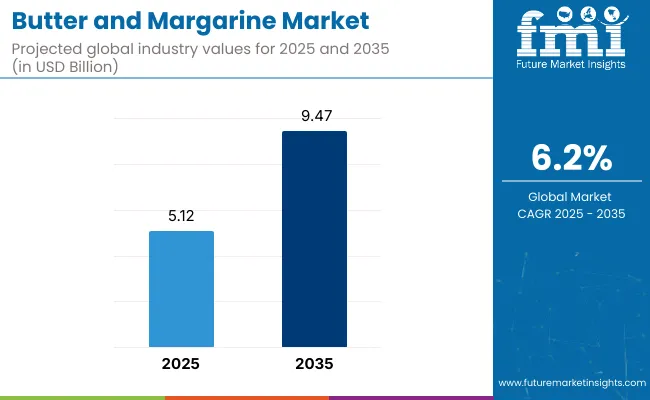

The demand for global Butter and Margarine market is expected to be valued at USD 5.12 Billion in 2025, forecasted at a CAGR of 6.2% to have an estimated value of USD 9.47 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 5.9% was registered for the market.

In baking cooking and table settings margarine-a spreadable butter-like substance-is frequently used in place of butter. Disperse. Usually vegetable oils like soybean palm or canola oil are used to make it these oils are hydrogenated to solidify them item. The process known as hydrogenation transforms the unsaturated fats in the oils into margarine saturated fats giving it a room temperature semi-solid consistency.

These vitamins are frequently added to margarine vitamins A and D in an attempt to replicate butters nutritional makeup. It comes in a variety of forms such as spreads sticks and tubs with choices including regular reduced-fat and non-hydrogenated types. Margarines versatility makes it valuable. cost-effectiveness and longer shelf life than butter.

A significant end-user of butter and margarine is the food industry. Butter and margarine are in high demand among food manufacturers due to their various uses in recipes.

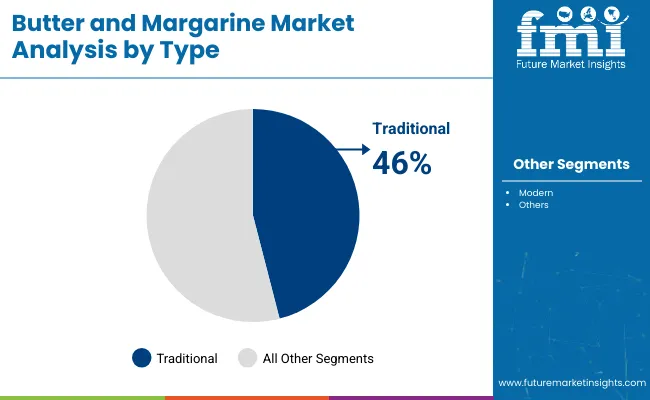

| Segment | Value Share (2025) |

|---|---|

| Traditional (Type) | 46% |

By type, traditional segment dominates the market. It has a market share of 46%. It is expected to grow even further during the forecasted period.

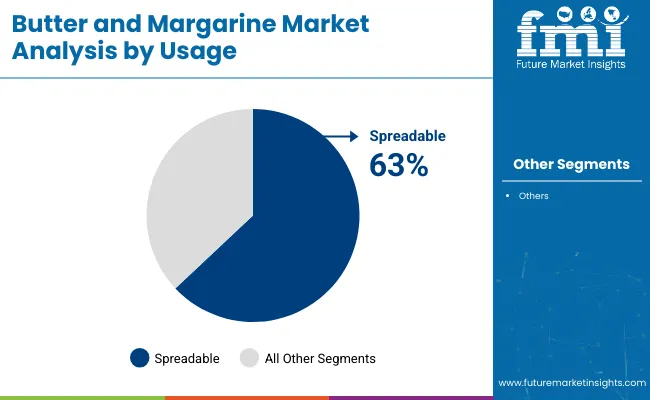

| Segment | Value Share (2025) |

|---|---|

| Spreadable (Usage) | 63% |

Spreadable products versatility in the kitchen draws in a larger consumer base which boosts butter and margarine sales. The ease of use for quick meal preparation makes spreadable butter and margarine popular among consumers with hectic schedules. Customers are drawn in by the variety of flavors offered which boosts sales of butter and margarine.

Demand for Veganism is Driving the Market Growth

Due to plant-based diets and veganism are becoming more and more popular the margarine market is growing multiple nations. There is a demand for margarine especially that made with vegetable oils and other non-dairy ingredients growing as a result of this factor.

Margarine which works similarly to butter is becoming more and more popular and doesn’t contain any animal products in its production. Plant-based diets are preferred by many people due to ethical health and environmental reasons embracing margarine. People are drawn to vegan margarines that are free of lactose and cholesterol who are seeking dairy-free and plant-based options.

During the period 2020 to 2024, the sales grew at a CAGR of 5.9%, and it is predicted to continue to grow at a CAGR of 6.2% during the forecast period of 2025 to 2035.

The market for dairy spreads is positioned to benefit from the growing demand for organic food. Demand for organic products devoid of chemicals and preservatives is rising as consumers become more conscious of what they put into their bodies. As a result, butter and margarine are becoming more popular among health-conscious individuals.

Novel distribution channels for butter and margarine products have emerged with the rise of online shopping platforms. The producers of margarine and butter can reach and attract a larger audience. Sales of margarine and butter are boosted by this.

Tier 1 companies comprises industry leaders acquiring a 50% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

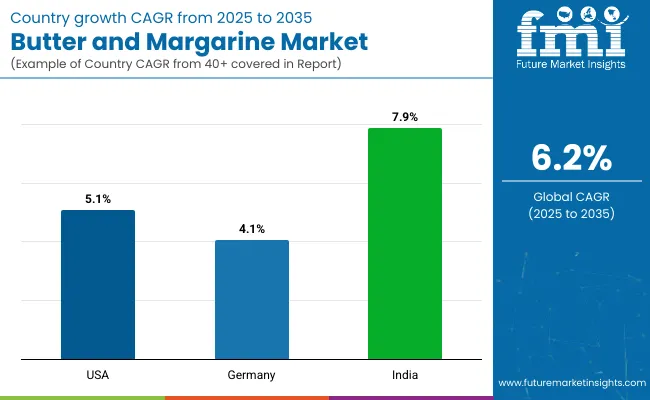

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 5.1%, 4.1% and 7.9%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 5.1% |

| Germany | 4.1% |

| India | 7.9% |

Plant-based butter substitutes are becoming more and more popular in the USA as more people follow vegetarian diets and vegan lifestyles. Traditional supermarkets hypermarkets and internet retail channels have all taken an interest in butter and margarine sales in the USA.

The growing popularity of bakery goods in the Western style propels the expansion of the butter and margarine markets in India. The adoption of butter and margarine is positively impacted by Indian consumers preference for ghee and clarified butter. In India the middle classs increasing disposable income and urbanization are driving up demand for premium butter and margarine. The demand for butter and margarine in Indian states is driven by shifting regional tastes and changing lifestyles.

In the German dairy spreads market eco-friendly packaging and sustainability gained popularity. Health-conscious German consumers are driving the market for plant-based and fat substitutes in the butter and margarine industries. The German butter and margarine industries are thriving due to the widespread use of convenience foods.

In the highly competitive market a variety of butter and margarine producers aim for both market share and customer loyalty. Prominent producers of butter and margarine Arla Foods Farmers’ Cooperative Creamery and Dean Foods Company offer a range of goods to suit diverse consumer preferences.

The competition is still fierce and each producer offers a unique opportunity to the market for butter substitutes. Competing for a sizable portion of the market and expanding their worldwide presence are the butter and margarine suppliers. The producers of butter and margarine manage the opportunities and obstacles to maintain their market leadership as consumers become more health conscious.

By Type, methods industry has been categorized into traditional and modern

By product, industry has been categorized into spread and all purpose

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 6.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 9.47 Billion.

Demand for veganism is increasing demand for Powder Induction and Dispersion Systems.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include BRF, Groupo Lala, NamChow and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Butter Flavor Market Trends – Food & Beverage Innovation 2025 to 2035

Butter Powder Market Growth – Applications & Demand 2025 to 2035

Competitive Breakdown of Buttermilk Powder Providers

Butter Concentrate Market

Nut Butters Market Insights - Premium Spreads & Consumer Trends 2025 to 2035

Dry Buttermilk Market

Shea Butter Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Aloe Butter Market

Kokum Butter Market Analysis by Application, End Use, and Region through 2035

Vegan Butter Market Insights - Dairy-Free Alternatives & Industry Growth 2025 to 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Lactic Butter Market Analysis - Size, Share & Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA