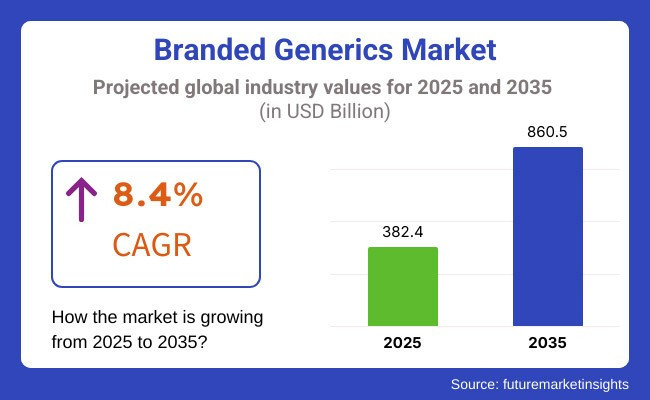

The global branded generics market is forecasted to expand from USD 382.4 billion in 2025 to USD 860.5 billion by 2035, registering a CAGR of 8.4%. This growth is driven by rising healthcare expenditures and the increasing prevalence of chronic diseases, particularly in emerging economies.

According to the World Bank’s 2023 healthcare expenditure data, countries like India have seen healthcare spending increase by over 12% annually from 2018 to 2023. Furthermore, the Global Burden of Disease Study 2022 reported a 23% increase in non-communicable diseases such as diabetes and cardiovascular conditions in low- and middle-income countries, intensifying demand for affordable medication options like branded generics.

Regulatory support has played a pivotal role in market expansion. The USA Food and Drug Administration’s (FDA) Generic Drug User Fee Amendments (GDUFA) program has accelerated generic drug approvals, cutting average review times by nearly 30% since 2017, according to FDA annual reports. The National Health Service (NHS) in the UK also reported that generic drug prescribing saved the system over GBP 13 billion between 2015 and 2022, underscoring the economic impact of generics adoption.

Pharmaceutical companies such as Sun Pharmaceutical Industries, Teva Pharmaceutical Industries, and Cipla have strategically invested in branded generics, recognizing their importance in emerging and mature markets. In 2023, Sun Pharma announced a USD 120 million investment focused on biosimilars and complex generics development to enhance market share in Asia Pacific and other emerging regions.

Teva’s 2024 financial disclosures revealed a 15% revenue growth driven by new branded generics in respiratory and oncology segments. These initiatives reflect the companies’ commitment to addressing unmet medical needs while offering cost-effective treatments.

Emerging markets in Asia Pacific, particularly India and China, are expected to be primary growth engines. The National Pharmaceutical Pricing Authority (NPPA) in India has enforced price control policies to increase the affordability of essential medicines, contributing to a 40% rise in generic drug prescriptions from 2020 to 2024, as per NPPA annual statistics.

Additionally, expanding health insurance coverage and government reimbursement schemes have improved access to branded generics. Technological innovations such as biosimilars and digital adherence solutions are enhancing patient outcomes. Biosimilars, anticipated to surpass USD 40 billion globally by 2030 (IQVIA, 2023), offer lower-cost alternatives to biologics without compromising efficacy.

Cipla’s biosimilar versions of Rituximab and Trastuzumab have been clinically validated and rapidly adopted in emerging markets. Digital health tools, like Teva’s AI-based medication adherence app launched in 2023, demonstrated a 20% reduction in missed doses among chronic disease patients during pilot studies, according to company-released data. North America is a mature market. The region continues to benefit from patent expirations and policies supporting generic substitution. IQVIA reports that generics account for nearly 90% of all prescriptions in the USA, with branded generics growing in specialty areas.

Europe maintains steady growth aided by the European Medicines Agency’s (EMA) fast-track biosimilar approvals, which numbered over 80 by 2024. Asia Pacific leads in growth rates, driven by demographic changes, urbanization, and infrastructure expansion. PhRMA data shows India’s pharmaceutical exports rose by 18% in 2023, reflecting increasing global demand for branded generics.

The anti-hypertensive segment is expected to account for 29% of the branded generics market by drug class in 2025, driven by the high global burden of hypertension and growing geriatric populations. Cardiovascular diseases are projected to lead by therapy area with a 19.3% market share in 2025, fueled by rising chronic disease incidence and the essential role of blood pressure control in treatment protocols.

By 2025, anti-hypertensive drugs are projected to hold 29% of the branded generics market by drug class. The segment’s dominance is largely attributed to the global prevalence of hypertension, which affects more than 1.28 billion people according to WHO estimates. As a leading risk factor for cardiovascular events, stroke, and renal dysfunction, hypertension demands long-term medication, ensuring consistent revenue flow for branded generics.

The market has been further supported by advancements in fixed-dose combinations, which enhance patient compliance and simplify treatment protocols. These innovations, aimed at reducing pill burden, are widely adopted by healthcare providers managing chronic cardiovascular conditions.

Lifestyle-related contributors-such as high sodium intake, sedentary routines, and rising obesity rates-have also exacerbated hypertension prevalence globally. The demand is particularly high among the aging population, where polypharmacy requires cost-effective, yet branded, treatment alternatives. In a 2024 stakeholder forum, a Novartis executive noted that branded generics in anti-hypertensives remain a cornerstone in both developed and emerging markets, thanks to therapeutic trust and affordability. Such positioning has allowed branded players to maintain relevance even as price pressures mount.

Cardiovascular diseases (CVDs) are expected to account for 19.3% of the branded generics market by therapy area in 2025. This leading position is underpinned by the global surge in CVD cases and the central role of hypertension management in preventing associated complications.

Anti-hypertensive therapies, particularly in branded generic formats, are widely prescribed to mitigate long-term cardiovascular risks. With healthcare systems globally shifting toward preventive care, branded generics offer a middle ground between cost control and brand recognition, enabling broader patient access to established treatments.

The growth in fixed-dose combinations and time-release formulations for CVD care has improved therapeutic outcomes and physician adherence to evidence-based prescribing practices. In countries with aging demographics and rising out-of-pocket health expenditures, branded generics are viewed as trusted alternatives to both premium brands and unregulated generics.

The continued advancement in drug delivery systems, coupled with high prevalence and chronic treatment cycles, is expected to sustain cardiovascular diseases as a dominant therapy area within the branded generics landscape through 2035.

The branded generics market is gaining momentum through supply chain resilience strategies and rising healthcare investments in emerging economies. However, increasing price pressure from unbranded generics continues to constrain margins. Companies are adapting through regional manufacturing, brand differentiation, and quality assurance to retain prescriber trust and market share.

Supply Chain Resilience Strategies Enhance Branded Generics Market Position

Efforts to build resilient pharmaceutical supply chains have bolstered the growth of branded generics. Companies are investing in redundant manufacturing hubs, regional production facilities, and diversified sourcing models to prevent disruptions caused by raw material shortages, geopolitical instability, or regulatory backlogs. These proactive strategies ensure continuous drug availability, reinforcing trust among healthcare professionals, hospitals, and payers. The visibility of a stable supply network enhances prescription confidence, leading physicians and pharmacists to favor branded generics over less reliable alternatives.

In 2024, a senior operations executive at Teva Pharmaceuticals remarked that predictable and stable supply chain often becomes the deciding factor between brands in therapeutic parity. Consistent product availability not only improves brand recall but also secures bulk procurement contracts and inclusion in insurance formularies, giving branded generics a competitive edge over their unbranded counterparts.

Increasing Competition from Unbranded Generics Poses Market Challenges

Unbranded generics continue to exert significant price pressure on branded equivalents. These products offer therapeutic equivalence at lower cost, making them more attractive to public health systems and private payers. In several markets, reimbursement policies actively promote unbranded generics through mandatory substitution laws or price ceilings.

In regions with automatic substitution protocols, pharmacists are often required to dispense the least expensive option available. This undermines brand loyalty unless differentiation through formulation improvements, patient compliance benefits, or manufacturer reputation is achieved. A 2024 analysis by IQVIA indicated that price sensitivity remains the single largest constraint to branded generics growth, particularly in countries with centralized drug procurement and narrow cost thresholds. To overcome this, companies must articulate clear clinical or brand advantages to justify premiums.

Rising Healthcare Expenditure in Emerging Markets Supports Branded Generics Expansion

Emerging economies such as India, Brazil, and China are experiencing sustained increases in public and private healthcare spending, creating fertile ground for branded generics adoption. As insurance coverage widens and chronic disease diagnoses increase, demand for affordable yet reliable medications is growing.

Branded generics are often preferred in these markets due to perceived quality assurance, particularly when associated with well-established pharmaceutical companies. Prescribers in both public and private healthcare settings are more inclined to choose brands that reflect clinical trust, regulatory compliance, and known manufacturing standards.

Out-of-pocket paying patients also favor branded options when quality and safety are perceived to be higher. As a senior market analyst at Dr. Reddy’s Laboratories noted in 2024 that Branding becomes a proxy for quality in markets where pharmacovigilance and regulatory enforcement remain uneven. With the rise in healthcare infrastructure and expanded access to treatment, branded generics manufacturers are gaining share through local partnerships, regional distribution networks, and formulation innovation, supporting long-term growth across emerging markets.

The branded generics market is expanding globally, with India and China leading due to manufacturing scale and government policy support. South Korea benefits from physician-driven prescribing, while the UK and the United States favor branded generics for quality assurance and insurance-tiered access. Regulatory alignment and local trust continue to drive regional growth.

India’s branded generics market is projected to grow at a CAGR of 7.6% from 2025 to 2035. The country remains the world’s largest producer of generics, supported by over 3,000 pharma companies and more than 10,000 manufacturing units. Growth is driven by low-cost production, international regulatory compliance (USFDA, EMA), and strong government policy backing under schemes like Ayushman Bharat and the Pharma PLI scheme. India’s domestic market is characterized by branded substitutes for nearly every major therapeutic class.

Physicians prefer brands due to familiarity, affordability, and quality assurance. Exports to emerging regions such as Africa, Latin America, and Southeast Asia have increased due to India’s pricing advantage and supply chain maturity. Companies such as Sun Pharma, Dr. Reddy’s, and Cipla are enhancing formulation offerings in oncology, cardiovascular, and anti-infective therapies. With continued demand for chronic care drugs, India remains central to branded generics expansion globally.

China’s branded generics market is forecast to grow at a CAGR of 6.6% between 2025 and 2035. The country’s national Volume-Based Procurement (VBP) program has reshaped drug pricing and procurement, creating an environment where low-cost branded generics thrive under state-influenced contracts. Domestic pharma giants such as Sinopharm, Jiangsu Hengrui, and CSPC Pharmaceutical dominate the landscape. These firms have scaled operations with government-backed incentives and regulatory streamlining by the National Medical Products Administration (NMPA).

While price competition remains intense, trusted domestic brands are preferred in public hospitals for chronic and essential medicines. Chinese branded generics also benefit from rapid approval timelines and strong provincial distribution networks. The integration of eHealth platforms and growing urban healthcare access have helped branded generics secure large-scale market presence. With a government push for innovation and affordability, China’s domestic industry continues to drive branded generics adoption across all major therapeutic areas.

South Korea’s branded generics market is projected to grow at a CAGR of 5.7% through 2035. Unlike many countries where pharmacists influence generic substitution, South Korea’s market is largely physician-driven, favoring trusted branded alternatives over unbranded generics. The Ministry of Food and Drug Safety (MFDS) enforces strict regulatory protocols for bioequivalence and quality, which supports strong prescriber confidence in branded products. Patients also associate branded generics with higher quality and better efficacy due to uniform manufacturing standards.

Local pharmaceutical firms, including Hanmi Pharmaceutical and Chong Kun Dang, dominate the branded generics segment by leveraging domestic preferences and policy support. Government-regulated pricing and reimbursement models further solidify market presence for branded options. With a robust regulatory framework and brand-driven prescription dynamics, South Korea offers a favorable environment for sustained growth in branded generics, particularly in diabetes, antihypertensives, and gastrointestinal treatments.

The United Kingdom is forecast to grow at a CAGR of 4.3% from 2025 to 2035 in the branded generics market. Growth is supported by a dual focus on cost control via NHS procurement and physician trust in quality-assured branded products. In certain therapeutic areas, including cardiovascular and endocrine disorders, branded generics remain widely prescribed due to reliability and adherence-enhancing formulations.

UK-based firms and European affiliates continue to supply branded generics that comply with MHRA guidelines, benefiting from post-Brexit localization strategies and resilient domestic manufacturing. Companies also use branded generics to maintain market continuity post-patent expiry, especially when originator brand equity remains high.

While unbranded generics are incentivized through policy, branded alternatives hold value through patient familiarity and loyalty. Moderate growth is expected to continue, particularly in therapeutic classes where treatment adherence, safety profile, and extended-release formulations offer distinct benefits.

The United States is projected to expand its branded generics market at a CAGR of 4.1% between 2025 and 2035. Branded generics in the USA benefit from insurance tiering, physician familiarity, and strategic brand retention by originator companies post-patent expiry. The Hatch-Waxman Act continues to support market entry of branded generics through abbreviated new drug applications (ANDAs), while payers leverage these products to offer low-cost branded options on formularies.

Branded generics often serve as a middle ground between premium brands and unbranded generics, offering trust with affordability. Market presence remains strong in antidepressants, antihypertensives, and cholesterol-lowering drugs, where therapeutic substitution is monitored. Companies use innovative delivery systems, such as extended-release or dual-action pills, to justify brand retention. With high generic penetration and pricing scrutiny, branded generics in the USA will continue to play a pivotal role in payer strategy, chronic disease management, and branded trust maintenance.

The branded generics market is characterized by intense competition driven by patent expiries, pricing pressure, and therapeutic equivalence. Unlike patented medicines, branded generics must navigate a landscape filled with unbranded competitors and other branded alternatives, resulting in price-sensitive dynamics across both developed and emerging markets.

Tier 1 players include global pharmaceutical giants such as Teva Pharmaceuticals, Pfizer, and Novartis, which maintain large branded generics portfolios in cardiovascular, metabolic, and CNS categories. According to Future Market Insights, these companies operate across multiple continents and utilize dual branding strategies, in which original brands are reformulated, rebranded, and repositioned post-patent expiry to retain market share.

Tier 2 firms such as Apotex Inc., Dr. Reddy’s Laboratories, and Mylan (a Viatris company) maintain regional strength through country-specific branding, doctor engagement models, and public health partnerships. These players focus on cost-effective branded alternatives, especially in primary care, gastroenterology, and dermatology.

Tier 3 companies, including Sun Pharma, Hanmi Pharmaceutical, and Sinopharm, dominate in local markets where regulatory familiarity, strong prescriber trust, and exclusive distributor networks give domestic firms a competitive edge. Foreign players often face challenges in penetrating such markets due to local clinical preferences and regulatory prioritization of homegrown manufacturing.

Key strategies across tiers include portfolio diversification, biosimilar-branded hybrid strategies, and brand recall campaigns. A growing focus on formulation enhancement, fixed-dose combinations, and patient compliance packaging is redefining brand positioning within generics.

Recent Branded Generics Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 382.4 billion |

| Projected Market Size (2035) | USD 860.5 billion |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Drug Classes Analyzed (Segment 1) | Anti-Hypertensive, Alkylating Agents, Antimetabolites, Hormones, Lipid Lowering Drugs, Anti-Depressants, Anti-Psychotics, Anti-Epileptics, Others |

| Therapy Areas Analyzed (Segment 2) | Oncology, Cardiovascular Diseases, Diabetes, Neurology, Gastrointestinal Diseases, Dermatology Diseases, Analgesics and Anti-inflammatory, Others |

| Formulation Types Analyzed (Segment 3) | Oral, Parenteral, Topical, Others |

| Distribution Channels Analyzed (Segment 4) | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Drug Stores |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Branded Generics Market | Mylan Pharmaceuticals Inc. (Viatris Inc.), Novartis AG, Teva Pharmaceuticals, Pfizer Inc., Sun Pharmaceutical, Aspen Pharmacare Holding Ltd., Abbott Laboratories, Bausch Health Companies Inc. (Valeant Pharmaceuticals Inc.), GlaxoSmithKline Pharmaceuticals Ltd., Zydus Lifesciences Ltd. (CADILA), Lupin Pharmaceuticals Inc., Sanofi S.A., AstraZeneca, Dr. Reddy’s Laboratories Ltd., AbbVie Inc. (Allergan, Inc.), Bayer AG, Cipla Pharmaceuticals, Apotex Inc., Endo International Inc. |

| Additional Attributes | Dollar sales by drug class (anti-hypertensive, antidepressants, antimetabolites), Dollar sales by therapy area (oncology, cardiovascular, diabetes), Dollar sales by formulation type (oral, parenteral, topical), Dollar sales by distribution channel (hospital, retail, online pharmacies), Regional demand trends by disease burden, Branded vs generic market penetration insights, Regulatory pathways influencing market entry |

| Customization and Pricing | Customization and Pricing Available on Request |

The global branded generics industry is projected to witness CAGR of 8.4% between 2025 and 2035.

The global branded generics industry stood at USD 353.7 billion in 2024.

The global Branded Generics industry is anticipated to reach USD 860.5 billion by 2035 end.

China is expected to show a CAGR of 6.6% in the assessment period.

The Key Players for branded generics industry are Mylan Pharmaceuticals Inc.(Viatris Inc.), Novartis AG, Teva Pharmaceuticals, Pfizer Inc., Sun Pharmaceutical, Aspen Pharmacare Holding Ltd., Abbott Laboratories, Bausch Health Companies Inc. (Valeant Pharmaceuticals Inc.), GlaxoSmithKline Pharmaceuticals Ltd., Zydus Lifesciences Ltd. (CADILA), Lupin Pharmaceuticals, Inc., Sanofi S.A., AstraZeneca, Dr. Reddy’s Laboratories Ltd., AbbVie Inc. (Allergan, Inc.), Bayer AG, Cipla Pharmaceuticals, Apotex Inc., Endo International Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume ( Thousand Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 4: Global Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 6: Global Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 8: Global Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 14: North America Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 16: North America Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 18: North America Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 24: Latin America Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 26: Latin America Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 28: Latin America Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 34: Western Europe Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 36: Western Europe Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 38: Western Europe Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 44: Eastern Europe Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 46: Eastern Europe Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 48: Eastern Europe Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 54: South Asia and Pacific Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 56: South Asia and Pacific Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 64: East Asia Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 66: East Asia Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 68: East Asia Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume ( Thousand Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Therapeutic Application, 2018 to 2033

Table 74: Middle East and Africa Market Volume ( Thousand Units) Forecast by Therapeutic Application, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 76: Middle East and Africa Market Volume ( Thousand Units) Forecast by Drug Class, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Formulation Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume ( Thousand Units) Forecast by Formulation Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume ( Thousand Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume ( Thousand Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 11: Global Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 15: Global Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 19: Global Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 28: Global Market Attractiveness by Formulation Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 41: North America Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 45: North America Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 49: North America Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: North America Market Attractiveness by Formulation Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 71: Latin America Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 75: Latin America Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 79: Latin America Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Formulation Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 101: Western Europe Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 105: Western Europe Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 109: Western Europe Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Formulation Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 131: Eastern Europe Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 135: Eastern Europe Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Formulation Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Formulation Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 191: East Asia Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 195: East Asia Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 199: East Asia Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Formulation Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Therapeutic Application, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Formulation Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume ( Thousand Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Therapeutic Application, 2018 to 2033

Figure 221: Middle East and Africa Market Volume ( Thousand Units) Analysis by Therapeutic Application, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Therapeutic Application, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Therapeutic Application, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 225: Middle East and Africa Market Volume ( Thousand Units) Analysis by Drug Class, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Formulation Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume ( Thousand Units) Analysis by Formulation Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Formulation Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Formulation Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume ( Thousand Units) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Therapeutic Application, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Drug Class, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Formulation Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Super Generics Market Is Segmented by Drug Type, Therapeutic Area, Route of Administration and Distribution Channel from 2025 To 2035

Super Generics Industry Analysis in Europe Report - Trends & Innovations 2025 to 2035

Complex Generics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Specialty Generics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA