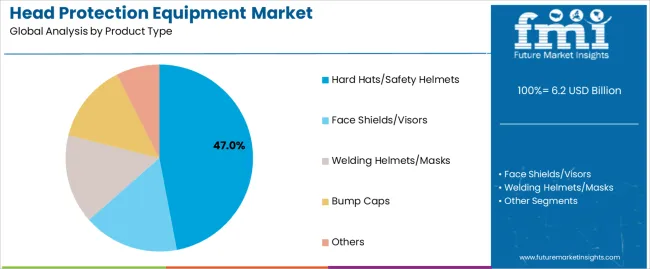

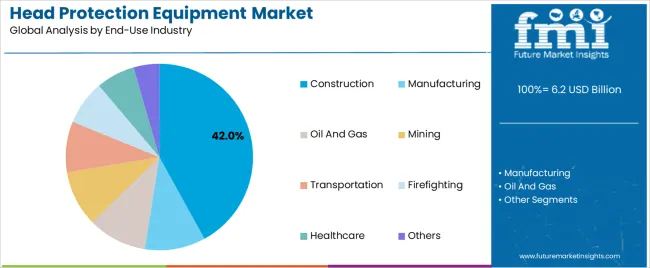

The market is segmented by Product Type and End‑Use Industry and region. By Product Type, the market is divided into Hard Hats/Safety Helmets, Face Shields/Visors, Welding Helmets/Masks, Bump Caps, and Others. In terms of End‑Use Industry, the market is classified into Construction, Manufacturing, Oil And Gas, Mining, Transportation, Firefighting, Healthcare, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hard Hats/Safety Helmets segment is projected to capture 47.00% of the head protection equipment market revenue in 2025, making it the most prominent product category. This segment’s growth has been propelled by regulatory enforcement of helmet use across high-risk work environments, especially in construction and industrial maintenance.

Safety authorities and labor departments have mandated helmet usage as part of compliance protocols to mitigate risks associated with falling debris, head trauma, and electrical exposure. Innovations in helmet design, such as the integration of suspension systems, shock absorption technologies, and ventilation features, have enhanced both functionality and wearer comfort.

Manufacturers have also introduced customizable options for different work conditions, including high-visibility helmets and those designed for extreme temperatures. As workplace injury prevention remains a top priority, the Hard Hats/Safety Helmets segment is expected to sustain its leadership, supported by ongoing investment in worker protection and global expansion of safety standards.

The Construction segment is expected to account for 42.0% of the head protection equipment market revenue in 2025, maintaining its position as the leading end-use industry. The sector’s dominance has been influenced by the inherently hazardous nature of construction activities, where workers are frequently exposed to falling objects, structural collapses, and overhead electrical lines.

Regulatory bodies and occupational safety institutions have imposed strict compliance requirements for headgear use on construction sites, driving consistent demand. Large-scale infrastructure development projects in emerging economies and ongoing urban expansion in developed nations have amplified the workforce size in the construction industry, thereby increasing equipment adoption.

Project management teams have prioritized worker safety as part of contractual obligations and corporate social responsibility metrics, further reinforcing helmet usage. Additionally, industry associations have promoted training programs and awareness initiatives highlighting the importance of head protection, encouraging adoption across both public and private sector projects. These drivers collectively support the segment’s continued growth and market share.

The table below presents the expected CAGR for the global sector over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 4.1%, followed by a slightly lower growth rate of 3.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 4.1% (2025 to 2035) |

| H2 | 3.1% (2025 to 2035) |

| H1 | 3.6% (2025 to 2035) |

| H2 | 3.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to surge slightly to 3.6% in the first half and remain relatively moderate at 3.1% in the second half.

Impact of Technology Advancements on Head Protection Equipment Design and Functionality

The impact of technology advancements on head protection equipment design and functionality is anticipated to remain positive through 2035. The field of materials science is experiencing constant innovations across the globe. Hence, the sector is anticipated to create new opportunities for helmet designers to develop improved models.

KOROYD, for instance, is a Monaco-based unique impact technology solution provider. The company is focusing on material development activities to offer an ideal balance of human-centric designs, protection, style, and ventilation.

The company follows a novel tubular development approach to help absorb harsh impacts more efficiently compared to conventional expanded polystyrene (EPS) foam liners. This design allows for the reduction of force directly to an individual’s head.

Several other established players in the safety equipment industry are focusing on creating innovative designs. A few of these companies are aiming to lower the thickness of unique materials to help surge protection and absorb impacts. The industry will likely witness the emergence of low-profile, slim head gears with enhanced safety features.

Stringent Laws Mandating Helmet Adoption to Spur Sales

Mandatory helmet laws for specific activities, including motorcycling and cycling, are anticipated to provide new growth opportunities to key players. In several parts of the globe, government agencies have implemented strict norms to mandate helmet-wearing practices for those traveling by two-wheelers.

Rising cases of fatal road accidents, especially in developing countries, are projected to compel government bodies to implement such norms. As per the Ministry of Road Transport and Highways, in 2025, the Police Departments of States and Union Territories (UTs) stated that around 1,68,491 lives were lost and 4,43,366 individuals were injured due to road accidents in the same year.

The World Health Organization (WHO), on the other hand, mentions that every year, about 1.19 million individuals die due to road traffic accidents. Injuries related to road traffic crashes mainly affect those belonging to the age group of 5 to 29 years. Global economic growth is also impacting disposable income and spending on head protection equipment.

Government Initiatives Promoting Workplace Safety and Reducing Head Injuries

Government regulations on safety standards for head protection equipment in different industries, such as construction and sports, are estimated to augment the sector.

A study published by the National Institutes of Health (NIH) states that around 1 in 4 mild traumatic injuries associated with the brain usually take place at work. Occupational disability, economic burden, and considerable production loss are a few negative effects of such injuries.

To prevent such incidences, certain government agencies have placed strict workplace safety norms. The Federal Occupational Safety and Health Administration (OSHA), for instance, has implemented laws to maintain the safety of workers across several industries.

If an accident occurs at the workplace and the officials are found guilty of not following the safety norms, OSHA tends to take strict action against such companies. To comply with such norms, companies are investing in new product development, thereby pushing the growth rate of the head protection equipment market.

The global head protection equipment industry witnessed a CAGR of 5.1% in the historical period 2020 to 2025. In 2025, the sector attained a value of about USD 5.8 billion. In the historical period, public focus on safety issues and social media movements increased.

Campaigns creating awareness of sports-related concussions and workplace injuries created interest in head protection gears. This further resulted in a high demand for helmets.

The impact of COVID-19 on the head protection equipment market was positive to a certain extent. Rising sanitation measures across several industries like healthcare and food processing led to rising utilization of disposable headgear among workers.

The role of e-commerce in the head protection equipment market is set to be robust. Booming e-commerce and home delivery services also propelled sales of helmets worldwide. Increasing need for safety among delivery personnel surged sales of bike and motorcycle helmets.

Increasing concerns about sustainability and the rising trend toward do-it-yourself (DIY) projects further pushed demand for hard hats in the historical period. Individuals started purchasing unique headgear for personal use amid outdoor activities and home improvement projects.

Surging adoption of robotics and automation in multiple sectors globally is anticipated to augment demand by 2035. Even though robots can do several tasks without errors, human workers will be employed to interact, operate, and maintain such complex equipment.

Rising human-robot interaction is projected to create safety issues, thereby bolstering demand for specialized head protection equipment. The aforementioned factors are set to create new head protection equipment market opportunities.

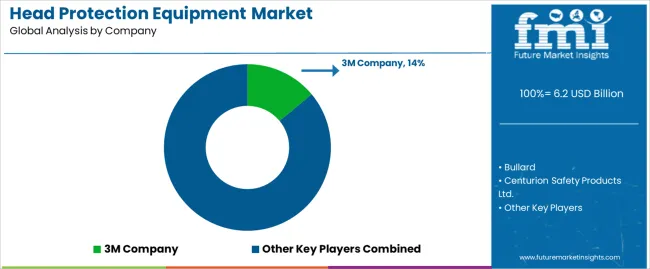

Tie 1 players in the industry include 3M, Honeywell International, and MSA Safety Incorporated. These players hold around 40% of the total share at present. Honeywell International, based in the United States, provides a range of hard hats under the personal protective equipment (PPE) portfolio to provide high performance, comfort, and safety.

Minnesota-based 3M, on the other hand, offers face shields, hard hats, and head protection accessories to several industries spanning automotive and energy.

Bullard, Uvex Safety Group, and Pyramax Safety Products are a few leading Tier 2 companies. These currently hold around 45% of the share. Kentucky-based Bullard’s head protection gear line contains a vast range of helmets.

These include protective sporty helmets, cap-style helmets, bump caps, hard hat face shields, and full-brim helmets. Uvex Safety Group, headquartered in Fürth, provides a wide range of industrial safety helmets to enhance protection.

Tier 3 companies include Centurion Safety Products Ltd., Gateway Safety Inc., and Riley Safety. The total share of these firms is 15% in the global sector. Centurion Safety Products Ltd., headquartered in the United Kingdom, offers specialized helmet protection systems, safety helmets, and hard hats.

The company’s product line consists of Centurion Universal Fleece Helmet Liner, Classic Helmet Accessory Clip Set, Concept General Purpose Safety Helmet, and Classic Face Screen Carrier.

The table below shows the value CAGRs of several countries to provide an overview of head protection equipment market investment considerations and risks to potential clients. South Korea is anticipated to remain at the forefront by witnessing a CAGR of 5.4% through 2035. Japan and the United Kingdom and set to follow with CAGRs of 4.9% and 4.5%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.6% |

| United Kingdom | 4.5% |

| China | 3.9% |

| Japan | 4.9% |

| South Korea | 5.4% |

The United States is anticipated to witness a CAGR of 3.6% in the forecast period. Increasing concerns of workplace violence and civil unrest across the country are projected to create high head protection equipment demand. Demand for helmets will likely surge among security personnel and law enforcement to control such events.

The United States often experiences extreme weather conditions. Intense and more frequent storms in the country are set to propel the use of safety helmets among homeowners dealing with damages caused by storms. At the same time, demand is anticipated to rise among disaster response teams and repair crews.

The booming construction sector in the United States is another key factor pushing demand for helmets. Growing infrastructure projects in the country require workers to wear head protection equipment with a rising focus on safety.

Analysis of head protection equipment market drivers shows that China is anticipated to showcase considerable growth in the assessment period. The country is investing huge sums in infrastructure projects, such as large-scale industrial zones, new urban development plans, and high-speed rail networks.

The rapid construction activities are projected to accelerate the need for worker safety. This is further anticipated to create a high demand for protective gear like helmets.

The country’s booming manufacturing sector is set to witness several factories by 2035. These factories are striving to meet high production requirements. At the same time, these are trying to comply with stringent safety norms. Increasing pressure from international businesses and strict norms implemented by China’s government are projected to fuel demand.

The United Kingdom will likely experience steady growth at a CAGR of 4.5% from 2025 to 2035. The United Kingdom has a vast network of aging buildings, bridges, and roads that require constant repairs and maintenance. Increasing number of renovation projects in the country to prevent deterioration of these infrastructures is set to propel the demand for safety gears like hard hats.

Increasing interest of millennials across the United Kingdom in specific hobbies and sports like skateboarding, rock climbing, and cycling is also estimated to propel demand for helmets. Apart from that, rising awareness of the consequences of head injuries among construction workers is projected to create new opportunities.

The section below explains the dominant segments in the global head protection equipment market. By product type, hard hats are anticipated to dominate the sector by holding a share of 47% in 2025. In terms of the end-use industry, the construction segment will likely remain at the forefront by showcasing a share of 42% in the same year.

| Segment | Hard Hats/Safety Helmets (Product Type) |

|---|---|

| Value Share (2025) | 47% |

Hard hats or safety helmets are anticipated to witness high demand across several industries globally. Companies, government agencies, and NGOs are realizing the importance of protecting the health of workers. Hence, such organizations are mandating the use of hard hats as a key piece of safety equipment in various settings.

In emerging economies like India and China, hard hats are finding increasing usage. Government bodies across these countries are putting forward stringent safety protocols as these witness the expansion of industrial capacities and infrastructure.

To prevent fatalities and accidents, hard hats are projected to be extensively used in these countries. A few companies are focusing on investments in HPE manufacturing facilities in developing countries.

| Segment | Construction (End-use Industry) |

|---|---|

| Value Share (2025) | 42% |

Demand for head protection equipment is anticipated to surge across construction sites as these are often filled with potential hazards. Hence, workers are at a high risk of developing serious injuries if strict safety norms are not implemented. Safety helmets are gaining impetus among construction workers as these are considered ideal personal protective equipment.

In March 2025, Singapore’s Ministry of Manpower stated that in 2025, the country’s fatal injury rate at workplaces declined to 0.99 per 100,000 workers.

The country has put forward a Workplace Safety and Health (WSH) 2035 target to enhance safety across workplaces. Similar initiatives taken by governments of other countries are projected to fuel growth rate of the head protection equipment market in the construction sector.

Regional players with a strong presence in the developing head protection equipment market are focusing on extending existing product portfolios. These companies are constantly investing in research and development activities to come up with innovative products. A few companies are not only launching safety products for adults but also for children.

Merger and acquisition activities in the head protection equipment industry are also projected to create new growth opportunities. Key companies are striving to co-develop innovative materials to produce helmets by acquiring small-scale players with a highly skilled workforce.

Geographic expansion and regional opportunities are further estimated to arise in the sector, thereby creating a favorable environment for key companies.

Industry Updates

The industry is segregated into hard hats/safety helmets, face shields/visors, welding helmets/masks, and bump caps. The hard hats/safety helmets category is bifurcated into type I (top impact protection) and type II (top and lateral impact protection).

The industry is divided into construction, manufacturing, oil and gas, mining, transportation, firefighting, and healthcare.

Information about key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa is given.

The global head protection equipment market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the head protection equipment market is projected to reach USD 8.6 billion by 2035.

The head protection equipment market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in head protection equipment market are hard hats/safety helmets, _type i (top impact protection), _type ii (top and lateral impact protection), face shields/visors, welding helmets/masks, bump caps and others.

In terms of end‑use industry, construction segment to command 42.0% share in the head protection equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

Head Band Ophthalmoscopes Market Size and Share Forecast Outlook 2025 to 2035

Head and Neck Cancer (HNC) Therapeutics Market - Growth & Drug Developments 2025 to 2035

Headspace Gas Analyzers Market - Trends & Forecast 2025 to 2035

Head Mounted Display Market Analysis by Product, HMD, Application, and Region through 2025 to 2035

Headwear Market Analysis by Product Type, Distribution Channel, and Region through 2025 to 2035

Headless CMS Software Market - Trends & Forecast 2025 to 2035

Head and Neck Squamous Cell Carcinoma Market

VR Headsets Market Size and Share Forecast Outlook 2025 to 2035

Bed Head Panel Market Size and Share Forecast Outlook 2025 to 2035

Overhead Crane Market Size and Share Forecast Outlook 2025 to 2035

Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Overhead Cables Market Size, Growth, and Forecast 2025 to 2035

Hogshead Barrel Market

Wellhead System Market

Cold Heading Wire Market Size and Share Forecast Outlook 2025 to 2035

Multihead Weighers Market Analysis - Size, Share and Forecast 2025 to 2035

Breaking Down Market Share in Multihead Weighers

Western Europe Multihead Weigher Market Analysis – Trends & Forecast 2024-2034

Japan Multihead Weigher Market Analysis – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA