The global agave syrup market is projected to grow from USD 645 million in 2025 to USD 1,233.6 million by 2035, reflecting a CAGR of 6.7%.

| Attributes | Description |

|---|---|

| Industry Size (2025E) | USD 645 million |

| Industry Value (2035F) | USD 1,233.6 million |

| CAGR (2025 to 2035) | 6.7% |

This expansion is being driven by the increasing consumer preference for natural, low-glycemic sweeteners as a healthier alternative to refined sugars. agave sweetener, extracted from the agave plant, is being recognized for its mild sweetness, low glycemic index, and versatility, which make it an attractive option for health-conscious individuals. The industry is being further supported by the growing trend of clean-label and natural products, with agave sweetener being increasingly incorporated into a variety of food and beverage offerings.

The agave syrup industry holds a 5-7% share of the broader natural sweeteners industry, which includes honey, maple syrup, and stevia. In the organic food and beverage industry, agave sweetener captures approximately 3-4% of the segment, driven by consumer preference for organic, low-glycemic alternatives. Within the plant-based & vegan products industry, agave sweetener share is around 2-3%, as it is a favored sweetener in vegan food and beverages.

In the functional foods & beverages industry, it makes up 1-2%, mainly used in products targeting blood sugar regulation and weight management. Lastly, in the clean label ingredients industry, agave sweetener constitutes around 1-2%, where it’s valued for its simple and natural ingredient profile. Despite its position, agave sweetener aligns well with health-conscious trends.

In July 2023, Ciranda introduced three new syrups, Agave Syrup AL40, Agave Syrup IN10, and Tapioca Syrup RS18, to help brands meet consumer demand for reduced-sugar products. These syrups offer lower sugar and calorie content while maintaining taste and quality. They can be used individually or combined in various applications, including desserts, bars, ice cream, cereals, beverages, and gummies. The launch aligns with the growing trend for healthier, reduced-sugar formulations in the food and beverage sector.

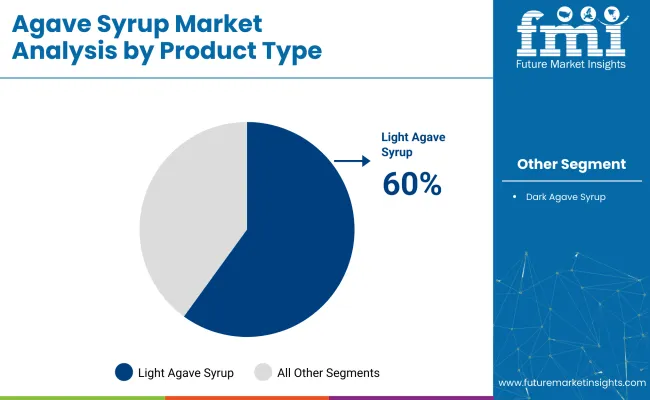

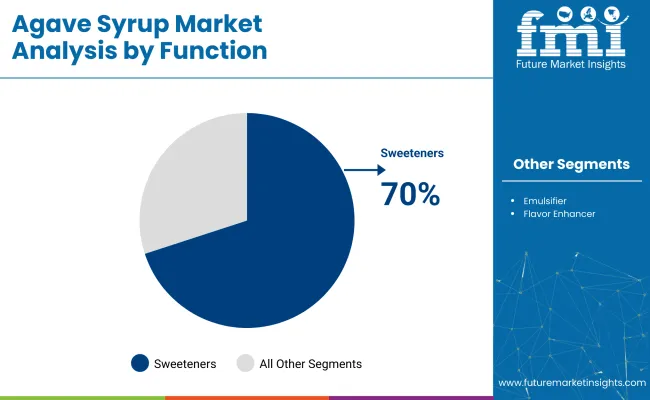

The agave sweetenerindustry is segmented by product type, function, application, and distribution channel. Light agave syrup leads the product type segment with a 60% share, while sweeteners dominate the function segment with 70%. The bakery application holds the largest share at 35%, and online retail is projected to lead the distribution channel with a 30% share.

Light agave syrup is projected to capture the largest share in 2025, with an estimated 60% share. This dominance is driven by its versatile use in various products, particularly in beverages, snacks, and health-conscious desserts.

Major companies such as Wholesome Sweeteners and Nature's Way are increasingly incorporating light agave sweetener into their offerings, driven by the demand for low-glycemic, plant-based sweeteners. The growing trend of clean-label and natural products is further cementing light agave sweetener role as the preferred choice for health-conscious consumers.

The sweetener segment is expected to dominate the sector in 2025, capturing around 70% of the share. This growth is driven by the increasing demand for natural, low-glycemic alternatives to refined sugars.

Companies like Pyure Brands and Maretai Organics are investing in agave sweetener to cater to health-conscious consumers seeking to reduce their sugar intake. With its natural composition and minimal processing, agave sweetener is gaining traction as a healthier sweetener option for various food and beverage formulations.

The bakery sector is expected to hold a significant 35% share in theindustry by 2025. This segment’s growth is fueled by the increasing demand for healthier ingredients in baked goods. Agave sweetener’s versatility and its ability to replace refined sugars in cakes, cookies, and other baked goods have made it a preferred choice among manufacturers.

Companies like Wholesome Sweeteners and Nature's Way are tapping into this demand, offering agave sweetner as a clean-label alternative to conventional sweeteners, catering to the growing trend of health-focused baking.

Online retail is expected to capture 30% of the industry share in 2025. The rise of e-commerce platforms, such as Amazon and Whole Foods, is making it easier for consumers to access agave sweetner products, especially in health-conscious communities.

The convenience of online shopping, combined with the ability to compare prices and read reviews, is contributing to the growing demand for agave sweetener. As consumers increasingly prefer shopping from home, online retail will continue to play a key role in expanding agave sweetener's industry reach.

The agave syrup market is experiencing growth driven by rising consumer demand for natural, low-glycemic sweeteners and plant-based ingredients. Manufacturers are focusing on clean-label products and innovations to cater to health-conscious consumers. The increasing popularity of organic and vegan alternatives is driving product development.

Expanding Demand from Food and Beverage Applications

Agave sweetenersare increasingly used as a healthier alternative to refined sugars, particularly in food and beverage products. It is favoured for its low glycemic index, making it a preferred choice for blood sugar regulation. The growing demand for plant-based and organic products is further boosting its adoption.

Innovation in Product Development and Production

The agave sweetner industry is seeing innovation in product types and production processes. New variations, such as dark and light agave sweetener, are being introduced to cater to diverse consumer preferences. Advancements in production technology are improving efficiency, reducing costs, and enhancing the accessibility of agave sweetener.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| Germany | 7.0% |

| China | 5.2% |

| Japan | 5.4% |

| India | 9.0% |

The agave syrup industry shows varied growth across OECD and BRICS countries. Among the OECD countries, the United States and Germany show steady growth, with respective CAGRs of 6.5% and 7.0%, driven by rising demand for natural, organic sweeteners and a health-conscious population. Germany leads within the OECD, benefiting from a strong trend toward functional and organic foods.

In contrast, Japan experiences slower growth at 5.4%, as agave sweetener remains a premium product amidst already established sweetener alternatives. In the BRICS group, India stands out with a robust 9.0% CAGR, fueled by a rapidly growing health-conscious middle class and rising interest in natural sweeteners. China shows moderate growth at 5.2%, driven by a gradual shift towards healthier alternatives. India’s growth highlights the shift in global demand towards emerging markets.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

Sales of agave sweetener in India are expected to grow at a 9.0% CAGR through 2035. The growth is driven by an increasing awareness of natural sweeteners, as well as the rising health-conscious population seeking sugar alternatives.

The demand is further supported by growing disposable incomes and urbanization. With the adoption of healthier dietary habits and government initiatives promoting wellness, agave sweetener is becoming a popular choice in India. Local manufacturers are increasingly diversifying their product offerings to meet this demand, while e-commerce platforms are helping to expand product accessibility.

The USA agave sweetenerindustry is projected to grow at a 6.5% CAGR through 2035. This growth is fueled by the growing consumer demand for natural sweeteners as part of the broader trend toward healthy eating. Agave sweetener, known for its low glycemic index, is increasingly being used as a sugar substitute in food and beverages. Major brands are offering diverse products, while the spread of health and wellness awareness is accelerating industry growth. Retail expansion and the increasing availability of this syrup in retail stores and health food stores are contributing to growth.

Demand for agave sweetener in Germany is expected to grow at a 7.0% CAGR through 2035. The demand for natural sweeteners is being driven by consumer preference for organic and sustainable food products. German consumers are becoming more health-conscious, seeking sugar alternatives to manage blood sugar levels. The increasing popularity of plant-based diets is further supporting industry growth. Local producers are embracing this demand by offering organic Agave sweetener, and retail channels, including supermarkets and health food stores, are expanding the availability of Agave sweetener products.

Sales of agave sweetener in China is projected to grow at a 5.2% CAGR through 2035. The industry is being fueled by a growing shift toward healthy living and an increasing awareness of the health benefits of natural sweeteners. Demand is rising as consumers look for alternatives to refined sugar. Major food and beverage companies are incorporating Agave sweetener into their products to cater to the health-conscious population. The rise in disposable income and the expanding middle class are also contributing to industry growth.

Demand foragave sweetener in Japan is projected to grow at a 5.4% CAGR through 2035. Growth is being driven by the increasing health-conscious population and a shift towards natural sweeteners as part of a broader wellness trend. Agave sweetener is gaining popularity due to its low glycemic index, and demand is particularly strong among consumers with a focus on weight management and diabetes prevention. Local companies are incorporating Agave sweetener in various food and beverage products, while e-commerce and retail store channels are improving accessibility.

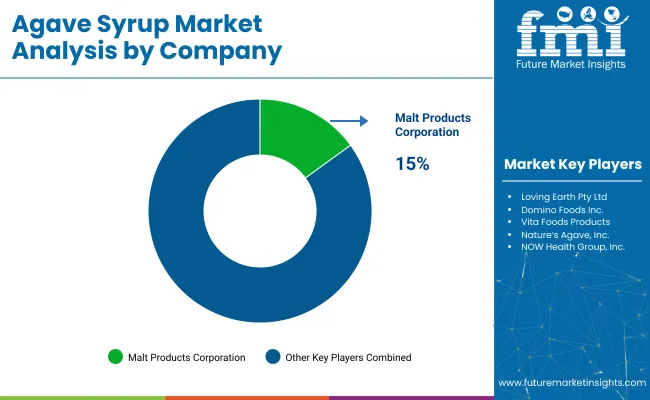

The agave sweetenerindustry is competitive, featuring leading players, key participants, and emerging companies. Malt Products Corporation, Sisana Sweeteners, and Maretai Organics Australia are key industry leaders, with strong portfolios including light, dark, and organic agave sweeteners. Their dominance is supported by strategic investments in sustainability, innovation, and distribution networks. Emerging players like Ciranda Inc. and Dipasa USA Inc. contribute to indsutry growth by offering specialized and organic agave sweetener options, enhancing product variety, and catering to health-conscious consumers.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 645 million |

| Industry Size (2035) | USD 1,233.6 million |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand metric tons for volume |

| Product Types Analyzed (Segment 1) | Light, Dark |

| Functions Analyzed (Segment 2) | Emulsifier, Sweetener, Flavor Enhancer |

| Applications Analyzed (Segment 3) | Bakery, Beverages, Confectionery, Others (Marinades, Salads) |

| Sales Channels Analyzed (Segment 4) | Direct, Indirect (Store-based Retailing, Online Retail) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Russia, Saudi Arabia, UAE, South Africa |

| Key Players | Malt Products Corporation, The IIDEA Company, Swanson Health Products Inc., Loving Earth Pty Ltd, Domino Foods Inc., Vita Foods Products, Nature’s Agave, Inc., NOW Health Group, Inc., Groovy Food Company Ltd, The Colibree Company, Inc., The American Beverage Marketers, Madhava Natural Sweeteners, Global Goods Inc., The Simple Syrup Co., SunOpta Inc., 21.1Natura BioFoods, Other Players (On Additional Request) |

| Additional Attributes | Dollar sales, share by product type and application, increasing demand in food and beverage sectors, rise in demand for natural sweeteners, clean label trends, regional market dynamics |

The industry is segmented into light and dark agave sweetener.

The industry includes emulsifier, sweetener, and flavor enhancer functions.

Agave sweetener is used in bakery, beverages, confectionery, and other sectors (marinades, salads).

The industry is segmented into direct and indirect sales channels (store-based retailing, online retail).

Geographically segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East & Africa.

The industry is valued at USD 645 million in 2025.

The industry is expected to grow at a CAGR of 6.7% from 2025 to 2035.

The industry is forecasted to reach USD 1,233.6 million by 2035.

Light Agave sweetener holds a 60% share of the industry in 2025.

Malt Products Corporation holds a 15% share in the industry.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agave Nectar Market Size and Share Forecast Outlook 2025 to 2035

Agave Inulin Market Size, Growth, and Forecast for 2025 to 2035

Syrup Market Size and Share Forecast Outlook 2025 to 2035

PET Syrup Bottle Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the PET Syrup Bottle Industry

Warm Syrup & Topping Dispensers Market – Enhanced Serving Solutions 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Market Share Breakdown of Maple Syrup Manufacturers

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Competitive Overview of Coconut Syrup Industry Share

Glucose Syrup Market

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocktail Syrup Market Analysis by Product Type, Flavor, and Region Through 2035

Dextrose Syrup Market

Specialty Syrup Market Analysis by Type, Application and Other Types Through 2035

Chocolate Syrup Market

Sugar-Free Syrups Market Insights - Innovations & Consumer Demand 2025 to 2035

Starch Glucose Syrup Market

Clarified Rice Syrup Market

Glucose-Fructose Syrup Market – Growth, Demand & Food Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA