The global vegan butter market is expected to witness steady growth during the forecast period, driven by the growing adoption of plant-based diets around the world, rising cases of lactose intolerance, and increasing concerns regarding animal welfare. With health-consciousness and sustainable awareness, more consumers are turning to dairy-free options.

The market is also poised to grow with the technology advances of the plant-based ingredient sector, the taste and texture improvement of vegan butter, and an increasing number of products with innovative formulations.

In addition, food manufacturers are investing in research and development (R&D), with an aim of developing functional, nutrient-dense variants of vegan butter, which fulfil the clean-label yet organic demand consumer preferences.

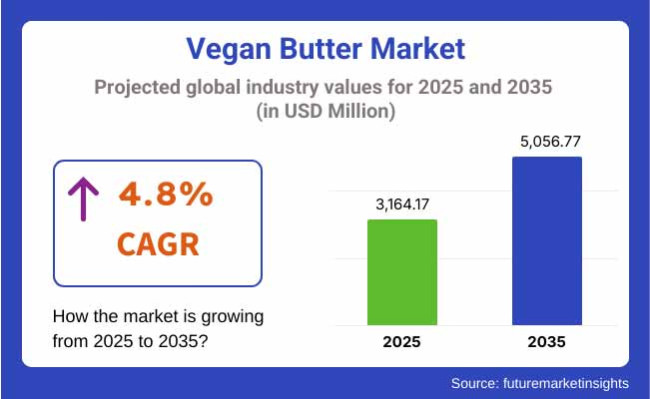

In 2025, the vegan butter market was valued at approximately USD 3,164.17 million. By 2035, it is projected to reach USD 5,056.77 million, reflecting a compound annual growth rate (CAGR) of 4.8%.

Increasing retail availability, rising consumer awareness about cholesterol-free and trans-fat-free alternatives, and expansion of plant-based product offerings by major food brands are further supporting market growth. Additionally, the growing trend of home baking and cooking with plant-based ingredients is driving demand for versatile vegan butter products.

The North American region is also anticipated to hold a significant share in the vegan butter market, owing to the increasing demand for plant-based products from the consumers and the presence of major plant-based food manufacturers with established channels of distribution in the retail sector.

Increased consumption of vegan butter in the United States and Canada is driven by the rise of veganism, awareness of lactose intolerance, and advancements in culinary applications of plant-based foods. Later, grocery retailers have open up their plant-based a product section, and foodservice operators are adding vegan butter on their menu to keep up with the emerging population of flexitarians with the rise of plant-based/products awareness.

Europe is a major market for vegan butter, backed up by strict food regulations favoring sustainable and ethical foods. In Europe, Germany, the UK, France, and the Netherlands are leading in plant-based consumption trends. Locally, consumers favor organic, non-GMO, clean-label vegan butter products.

And big players in the dairy sector are widening their plant-based portfolios with new and improved dairy-free spreads that are fortified with added nutritional benefits! Home to a growing food menu, vegan items are showcasing to bulk e-commerce sales, especially within a regulated market in Europe, where health-focused customers are driving growth.

Factors such as growing population of lactose intolerant people, rising health consciousness, and changing dietary pattern are major contributors in the growth of vegan butter market in Asia-Pacific region. Countries like China, India, Japan and Australia have been increasing their demand for plant-based substitutes, aided in part by urban migration and changing types of consumers.

The increase in plant-based dairy brands and international availability of products like vegan butter along with the emergence of local food manufacturers that are using region-specific formulations are the substantial growth factors for the market. Further growth is being bolstered by government initiatives encouraging population-wide adoption of plant-based diets for sustainability and health reasons.

The global vegan butter market is poised for further growth as plant-based diets become mainstream across the world. Major growth drivers include rising health awareness, greater access to novel dairy-free products, and growing adoption by retail and foodservice.

Driven by innovation in product formulations, growing consumer preference for sustainable and ethical food choices, and significant investments in plant-based food R&D, the vegan butter market continues to witness steady growth in the coming years.

Challenges

High Production Costs and Supply Chain Complexities

The thread of the Vegan butter market could be woven with the increasing price of plant-based constituents, processing methods, and supply destruction loopholes. High-quality ingredients like coconut oil, almond butter, and cashew-derived fats all significantly increase the cost of production.

Transporting and storing them can be complicated and expensive, and affects the pricing structure and go to market strategies. Companies need to use cost effective sourcing and improve manufacturing techniques to increase their profitability and cost effectiveness of their products.

Regulatory Compliance and Labeling Requirements

The vegan butter industry has to pay attention to a range of laws governing aspects like food labeling, product claims and source of ingredients. Various countries have their own ways of defining plant-based and dairy-free labeling, which can make it difficult to comply. To maintain consumer trust and comply with regulations, manufacturers should be adding transparency to their ingredient lists, nutritional claims and non-GMO certifications.

Opportunities

Rising Demand for Dairy-Free Alternatives

The increase in veganism, lactose intolerance, and consumers' preference for plant-based diets are factors driving the demand for vegan butter. There is growing demand for dairy alternatives with clean-label, functional benefits among health conscious consumers. The avatars of innovation will get a leg up through healthier fat sources, flavor enhancements and fortifications with omega-3s or vitamins.

Expansion of E-Commerce and Direct-to-Consumer Sales

E-commerce platforms and direct-to-consumer sales models are opening expansion opportunities for vegan butter brands in new markets. E-commerce provides consumers with a platform to explore a plethora of plant-based butter alternatives, complete with detailed product descriptions and customer reviews. Subscription models, influencer marketing, and social media campaigns also help to reinforce brands and connect with consumers.

Due to the plant-based food movement, product diversification, and increased retail availability, demand for Vegan butter surged between 2020 and 2024. Major players shifted towards sustainable packaging, non-GMO formulations, and advanced texture development to more closely replicate traditional butter. Buyers, however, faced challenges with price sensitivity and supply chain disruptions.

For 2025 to 2035, innovations in precision fermentation, sustainable sourcing of ingredients, and personalized nutrition will be prevalent in the market. Consumer options will continue to grow with the development of AI food formulation; packaging that decomposes, and the growing number of organic plant-based butter choices. Market growth will be driven by companies investing in technological innovations, functional ingredient enhancements and sustainable sourcing.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with clean-label and dairy-free claims |

| Technological Advancements | Innovations in plant-based fat blends |

| Industry Adoption | Increased retail presence and product diversification |

| Supply Chain and Sourcing | Dependency on traditional plant-based fats |

| Market Competition | Dominance of leading plant-based food brands |

| Market Growth Drivers | Demand for dairy alternatives and sustainability focus |

| Sustainability and Energy Efficiency | Focus on eco-friendly packaging |

| Integration of Smart Monitoring | Limited digital tracking of production and distribution |

| Advancements in Product Innovation | Growth in flavor and texture enhancement |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-powered traceability and blockchain -based transparency |

| Technological Advancements | Precision fermentation and bioengineered dairy-free butter |

| Industry Adoption | Expansion of personalized and functional vegan butter |

| Supply Chain and Sourcing | Adoption of sustainable, regenerative agriculture sourcing |

| Market Competition | Rise of niche, organic, and artisanal brands |

| Market Growth Drivers | Functional nutrition, allergen-free products, and cleaner labels |

| Sustainability and Energy Efficiency | Large-scale adoption of biodegradable and zero-waste packaging |

| Integration of Smart Monitoring | AI-driven food formulation and real-time quality monitoring |

| Advancements in Product Innovation | Introduction of fortified, gut-health-supportive vegan butter |

The growth of the USA vegan butter market can be attributed to the growing consumer preference for plant-based dairy counterparts. Increased lactose intolerance and dairy allergies have propelled demand for non-dairy butter products. Big food companies and start-ups are also pouring money into new formulations that improve taste, texture and nutritional value.

With the growing vegan trend, various retail distribution channels, such as supermarkets, specialty stores, and online platforms, have been widened for the accessibility of vegan butter to consumers. Market trends are being shaped by the increasing impact of sustainable and ethical food choices, with brands promoting organic food, non-genetically modified organisms (non-GMO) and Palm oil-free products, for example.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The vegan butter market in the UK is being propelled by a rapidly expanding vegan population and solid government support for plant-based options. The increase in flexitarian diets has led to the use of plant-based replacements, including vegan spreads. Grocers and foodservice chains are adding more plant-based products, which drives more demand.

Moreover, the focus on sustainability and sustainable sourcing has resulted in an increase in interest in brands that provide cruelty-free and eco-friendly alternatives. Innovative sourcing of ingredients like cashew, almond, and coconut based formulations, is also augmenting the market attractiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

Consumer demand for plant-based food products has been on the rise, and as a result, the vegan butter market in European Union is propelling forward. Germany, France, and the Netherlands are amongst the leaders in the plant-food movement with growing investments in dairy alternatives.

Tight food labeling regulations and increasing consumer demand for clean-label products are driving companies to focus on transparency and sourcing of natural ingredients. An increasing application of vegan butter in bakery and confectionery is another factor fuelling the market growth. In addition, major retailers have increased shelf space for dairy-free alternatives, adding to the diversity of vegan butter choices in stores.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The surge in vegan butter sales in Japan is attributed to the rise in popularity of plant-based diets and a cultural shift in healthier food options. The growing population of lactose-intolerant consumers has led to a demand for dairy-free alternatives in the market.

Japanese food industry is leaning towards functional and fortified plant-based products which additionally augments the value-additional of vegan butter. The growth of vegan cafes and bakeries also certified as vegan is further stimulating market growth as consumers look for high-quality alternatives to dairy butter. Luxury packaging and branding tricks are also piquing consumer interest in the vegan butter segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The market for vegan butter is steadily increasing in South Korea thanks to greater awareness of plant-based nutrition and an increasing need for dairy alternatives. The growth of plant-based bakeries and dessert cafes has expedited the adoption of vegan butter for a foodservice application.

Furthermore, government initiatives that promote sustainable and eco-friendly food consumption are driving consumers to try the dairy-free alternatives. Vegan butter brands have seen their visibility boosted by the influence of Western food trends and aggressive social media marketing. The popularity of e-commerce has also increased plant-based butter products for consumers across the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

| Source | Market Share (2025) |

|---|---|

| Almond Milk | 35% |

Vegan butter based on almond milk accounts for the largest market share, with a creamy consistency, a mild flavor and high levels of vitamin E. Almond-based alternatives are typically preferred because they are one of the tastiest and most versatile of alternatives and have a long shelf life from baking to cooking, spreading, and in cereals.

With an increasing presence of organic and unsweetened almond milk-based products, its dominance seems untouched, targeting the health-conscious consumer and clear-label dieters. Soy milk-based and oat milk-based vegan butter is also witnessing utmost growth due to cost-effective nature and increasing penetration in foodservice industries.

Soy based alternatives are common for their high protein content, while oat based substitutes are picking up traction for their naturally sweet flavor and sustainable production processes. The newer formulations of pea milk and cashew milk is creating more visually appealing for consumers as well as premium and health-orientated products are extremely popular and highly demanded in dairy-alternative and nutrient-dense food categories.

Moreover, brands are fortifying formulations with nutrients, probiotics and clean-label ingredients to meet rising demand for nutritious and allergen-friendly dairy alternatives. The introduction of private-label vegan butters and the growing prevalence of plant-based culinary trends in home cooking collectively drive market growth, promising that the trend towards new and yummy dairy free buttery spreads will continue.

| Sales Channel | Market Share (2025) |

|---|---|

| Hypermarkets/Supermarkets | 42% |

Supermarkets and hypermarkets will remain the dominant sales channel for vegan butter, due to the wide variety of brands and the accessibility of bulk purchasing options and promotional discounts. For consumers, product sampling, ingredient verification, and immediate availability make physical stores preferable, especially for new and returning buyers.

Larger retail chains also are increasingly creating plant-based sections, making vegan butter products easier to find. At the same time, online retail is gaining steam as a result of e-commerce growth, direct-to-consumer (DTC) brand tactics and subscription purchases. The ability to shop a wider selection of specialty and international brands at their fingertips along with exclusive online discounts is enticing digitally savvy consumers.

While specialty food stores and convenience stores are becoming significant distribution channels targeted toward busy and niche health-conscious customers seeking premium, organic and allergen-free products. As consumers become more aware and the plant-based butter becomes more readily available in retail stores and digital marketplaces, the demand for the product is likely to continue to rise.

Online players are using AI recommendations and personalized shopping experiences to bring in more customers, while retailers are focusing on better shelf space, more in-store promotions and loyalty programs to keep plant-based customers. The growing trend of vegan meal kits and home baking amid the pandemic is also driving up sales through both brick-and-mortar and online distribution channels.

The vegan butter market is also witnessing an extensive expansion, owing to the growing consumer inclination towards plant-based substitutes, rise in veganism trends, and increasing awareness regarding dairy free diet. Technological improvements in plant-based food, taste and texture formulations, clean-label ingredients, expanding market are being additionally encouraged by the growing demand for plant-based protein amongst consumers.

Moreover, brands are solidifying their position via robust retail presence, innovative marketing strategies, and strategic partnerships. The industry's growth trajectory in the coming years is supported by a solid global CAGR of 4.8% - indicating that more consumers are looking for sustainable and cruelty-free food options.

Availability of allergen-free butter variants, organic butters, nut-based and other such types of butter vegan versions are accelerating adhesion of market and catering to the needs of consumers with dietary preferences across the categories.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Upfield (Flora, Country Crock) | 25-30% |

| Miyoko’s Creamery | 15-20% |

| Conagra Brands (Earth Balance) | 10-15% |

| Califia Farms | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Upfield | In 2025 , Upfield introduced a new premium vegan butter blend incorporating fermented plant-based ingredients for enhanced flavor and nutrition. The company also expanded its distribution channels across North America and Europe, ensuring wider availability. With a focus on sustainability, Upfield has improved its eco-friendly packaging and carbon-neutral production processes, reinforcing its leadership in the plant-based sector. |

| Miyoko’s Creamery | In 2024 , Miyoko’s Creamery launched an oat-based vegan butter to cater to consumers with nut allergies. The company also strengthened its organic and artisanal product range, gaining popularity among health-conscious buyers. Expansion into Asia-Pacific markets further boosted its global footprint, supported by increased online and retail collaborations. |

| Conagra Brands | In 2025 , Conagra Brands expanded its Earth Balance line with a high-protein vegan butter variant, targeting fitness and wellness consumers. The company also invested in research to improve shelf stability and enhance the creamy texture of its spreads, increasing its appeal to mainstream consumers switching to plant-based diets. |

| Califia Farms | In 2024 , Califia Farms diversified its portfolio by introducing a coconut oil-infused vegan butter with a higher smoke point, appealing to home cooks and chefs. The brand leveraged its existing plant-based beverage consumer base to cross-promote its new offerings, driving market growth through strategic digital campaigns. |

Key Company Insights

Upfield (25-30%)

With prominent brands like flora and country crock, upfield has a significant share in the Vegan butter market. Enveloped in the company's top-line strategy is sustainable innovation, ingredient transparency and global market expansion. These taste and texture innovations, along with new investments in the next generation of dairy-free butter alternatives, have put Upfield at the forefront of appealing to both vegans and flexitarians.

Miyoko’s Creamery (15-20%)

Miyoko’s Creamery specializes in artisanal and organic varieties of vegan butter aimed at premium market segments. Its focus on cultured plant-based products, along with traditional dairy fermentation techniques, has helped to set its products apart. Miyoko’s is expanding into foodservice and hospitality channels, increasing its brand exposure.

Conagra Brands (10-15%)

Through its Earth Balance line, Conagra Brands targets health-conscious consumers wanting functional plant-based butter alternatives. Recent launches with added proteins and omega-3s meet changing dietary trends. Its strong retail presence at supermarkets and health food stores, and its promotional efforts there, keep working for sales.

Califia Farms (8-12%)

Califia Farms enters the vegan butter market with strong brand recognition for their plant-based beverages. The coconut and almond oil based butters offer a unique selling point that is aligned to its mission of clean-label, allergen-friendly and naturally flavored products.

Other Key Players (20-30% Combined)

Several brands contribute to the vegan butter market, focusing on unique formulations and distribution strategies:

The overall market size for vegan butter market was USD 3,164.17 million in 2025.

The vegan butter market expected to reach USD 5,056.77 million in 2035.

Rising veganism, lactose intolerance prevalence, health-conscious consumers, plant-based diet trends, and product innovations will drive the vegan butter market during the forecast period.

The top 5 countries which drives the development of vegan butter market are USA, UK, Europe Union, Japan and South Korea.

Supermarkets & hypermarkets driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Flavor, 2023 to 2033

Figure 28: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Flavor, 2023 to 2033

Figure 58: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Flavor, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 118: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Flavor, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: MEA Market Attractiveness by Source, 2023 to 2033

Figure 177: MEA Market Attractiveness by Flavor, 2023 to 2033

Figure 178: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: MEA Market Attractiveness by Application, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA