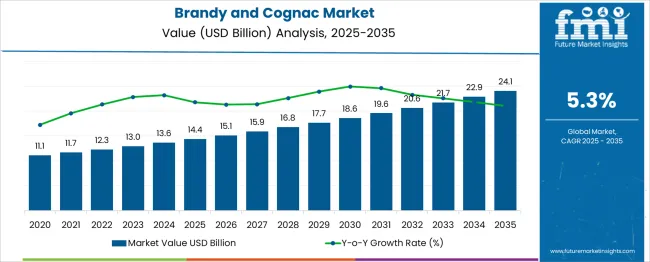

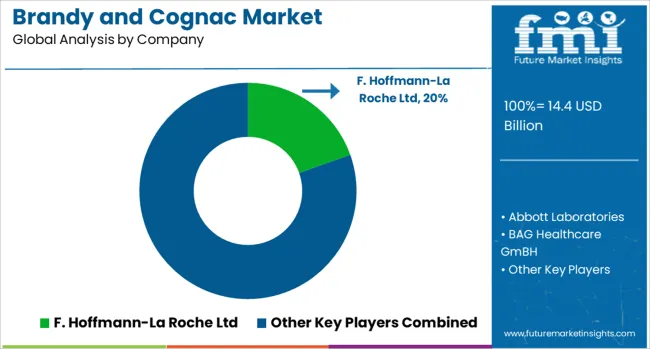

The Brandy and Cognac Market is estimated to be valued at USD 14.4 billion in 2025 and is projected to reach USD 24.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Brandy and Cognac Market Estimated Value in (2025 E) | USD 14.4 billion |

| Brandy and Cognac Market Forecast Value in (2035 F) | USD 24.1 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

Market trends show a rising demand for refined and authentic products that offer unique taste profiles and heritage value. Consumers are increasingly gravitating toward age-stated cognacs, which are perceived to provide better quality and richer flavor complexity.

This has encouraged producers to focus on mature cognacs that appeal to sophisticated drinkers seeking premium experiences. The growth of upscale hospitality and luxury lifestyle segments has also played a crucial role in boosting market demand.

Expansion in global distribution networks and the rise of experiential marketing efforts have helped brands reach discerning consumers in emerging and developed markets. Looking ahead, the market is expected to benefit from continued innovation in product offerings and an expanding base of connoisseurs appreciating the craftsmanship behind brandy and cognac.

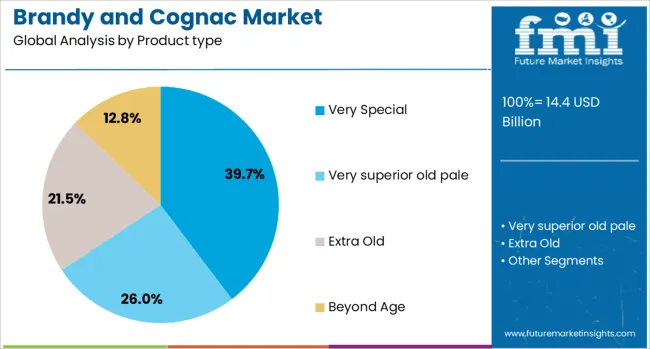

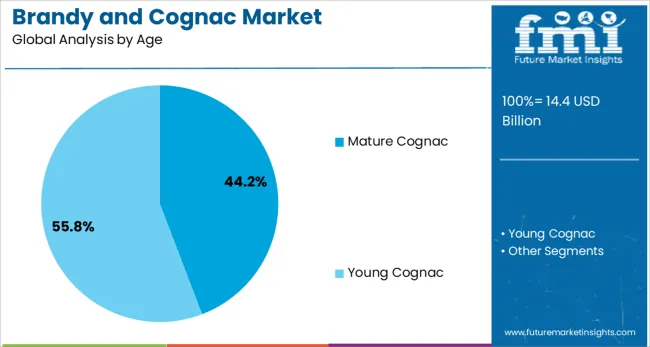

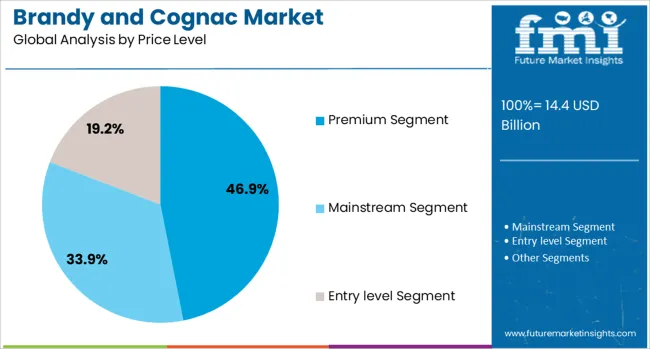

The brandy and cognac market is segmented by product type, age, price level, and distribution channel and geographic regions. The brandy and cognac market is divided by product type into Very Special, Very Superior Old Pale, Extra Old, and Beyond Age. The brandy and cognac market is classified into Mature Cognac and Young Cognac. Based on the price level of the brandy and cognac market, it is segmented into Premium Segment, Mainstream Segment, and Entry-level Segment. The distribution channel of the brandy and cognac market is segmented into Retail Stores, Supermarkets, Liquor Shops, Bars, Restaurants, and Clubs. Regionally, the brandy and cognac industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Very Special product type segment is expected to hold 39.7% of the brandy and cognac market revenue in 2025, maintaining its position as the leading category. This segment has been favored for its balance of quality and accessibility, appealing to a broad consumer base, including those new to cognac as well as experienced drinkers. The relatively younger age of Very Special cognacs allows for more dynamic flavors while maintaining tradition.

Brand loyalty and consistent taste profiles have helped sustain demand. Additionally, these products are widely used in mixology and cocktails, expanding their appeal in bars and restaurants.

As consumers seek approachable yet authentic brandy experiences, the Very Special segment is expected to retain its strong market presence.

The Mature Cognac segment is projected to contribute 44.2% of the market revenue in 2025, reflecting growing consumer interest in aged spirits. The extended aging process is valued for producing smoother, more complex flavors that enhance the drinking experience. Consumers are increasingly educated about the significance of maturation and are willing to invest in higher-quality products.

This has encouraged producers to emphasize age statements and traditional aging techniques. The segment also benefits from the luxury appeal associated with mature cognac, which is often positioned as a premium gift option.

As appreciation for aged spirits grows, the Mature Cognac segment is anticipated to sustain robust demand.

The Premium Segment is projected to represent 46.9% of the brandy and cognac market revenue in 2025, establishing itself as the dominant price category. This segment has gained traction as consumers seek superior quality and exclusivity in their spirit choices. The premium price tier reflects craftsmanship, heritage, and often limited production runs, which resonate with connoisseurs and collectors.

Growth has been supported by increasing disposable incomes and expanding luxury markets globally. Marketing efforts focusing on storytelling and product provenance have enhanced consumer perception of value.

The segment’s continued expansion is anticipated as more consumers prioritize quality and experience over price, driving demand for premium brandy and cognac.

Premium brandy and cognac categories have achieved growth from increasing consumer interest in craft spirits, mature oak-aged offerings, and luxury gifting occasions. Producers have emphasized regional authenticity, single estate sourcing, and heritage aging programs to attract discerning drinkers. Market expansion has been supported by targeted launches in emerging markets and by luxury retailers through curated tasting events and limited-edition releases. Value has been derived from collaborations with hospitality venues and digital elite-branding initiatives.

Brandy and cognac brands are focusing on heritage credentials and authentic aging techniques to attract discerning buyers. Distillers emphasize traditional copper pot still methods combined with oak barrel aging to deliver distinct aroma and flavor profiles. Origin-based designations such as Cognac and Armagnac are influencing purchase decisions by validating authenticity and craftsmanship. Limited-release variants and curated tasting events have been introduced to create exclusivity and consumer engagement. Hospitality venues are collaborating with brands for menu pairings, luxury cocktails, and table-side service presentations. Producers are strengthening retail presence through fine spirits boutiques and online platforms targeting collectors and enthusiasts seeking age-stated products with strong provenance.

Regulatory requirements related to labeling, geographical indication, and production standards have created complexities in market access for producers targeting multiple regions. Import duties and trade restrictions have raised final consumer prices, limiting affordability in certain markets. Counterfeit spirits and parallel trade have undermined consumer trust, particularly in duty-free and secondary retail channels. Limited vineyard output and dependence on long aging cycles have constrained production scalability for high-demand expressions. Digital age verification laws and advertising restrictions have further limited brand engagement through direct marketing channels. Smaller brands face challenges in securing distribution partnerships, as established players dominate retail visibility and trade allocations in both on-trade and off-trade segments.

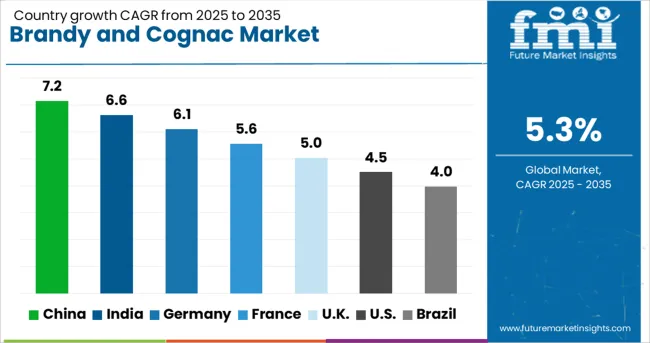

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global brandy and cognac market is projected to grow at a 5.3% CAGR from 2025 to 2035, supported by premiumization trends, craft production, and rising demand for aged spirits. BRICS countries lead growth, with China at 7.2% and India at 6.6%, driven by the expansion of luxury hospitality channels and growing disposable incomes. Among OECD economies, Germany grows at 6.1%, reflecting strong preference for premium imports and private-label innovation, while France at 5.6% focuses on heritage-driven branding and limited-edition offerings. The United Kingdom, at 5.0%, emphasizes premium cocktails and e-commerce-driven sales of luxury spirits. The report includes analysis of over 40 countries, with five profiled below for reference.

China is expected to grow at a 7.2% CAGR, supported by increasing demand for premium spirits across urban hospitality channels and luxury retail. Cognac consumption dominates the segment, with major international brands investing in digital-first marketing campaigns and immersive tasting experiences. Domestic producers are focusing on brandy variants with localized flavor profiles to capture younger consumers. E-commerce platforms such as Tmall and JD.com are major distribution drivers, offering exclusive editions and personalized gifting solutions. Growth is further strengthened by expanding duty-free retail spaces in airports and commercial hubs.

India is projected to grow at a 6.6% CAGR, led by rising demand for aspirational spirits among millennials and premium hospitality chains. Domestic distillers are introducing blended brandy products in mid-premium segments to cater to evolving consumer preferences. Imports of cognac are expanding in Tier I cities, supported by gifting culture during festivals and weddings. Modern trade channels and premium liquor boutiques are enhancing visibility for international labels. Strategic partnerships between global brands and local distributors are boosting product availability in metro and semi-urban regions.

Germany is forecast to grow at a 6.1% CAGR, driven by rising demand for authentic and artisanal spirits in the premium category. Cognac continues to hold a strong position in high-end bars and fine dining venues, while brandy enjoys popularity in retail channels. Innovation in packaging and sustainability-focused production processes are being adopted by leading European producers. Private-label offerings in supermarkets are adding affordable premium choices for consumers seeking quality at competitive prices. E-commerce growth in spirits retail is further accelerating the sale of imported cognac and brandy products.

France is expected to grow at a 5.6% CAGR, with strong focus on heritage-driven branding and innovation in cognac production. Limited-edition releases and age-specific blends are strengthening consumer engagement in domestic and export markets. Producers are incorporating traceability systems to authenticate origin and build consumer trust. Rising demand from Asia and the Middle East is driving strategic partnerships for distribution. Efforts to modernize production processes while maintaining traditional craftsmanship ensure brand loyalty among premium buyers.

The United Kingdom is projected to grow at a 5.0% CAGR, fueled by increasing consumption of premium cocktails in on-trade channels and rising demand for luxury spirits via e-commerce. Brandy-based cocktails are gaining traction among younger consumers, driving category revival in bars and restaurants. Cognac remains a preferred choice in high-end hospitality, supported by marketing collaborations with celebrity mixologists. Retailers and digital platforms are offering personalized bottle engraving and subscription models to boost consumer engagement. The premiumization trend is supported by innovative packaging and limited-edition launches targeting gifting occasions.

The global brandy and cognac market is defined by dominant players in the luxury and mainstream categories. Hennessy (LVMH), Rémy Martin, Courvoisier, Martell (Pernod Ricard), and Camus Wines & Spirits lead the cognac segment through heritage branding, strong Asian market penetration, and experiential marketing. In the broader brandy category, Mansion House by Tilaknagar Industries maintains a significant position in India with premium offerings tailored to local preferences. Other influential players such as Beam Suntory (Courvoisier), E&J Gallo, Diageo, and Suntory address diverse consumer tiers across global markets. Regional specialists like Asbach, Thomas Hine, and Louis Royer cater to niche premium demand. Competitive dynamics are shaped by premiumization, growth in cocktail culture, e-commerce-led personalization, and trade regulations, with EU–China tariff tensions influencing French cognac exports.

In June 2024, Sazerac partnered with rapper Quavo to launch White X Cognac, a USA-exclusive “white cognac” offering delicate fruit and vanilla notes. It debuted on BlockBar and rolled out widely thereafter at ~USD 60 a bottle.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.4 Billion |

| Product type | Very Special, Very superior old pale, Extra Old, and Beyond Age |

| Age | Mature Cognac and Young Cognac |

| Price Level | Premium Segment, Mainstream Segment, and Entry level Segment |

| Distribution Channel | Retail Stores, Supermarkets, Liquor Shops, Bars, Restaurants, and Club |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd, Abbott Laboratories, BAG Healthcare GmBH, Bio-Rad Laboratories, Inc, Danaher Corporation, Diagnostica Stago, DiaSorin S.p.A., Grifols S.A., Hologic, Inc., Immucor Inc., Merck KGaA, Ortho Clinical Diagnostics, Quotient Ltd, and Thermo Fisher Scientific Inc. |

| Additional Attributes | Dollar sales by spirit type (VS, VSOP, XO) and bottle format (standard glass, gift sets, collector editions), demand dynamics across aged cognacs, flavored brandy variants, and luxury blends; regional trends led by Europe with Asia‑Pacific emerging in premium segments; innovation in limited‑edition vintages, craft distillery blends, and sustainable cork and packaging; and regulatory impact of export tariffs, appellation controls, and single‑serve portion regulations. |

The global brandy and cognac market is estimated to be valued at USD 14.4 billion in 2025.

The market size for the brandy and cognac market is projected to reach USD 24.1 billion by 2035.

The brandy and cognac market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in brandy and cognac market are very special, very superior old pale, extra old and beyond age.

In terms of age, mature cognac segment to command 44.2% share in the brandy and cognac market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brandy Flavor Market Size, Growth, and Forecast for 2025 to 2035

Demand for Brandy Flavor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Brandy Flavor in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA