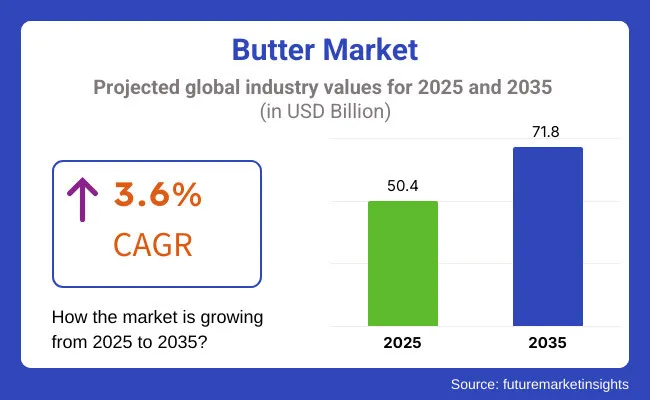

The global butter market is expected to be reach USD 71.8 billion by 2035, registering a CAGR of 3.6% during the forecast period. Global sales of butter are pegged at USD 50.4 billion in 2025. The product segment is anticipated to be led by salted butter, accounting for approximately 40% of the market in 2025. In terms of processing, a dominant share of 65% is likely to be held by processed butter.

Growth in the butter market is being driven by rising demand for natural and high-fat dairy options. A preference for clean-label products is being observed among consumers, particularly in developed regions. Home baking trends and a revival of traditional dietary fats are supporting market expansion. Grass-fed and organic butter varieties are being increasingly adopted, as premium offerings continue to be prioritized by health-conscious shoppers.

Widespread application across foodservice sectors such as bakeries and confectioneries is contributing to consistent demand. Enhanced shelf visibility and accessibility of specialty butters are being enabled by improvements in modern retail and online grocery platforms. In mature economies, premium formulations including probiotic-enhanced and flavored butters are being introduced to attract niche segments.

However, market expansion is being restrained by concerns related to saturated fat intake. Competitive pressure from plant-based alternatives is also being intensified. In response, manufacturers are adopting sustainable packaging, exploring zero-waste production methods, and integrating AI-supported dairy processing.

Retail shelves are expected to continue being dominated by indirect distribution, which includes supermarkets and digital grocery stores, with a projected 70% share in 2025. Growth in direct channels such as subscription models is also being noted. Overall, the butter market is expected to remain resilient, supported by innovation and shifts in consumer behavior.

Salted butter is expected to dominate the product type segment, capturing nearly 40% of the global butter market in 2025. This widespread use can be attributed to its ability to enhance flavor and extend shelf life, making it a preferred choice in both household and commercial kitchens. Its functionality in cooking, baking, and food preparation has ensured consistent demand across diverse geographies.

Processed butter is projected to account for approximately 65% of the butter market in 2025, making it the leading segment by processing type. Its dominance is driven by the food industry's need for consistency, extended shelf life, and standardized composition across large-scale operations.

Spreadable butter is anticipated to hold around 55% of the usage segment in 2025, making it the most preferred format among consumers. Its convenience, ease of application, and suitability for everyday consumption have made it a staple in both retail and foodservice environments.

The bakery segment is projected to lead the end use category, capturing approximately 35% of the global butter market in 2025. This dominance is being driven by butter’s essential role in delivering flavor, texture, and moisture in a wide variety of baked goods.

The United States is expected to remain the largest market for butter globally, driven by demand for organic, grass-fed, and premium salted variants, with a CAGR of 3.9% from 2025 to 2035. The United Kingdom is witnessing steady growth at 3.3%, supported by sustainable packaging initiatives and the expansion of online and private-label offerings.

Germany, growing at 3.9%, is characterized by strong consumer preference for reusable, organic, and artisan butters, backed by strict dairy regulations. France, with a projected CAGR of 4.3%, is experiencing robust demand for eco-certified and dermatologically tested butters, reinforced by a rich culinary tradition.

Japan, although facing demographic headwinds, is expected to grow at 3.2% CAGR due to premiumization, advanced dairy technologies, and rising demand for functional butter formats. These regional shifts reflect a broader global trend toward product innovation, and clean-label dairy consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| United Kingdom | 3.3% |

| Germany | 3.9% |

| France | 4.3% |

| Japan | 3.2% |

The United States is expected to maintain its dominance in the global butter market with a CAGR of 3.9% from 2025 to 2035. As one of the most mature and innovation-driven dairy economies, the USA market continues to benefit from growing demand for organic, grass-fed, and premium salted butter. Rising consumer awareness around clean-label ingredients and a preference for hormone-free dairy are shaping product innovation. Retail sales are being supplemented by strong growth in subscription-based and D2C delivery models. High-fat dietary trends, including keto and paleo, are further boosting butter consumption.

The UK butter market is projected to grow at a CAGR of 3.3% from 2025 to 2035, supported by a strong consumer tilt toward quality. British households are increasingly favoring compostable packaging, pasture-raised dairy sources, and organic certifications. The rise in online retail and recurring delivery models is making premium butter more accessible. Retailers are promoting private-label butter options aligned with the UK government’s push for sustainable and eco-labeled consumer goods. Simultaneously, hybrid and plant-forward butter alternatives are being tested, especially by millennial parents and urban consumers.

Germany’s butter market is forecasted to grow at a CAGR of 3.9% from 2025 to 2035. Recognized as one of Europe’s most eco-conscious economies, Germany is witnessing a strong consumer pivot toward reusable, organic, and pasture-raised butter products. A preference for clean-label dairy is supported by robust regulatory frameworks and a tradition of high dairy standards. Artisanal and cultured butters are seeing renewed interest as consumers seek richer flavors and healthier options. Private-label growth in retail is evident, with German supermarket chains expanding sustainable dairy shelves to capture growing demand.

France is projected to register a CAGR of 4.3% between 2025 and 2035. Known for its culinary heritage and high butter consumption, France is seeing a strong rise in premium, organic, and skin-sensitive butter varieties. Compostable and plastic-free packaging is becoming more common, aligned with both consumer preference and regulatory push. Reusable and hybrid butter models are gaining visibility, particularly among younger, eco-conscious parents. Domestic and EU-based brands continue to dominate distribution, with dermatologically tested and specialty butters making gains across retail and foodservice outlets.

Japan's butter market is expected to grow at a CAGR of 3.2% from 2025 to 2035. While demographic challenges such as a declining birth rate limit volume growth, the market is supported by premiumization and innovation in product formats. Japanese consumers prefer high-quality, ultra-thin, and breathable butter packaging formats. Strong interest in locally produced, small-batch butter continues, supported by food safety and quality standards. Technological innovation is playing a major role, with companies focusing on advanced processing and low-waste production models.

The global butter market is being shaped by a mix of legacy dairy giants, and premium brand innovators. The competitive landscape is marked by strong regional preferences, rising demand for differentiated offerings, and investment in smart dairy technologies. Key players are focusing on expanding product portfolios with organic, flavored, and functional butter variants while integrating AI-driven processing and eco-friendly packaging to align with evolving consumer expectations.

Tier 1 companies such as Amul, Land O'Lakes, and Arla Foods are maintaining leadership through product innovation, sustainable sourcing, and deep retail penetration. Fonterra and Lactalis Group continue to scale exports and specialty formats to strengthen their global footprint.

Tier 2 players, including Kerrygold, Organic Valley, Danone, Saputo, and FrieslandCampina, are gaining traction with clean-label, vegan, and fortified butter solutions. Private-label brands and regional artisanal producers are also expanding presence, especially in Europe and Asia, by offering niche variants catering to local taste and regulatory demands.

Key strategic priorities across the industry include:

Competition is expected to intensify as regulations tighten and consumer expectations shift toward transparency, nutrition, and ethical production.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 50.4 Billion |

| Projected Market Size (2035) | USD 71.8 Billion |

| CAGR (2025 to 2035) | 3.6% |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and Volume Units |

| Product Types Analyzed | Cultured, Uncultured, Salted, Whipped, Others |

| Processing Types Analyzed | Processed, Unprocessed |

| Usage Categories | Spreadable, Non-spreadable |

| End Use Segments | Food Processing, Bakery, Dairy and Frozen Desserts, Dressings and Spreads |

| Distribution Channels Analyzed | Direct, Indirect |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea |

| Key Companies Profiled | Amul, Land O'Lakes, Arla Foods, Fonterra, Lactalis, Kerrygold, Organic Valley, Danone, Saputo, FrieslandCampina |

| Additional Attributes | AI-enabled production, packaging innovations, market expansion strategies |

The market is valued at USD 50.4 billion in 2025 and projected to reach USD 71.8 billion by 2035.

Salted butter is expected to lead the market with a 40% share in 2025.

Processed butter dominates with around 65% of the market share.

South Korea is expected to be the fastest-growing developed market with a CAGR of 3.7%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Butter Powder Market Growth – Applications & Demand 2025 to 2035

Butter Flavor Market Trends – Food & Beverage Innovation 2025 to 2035

Analysis and Growth Projections for Butter and Margarine Business

Competitive Breakdown of Buttermilk Powder Providers

Butter Concentrate Market

Nut Butters Market Insights - Premium Spreads & Consumer Trends 2025 to 2035

Dry Buttermilk Market

Shea Butter Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Aloe Butter Market

Kokum Butter Market Analysis by Application, End Use, and Region through 2035

Vegan Butter Market Insights - Dairy-Free Alternatives & Industry Growth 2025 to 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Lactic Butter Market Analysis - Size, Share & Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA