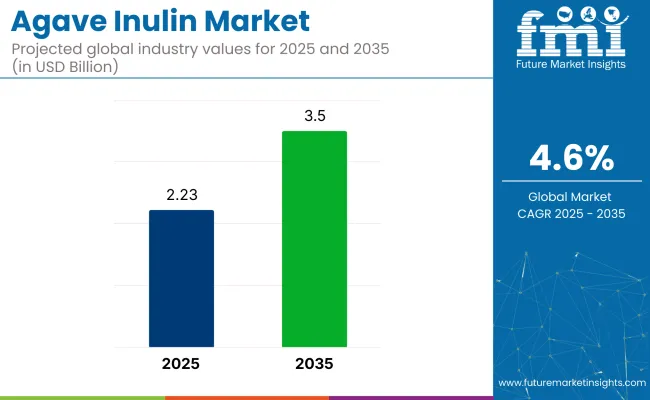

The agave inulin market is expected to grow from a valuation of USD 2.23 billion in 2025 to USD 3.50 billion by 2035, with a steady CAGR of 4.6% over the forecast period. Increasing awareness of gut health, prebiotic fibers, and natural sugar alternatives has established agave fiber as a preferred functional ingredient in food, beverage, and nutraceutical applications.

| Attributes | Description |

|---|---|

| Industry Size (2025E) | USD 2.23 billion |

| Industry Value (2035F) | USD 3.50 billion |

| CAGR (2025 to 2035) | 4.6% |

This growth is largely driven by the increasing demand for naturally occurring, functional ingredients in the food and beverage industry. Agave Fibre is a soluble fiber extracted from the agave plant, is well-regarded for its prebiotic effects, promoting gut health and digestive system wellness.

The industry accounts for an estimated 12-15% share of the global inulin industry, where chicory remains dominant. Within the broader prebiotic and dietary fiber ingredients industry, its share ranges between 2-3%, as it competes with ingredients like FOS, GOS, and beta-glucan. In the functional foods and beverages industry, agave fiber constitutesless than 1%, used mainly in niche clean-label and sugar-reduced formulations.

In the dietary supplements and nutraceuticals industry, its contribution is modest-about 1-2%, mostly in fiber blends and digestive health products. Its presence in the pharmaceutical ingredients industry is minimal, well under 0.5%, though growing due to its GRAS status and emerging gut microbiome applications. Its impact remains high despite low volumetric share.

A June 2024 article published in SupplySide Food & Beverage Journal showcased Ciranda’s leadership. Eric Lofgren, Vice President of Innovation & Sustainability at Ciranda, stated, “Ciranda looks forward to helping more product developers offer the functional health benefits of inulin.

These ingredient options deliver taste and texture, while also satisfying the health-conscious consumer's desire for more fiber and reduced-sugar options.” The article underscored rising demand for prebiotic dietary fibers, positioning organic agave fiber as a key clean-label ingredient in functional foods, beverages, and low-sugar product innovations

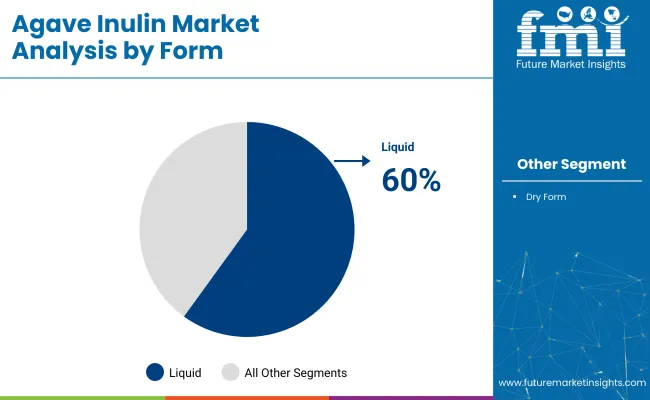

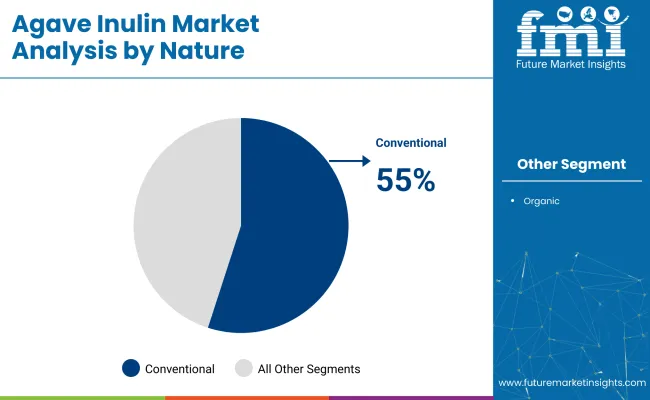

The industry is segmented into form, nature, application, and sales channel. Liquid form leads with 60%, followed by conventional products at 55%. Food & beverages hold 30%, and offline sales dominate with 70%. Growing demand for digestive health and plant-based products is driving the idustry, while affordability and availability make conventional Agave fiber the preferred choice.

The liquid form is expected to hold the largest share of 60% share in 2025. This dominance is driven by its widespread use in beverages and liquid supplements. The solubility and ease of integration into drinks make it a preferred choice for functional beverage development.

Agave fibre is increasingly incorporated into products by leading companies like Danone and Yakult, with its digestive health benefits being promoted. As demand for gut health solutions grows, the position of liquid agave fiber in the industry is strengthened, particularly in formats like smoothies, juices, and health drinks.

The conventionalsegment is expected to dominate, accounting for 55% of the share in 2025. This dominance is largely due to its cost-effectiveness compared to organic variants. Companies like Chr. Hansen and DuPontcontinue to offer conventional agave fibre, which is widely used across various industries.

The affordability and availability of conventional products make them the preferred option for manufacturers, particularly in price-sensitive segments like food and beverages. While the demand for organic agave fibre is growing, conventional variants continue to dominate the industry because they are more economically viable for mass production.

The food and beverages sector is expected to account for 30% share in 2025. The demand for functional foods that support digestive health is driving the growth of sector. Leading brands like Nestlé and Kraft Heinz are increasingly incorporating agave fibre into their food products to meet the needs of health-conscious consumers.

Agave fibre is used in products like smoothies, yogurts, and energy bars, offering a natural source of fiber and prebiotics. As consumers continue to seek health-promoting food options, agave fibres in food and beverages are likely to grow, with more companies leveraging their benefits for digestive wellness.

The offline sales channel is expected to dominate, capturing 70% share in 2025. Traditional retail stores, including retail stores and health food stores, are crucial for the distribution of agave fibre products. Consumers continue to prefer in-store shopping where they can compare products, read labels, and receive expert advice.

Health-focused retail chains like Whole Foods and CVS Health are playing an important role in distributing agave fibre-based products. Offline retail remains a strong distribution channel due to its established presence, consumer trust, and the tactile shopping experience it provides, especially for health and wellness products.

Growing Demand for Prebiotic Ingredients

The demand for prebiotic ingredients is being driven by the growing awareness of gut health. Consumers are increasingly seeking products that support digestion. Inulin, being rich in prebiotics, is now widely incorporated into various food and beverage items, such as yogurts, smoothies, and dietary supplements. This shift in consumer preference is prompting manufacturers to create new products that highlight agave fibren as a functional ingredient for digestive health.

Rise of Plant-Based and Clean Label Products

The rise of plant-based diets and clean label products is having a considerable impact on the industry. As more consumers adopt vegan and vegetarian lifestyles, the preference for food without animal products and artificial additives is growing. While agave fibre is a natural, plant-derived ingredient, meeting the clean label demand is challenging. Manufacturers are striving to offer products that maintain ingredient integrity while aligning with the clean-label trend.

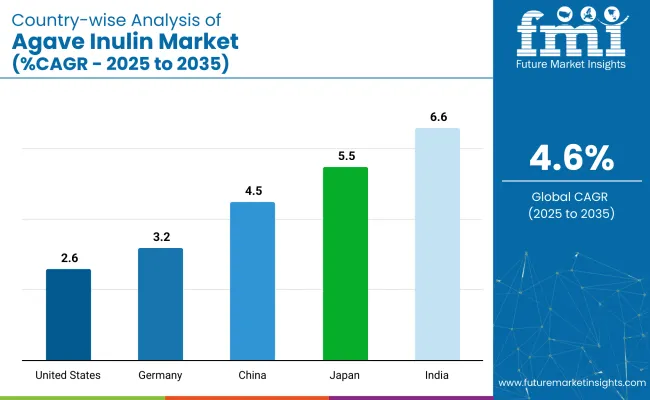

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| Germany | 3.2% |

| China | 4.5% |

| Japan | 5.5% |

| India | 6.6% |

In the global context, uneven growth is shown across major economies in the industry. Among the OECD countries, a below-average CAGR of 2.6% is exhibited by the United States, underperforming the global growth rate by 2.0 percentage points. A moderate CAGR of 3.2% is reported by Germany, reflecting steady uptake, particularly in food and health sectors, but still trailing the global growth pace by 1.4%.

In contrast, the BRICS group, strong momentum is demonstrated by India, with a projected CAGR of 6.6%, driven by increasing interest in functional foods and dietary fiber. A near-global average CAGR of 4.5% is posted by China. Japan, part of the OECD, exceeds the global average with a 5.5% CAGR, attributed to its proactive functional food culture.

The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

Demand for the agave fibrein india is expanding at a 9.7% CAGR through 2035. This growth is driven by rising consumer awareness, increased disposable income, and demand for lactose-free dairy alternatives. Leading companies like Amul, Parle Agro, and Nestlé India are expanding their portfolios to meet the growing demand for lactose-free products.

The industry is also benefiting from increased health-conscious lifestyles, government campaigns, and better product labeling. E-commerce platforms are making these products more accessible, while innovation in formulations and packaging is meeting diverse consumer needs.

Demand for agave fibre in the USA, growing at a 6.1% CAGR from 2025 to 2035. The industry benefits from a well-established healthcare infrastructure and increasing demand for functional, lactose-free products. Companies like Danone,

Dairy Farmers of America, and Blue Diamond Growers are expanding their lactose-free offerings in retail and foodservice sectors. Growth is also driven by consumer preference for plant-based alternatives, with government healthcare initiatives and awareness campaigns contributing to faster adoption.

Germany holds a dominant position with a CAGR of 3.2% through 2035, driven by the increasing demand for organic and clean-label products. Consumers are becoming more informed about food labeling and ingredient sourcing, which is raising the preference for agave fibre.

Local producers are capitalizing on this by offering a range of certified organic agave fibre products. Retailers, including health food stores, retail stores, and e-commerce platforms, are ensuring widespread availability, making these products easily accessible to consumers.

Sales of agave fibre in China are projected to grow at an 8.9% CAGR through 2035. This growth is fueled by dietary shifts and rising health awareness. Dairy companies such as Yili Group, Mengniu Dairy, and Beingmate are investing heavily in lactose-free products to cater to the growing demand.

Government initiatives to promote nutritional education and awareness are further supporting industrial growth. Expanding retail chains and e-commerce platforms are making it easier for consumers to access agave fibre products.

Demand for agave fibrein Japan is projected to grow at a 5.5% CAGR through 2035. Growth is influenced by the country’s aging population, which faces increased digestive sensitivities, and rising dietary awareness. Major companies such as Meiji Holdings, Morinaga Milk Industry, and Snow Brand Milk Products are leading the development of lactose-free products. Government initiatives promoting digestive health and functional foods are supporting industry growth. E-commerce and retail stores are expanding the availability of these products to a wider consumer base.

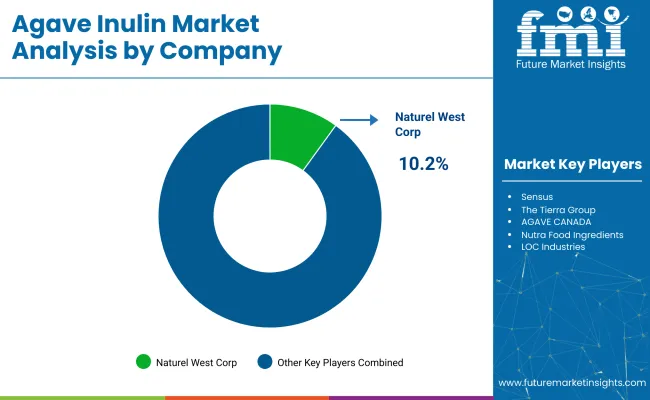

The industry features a mix of leading, key, and emerging players. Leading players like Naturel West Corp, Sensus, and Beneo dominate the industry with extensive product portfolios and global reach. Key players such as The Tierra Group and Nutra Food Ingredients focus on regional sectors, offering specialized products tailored to local preferences.

Emerging players like AGAVE CANADA and LOC Industries primarily serve specific geographic areas, providing agave fibre at competitive prices while promoting local economies. These players contribute to industry innovation, catering to growing demand for prebiotic ingredients and functional foods globally.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 2.23 billion |

| Industry Size (2035) | USD 3.50 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Forms Analyzed (Segment 1) | Liquid, Dry |

| Nature Types Analyzed (Segment 2) | Organic, Conventional |

| Applications Analyzed (Segment 3) | Pharmaceuticals, Dietary Supplements, Food & Beverages, Industrial |

| Sales Channels Analyzed (Segment 4) | Online, Offline |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Naturel West Corp, Sensus, The Tierra Group, AGAVE CANADA, Nutra Food Ingredients, LOC Industries, Beneo, Pyure Brands, Maretai Organics, 21 Missions’ Organics, EDULAG, Ciranda |

| Additional Attributes | Dollar sales, share by form and application, rising use in dietary fibers and sugar alternatives, increased demand in functional foods, clean label and organic formulation trends, regional supply chain expansion |

The industry is segmented into liquid and dry forms.

The industry includes both organic and conventional types.

The industry finds applications in pharmaceuticals, dietary supplements, food & beverages, and industrial sectors.

Agave inulin is distributed through online and offline sales channels.

Geographically segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East & Africa.

The industry is projected to reach USD 3.50 billion by 2035.

The industry is expected to grow at a CAGR of 4.6% from 2025 to 2035.

Liquid form will dominate the industry with a 60% share in 2025.

It is projected to be USD 2.23 billion in 2025.

South Asia, with India leading at a CAGR of 6.6%, is expected to drive the growth.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Agave Nectar Market Size and Share Forecast Outlook 2025 to 2035

Agave Syrup Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Inulin Market Analysis by Source, Type, Application, Form, Function Type, Sales Channels and Region through 2035

Inulinase Market Growth & Demand Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA