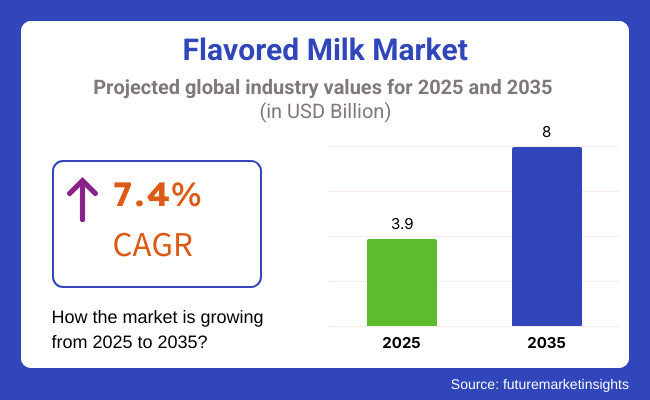

The global flavored milk market is expected to achieve USD 3.9 billion in 2025 and USD 8.0 billion by 2035, with a 7.4% CAGR during 2025 to 2035. This growth is largely due to increased consumer demand for value-added dairy products as players concentrate on product innovation, premiumization and healthy formulations.

As consumer tastes shift toward healthy, convenient drinks, the industry’s leaders harness new processing technologies and future-looking investments to focus on product development and industry expansion. It has been transformed from a traditional dairy category to an exuberant and diverse category that speaks to contemporary health trends and shifts in lifestyle.

The product development activities in the industry are driven by the increasing demand for fortified functional dairy products. Companies are making flavored versions of milk fortified with proteins, vitamins and probiotics while reducing sugar and artificial ingredients.

Moreover, the industry has also significantly benefitted from the proliferation of new dairy substitutes, and clean-label products, as brands are constantly looking to expand upon this base. The industry is mainly driven by growing focus on natural, healthier formulations. As a result, confectionery manufacturers are lowering sugar levels and using natural sweeteners and plant-based flavoring agents to cater to the increasing health-conscious consumer base.

Compared to powdered milk, which is much more difficult to prepare, RTD flavored milk is much more convenient as it can be found in a variety of retail channels, including supermarkets, convenience stores, and even online, which drives the demand for it. Oatly and Califia Farms are challengers in lactose-free and plant-based flavor milk, with challenges in untapped segments, in particular lactose-intolerant or vegan consumers.

The industry is experiencing strong growth (20%+) but also deals with an environment of fluctuating raw material prices (including dairy) in conjunction with supply chain disruptions for the individual manufacturers, as well as regulatory and business limitations on the level of sugar and source of dairy. Moreover, the transition to plant-based drinks exerts competitive pressure on traditional dairy-based flavored milk.

As the environmental sustainability becomes a relative issue, particularly in dairy production and waste of packing, the industry participants will need to use a more sustainable production process and sustainable packaging solutions in order to maintain the consumer's trust. With the industry continuously evolving, companies that make flavored milk work to stay relevant by creating sustainable and health-conscious products. Moving to recyclable cartons, biodegradable bottles, and carbon-free production methods is becoming a industry differentiator.

Strategic product distribution channels: When it comes to strategies like digital marketing, e-commerce and direct-to-consumer subscription-based models these result in transforming the product distribution channels.

Ongoing investment into research and development from numerous players will ensure that this industry is one that will grow and stratify for consumers, something to await, littered with functional, indulgent, and sustainable dairy drinks.

Dairy milk-based flavored milk is everybody's favorite, with a whopping 84.5% of total sales in the industry. Consumer acceptance, rich nutrition, and versatile flavors are driving its popularity. Big names such as Nestlé (Milo), Danone (Horizon Organic), and Arla Foods provide full-fat, low-fat, and skimmed milk for all tastes.

With innovation driving sales, brands are expanding lines to include lactose-free, fortified, organic, and health-conscious consumers. Fairlife, owned by Coca-Cola Co., has moved into this segment with its high-protein, ultra-filtered milk. Allied packaging flexibility, like those single-serve formats from Tetra Pak, has increased demand from on-the-go consumers.

As the plant-based industry adapts, dairy-based flavored milk remains very much king - elevated with functional ingredients, sugar-free options and sustainable production practices.

The industry is one of the changing sectors, which is giving rise to plant-based flavored milk for the consumers when they are switching to dairy substitutes. But brands like Oatly, Califia Farms and Alpro are offering innovation, with almonds, oats, soy and coconuts that serve lactose-intolerant and vegan consumers.

The demand for clean-label, protein-rich, and allergen-free beverages is on the rise, which has increased the popularity of plant-based beverages. Firms such as Silk and Ripple Foods are offering fortified, sugar-free, and high-protein formulations to improve nutritional value.

Supermarkets, health stores, and e-commerce have enabled even faster industry penetration for retailers. As sustainability takes center stage, continuous innovation of flavors, ingredients & sustainable packaging can be expected for plant-based it up to 2035.

Supermarkets and hypermarkets (47.2%) dominate the global consumption. Walmart, for instance, or Tesco or Carrefour: these are significant players that drive their sales through a variety of products, discounts, and availability. Organized retail is on the rise, particularly in urban areas, making supermarkets an important channel for it.

Retailers are increasingly creating shelf space for a wide array of brands used to offer new flavors, innovative packaging, and health-forward options from companies like Nestlé, Danone, and Arla Foods. Supermarkets are also now full of plant-based flavored milk as consumer preferences change. Pushing for online ordering and home delivery as part of digital integration means that as global retail infrastructure grows, a strong showing in this segment will continue for retailers.

Convenience stores are a crucial segment for it, accounting for 28.6% of total global sales. Major chains like 7-Eleven, Circle K, and Lawson are key sales drivers by providing immediate access to ready-to-drink products. The world demands it, and convenience stores are undoubtedly the best retail channel for single-serve bottles and cartons.

Nestlé, Coca-Cola (Fairlife), and FrieslandCampina brands rely on convenience store partnerships to succeed in the channel, focusing on the busy urban consumer and commuter. The growing availability of refrigeration units in convenience stores has also contributed to the growth of these products in both dairy and plant-based categories. Being located in an area with high traffic flows is also strategic, showing that convenience stores will continue to account for good industry growth in the distribution.

The table below provides a comparative analysis of the CAGR variation over six-month periods for the base year (2024) and the current year (2025) in the industry. This evaluation highlights critical performance changes and revenue realization patterns, offering insights into the industry's growth trajectory.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 5.4% |

| 2024 to 2034 (H2) | 6.0% |

| 2025 to 2035 (H1) | 5.7% |

| 2025 to 2035 (H2) | 6.4% |

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. From 2025 to 2035, the industry is expected to witness a CAGR of 5.4% in the first half (H1) of the decade, followed by an accelerated growth rate of 6.0% in the second half (H2).

In the subsequent period, from H1 2025 to H2 2035, the industry is projected to grow at 5.7% in the first half and maintain strong momentum at 6.4% in the second half. While H1 witnessed a 30 BPS increase, H2 experienced a 40 BPS increase, indicating fluctuating consumer demand and seasonal purchasing patterns.

The industry is increasingly being sought after as consumer demand for nutritional and protein-rich functional beverages grows. Recognizing the trend, the dairy companies sell predominantly flavored and fortified drinks along with novelty flavors thus piquing the interest of a very varied group of consumers such as health-conscious and kids.

Suppliers of ingredients are now moving towards natural sweeteners, organic flavors, and clean-label ingredients since these ideas best fit with the trends in society. The companies that sell these beverages through distributors and retailers believe that by having a proper supply chain, a long shelf life, and the lowest price possible will help them penetrate both urban and rural markets.

Many consumers are now opting for it due to its health benefits instead of carbonated beverages, besides, there's a particular interest in lactose-free, plant-based, and protein-enriched options. The industry's growth is also backed by the trends such as sustainable packaging, ready-to-drink (RTD) formats, and regionally inspired flavors. It is likely to see an increase in their industry share as long as people are more health-conscious and preferring to consume in convenience.

The sales around the world grew at a CAGR of 5.8% between 2020 to 2024. Between 2025 to 2035, the industry is expected to expand at a 6.4% CAGR. The increasing demand for dairy beverages that have added nutrition has taken the industry ahead, with consumers turning to it as a healthy and convenient alternative to carbonated soft drinks.

Demand for 2020 to 2024 was largely driven by expansion in single-serve packaging, rising retail penetration, and innovation in faddish flavors. However, growth is expected in the future as customers have been focusing on protein-enriched, lactose-free, and low-calorie alternatives.

Brands are employing digital marketing, social media, and influencer partnerships to gain increased visibility of products. Besides this, environmental considerations, like recyclable packages and clean labels, are highly influencing consumers at the time of purchase. Amidst these patterns dictating the industry, the sale is forecasted to witness continued growth during the period of prediction.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Continuous demand for flavored milk because it is convenient to consume and comes in a lot of flavors | Growing demand for functional and fortified products containing proteins, vitamins, and probiotics |

| Chocolate and vanilla are among the top flavors globally | Growing innovation in flavors using exotic fruits, botanicals, and local flavors |

| North America and Europe as large industries with large dairy consumption rates | Robust growth in the Asia-Pacific and Latin American industries because of expanding dairy consumption as well as urbanization |

| Choice by consumers of flavored milk from dairy as against more plant-based alternatives | Greater consumption of plant-based substitutes of it owing to lactose intolerance as well as concern about the environment |

| Supply chain challenge because manufacture of milk is not a continuous process | Improved supply chain efficiency through modernization of dairy farms and procurement of alternative ingredients |

| Regulatory pressure on sugar content and artificial ingredients in the products | Stringent labeling regulations and reduction in sugar affecting product re-formulation |

| Product segmentation based on restricted age and nutritional requirement | More focus on children, sportspersons, and elderly-citizen-oriented age-life and nutritional requirement-based products |

The industry is facing various risks such as raw material price changes, regulatory issues, consumer behavior changes, competition, and supply chain problems.

Raw material price changes are a big concern as it is produced from dairy ingredients, sweeteners, and flavoring agents. Climatic conditions, feed costs, and dairy supply chain problems can affect milk prices thus impact profitability. Moreover, the sugar, cocoa, and fruit extracts traded in the industry for its price changes depending on the demand and international trade regulations.

The regulatory environment is a major issue for the industry as food safety measures, sugar content limits, and the dairy industry regulations set by the authorities like the FDA (USA), EFSA (Europe), and FSSAI (India) impose a burden on it. The regulations which are stricter regarding added sugars, artificial flavors, and preservatives may necessitate the changes in the formula which in turn will raise the production costs.

Consumer preference changes becoming a threat as there is a growing request for healthier, low-sugar, plant-based, and organic options. Companies that are not dealing with the trend of health majority may lose their marketing share. Similarly, the worries over lactose intolerance and dairy allergies are the main reasons for the growth of non-dairy alternatives and competition in the marketplace.

The industry stands against the competition which is enormous, with global dairy brands, local manufacturers, and companies that deal with plant-based milk all fighting for the customer's attraction. The firms that do not innovate through different flavors, nutritional benefits, or the ecological packaging, will be in danger of being non-relevant in the industry anymore.

The disruptions in the supply chain happen because of the transportation costs, the policies of the dairy global trade, and the problems regarding the raw materials. This can lead to production shortages, increased costs, and improper distribution.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.6% |

| USA | 5.2% |

| India | 6.8% |

| Indonesia | 5.4% |

| Brazil | 4.9% |

China's industry is growing robustly, with an estimated CAGR of 5.6% between 2025 and 2035. Urbanization and rising disposable incomes are driving demand for healthy and convenient beverages. Government initiatives encouraging dairy consumption to improve public health also support industry growth.

Consumers increasingly demand for it with functional aspects like added vitamins and minerals, which appeal to their rising health awareness. Innovating new flavors suitable for local tastes and trendy packaging styles has drawn young consumers. Increasing online channels makes the product more accessible to more people and facilitates access to it. FMI believes China's industry for it will capture a 5.6% CAGR in the study period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Urbanization and Income Growth | Better disposable incomes translate to greater consumption of dairy. |

| Government Dairy Promotion | Public health campaigns encourage milk consumption. |

| Functional Ingredient Demand | Consumers look for more vitamins and minerals. |

| E-commerce Expansion | Retail sites over the Internet expand industry access. |

The USA industry is projected to expand at a 5.2% CAGR during the period 2025 to 2035. Consumers desire more convenient-to-drink items with good taste and nutritional value. Customers prefer low-fat and low-sugar products as an alternative to sweetened carbonated beverages.

The consumption of plant-based flavored milk is becoming more popular among customers with lactose intolerance and vegan customers. Convenience packs like on-the-go, single-serve, and mini-packs appeal to busy executives and school students. Promotional campaigns emphasizing it's health benefits fuel consumption volume growth.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Demand for Healthier Options | Customers opt for low-fat and low-sugar forms. |

| Growth of Plant Milk | Growing acceptability among lactose-intolerant and vegan consumers. |

| Innovation in Packaging | Single-serving packaging fuels consumption. |

| Strategic Marketing | Health-oriented promotions push consumption. |

Based on a burgeoning population with growing disposable incomes, India's industry will likely grow at a 6.8% CAGR during 2025 to 2035. Demand for nutritious yet flavorful drinking products continues to grow. Including traditional Indian flavors like cardamom, saffron, and mango has boosted consumer demand.

Government measures to improve levels of nutrition and the rising development of organized retail channels in rural regions are more appropriate for it. Wellness consciousness drives motivating consumers to look at it as a healthier option, thus fueling industry growth. FMI believes the India-industry will grow at a 6.8% CAGR during this study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Youth-Oriented Industry | Youth consumers require convenient-to-consume dairy drinks. |

| Traditional Flavor Trends | Cardamom, saffron, and mango flavors are driving sales. |

| Government Nutrition Initiatives | Dairy initiatives promote it. |

| Rural Retail Expansion | Improved access in rural and semi-urban channels. |

Indonesia's industry is projected to grow at an estimated 5.4% CAGR during 2025 to 2035. Industry growth is fuelled by expanding middle-class families and urbanization. Local consumers perceive it as a more convenient option to traditional dairy, and an emerging health consciousness pushes demand for nutrition-fortified beverages.

Companies are launching flavors that resonate with Indonesian palates, including coconut, pandan, and tropical fruit flavors. The growing availability of flavor milk in modern retail chain stores and online hypermarkets is bringing it within reach of a larger segment.

Growth Drivers in Indonesia

| Key Drivers | Details |

|---|---|

| Middle-Class Expansion | Increased disposable incomes drive the consumption of dairy drinks. |

| Regional Flavor Innovations | Tropical fruit and coconut flavors are on the rise. |

| Increase in Health Awareness | Customers demand fortified dairy drinks. |

| Retail and Online Growth | Access becomes more convenient through supermarkets and the Internet. |

The industry in Brazil is likely to record a CAGR of 4.9% during 2025 to 2035 because of a rise in demand for dairy drinks among young and active consumers. The demand for protein-enriched milk drinks is gaining traction, especially in urban areas where nutrition tops the list of consumers.

Companies are addressing the industry with lactose-free and plant-based flavor milk to suit shifting food trends. Convenience stores and supermarket expansion are key drivers of enhanced product availability nationwide. FMI estimates that the Brazilian industry will capture a 4.9% CAGR throughout this study.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Growing Demand in Health-Aware Consumers | Increasing demand for protein-contained dairy beverages. |

| Increasing Lactose-Free Products | Brands launch lactose-free offerings. |

| Shopping Convenience | Increased availability in supermarkets and retail stores. |

| Urban Consumer Trends | Health-conscious individuals drive sales of it. |

The industry is growing worldwide, backed by rising consumer demand for nutritional and convenient on-the-go beverage options and innovations within the dairy as well as plant-based formulation segments. The industry is fueled by health consciousness, health-oriented fortified product offerings, and retail channels for distribution. Companies are working on differentiating their products by investing in premiumization, functional ingredients, and sustainable packaging to grab a larger chunk of the industry.

The industry is primarily dominated by key players like Yili Industrial Group, Mengniu Dairy, Amul, and Nestlé, with the help of their strong supply chains in dairy, advanced processing technologies, and strong brand equity. With an innovative approach toward flavors, lactose-free versions, high-protein variations, and convenient packaging formats, they cater to an array of consumer segments.

On the other hand, organic, plant-based, and clean-label competition offered by start-ups and niche brands is stiffening competition in this industry. Competitive strategies are also being shaped by sustainability initiatives such as carbon-neutral dairy sourcing and eco-friendly packaging. Invest in R&D, digital marketing, and health-based formulations, as these are the companies that will solidify their position as the luster continues to grow and shine for this fast-developing products.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Yili Industrial Group Co., Ltd. | 20-25% |

| Mengniu Dairy Co., Ltd. | 18-22% |

| Gujarat Cooperative Milk Marketing Federation (GCMMF - Amul) | 10-15% |

| Nestlé S.A. | 8-12% |

| Arla Foods | 5-8% |

| Other Players | 20-34% |

| Company Name | Key Offerings/Activities |

|---|---|

| Yili Industrial Group Co., Ltd. | It's the industry leader in China with a diverse range of flavored milk products, including protein-rich and functional dairy drinks. |

| Mengniu Dairy Co., Ltd. | Innovative flavors focus on lactose-free and pro-biotic, vitamin-fortified dairy beverages. |

| Gujarat Cooperative Milk Marketing Federation (Amul) | A stronghold in India, known for a vast range of flavored milk such as saffron, chocolate, and fruit-based options. |

| Nestlé S.A. | Global presence with a focus locked on fortified dairy beverages, which it makes through research-based formulations. |

| Arla Foods | Extension of flavored milk category into organic clean label dairy drinks for premium industry segmentation. |

Key Company Insights

Yili Industrial Group Co., Ltd. (20-25%)

It dominates China as a fresh innovator in high-protein and functional flavored milk beverages.

Mengniu Dairy Co., Ltd. (18-22%)

A fiercely competitive rival with Yili while emphasizing its premium fortified and lactose-free dairy products.

Gujarat Cooperative Milk Marketing Federation (Amul) (10-15%)

India's dairy leader is diversifying its flavored milk section to include traditional and health-oriented varieties.

Nestlé S.A. (8-12%)

Comes from a robust international base of developing fortified dairy propositions that are R&D-led and enhanced by health-oriented flavors.

Arla Foods (5-8%)

The premium dairy segment is gaining ground on sustainability and organic flavored milk options.

Other Key Players (20-34% Combined)

By type, the industry is segmented into dairy based and plant based.

By distribution channel, the industry is segmented into supermarkets/hypermarkets, convenience stores, specialist stores, online retail stores, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is expected to reach USD 3.9 billion in 2025.

The industry is projected to reach USD 8.0 billion by 2035.

The key players in the industry include Yili Industrial Group Company Limited, Mengniu Dairy Company Limited, Gujarat Cooperative Milk Marketing Federation Limited (Amul), Mother Dairy Fruit and Vegetable Private Limited, Parle Agro, Nestle, Arla Foods, Danone, and Dean Foods.

India, slated to grow at a CAGR of 6.8% during the forecast period, is expected to see the fastest growth.

Dairy-based flavored milk is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litres) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Flavours, 2018 to 2033

Table 4: Global Market Volume (Litres) Forecast by Flavours, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 6: Global Market Volume (Litres) Forecast by Packaging, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Litres) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Flavours, 2018 to 2033

Table 12: North America Market Volume (Litres) Forecast by Flavours, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 14: North America Market Volume (Litres) Forecast by Packaging, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Litres) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Flavours, 2018 to 2033

Table 20: Latin America Market Volume (Litres) Forecast by Flavours, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 22: Latin America Market Volume (Litres) Forecast by Packaging, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Litres) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Flavours, 2018 to 2033

Table 28: Europe Market Volume (Litres) Forecast by Flavours, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 30: Europe Market Volume (Litres) Forecast by Packaging, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (Litres) Forecast by Sales Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Flavours, 2018 to 2033

Table 36: Asia Pacific Market Volume (Litres) Forecast by Flavours, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Asia Pacific Market Volume (Litres) Forecast by Packaging, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Litres) Forecast by Sales Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Litres) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Flavours, 2018 to 2033

Table 44: MEA Market Volume (Litres) Forecast by Flavours, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 46: MEA Market Volume (Litres) Forecast by Packaging, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (Litres) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Flavours, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Litres) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Flavours, 2018 to 2033

Figure 10: Global Market Volume (Litres) Analysis by Flavours, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Flavours, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Flavours, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 14: Global Market Volume (Litres) Analysis by Packaging, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Litres) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Flavours, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Flavours, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Flavours, 2018 to 2033

Figure 34: North America Market Volume (Litres) Analysis by Flavours, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Flavours, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Flavours, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 38: North America Market Volume (Litres) Analysis by Packaging, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Litres) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Flavours, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Flavours, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Flavours, 2018 to 2033

Figure 58: Latin America Market Volume (Litres) Analysis by Flavours, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Flavours, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Flavours, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 62: Latin America Market Volume (Litres) Analysis by Packaging, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Litres) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Flavours, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Flavours, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Flavours, 2018 to 2033

Figure 82: Europe Market Volume (Litres) Analysis by Flavours, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Flavours, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Flavours, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 86: Europe Market Volume (Litres) Analysis by Packaging, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (Litres) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Flavours, 2023 to 2033

Figure 94: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Flavours, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Flavours, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Litres) Analysis by Flavours, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Flavours, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Flavours, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Litres) Analysis by Packaging, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Litres) Analysis by Sales Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Flavours, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Flavours, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Litres) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Flavours, 2018 to 2033

Figure 130: MEA Market Volume (Litres) Analysis by Flavours, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Flavours, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Flavours, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 134: MEA Market Volume (Litres) Analysis by Packaging, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: MEA Market Volume (Litres) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Flavours, 2023 to 2033

Figure 142: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Liquor Flavored Cigars Market

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA