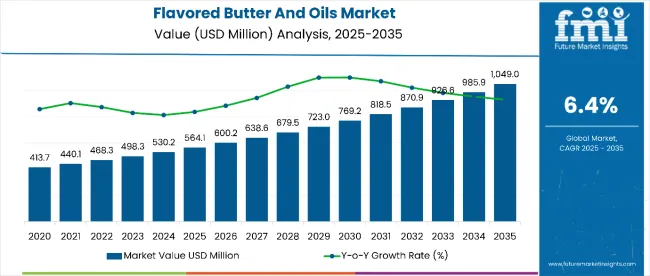

The flavored butter and oils market is valued at USD 564.1 million in 2025 and is poised to reach USD 1,049.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 564.1 million |

| Market Forecast Value in (2035F) | USD 1,049.0 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

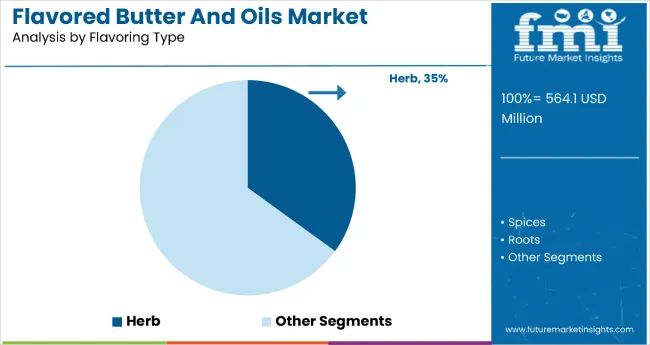

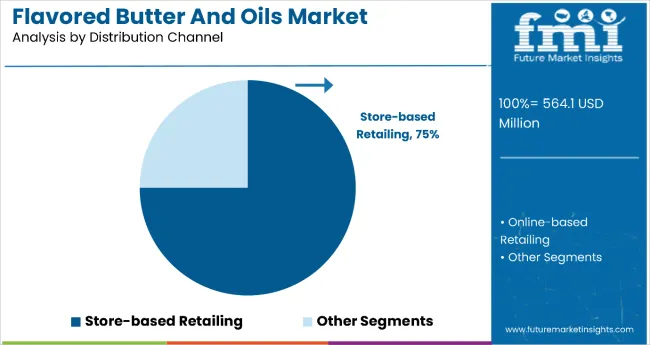

The market is projected to add an absolute dollar opportunity of USD 484.9 million, representing a 1.86-times growth during this time. This growth is driven by increasing consumer interest in gourmet cooking, premium ingredients, and natural flavor infusions. Rising culinary experimentation, health-oriented eating trends, and the influence of global cuisines are key factors fueling demand. Additionally, herb-flavored products, expected to hold a 35% market share, along with store-based retailing capturing 75% of sales in 2025, will play a significant role in shaping the market’s expansion.

By 2030, the market is likely to hit USD 769.2 million, generating USD 205.1 million in growth during the first half of the period. The second half is expected to add USD 279.8 million, signaling a faster expansion rate. Premiumization trends, greater awareness of herb-infused health benefits, and wider availability in retail will boost demand. Store-based channels will dominate, supported by product innovation, brand storytelling, and marketing strategies targeting flavor-conscious consumers.

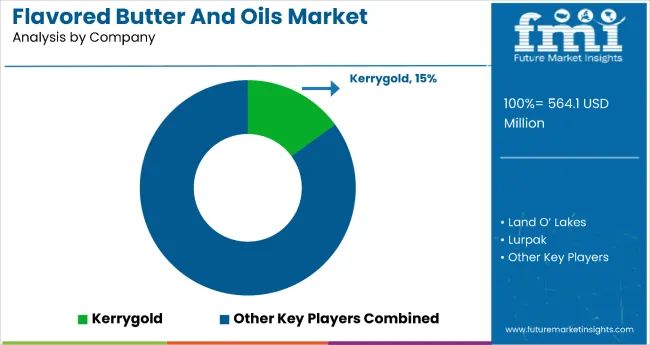

Companies such as Kerrygold, Land O’ Lakes, and Lurpak are advancing their competitive positions through investments in herb-flavored product innovation, premium artisanal butter formulations, and expanded store-based retail presence. Growing consumer interest in gourmet cooking, health-conscious eating, and natural flavor infusions is driving demand for both traditional and plant-based options. Market performance remains anchored in responsible sourcing, clean-label production, and high-quality ingredients. Leading brands are focusing on product diversification, innovative flavor pairings, and strategic marketing campaigns to enhance visibility.

The market commands approximately 35% of the herb-flavored condiments segment, driven by consumer demand for culinary versatility and the health benefits of natural herbs. It accounts for around 75% of the store-based retail gourmet spreads category, supported by its strong placement in supermarkets, hypermarkets, and specialty stores. The market contributes nearly 15% to the global premium butter and oil brand segment through Kerrygold’s share, reflecting its leadership in artisanal, high-quality products.

The market is undergoing structural change as gourmet cooking, premiumization, and natural flavor infusions become mainstream trends. Advances in flavor formulation, sustainable sourcing, and premium packaging are enhancing consumer appeal while extending shelf life. Manufacturers are innovating with herb-infused, low-sodium, and plant-based varieties, catering to both traditional and health-conscious consumers. These products are expanding beyond core culinary uses into applications in hospitality, premium dining, and artisanal packaged foods, reinforcing their role as value-added, high-demand offerings in both mature and emerging markets.

The market is benefiting from rising consumer interest in gourmet cooking, artisanal flavors, and health-oriented eating. Herb-infused varieties, which combine rich taste with potential health benefits, are particularly appealing to consumers seeking premium and natural culinary products. Salted and herb-flavored options are gaining traction for their versatility in enhancing both home-cooked meals and professional recipes.

Growing awareness of clean-label, sustainably sourced ingredients is further boosting demand, especially through store-based retail channels, which account for the majority of sales. Lifestyle trends favoring home cooking, global flavor exploration, and premium dining experiences are driving adoption across multiple demographics.

As consumers seek high-quality, authentic flavors, manufacturers are innovating with plant-based, low-sodium, and functional varieties to meet evolving tastes. The market outlook remains favorable, supported by expanding retail distribution, premium packaging, and culinary partnerships. With strong growth in key markets such as the United Kingdom, United States, and Germany, flavored butter and oils are well-positioned to capture increasing demand in both traditional and emerging food categories.

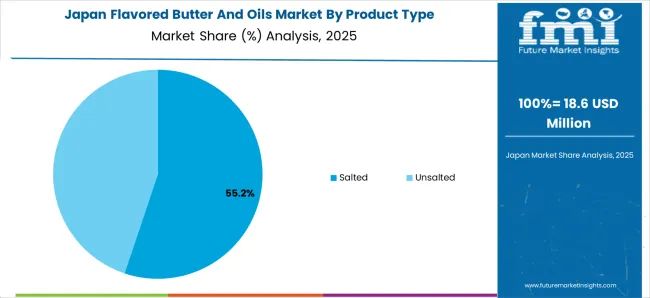

The market is segmented by product type, flavoring type, application, distribution channel, and region. By product type, the market is bifurcated into salted and unsalted. Based on flavoring type, the market is classified into herb, spices, roots, citrus, vegetable, and others (fruit-based flavors, floral infusions, nut-based flavors, and fusion blends). In terms of application, the market is divided into milk and dairy, bakery products, value-added food and beverages, dips and sauces, and blends and seasonings. By distribution channel, the market is segmented into store-based retailing, hypermarkets and supermarkets, convenience stores, specialty stores, discounters, forecourt retailers, and online-based retailing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The herb-flavored segment, holding 35% of the flavored butter and oils market, stands out as the most lucrative due to its strong alignment with current consumer preferences for natural, clean-label, and health-oriented products. Popular herbs such as rosemary, basil, thyme, parsley, dill, and garlic offer versatile culinary applications, enhancing everything from bakery products to gourmet sauces and grilled dishes. This versatility drives consistent demand across both home cooking and foodservice sectors. Herb-infused products also benefit from the perception of added health value, as many herbs contain antioxidants and anti-inflammatory compounds, which resonates with health-conscious buyers seeking flavor without artificial additives.

Retail performance is particularly strong in store-based channels, which account for 75% of sales, where herb-flavored SKUs enjoy prime shelf placement and premium positioning. Manufacturers are leveraging this by introducing artisanal small-batch herb butters, chef-collaboration lines, and plant-based herb spreads to tap into vegan and flexitarian markets. Technological advances in infusion methods help maintain fresh herb aroma and taste while extending shelf life, making these products both indulgent and practical. With sustained innovation and strong cross-market appeal, the herb-flavored segment is poised to maintain its leadership position over the forecast period.

The store-based retailing segment is the largest distribution channel for flavored butter and oils, commanding 75% of total market sales in 2025. Its dominance stems from the sensory advantage of in-store shopping, where consumers can visually assess packaging, read ingredient labels, and, in some cases, participate in tasting or sampling events. Hypermarkets and supermarkets form the backbone of this channel. They provide broad product assortments, competitive pricing, and high product visibility through strategic shelf placement. Specialty stores add value by catering to gourmet and artisanal preferences, often featuring premium herb-infused or limited-edition variants.

Convenience stores further extend accessibility, offering smaller pack sizes suited for quick purchases. Store-based retailing benefits from established supply chains, robust brand promotions, and seasonal merchandising, making it particularly effective for driving impulse buys and trial of new flavors. Its ability to create immediate, tangible product experiences gives it a significant edge over online sales, ensuring its continued leadership position in the flavored butter and oils market throughout the forecast period.

From 2025 to 2035, food manufacturers are expected to introduce premium, chef-inspired flavored butter and oil products to cater to evolving consumer palates and demand for gourmet experiences at home. This shift positions producers offering herb-infused, spice-blended, and artisanal flavor profiles as key players in enhancing taste diversity across multiple food categories.

Growth Inhibitors in the Flavored Butter and Oils Sector

The market faces notable restraints, particularly the high production costs associated with sourcing premium, natural herbs and spices, which can limit penetration among price-sensitive consumers. Seasonal variability in raw material availability especially fresh herbs can disrupt supply chains and impact consistent production. Additionally, regulatory restrictions on labeling and claims for natural or organic products may slow market entry for new formulations. Competition from lower-priced synthetic flavor alternatives can also challenge premium positioning.

Emerging Trends Driving the Flavored Butter and Oils Market

The market includes the rapid rise of clean-label, organic, and minimally processed formulations to meet growing health-conscious consumer demand. Herb-flavored variants, holding 35% of the market in 2025, are gaining popularity due to their perceived wellness benefits and culinary versatility. Brands are expanding beyond traditional spreads into bakery, dairy, dips, sauces, and gourmet ready-to-eat products. Innovative flavor infusion methods are improving shelf life while preserving natural taste and aroma. Responsible production is emerging as a differentiator, with eco-friendly packaging and ethically sourced ingredients appealing to conscious buyers.

| Countries | CAGR |

|---|---|

| UK | 6.8% |

| USA | 6.5% |

| Germany | 6.2% |

| Japan | 6.1% |

| France | 3.5% |

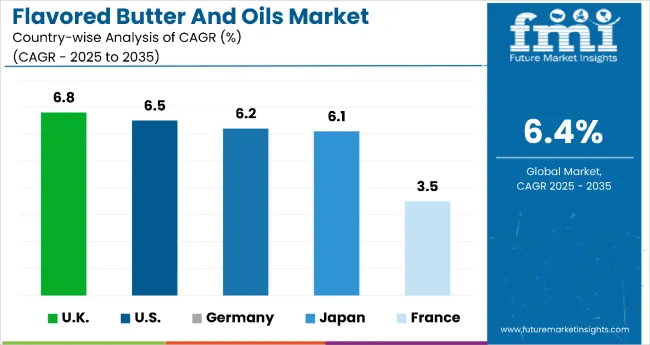

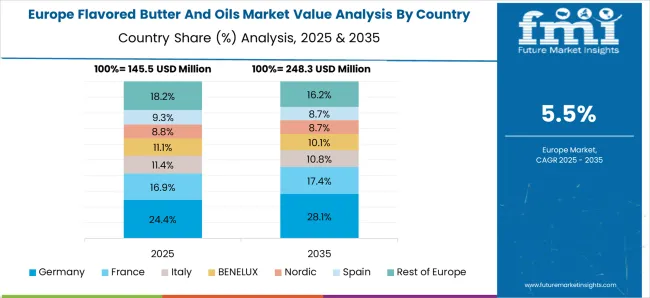

The UK leads the market with the highest CAGR of 6.8%, driven by strong consumer demand for premium herb-infused products and expanding bakery and dairy applications. The US follows closely with a 6.5% CAGR, supported by large-scale production, clean-label trends, and extensive distribution through hypermarkets and e-commerce. Germany’s market grows steadily at 6.2%, reflecting strong adoption of organic and sustainable practices alongside expanding bakery uses. Japan, with a 6.1% CAGR, benefits from culinary innovation and a robust presence in convenience and specialty stores, emphasizing artisanal and natural ingredients. France exhibits a more moderate growth rate of 3.5%, consistent with its mature gourmet market, focusing on niche artisanal products and steady demand for organic and natural flavors.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The UK flavored butter and oils market is expanding rapidly with a CAGR of 6.8%, fueled by increasing consumer demand for premium, herb-infused products. The production capacity is growing as manufacturers invest in advanced processing to meet the rising health-conscious consumer base. The bakery and dairy sectors lead product adoption, supported by expanding store-based retailing channels. Organic and natural flavor variants gain popularity, driving innovation in production techniques. Local brands focus on sustainable sourcing and clean-label offerings to maintain competitiveness. Retailers are enhancing shelf presence to cater to growing demand. The market shows strong potential for value-added flavored butter products.

The USA flavored butter and oils revenue is witnessing robust output expansion with a CAGR of 6.5%. High consumer preference for clean-label, herb-flavored variants propels production growth. Large-scale manufacturers are scaling operations to meet rising demand across bakery, dairy, and functional food sectors. E-commerce and hypermarket distribution channels are significantly improving product accessibility. Innovation in flavor profiles and organic certifications strengthens market positioning. Producers focus on sustainability and health trends, contributing to market resilience. The US market is expected to see continual growth through product diversification and wider retail penetration.

Revenue from flavored butter and oils in Germany is growing steadily at a CAGR of 6.2%, driven by structural adoption of natural and organic products. Production capacity is increasing to cater to consumer demand for herb and spice-flavored butter, especially in bakery and value-added food applications. Sustainable farming and eco-friendly manufacturing practices are being widely embraced. Retailers, especially specialty and convenience stores, play a crucial role in market expansion. Consumers show strong preference for products with clean labels and functional benefits. This structural shift is prompting manufacturers to upgrade facilities and innovate product lines. The market reflects a mature yet dynamic growth pattern.

Sales of flavored butter and oils in Japan are expanding production capacity at a CAGR of 6.1%, supported by rising consumer interest in unique herb and spice blends. Culinary experimentation and demand for premium, value-added products encourage manufacturers to increase output. Convenience stores and specialty outlets dominate the distribution landscape, facilitating easy product access. There is growing emphasis on artisanal and high-quality products with natural ingredients. Producers are investing in innovative processing techniques to enhance flavor retention and shelf life. Consumer trends toward health and wellness continue to shape production strategies. The market shows strong prospects for innovation-led growth.

Demand for flavored butter and oils in France demonstrates moderate output growth with a CAGR of 3.5%, aligned with its mature gourmet food culture. Production focuses on premium herb-flavored butters and oils catering to niche artisanal and specialty segments. Though growth is slower, demand for organic and clean-label products remains steady. Farmers’ markets and specialty stores serve as key distribution channels, emphasizing local and sustainable production. Manufacturers maintain focus on quality, flavor authenticity, and traditional methods. Market trends indicate gradual expansion supported by consumer preference for natural, health-oriented products. Output growth is steady, reflecting a well-established market base.

The market is moderately consolidated, dominated by key players specializing in flavor innovation, quality, and sustainable sourcing. Kerrygold leads with a 15% market share, leveraging its strong brand reputation and focus on premium, herb-infused products. Major manufacturers invest heavily in advanced processing technologies to ensure consistent flavor profiles and extended shelf life. Regional players emphasize local ingredient sourcing and cater to niche consumer preferences for organic and natural flavor variants.

Retail giants and specialty food producers are expanding product portfolios to include innovative blends, targeting bakery, dairy, and value-added food sectors. Sustainability and clean-label trends are driving product development and differentiation. Entry barriers include maintaining high-quality flavor extraction, meeting stringent food safety regulations, and responding swiftly to evolving consumer tastes. Competitiveness is shaped by innovation in flavor formulations, adherence to organic certifications, and strong distribution networks across store-based and online retail channels.

| Item | Value |

|---|---|

| Quantitative Units | USD 564.1 Million |

| Product Type | Salted and Unsalted |

| Flavoring Type | Herb, Spices, Roots, Citrus, Vegetable, and Others (Floral, Nutty, Smoky, and Exotic Fruit Flavors) |

| Application | Bakery Products, Milk and Dairy, Value-added Food and Beverages, Dips and Sauces, Blends and Seasonings |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia and 40+ countries |

| Key Companies Profiled | Land O’ Lakes, Lurpak, Kerrygold, Amul, Carrington Farms, Golden Barrel, Butter Buds Inc, Mainland, Arla Foods amba |

| Additional Attributes | Market share by source and application, growing demand for natural and organic flavors, store-based retail share, rising bakery and dairy usage, flavor infusion innovations, sustainable sourcing, expanding online sales, and focus on clean-label premium herb products. |

The global flavored butter and oils market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the flavored butter and oils market is projected to reach USD 1.2 billion by 2035.

The flavored butter and oils market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in flavored butter and oils market are salted and unsalted.

In terms of flavoring type, herb segment to command 28.3% share in the flavored butter and oils market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Butter and Margarine Business

Demand for Butter Flavor in Japan Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Compressor Oils in EU Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA