The demand for brandy flavor in the USA is projected to grow from USD 1.5 billion in 2025 to USD 2.2 billion by 2035, reflecting a CAGR of 4%. Brandy flavoring is widely used in the beverages and food industries, primarily in the production of alcoholic drinks, cocktails, and flavored foods. The growth in demand for brandy flavor can be attributed to rising consumer interest in flavored spirits and premium alcoholic beverages. As consumers increasingly seek novel and diverse flavors in their drinks, brandy flavor provides a rich, complex taste profile that is particularly popular in cocktails and mixology.

As the trend for craft cocktails and premium spirits continues to rise, the use of brandy-flavored ingredients in various formulations will also expand. The market will also benefit from innovations in flavor formulations and food science, making it easier for manufacturers to integrate brandy flavor into a range of products. With the ongoing demand for premium experiences and the growing popularity of flavored liqueurs, the market for brandy flavor in the USA is set for steady growth throughout the forecast period.

From 2025 to 2030, the demand for brandy flavor in the USA will grow from USD 1.5 billion to USD 1.8 billion, adding USD 0.3 billion in value. This early phase will see moderate growth, driven by increased consumer interest in flavored spirits and mixology trends. The rise of craft cocktail culture and the demand for premium alcohol will particularly boost the consumption of brandy-based products. The increased use of brandy flavor in liqueurs, desserts, and flavored snacks will also contribute to the overall market expansion.

From 2030 to 2035, the market will grow from USD 1.8 billion to USD 2.2 billion, contributing an additional USD 0.4 billion in value. The growth in this phase will reflect a mature phase of market expansion, with demand continuing to rise, albeit at a slower rate compared to earlier years. The focus will be on the premiumization of brandy-based drinks and the ongoing diversification of flavored beverages and foods. As the market stabilizes, the emphasis will be on innovative flavor combinations and sustainable production practices, maintaining growth through new product development and premium offerings that align with shifting consumer preferences.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.5 billion |

| Industry Forecast Value (2035) | USD 22 billion |

| Industry Forecast CAGR (2025-2035) | 4% |

Demand for brandy flavor formulations in the USA is rising as beverage and food manufacturers expand use of spirit inspired notes in products such as ready to drink cocktails, desserts and sauces. Flavour houses report higher placement of brandy style aroma profiles as the cocktail culture broadens and consumer interest in sophisticated flavour experiences increases. There is also growing activity in non alcoholic beverage categories that replicate aged spirit flavours, which supports uptake of brandy flavour ingredients.

Another contributing factor is the regulatory and ingredient innovation environment that encourages natural and clean label flavour variants. Manufacturers prefer brandy flavor extracts claimed as "natural", and invest in micro encapsulation or stabilised solutions to accommodate diverse applications such as bakery fillings and dairy desserts. Although competition from other spirit flavour segments and fluctuations in raw material cost remain constraints, the market outlook suggests moderate growth with a compound annual growth rate (CAGR) around 4% from 2025 2035.

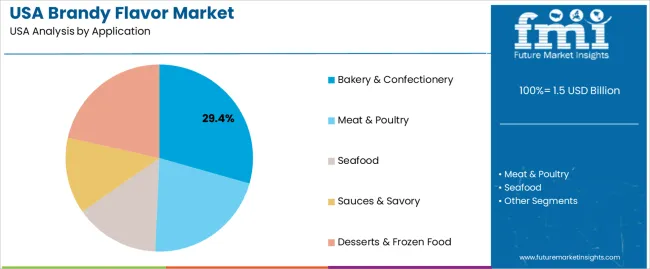

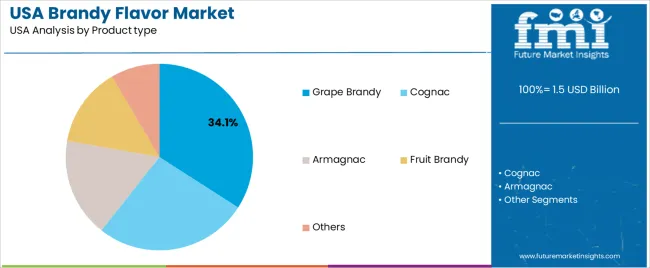

The demand for brandy flavor in the USA is driven by application and product type. The leading application is bakery & confectionery, capturing 29% of the market share, while the dominant product type is grape brandy, accounting for 34.1% of the demand. Brandy flavor is widely used across various food and beverage sectors to add depth and complexity to flavor profiles. The growing interest in premium, high-quality ingredients and the desire for unique flavor profiles is driving the demand for brandy flavor in the USA.

Bakery & confectionery is the leading application for brandy flavor in the USA, holding 29% of the demand. Brandy flavor is commonly used in the bakery and confectionery industries to enhance the taste of cakes, pastries, chocolates, and other sweet treats. It adds a rich, aromatic profile that complements a variety of baked goods and confectionery items, making it a preferred ingredient for both traditional and innovative recipes.

The demand for brandy flavor in bakery and confectionery is driven by its ability to enhance the overall taste experience, providing a sophisticated, deep flavor that pairs well with sweet, fruity, or nutty profiles. As consumers increasingly seek unique, premium flavors in their baked goods and sweets, the demand for brandy flavor is expected to grow. The continued trend towards artisanal and high-quality baked products, combined with the growing popularity of flavored desserts, ensures that bakery and confectionery will remain a key application for brandy flavor in the USA.

Grape brandy is the dominant product type for brandy flavor in the USA, accounting for 34.1% of the demand. Grape brandy, which is derived from distilled wine, is known for its smooth, fruity flavor and is widely used in both culinary and beverage applications. Its popularity is driven by its versatility and its ability to impart a refined and rich taste to a variety of food and drink products.

The demand for grape brandy flavor is supported by its extensive use in both alcoholic and non-alcoholic products, particularly in sauces, marinades, desserts, and flavoring agents for premium products. As the demand for high-end, complex flavors grows in the food and beverage industry, grape brandy remains the preferred choice due to its consistency, rich profile, and wide range of applications. The trend toward premium, authentic ingredients in cooking and baking, along with the continued growth of the craft beverage sector, ensures that grape brandy will maintain its leading position in the market.

Demand for brandy flavor in the United States is increasing as consumers seek unique and sophisticated tastes in both alcoholic and non alcoholic beverages. The growing craft cocktail movement, use of flavoring agents in food and beverages, and the rise of premium flavored spirits are driving growth in brandy flavor use. At the same time, competition from other flavored liquors and natural flavor alternatives can moderate the growth of brandy flavor in the market. These dynamics define the trajectory of brandy flavor adoption in the USA

Several factors support the growth of brandy flavor in the USA First, the increasing popularity of craft cocktails and home bartending has amplified demand for diverse and premium flavor profiles, with brandy flavor gaining traction for its richness and versatility. Second, the use of brandy flavor as a key ingredient in flavored liqueurs and spirit based beverages has expanded, appealing to millennials and other flavor adventurous consumers. Third, the growing demand for unique culinary flavors in both sweet and savory food products drives the use of brandy flavor as a flavoring agent in cooking and confectionery.

Despite favourable conditions, several constraints limit growth. The higher cost of brandy flavoring, particularly when it is derived from premium or aged brandy, can hinder widespread adoption in low price sensitive market segments. Additionally, consumer preference for more established or widely recognized flavors, such as vanilla or chocolate, can reduce demand for brandy flavor in certain applications. Furthermore, regulatory challenges regarding flavoring agents and labeling requirements may impose restrictions, adding complexity for manufacturers seeking to use brandy flavor in both alcoholic and non alcoholic products.

Key trends include the rising popularity of premium and craft spirits, where brandy flavor is often used to enhance the profile of cocktails and premium beverages. Additionally, there is an increasing trend toward natural and clean label products, which is motivating the development of more natural brandy flavoring options derived from brandy or its byproducts. The expansion of the functional beverage sector also plays a role, as brandy flavor is increasingly used in low alcohol, wellness focused drinks. Finally, growing interest in international and artisanal flavors encourages the use of brandy flavor in a wide range of innovative food products.

The demand for brandy flavor in the USA exhibits moderate growth across different regions, with the West leading at a CAGR of 4.6%. The South follows closely with a CAGR of 4.1%, driven by the popularity of flavored spirits and cocktails. The Northeast shows a slower growth rate of 3.7%, influenced by a more traditional consumer base with steady demand for flavored beverages. The Midwest has the lowest growth rate at 3.2%, reflecting more conservative consumption trends. Overall, the demand for brandy flavor is growing steadily, with regional variations influenced by local preferences, trends in the spirits market, and consumer behavior.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.6% |

| South | 4.1% |

| Northeast | 3.7% |

| Midwest | 3.2% |

The demand for brandy flavor in the West is projected to grow at a CAGR of 4.6%, supported by a dynamic and diverse consumer market. The West, particularly states like California, is a hub for innovation in the food and beverage industry, including the spirits sector. The growing popularity of flavored spirits and craft cocktails is driving increased demand for brandy-flavored products.

The West’s strong cocktail culture, combined with a younger, trend-conscious population, has led to a higher interest in unique and flavorful spirits. As consumers seek new and innovative flavor profiles, brandy flavor has gained traction in both high-end bars and casual settings. Additionally, the West’s focus on premium, craft beverages further fuels the demand for high-quality flavored spirits, including brandy, as part of the expanding trend of artisanal and small-batch production.

In the South, the demand for brandy flavor is expected to grow at a CAGR of 4.1%, reflecting the region’s strong connection to traditional spirits and cocktail culture. The South has long been known for its rich history with whiskey and other aged spirits, and this influence extends to the growing demand for flavored brandy. As the region embraces a broader range of flavored beverages, including brandy, it aligns with the rising consumer interest in craft cocktails and new, sophisticated flavor profiles. Additionally, the popularity of Southern-style cocktails, such as brandy-based drinks, supports the continued growth of brandy flavor demand. The region's warm climate also makes it conducive to outdoor gatherings and events where cocktails featuring brandy flavor are commonly enjoyed, further driving consumer interest in this flavor category.

The demand for brandy flavor in the Northeast is projected to grow at a CAGR of 3.7%, influenced by the region’s more established and conservative approach to spirits consumption. While traditional beverages like whiskey, rum, and vodka dominate the market, flavored spirits are gaining popularity, especially in craft cocktail bars and among younger consumers. The Northeast, home to major cities like New York and Boston, has a vibrant cocktail culture that encourages experimentation with different spirits and flavors.

Brandy flavor is increasingly being incorporated into new cocktail recipes, contributing to its growing demand. However, the overall growth remains moderate, as the region’s more traditional preferences for classic spirits like bourbon and rye whiskey temper the speed at which brandy flavor is adopted. Despite this, the region’s love for innovative cocktails and premium experiences supports a steady, if slower, increase in demand.

The demand for brandy flavor in the Midwest is expected to grow at a CAGR of 3.2%, reflecting a more conservative consumption trend compared to other regions. The Midwest has a long-standing preference for traditional spirits such as whiskey and bourbon, which limits the faster adoption of flavored spirits like brandy. However, as consumers in the region become more open to craft cocktails and new flavor experiences, brandy flavor is slowly gaining traction.

The rise of local craft distilleries and an increasing interest in premium, artisanal beverages are factors contributing to the moderate growth in demand for brandy-flavored products. The Midwest’s consumption habits tend to evolve more gradually, but as the craft spirits movement continues to grow, the demand for flavored spirits like brandy is expected to follow suit, though at a slower pace than in the West and South.

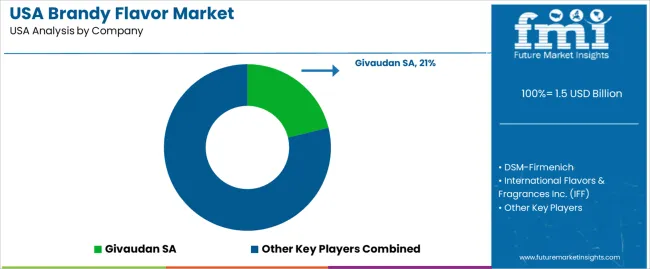

Demand for brandy flavor solutions in the United States is growing as food, beverage and cocktail‐mixing sectors seek rich spirit inspired profiles. The global brandy flavor market is expected to grow from about USD 4.1 billion in 2025 to approximately USD 6.2 billion by 2035, with the USA among the key regional markets. Natural brandy flavors hold the largest product segment share as of 2025. Source: Future Market Insights. Companies such as Givaudan SA (holding approximately 21.2% share within flavor houses), DSM Firmenich, International Flavors & Fragrances Inc. (IFF), Symrise AG and Mane SA are major suppliers of these flavors in the USA

Competition in this industry centres on flavor authenticity, clean‐label credentials and cross‐category versatility. Suppliers develop brandy flavor systems that mimic aged spirit notes such as oak, caramel and vanilla while meeting clean‐label demands and regulatory specifications for use across beverages, bakery and confectionery. Another dimension is the adaptation of these flavors to ready‐to‐drink (RTD) cocktails, non‐alcoholic mixers and gourmet desserts.

Companies also prioritise heat stable and water soluble formats for broad application. Marketing materials typically highlight flavour profile fidelity, use of natural extracts, regulatory compliance in food and beverage applications, and versatility across end use categories. By aligning their innovations with growing demand for differentiated, premium and multifunctional flavor solutions, these firms aim to strengthen their presence in the USA brandy flavor industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Application | Bakery & Confectionery, Meat & Poultry, Seafood, Sauces & Savory, Desserts & Frozen Food |

| Product Type | Grape Brandy, Cognac, Armagnac, Fruit Brandy, Others |

| Distribution Channel | B2B (Direct Sales), B2C (Indirect Sales), Store-based Retailing, Supermarket/Hypermarket, Convenience Stores |

| Key Companies Profiled | Givaudan SA, DSM-Firmenich, International Flavors & Fragrances Inc. (IFF), Symrise AG, Mane SA |

| Additional Attributes | The market analysis includes dollar sales by application, product type, distribution channel, and company categories. It also covers regional demand trends in the USA, driven by the growing use of brandy flavors in a variety of food and beverage products, particularly in the bakery, confectionery, and savory segments. The competitive landscape highlights key manufacturers focusing on innovations in flavor formulations for culinary and beverage applications. Trends in the increasing demand for premium brandy flavors like Cognac and Armagnac, as well as the rising popularity of flavored sauces, savory items, and desserts, are explored, along with advancements in flavor extraction and application technologies. |

The demand for brandy flavor in usa is estimated to be valued at USD 1.5 billion in 2025.

The market size for the brandy flavor in usa is projected to reach USD 2.2 billion by 2035.

The demand for brandy flavor in usa is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in brandy flavor in usa are bakery & confectionery, meat & poultry, seafood, sauces & savory and desserts & frozen food.

In terms of product type, grape brandy segment is expected to command 34.1% share in the brandy flavor in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brandy Flavor Market Size, Growth, and Forecast for 2025 to 2035

Demand for Brandy Flavor in Japan Size and Share Forecast Outlook 2025 to 2035

Flavor Modulator Market Size and Share Forecast Outlook 2025 to 2035

Flavor Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Flavor Masking Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavor Modulators Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA