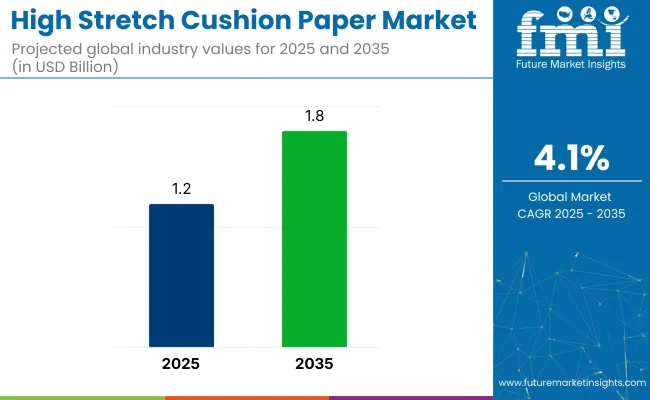

The global high stretch cushion paper market will reach USD 1.2 billion in 2025 and touch USD 1.8 billion by 2035, reflecting a CAGR of 4.1%. Expansion is supported by rising demand for recyclable, lightweight packaging across e-commerce, consumer goods, and food industries.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.2 billion |

| Market Size (2035) | USD 1.8 billion |

| CAGR (2025 to 2035) | 4.1% |

Known for its shock-absorbing and void-filling qualities, high stretch cushion paper is being adopted as a practical alternative to plastic-based wraps. As online shopping accelerates, logistics chains are prioritizing packaging materials that offer protection without adding bulk. With its ability to protect fragile items while reducing environmental burden, this paper type is gaining traction across high-volume packaging sectors.

The high stretch cushion paper market holds varying shares within its parent markets due to its specialized use. In the protective packaging market, it accounts for 5-7%, as alternatives like bubble wrap and foam dominate. The flexible packaging market has a share of 3-5%, competing with plastics and films.

In the paper packaging market, it represents 2-4%, as corrugated and kraft papers lead. The e-commerce packaging market drives higher demand, contributing 6-8%, due to its lightweight, protective qualities. In the industrial packaging market, its share is 4-6%, used for fragile goods. Growth is fueled by eco trends, as the high stretch cushion paper is recyclable and eco-friendly compared to plastic alternatives.

Leading companies are driving unprecedented innovation in packaging technology. Siemens introduced AI-powered predictive maintenance systems that slash equipment downtime by 30%, while Texo Trade pioneered 100% recycled PVC/TPE strips for sustainable textile applications.

YJNPACK revolutionized logistics with IoT-connected cushion machines that optimize material use in real-time. Sealed Air developed energy-efficient, beltless air cushion systems that reduce power consumption by 40%, and DS Smith advanced plant-based fiber solutions for compostable protective packaging.

These innovations respond to tightening global eco-mandates and consumer demand for greener options. WestRock and Mondi are leading the charge in smart packaging integration, combining digital tracking with automated warehouse systems. Meanwhile, Smurfit Kappa’s nanocellulose research promises stronger, lighter, eco-friendly materials.

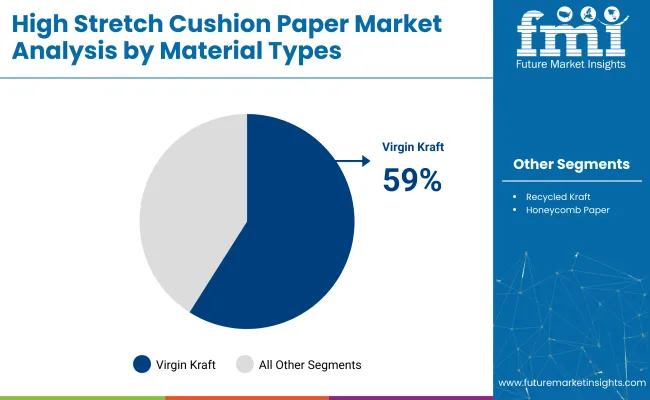

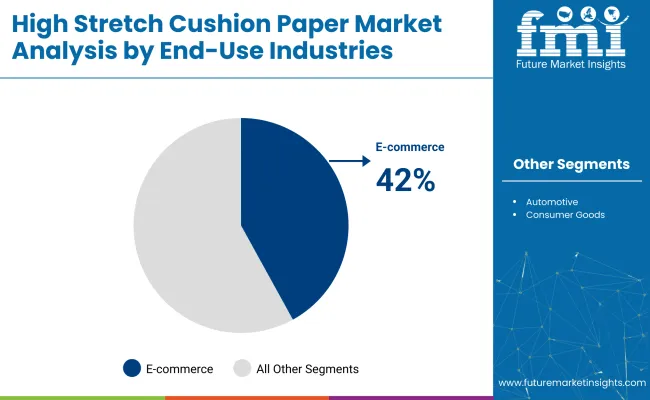

Virgin Kraft paper dominates the material type segment with a 59% share in 2025, prized for its superior strength and cushioning performance. The e-commerce sector leads end-use applications, capturing 42% of market demand driven by electronics and fragile goods packaging needs.

Virgin Kraft paper holds a dominant 59% share of high-stretch cushion paper use in 2025. It remains preferred for applications requiring durability, stretch capacity, and moisture protection in transit.

The e-commerce segment holds a 42% share of high-stretch cushion paper consumption in 2025. Electronic items, apparel, and fragile homeware categories drive large-scale usage across packaging operations globally.

Crimped paper structure leads with a 47% penetration rate in 2025. Its balance of load absorption, flexibility, and adaptability supports packaging needs across sectors, including auto parts, appliances, and electronics.

Wrapping applications comprise 51% of the high stretch cushion paper usage in 2025. This form factor has become popular for replacing films in wrapping electronics, furniture, and fragile household goods.

Dynamics Demand from e-commerce and automotive packaging has raised the profile of high stretch cushion paper. Performance-focused upgrades, low plastic reliance, and regulatory preferences for recyclable packaging materials are supporting volume growth across regions, with manufacturers scaling up crimped and accordion structures for protective versatility.

Pioneering Product Formats and Adaptive Engineering Lead Industry Trends

Structural Challenges and Cost Pressures Restrain Market Expansion

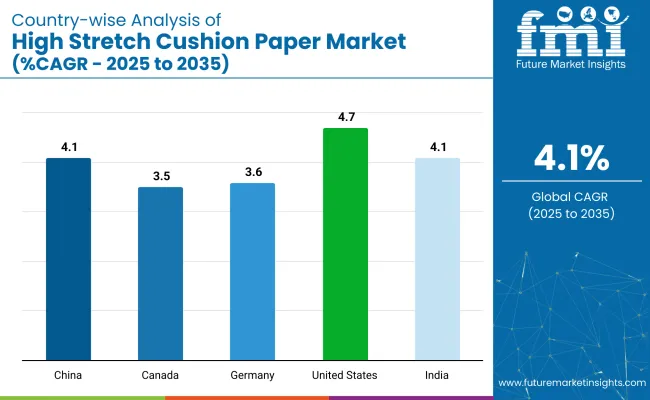

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

| Canada | 3.5% |

| Germany | 3.6% |

| China | 4.1% |

| India | 4.1% |

Global demand for High Stretch Cushion Paper is projected to grow at a 4.1% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, the United States leads at 4.7%, followed by China and India at 4.1% each, while Germany posts 3.6% and Canada records 3.5%.

These growth rates translate to a +12% premium for the United States, +0% for China and India, and -2% for Germany and Canada compared to the baseline. Divergence in growth is driven by factors such as the strong demand for packaging in the United States, the rise of e-commerce and logistics in China and India, and moderate demand in mature markets like Germany and Canada.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

A CAGR of 4.7% has been projected for the United States between 2025 and 2035. Demand has been fueled by e-commerce consolidation, where protective paper packaging is gaining preference over polyethylene-based void fill. Custom crimped formats and kraft variants are being integrated into fulfillment centers due to operational compatibility with high-speed pack lines. Domestic manufacturing incentives and waste-reduction mandates have positioned recycled cushion paper as a favored void fill.

The market is anticipated to expand at a CAGR of 3.5% through 2035, led by specialty paper grades aligned with eco-certification protocols. Retail distributors have shifted toward accordion-format papers for gift-packaged goods, influenced by voluntary packaging scorecards. Corrugated packaging regulations in British Columbia have broadened applications for paper-based cushioning in inter-provincial logistics.

Germany’s market is forecast to register a 3.6% CAGR from 2025 to 2035. Adoption has risen under VerpackG compliance, with retail and B2B shipments integrating crimped kraft inserts. Honeycomb-patterned variants have gained momentum in the glassware export segment due to weight optimization. Efficiency in logistics and high recyclability have made high-stretch cushion paper a favored material under eco-modulated fee schemes.

China’s market is expected to advance at a CAGR of 4.1% over the forecast period. Expansion has been centered on cross-border e-commerce and OEM electronics packaging. Domestic kraft production has surged to offset virgin imports, with recycled crimped paper formats widely adopted by consumer goods packaging hubs in Guangdong and Zhejiang. Regional freight firms have switched from foam to paper-based solutions due to rising restrictions on non-degradable fillers.

India’s CAGR of 4.1% has been supported by D2C e-commerce logistics and changes in warehousing practices. National logistics parks and third-party fulfillment centers are phasing out EPS fill, replacing it with kraft-based alternatives. Tier-2 city demand for homeware, ceramics, and mid-segment electronics packaging has opened consistent volume channels. GST-linked packaging standards and waste compliance audits have motivated domestic firms to internalize void fill operations using high-stretch cushion paper.

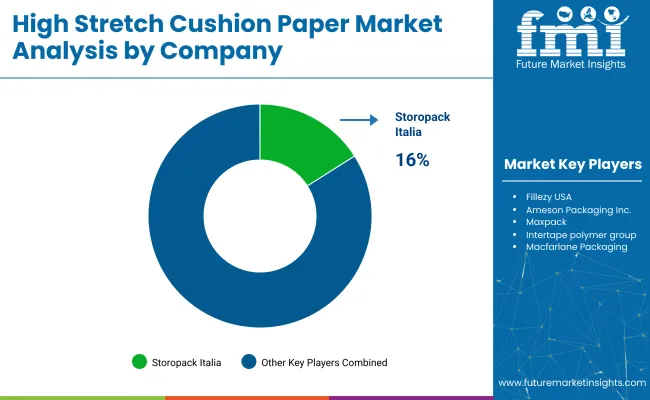

Leading Player Storopack Italia 16% Share

High stretch cushion paper supply remains moderately consolidated, led by Storopack Italia, Intertape Polymer Group, and Macfarlane Packaging. Storopack introduced PaperWave AirWave formats in 2024, while Intertape expanded its production base through a facility acquisition in Illinois. Macfarlane invested in improving fiber strength properties for branded cushion systems. Fillezy USA and Ameson Packaging are gaining visibility with proprietary paper-based fill kits, while Maxpack is targeting D2C shippers with lightweight roll formats.

Entry barriers include machine integration costs, patented paper-forming techniques, and long-term vendor contracts. However, private-label converters have started offering low-volume services, enabling regional growth. Though dominated by a few suppliers, the market still shows pricing competition, especially in e-commerce-driven zones seeking paper-based void fill alternatives.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.2 billion |

| Projected Market Size (2035) | USD 1.8 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed | Virgin Kraft, Recycled Kraft, Honeycomb Paper |

| Paper Structures Analyzed | Crimped, Accordion, Mesh Pattern |

| Applications Analyzed | Wrapping, Void Fill, Edge Protection |

| End-Use Industries Analyzed | E-commerce (Electronics, Apparel, Homeware), Glassware (Ceramics, Fragile Goods), Automotive (Spare Parts, Toolkits), Consumer Goods (Furniture, Gift Packaging) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, South Korea, Brazil, Mexico, UAE, South Africa |

| Leading Players | Storopack Italia, Fillezy USA, Ameson Packaging Inc., Maxpack, Intertape Polymer Group, Macfarlane Packaging |

| Additional Attributes | Dollar sales growth by material type (Kraft, Honeycomb), regional demand trends, competitive landscape, pricing strategies, packaging innovations, supply chain insights. |

The segment includes Virgin Kraft, Recycled Kraft, and Honeycomb Paper

This category comprises Crimped, Accordion, and Mesh Pattern formats.

The market is divided into Wrapping, Void Fill, and Edge Protection based on usage in parcel integrity during transit.

This segment is further categorized into E-commerce (Electronics, Apparel, Homeware), Glassware (Ceramics, Fragile Goods), Automotive (Spare Parts, Toolkits), Consumer Goods (Furniture, Gift Packaging)

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The industry size is projected to be USD 1.2 billion in 2025 and USD 1.8 billion by 2035.

The expected CAGR is 4.1% from 2025 to 2035.

Virgin kraft paper dominates the paper type segment with a 59% market share in 2025.

Storopack Italia is the leading company in the industry, holding a 16% market share.

India is projected to grow at a CAGR of 4.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Heat Waste Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High-power Objective Lens Market Size and Share Forecast Outlook 2025 to 2035

High Purity PFA Resins Market Size and Share Forecast Outlook 2025 to 2035

High Purity Mullite Powder Market Size and Share Forecast Outlook 2025 to 2035

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA