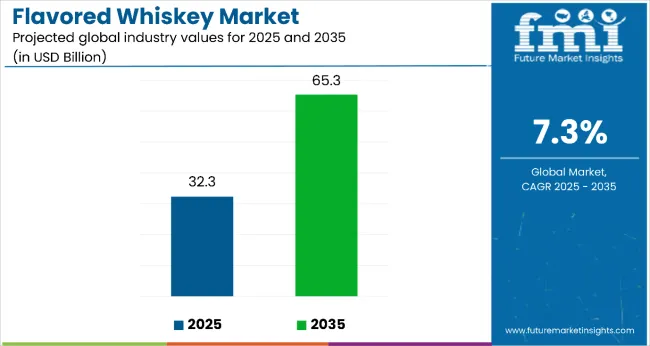

The flavored whiskey market is estimated to be valued at USD 32.3 billion in 2025 and is projected to reach USD 65.3 billion by 2035, registering a compound annual growth rate CAGR of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 32.3 billion |

| Industry Value (2035F) | USD 65.3 billion |

| CAGR (2025 to 2035) | 7.3% |

The flavored whiskey market is projected to add an absolute dollar opportunity of USD 33.0 billion over the forecast period, reflecting a 2.03 times growth at a compound annual growth rate of 7.3%. Market expansion will be driven by increasing consumer interest in premium flavored spirits, evolving taste preferences, and growing adoption of innovative flavor profiles targeting younger demographics and experimental drinkers.

By 2030, the market is likely to reach approximately USD 45.9 billion, accounting for USD 13.6 billion in incremental value over the first half of the decade. The remaining USD 19.4 billion is expected during the second half, indicating a slightly accelerated growth pace in later years. Product innovation in natural flavor infusion and limited-edition releases is gaining momentum, supported by the premiumization trend and demand for craft-style production methods.

Leading companies such as Brown-Forman, Beam Suntory, and Diageo are enhancing their market positioning through flavor diversification strategies, targeted marketing campaigns, and expansion into emerging markets. The market’s performance will remain anchored in flavor authenticity, brand storytelling, and the ability to balance tradition with innovation in whiskey production.

The market accounts for approximately 38% of the flavored spirits segment, driven by its wide appeal among millennials and Gen Z consumers, as well as increasing interest in smooth, approachable alcoholic beverages. It represents nearly 27% of the RTD alcoholic beverages market, supported by rising demand for convenience-based consumption.

The category contributes around 24% to the premium spirits segment, with brands leveraging seasonal flavors, limited-edition offerings, and cocktail versatility to attract new demographics. Its role in the low-ABV and experiential alcohol space continues to expand, with product innovation playing a central role in shaping future demand.

The market is undergoing structural transformation, influenced by shifting consumer behaviors, evolving lifestyles, and increasing openness to flavor experimentation in whiskey. Manufacturers are investing in sustainable packaging, mini bottle formats, and digital engagement strategies to appeal to younger and health-conscious audiences.

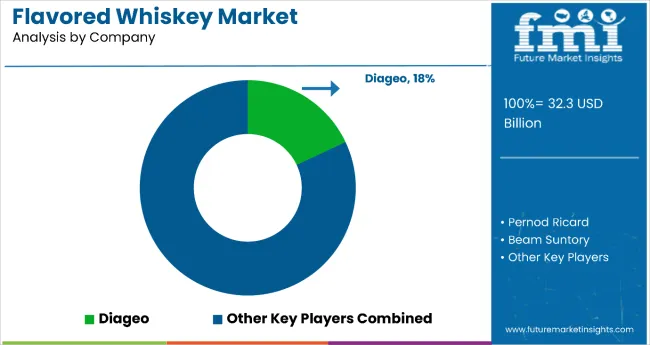

Strategic collaborations, product diversification, and experiential marketing campaigns are driving broader adoption across both retail and on-premise channels. As a result, companies like Diageo, Pernod Ricard, and Beam Suntory are capitalizing on the momentum by expanding their flavored whiskey portfolios to meet growing global demand across North America, Asia Pacific, and Europe.

Rising demand for flavored and approachable alcoholic beverages is fueling sustained growth in the flavored whiskey market. As younger consumers, especially millennials and Gen Z, seek sweeter, smoother alternatives to traditional spirits, flavored whiskey has emerged as a go-to option. Its versatility in cocktails and appeal across gender demographics supports increasing adoption, particularly in social and casual drinking settings.

The market also benefits from rapid innovation in flavor development, packaging formats, and ready-to-drink (RTD) variants. As consumers explore new drinking experiences and shift away from high-proof spirits, flavored whiskey fits well within the low-ABV and experiential alcohol trends. Growing availability across modern retail, e-commerce, and on-premise channels further strengthens market reach and growth momentum.

With premiumization strategies, influencer-driven marketing, and rising cultural acceptance of flavored alcohols, the flavored whiskey market is well-positioned to expand across both developed and emerging regions globally.

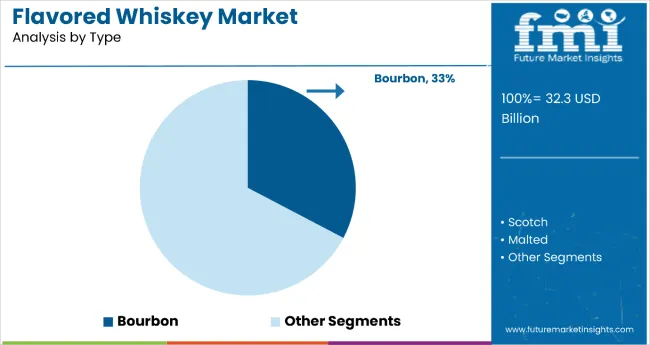

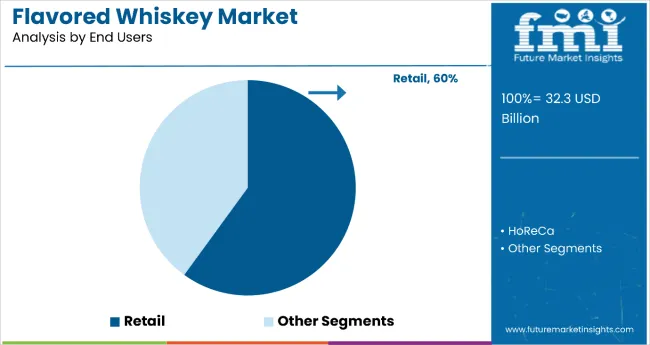

The market is segmented by type, end users, flavor type, distribution channel, and region. By type, the market is characterized into bourbon, scotch, malted, blended, and other types such as rye, Tennessee, corn-based, single grain, and Japanese whiskey. Based on end user, the market is bifurcated into retail and HoReCa. In terms of flavor type, the market is classified into citrus, honey, caramel, cider, and apple.

By distribution channel, the market is divided into modern store formats (hypermarkets/supermarkets, departmental stores, liquor stores), traditional store formats (food & drink specialty stores, independent liquor stores, others such as duty-free outlets, kiosks, and corner shops), and e-commerce. Regionally, the market is characterized into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The bourbon segment leads the flavored whiskey market with a 33% share in 2025, supported by its strong legacy appeal, particularly in North America, and its compatibility with diverse flavor infusions such as honey, apple, and caramel. Bourbon’s naturally sweet, rich, and full-bodied profile makes it ideal for flavor innovation, appealing to younger consumers seeking premium yet approachable spirit options. The growth of craft distilleries in the USA is further driving experimentation with small-batch flavored bourbon variants, attracting both connoisseurs and casual drinkers.

Regulatory protections and authenticity claims enhance bourbon’s premium perception worldwide, while expanding acceptance of Western-style spirits in markets like China and India strengthens its global potential. Marketing strategies focused on heritage, mixability, and authenticity continue to secure bourbon’s leadership position in the evolving flavored whiskey category.

The retail segment dominates the flavored whiskey market with a 60% share in 2025, driven by increasing consumer preference for at-home consumption and the wide availability of flavored whiskey in hypermarkets, supermarkets, liquor chains, and specialty stores. Retail channels benefit from rising demand for personalized and flavored spirits, especially among millennials and Gen Z consumers, who favor unique taste profiles such as honey, apple, and citrus in affordable premium formats.

The expansion of modern retail formats in urban and semi-urban markets across China, India, and the USA is boosting brand visibility through attractive promotional pricing, tasting events, and strategic product placement. Additionally, the post-pandemic shift toward home-based socializing and gifting has accelerated retail sales, making the channel a central growth driver for flavored whiskey globally.

In 2024, rising disposable incomes and evolving social drinking cultures, particularly among millennials and Gen Z, have driven demand for premium alcoholic beverages. Flavored whiskey, offering accessible flavor profiles like honey, apple, and citrus, is increasingly preferred by new whiskey drinkers and cocktail enthusiasts. Consumers are drawn to its versatility, making it suitable for both casual sipping and mixology.

Regulatory, Cultural, and Supply Chain Barriers Slowing Flavored Whiskey Market Growth

Despite promising growth, the flavored whiskey market faces several restraints that could hinder its potential. Regulatory hurdlesincluding strict advertising rules, taxation, and age restrictionspose challenges across various regions. In culturally conservative markets, social norms around alcohol consumption continue to restrict growth. Additionally, the rise of wellness trends and sober lifestyles is encouraging some consumers to limit or avoid alcohol altogether. Supply chain disruptions, particularly in premium and imported whiskey segments, also affect pricing and availability.

Natural Ingredients, and Digital Experiences Define Future Growth of Flavored Whiskey Market

Key trends defining the flavored whiskey market include rapid premiumization, flavor experimentation, and sustainable practices. Consumers are seeking small-batch, craft-style whiskeys with authentic stories and artisanal flavor infusions. Limited-edition releases and collaborations with mixologists or celebrities are creating buzz and encouraging brand loyalty. Brands focusing on natural flavorings, organic ingredients, and eco-friendly packaging are resonating with health- and environment-conscious buyers. The popularity of flavored whiskey is also expanding across Asia, especially in China, which leads in market value.

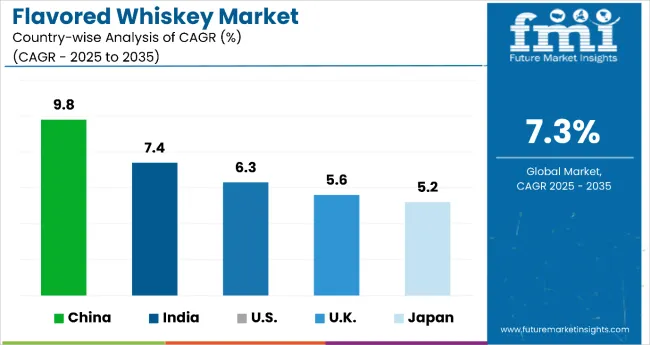

| Countries | CAGR |

|---|---|

| China | 9.8% |

| India | 7.4% |

| USA | 6.3% |

| UK | 5.6% |

| Japan | 5.2% |

In the flavored whiskey market, China leads with the highest projected CAGR of 9.8%, driven by youth-driven consumption, e-commerce growth, and localization by global brands. India follows with a strong 7.4% CAGR, fueled by urbanization, affordability, and shifting preferences toward smoother spirits among millennials.

The USA market, with a 6.3% CAGR, benefits from a mature bourbon culture, innovation from craft distilleries, and high demand for RTD formats. The UK sees a 5.6% CAGR, reflecting rising mixology trends and influence from American-style flavored whiskeys. Japan, though more conservative, is steadily expanding at a 5.2% CAGR, driven by artisanal production and a premium focus in metro areas.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Flavored whiskey revenue in China is projected CAGR of 9.8%, driven by shifting consumer preferences, rising incomes, and increased Western cultural influence. Younger consumers are replacing traditional baijiu with flavored spirits, particularly in Tier-1 and Tier-2 cities. The popularity of cocktails, social drinking, and e-commerce delivery is fueling demand.

International players like Diageo and Pernod Ricard are localizing flavor profiles and ramping up production capacity in the region. In addition, government support for premium food and beverage sectors is easing distribution. Local distilleries are also experimenting with infusions to appeal to modern Chinese palates. Digital marketing and influencer culture are accelerating brand visibility across platforms like Douyin and WeChat.

Flavored whiskey revenue in India is expanding rapidly, with a CAGR of 7.4%, supported by urbanization, rising disposable incomes, and growing acceptance of alcohol consumption among younger demographics. Consumers are shifting from conventional whiskey to flavored variants for their smoother taste and mixability. Regional flavors and affordability are major selling points, especially in metro cities like Mumbai, Delhi, and Bangalore.

Local players are launching cost-effective flavored spirits, while global brands are capturing premium segments through bars, clubs, and online retail. Increasing exposure to global beverage trends through travel and social media is reshaping consumer expectations. However, high excise duties and regulatory fragmentation across states pose operational challenges.

The USA flavored whiskey demand is growing steadily, with a CAGR of 6.3%, anchored in a strong bourbon culture and a thriving craft distillery ecosystem. Demand is supported by Gen Z and millennials who favor sweet, approachable profiles such as honey, apple, and cinnamon. Flavored whiskeys serve as a gateway for non-traditional whiskey consumers, making the category inclusive and accessible.

Craft distillers continue to push boundaries with seasonal flavors and RTD formats. Brand storytelling, celebrity endorsements, and social media engagement are core strategies driving consumer loyalty. Bars and grocery stores provide strong retail support, while regulatory stability fosters continuous innovation across segments.

The UK flavored whiskey revenue is evolving with a CAGR of 5.6%, as flavored whiskey gains favor among younger, cocktail-savvy consumers. Traditionally a Scotch-leaning nation, the shift towards flavored whiskey reflects evolving palates and broader acceptance of spirit innovation. The on-trade segmentespecially bars and clubsis driving experimentation with mixers and seasonal infusions. Limited-edition offerings from international and domestic brands are creating urgency and excitement. The influence of American bourbon and global whiskey trends is noticeable in retail assortments.

Demand for flavored whiskey in Japan is emerging at a steady pace, with a CAGR of 5.2%, anchored in a culture of craftsmanship and premium beverage experience. While the overall whiskey market is well-established, flavored variants are slowly gaining traction, particularly in metropolitan areas like Tokyo and Osaka. Domestic distillers are beginning to introduce refined infusions such as yuzu or sakura, aligning with Japanese taste sensibilities.

Flavored whiskey is also gaining favor in upscale bars and fusion restaurants. With a consumer base that values quality over volume, smaller releases with artisanal touches are performing well. Innovations in packaging and a preference for minimalist, elegant branding further differentiate offerings.

The market is moderately consolidated, comprising a mix of multinational spirits companies and agile regional distilleries. Global leaders such as Diageo Plc, Pernod Ricard SA, Beam Inc., and Brown-Forman Corporation dominate the premium segment, leveraging strong brand equity, advanced R&D for flavor development, and extensive global distribution networks. Their product portfolios feature popular variants like honey, apple, and cinnamon, appealing to younger consumers seeking smoother, mixable options.

Regional players such as Allied Blenders & Distillers Pvt Ltd, La Martiniquaise, and Constellation Brands compete by offering localized flavor innovations and affordable pricing, especially in high-growth markets like India and Europe. These firms emphasize regional preferences, cost-effective production, and quick product rollout cycles. Entry barriers remain high due to regulatory complexity, quality consistency in flavor infusions, and compliance challenges.

Key Developments in Flavored Whiskey Market

| Item | Details |

|---|---|

| Value | USD 32.3 Billion (2025) |

| Type | Bourbon, Scotch, Malted, Blended, Other Types |

| End-Use rs | Retail and HoReCa (Hotels, Restaurants, Cafés) |

| Flavor Type | Citrus, Honey, Caramel, Cider, Apple |

| Distribution Channel | Modern Store Formats (Hypermarket/Supermarket, Departmental Stores, Liquor Stores), Traditional Store Formats (Food & Drink Specialty Stores, Independent Liquor Stores, Others [e.g., convenience stores, kiosks]), E-commerce |

| Regions Covered | Asia-Pacific, North America, Europe, Rest of World |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Brown-Forman Corporation, Bacardi Limited, Beam Inc., The Crown Royal Company, The Old Bushmills Distillery Co., Pernod Ricard SA, Diageo Plc, Allied Blenders & Distillers Pvt Ltd, Constellation Brands, Inc., La Martiniquaise |

| Additional Attributes | Rising cocktail culture, premiumization trend, flavored innovation, influencer marketing |

The global flavored whiskey market is estimated to be valued at USD 32.3 billion in 2025.

The market size for the flavored whiskey market is projected to reach USD 63.4 billion by 2035.

The flavored whiskey market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in flavored whiskey market are bourbon, scotch, malted, blended and other types.

In terms of end users, retail segment to command 57.2% share in the flavored whiskey market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Flavored Milk Market Analysis by Type, Distribution Channel, and Region through 2035

Whiskey Market Analysis by Beverage Type, Product Type, Flavor, End User, Sales Channel, and Region Through 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Liquor Flavored Cigars Market

Demand for Whiskey in USA Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA