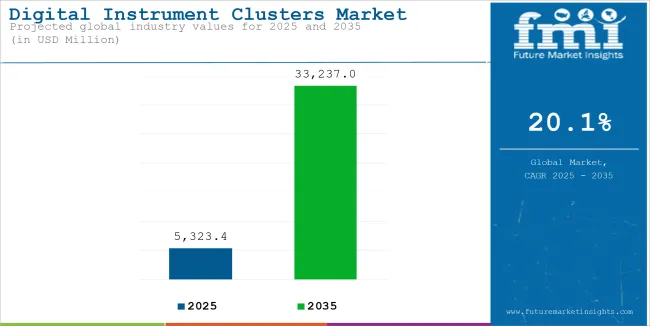

The global sales of Digital Instrument Clusters are anticipated to reach USD 4,432.5 million by 2024, with a growing demand increase from end users at 20.1% CAGR over the forecast period. The market value is forecast to grow from USD 5,323.4 million in 2025 to USD 33,237.0 million by 2035.

Digital instrument clusters are displays that are used to express the measuring quantity of devices such as speedometers, frequency meters, voltmeters, and others in a numeric format. These displays enable appliances and machines such as smartphones, laptops, digital cameras, inverters, and automotive vehicles to present a wide variety of information on a single digital platform.

| Attributes | Key Insights |

|---|---|

| Market Value, 2024 | USD 4,432.5 Million |

| Estimated Market Value, 2025 | USD 5,323.4 Million |

| Projected Market Value, 2035 | USD 33,237.0 Million |

| Market Value CAGR (2025 to 2035) | 20.1% |

These instrument clusters with digital displays are increasingly gaining popularity as an alternative to electromechanical pointer instruments, owing to their ability to show precise and accurate measurements in numeric format. On account of this, the sales of digital instrument clusters are estimated to register rapid growth in the market over the forthcoming years.

As the automotive industry faces mounting competition, with growing tech-savvy populations globally, major automobile manufacturers are giving priority to the introduction of advanced automobile vehicles with improved features.

This is well shown in 2021 when Japanese public multinational conglomerate automobile maker Honda launched its NS100Q scooter, equipped with new features that include a full digital instrument cluster. These kind of developments and product launches will keep increasing the market demand for the digital instrument cluster.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Digital Instrument Clusters market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The below table presents the expected CAGR for the global Digital Instrument Clusters sales over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 19.7%, followed by a slightly higher growth rate of 20.2% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 19.7% (2024 to 2034) |

| H2 | 20.2% (2024 to 2034) |

| H1 | 19.8% (2025 to 2035) |

| H2 | 20.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 19.8% in the first half and remain relatively moderate at 20.4% in the second half. In the first half (H1) the market witnessed an increase of 10 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

This section below examines the value shares of the leading segments in the industry. In terms of Display Type, the FT-LCD segment is expected to have the Highest Market Share during the Forecast Period and generate a CAGR of around 25.4% in 2024.

Based on the application type, the Automobile segment is projected to account for a share of 45.2% in 2024. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value CAGR (2024) |

|---|---|

| FT-LCD (Display Type) | 25.4% |

The TFT-LCD (Thin-Film Transistor Liquid Crystal Display) is expected to gain the largest market share of almost 45% in the global digital instrument clusters market by 2035, as this market segment offers it a competitive cost advantage over its peers due to better performance and extensive acceptance in mid to high-tier class vehicles.

TFT-LCD displays are very customizable. Several interfaces like speedometers, navigation, and ADAS information can be packaged in one cohesive dashboard. It supports flexible layouts and interactive touch features, making user experience rich and classy.

Continuous advancement in TFT-LCD technology, such as an improved backlighting mechanism and energy efficiency, has further reduced the visual quality gap in comparison with OLED. Improving the energy consumption scenario for EVs, TFT-LCD has emerged as a viable option.

| Segment | Value Share (2024) |

|---|---|

| Automobile (Application) | 45.2% |

By 2035, the car segment is predicted to dominate the digital instrument clusters market, accounting for around 45%. This expansion can be ascribed to increased acceptance of innovative automotive technology, the proliferation of electric vehicles, and the rising demand for personalized, connected, and interactive user experiences in vehicles.

Electric vehicles and self-driving cars rely heavily on digital clusters to display all of the vehicle's vital information, such as battery level, range, navigation, and safety alerts. Global EV sales will reach 40 million units per year by 2035. In this context, there is a high demand for premium digital displays. Similarly, with autonomous vehicles, a comprehensive dashboard is required for real-time feedback, which will further boost demand.

Modern vehicles are getting more networked, so the driver can access navigation, entertainment, and diagnostics in a single interface. These are mostly accessed via digital instrument clusters, which are used in a large number of premium and mass-market vehicles.

Growing consumer preference towards comfortable travel and increasing per capita income

With the growing consumer preference towards comfortable travel and increasing per capita income of the population, significant rises in the production and sales of automotive vehicles are being witnessed across the globe, which results in creating strong demand for associated devices.

For example, the Bureau of Transportation Statistics has reported in 2020 that nearly 1.92 Million and 2.56 Million units of passenger cars were manufactured and sold in the USA respectively. As more modern vehicles nowadays apply digital instrument clusters to guide drivers by providing more accurate information concerning vehicle parameters and functions, fast-moving sales of automobiles are expected to create profitable prospects for growth in the market.

There are many car automobile companies, which are nowadays rapidly shifting their preference from traditional instrument clusters towards adopting digital ones as these carry good features of high user interaction, more readability, and high resolution.

Further, the market will see increased introduction of latest devices carrying the innovative technology such as artificial intelligence in the form of devices like AI-powered cars that would lead to a positive influence on the digital instrument cluster market.

Rising Adoption of Advanced Vehicle Connectivity Technologies

An increase in the installation of connected technologies in modern cars is a critical factor for digital instrument clusters to be adopted in vehicles. Advances in ADAS, navigation aid, and live vehicle diagnostics installations are gradually eradicating traditional analog displays through digital interfaces which can display dynamic and customizable information.

The in-vehicle infotainment system and any external devices such as a smartphone can be combined with digital instrument clusters using the technologies of Bluetooth and Wi-Fi. Such a connection will also enhance the driver's experience with live traffic updates, fuel efficiency statistics, and safety alerts in one single and central display.

Industry reports have indicated that the global connected car market is going to grow at a CAGR of 18% from 2025 to 2030, in accordance with the growing demand for smart vehicle technologies. This trend directly affects the growth of digital clusters because automakers focus on offering improved connectivity and user-centric designs to meet consumer expectations.

Shift toward Electric and Autonomous Vehicles

Digital instrument clusters are the result of rapid growth in electric vehicle and autonomous vehicle markets. The reason for this is that EVs and AVs demand complex display systems that can deliver battery status, range, autonomous driving modes, and energy usage. A digital cluster can offer flexibility and functionality to represent the data in a very intuitive manner.

Acceptance of EVs increases through supportive incentives and technological advancements as governments promise sustainable goals with active commitment from automakers. Interestingly, IEA estimates that, to date, over 35 million units of EVs were sold worldwide as of 2024, and the estimates keep going up and up. This is also reflected in improvements in AV technologies, where interfaces need to process real-time data coming from sensors, cameras, and other navigation systems.

The growing demand for these latest-generation cars is being driven up by indispensability of digital instrument clusters that can adapt to multiple operational modes.

Integration of Advanced Driver Assistance Systems (ADAS) and Autonomous Driving Technologies

The adoption of ADAS and autonomous driving technologies provides a key opportunity for the digital instrument cluster market. Advanced Driver Assistance Systems require sturdy displays to provide instantaneous feedback on how well the vehicle is performing, road conditions, and navigation information. In this respect, digital instrument clusters are the central hub from where such critical information is delivered to improve the experience in driving overall.

With global regulations increasingly encouraging the adoption of ADAS, such as automatic emergency braking and lane-keeping assistance, car manufacturers are integrating digital clusters that can seamlessly incorporate all ADAS features. For instance, the ADAS market size is expected to grow at a CAGR of over 12% from 2023 to 2030, fueling demand for customizable and high-resolution digital instrument displays.

This trend creates demand even greater for such systems. Once vehicles are set to more significant levels of autonomy, where user trust as well as the situational awareness are even further paramount, such digital instrument clusters will play a bigger role.

In this regard, higher visualization possibilities with AR overlays, and interactive interfaces, are to create immense possibilities for growth in this area as well. Automotive ecosystems of tomorrow will have digital instrument clusters as its core element.

From 2020 to 2024, the global digital instrument clusters market witnessed steady growth, driven by the automotive industry's shift toward vehicle electrification and enhanced in-car experiences. Automakers increasingly replaced analog clusters with digital counterparts to offer customizable and real-time displays of critical vehicle information.

The market grew at an estimated CAGR of 8% during this period, fueled by the rising adoption of Advanced Driver Assistance Systems (ADAS) and demand for improved connectivity features.

Between 2025 and 2035, the market is projected to accelerate, with an expected CAGR exceeding 10%. Factors such as the growing penetration of electric vehicles (EVs), autonomous driving technologies, and consumer preference for personalized interfaces will drive this expansion. By 2035, it is anticipated that over 85% of new vehicles globally will feature digital instrument clusters, compared to approximately 50% in 2024.

Advancements in display technologies, such as OLED and augmented reality (AR), are also expected to shape the market's future. Additionally, regional growth in markets like Asia-Pacific, driven by increased automobile production and technology adoption, will further propel demand. Enhanced user interfaces and a focus on energy-efficient displays will remain key factors influencing the evolution of the market in the coming decade.

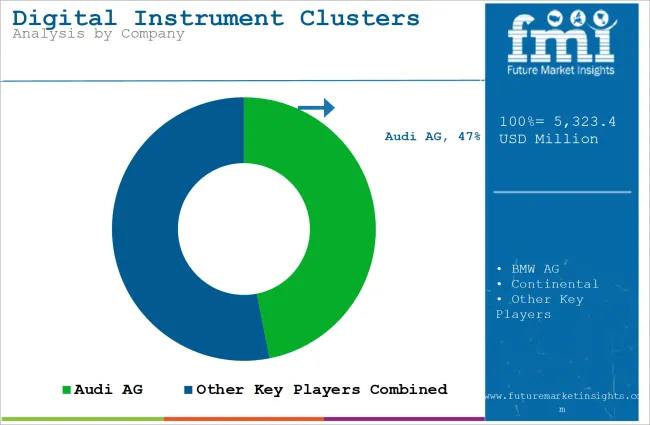

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 Million. These companies are currently capturing a significant share of 55% to 60% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Audi AG, BMW AG, Continental, Dakota Digital, Ford Motor Company, Jaguar Land Rover Limited, Luxoft Holding, Inc and others.

Tier 2 includes most of the small-scale companies operating at the local level-serving niche Digital Instrument Clusters vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the Digital Instrument Clusters industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 23.5% through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| The USA | 24.1% |

| India | 23.5% |

| China | 21.4% |

| Germany | 18.6% |

| Japan | 17.1% |

The United States dominates the digital instrument clusters market due to the growing automotive sector and utilization of state-of-art technology, which has led to increased customer demand for premium vehicles. Among the nation's largest automakers, Tesla, Ford, and General Motors are making big investments in the development of new digital interfaces.

In 2024, more than 15 million automobiles were sold in the United States, with digital instrument clusters accounting for 70% of all new sales. This tendency is being fueled even further by ADAS and electric vehicles. For example, Tesla's EV models feature a fully computerized cockpit with advanced personalization possibilities.

Government initiatives like Infrastructure Investment and Jobs Act, too, drive support for the establishment of smart vehicle technologies and demand for digital clusters. Additionally, high spending in luxury vehicle, the USA markets are also booming hotspots with respect to innovative growth.

China controls the global automobile market and leads in EV production and adoption, which drives demand for digital instrument clusters.

China accounted for over 50% of global EV sales in 2024, with more than 7 million units sold, outpacing all other regions. The rapid use of EVs needs improved digital dashboards that maximize the user experience and give critical vehicle details. The Chinese government promotes connected and autonomous vehicle development, with programs such as the "Intelligent Vehicle Innovation and Development Strategy" intending to position China as a leader in automotive AI and connectivity by 2035.

China remains the world's largest automobile producer, with over 27 million vehicles manufactured in 2024. This includes a substantial share of mid- to high-tier vehicles equipped with digital instrument clusters. China’s push for innovation, supported by local tech giants and favorable government policies, ensures its leadership in the adoption of next-generation digital cluster solutions.

As per FMI, Asia Pacific excluding Japan is projected to exhibit rapid growth in the global digital instrument cluster market between 2025 and 2035.

A significant rise in laptop and smartphone penetration is being witnessed, especially across the countries such as China, India, South Korea, Australia, and others, owing to the growing usage of the internet and the increasing gamer population. For instance, according to a report by the India Brand Equity Foundation, smartphone shipments across India totaled 189 million in terms of units in the year 2023, exhibiting more than 14% growth in comparison to 2022.

With this rise in smartphone adoption and the advent of upcoming 5G technology, numerous smartphone manufacturers are increasingly focusing on launching novel smartphones with innovative features such as digital instrument clusters.

This is expected to facilitate the growth in the digital instrument cluster market across the Asia Pacific excluding Japan. One of the significant growth drivers for the Digital Instrument Clusters industry is China, which is due to the rising domestic market and exports.

The digital instrument clusters market is highly competitive, with key players focusing on technological advancements, strategic partnerships, and innovation to maintain their market position. Companies such as Bosch, Denso, Continental, Visteon, and Magna International lead the market, offering a wide range of digital dashboard solutions for automobiles, including advanced display systems, customizable interfaces, and integrated connectivity features.

As automotive manufacturers demand more integrated and sophisticated digital solutions for their vehicles, the competition is intensifying. Companies are investing in research and development to incorporate cutting-edge technologies like augmented reality (AR), head-up displays (HUD), and AI-powered user interfaces. These innovations are aimed at providing seamless connectivity, improved driver experience, and real-time vehicle data analysis.

The shift toward electric vehicles (EVs) and autonomous driving is fueling competition, as these vehicles require more advanced digital clusters to support new functionalities like energy monitoring, navigation, and safety features.

Industry Updates

Based on Display Type, the industry is segmented into LCD, TFT-LCD and OLED.

Based on Display Size, the industry is segmented into 5-8 inch, 9-11 inch and >12 inch

Based on Application, the Digital Instrument Clusters Springs Market is segmented into smartphones, tablet pc/desktop/notebook, automobile and others

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 4,432.5 Million in 2024

The industry is set to reach USD 5,323.4 Million in 2025

The industry value is anticipated to rise at 20.1% CAGR through 2035

The industry is anticipated to reach USD 33,237.0 Million by 2035

China accounts for 17.2% of the global Digital Instrument Clusters market revenue share alone.

India is predicted to witness the highest CAGR of 23.5% in the Digital Instrument Clusters market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Display, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Application, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Display, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Display, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by Application, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast by Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast by Display, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by Application, 2017 to 2032

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 35: East Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 36: East Asia Market Volume (Units) Forecast by Type, 2017 to 2032

Table 37: East Asia Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 38: East Asia Market Volume (Units) Forecast by Display, 2017 to 2032

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 40: East Asia Market Volume (Units) Forecast by Application, 2017 to 2032

Table 41: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: South Asia & Pacific Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 44: South Asia & Pacific Market Volume (Units) Forecast by Type, 2017 to 2032

Table 45: South Asia & Pacific Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 46: South Asia & Pacific Market Volume (Units) Forecast by Display, 2017 to 2032

Table 47: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 48: South Asia & Pacific Market Volume (Units) Forecast by Application, 2017 to 2032

Table 49: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: MEA Market Volume (Units) Forecast by Country, 2017 to 2032

Table 51: MEA Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 52: MEA Market Volume (Units) Forecast by Type, 2017 to 2032

Table 53: MEA Market Value (US$ Million) Forecast by Display, 2017 to 2032

Table 54: MEA Market Volume (Units) Forecast by Display, 2017 to 2032

Table 55: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 56: MEA Market Volume (Units) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Display, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 10: Global Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 14: Global Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 18: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 21: Global Market Attractiveness by Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Display, 2022 to 2032

Figure 23: Global Market Attractiveness by Application, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Display, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 34: North America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 38: North America Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 42: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 45: North America Market Attractiveness by Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Display, 2022 to 2032

Figure 47: North America Market Attractiveness by Application, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Display, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Display, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Display, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 90: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 93: Europe Market Attractiveness by Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Display, 2022 to 2032

Figure 95: Europe Market Attractiveness by Application, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: East Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 98: East Asia Market Value (US$ Million) by Display, 2022 to 2032

Figure 99: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 100: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: East Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 106: East Asia Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 109: East Asia Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 110: East Asia Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 113: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 114: East Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 117: East Asia Market Attractiveness by Type, 2022 to 2032

Figure 118: East Asia Market Attractiveness by Display, 2022 to 2032

Figure 119: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 120: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 121: South Asia & Pacific Market Value (US$ Million) by Type, 2022 to 2032

Figure 122: South Asia & Pacific Market Value (US$ Million) by Display, 2022 to 2032

Figure 123: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 124: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 127: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: South Asia & Pacific Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 130: South Asia & Pacific Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 131: South Asia & Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 132: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 133: South Asia & Pacific Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 134: South Asia & Pacific Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 135: South Asia & Pacific Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 136: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 137: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 138: South Asia & Pacific Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 139: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 140: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 141: South Asia & Pacific Market Attractiveness by Type, 2022 to 2032

Figure 142: South Asia & Pacific Market Attractiveness by Display, 2022 to 2032

Figure 143: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 144: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 145: MEA Market Value (US$ Million) by Type, 2022 to 2032

Figure 146: MEA Market Value (US$ Million) by Display, 2022 to 2032

Figure 147: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 148: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 149: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 150: MEA Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 151: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 152: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 153: MEA Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 154: MEA Market Volume (Units) Analysis by Type, 2017 to 2032

Figure 155: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 157: MEA Market Value (US$ Million) Analysis by Display, 2017 to 2032

Figure 158: MEA Market Volume (Units) Analysis by Display, 2017 to 2032

Figure 159: MEA Market Value Share (%) and BPS Analysis by Display, 2022 to 2032

Figure 160: MEA Market Y-o-Y Growth (%) Projections by Display, 2022 to 2032

Figure 161: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 162: MEA Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 163: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 164: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 165: MEA Market Attractiveness by Type, 2022 to 2032

Figure 166: MEA Market Attractiveness by Display, 2022 to 2032

Figure 167: MEA Market Attractiveness by Application, 2022 to 2032

Figure 168: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA