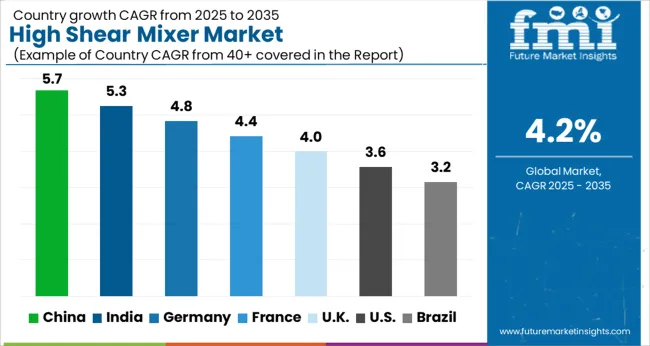

The High Shear Mixer Market is estimated to be valued at USD 845.6 million in 2025 and is projected to reach USD 1276.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| High Shear Mixer Market Estimated Value in (2025 E) | USD 845.6 million |

| High Shear Mixer Market Forecast Value in (2035 F) | USD 1276.0 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The High Shear Mixer market is experiencing steady expansion due to the rising need for precision mixing technologies across key process industries. The current landscape is characterized by a strong emphasis on improving product quality, reducing production time, and enabling process scalability. The shift toward automated and energy-efficient mixing equipment has been encouraged by corporate initiatives and innovation-led investments, as observed in industry journals and company press releases.

The market is also responding to growing demand in sectors such as pharmaceuticals, chemicals, and food processing, where consistency and uniform dispersion are critical. As reported in annual reports and investor communications, manufacturers are prioritizing modular mixer designs with enhanced control features, which cater to diverse industrial requirements.

The ongoing shift toward continuous processing, compliance with safety standards, and rising adoption of clean-in-place systems are expected to influence future growth With advancements in rotor-stator technologies and increasing focus on flexible batch processing, the market is projected to witness long-term stability and innovation-driven acceleration.

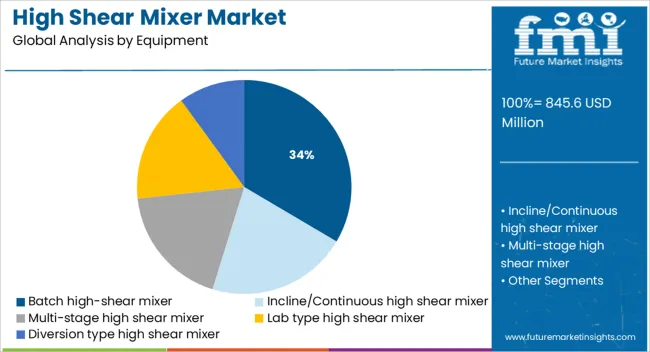

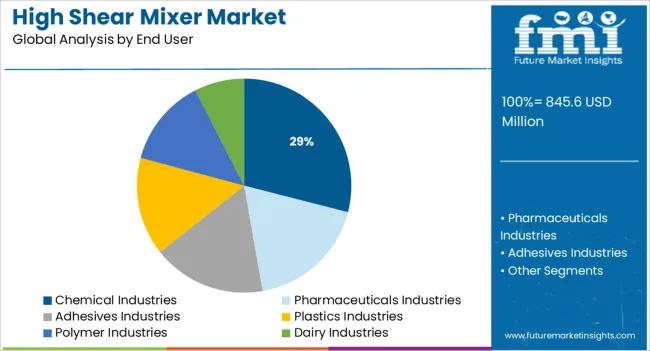

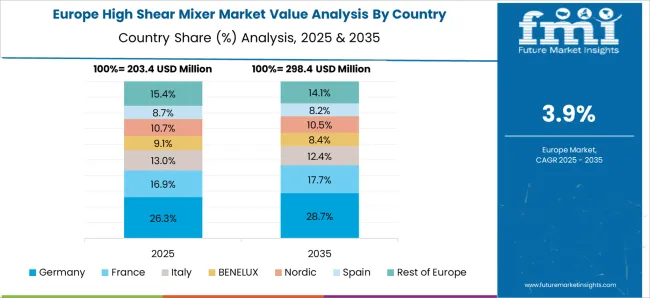

The market is segmented by Equipment and End User and region. By Equipment, the market is divided into Batch high-shear mixer, Incline/Continuous high shear mixer, Multi-stage high shear mixer, Lab type high shear mixer, and Diversion type high shear mixer. In terms of End User, the market is classified into Chemical Industries, Pharmaceuticals Industries, Adhesives Industries, Plastics Industries, Polymer Industries, and Dairy Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The batch high shear mixer segment is projected to account for 33.5% of the High Shear Mixer market revenue share in 2025, positioning it as the leading equipment type. This segment’s prominence has been driven by its operational flexibility and compatibility with a wide range of viscosities, making it suitable for both small and large-scale formulations. Technical specifications highlighted in product bulletins and corporate updates indicate that batch mixers offer better process control and reduced energy consumption compared to continuous systems in specific use cases.

The segment has also benefited from increased preference in industries where small-to-medium production volumes require strict formulation accuracy. The ability of batch mixers to deliver high levels of shear force, reduce particle size, and ensure uniform mixing has led to their broad deployment across diverse applications.

Additionally, simplified maintenance, easier cleaning processes, and lower capital investment have strengthened their appeal among manufacturers seeking efficient, scalable solutions These combined factors have contributed to the segment’s market leadership.

The chemical industries segment is expected to hold 29.0% of the High Shear Mixer market revenue share in 2025, establishing it as the dominant end user. This leadership position has been shaped by the growing complexity of chemical formulations that require precision blending, emulsification, and dispersion. Statements from manufacturing companies and sector publications have noted that chemical firms are increasingly adopting high shear mixers to improve batch consistency, enhance reaction kinetics, and support product innovation.

Demand for high-performance equipment has been reinforced by regulatory pressures for cleaner and safer chemical processing, pushing firms to upgrade from conventional mixers. Moreover, the adaptability of high shear mixers to handle corrosive, reactive, and viscous materials has made them integral to both specialty and commodity chemical operations.

The segment’s strong presence has also been linked to the emphasis on process intensification, energy savings, and high-throughput production As the chemical sector continues to evolve, the reliance on high shear mixing solutions is projected to deepen further.

The global demand for high-shear mixers is anticipated to grow at 4.2% CAGR between 2025 and 2035 in comparison to the 6.4% CAGR registered during the historical period from 2020 to 2025.

Rising applications of high-shear mixers across industries like food & beverages, pharmaceuticals, adhesives, paint & coatings, chemicals, and plastics is a key factor driving the global high-shear mixer market.

High-shear mixers are extensively used for the effective dissolution of coatings, adhesives, and additives. They help end users blend various heterogeneous mixtures easily. As a result, they are becoming extremely popular in industries like pharmaceuticals, polymers, and chemicals.

Rapid Growth of End-Use Industries Boosting the High Shear Mixer Market

One of the key trends shaping the global high-shear mixer market is the rapid expansion of end-use industries, particularly plastics, chemicals, adhesives, and pharmaceuticals. All these industries employ high-shear mixers for high shear mixing to produce solutions, emulsions, and dispersions.

Strong Presence of Leading Manufacturers Boosting market in the USA.

As per FMI, the USA dominates the North American high-shear mixer market with a total share of around 68% and it is further expected to grow at a healthy pace during the next ten years. Growth in the USA high-shear mixer market is driven by the rapid expansion of end-use industries such as food & beverages, pharmaceuticals, and adhesives.

Similarly, the heavy presence of leading manufacturers such as Eriez, who are constantly innovating to develop advanced high-shear mixers is positively influencing the USA market.

In the USA, Eriez is the leading name in separation technology. For more than 80 process and metalworking industries, the company designed, produced, and marketed equipment for magnetic separation, material feeding (vibratory feeders), metal detection, screening, conveying and regulating.

Similarly, Scott Turbon offers a broad spectrum of mixing technologies and solutions to enable end users to easily mix both homogenous and heterogenous mixtures.

Rapid Growth of Chemical Industry Facilitating Market Expansion in China

With the rapid expansion of the chemical and plastics industries and subsequent usage of high-shear mixers across these sectors, China will emerge as one of the most lucrative high-shear mixer markets during the forecast period.

According to FMI, China's chemical sector continues to outperform the rest of the world. This can be seen in China's growing share of global chemical sales. Over the last two decades, China's chemical boom has been marked by rapid investment, strong competition, and fragmentation across a wide range of areas. This is positively influencing the high-shear mixer sales in the country.

A steady CAGR of 4.2% has been predicted by FMI for China’s high-shear mixer market during the forecast period (2025 to 2035).

Increasing Adoption Across Thriving Dairy Industry Pushing Sales in Germany

The German high-shear mixer market is projected to expand at 3.6% CAGR throughout the forecast period of 2025 and 2035 owing to the rapid expansion of the dairy industry, the presence of advanced mixing technologies, and favorable government support.

Germany produces the most milk or dairy products in the EU. This in turn is generating a huge demand for mixing technologies like high-shear mixers in the country and the trend is likely to continue during the projected period.

Need for Effective Dissolution of Adhesives and Polymers Fuelling Demand for High Shear Mixers

As per FMI, demand for high-shear mixers will continue to remain high in the adhesives and polymer industries due to the increasing application of this equipment for the effective dissolution of adhesives, coatings, additives, and polymers.

High-shear mixers are used to emulsify, disperse, grind, and dissolve immiscible mixtures with components of the same or different phases. These mixers work by shearing a mixture made up of a dispersed and continuous phase.

The scattered particles are decreased to smaller sizes during the shearing process, making them much easier to dissolve and combine, resulting in a homogenized, continuous phase. As a result, these mixers are widely used in adhesives and polymer industries.

The quickly changing technical environment is prompting manufacturers to regularly update their product portfolios. As a result, they are investing in research and development activities to develop advanced high-shear mixers.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 845.6 million |

| Projected Market Size (2035) | USD 1276.0 million |

| Growth Rate (2025 to 2035) | 4.2% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Europe; Asia Pacific; South America; Middle East & Africa (MEA) |

| Key Countries Covered | The USA, Germany, The UK, France, Italy, Russia, Turkey, Spain, China, Japan, Korea, India, Indonesia, Thailand, Philippines, Malaysia, Vietnam, South Korea, Australia, Brazil, Argentina, Colombia |

| Key Segments Covered | Equipment Type, End-user, Region |

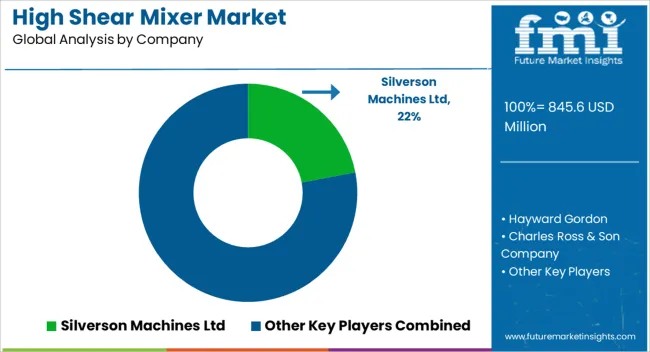

| Key Companies Profiled | Silverson Machines Ltd; Hayward Gordon; Charles Ross & Son Company; GEA Process Engineering Ltd; Renders India Pvt Ltd.; Fujian South Highway Machinery Co., Ltd.; Jinhu Ginhong Machinery Co., Ltd; Nantong Hennly Machinery Equipment Co. Ltd; IKA-Werke GmbH & Co. KG; Bematek Systems Inc.; Tetra Pak International; SPX FLOW; Max Mixer |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global high shear mixer market is estimated to be valued at USD 845.6 million in 2025.

The market size for the high shear mixer market is projected to reach USD 1,276.0 million by 2035.

The high shear mixer market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in high shear mixer market are batch high-shear mixer, incline/continuous high shear mixer, multi-stage high shear mixer, lab type high shear mixer and diversion type high shear mixer.

In terms of end user, chemical industries segment to command 29.0% share in the high shear mixer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA