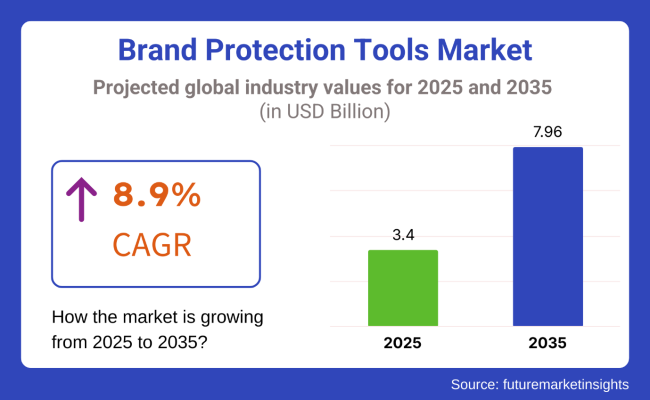

The global brand protection tools market is expected to witness significant growth during the forecast period, with the market size projected to rise from USD 3.40 billion in 2025 to USD 7.96 billion by 2035, registering a CAGR of 8.9%. This growth will be driven by the rising need to secure digital assets, trademarks, and product authenticity in an increasingly connected global economy.

As online commerce platforms and marketplaces continue to expand, counterfeiting, trademark abuse, and impersonation are becoming more widespread. As a result, the adoption of brand protection technologies is being accelerated by both large corporations and smaller enterprises looking to safeguard brand equity and consumer trust.

Greater emphasis has been placed on automating enforcement actions, detecting infringements in real time, and consolidating reporting across platforms. Advanced analytics and AI algorithms are being embedded into cloud-based platforms to monitor brand mentions, unauthorized listings, fake websites, and impersonator profiles. This technological shift has allowed businesses to respond more quickly to digital brand threats.

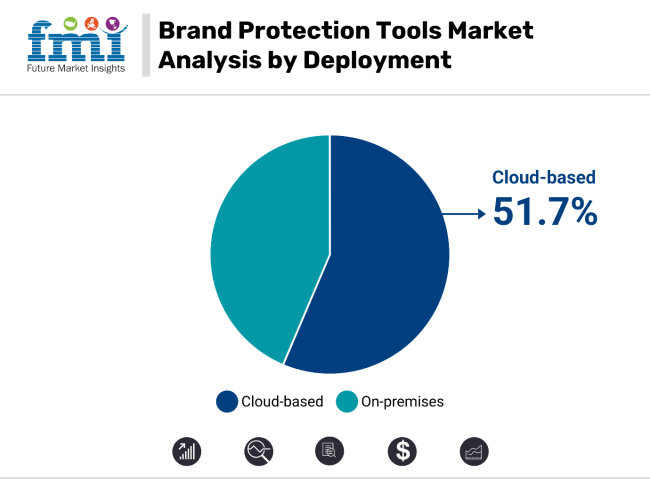

Cloud-based deployment models are increasingly being adopted due to their scalability and flexibility, allowing brand protection teams to act across geographies without dependence on physical infrastructure. The importance of digital brand monitoring tools has been elevated across industries such as fashion, electronics, and pharmaceuticals, where product misuse and counterfeit risk remain high.

According to Robert Reading, Head of Content Strategy at Clarivate opines that the digital ecosystem is evolving faster than ever, and brand owners must proactively defend against increasingly sophisticated threats. Modern brand protection requires not just detection, but integrated enforcement and intelligence.” His view reinforces the strategic shift that is underway across global enterprises. Increased regulatory oversight, evolving consumer expectations, and the expanding scope of online marketplaces will continue to position brand protection tools as critical to digital operations.

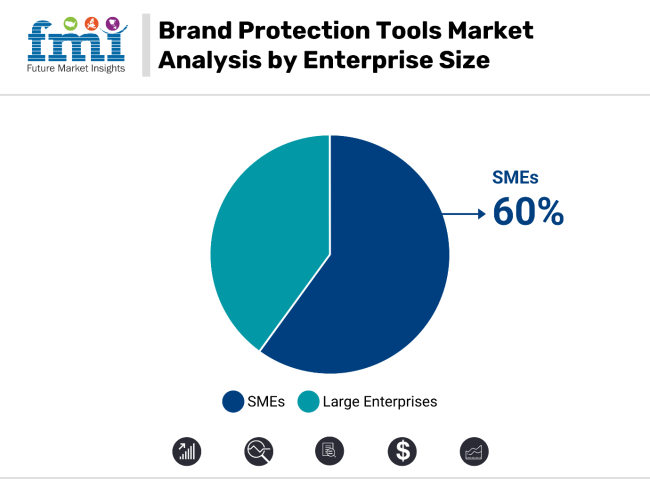

Small & medium enterprises are witnessing accelerated adoption of brand protection tools, driven by rising IP risks and anti-counterfeiting needs. At the same time, cloud-based deployment has become the top choice due to its scalability, real-time protection, and cost-effectiveness for modern businesses.

Small and medium enterprises (SMEs) are rapidly emerging as the primary adopters in the brand protection tools market, with a CAGR of 10.9% from 2025 to 2035. The increasing risk of counterfeit products, especially across e-commerce platforms, has compelled SMEs to invest in IP protection software, trademark monitoring, and online brand enforcement tools. Their adoption is driven by rising brand vulnerability in online marketplaces, amplified by global reach and low entry barriers for counterfeiters.

Companies like Red Points, Incopro, and Smart Protection are tailoring affordable, automated solutions that suit the needs of SMEs. The USA government’s stricter IP laws enacted in 2023, along with a 20% rise in IP litigation, have further pushed SMEs to deploy structured brand defense strategies. With more digital-native small businesses emerging worldwide, this segment is expected to contribute over 60% of the market’s growth by 2025.

Cloud-based deployment has taken the lead in the brand protection tools market, accounting for a 51.7% share in 2025. Cloud platforms are favoured for their real-time threat detection, cost-efficiency, and scalability, especially by companies with distributed operations. Businesses facing rising risks of digital impersonation, IP theft, and trademark abuse prefer cloud solutions due to their automated updates, AI-driven insights, and seamless integration with existing cybersecurity infrastructure.

Leading vendors such as MarkMonitor, AppDetex, and ZeroFOX have strengthened their cloud-first offerings to help clients monitor digital channels continuously. In response to a 15% surge in online counterfeiting in the USA in 2023, enterprises are shifting toward proactive brand protection, replacing legacy on-premise systems. The move is also supported by regulatory frameworks demanding faster incident response and global IP visibility.

The brand protection tools market is being propelled by rising digital threats such as counterfeiting, piracy, and brand impersonation. Advanced technologies are being adopted to detect and remove infringements. However, broader adoption is being slowed by cost barriers, legal inconsistencies, and the constant evolution of online threats across platforms and regions.

Rising digital exposure is driving the adoption of protection tools

As digital interactions are being expanded across social media, e-commerce platforms, and content-sharing networks, brand misuse is being intensified. Unauthorized sellers and counterfeit product listings are being circulated, damaging brand trust and misleading consumers. In response, brand protection tools powered by artificial intelligence and machine learning are being employed. These tools are being used to monitor product listings, logos, and unauthorized brand mentions across various digital channels.

Real-time detection and automated takedown mechanisms are being prioritized by companies to safeguard brand reputation and customer loyalty. Industries such as apparel, pharmaceuticals, and consumer electronics are being impacted most severely due to high levels of imitation and piracy. Brand monitoring strategies are now being incorporated into digital marketing and compliance frameworks to ensure consistent online presence management.

High costs and integration challenges are limiting broader adoption

Wider adoption of brand protection technologies is being constrained by cost-related barriers and technical complexities. Small and medium-sized enterprises are often being excluded from accessing these tools due to high licensing fees and infrastructure requirements.

Implementation is being delayed as compatibility issues with existing systems, such as customer relationship management and digital asset management platforms, are being encountered. In several cases, insufficient internal capabilities are being reported, with businesses unable to allocate dedicated resources for customization, training, and continuous monitoring.

Furthermore, regional adaptation involving local language capabilities, regulatory requirements, and marketplace-specific adjustments is being considered essential, thereby increasing operational complexity. Unless simplified integration models and tiered pricing structures are introduced, the adoption rate is expected to remain limited in resource-constrained sectors.

AI capabilities and regional expansions are unlocking new growth areas

New opportunities are being unlocked as AI-powered brand protection tools are being increasingly adopted. Through machine learning algorithms, these tools are being trained to identify counterfeiting trends, generate enforcement workflows, and streamline violation resolution across digital touchpoints. Automated alerts and performance analytics are being used to support brand managers and legal teams.

Meanwhile, rising online commerce activity in Asia Pacific, South America, and Eastern Europe is contributing to increased demand for localized brand protection systems. Emerging markets are being prioritized for deployment of region-specific, multilingual tools that align with unique platform dynamics and compliance expectations. As digital maturity expands in these regions, brand protection solutions are being positioned as vital for market entry and long-term brand integrity.

Evolving threats and legal fragmentation are creating persistent risks

Persistent risks are being created by counterfeiters who continuously employ advanced digital evasion techniques to bypass brand protection measures. Technologies such as deepfakes, AI-generated content, and cloned marketplaces are being utilized to deceive consumers and evade detection tools. Meanwhile, global enforcement efforts are being impeded by fragmented intellectual property laws, slow judicial processes, and uncooperative jurisdictions, which complicate timely legal action.

Takedown requests are often inconsistently handled, and accountability among hosting platforms remains limited, allowing infringing content to persist online. To effectively counter these threats, adaptive brand protection strategies are being required, emphasizing stronger legal advocacy, enhanced industry collaboration, and robust cross-border enforcement protocols. These approaches are essential to improving the efficiency and scope of anti-counterfeiting efforts worldwide.

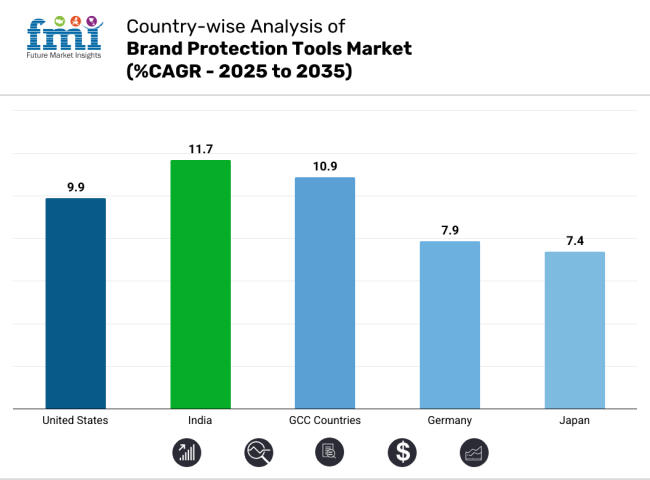

The brand protection tools market is expanding rapidly, with India, GCC countries, and the United States leading growth. Technology providers can capitalize on digital enforcement, threat monitoring, and anti-counterfeiting trends. These countries present strong opportunities for strategic investment across 30+ tracked markets through 2035.

The United States is a leading market for digital brand protection technologies, expected to expand at a CAGR of 9.9% from 2025 to 2035. Growth is driven by rising digital content in film, music, and streaming platforms like Netflix, Disney+, and Hulu. USA firms are adopting AI-powered trademark monitoring tools, copyright detection software, and automated enforcement systems.

The Digital Millennium Copyright Act (DMCA) provides a strong legal framework. Global e-commerce growth has raised demand for domain monitoring and anti-counterfeit detection. The USA benefits from a mature IP enforcement system and a tech-enabled enterprise ecosystem. These factors position the country as a benchmark in global brand protection efforts.

India is the fastest-growing market for brand protection tools, forecast to grow at a CAGR of 11.7% from 2025 to 2035. The surge in e-commerce has increased cases of counterfeit products and unauthorized sellers, especially in consumer electronics, apparel, and fast-moving consumer goods (FMCG). Indian companies are adopting anti-counterfeiting software, online trademark monitoring, and digital IP enforcement tools. Investments in cloud-based brand protection platforms are rising.

Government programs such as the National IPR Policy and support from the Department for Promotion of Industry and Internal Trade (DPIIT) are enabling small businesses to protect intellectual property. As India’s digital economy grows, real-time IP protection and brand monitoring are becoming essential strategies.

The Gulf Cooperation Council (GCC) region, led by Saudi Arabia and the United Arab Emirates (UAE), is emerging as a high-growth region in the brand protection software market, with a CAGR of 10.9% from 2025 to 2035. E-commerce is expanding rapidly, raising concerns about counterfeit goods, especially in luxury fashion, electronics, and pharmaceuticals.

Governments are implementing cybercrime laws, enhancing trademark registration systems, and launching digital IP reform initiatives under programs like Saudi Vision 2030. Businesses are deploying track-and-trace technologies, product serialization systems, and digital brand monitoring tools. GCC nations are collaborating with global enforcement bodies to elevate cross-border IP compliance.

Germany is a mature and industrially advanced market in Europe for brand protection technologies, with a projected CAGR of 7.9% from 2025 to 2035. Leading sectors such as automotive, engineering, and biopharma face threats from patent infringements and product counterfeiting. German firms are investing in product authentication systems, digital watermarking, and online trademark enforcement tools. The German Patent and Trade Mark Office (DPMA) plays a key role in raising awareness and ensuring IP compliance.

German SMEs are also adopting cloud-based brand surveillance and AI-enabled infringement detection tools. Germany’s export-led economy and legal adherence to EU IP regulations support long-term demand for digital IP protection.

Japan is a strategically important market for anti-counterfeit solutions and IP monitoring platforms, forecast to grow at a CAGR of 7.4% from 2025 to 2035. Key sectors include automotive, consumer electronics, medical devices, and luxury goods. Japanese companies are implementing blockchain-based product tracking, AI-driven brand enforcement, and serialization tools to protect global and domestic markets.

The Japan Patent Office (JPO) has strengthened international IP collaborations and increased penalties for infringements. Japan’s export-heavy industries prioritize IP protection in foreign trade, particularly with China, the United States, and the European Union. The focus on manufacturing precision, compliance, and brand value preservation supports growth in digital brand protection solutions.

The global brand protection tools market is categorized into three supplier tiers, each addressing rising threats like counterfeiting, intellectual property theft, and digital piracy. Tier 1 vendors such as MarkMonitor, BrandShield, and PhishLabs offer full-scale solutions including anti-piracy services, domain monitoring, cyber threat detection, and automated takedown systems. These companies serve multinational enterprises requiring legal support and technology-driven enforcement.

Tier 2 providers like Red Points, BrandVerity, and AppDetex focus on e-commerce fraud protection, social media brand infringement tracking, and digital shelf monitoring. Red Points uses artificial intelligence (AI) and machine learning algorithms to process over 2.7 billion online data points monthly, protecting 1,300+ brands worldwide. Tier 3 players such as Pointer Brand Protection, Enablon, and Ruvixx target niche regions using hybrid enforcement models that blend manual investigation with automated detection tools.

The market remains moderately fragmented, though consolidation is increasing due to strategic acquisitions. High entry barriers are maintained by AI infrastructure requirements, cross-border legal compliance, and cybersecurity integration.

Recent Brand Protection Tools Industry News

Between 2023 and 2025, the brand protection tools industry has undergone major strategic shifts amid escalating online fraud, counterfeiting, and intellectual property abuse. A key milestone occurred in December 2024, when Red Points announced a strategic partnership with TaskUs to bolster its fraud prevention capabilities and scale enterprise-grade enforcement. Highlighting the importance of this alliance, Laura Urquizu, CEO of Red Points, stated that we are thrilled to partner with TaskUs, a collaboration that reflects our shared commitment to innovation and advancing digital safety.

Through our intuitive AI platform and the unique AI+Human-in-the-loop framework by TaskUs, clients will be able to leverage a one-of-a-kind, end-to-end solution that diligently guards against fraud while allowing them to remain focused on business goals. This alliance sets a benchmark in delivering scalable, hybrid brand protection solutions at the intersection of AI automation and human expertise.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.40 billion |

| Projected Market Size (2035) | USD 7.96 billion |

| CAGR (2025 to 2035) | 8.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Software Types Analyzed (Segment 1) | Digital Rights Management Tools, Anti-Counterfeiting Solutions, Trademark Monitoring and Enforcement Tools, Domain Monitoring and Protection Tools, Social Media Monitoring and Brand Reputation Management Tools, Online Brand Enforcement Tools, Intellectual Property Protection Tools, Others |

| Deployment Models Analyzed (Segment 2) | Cloud-Based, On-Premises |

| Enterprise Sizes Analyzed (Segment 3) | Large Enterprises, Small & Medium Enterprises (SMEs) |

| Applications Analyzed (Segment 4) | Consumer Goods and Retail, Pharmaceuticals and Healthcare, Electronics and Electrical, Automotive, Luxury Goods, Media and Entertainment, Software and Technology, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, China, Japan, South Korea, India, Australia, GCC Countries, South Africa |

| Key Players Influencing the Market | Red Points, BrandShield, Corsearch, MarkMonitor, Counterfind, OpSec Security, NetNames, Sprockets, Incopro, Cimpress, Fraudwatch International, Horizon Software, Pangea, Trustwave, McAfee |

| Additional Attributes | Rising IP infringement across e-commerce platforms, SME adoption driven by cloud-based tools, AI and ML integration in threat detection, Increasing digital piracy risks, Domain and social media monitoring tools gaining traction globally |

The market is segmented into digital rights management tools, anti-counterfeiting solutions, trademark monitoring and enforcement tools, domain monitoring and protection tools, social media monitoring and brand reputation management tools, online brand enforcement tools, intellectual property protection tools, and others.

The market is segmented into cloud-based and on-premises.

The market is segmented into large enterprises and SMEs.

The market is segmented into consumer goods and retail, pharmaceuticals and healthcare, electronics and electrical, automotive, luxury goods, media and entertainment, software and technology, and others.

The market is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The global brand protection tools sector is projected to reach USD 3.40 billion by 2025.

The industry is anticipated to grow to approximately USD 7.96 billion by 2035, registering a CAGR of 8.9% from 2025 to 2035.

Key companies include Red Points, BrandShield, Corsearch, MarkMonitor, Counterfind, OpSec Security, NetNames, Sprockets, Incopro, Cimpress, Fraudwatch International, Horizon Software, Pangea, Trustwave, and McAfee.

The increasing prevalence of online counterfeiting, expansion of e-commerce, and the need for safeguarding intellectual property are significant contributors to growth.

South Asia and Pacific is set to record the highest CAGR of 11.3% in the assessment period, driven by rapid digital adoption and increasing awareness of brand protection.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Europe Market Attractiveness by Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: MEA Market Attractiveness by Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by Application, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Brand Protection Tools Providers

Brandy and Cognac Market Size and Share Forecast Outlook 2025 to 2035

Brandy Flavor Market Size, Growth, and Forecast for 2025 to 2035

Branded Generics Market Analysis - Size, Share, and Forecast Outlook from 2025 to 2035

Authentication and Brand Protection Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Head Protection Equipment Market Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Data Protection as a Service (DPaaS) Market

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paint Protection Film Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA