The global shea butter market is valued at USD 3.1 billion in 2025 and is projected to reach USD 6.8 billion by 2035, expanding at a CAGR of 8.2%. The growth of the market is primarily driven by the rising global demand for natural and organic personal care products.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3.1 billion |

| Projected Market Size in 2035 | USD 6.8 billion |

| CAGR (2025 to 2035) | 8.2% |

As consumers become more ingredient-conscious, there is a strong shift toward clean-label formulations free from synthetic chemicals. Shea butter, known for its moisturizing, anti-inflammatory, and antioxidant properties, is widely used in skincare and haircare products such as creams, body lotions, conditioners, and lip balms. Its natural origin and skin-healing benefits make it especially appealing to health-conscious and environmentally-aware consumers.

Another major growth factor is the increasing use of shea butter in the food industry. It is being adopted as a functional fat and cocoa butter substitute in bakery items, confectionery, and vegan food products. Its acceptance in the food sector is further supported by regulatory bodies such as the FDA and EFSA, making it a viable choice for formulators looking for sustainable and healthier fat alternatives. This is especially true in chocolate production, where shea stearin blends well with cocoa butter equivalents.

In addition, shea butter’s applications in traditional medicine and pharmaceuticals are expanding. It is used for treating minor skin irritations, burns, eczema, and arthritis-related inflammation. This therapeutic appeal, backed by centuries of use in African herbal practices, is drawing interest from pharmaceutical and nutraceutical manufacturers exploring plant-based formulations for topical and dietary applications.

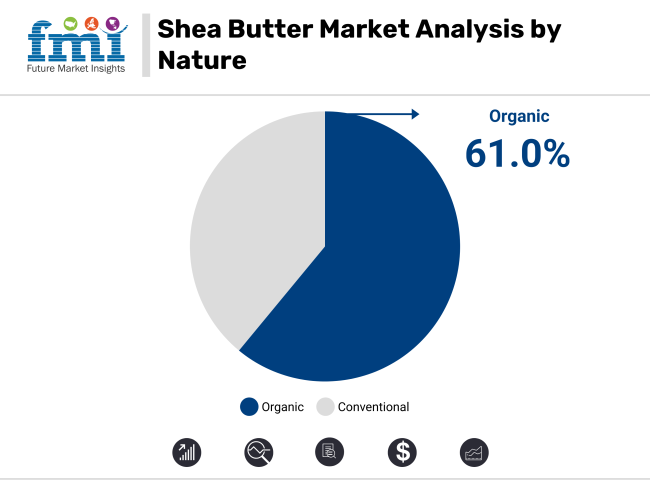

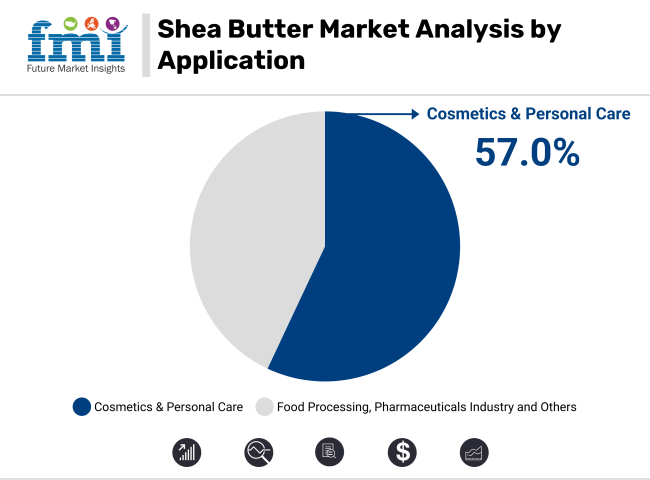

In terms of nature, the organic segment accounts for 61% share. On the basis of application, the cosmetics & personal care segment registers 57% share. The market is also growing due to increasing awareness of ethical and sustainable sourcing practices.

Shea butter is often sourced through women-led cooperatives in West Africa, providing income and empowerment to rural communities. Brands that promote Fair Trade-certified shea butter attract socially responsible consumers who prioritize environmental sustainability and equitable supply chains.

The shea butter market is segmented by nature into organic and conventional. By grade, it includes grade A (raw or unrefined), grade B (refined), grade C (highly refined), grade D (lowest uncontaminated grade), and grade E (with contaminants). Based on application, the market covers food processing, cosmetics & personal care, pharmaceuticals industry, and others. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The organic segment registers 61% share of the market. Organic shea butter is increasingly preferred due to rising consumer awareness around natural, chemical-free, and sustainably sourced ingredients. Unlike conventional shea butter, organic variants are extracted without the use of pesticides, synthetic fertilizers, or chemical solvents, making them safer for sensitive skin and more appealing to clean beauty consumers. As demand for eco-conscious personal care products grows, shoppers are actively choosing certified organic ingredients for their proven purity and reduced environmental footprint.

Grade A (raw or unrefined) shea butter holds the leading share of 42% in the global shea butter market due to its strong alignment with current consumer preferences for natural and minimally processed ingredients. Unlike refined or highly processed grades, Grade A shea butter retains its full nutrient profile, including vitamins A and E, essential fatty acids, and anti-inflammatory compounds. These qualities make it highly desirable for skincare, haircare, and therapeutic applications where efficacy and purity are key purchasing drivers.

As the organic and clean beauty movement gains momentum worldwide, Grade A shea butter has become a staple ingredient in formulations labeled as organic, vegan, or non-toxic. Consumers are increasingly scrutinizing product labels and opting for skincare items free from chemical additives, preservatives, or bleaching agents.

The cosmetics & personal care segment accounts for 57% share. Shea butter is widely used in cosmetics and personal care products due to its rich composition of vitamins A, E, and F, along with essential fatty acids that nourish, hydrate, and protect the skin. Its natural emollient properties help soften and smooth dry or damaged skin, making it ideal for use in moisturizers, body lotions, and lip balms. Unlike synthetic ingredients, shea butter is well-tolerated by sensitive skin and rarely causes irritation, which enhances its appeal in hypoallergenic and baby care products.

In addition, shea butter possesses anti-inflammatory and antioxidant properties that support skin healing, reduce redness, and prevent premature aging. This makes it valuable in formulations aimed at soothing conditions like eczema, psoriasis, and sunburn. Its ability to lock in moisture and form a protective barrier also benefits hair care products such as conditioners and scalp treatments.

Inconsistent Supply Chain, Manual Processing, and Quality Control Issues

One of the biggest challenges to the shea butter market is its labor-intensive and highly fragmented supply chain. Most of the shea butter is hand-processed in rural West African villages, which causes varying levels of quality and purity. Seasonal harvesting cycles also cause supply bottlenecks for manufacturers that require large volumes with uniform specifications. Certification and product standardization barriers caused by regulation also make international trade and bulk procurement challenging.

Processing Technology, Product Diversification, and Ethical Sourcing Models

Despite these constraints, the market presents exciting opportunities for sustainable growth. Technologies such as cold-press extraction and high-performance filtration systems are enhancing product consistency and safety. Companies are investing in diversification of products, producing specialized shea butter products for sensitive skin, baby care, and medicinal balms.

Moreover, heightened demand for ethically sourced, community-stimulating ingredients is propelling multinational companies to engage in direct relationships with cooperatives, increasing transparency while improving livelihoods for shea-producing communities.

The shea butter market is projected to experience steady growth across these countries from 2025 to 2035, with the European Union leading at a CAGR of 7.8%, driven by strong demand in cosmetics and personal care. The USA and South Korea follow closely with growth rates of 7.5% and 7.4%, respectively, reflecting increasing consumer preference for natural and sustainable ingredients.

The UK shows a slightly lower CAGR of 7.2%, while Japan has the slowest growth at 6.9%, likely due to market maturity and competition from alternative ingredients. Overall, the market demonstrates consistent expansion across these key regions.

The USA shea butter market is growing with increasing awareness among consumers about natural and organic products. Demand is the greatest in the personal care and cosmetics markets, with more desire for sustainability and ethically produced ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

In the UK, shea butter demand is motivated by the expanding clean beauty trend and ethical consumerism. Shea butter is also sought after in the food sector due to the fact that it can be a substitute for cocoa butter, and this addresses vegan and health trends as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

The EU market has robust demand in the cosmetics and also the food market. Market growth is encouraged by support policies for organic and sustainable products, with Germany and France taking the lead in consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.8% |

The shea butter market in Japan is growing with natural ingredients being incorporated into cosmetics and skincare. Healthy and properly cared-for skin sought by the elderly population results in constant demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

South Korea is seeing higher usage of shea butter in K-beauty products focusing on hydration and naturals. Going towards sustainable and ethical sourcing aligns with consumer demand and drives market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

The shea butter market is moderately fragmented, featuring a mix of large multinational agribusinesses and specialized regional suppliers. Major players like BASF SE, Bunge Limited, Cargill, Inc., and Archer Daniels Midland Company leverage their vast supply chains and processing capabilities to serve global cosmetic and food industries. Wilmar International and Fuji Oil Holdings provide significant production capacity, especially in Asia.

Regional companies such as Ghana Nuts Company Limited and International Oils & Fats Limited focus on sourcing and processing within key shea-producing regions, ensuring quality and sustainability. Croda International and 3F Industries Ltd. bring innovation and specialty formulations to the market. This blend of global giants and regional players maintains a competitive, yet not fully consolidated, market landscape.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.1 billion |

| Projected Market Size (2035) | USD 6.8 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Nature Analyzed (Segment 1) | Organic, Conventional |

| Grade Analyzed (Segment 2) | Grade A (Raw/Unrefined), Grade B (Refined), Grade C (Highly Refined), Grade D (Lowest Uncontaminated Grade), Grade E (With Contaminants) |

| Application Analyzed (Segment 3) | Food Processing, Cosmetics & Personal Care, Pharmaceuticals Industry, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, South Africa, GCC Countries |

| Key Players influencing the Shea Butter Market | BASF SE, Bunge Limited, Croda International, Cargill, Inc., Archer Daniels Midland Company, Wilmar International, International Oils & Fats Limited, Ghana Nuts Company Limited, Fuji Oil Holdings, Inc., 3F Industries Ltd. |

| Additional Attributes | Dollar sales by grade and application, Growth in organic vs. conventional demand, Cosmetic industry usage patterns, Regional price trends, Sustainability and fair-trade certifications impact |

The overall market size for shea butter market was USD 3.1 billion in 2025.

The shea butter market is expected to reach USD 6.8 billion in 2035.

The increasing demand driven by rising consumer preference for natural and organic personal care products, expansion in the food industry.

The top 5 countries which drive the development of shea butter market are USA, China, India, Germany, and France.

On the basis of application, cosmetics and personal care to command significant share over the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Butter Flavor Market Trends – Food & Beverage Innovation 2025 to 2035

Butter Powder Market Growth – Applications & Demand 2025 to 2035

Analysis and Growth Projections for Butter and Margarine Business

Competitive Breakdown of Buttermilk Powder Providers

Butter Concentrate Market

Hogshead Barrel Market

Nut Butters Market Insights - Premium Spreads & Consumer Trends 2025 to 2035

Dry Buttermilk Market

High Shear Mixer Market Size and Share Forecast Outlook 2025 to 2035

Aloe Butter Market

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Kokum Butter Market Analysis by Application, End Use, and Region through 2035

Vegan Butter Market Insights - Dairy-Free Alternatives & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA