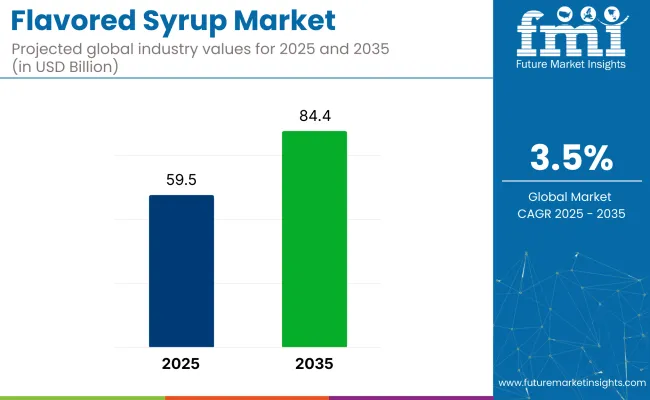

The global flavored syrup market is projected to grow from USD 59.5 billion in 2025 to USD 84.4 billion by 2035, registering a CAGR of 3.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 59.5 billion |

| Industry Value (2035F) | USD 84.4 billion |

| CAGR (2025 to 2035) | 3.5% |

The market expansion is driven by rising demand for premium, customizable flavor experiences across food and beverage segments. Innovations in syrup formulation featuring organic ingredients, reduced sugar content, and novel flavor profiles are further fueling demand across cafes, restaurants, home kitchens, and food manufacturing sectors.

The market holds a 100% share within the specialty syrup segment. It accounts for approximately 29% of the global flavor and sweetener market, around 6% of the beverage ingredients segment, and nearly 4% of the broader food additives market. Within the expansive food and beverage industry, its presence is relatively modest, estimated at below 0.5%. Despite this, its role in product differentiation keeps it strategically important.

Government regulations impacting the market focus on food safety, labeling transparency, and nutritional content. Agencies such as the USA Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) enforce standards regarding additive usage, allergen disclosure, and sugar labeling.

Regulations like the Nutrition Labeling and Education Act (NLEA) in the USA and Regulation (EU) No 1169/2011 in Europe mandate clarity on nutritional profiles and encourage clean-label practices. These frameworks are driving the reformulation of syrups to meet consumer preferences for natural, organic, and sugar-reduced options, thus accelerating the adoption of premium syrup lines that align with health-conscious purchasing behavior.

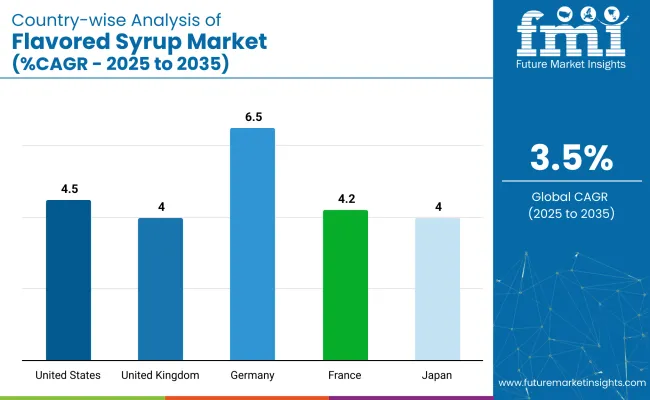

Germany is projected to be the fastest-growing market, expanding at a CAGR of 6.5% from 2025 to 2035. Coffee-flavored syrups will lead the flavor segment with a 13% share, while natural syrups will dominate the sourcing segment with a 66% share. The USA and France markets are also expected to grow steadily at CAGRs of 4.5% and 4.2%, respectively.

The flavored syrup market is segmented by flavor, application, flavor type, product type, and region. By flavor, the market is divided into fruit, chocolate, vanilla, coffee, and herbs & seasonings. Based on application, the market includes beverages, dairy & frozen desserts, confectionery, and bakery.

By flavor type, the market is segmented into sweet, salty, sour, savoury, and mint. In terms of product type, the market is bifurcated into natural and synthetic. Regionally, the market covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

Coffee is expected to dominate the flavor segment, capturing 13% of the market share by 2025. This trend is driven by the global coffee culture boom and increased demand for barista-style beverages.

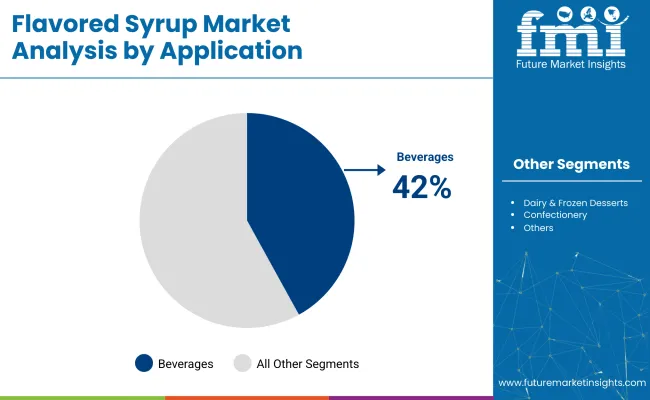

The beverage is expected to capture 42% of the market share in 2025. These syrups enhance taste, color, and aroma, and are key to customization trends in cafes, restaurants, and ready-to-drink beverage products.

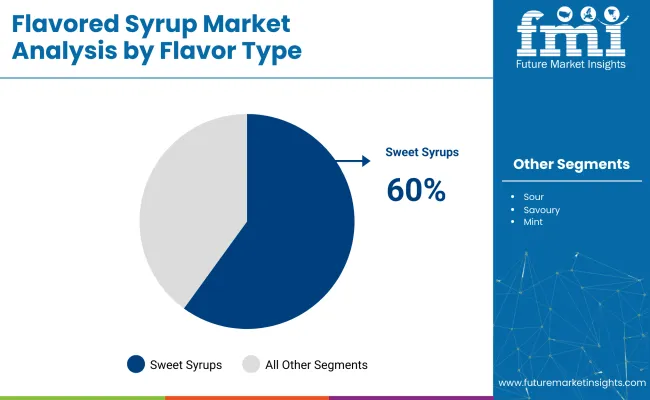

Sweet are expected to capture 60% share in 2025.These syrups are extensively used across multiple food and beverage products.

Natural products are expected to capture 66% of the market in 2025. These syrups are primarily used for their organic nature.

The global flavored syrup market is experiencing steady growth, driven by increasing demand for flavor customization, rising disposable incomes, and evolving cafe culture across emerging economies.

Recent Trends in the Flavored Syrup Market

Challenges in the Flavored Syrup Market

Germany leads with the highest projected CAGR of 6.5% from 2025 to 2035, fueled by rising demand for organic, non-GMO, and clean-label syrups, particularly in beverages and dairy applications. The USA remains a dominant force, with a steady CAGR of 4.5% over the forecast period. It serves as a major manufacturing and innovation hub, supported by advance food processing infrastructure, favorable food safety regulations, and a strong presence of major syrup producers like The Hershey Company and Monin.

USA consumers continue to drive demand for premium, functional, and customizable syrup options, especially in the booming cafe, quick-service restaurant (QSR), and craft beverage sectors. There is increasing focus on health-conscious formulations, such as low-calorie, sugar-free, and natural flavor blends. France, Japan, and the UK also contribute significantly, each growing at 4% to 4.2%, driven by changing dietary habits, growing cafe culture, and preference for specialty and seasonal flavors.

This report includes in-depth data from over 40+ countries. Below is a focused analysis of five top-performing OECD nations.

The sales of flavored syrup in Japan are projected to grow at a CAGR of 4% from 2025 to 2035. Growth is supported by hybrid beverage formats such as matcha lattes and regional tea infusions. Convenience stores, vending outlets, and fast-casual restaurants account for a large share of syrup sales.

The flavored syrup market in Germany is expected to grow at a CAGR of 6.5% during the forecast period. Growth is driven by EU sugar-reduction policies, rising organic product adoption, and increasing demand from beverage innovators.

The French flavored syrup market is forecast to expand at a CAGR of 4.2% during the forecast period. Growth is supported by strong demand for gourmet desserts, seasonal beverages, and culinary innovation.

The USA flavored syrup revenue is projected to grow at a CAGR of 4.5% from 2025 to 2035. Growth is driven by the rise of specialty coffee shops, personalized beverage culture, and sugar-free lifestyle products.

The demand for flavored syrup in the UK is expected to grow at a CAGR of 4% from 2025 to 2035. Growth is driven by public health campaigns targeting sugar reduction and a growing preference for premium beverages at home.

The market is moderately consolidated, with leading players like Monin Inc., Sensient Technologies, The Hershey Company, Tate & Lyle, and Kerry Group dominating the industry. These companies offer a diverse portfolio of high-quality flavored syrups catering to sectors such as beverages, bakery, confectionery, dairy, and foodservice.

Many of these manufacturers are investing heavily in R&D to develop health-oriented formulations, including sugar-free, organic, and plant-based syrups. Additionally, global expansion through strategic partnerships and acquisitions is helping these players strengthen their footprint across emerging markets in Asia-Pacific and Latin America.

Other key players like Fuerst Day Lawson, Toschi Vignola, R. Torre & Company, Concord Foods, and Sensory Effects contribute significantly by offering specialized, regionally inspired, and functional syrups across a wide array of end-use applications.

Recent Flavored Syrup Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 59.5 billion |

| Projected Market Size (2035) | USD 84.4 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value / volume in million liters |

| Flavor Analyzed | Fruit, Chocolate, Vanilla, Coffee, and Herbs & Seasonings |

| Application Analyzed | Beverages, Dairy & Frozen Desserts, Confectionery, and Bakery |

| Flavor Type Analyzed | Sweet, Salty, Sour, Savoury, and Mint |

| Product Type Analyzed | Natural and Synthetic |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Monin Inc., Sensient Technologies, The Hershey Company, Tate & Lyle, Kerry Group, Fuerst Day Lawson, Toschi Vignola, R. Torre & Company, Concord Foods, Sensory Effects |

| Additional Attributes | Market share analysis by source and grade, country-wise CAGR analysis, and brand positioning |

The market is valued at USD 59.5 billion in 2025.

The market is forecasted to reach USD 84.4 billion by 2035, reflecting a CAGR of 3.5%.

Sweet-flavored syrups are expected to hold approximately over 60% of the global market share in 2025.

Beverages will dominate the application segment with a 42% share in 2025.

Germany is anticipated to be the fastest-growing market, with a CAGR of 6.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Milk Market Analysis by Type, Distribution Channel, and Region through 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Liquor Flavored Cigars Market

Syrup Market Size and Share Forecast Outlook 2025 to 2035

PET Syrup Bottle Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the PET Syrup Bottle Industry

Warm Syrup & Topping Dispensers Market – Enhanced Serving Solutions 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Agave Syrup Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Maple Syrup Manufacturers

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Competitive Overview of Coconut Syrup Industry Share

Glucose Syrup Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA