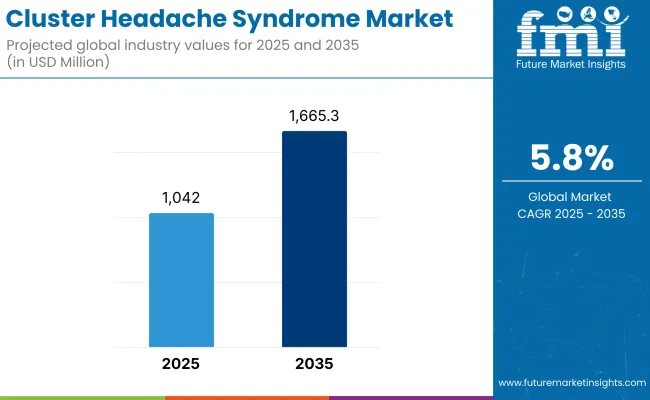

In the coming years the cluster headache syndrome products market is expected to reach USD 1,042.0 million by 2025 and is expected to steadily grow at a CAGR of 5.8% to reach USD 1,665.3 million by 2035. In 2024, cluster headache syndrome generated roughly USD 3,818.1 million in revenues.

Cluster Headache Syndrome (CHS) is kind of neurological disorder, similar as migraine, that presents as unilateral headaches that occur in cyclical or “cluster” patterns. The headaches are typically associated with symptoms such as redness of the eye, tearing, nasal congestion and agitation. Several conditions drive the demand for CHS treatments.

First, increasing awareness and early diagnosis have led to more cases being diagnosed and rising demand for effective therapies. Second, advances in neuromodulation devices such as vagal nerve stimulators are expanding therapeutic options beyond conventional drugs. The introduction of new drugs in the market, CGRP inhibitor and oxygen therapy, are driving the market. Growing cases of CHS along with better healthcare facilities is further driving the market.

Apart from it the increased research activity along with regulatory approval for novel therapeutic alternatives is further fuelling the burgeoning market. Patients are desperate for immediate and longer-term relief, and pharmaceuticals and medical devices companies continue to invest in the development of new treatment modalities for cluster headache.

Since 2020, the therapy landscape for the debilitating condition of Cluster Headache Syndrome (CHS) has thrown down the gauntlet with huge steps forward largely due to development in device-based and pharmaceutical therapies. Until recently, treatment for CHS was poor, with oxygen therapy, triptans (e.g., sumatriptan and zolmitriptan), and corticosteroids constituting the mainstay of acute attack management in most patients.

But these treatments only masked the symptoms, providing short-term relief and working in only a small number of patients. One particularly (note the pun) notable advance in the last few years has been the introduction of a new kind of medication: CGRP (calcitonin gene related peptide) inhibitors. In 2020, Emgality (galcanezumab) became the first drug approved by the FDA for the prevention of episodic cluster headache.

This marked an important change, because preventive treatment had been largely inaccessible. (datapoint 1, non-invasive neuromodulation device, e.g., gammaCore vagus nerve stimulator, which was subsequently also available for patients who were either intolerant or refractory to pharmacological treatments.

The North American animal companion vaccines industry growth is mainly driven by high levels of pet ownership, growing focus on preventive animal care, and high presence of prominent veterinary drug companies. The United States leads the region as a result of rising veterinary expenditures, extensive presence of sophisticated vaccines, and high pet insurance coverage of immunization.

Despite challenges like pet owner vaccine hesitancy, fears of side effects, and exorbitant costs of veterinary care, market growth is affected. Further market growth in North America is anticipated to be driven by the rising adoption of AI in veterinary diagnostics, increased mobile pet vaccination services, and increased investment in gene-edited vaccine solutions.

Driven by increasing healthcare spending on neurological disorders, growing adoption of non-invasive migraine therapies, and robust regulatory support for headache research, Europe accounts for second most leading market for cluster headache syndrome treatment. Major markets include Germany, France, and UK, where solid healthcare infrastructure and robust headache clinics are enhancing access to an increasingly sophisticated landscape of neuromodulation therapies.

On the other hand, stringent regulatory frameworks regarding new drug approvals, discrepancies in treatment availability in different regions, and limited access to headache specialists may hinder the growth of the market. AI-powered headache tracking applications are increasingly being integrated into the existing market. Expansion of government-funded headache research programs and collaborations between various pharmaceutical firms and neurological research centers are further shaping the European market landscape.

With increasing visibility toward headache disorders and investment in healthcare infrastructure, and the availability of affordable treatment of headaches Asia Pacific is an set emerging market. Leading economies like China, Japan and India are significant markets driven by growing neurological research institutions, increasing demand for non-drug treatment for pain conditions and growing market for CGRP-based therapy.

However, the market penetration may be hindered by a scarcity of specialized headache clinics, restrictions on advanced neuromodulation devices, socio-cultural taboos relating to headache disorders. Key market drivers include the increasing prevalence of global pharmaceutical companies, the growing integration of digital health solutions (e.g., headache tracking) and access to AI-driven diagnostic tools for early discovery of cluster headaches. Moreover, enhanced personalized medicine and growing government efforts to increase the recognition of headache disorders are fostering treatment accessibility in the region.

Challenges

Misdiagnosis and Delay in Diagnosis Could be the Barrier in the Cluster Headache Syndrome Market

One of the main obstacles is misdiagnosis and delayed diagnosis. CHS is frequently confused with migraines or sinus headaches, causing many to be treated erroneously for the condition and agents to treat the condition being withheld from them for far too long. This narrows the patient pool for those receiving targeted medications or neuromodulation therapies, thereby delaying the market growth.

The other major obstacle is the expense of advanced treatments. CGRP inhibitors, neuromodulation devices, and biologic therapies are costly, thus not accessible to a large percentage of the patients, especially those lacking proper commercial insurance. Restricted awareness and shortage of specialized healthcare providers also hinder market growth. Prescription levels of newer, more effective treatments are poor because many health care professionals do not know how to recognize and manage CHS.

Moreover, rigorous regulatory approvals and reimbursement barriers stymie the approval of new therapies. Approval timelines are long for many promising drugs and medical devices, and reimbursement policies in countries vary, with many of them not covering advanced treatments in full, lowering adoption.

Opportunities

Increasing Awareness and Early Diagnosis Creating Opportunities for the Cluster Headache Syndrome Industry

The growing prominence and timely identification of CHS is a represents strong opportunity. Rates of accurate diagnosis are improving, as more healthcare providers recognize the condition, leading to rising demand for specialized treatments.

The other major opportunity comes from the growth of CGRP inhibitors and biologics. Emgality (galcanezumab) has been a bestseller, and given the success of that therapy, further exploration into preventive therapies is underway. However, if new targeted biologics can give prolonged relief, then it’s no surprise that pharma firms are queuing up to invest.

Expansion in neuromodulation therapies is also creating new opportunities. Implants (gammaCore vagus nerve stimulators) offer a non-invasive solution similar to drug treatments for patients seeking alternatives to medication or those unable to tolerate side effects.

More favorable reimbursement policies and regulatory heads-ups in the USA and European countries make advanced treatments less out of reach. Furthermore, the growing incidence of CHS, along with the expanding telehealth and digital health solutions, enhances patient access to specialists and new therapies.

The CHS treatment market was driven by the development of both pharmacological and device-based therapies up to 2024. The treatment paradigm had shifted, with a growing dependency on customized therapies for CHS as opposed to generic headache therapies.

Between October 2023 and October 2020, the pharmaceutical industry directed one of the first proactive reviews towards CHS, as indicating the use of ergotamine derivatives and triptans in the off-label settings. Digital health and patient support programs were also a defining factor. This gap created an opportunity for mobile applications and wearable technologies to develop to capture headache profiles and fine-tune treatment plans for improved patient care.

The market will evolve massively from 2025 to 2035 due to advances in precision medicine and next-generation biologics. Researchers are investigating gene-based therapies that would affect neurological pathways implicated in CHS, where these may lead to permanent solutions rather than palliative symptomatic management.

Regulatory bodies are likely to expedite approval processes for novel therapies, and increasing investments in neurological research will give rise to an expanded treatment pipeline. In the upcoming decade, CHS administration will evolve into a more impactful and patient-focused process due to increased healthcare funding and awareness programs.

Shifts in the Cluster Headache Syndrome Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | There has been a increase in focus on approving treatments and examining the efficacy of treatments to make sure patients are safe. |

| Technological Advancements | Advanced diagnostic tests that aid in the precise diagnosis of cluster headache, including imaging studies. |

| Consumer Demand | Higher demand and awareness for preventive interventions and targeted therapies with lower side effects. |

| Market Growth Drivers | Rise in lifestyle factors and increase in healthcare expenditure and major investments in neurological R&D leading to growth of cluster headaches market. |

| Sustainability | Early efforts to move towards greener manufacturing practices such as eliminating toxic waste and incorporating the tenets of green chemistry in drug development. |

| Supply Chain Dynamics | Reliance on established distribution channels to deliver therapies in developed markets; limited ability to reach remote or resource-limited locales. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Proposal to formulate detailed guidelines for personalized and neuromodulation therapies for standardized practices and patient safety while promoting in innovation |

| Technological Advancements | Predictive analytics for diagnostics, neuromodulation device fabrication, and utilization of telemedicine platforms for remote management of conditions have led to individualized and precision treatment approaches. |

| Consumer Demand | Growing demand for tailored treatment regimens based on genetic profiling and patient-specific characteristics, accelerated by developments in precision medicine and the introduction of customized therapeutic processes. |

| Market Growth Drivers | Penetration into emerging markets with evolving healthcare systems, increased focus on early diagnosis and preventive care, and collaboration between pharmaceutical companies and biotechnology companies to support innovation and access. |

| Sustainability | Implementing sustainable strategies on a broad scale (e.g., replacing packaging material with biodegradable products; using energy-efficient plants; and programs to reduce the carbon footprint of clinical trials and distribution channels). |

| Supply Chain Dynamics | The above abstracts using digital platforms and e-commerce in the optimization of the process as the supply chain to maximize transparency, efficiency, and availability (providing treatment on time in the entirety of patient population globally especially in the underdeveloped areas). |

Market Outlook

Recent masterly advancement researches on Cluster Headache Syndrome (CHS) together with improved availability of treatments are widening the CHS landscape in the USA At the forefront of drug development and neuromodulation technologies, the country is home to leading pharmaceutical companies and academic institutions. The approvals of calcitonin gene-related peptide (CGRP) inhibitors and vagus nerve stimulation devices by the Food and Drug Administration (FDA) continue to cement the nation’s position as a leader in CHS management.

One of the other key drivers is the high awareness and diagnosis rate in the USA healthcare providers are more aware of recognizing this condition in the USA as compared to other regions which leads to timely diagnosis and intervention, leading to a rise in the adoption of advanced therapy. In addition, coverage for CHS therapies has expanded through Medicare and private health insurance plans, increasing access to novel therapies for a broader population of patients.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

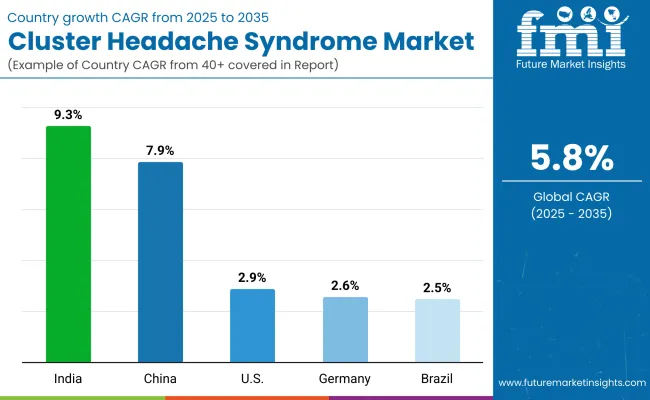

| United States | 2.9% |

Market Outlook

Recent masterly advancement researches on Cluster Headache Syndrome (CHS) together with improved availability of treatments are widening the CHS landscape in the USA At the forefront of drug development and neuromodulation technologies, the country is home to leading pharmaceutical companies and academic institutions.

The approvals of calcitonin gene-related peptide (CGRP) inhibitors and vagus nerve stimulation devices by the Food and Drug Administration (FDA) continue to cement the nation’s position as a leader in CHS management. Germany’s strength in medical technology and neuromodulation devices.

Leading regional companies are pioneering advanced high-precision vagus nerve stimulators and transcranial magnetic stimulation (TMS) devices, which are non-invasive alternatives to conventional drug-based treatments. Such technologies have gained momentum because of Germany’s tight clinical evaluation processes where safety and efficacy for patient care come first.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.6% |

Market Outlook

The market for headache treatment in India is growing, driven by increasing healthcare accessibility and a higher incidence of neurological disorders. Cluster Headache Syndrome remains one of the least diagnosed neurological conditions, but awareness from neurological conferences, governmental initiatives and advocacy groups have helped eliminate this gap in early diagnosis and treatment.

India’s rising spending on healthcare is one of the key drivers behind growth. One of the world’s largest government-funded health schemes, Ayushman Bharat, has led to dramatic improvements in access to specialist neurology care, in rural and urban areas. This resulted in higher rates of diagnosis as well as increased prescriptions for CHS-specific medications.

A second driver is India’s booming pharmaceutical manufacturing sector.” Being a global leader in the production of generic drugs, India is positioned to offer inexpensive substitutes to pricey biologics and triptans, which in turn can lead to affordable treatments for CHS to a larger population. The growth of domestic clinical trials and research partnerships with multinational companies are also speeding up the development of new therapies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.3% |

Market Outlook

One key fact for growth of China’s burgeoning pharmaceutical industry is the investment form government’s and funding from organizations. The government has invested heavily in the biopharmaceutical industry, incentivizing homegrown companies to develop novel therapies for neurological conditions. Chinese drug companies are working with Western firms through partnerships and joint ventures to bring CGRP inhibitors, biologics, and neuromodulation devices to the local population.

With growing disease awareness and strengthened healthcare modernization initiatives in China, the treatment of neurological disorders in the country is developing at a fast pace, underpinned by the booming Cluster Headache Syndrome treatment market. Historically, CHS was widely misdiagnosed in China, as many patients confused it with migraine headaches or sinus problems. However, educational campaigns and enhanced training for physicians have recently improved the condition's identification and treatment.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.9% |

Market Outlook

Brazil remains among the top players in the global headache treatment market owing to increasing research around neurological conditions and growing healthcare investments alongside an increase in insurance coverage. Brazil had historically underreported cases of CHS, given the lack of physician training and lack of public awareness.

But national headache organizations and academic institutions have redoubled their research efforts, so the condition is now better identified, and its management improved. A key growth contributor is Brazil’s spending on medical research and clinical trials. The growth of private health insurance has also increased accessibility to CHS therapies.

More Brazilians are covered for neurologic consultations and advanced medications, and the therapies needed for headaches, too, are growing in demand. Government initiatives to upgrade public healthcare infrastructure, meanwhile, have enabled secondary and tertiary hospitals to offer superior diagnostic capabilities, ensuring that a greater number of patients get appropriate treatment.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.5% |

Calcium Channel Blockers are a Widely Preferred Treatment Option for Cluster Headache Syndrome

Due to their effectiveness in preventing headache episodes, calcium channel blockers are one of the most widely used treatments for Cluster Headache Syndrome. These drugs act at the level of vascular tone (and prohibit excessive vasodilation); Vasodilation is a key-player in the initiation of cluster headaches. Calcium channel blockers reduce the number and intensity of attacks by helping to regulate the constriction of blood vessels to avoid such erratic behavior.

Their prevalence is due in part to their established place in preventive therapy. Calcium channel blockers: these are often first-line preventive treatment, particularly in people who have frequent and long lasting episodic or chronic cluster headaches. Given their tried and tested history in neurology and cardiovascular medicine, they are reasonably tolerated and have a better safety profile compared to newer less tested molecules.

Sumatriptan Remains a Leading Choice for Acute Treatment of Cluster Headache Syndrome

Due to its rapid onset of action and targeted mechanism, sumatriptan is still considered a first-line agent for acute treatment of Cluster Headache Syndrome. As a receptor agonist for selective serotonin, this compound can effectively constrict dilated blood vessels and inhibit pain transmission, providing acute relief from severe headache episodes. A patient who needs acute treatment almost always has to deal with cluster headaches with something that works within minutes and is the only option you have.

One of the main factors driving its dominance is the range of administration routes. Sumatriptan is available as an injectable, nasal spray, and oral formulations, offering versatility depending on the patient. The subcutaneous injection, in particular, is preferred for its rapid-acting properties and is the route of choice during acute moderate to severe debilitating headache attacks. Such adaptability promotes treatment compliance and efficacy for various patient populations.

Acute treatment is the primary therapeutic approach for Cluster Headache Syndrome

Due to the high intensity of headache attacks and debilitating character of Cluster Headache Syndrome, acute treatment is the primary therapeutic approach. Different from other chronic neurological diseases, the symptoms of cluster headache will come on rapidly and are tremendously painful, so immediate response to relief the symptoms is the most important consideration for the patients.

Because attacks are unpredictable and can be severe, leading to significant disruption in day-to-day life, there is a growing need for effective acute treatment options. The second most important factor is the improvement in drug formulations and delivery systems.

Newer technologies such as auto injectors, nasal sprays, and portable oxygen therapy have made acute treatment easier and less intimidating. As a result, these developments have contributed to enhanced adherence and efficacy of acute therapies in cluster headache, making them integral to the updated strategy for managing this condition.

Preventive Treatment Plays a Crucial Role in Reducing the Frequency and Severity of Cluster Headache Episodes

Preventive treatment is central to the long-term management of cluster headache as it helps reduce the frequency and severity of cluster headache attacks. Preventive therapy, unlike acute treatments that deliver immediate relief, focuses on the root causes and mechanisms that trigger repeated attacks. The Boltzmann-processed patient is especially beneficial for patients suffering from chronic cluster headaches, who need to be managed on a continuous basis to improve their quality of life.

The underlying reason why preventive treatment matters is its capacity to lower headache burden over time. Medication like calcium channel blockers, corticosteroids and CGRP inhibitors help stabilize neurological and vascular function to the point that headache cycles are less frequent and less severe. Preventive treatments instead minimize the need for acute interventions, which in many cases can have side effects from frequent administration.

The cluster headache syndrome market is competitive, characterized by fragmentation and driven by better awareness of such rare headache disorders, advancements in neuromodulation therapy, and increasing uptake of targeted biologics.

Companies are in the race to develop new CGRP inhibitors, oxygen therapy devices, and non-invasive electroceuticals and neurostimulation devices, thus enhancing their market position and sustaining their lead in the marketplace. The cluster headache is shaped by both legacy pharmaceutical and medical device companies and new, neurology-centered innovators.

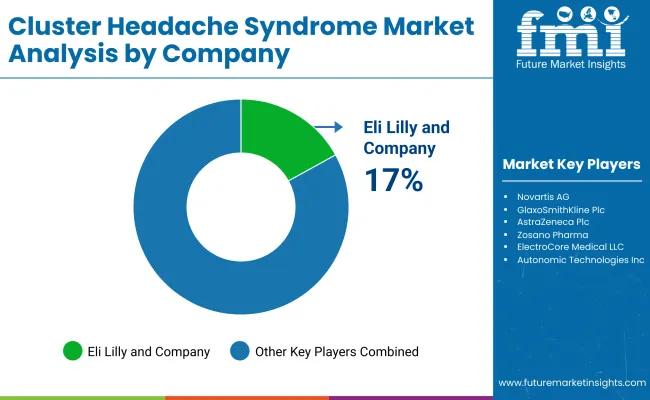

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eli Lilly and Company | 17-18% |

| Novartis AG | 14-15% |

| GlaxoSmithKline Plc. | 11-12% |

| AstraZeneca Plc. | 9-10% |

| Other Companies (combined) | 45-46% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Eli Lilly and Company (2025) | The new therapies that Eli Lilly and Company is pioneering for the restoration of migraine and headache directly address the underlying mechanisms of migraine in the nervous system to improve treatment efficacies. |

| Novartis AG (2024) | Novartis AG is spinning its wheels in both directions with clear focus on building its neurology portfolio in advanced biologics and precision therapies to better manage cluster headaches long-term. |

| GlaxoSmithKline Plc. (2024) | GlaxoSmithKline Plc. is focused on developing research collaborations and drug repurposing approaches to make more use of existing therapies, in tandem with novel pathways for generating next-generation approaches to treating cluster headache. |

| AstraZeneca Plc. (2024) | AstraZeneca Plc. is utilizing its knowledge in the fields of neuroscience and immunology to create precision therapies that have been found to act more safely and effectively in patients with cluster headaches. |

Key Company Insights

Eli Lilly and Company (17-18%)

Eli Lilly and Company is building its robust pipeline of headache and migraine treatments as part of its strategy to establish itself in the neurology space. It aims to broaden its biologics product line, increase patient access by forming partnerships with key players in healthcare, and utilize digital health solutions to optimize the diagnosis and treatment of cluster headache patients.

Novartis AG (14-15%)

Then Novartis AG is propelling growth with focused therapies across neurology, notably biologics, as well as personalized medicine. In addition, the company is also expanding its global footprint via collaborations and acquisitions, which are providing it with a steady pipeline of next-gen therapeutics.

GlaxoSmithKline Plc. (11-12%)

GlaxoSmithKline Plc. is pursuing a multi-pronged growth strategy focused on the precision medicine and drug repurposing opportunity in headache disorders. It is using partnerships with research institutions to accelerate the development of new therapies.

AstraZeneca Plc. (9-10%)

AstraZeneca Plc. Learn underscore collaborate among diverse teams with the depth of expertise in immunology and neuroscience to develop potential first-in-class treatments for cluster headache. It specializes in new drug delivery systems, patient-centered therapeutics, and advanced digital health forms for improved treatment results.

Other Key Players (14-15% Combined)

A number of other companies are major contributors to the cluster headache syndrome market through innovative technologies and increased distribution networks. They include:

With the demand for cluster headache syndrome procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Calcium Channel Blockers, Corticosteroids, Sumatriptan, Lithium Carbonate, Ergots, Melatonin, Anti-Seizure Drugs and Local Anaesthetics

Acute Treatment, Preventive Treatment and Alternative & Emerging Therapies

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies and Specialty Clinics & Neurology Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for cluster headache syndrome market was USD 1,042.0 million in 2025.

The cluster headache syndrome market is expected to reach USD 1,665.3 million in 2035.

Introduction of CGRP (calcitonin gene-related peptide) inhibitors, growing investment in research on headache disorders has significantly increased the demand for cluster headache syndrome.

The top key players that drives the development of cluster headache syndrome market are Eli Lilly and Company, Novartis AG, GlaxoSmithKline Plc., AstraZeneca Plc. and Takeda Pharmaceutical Company Limited.

Calcium channel blockers is by drug leading segment in cluster headache syndrome market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 3: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 5: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: Latin America Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 7: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Western Europe Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 9: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Eastern Europe Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 11: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 13: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: East Asia Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 15: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Middle East and Africa Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 5: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 9: Global Market Attractiveness by Drug Type, 2023 to 2033

Figure 10: Global Market Attractiveness by Region, 2023 to 2033

Figure 11: North America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 12: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 13: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 14: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 15: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 16: North America Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 19: North America Market Attractiveness by Drug Type, 2023 to 2033

Figure 20: North America Market Attractiveness by Country, 2023 to 2033

Figure 21: Latin America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 22: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 23: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 24: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: Latin America Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 27: Latin America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 28: Latin America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 29: Latin America Market Attractiveness by Drug Type, 2023 to 2033

Figure 30: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 31: Western Europe Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 32: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 33: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 34: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 35: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 36: Western Europe Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 37: Western Europe Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 38: Western Europe Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 39: Western Europe Market Attractiveness by Drug Type, 2023 to 2033

Figure 40: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 41: Eastern Europe Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 42: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: Eastern Europe Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 47: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 48: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 49: Eastern Europe Market Attractiveness by Drug Type, 2023 to 2033

Figure 50: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 51: South Asia and Pacific Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 52: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 55: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 56: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 57: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 58: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 59: South Asia and Pacific Market Attractiveness by Drug Type, 2023 to 2033

Figure 60: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 61: East Asia Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 62: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 63: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 64: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 65: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 66: East Asia Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 67: East Asia Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 68: East Asia Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 69: East Asia Market Attractiveness by Drug Type, 2023 to 2033

Figure 70: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 71: Middle East and Africa Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 72: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 73: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 74: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 75: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 76: Middle East and Africa Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 77: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 78: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 79: Middle East and Africa Market Attractiveness by Drug Type, 2023 to 2033

Figure 80: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cluster Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cluster Packaging for Beer Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Cluster Packaging for Beer Suppliers

Digital Instrument Clusters Market Growth - Trends & Forecast 2025 to 2035

WHIM Syndrome Management Market Insights and Analysis for 2025 to 2035

Marfan Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Kounis Syndrome Market Size and Share Forecast Outlook 2025 to 2035

Laband Syndrome Therapeutics Market Growth - Trends & Future Innovations 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Donohue Syndrome Treatment Market Growth - 2025 to 2035.

Triple X Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Barlow’s Syndrome Market Size and Share Forecast Outlook 2025 to 2035

Edward’s Syndrome Treatment Market – Growth & Future Prospects 2025 to 2035

Sjogren's Syndrome Market Size and Share Forecast Outlook 2025 to 2035

Global Takotsubo Syndrome Therapeutics Market Analysis - Size, Share & Forecast 2025 to 2035

Carcinoid Syndrome Management Market

Carcinoid Syndrome Diarrhea Treatment Market

Short sleep syndrome Treatment Market Growth & Demand 2025 to 2035

Klinefelter Syndrome Therapeutics Market - Growth & Demand 2025 to 2035

Central Pain Syndrome Management Market – Size, Share & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA